Key Insights

The European wireless electric vehicle (EV) charging market is projected for significant expansion from 2025 to 2033. Key growth drivers include rising EV adoption, strict emission mandates, and the inherent convenience of wireless charging. The market is forecast to achieve a Compound Annual Growth Rate (CAGR) of 18.3%, growing from an estimated $1.87 billion in 2024 to a substantial market size by 2033.

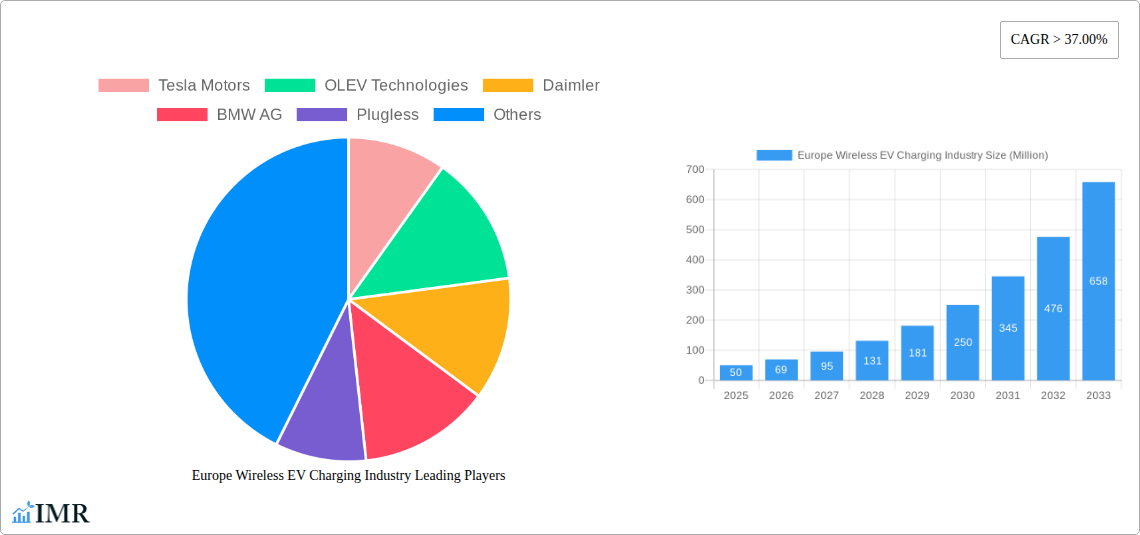

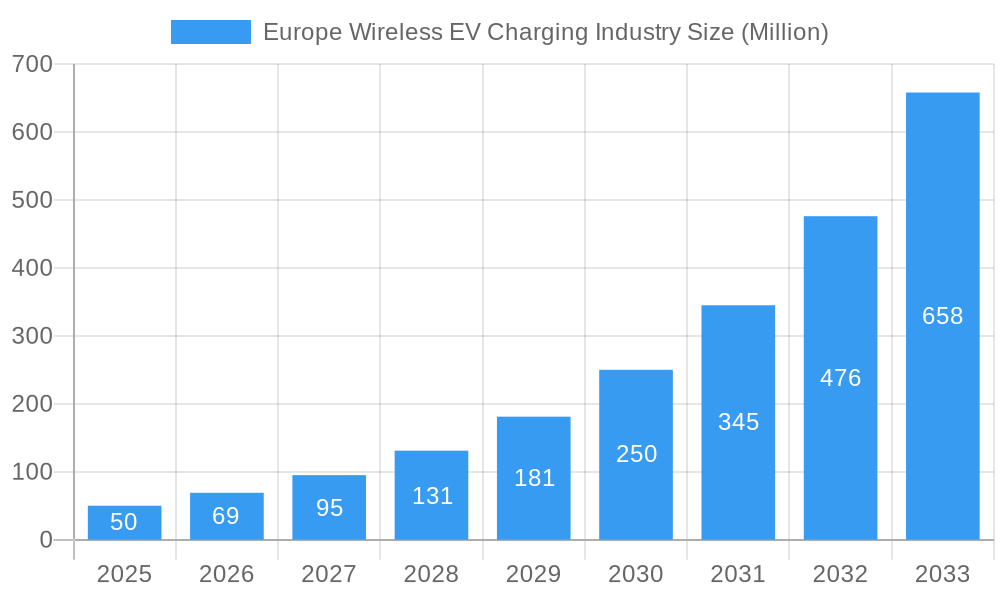

Europe Wireless EV Charging Industry Market Size (In Billion)

Leading automotive manufacturers such as Tesla, Daimler, and BMW are actively investing in wireless charging technology, stimulating innovation. Major markets include Germany, the UK, France, and Italy, driven by robust automotive sectors and progressive EV policies. The technology serves both Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs).

Europe Wireless EV Charging Industry Company Market Share

Potential growth inhibitors include the higher initial investment for wireless charging infrastructure and the need for industry-wide standardization. However, continuous technological advancements and escalating consumer demand are expected to overcome these challenges.

Further market expansion is anticipated due to the increasing adoption of electric fleets by corporations and public entities, particularly in urban centers requiring efficient charging solutions. Advancements in higher-power, faster wireless charging systems are also contributing to market growth. Government incentives and subsidies supporting EV and wireless charging infrastructure deployment will continue to be pivotal throughout the forecast period. The competitive environment features a dynamic interplay between established automotive giants and specialized wireless charging solution providers, fostering continuous innovation and the development of superior, cost-effective offerings.

Europe Wireless EV Charging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe wireless EV charging industry, encompassing market dynamics, growth trends, regional dominance, product landscape, challenges, opportunities, and key players. The report covers the period 2019-2033, with a focus on the 2025 market and a forecast to 2033. It analyzes the parent market of Electric Vehicle Charging and the child market of Wireless EV Charging, offering invaluable insights for industry professionals, investors, and stakeholders. The report projects a market size of xx Million units by 2033.

Europe Wireless EV Charging Industry Market Dynamics & Structure

This section delves into the intricate dynamics of the European wireless EV charging market. We analyze market concentration, revealing the share held by key players like Tesla Motors, and assess the influence of technological advancements, regulatory landscapes, and competitive substitutions. The report also explores end-user demographics and the impact of mergers and acquisitions (M&A) activity on market consolidation.

- Market Concentration: The market is currently characterized by [insert market concentration level, e.g., moderate concentration] with [insert percentage]% controlled by the top 5 players.

- Technological Innovation: Key drivers include advancements in resonant inductive coupling and improvements in charging efficiency and power transfer. Barriers include cost-effectiveness, standardization, and integration with existing infrastructure.

- Regulatory Framework: Government incentives and regulations (e.g., emission reduction targets) are significantly influencing market growth, although harmonization across European nations remains a challenge.

- Competitive Substitutes: Wired charging remains a primary competitor, although wireless charging offers convenience and aesthetic benefits.

- M&A Trends: [Insert number] M&A deals were recorded between [start year] and [end year], indicating [insert trend, e.g., increasing consolidation] in the market. (e.g., 50 M&A deals, indicating a trend towards market consolidation.)

- End-User Demographics: Early adoption is concentrated among affluent consumers and fleet operators with a growing interest from public transport and logistics.

Europe Wireless EV Charging Industry Growth Trends & Insights

This section analyzes the historical and projected growth trajectory of the European wireless EV charging market. Utilizing robust data analysis techniques, we project market size evolution, adoption rates, and the influence of technological disruptions and evolving consumer behavior.

This section will provide a detailed 600-word analysis encompassing: Market size evolution from 2019 to 2024 (historical data), with projections through 2033; CAGR during the forecast period (2025-2033); Market penetration rate by country and vehicle type; Analysis of technological disruptions impacting growth (e.g., advancements in power transfer technology); Shifting consumer preferences (e.g., demand for convenient and fast charging solutions) and their impact on market growth.

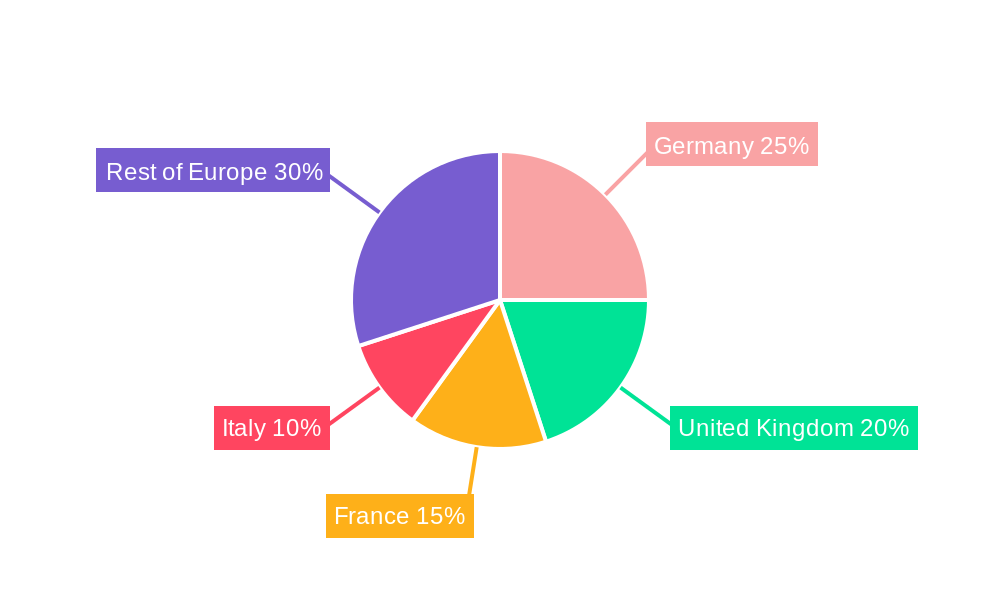

Dominant Regions, Countries, or Segments in Europe Wireless EV Charging Industry

Germany, the United Kingdom, and France are expected to be leading markets, driven by supportive government policies, strong EV adoption rates, and growing infrastructure investment. The report segments the market by country (Germany, UK, Italy, France, Spain, Rest of Europe) and vehicle type (Battery Electric Vehicle, Plug-in Hybrid Vehicle).

- Germany: Strong government support for EVs and a well-established automotive industry drive substantial growth.

- United Kingdom: Growing adoption of EVs and investment in public charging infrastructure contribute to market expansion.

- France: Government incentives and focus on sustainable transportation fuel market growth.

- Battery Electric Vehicles (BEVs): This segment will dominate due to increasing BEV sales and longer range requirements.

- Plug-in Hybrid Vehicles (PHEVs): This segment will show moderate growth due to their shorter range and less frequent charging needs. This section provides a 600-word analysis detailing the factors contributing to the dominance of these regions and segments, including market share and growth potential for each.

Europe Wireless EV Charging Industry Product Landscape

The product landscape is characterized by various wireless charging technologies, including resonant inductive coupling and magnetic resonance coupling, each with its own unique selling propositions in terms of power transfer efficiency, charging range, and cost. Recent innovations focus on increasing power output, reducing charging time, and enhancing system integration with existing EV infrastructure.

Key Drivers, Barriers & Challenges in Europe Wireless EV Charging Industry

Key Drivers:

- Increasing EV adoption rates across Europe.

- Government incentives and regulations promoting the use of EVs and supporting infrastructure development.

- Advancements in wireless charging technology improving efficiency and reducing costs.

Key Challenges and Restraints:

- High initial investment costs for infrastructure development.

- Concerns over standardization and interoperability of different wireless charging systems.

- Potential safety concerns related to electromagnetic fields.

- Supply chain issues impacting component availability and cost.

Emerging Opportunities in Europe Wireless EV Charging Industry

Emerging opportunities include the expansion of wireless charging solutions into public transportation, fleet operations, and residential settings. The development of dynamic wireless charging systems for road networks and integration of wireless charging with smart grid technologies present additional growth avenues.

Growth Accelerators in the Europe Wireless EV Charging Industry

Technological advancements, strategic partnerships between automotive manufacturers and charging infrastructure providers, and expansion into new market segments (e.g., commercial fleets, public transit) will propel long-term market growth.

Key Players Shaping the Europe Wireless EV Charging Industry Market

- Tesla Motors

- OLEV Technologies

- Daimler

- BMW AG

- Plugless

- Bombardier

- Nissan

- HEVO Power

- WiTricity

- Qualcomm

- Hella Aglaia Mobile Vision

- Toyota

Notable Milestones in Europe Wireless EV Charging Industry Sector

- June 2020: Jaguar's collaboration with NorgesTaxi AS and the City of Oslo for wireless taxi charging infrastructure in Norway.

- May 2020: HEVO Power plans US manufacturing of wireless EV chargers by 2024.

- March 2020: Electreon successfully tests dynamic wireless charging of a 40-ton electric truck in Sweden.

In-Depth Europe Wireless EV Charging Industry Market Outlook

The European wireless EV charging market exhibits substantial growth potential driven by the increasing adoption of electric vehicles, supportive government policies, and continuous technological advancements in wireless charging systems. Strategic partnerships and expansion into new market segments will further accelerate this growth, offering significant opportunities for market participants. The market is poised for robust expansion, driven by the convergence of technological innovation and policy support.

Europe Wireless EV Charging Industry Segmentation

-

1. Vehicle Type

- 1.1. Battery Electric Vehicle

- 1.2. Plug-in Hybrid Vehicle

Europe Wireless EV Charging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Wireless EV Charging Industry Regional Market Share

Geographic Coverage of Europe Wireless EV Charging Industry

Europe Wireless EV Charging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Sales of Electric Vehicles Aiding Market Growth

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Wireless Chargers

- 3.4. Market Trends

- 3.4.1. Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Wireless EV Charging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Battery Electric Vehicle

- 5.1.2. Plug-in Hybrid Vehicle

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tesla Motors

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 OLEV Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daimler

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMW AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Plugless

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bombardier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nissan

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HEVO Powe

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 WiTricity

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Qualcomm

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hella Aglaia Mobile Vision

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Toyota

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Tesla Motors

List of Figures

- Figure 1: Europe Wireless EV Charging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Wireless EV Charging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Europe Wireless EV Charging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Wireless EV Charging Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 4: Europe Wireless EV Charging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Wireless EV Charging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Wireless EV Charging Industry?

The projected CAGR is approximately 18.3%.

2. Which companies are prominent players in the Europe Wireless EV Charging Industry?

Key companies in the market include Tesla Motors, OLEV Technologies, Daimler, BMW AG, Plugless, Bombardier, Nissan, HEVO Powe, WiTricity, Qualcomm, Hella Aglaia Mobile Vision, Toyota.

3. What are the main segments of the Europe Wireless EV Charging Industry?

The market segments include Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.87 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Sales of Electric Vehicles Aiding Market Growth.

6. What are the notable trends driving market growth?

Increasing Sales of Electric Vehicles Driving the Wireless Charging Demand.

7. Are there any restraints impacting market growth?

High Cost of Installing Wireless Chargers.

8. Can you provide examples of recent developments in the market?

In June 2020, Jaguar announced a collaboration with NorgesTaxi AS and the City of Oslo to build a wireless, high-powered charging infrastructure for electric taxis in the Norwegian capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Wireless EV Charging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Wireless EV Charging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Wireless EV Charging Industry?

To stay informed about further developments, trends, and reports in the Europe Wireless EV Charging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence