Key Insights

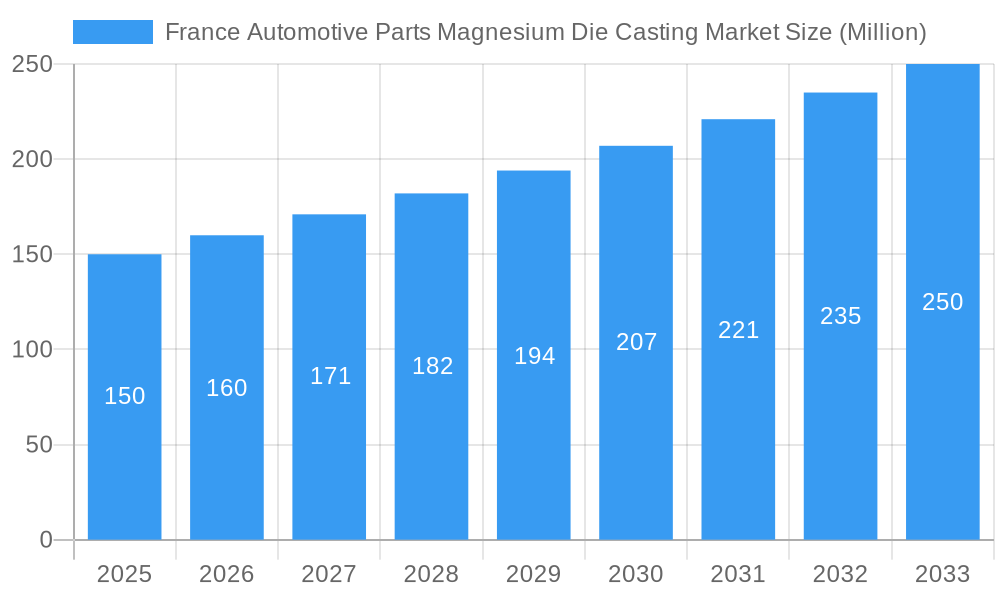

The France automotive parts magnesium die casting market is poised for significant expansion, driven by the escalating demand for lightweight vehicles to improve fuel efficiency and reduce emissions. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% from 2024 to 2033. This growth is underpinned by the superior strength-to-weight ratio of magnesium die casting over aluminum in automotive applications. Key market segments include engine and transmission components, crucial for powertrain lightweighting. While pressure die casting currently leads, vacuum and semi-solid techniques are emerging for complex, high-performance parts. Leading players such as Brabant Alucast, Kinetic Die Casting, and Gibbs Die Casting Group are instrumental in market development through innovation and collaborations. Government initiatives favoring sustainable transport and robust automotive R&D investment in France further accelerate market growth.

France Automotive Parts Magnesium Die Casting Market Market Size (In Billion)

Despite a positive outlook, market growth faces certain constraints. The comparative cost of magnesium and the intricate nature of the die casting process present challenges. Volatility in raw material prices and the requirement for specialized expertise may also impact growth. Nevertheless, the long-term forecast remains robust, with substantial expansion anticipated from 2025 to 2033. The inherent benefits of lightweighting in enhancing vehicle performance and environmental sustainability, coupled with ongoing investments in advanced die casting technologies and the rising adoption of electric and hybrid vehicles, solidify this positive trajectory. The estimated market size is 3.3 billion by 2033.

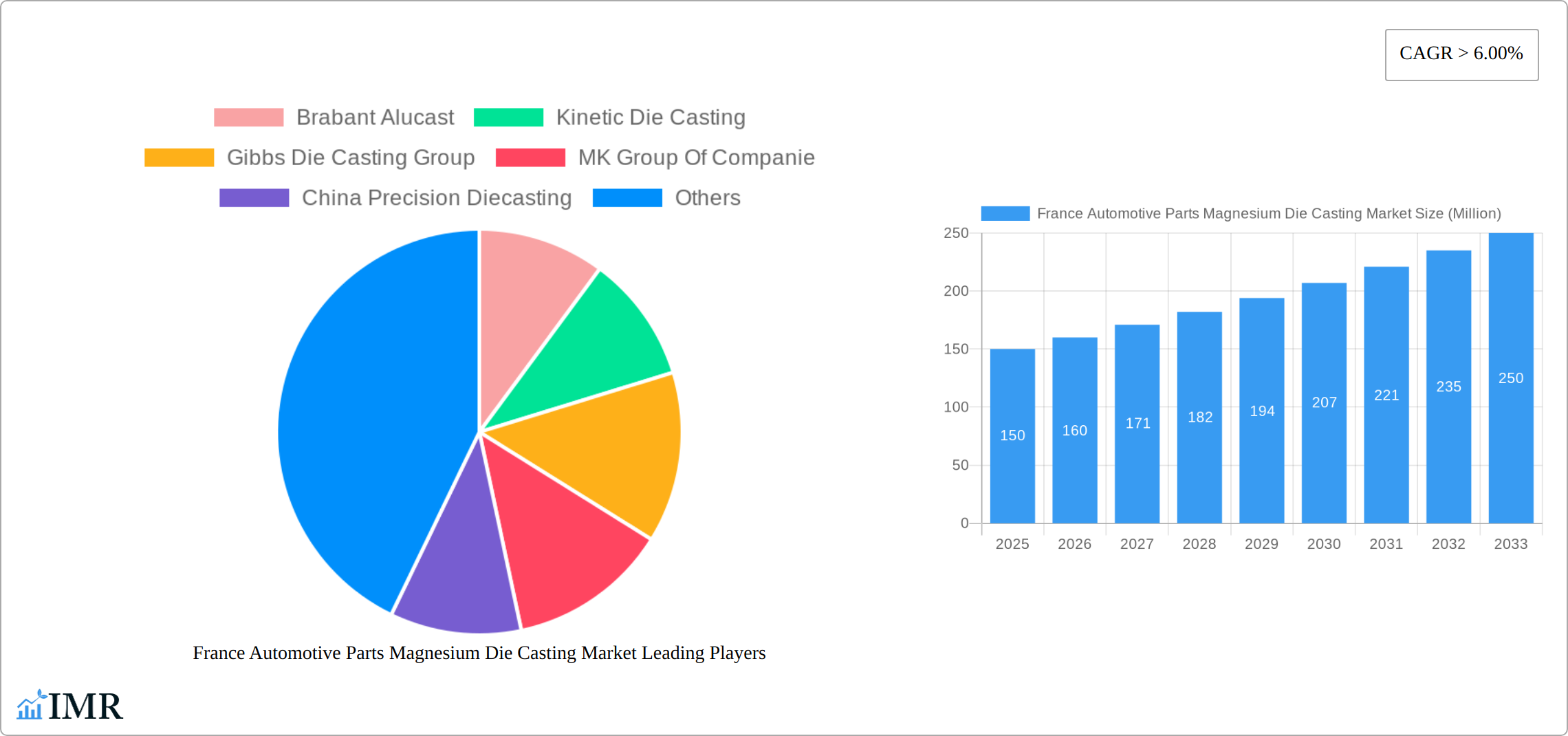

France Automotive Parts Magnesium Die Casting Market Company Market Share

France Automotive Parts Magnesium Die Casting Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France automotive parts magnesium die casting market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with 2025 as the base year and a forecast period spanning 2025-2033. The report segments the market by production process type (Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-Solid Die Casting) and application type (Engine Parts, Transmission Components, Body Parts, Others), providing a granular understanding of market dynamics and growth potential. The market size is expressed in Million units.

Keywords: France Automotive Parts, Magnesium Die Casting Market, Pressure Die Casting, Vacuum Die Casting, Squeeze Die Casting, Semi-Solid Die Casting, Engine Parts, Transmission Components, Body Parts, Automotive Industry, Market Analysis, Market Forecast, Market Size, Growth Opportunities, Competitive Landscape, Brabant Alucast, Kinetic Die Casting, Gibbs Die Casting Group, MK Group Of Companies, China Precision Diecasting, Chicago White Metal Casting Inc, Meridian Lightweight Technologies, George Fischer Ltd, Continental Casting LLC, Magic Precision Inc

France Automotive Parts Magnesium Die Casting Market Market Dynamics & Structure

This section analyzes the France automotive parts magnesium die casting market's structure, exploring market concentration, technological innovation, regulatory influences, competitive substitutes, end-user demographics, and mergers & acquisitions (M&A) activity. The market exhibits a moderately fragmented structure, with a few large players and numerous smaller niche operators. Technological advancements in die casting processes (e.g., improved automation, enhanced material properties) are driving market growth. Stringent automotive emission standards and lightweighting regulations within the EU influence material selection, favoring magnesium's lightweight properties. Aluminum die castings and other lightweight materials pose significant competitive pressure. The automotive sector's cyclical nature and consumer preference for specific vehicle types (SUVs, electric vehicles) directly impact market demand. M&A activity has been moderate in recent years, with xx deals recorded between 2019 and 2024, largely driven by consolidation efforts among smaller players.

- Market Concentration: Moderately fragmented, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Significant advancements in die casting processes improving efficiency and product quality.

- Regulatory Framework: EU emission standards and lightweighting regulations are key drivers.

- Competitive Substitutes: Aluminum and other lightweight materials present strong competition.

- End-User Demographics: Growth linked to automotive production trends and consumer preferences for specific vehicle types.

- M&A Trends: Moderate activity (xx deals between 2019-2024), primarily driven by consolidation.

France Automotive Parts Magnesium Die Casting Market Growth Trends & Insights

The France automotive parts magnesium die casting market is poised for robust expansion, driven by the escalating demand for lighter and more fuel-efficient vehicles, a trend amplified by the growing popularity of electric vehicles (EVs). Between 2019 and 2024, the market witnessed a steady upward trajectory. While specific market size figures (xx million units in 2024 and projected xx million units by 2033) and CAGR (xx%) are indicative of this growth, the underlying drivers are multifaceted. These include significant technological advancements in die casting processes, leading to enhanced precision and cost-effectiveness for magnesium alloy components. Furthermore, supportive governmental regulations and incentives aimed at promoting lightweight materials for improved fuel economy and reduced emissions are acting as powerful catalysts. Despite a notable increase in adoption, the market penetration rate of magnesium die castings in the French automotive sector is still evolving, presenting considerable room for growth compared to alternative materials. The shifting consumer preference towards environmentally conscious mobility, coupled with the continuous introduction of innovative vehicle models featuring advanced lightweight structures, is expected to further invigorate market expansion. Crucially, the development of novel magnesium alloys with superior mechanical properties and improved recyclability is set to be a key technological disruptor, solidifying the role of magnesium die castings in the future of automotive manufacturing.

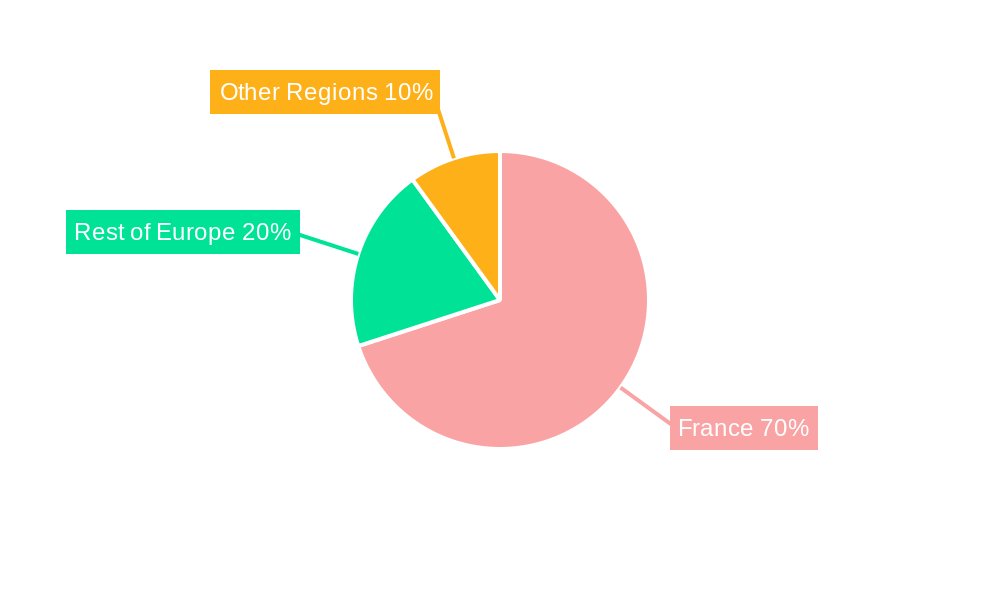

Dominant Regions, Countries, or Segments in France Automotive Parts Magnesium Die Casting Market

The French automotive parts magnesium die casting landscape is significantly shaped by regional strengths and specific market segments. The Auvergne-Rhône-Alpes region stands out as the primary hub, largely due to its dense concentration of automotive manufacturing plants and a highly developed, interconnected supply chain. This region benefits from substantial public and private sector investment in research and development, fostering innovation within the automotive sector. Analyzing market segmentation reveals that pressure die casting commands the largest market share. This dominance is attributable to its inherent cost-efficiency and its capability to produce intricate parts in high volumes, making it ideal for mass production automotive needs. In terms of applications, engine parts represent the leading segment. This is directly linked to the continuous drive for enhanced fuel efficiency and reduced emissions in internal combustion engines, where lightweight magnesium components offer a distinct advantage in reducing overall vehicle weight.

- Leading Region: Auvergne-Rhône-Alpes

- Key Drivers: Proximity to major automotive OEMs, robust industrial ecosystem, favorable government policies supporting manufacturing and innovation, and a mature supply chain infrastructure.

- Dominant Production Process Type: Pressure Die Casting

- Key Drivers: High throughput capacity, excellent surface finish, intricate design capabilities, and a strong cost-performance ratio for mass-produced components.

- Leading Application Type: Engine Parts

- Key Drivers: Critical role in weight reduction for improved fuel economy and emission standards, performance enhancement through reduced inertia, and growing demand for more complex engine component designs.

France Automotive Parts Magnesium Die Casting Market Product Landscape

The product innovation within the French automotive parts magnesium die casting market is characterized by a relentless pursuit of advanced materials and refined manufacturing techniques. A primary focus is on developing high-strength magnesium alloys that offer exceptional durability while significantly reducing component weight. These alloys are engineered for improved castability, enabling intricate designs and superior surface finishes that minimize post-casting processing. Emerging die casting technologies, such as semi-solid die casting, are gaining significant traction. This advanced method yields components with enhanced mechanical properties, including superior tensile strength and reduced porosity, which are crucial for safety-critical and performance-oriented automotive applications. The development is highly application-specific, with tailored solutions for components like engine blocks, transmission casings, and critical structural elements. The unique selling propositions of these advanced magnesium die castings lie in their direct contribution to improved fuel efficiency, enhanced vehicle performance, and overall vehicle dynamics. The industry's commitment to refining dimensional accuracy and minimizing defects is paramount, ensuring the reliable integration of these lightweight components into modern vehicle architectures.

Key Drivers, Barriers & Challenges in France Automotive Parts Magnesium Die Casting Market

Key Drivers:

- Increasing demand for lightweight vehicles due to stringent fuel efficiency regulations.

- Technological advancements in die casting processes and magnesium alloys resulting in improved product quality and cost-effectiveness.

- Government incentives and supportive policies promoting the use of lightweight materials in the automotive industry.

Key Challenges & Restraints:

- The relatively higher cost of magnesium compared to aluminum presents a barrier to wider adoption.

- Concerns about magnesium's flammability and corrosion resistance require careful material design and surface treatment.

- Competition from other lightweight materials such as aluminum and high-strength steels. This competition reduces the market share of magnesium castings, limiting the overall growth by approximately xx%.

Emerging Opportunities in France Automotive Parts Magnesium Die Casting Market

Emerging opportunities lie in the growing demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs). The lightweight nature of magnesium is especially beneficial in EVs, where weight reduction significantly impacts range and performance. Furthermore, the increasing adoption of advanced driver-assistance systems (ADAS) and autonomous driving features presents opportunities for the use of magnesium in complex, lightweight components. The development of high-performance magnesium alloys with enhanced corrosion resistance and improved machinability will expand the application range. Untapped markets include specialized automotive niches, such as motorsport and high-performance vehicles, where weight reduction is paramount.

Growth Accelerators in the France Automotive Parts Magnesium Die Casting Market Industry

The sustained and accelerated growth of the France automotive parts magnesium die casting market will be propelled by several strategic initiatives and technological advancements. Strategic collaborations between leading magnesium die casters and automotive manufacturers are vital for co-developing innovative lightweight components tailored to evolving vehicle designs. These partnerships will foster a more integrated approach to material selection and component engineering. Furthermore, continuous technological breakthroughs, particularly in the development of next-generation magnesium alloys with superior strength-to-weight ratios and enhanced corrosion resistance, will be instrumental. Expansion into new and emerging application areas within the automotive sector, beyond traditional engine and structural parts, will unlock new market potential. Establishing and strengthening robust and resilient supply chains will ensure consistent availability of raw materials and efficient delivery of finished products, mitigating potential disruptions. A sustained and significant investment in research and development (R&D), coupled with the optimization of efficient and sustainable production processes, will be critical for maintaining a competitive edge and capitalizing on future market opportunities. This includes exploring advanced simulation and modeling techniques to predict component performance and optimize manufacturing parameters.

Key Players Shaping the France Automotive Parts Magnesium Die Casting Market Market

- Brabant Alucast

- Kinetic Die Casting

- Gibbs Die Casting Group

- MK Group Of Companies

- China Precision Diecasting

- Chicago White Metal Casting Inc

- Meridian Lightweight Technologies

- George Fischer Ltd

- Continental Casting LLC

- Magic Precision Inc

- Rheinmetall AG

- Norsk Hydro ASA

- Magnesium Elektron Ltd

- Foundry & Engineering Services (FES)

- Alu-Schmiedetechnik GmbH

Notable Milestones in France Automotive Parts Magnesium Die Casting Market Sector

- 2021 (Q3): Introduction of a new high-strength magnesium alloy by a major die casting company, expanding application possibilities.

- 2022 (Q1): A significant automotive manufacturer announced a new vehicle model incorporating magnesium die castings extensively.

- 2023 (Q4): A merger between two smaller die casting companies led to increased market consolidation.

In-Depth France Automotive Parts Magnesium Die Casting Market Market Outlook

The France automotive parts magnesium die casting market is poised for substantial growth over the next decade, driven by the increasing adoption of lightweight materials, technological advancements in die casting processes, and the expansion of the electric vehicle market. Strategic opportunities exist in developing new alloys tailored to specific automotive applications, expanding production capacity to meet growing demand, and forging strong partnerships with automotive manufacturers. Focusing on sustainability and reducing environmental impact through efficient manufacturing processes will attract environmentally conscious buyers and enhance the market position. The market's future potential is substantial, and companies that can adapt to the evolving automotive landscape and embrace innovation will be well-positioned to capture significant market share.

France Automotive Parts Magnesium Die Casting Market Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Application Type

- 2.1. Engine Parts

- 2.2. Transmission Components

- 2.3. Body Parts

- 2.4. Others

France Automotive Parts Magnesium Die Casting Market Segmentation By Geography

- 1. France

France Automotive Parts Magnesium Die Casting Market Regional Market Share

Geographic Coverage of France Automotive Parts Magnesium Die Casting Market

France Automotive Parts Magnesium Die Casting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of The Global Automotive Turbocharger Market

- 3.3. Market Restrains

- 3.3.1. Increasing Complexity of Modern Vehicles

- 3.4. Market Trends

- 3.4.1. Increased Application in Body Assemblies

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Automotive Parts Magnesium Die Casting Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Engine Parts

- 5.2.2. Transmission Components

- 5.2.3. Body Parts

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Brabant Alucast

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kinetic Die Casting

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gibbs Die Casting Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 MK Group Of Companie

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Precision Diecasting

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Chicago White Metal Casting Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Meridian Lightweight Technologies

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 George Fischer Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Continental Casting LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Magic Precision Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Brabant Alucast

List of Figures

- Figure 1: France Automotive Parts Magnesium Die Casting Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Automotive Parts Magnesium Die Casting Market Share (%) by Company 2025

List of Tables

- Table 1: France Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 2: France Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 3: France Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: France Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Production Process Type 2020 & 2033

- Table 5: France Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Application Type 2020 & 2033

- Table 6: France Automotive Parts Magnesium Die Casting Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Automotive Parts Magnesium Die Casting Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the France Automotive Parts Magnesium Die Casting Market?

Key companies in the market include Brabant Alucast, Kinetic Die Casting, Gibbs Die Casting Group, MK Group Of Companie, China Precision Diecasting, Chicago White Metal Casting Inc, Meridian Lightweight Technologies, George Fischer Ltd, Continental Casting LLC, Magic Precision Inc.

3. What are the main segments of the France Automotive Parts Magnesium Die Casting Market?

The market segments include Production Process Type, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.3 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growth of The Global Automotive Turbocharger Market.

6. What are the notable trends driving market growth?

Increased Application in Body Assemblies.

7. Are there any restraints impacting market growth?

Increasing Complexity of Modern Vehicles.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Automotive Parts Magnesium Die Casting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Automotive Parts Magnesium Die Casting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Automotive Parts Magnesium Die Casting Market?

To stay informed about further developments, trends, and reports in the France Automotive Parts Magnesium Die Casting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence