Key Insights

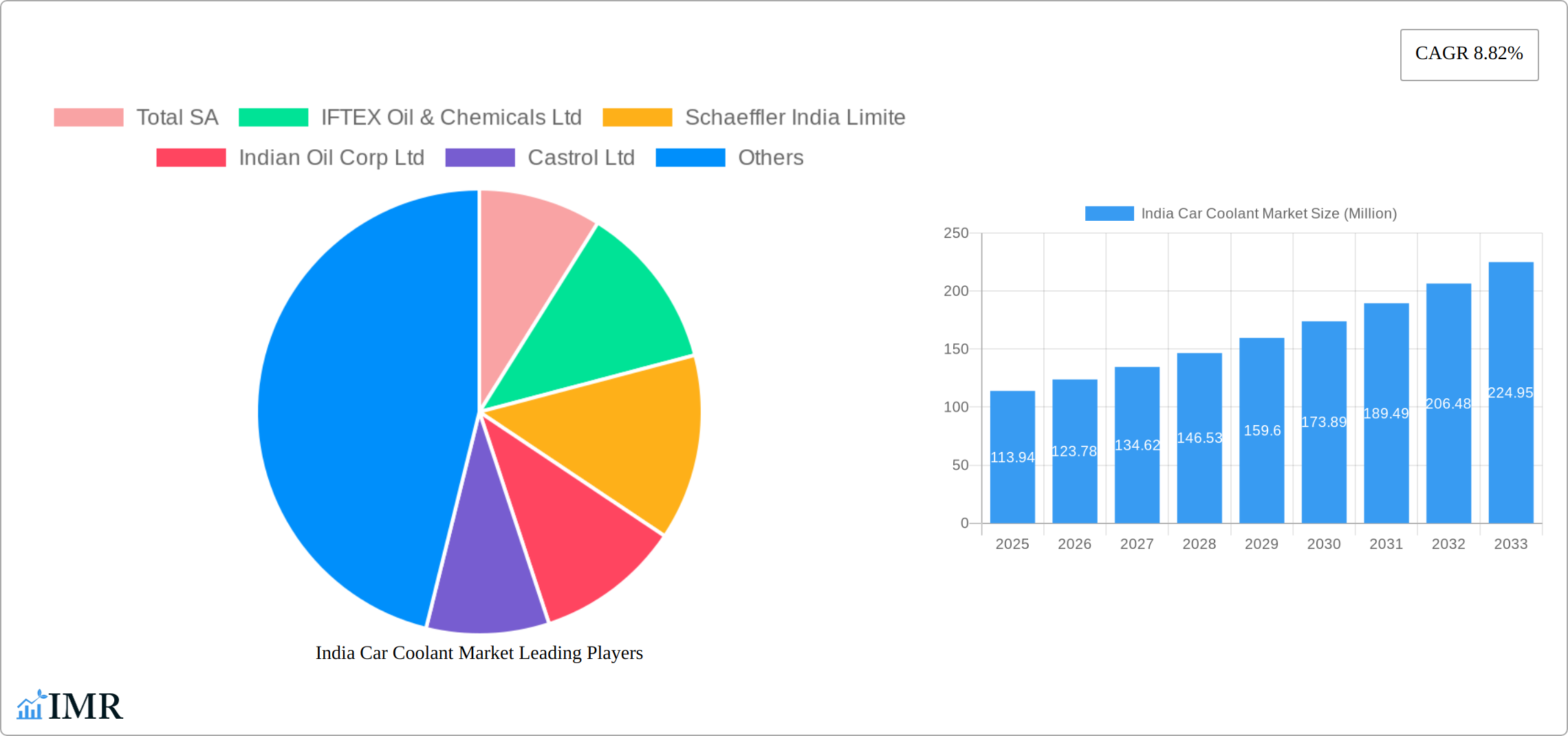

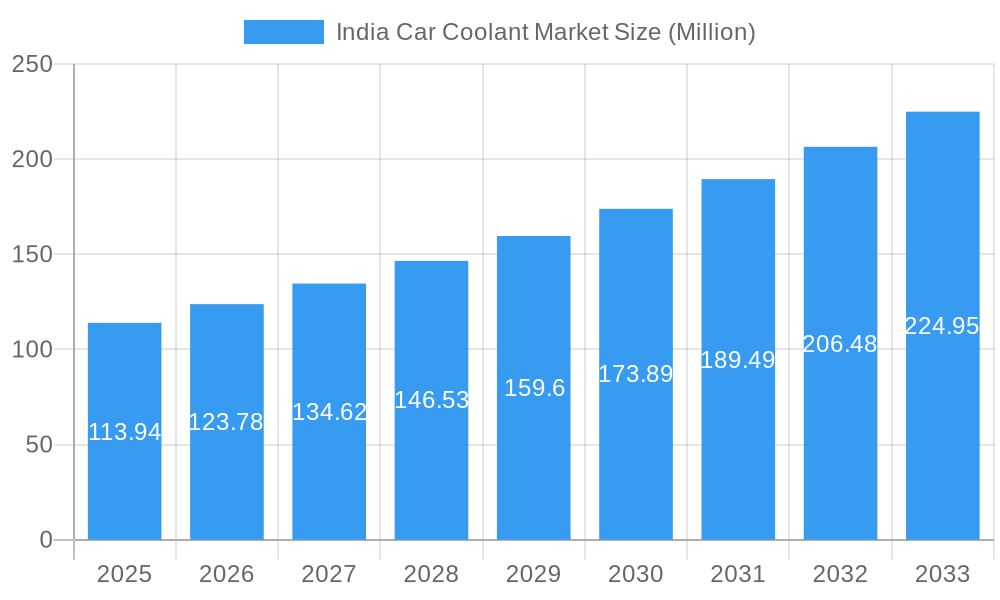

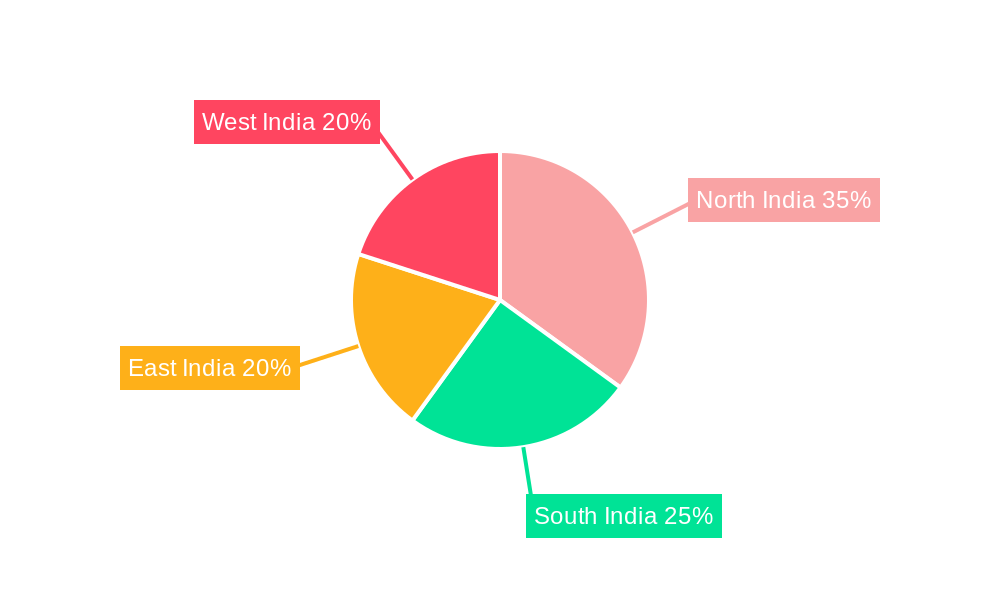

The India car coolant market, valued at $113.94 million in 2025, is poised for robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 8.82% from 2025 to 2033. This expansion is driven by several factors. The burgeoning automotive sector in India, particularly the increasing sales of passenger cars, is a primary catalyst. Higher vehicle ownership necessitates a greater demand for coolant, fueling market expansion. Furthermore, rising awareness regarding the importance of engine maintenance and the detrimental effects of overheating contributes to increased coolant usage and adoption of higher-quality products. Technological advancements in coolant formulations, focusing on improved heat transfer efficiency and extended lifespan, also contribute to market growth. The market is segmented by vehicle type (passenger cars and commercial vehicles) and chemical type (ethylene glycol and propylene glycol), with passenger cars currently holding a larger market share due to higher vehicle sales. Regional variations exist, with North and West India likely exhibiting stronger growth due to higher vehicle density and industrial activity. However, growing infrastructure development and automotive manufacturing in other regions like South and East India present significant opportunities for future expansion. Competitive dynamics are shaped by a mix of multinational corporations and domestic players, each vying for market share through product innovation, distribution networks, and branding strategies.

India Car Coolant Market Market Size (In Million)

The competitive landscape involves established international players like Total SA, Castrol Ltd, ExxonMobil Corp, and Motul, alongside significant domestic players such as Indian Oil Corp Ltd and IFTEX Oil & Chemicals Ltd. These companies are actively engaged in strategies to enhance their market presence, such as launching new product lines tailored to the specific needs of the Indian market, investing in research and development to improve coolant formulations, and expanding their distribution channels to reach a wider customer base. While pricing pressure and the availability of cheaper substitutes could pose challenges, the overall growth trajectory of the Indian automotive sector and the increasing emphasis on vehicle maintenance suggest a positive outlook for the car coolant market throughout the forecast period. The market’s growth will be influenced by factors including government regulations on emissions and fuel efficiency, which indirectly impact coolant technology adoption.

India Car Coolant Market Company Market Share

This comprehensive report provides a detailed analysis of the India car coolant market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and strategists seeking to understand and capitalize on opportunities within this dynamic market. The parent market is the automotive fluids market and the child market is the car coolant segment specifically for India.

India Car Coolant Market Dynamics & Structure

The Indian car coolant market exhibits a moderately concentrated structure, with key players such as Total SA, Castrol Ltd, and ExxonMobil Corp holding significant market share. Technological innovation, driven by the need for enhanced cooling performance and environmental regulations, is a key driver. Stringent emission norms influence the chemical composition of coolants, favoring environmentally friendly formulations like propylene glycol-based coolants. The market is also shaped by the availability of competitive product substitutes, primarily water-based coolants, and evolving end-user demographics, particularly the rise of the middle class and increased car ownership. M&A activity within the automotive fluids sector has been moderate, with approximately xx deals recorded between 2019 and 2024, primarily focusing on expanding distribution networks and product portfolios.

- Market Concentration: Moderately concentrated, with top 5 players holding xx% market share in 2024.

- Technological Innovation: Focus on improved heat transfer, corrosion resistance, and extended lifespan.

- Regulatory Framework: Stringent emission norms driving demand for eco-friendly coolants.

- Competitive Substitutes: Water-based coolants pose a significant competitive threat.

- End-User Demographics: Rising middle class and increased vehicle ownership fueling demand.

- M&A Trends: xx M&A deals between 2019 and 2024, primarily focused on distribution expansion.

India Car Coolant Market Growth Trends & Insights

The India car coolant market witnessed robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributable to several factors, including the expanding automotive sector, rising disposable incomes, and increasing vehicle ownership rates. The market is segmented by vehicle type (passenger cars and commercial vehicles) and chemical type (ethylene glycol and propylene glycol). Passenger cars currently dominate the market, accounting for xx% of total volume in 2024, while ethylene glycol-based coolants hold the larger market share due to their cost-effectiveness. Technological disruptions, such as the introduction of electric vehicles, are expected to influence the market's trajectory, leading to increased demand for specialized e-thermal fluids. Consumer behavior is shifting towards premium coolants offering enhanced performance and longevity. Market penetration of propylene glycol coolants is expected to increase in the forecast period due to environmental concerns. The market is projected to reach xx Million units by 2025 and further expand to xx Million units by 2033, with a CAGR of xx% during the forecast period (2025-2033).

Dominant Regions, Countries, or Segments in India Car Coolant Market

The Indian car coolant market is significantly shaped by the dominance of passenger cars, fueled by a consistent rise in personal vehicle ownership, particularly in metropolitan and Tier-1 cities. This surge is underpinned by increasing disposable incomes and a growing aspiration for personal mobility. Complementing this, the commercial vehicles segment is experiencing robust expansion, directly correlated with the burgeoning logistics and transportation sectors, which are critical for India's economic growth. The demand for efficient supply chains and increased freight movement directly translates to a higher need for effective engine cooling solutions in trucks, buses, and other commercial fleets.

In terms of chemical composition, ethylene glycol coolants continue to command a larger market share primarily due to their cost-effectiveness and established performance profiles. However, there is a discernible and growing trend towards propylene glycol coolants. This shift is being propelled by increasingly stringent environmental regulations and a heightened awareness of sustainability among consumers and manufacturers alike. Propylene glycol offers superior environmental benefits and enhanced performance characteristics, including lower toxicity and better heat transfer properties, making it an attractive alternative for those seeking premium and eco-conscious solutions.

The overarching growth trajectory of the India car coolant market is further bolstered by several key drivers::

- Favorable Government Policies: Initiatives like 'Make in India' and production-linked incentive (PLI) schemes are actively promoting domestic vehicle manufacturing, leading to an increased production of vehicles that require coolants.

- Infrastructure Development: Extensive investments in road networks and transportation infrastructure facilitate increased vehicle usage, consequently driving the demand for maintenance products like coolants.

- Rapid Urbanization: The continuous migration to urban centers leads to a denser population and higher vehicle density, creating a substantial and concentrated market for automotive fluids.

- Passenger Cars: This segment is the cornerstone of the market, propelled by the aspirational rise in personal mobility and a growing middle class.

- Commercial Vehicles: A key growth engine driven by the expanding e-commerce sector, robust trade activities, and the need for reliable transportation fleets.

- Ethylene Glycol: Retains a significant market share owing to its economical pricing, making it the go-to option for mass-market vehicles.

- Propylene Glycol: Witnessing increasing adoption driven by environmental consciousness and the demand for advanced, safer, and more efficient coolant formulations.

- Key Drivers: A synergistic combination of supportive government policies, significant investments in national infrastructure, and ongoing urbanization are collectively fueling market expansion.

India Car Coolant Market Product Landscape

The India car coolant market offers a range of products, from conventional ethylene glycol-based coolants to advanced formulations incorporating additives for enhanced corrosion protection and freeze/boil protection. Technological advancements focus on improving heat transfer efficiency, extending coolant lifespan, and reducing environmental impact. Unique selling propositions include longer service intervals, improved engine protection, and eco-friendly compositions. The market is witnessing an increasing demand for pre-mixed coolants that offer convenience and reduce the risk of incorrect mixing ratios.

Key Drivers, Barriers & Challenges in India Car Coolant Market

Key Drivers:

- Rising Vehicle Sales and Increased Car Ownership: India's burgeoning automotive sector, with consistent year-on-year growth in both new vehicle registrations and the existing car parc, directly translates to a larger addressable market for coolants. The increasing disposable incomes and evolving consumer preferences further accelerate this trend.

- Stringent Emission Norms Promoting Eco-Friendly Coolants: As India aligns with global standards for vehicular emissions (e.g., BS-VI norms), there's a growing impetus to adopt advanced engine technologies and associated fluids. This includes a shift towards coolants that are less harmful to the environment, thereby encouraging the use of more sustainable formulations like propylene glycol-based coolants.

- Growing Demand for Higher-Performance Coolants from both OEMs and Aftermarket: Both Original Equipment Manufacturers (OEMs) and the aftermarket are increasingly seeking coolants that offer superior protection against corrosion, enhance heat dissipation, and provide longer service intervals. This demand is driven by the need for improved engine efficiency, durability, and reduced maintenance costs.

Barriers:

- Price Sensitivity and Availability of Alternatives: A significant portion of the Indian market remains price-sensitive, making it challenging for premium coolants to gain immediate traction. The widespread availability of cheaper, albeit less advanced, alternatives also poses a barrier to the adoption of higher-end products.

- Lack of Consumer Awareness and Proper Maintenance Practices: A substantial segment of vehicle owners may not fully understand the critical role of coolant in engine health or adhere to recommended maintenance schedules. This often leads to the use of incorrect coolants, improper dilution, or delayed replacements, impacting engine longevity and performance.

Challenges:

- Fluctuations in Raw Material Prices, Particularly Ethylene Glycol: The volatile global prices of key raw materials like ethylene glycol can significantly impact the production costs and profitability of coolant manufacturers. This necessitates agile supply chain management and hedging strategies.

- Intense Competition Among Established and Emerging Players: The Indian car coolant market is characterized by a highly competitive landscape, featuring both well-established global brands and numerous domestic players. This intense rivalry can lead to price wars and pressure on profit margins.

- Counterfeit Products Impacting Market Quality and Consumer Trust: The proliferation of counterfeit or substandard coolant products poses a significant threat to the market's integrity and consumer confidence. These products often fail to meet performance standards, leading to engine damage and safety concerns. This has a measurable impact on market value, estimated at a ~7-10% loss annually in 2024 due to compromised quality and lost revenue.

Emerging Opportunities in India Car Coolant Market

- Growing Demand for Specialized Coolants for Electric and Hybrid Vehicles: The rapid adoption of electric vehicles (EVs) and hybrid vehicles presents a significant new frontier. These vehicles have distinct thermal management requirements, necessitating specialized coolants that can efficiently handle higher operating temperatures and protect sensitive electronic components.

- Increasing Awareness of the Importance of Coolant Maintenance Among Consumers: As vehicle owners become more informed about vehicle care and the long-term benefits of proper maintenance, there's a growing opportunity for coolant brands to educate consumers about their product's value and the critical role of regular coolant checks and replacements. This can be driven through targeted marketing campaigns and service partnerships.

- Potential for Expansion into the Rural Market with Focused Distribution Strategies: While urban centers are saturated, the vast rural landscape in India represents a significant untapped market. Developing cost-effective products and implementing tailored distribution networks, possibly through partnerships with local mechanics and agricultural outlets, can unlock substantial growth potential in these areas.

- Development of Biodegradable and Extended Life Coolants: Driven by global environmental trends and stricter regulations, there is a growing market for coolants that are not only effective but also environmentally friendly, such as biodegradable formulations. Furthermore, extended life coolants that offer longer service intervals appeal to consumers looking for reduced maintenance frequency and cost savings.

Growth Accelerators in the India Car Coolant Market Industry

The long-term growth of the India car coolant market will be fueled by technological advancements in coolant formulations, strategic partnerships between coolant manufacturers and automotive OEMs, and expansion into new markets. The development of coolants tailored for electric and hybrid vehicles will create significant new opportunities. Moreover, the increased focus on after-market sales through wider distribution networks will contribute to market growth.

Key Players Shaping the India Car Coolant Market Market

- Total SA

- IFTEX Oil & Chemicals Ltd

- Schaeffler India Limite

- Indian Oil Corp Ltd

- Castrol Ltd

- Voltronic GmbH

- Motul

- Valvoline LLC

- ExxonMobil Corp

- Euroils

Notable Milestones in India Car Coolant Market Sector

- August 2022: Shell Lubricants launched e-thermal fluids for electric vehicles in India. This signals a shift towards specialized coolants for the burgeoning EV market.

- March 2023: ExxonMobil announced plans to build its first lubricant blending plant in India, indicating confidence in the market's growth potential and a commitment to local manufacturing.

In-Depth India Car Coolant Market Market Outlook

The India car coolant market is poised for sustained growth in the coming years, driven by a combination of factors including rising vehicle sales, increasing demand for premium coolants, and the emergence of electric vehicles. Strategic partnerships and technological advancements will further accelerate market expansion. Opportunities exist for companies to focus on developing eco-friendly formulations, expanding distribution networks, and capitalizing on the growing aftermarket segment. The market's long-term prospects remain positive, with significant potential for both established players and new entrants.

India Car Coolant Market Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicles

-

2. Chemical Type

- 2.1. Ethylene Glycol

- 2.2. Propylene Glycol

India Car Coolant Market Segmentation By Geography

- 1. India

India Car Coolant Market Regional Market Share

Geographic Coverage of India Car Coolant Market

India Car Coolant Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.82% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Vehicle Production

- 3.3. Market Restrains

- 3.3.1. Increasing Environmental Concerns and Regulations

- 3.4. Market Trends

- 3.4.1. Increasing Investment in the Automobile Sector in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Car Coolant Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicles

- 5.2. Market Analysis, Insights and Forecast - by Chemical Type

- 5.2.1. Ethylene Glycol

- 5.2.2. Propylene Glycol

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Total SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IFTEX Oil & Chemicals Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schaeffler India Limite

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Indian Oil Corp Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Castrol Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Voltronic GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Motul

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Valvoline LLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ExxonMobil Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Euroils

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Total SA

List of Figures

- Figure 1: India Car Coolant Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Car Coolant Market Share (%) by Company 2025

List of Tables

- Table 1: India Car Coolant Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 2: India Car Coolant Market Revenue Million Forecast, by Chemical Type 2020 & 2033

- Table 3: India Car Coolant Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Car Coolant Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 5: India Car Coolant Market Revenue Million Forecast, by Chemical Type 2020 & 2033

- Table 6: India Car Coolant Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Car Coolant Market?

The projected CAGR is approximately 8.82%.

2. Which companies are prominent players in the India Car Coolant Market?

Key companies in the market include Total SA, IFTEX Oil & Chemicals Ltd, Schaeffler India Limite, Indian Oil Corp Ltd, Castrol Ltd, Voltronic GmbH, Motul, Valvoline LLC, ExxonMobil Corp, Euroils.

3. What are the main segments of the India Car Coolant Market?

The market segments include Vehicle Type, Chemical Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 113.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Vehicle Production.

6. What are the notable trends driving market growth?

Increasing Investment in the Automobile Sector in the Country.

7. Are there any restraints impacting market growth?

Increasing Environmental Concerns and Regulations.

8. Can you provide examples of recent developments in the market?

March 2023: ExxonMobil decided to build its first lubricant blending plant in India to meet the augmenting demand.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Car Coolant Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Car Coolant Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Car Coolant Market?

To stay informed about further developments, trends, and reports in the India Car Coolant Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence