Key Insights

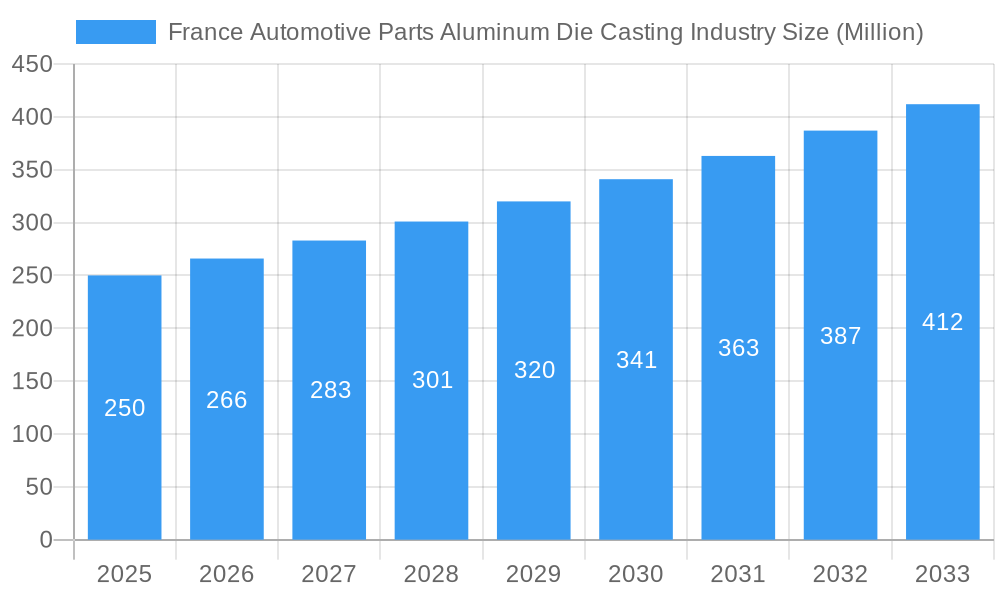

The French automotive aluminum die casting market is projected to reach 12.02 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 7.28% between 2025 and 2033. This significant growth is attributed to the automotive industry's increasing focus on lightweight vehicle construction for enhanced fuel efficiency and reduced emissions. Advancements in die casting technologies, including vacuum and pressure techniques, are enabling the production of intricate, high-precision components, further stimulating market expansion. The accelerating shift towards electric vehicles (EVs) presents a substantial growth avenue, as aluminum's inherent lightweight nature and excellent electrical conductivity are critical for efficient EV battery systems and motor components. Key market segments encompass body assemblies and engine parts, with transmission parts demonstrating particularly strong expansion potential. Leading industry participants, such as Sandhar Technologies Ltd and Empire Casting Co, are strategically investing in production capacity and technological enhancements to address escalating demand.

France Automotive Parts Aluminum Die Casting Industry Market Size (In Billion)

Despite the positive growth trajectory, certain challenges may impede market expansion. Volatility in aluminum pricing and the general economic performance of the automotive sector pose potential risks. Additionally, stringent environmental regulations governing emissions from die casting operations necessitate ongoing investment in sustainable production technologies. Nevertheless, the overall outlook for the French automotive aluminum die casting market remains favorable, propelled by robust demand from the automotive sector and continuous technological innovation. The broad spectrum of applications within the automotive industry contributes to a stable demand, offering resilience against economic cycles. Strategic alliances and collaborations between die casters and automotive manufacturers are anticipated to foster accelerated growth and innovation in the foreseeable future.

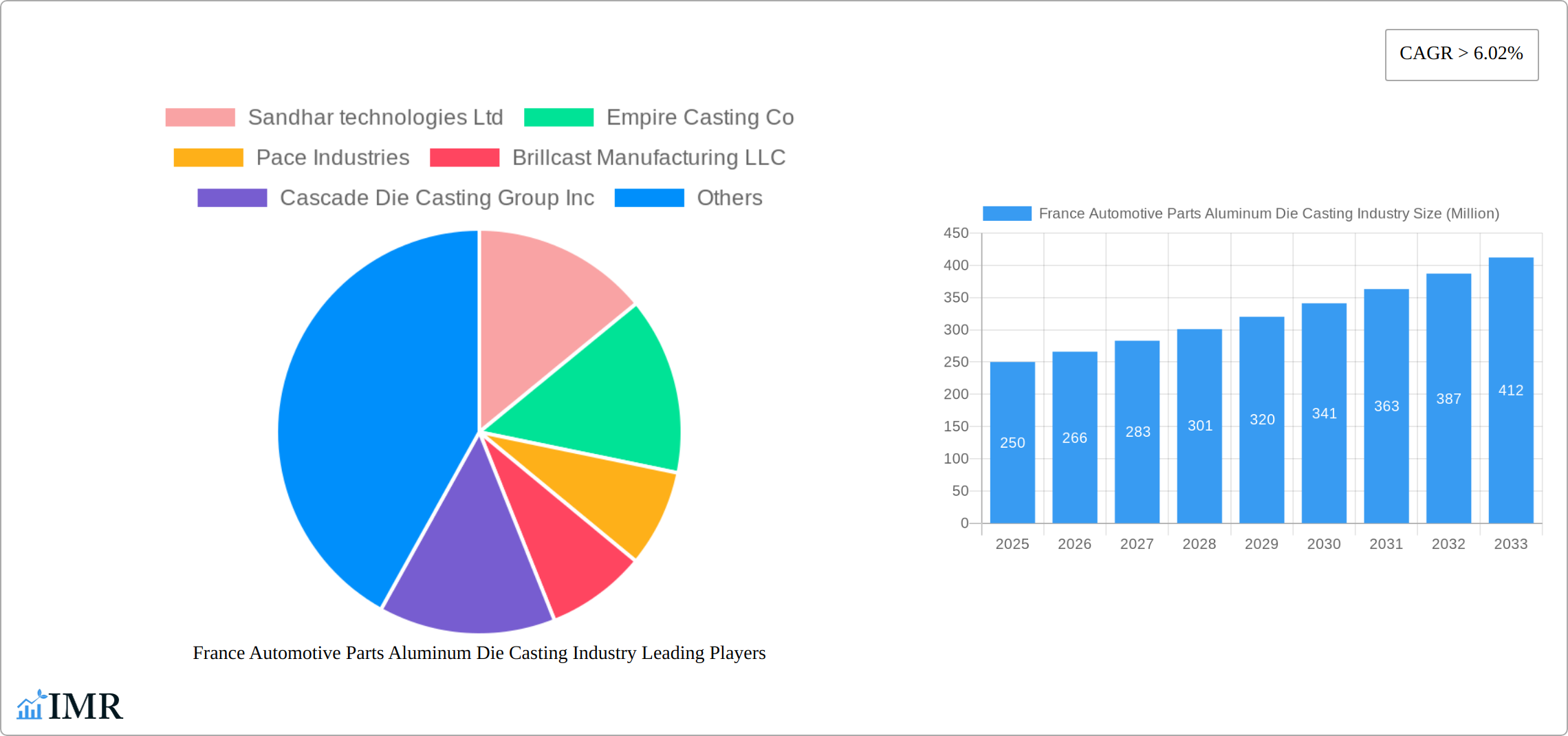

France Automotive Parts Aluminum Die Casting Industry Company Market Share

France Automotive Parts Aluminum Die Casting Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France automotive parts aluminum die casting industry, offering valuable insights for industry professionals, investors, and strategic decision-makers. Covering the period from 2019 to 2033, with a focus on 2025, this report unveils market dynamics, growth trends, key players, and future opportunities within this lucrative sector. The report meticulously examines the parent market (Automotive Parts Manufacturing) and the child market (Aluminum Die Casting for Automotive Applications in France).

France Automotive Parts Aluminum Die Casting Industry Market Dynamics & Structure

The French automotive parts aluminum die casting market exhibits a moderately concentrated structure, with a few major players holding significant market share. Technological innovation, particularly in vacuum die casting and lightweighting technologies, is a key driver. Stringent environmental regulations and safety standards influence production methods and material choices. Competitive substitutes, such as plastic components, constantly challenge the market. The end-user demographics are largely driven by the automotive manufacturing sector’s production volumes and model mix. M&A activity within the sector has been moderate in recent years, with xx deals recorded between 2019-2024, resulting in a xx% shift in market share concentration.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Focus on lightweighting, precision casting, and automation driving efficiency and cost reduction.

- Regulatory Framework: Strict emission standards and safety regulations impacting material choices and production processes.

- Competitive Substitutes: Growing competition from plastics and other lightweight materials impacting demand.

- End-User Demographics: Primarily driven by French automotive OEMs and Tier-1 suppliers.

- M&A Trends: Moderate activity in recent years, with a focus on expanding production capacity and technological capabilities.

France Automotive Parts Aluminum Die Casting Industry Growth Trends & Insights

The French automotive parts aluminum die casting market is experiencing robust growth, propelled by the escalating demand for lightweight vehicles aimed at enhancing fuel efficiency and reducing environmental impact. This trend is further amplified by the increasing integration of advanced technologies and materials within the automotive sector. The market size reached approximately **XX Million units in 2024**, demonstrating a Compound Annual Growth Rate (CAGR) of **XX%** during the historical period (2019-2024). The strategic adoption of Industry 4.0 technologies, including automation, data analytics, and smart manufacturing processes, is a significant catalyst for this expansion. Moreover, evolving consumer preferences for greener and more fuel-conscious transportation solutions are directly driving the demand for sophisticated aluminum die-cast components. Looking ahead, the market is projected to sustain its upward trajectory, reaching an estimated **XX Million units by 2033**, with a projected CAGR of **XX%** for the forecast period (2025-2033). The penetration of aluminum die casting in automotive applications is anticipated to reach approximately **XX%** by 2033, underscoring its growing significance in vehicle manufacturing.

Dominant Regions, Countries, or Segments in France Automotive Parts Aluminum Die Casting Industry

Within France's automotive parts aluminum die casting landscape, key automotive hubs like **Île-de-France** and **Auvergne-Rhône-Alpes** stand out as dominant segments. In 2024, these regions collectively held a significant market share, with Île-de-France accounting for **XX%** and Auvergne-Rhône-Alpes for **XX%**. The prevalence of **Pressure Die Casting** as the primary production process is attributed to its inherent cost-effectiveness and high-volume output capabilities, crucial for meeting the demands of mass vehicle production. From an application perspective, **engine parts** represent the largest and most dynamic segment, followed by critical components for **transmission systems** and **body assemblies**. The growth in these segments is underpinned by several factors:

- Île-de-France: Its strategic importance is derived from the high concentration of major automotive manufacturers, Tier-1 suppliers, and research and development centers, fostering a collaborative ecosystem.

- Auvergne-Rhône-Alpes: This region boasts a deeply entrenched automotive industrial base, complemented by a highly skilled workforce and specialized manufacturing expertise, making it a cornerstone of production.

- Pressure Die Casting: Its undisputed dominance is driven by its superior production efficiency and cost advantages, essential for large-scale automotive component manufacturing.

- Engine Parts: The increasing complexity and miniaturization of modern engine designs, coupled with the need for lightweight yet durable components, are fueling substantial demand for advanced aluminum die-cast engine parts.

France Automotive Parts Aluminum Die Casting Industry Product Landscape

The product landscape features a diverse range of aluminum die-cast components tailored to various automotive applications, encompassing engine blocks, cylinder heads, transmission housings, and body parts. Recent innovations focus on high-strength alloys, improved surface finishes, and integrated design features to enhance performance, durability, and weight reduction. Unique selling propositions often center around reduced weight, improved fuel economy, and enhanced structural integrity, providing competitive advantages in the market.

Key Drivers, Barriers & Challenges in France Automotive Parts Aluminum Die Casting Industry

Key Drivers:

- Lightweighting Initiatives: The persistent global drive towards lightweight vehicles to achieve improved fuel economy and reduced CO2 emissions is a primary growth engine for aluminum die casting.

- Advanced Driver-Assistance Systems (ADAS) Integration: The burgeoning adoption of ADAS technologies necessitates the production of more intricate and precise casting designs, creating new opportunities for aluminum die casting.

- Sustainability and Environmental Regulations: Government incentives and stringent environmental regulations promoting the use of sustainable materials and reducing the carbon footprint of vehicles are actively favoring aluminum components.

- Electrification of Vehicles: The shift towards electric vehicles (EVs) also presents significant opportunities, as aluminum die castings are increasingly utilized in battery enclosures, motor housings, and thermal management systems.

Challenges:

- Raw Material Price Volatility: Fluctuations in the global aluminum market can significantly impact production costs. For instance, a notable **XX%** increase in aluminum prices in 2022 directly led to a **XX%** rise in production costs for die casters, impacting profit margins.

- Intense Inter-material Competition: Aluminum die casting faces competition from alternative manufacturing processes and materials like magnesium, advanced plastics, and steel, which also offer lightweighting solutions.

- Stringent Quality and Regulatory Compliance: Maintaining consistent, high-quality output and adhering to the increasingly stringent safety and performance standards set by the automotive industry requires continuous investment in advanced technologies and quality control measures.

- Energy Costs: The energy-intensive nature of die casting processes can make manufacturers susceptible to rising energy prices, particularly in regions with high energy costs.

Emerging Opportunities in France Automotive Parts Aluminum Die Casting Industry

Emerging opportunities lie in the increasing adoption of electric vehicles (EVs), requiring specialized lightweight castings for battery housings and other components. There's also growth potential in the development of high-strength aluminum alloys for improved durability and crashworthiness. Further opportunities exist in exploring sustainable manufacturing practices to address environmental concerns.

Growth Accelerators in the France Automotive Parts Aluminum Die Casting Industry Industry

Long-term growth will be driven by continued technological advancements, particularly in automation, additive manufacturing, and the development of new alloys with superior properties. Strategic partnerships between die casters and automotive manufacturers to facilitate joint development and supply chain integration will also play a crucial role. Market expansion through exports to other European countries and regions with growing automotive industries promises further growth.

Key Players Shaping the France Automotive Parts Aluminum Die Casting Industry Market

The France automotive parts aluminum die casting industry is characterized by the presence of a dynamic set of companies, both domestic and international, contributing to its innovation and growth. Some of the key players actively shaping the market include:

- Sandhar Technologies Ltd

- Empire Casting Co.

- Pace Industries

- Brillcast Manufacturing LLC

- Cascade Die Casting Group Inc.

- Ningbo Die Casting Company

- Ashok Minda Group

- Dynacast

- Kemlows Diecasting Products Ltd.

- Riken AIF Corporation

- Fuji Die Co., Ltd.

- Ryobi Die Casting (USA), Inc.

Notable Milestones in France Automotive Parts Aluminum Die Casting Industry Sector

The France automotive parts aluminum die casting sector has been marked by significant developments and strategic moves by industry participants, reflecting its dynamism and commitment to innovation:

- April 2023: Ryobi Die Casting (USA), Inc. received the prestigious 2022 General Motors Supplier of the Year award. This recognition underscores the critical role of high-quality, precision die casting solutions in meeting the rigorous demands of leading automotive manufacturers and highlights the global standards of excellence achieved by industry players.

- May 2022: Fondarex, a prominent provider of vacuum die casting technology, strategically opened a new plant in Europe. This expansion significantly boosts their manufacturing capacity for advanced vacuum die casting systems, directly addressing the burgeoning demand for sophisticated, high-performance components across various industrial sectors, with a particular focus on the evolving automotive industry.

- 2021-2023: A period marked by increased investment in automation and digital transformation across several French die casting facilities, in response to the need for enhanced efficiency, improved quality control, and greater flexibility in production to meet the complex requirements of modern automotive platforms.

- Ongoing: Continuous research and development efforts by key players are focused on exploring novel aluminum alloys with enhanced properties, optimizing casting processes for greater energy efficiency, and developing sustainable manufacturing practices to align with the industry's environmental goals.

In-Depth France Automotive Parts Aluminum Die Casting Industry Market Outlook

The future of the French automotive parts aluminum die casting market is positive. Continued growth is expected, driven by technological innovation, the rise of electric vehicles, and the ongoing demand for lightweight and high-performance automotive components. Strategic partnerships, investments in automation, and a focus on sustainability will be key factors in shaping the market's future landscape. Significant opportunities exist for companies that can adapt to evolving industry trends and consumer demands.

France Automotive Parts Aluminum Die Casting Industry Segmentation

-

1. Production Process Type

- 1.1. Vacuum Die Casting

- 1.2. Pressure Die Casting

- 1.3. Other Productino Process Types

-

2. Application Type

- 2.1. Body Assemblies

- 2.2. Engine Parts

- 2.3. Transmission Parts

- 2.4. Other Aplication Types

France Automotive Parts Aluminum Die Casting Industry Segmentation By Geography

- 1. France

France Automotive Parts Aluminum Die Casting Industry Regional Market Share

Geographic Coverage of France Automotive Parts Aluminum Die Casting Industry

France Automotive Parts Aluminum Die Casting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Lightweight Vehicles

- 3.3. Market Restrains

- 3.3.1. Competition from Other Materials

- 3.4. Market Trends

- 3.4.1. Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Automotive Parts Aluminum Die Casting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Vacuum Die Casting

- 5.1.2. Pressure Die Casting

- 5.1.3. Other Productino Process Types

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Body Assemblies

- 5.2.2. Engine Parts

- 5.2.3. Transmission Parts

- 5.2.4. Other Aplication Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sandhar technologies Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Empire Casting Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pace Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Brillcast Manufacturing LLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cascade Die Casting Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ningbo Die Casting Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ashook Minda Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dynacast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Kemlows Diecasting Products Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Sandhar technologies Ltd

List of Figures

- Figure 1: France Automotive Parts Aluminum Die Casting Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Automotive Parts Aluminum Die Casting Industry Share (%) by Company 2025

List of Tables

- Table 1: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: France Automotive Parts Aluminum Die Casting Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Automotive Parts Aluminum Die Casting Industry?

The projected CAGR is approximately 7.28%.

2. Which companies are prominent players in the France Automotive Parts Aluminum Die Casting Industry?

Key companies in the market include Sandhar technologies Ltd, Empire Casting Co, Pace Industries, Brillcast Manufacturing LLC, Cascade Die Casting Group Inc, Ningbo Die Casting Company, Ashook Minda Grou, Dynacast, Kemlows Diecasting Products Ltd.

3. What are the main segments of the France Automotive Parts Aluminum Die Casting Industry?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.02 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Lightweight Vehicles.

6. What are the notable trends driving market growth?

Vacuum Die Casting Segment is Expected to Witness the Fastest Growth Rate.

7. Are there any restraints impacting market growth?

Competition from Other Materials.

8. Can you provide examples of recent developments in the market?

April 2023: Ryobi Die Casting, a leading company that supplies casting parts for most of the well-known automotive brands in the market, recently General Motors recognized Ryobi Die Casting (USA), Inc. as a 2022 supplier of the year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Automotive Parts Aluminum Die Casting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Automotive Parts Aluminum Die Casting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Automotive Parts Aluminum Die Casting Industry?

To stay informed about further developments, trends, and reports in the France Automotive Parts Aluminum Die Casting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence