Key Insights

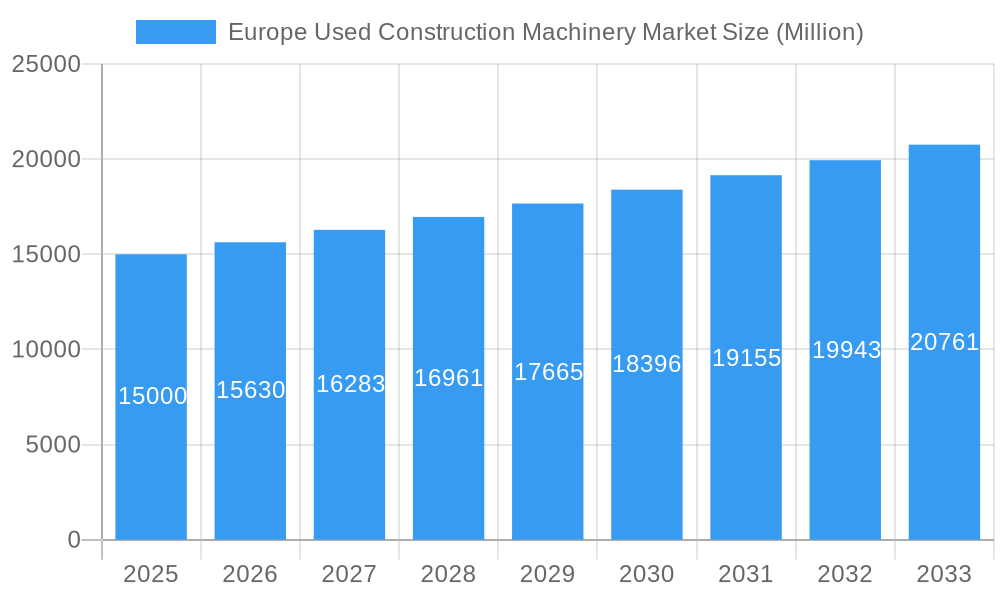

The European used construction machinery market, valued at approximately €46.15 billion in 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% from 2025 to 2033. This expansion is driven by the aging existing machinery fleet, necessitating replacements and upgrades. Budgetary constraints for smaller construction firms also favor cost-effective used equipment over new purchases. Ongoing infrastructure development across key European nations further fuels demand for both new and used construction machinery. The market is segmented by machinery type (cranes, telescopic handlers, excavators, loaders & backhoes, motor graders) and drive type (internal combustion engine, electric). While IC engine-powered machinery currently dominates, a growing emphasis on sustainability and environmental regulations is spurring a gradual shift towards electric-powered used equipment.

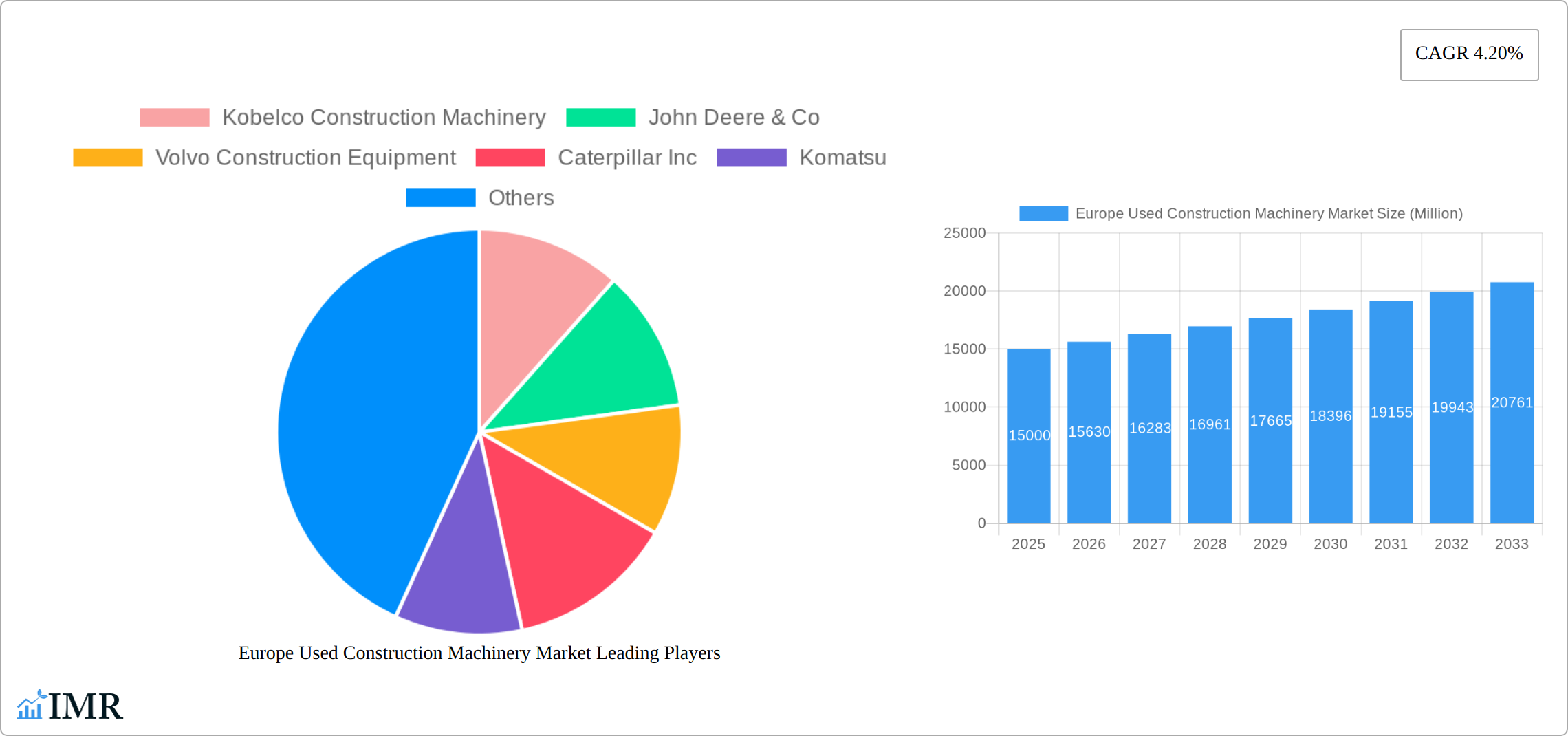

Europe Used Construction Machinery Market Market Size (In Billion)

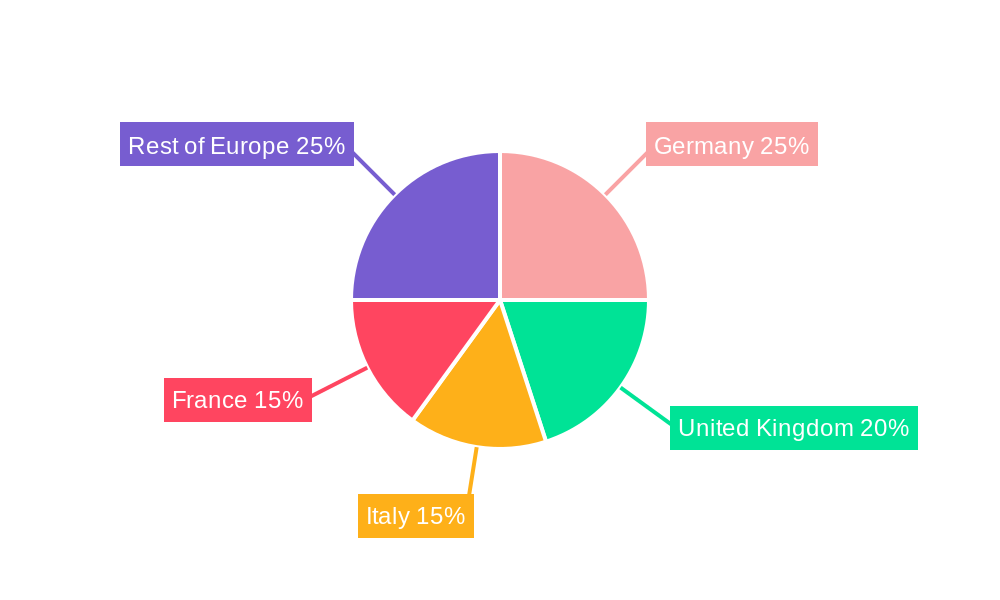

Market restraints include price volatility due to supply chain disruptions and economic fluctuations, as well as concerns about the reliability and maintenance costs of used machinery. However, established dealers, rental companies, and available financing options help to alleviate these challenges. Germany, the UK, France, and Italy are the largest national markets, driven by their robust construction sectors and significant infrastructure investments. The competitive landscape features global manufacturers such as Caterpillar, Komatsu, and Volvo, alongside smaller regional players. Future market growth will be shaped by economic conditions, government infrastructure spending, technological advancements, and evolving environmental regulations.

Europe Used Construction Machinery Market Company Market Share

Europe Used Construction Machinery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Used Construction Machinery market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The report segments the market by machinery type (Crane, Telescopic Handlers, Excavators, Loaders & Backhoe, Motor Grader), drive type (IC Engine, Electric), and country (Germany, United Kingdom, Italy, France, Rest of Europe), offering a granular understanding of this dynamic market. Key players analyzed include Kobelco Construction Machinery, John Deere & Co, Volvo Construction Equipment, Caterpillar Inc, Komatsu, Liebherr International, Mitsubishi Heavy Industries Ltd, and Manitou B. The total market size is projected to reach XX million units by 2033.

Europe Used Construction Machinery Market Dynamics & Structure

The European used construction machinery market exhibits a moderately fragmented structure, with a few major players holding significant market share, alongside numerous smaller regional players. Market concentration is influenced by factors such as brand reputation, technological capabilities, and distribution networks. Technological innovation, particularly in areas like emission control and automation, is a key driver, but faces challenges in terms of adoption rate and cost. Stringent environmental regulations in Europe significantly impact the market, pushing the adoption of greener technologies and influencing the demand for certain machinery types. The availability of readily available replacement parts, the existence of a robust aftermarket support system, and the comparative affordability of used machinery in contrast to newer models drive overall market health. Mergers & Acquisitions (M&A) activity has been moderate, reflecting both consolidation trends among larger players and smaller, specialized firms seeking access to wider markets.

- Market Concentration: Moderately fragmented, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on emission reduction and automation creates opportunities, but high upfront investment remains a barrier.

- Regulatory Framework: Stringent environmental regulations drive demand for newer, compliant used machinery.

- Competitive Substitutes: Limited direct substitutes; competition primarily occurs within segments.

- End-User Demographics: Primarily construction companies, rental firms, and individual contractors, with varying needs and budget constraints.

- M&A Trends: Moderate activity observed, with larger firms acquiring smaller players to broaden market reach and service offerings. XX M&A deals recorded between 2019-2024.

Europe Used Construction Machinery Market Growth Trends & Insights

The Europe used construction machinery market experienced a robust CAGR of [Insert Historical CAGR Here] during the historical period (2019-2024). This growth was propelled by significant infrastructural development initiatives across the continent, a surge in construction activities spanning residential, commercial, and industrial sectors, and a pronounced preference for cost-effective equipment solutions. The market is poised for continued expansion, albeit at a slightly moderated pace, with a projected CAGR of [Insert Forecast CAGR Here] for the forecast period (2025-2033). Established markets such as Germany and the United Kingdom continue to exhibit high market penetration, while the market is witnessing increasing adoption in emerging European economies. Technological advancements are primarily concentrated in innovations related to engine efficiency, advanced emission control systems, and the integration of digitalization and telematics. A growing consumer consciousness towards sustainability and economic efficiency is further fueling the demand for used machinery that is both fuel-efficient and incorporates modern technological upgrades.

Dominant Regions, Countries, or Segments in Europe Used Construction Machinery Market

Germany and the United Kingdom are the dominant markets for used construction machinery in Europe, driven by robust construction industries, high investment in infrastructure projects, and a large pool of construction companies and contractors. Among the machinery types, excavators and loaders & backhoes hold the largest market share due to their widespread applications across various construction projects. The IC engine-driven machinery segment dominates in terms of volume, although the electric segment is experiencing growth albeit from a smaller base.

- Germany: Large construction sector, strong infrastructure investments, and established distribution networks.

- United Kingdom: Similar factors as Germany, with considerable government spending on infrastructure.

- Italy & France: Significant markets, but with slightly lower growth rates than Germany and the UK.

- Rest of Europe: Shows considerable potential for growth, with increasing infrastructural investments and construction activities.

- Machinery Type: Excavators and Loaders & Backhoes dominate due to high demand and versatility.

- Drive Type: IC Engine-driven machinery holds the largest market share, with Electric segment showing increasing growth.

Europe Used Construction Machinery Market Product Landscape

The used construction machinery market offers a diverse range of products, varying in age, condition, and technological features. Innovations in engine technology and emission control systems are prominent, focusing on improved fuel efficiency and reduced environmental impact. The integration of telematics and advanced safety features is also gaining traction, enhancing operational efficiency and worker safety. Key selling propositions include cost-effectiveness compared to new machinery, availability of readily available parts, and established aftermarket service support.

Key Drivers, Barriers & Challenges in Europe Used Construction Machinery Market

Key Drivers:

- Accelerating construction activities across diverse segments in Europe.

- Substantial investments in public and private infrastructure development projects.

- Compelling cost-effectiveness and reduced total cost of ownership compared to purchasing new machinery.

- Rising demand for environmentally compliant and fuel-efficient equipment in line with sustainability goals.

- The growing availability of well-maintained, technologically updated used machinery.

Key Barriers & Challenges:

- Volatility in global raw material prices impacting the cost of remanufacturing and repairs.

- Persistent global supply chain disruptions affecting the availability of spare parts and components.

- Increasingly stringent environmental regulations and emission standards necessitating compliance for used equipment.

- Intense market competition from both new machinery manufacturers and a fragmented landscape of used equipment suppliers. The market is facing pressure from an estimated [Insert Component Supply Decrease Percentage] decrease in the supply of critical components from 2024 to 2025, potentially impacting availability and pricing.

- Ensuring the quality and reliability of older machinery to meet evolving industry demands.

Emerging Opportunities in Europe Used Construction Machinery Market

- Growth in the rental market for used construction equipment.

- Increased demand for refurbished and reconditioned machines.

- Expansion into underserved European markets.

- Growing adoption of telematics and digital solutions.

Growth Accelerators in the Europe Used Construction Machinery Market Industry

Strategic collaborations and partnerships between leading equipment manufacturers, authorized dealerships, and established rental companies are significantly accelerating market growth. These alliances facilitate a streamlined flow of quality used machinery and enhance customer accessibility. Furthermore, continuous technological advancements in engine efficiency, sophisticated emission control systems, and the increasing adoption of automation and telematics in used equipment are key growth catalysts. The expansion of market reach into new and developing European regions, coupled with supportive governmental policies and incentives for infrastructure development, further contributes to the accelerated growth trajectory of the used construction machinery market.

Key Players Shaping the Europe Used Construction Machinery Market Market

Notable Milestones in Europe Used Construction Machinery Market Sector

- 2020: A heightened global and regional emphasis on sustainable construction practices and the implementation of stricter environmental regulations significantly influenced the demand and supply dynamics of used machinery.

- 2021: The introduction and enforcement of new, more rigorous emission standards across various European countries directly impacted the market, driving demand towards machinery compliant with these regulations.

- 2022: A notable wave of mergers, acquisitions, and strategic alliances occurred within the market, aimed at consolidating market share, expanding service offerings, and enhancing operational efficiencies.

- 2023: The market saw the successful launch and integration of several advanced telematics systems and automation features into a wider range of used construction machinery, improving operational insights and productivity for end-users.

- [Insert Future Milestone Year, e.g., 2024/2025]: [Describe a relevant future development or trend, e.g., Increased focus on the circular economy and remanufacturing of construction equipment.]

In-Depth Europe Used Construction Machinery Market Market Outlook

The Europe used construction machinery market is poised for steady growth, driven by ongoing infrastructure development, increasing construction activities, and a focus on cost-effective solutions. Strategic partnerships, technological advancements, and effective expansion into untapped markets will further propel growth. Opportunities exist in the rental sector, the refurbishment market, and the integration of digital technologies. The focus on sustainability and emission reduction will continue to shape the market landscape, encouraging innovation and adoption of environmentally friendly equipment.

Europe Used Construction Machinery Market Segmentation

-

1. Machinery Type

- 1.1. Crane

- 1.2. Telescopic Handlers

- 1.3. Excavators

- 1.4. Loaders & Backhoe

- 1.5. Motor Grader

-

2. Drive Type

- 2.1. IC Engine

- 2.2. Electric

Europe Used Construction Machinery Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Used Construction Machinery Market Regional Market Share

Geographic Coverage of Europe Used Construction Machinery Market

Europe Used Construction Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Integration With Telematics And Fleet Management Systems; Others

- 3.3. Market Restrains

- 3.3.1. The Initial Costs Associated With Purchasing And Installing ELD Systems is High; Others

- 3.4. Market Trends

- 3.4.1. Used Cranes to Drive the Construction Machinery Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Used Construction Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 5.1.1. Crane

- 5.1.2. Telescopic Handlers

- 5.1.3. Excavators

- 5.1.4. Loaders & Backhoe

- 5.1.5. Motor Grader

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. IC Engine

- 5.2.2. Electric

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Machinery Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kobelco Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 John Deere & Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Volvo Construction Equipment

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Caterpillar Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Komatsu

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Liebherr International

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mitsubishi heavy Industries Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Manitou B

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Kobelco Construction Machinery

List of Figures

- Figure 1: Europe Used Construction Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Used Construction Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Used Construction Machinery Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 2: Europe Used Construction Machinery Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 3: Europe Used Construction Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Used Construction Machinery Market Revenue billion Forecast, by Machinery Type 2020 & 2033

- Table 5: Europe Used Construction Machinery Market Revenue billion Forecast, by Drive Type 2020 & 2033

- Table 6: Europe Used Construction Machinery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Used Construction Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Used Construction Machinery Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Europe Used Construction Machinery Market?

Key companies in the market include Kobelco Construction Machinery, John Deere & Co, Volvo Construction Equipment, Caterpillar Inc, Komatsu, Liebherr International, Mitsubishi heavy Industries Ltd, Manitou B.

3. What are the main segments of the Europe Used Construction Machinery Market?

The market segments include Machinery Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Integration With Telematics And Fleet Management Systems; Others.

6. What are the notable trends driving market growth?

Used Cranes to Drive the Construction Machinery Market Growth.

7. Are there any restraints impacting market growth?

The Initial Costs Associated With Purchasing And Installing ELD Systems is High; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Used Construction Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Used Construction Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Used Construction Machinery Market?

To stay informed about further developments, trends, and reports in the Europe Used Construction Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence