Key Insights

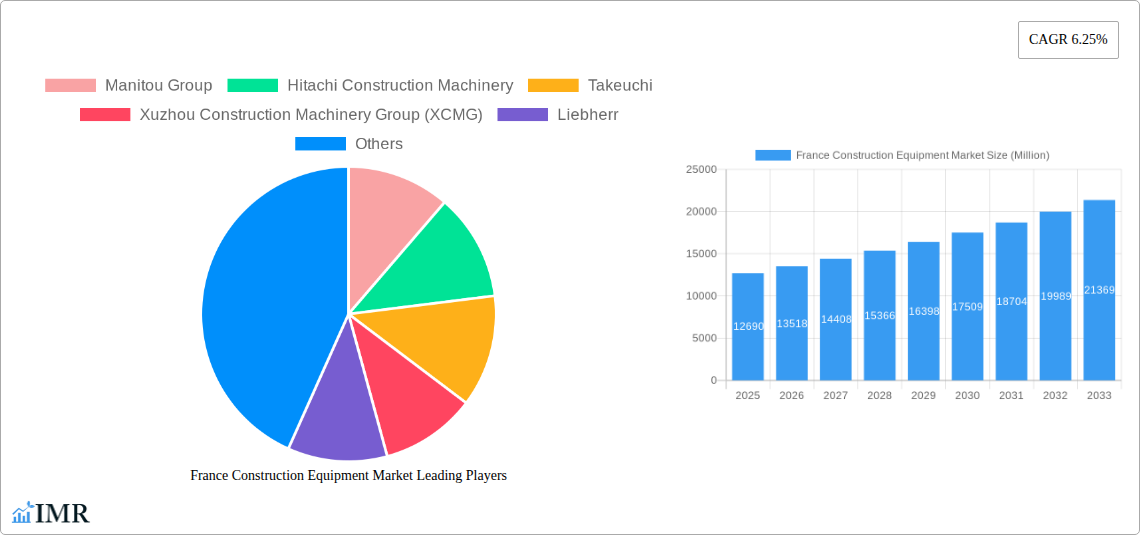

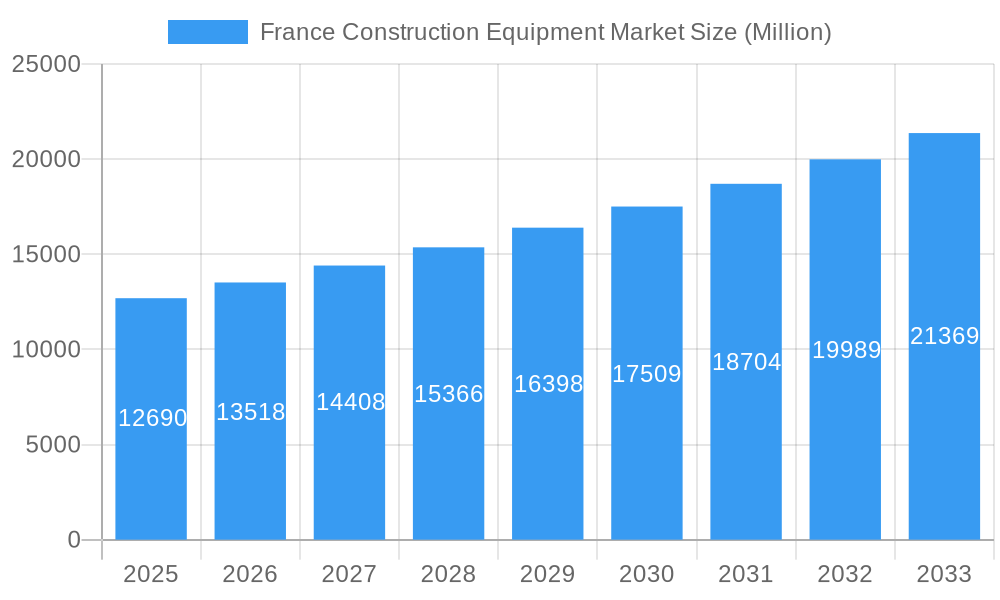

The France Construction Equipment market is experiencing robust growth, projected to reach €12.69 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 6.25% from 2025 to 2033. This expansion is fueled by several key drivers. Significant infrastructure development projects within France, including road construction, building renovations, and urban renewal initiatives, are boosting demand for diverse equipment types. Furthermore, the increasing adoption of technologically advanced equipment, such as electric/hybrid models and equipment incorporating advanced automation features, is contributing to market growth. Government investments in sustainable construction practices are also encouraging the shift towards more environmentally friendly equipment. While challenges exist, such as potential fluctuations in raw material prices and economic uncertainties, the overall market outlook remains positive. The segmentation reveals significant contributions from earthmoving equipment (bulldozers, excavators etc.), road construction equipment (asphalt pavers), and material handling equipment (articulated boom lifts, forklifts etc.). Key players like Manitou Group, Hitachi Construction Machinery, and Caterpillar are leveraging their established presence and technological advancements to capture market share. The consistent growth projection reflects the ongoing need for efficient and effective construction processes within the French construction sector, positioning the market for sustained expansion throughout the forecast period.

France Construction Equipment Market Market Size (In Billion)

The market's diverse segmentation offers opportunities for specialized equipment providers. The "Other Material Handling Equipment" segment, encompassing articulated boom lifts and similar machinery, is experiencing growth driven by the increasing complexity and height of modern construction projects. Similarly, "Other Earthmoving Equipment," including bulldozers and related machinery, remains a significant segment due to its vital role in large-scale infrastructure development. The adoption of hydraulic drive types continues to dominate, although the electric/hybrid segment is witnessing gradual growth as sustainability concerns gain prominence. Regional data focusing specifically on France highlights the nation's role as a key market within Europe, reflecting its robust construction industry and commitment to infrastructure modernization. The historical period (2019-2024) likely showcased stable to moderate growth, setting the stage for the accelerated expansion predicted through 2033.

France Construction Equipment Market Company Market Share

France Construction Equipment Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France construction equipment market, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from 2019-2024 (historical period), with the base year being 2025 and a forecast period spanning 2025-2033. The market is segmented by equipment type (earthmoving, road construction, material handling), drive type (hydraulic, electric/hybrid), and specific equipment categories (e.g., asphalt pavers, bulldozers, articulated boom lifts). The total market size is projected to reach xx Million units by 2033.

Keywords: France Construction Equipment Market, Construction Equipment, France, Earthmoving Equipment, Road Construction Equipment, Material Handling Equipment, Hydraulic Excavators, Electric Excavators, Market Size, Market Share, Market Growth, Industry Analysis, Market Forecast, Manitou Group, Hitachi Construction Machinery, Liebherr, Caterpillar, Volvo Construction Equipment, Komatsu.

France Construction Equipment Market Dynamics & Structure

The French construction equipment market is characterized by moderate concentration, with several multinational players and a significant number of domestic companies competing. Technological innovation, driven by stricter environmental regulations and a focus on efficiency, is a key market dynamic. The regulatory landscape, including safety standards and emissions regulations, significantly influences equipment adoption. Competitive product substitutes, particularly in the material handling segment, present challenges to established players. End-user demographics, including a growing preference for specialized equipment, influence market segmentation. M&A activity remains relatively modest; however, strategic acquisitions to expand product portfolios or gain market share are observed.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on automation, electrification, and improved fuel efficiency; significant barrier to entry for smaller companies due to high R&D costs.

- Regulatory Framework: Stringent emission standards (Stage V) drive demand for cleaner equipment.

- Competitive Substitutes: Alternative technologies and rental services pose competitive threats.

- End-User Demographics: Large infrastructure projects and increasing urbanization drive demand for heavy equipment.

- M&A Trends: Consolidation expected, particularly among smaller players. xx M&A deals recorded between 2019 and 2024.

France Construction Equipment Market Growth Trends & Insights

The French construction equipment market experienced fluctuating growth between 2019 and 2024, primarily influenced by economic cycles and government spending on infrastructure. However, a steady recovery is projected throughout the forecast period. Adoption rates for new technologies, such as electric and hybrid equipment, are increasing slowly but steadily. Technological disruptions, particularly in automation and digitalization, present both opportunities and challenges. Consumer behavior shifts toward sustainability and preference for rental options are reshaping the market.

- Market Size Evolution: The market grew from xx Million units in 2019 to xx Million units in 2024, exhibiting a CAGR of xx%. It is projected to reach xx Million units by 2033.

- Adoption Rates: Electric/Hybrid adoption is expected to increase from xx% in 2025 to xx% by 2033.

- Technological Disruptions: Automation (e.g., autonomous bulldozers) is projected to drive market transformation over the forecast period.

- Consumer Behavior Shifts: Emphasis on environmental considerations & increasing use of equipment rental services are reshaping the industry.

Dominant Regions, Countries, or Segments in France Construction Equipment Market

The Île-de-France region, due to its high concentration of construction activity and infrastructure projects, represents the largest segment within the French construction equipment market. The Paris metropolitan area alone drives significant demand for earthmoving and material handling equipment. Other regions with robust infrastructure development contribute substantially to market growth. The earthmoving equipment segment, particularly excavators and bulldozers, consistently holds the largest market share.

- Key Drivers: Government investment in infrastructure projects, urbanization, and strong construction activity in Île-de-France.

- Dominance Factors: High construction spending, extensive infrastructure development, and a concentrated population in urban areas.

- Growth Potential: Continuous investment in infrastructure projects promises sustained demand for various equipment types in Île-de-France and other growing regions.

- Market Share: Île-de-France holds approximately xx% market share in 2025, with the earthmoving equipment segment accounting for xx%.

France Construction Equipment Market Product Landscape

The French market shows a diverse product landscape, ranging from traditional hydraulic excavators to technologically advanced electric and hybrid models. Key product innovations include enhanced automation features, improved fuel efficiency, and incorporation of telematics for remote monitoring. Manufacturers emphasize unique selling propositions like enhanced safety features, reduced emissions, and improved operator comfort. Technological advancements focus on improving performance metrics like fuel consumption, productivity, and environmental impact.

Key Drivers, Barriers & Challenges in France Construction Equipment Market

Key Drivers: Government initiatives promoting infrastructure development, rising construction activity in major urban areas, and increasing demand for sustainable construction practices are key drivers. The implementation of the European Green Deal is expected to further accelerate the adoption of electric and hybrid machinery.

Challenges: Supply chain disruptions, particularly of crucial components, are a significant hurdle. Stricter emission regulations increase the cost of compliance for manufacturers. Intense competition from established global players and smaller domestic firms creates a challenging market environment.

Emerging Opportunities in France Construction Equipment Market

The increasing focus on sustainable construction presents substantial opportunities for manufacturers of electric, hybrid, and hydrogen-powered equipment. The growing demand for specialized equipment in niche areas, like demolition and recycling, offers further expansion potential. The adoption of digital technologies, including remote monitoring and predictive maintenance, creates new service opportunities.

Growth Accelerators in the France Construction Equipment Market Industry

Technological breakthroughs in areas such as automation, electrification, and digitalization are driving long-term growth. Strategic partnerships between equipment manufacturers and technology providers are accelerating innovation. Expansion into new market segments, particularly those focused on sustainable construction, offers significant growth opportunities.

Key Players Shaping the France Construction Equipment Market Market

Notable Milestones in France Construction Equipment Market Sector

- October 2022: Liebherr-France SAS receives Bauma Innovation Award for its hydrogen-powered excavator (R 9XX H2). This highlights the market shift toward sustainable equipment.

- February 2023: Hitachi Construction Machinery announces an 8% price increase across its product range in France, reflecting increased material and manufacturing costs.

- June 2023: Liebherr-France SAS invests €170 million (USD 182 million) in a new manufacturing facility in Alsace, signifying commitment to the French market and local supply chain expansion.

In-Depth France Construction Equipment Market Market Outlook

The French construction equipment market is poised for sustained growth driven by continued infrastructure investments, urbanization, and the increasing adoption of sustainable construction practices. The market is expected to witness a shift toward more technologically advanced and environmentally friendly equipment, creating significant opportunities for innovation and market expansion. Strategic partnerships, focused research and development, and a proactive approach to addressing supply chain challenges will be key factors determining success in the coming years.

France Construction Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Earthmoving Equipment

- 1.1.1. Excavators

- 1.1.2. Backhoe Loaders

- 1.1.3. Motor Graders

- 1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

-

1.2. Road Construction Equipment

- 1.2.1. Road Rollers

- 1.2.2. Asphalt Pavers

-

1.3. Material Handling Equipment

- 1.3.1. Cranes

- 1.3.2. Forklift & Telescopic Handlers

- 1.3.3. Other Ma

- 1.4. Other Co

-

1.1. Earthmoving Equipment

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric/Hybrid

France Construction Equipment Market Segmentation By Geography

- 1. France

France Construction Equipment Market Regional Market Share

Geographic Coverage of France Construction Equipment Market

France Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Spending on Construction and Infrastructure Development

- 3.3. Market Restrains

- 3.3.1. High Cost of Replacement and Maintenance

- 3.4. Market Trends

- 3.4.1. Increasing Government Spending on Construction and Infrastructure Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Earthmoving Equipment

- 5.1.1.1. Excavators

- 5.1.1.2. Backhoe Loaders

- 5.1.1.3. Motor Graders

- 5.1.1.4. Other Earthmoving Equipment (Bull Dozers, etc.)

- 5.1.2. Road Construction Equipment

- 5.1.2.1. Road Rollers

- 5.1.2.2. Asphalt Pavers

- 5.1.3. Material Handling Equipment

- 5.1.3.1. Cranes

- 5.1.3.2. Forklift & Telescopic Handlers

- 5.1.3.3. Other Ma

- 5.1.4. Other Co

- 5.1.1. Earthmoving Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric/Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Manitou Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hitachi Construction Machinery

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Takeuchi

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xuzhou Construction Machinery Group (XCMG)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Liebherr

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Toyota Material Handling

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kobelco

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 JCB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Volvo Construction Equipment

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kubota

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hyundai Construction Equipment

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Komatsu

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Yanmar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Konecrane

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Caterpillar

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Manitou Group

List of Figures

- Figure 1: France Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: France Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: France Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: France Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: France Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: France Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: France Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: France Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Construction Equipment Market?

The projected CAGR is approximately 6.25%.

2. Which companies are prominent players in the France Construction Equipment Market?

Key companies in the market include Manitou Group, Hitachi Construction Machinery, Takeuchi, Xuzhou Construction Machinery Group (XCMG), Liebherr, Toyota Material Handling, Kobelco, JCB, Volvo Construction Equipment, Kubota, Hyundai Construction Equipment, Komatsu, Yanmar, Konecrane, Caterpillar.

3. What are the main segments of the France Construction Equipment Market?

The market segments include Equipment Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.69 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Spending on Construction and Infrastructure Development.

6. What are the notable trends driving market growth?

Increasing Government Spending on Construction and Infrastructure Development.

7. Are there any restraints impacting market growth?

High Cost of Replacement and Maintenance.

8. Can you provide examples of recent developments in the market?

June 2023: Liebherr-France SAS, a prominent construction equipment company operating in France, made a significant investment of Euro 170 million (USD 182 million) to establish a state-of-the-art manufacturing facility in Alsace, France. This strategic move aims to enhance and fortify the company's local supply chain infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Construction Equipment Market?

To stay informed about further developments, trends, and reports in the France Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence