Key Insights

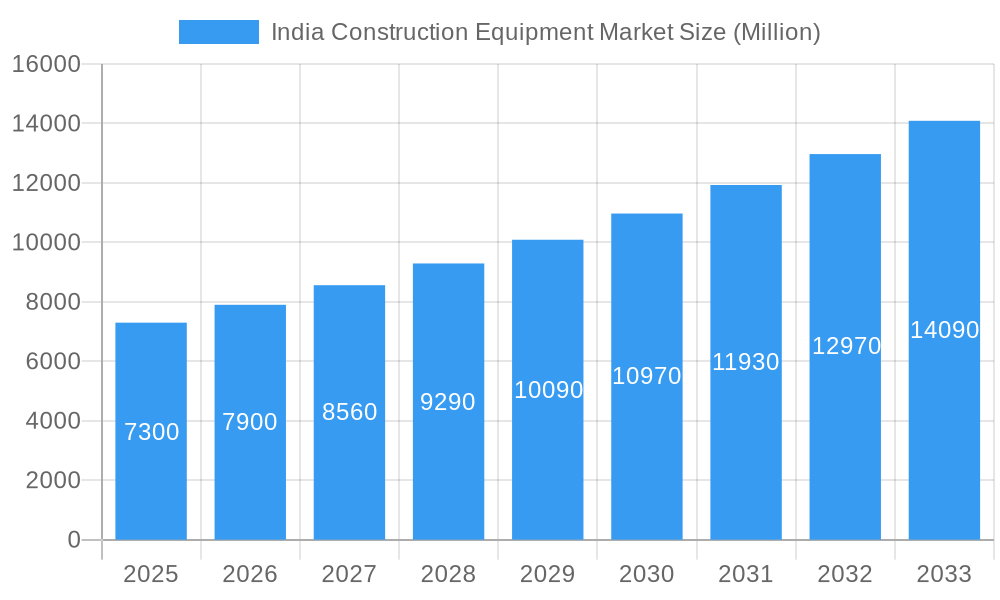

The India construction equipment market is experiencing robust growth, projected to reach a market size of $7.30 billion in 2025, expanding at a compound annual growth rate (CAGR) of 8.30% from 2025 to 2033. This significant expansion is driven by several key factors. India's ongoing infrastructure development initiatives, including the ambitious "Bharat Mala" project and smart city programs, are fueling substantial demand for earthmoving, material handling, and concrete equipment. The government's focus on affordable housing and industrial growth further contributes to this positive market outlook. Technological advancements, such as the adoption of electric/hybrid equipment and advanced construction techniques, are also shaping market trends. However, factors such as fluctuating raw material prices, supply chain disruptions, and the impact of global economic conditions pose potential restraints to the market's growth trajectory. The market is segmented by equipment type (earthmoving & road construction, material handling, concrete, material processing) and drive type (hydraulic, electric/hybrid), offering diverse investment opportunities across various segments. Regional variations exist, with North and West India likely demonstrating strong growth due to concentrated infrastructure development in these regions. Major players, including XCMG, Liebherr, Kobelco, and Caterpillar, are actively competing in this dynamic market.

India Construction Equipment Market Market Size (In Billion)

The competitive landscape is characterized by both domestic and international players, leading to fierce competition. The increasing demand for specialized equipment, such as articulated boom lifts and concrete pumps, presents growth opportunities for manufacturers. Furthermore, the focus on improving construction efficiency and reducing environmental impact is driving the adoption of technologically advanced, eco-friendly equipment, which represents a key trend for future market growth. While challenges exist, the long-term outlook for the India construction equipment market remains positive, driven by sustained government investment and a robust private sector participation in infrastructure and construction activities. The continued urbanization and industrialization within India will further fuel demand for construction equipment across various segments and regions.

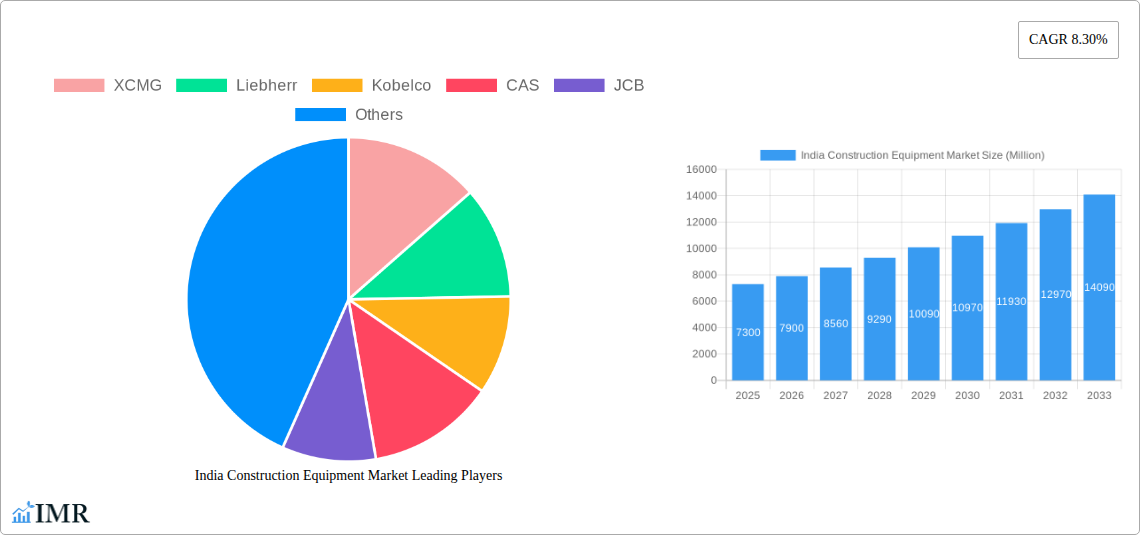

India Construction Equipment Market Company Market Share

This comprehensive report provides an in-depth analysis of the India construction equipment market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by equipment type (earthmoving & road construction, material handling, concrete equipment, material processing) and drive type (hydraulic, electric/hybrid). The report leverages extensive market research to deliver actionable insights for industry professionals. Expected market size values are presented in million units.

India Construction Equipment Market Dynamics & Structure

The Indian construction equipment market is characterized by moderate concentration, with several multinational and domestic players vying for market share. Technological innovation, particularly in areas like automation and emission reduction, is a key driver, while stringent regulatory frameworks concerning environmental standards and safety are shaping market practices. The availability of substitute technologies (e.g., manual labor for smaller projects) influences adoption, particularly in less developed regions. The market's end-user demographic spans large-scale infrastructure projects, real estate developers, and smaller contractors. M&A activity has been moderate, with strategic acquisitions focused on expanding product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Driven by automation, digitalization, and emission control technologies. Barriers include high R&D costs and infrastructure limitations.

- Regulatory Framework: Stringent emission norms and safety standards influence product development and adoption.

- Competitive Product Substitutes: Manual labor remains a significant competitor, especially in smaller projects.

- End-User Demographics: Diverse, including large infrastructure projects, real estate developers, and small contractors.

- M&A Trends: Moderate activity, primarily focused on strategic acquisitions and expansion. Approximately xx M&A deals were recorded between 2019 and 2024.

India Construction Equipment Market Growth Trends & Insights

The Indian construction equipment market witnessed significant growth during the historical period (2019-2024), driven by robust infrastructure development initiatives and increased private sector investment in real estate. The market experienced a CAGR of xx% during this period, reaching a market size of xx million units in 2024. This growth is expected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, driven by government initiatives like the Smart Cities Mission and the Bharatmala Project. Adoption rates are highest in urban areas and for technologically advanced equipment. Technological disruptions, especially the adoption of electric and hybrid equipment, are transforming the market landscape. Consumer behavior is shifting towards greater preference for fuel-efficient, environmentally friendly, and technologically advanced machines. The market is projected to reach xx million units by 2033, with a projected CAGR of xx% from 2025 to 2033. Market penetration remains relatively low in certain rural areas.

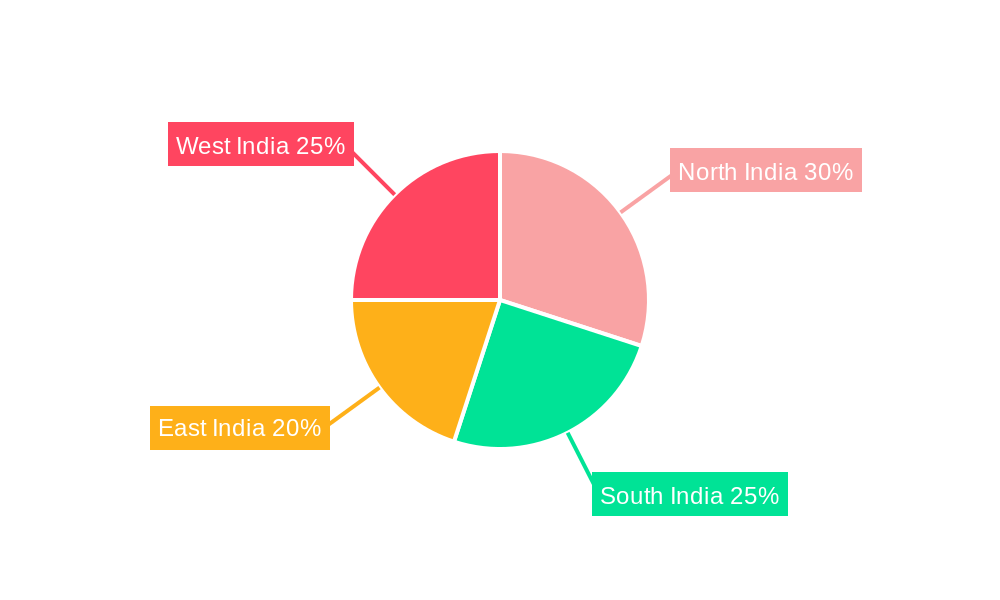

Dominant Regions, Countries, or Segments in India Construction Equipment Market

The Indian construction equipment market is geographically diverse, with significant variations in growth rates across different regions. However, urbanized regions and states witnessing significant infrastructure development, such as Maharashtra, Tamil Nadu, and Gujarat, dominate the market. Within the equipment type segments, earthmoving and road construction equipment consistently holds the largest market share, driven by ongoing infrastructure projects. The hydraulic drive type dominates the market currently but electric/hybrid segments are projected for strong growth in the coming years due to environmental concerns and policy shifts.

- Key Growth Drivers: Government infrastructure projects (Smart Cities, Bharatmala), rising private sector investment, urbanization.

- Dominant Regions: Maharashtra, Tamil Nadu, Gujarat, and other urbanized centers.

- Leading Segment: Earthmoving and road construction equipment, followed by material handling equipment.

- Market Share: Earthmoving and road construction equipment holds approximately xx% market share in 2024.

- Growth Potential: Electric/hybrid drive type is poised for significant growth due to environmental regulations and technological advancements.

India Construction Equipment Market Product Landscape

The Indian construction equipment market offers a diverse range of products, encompassing excavators, loaders, cranes, bulldozers, and other specialized machinery. Recent innovations focus on enhanced fuel efficiency, improved safety features, and automation capabilities. Product applications vary widely across infrastructure, mining, and real estate sectors. Key performance indicators (KPIs) include fuel consumption, operational efficiency, and uptime. Unique selling propositions often include advanced telematics systems, remote diagnostics, and customized solutions for specific applications. Technological advancements are particularly notable in the adoption of electric and hybrid drive systems, as well as automation and AI-powered features.

Key Drivers, Barriers & Challenges in India Construction Equipment Market

Key Drivers:

- Robust government infrastructure spending.

- Increased private sector investments in real estate and construction.

- Growing urbanization and industrialization.

- Technological advancements leading to improved efficiency and productivity.

Key Challenges & Restraints:

- High initial investment costs for advanced equipment.

- Fluctuations in raw material prices and fuel costs.

- Supply chain disruptions impacting equipment availability.

- Stringent emission norms and regulatory compliance requirements.

- Intense competition from both domestic and international players. This competition has led to price pressures and reduced profit margins in certain segments. The approximate impact is xx% reduction in average profit margins for 2024.

Emerging Opportunities in India Construction Equipment Market

- Growing demand for sustainable and eco-friendly equipment.

- Expanding adoption of technologically advanced equipment, such as automated and robotic systems.

- Untapped potential in rural infrastructure development projects.

- Increasing demand for rental services and equipment financing options.

- Opportunities in specialized equipment segments for niche applications (e.g., mining, tunneling).

Growth Accelerators in the India Construction Equipment Market Industry

The long-term growth of the Indian construction equipment market is poised to be propelled by sustained government investments in infrastructure projects, coupled with technological innovations promoting efficiency and sustainability. Strategic partnerships between domestic and international players are fostering technology transfer and market penetration. Expansion into previously underserved rural markets and the development of innovative financing models will further accelerate market expansion. The increasing emphasis on sustainable construction practices is driving demand for eco-friendly equipment, representing a significant growth opportunity.

Key Players Shaping the India Construction Equipment Market Market

- XCMG

- Liebherr

- Kobelco

- CAS

- JCB

- Volvo Construction Equipment

- Zoomlion

- Hyundai Construction Equipment

- Tata Hitachi Construction Machinery

- Komatsu

- Action Construction Equipment

- BEML

- Caterpillar

- SANY

- Terex

Notable Milestones in India Construction Equipment Market Sector

- September 2022: Schwing Stetter India launched a new range of XCMG hydraulic excavators and wheel loaders.

- January 2023: Komatsu India launched bio-diesel compatible off-highway trucks.

- February 2023: Volvo Construction Equipment launched its first electric compact excavator, the EC55, in India.

- February 2023: XCMG showcased six new customized products at ConExpo India, receiving nearly 100 pre-sale orders.

- August 2023: SANY India delivered 8 units of the SANY SCC7500A 750 Ton crawler cranes to Sanghvi Movers Limited.

In-Depth India Construction Equipment Market Market Outlook

The future of the Indian construction equipment market appears promising, driven by sustained infrastructure development, technological advancements, and increasing private sector investment. Opportunities abound in the adoption of sustainable equipment, automation, and digital technologies. Strategic partnerships and the development of robust supply chains will be crucial for continued growth. The market is expected to experience significant expansion, driven by both government and private sector initiatives, leading to considerable growth in the coming years.

India Construction Equipment Market Segmentation

-

1. Equipment Type

-

1.1. Earthmoving and Road Construction Equipment

- 1.1.1. Excavator

- 1.1.2. Backhoe Loader

- 1.1.3. Wheeled Loader

- 1.1.4. Motor Grader

- 1.1.5. Other Ea

-

1.2. Material Handling Equipment

- 1.2.1. Crane

- 1.2.2. Forklift & Telescopic Handler

- 1.2.3. Other Ma

-

1.3. Concrete Equipment

- 1.3.1. Asphalt Finishers

- 1.3.2. Transit Mixers

- 1.3.3. Other Co

- 1.4. Material Processing Equipment (Crushing Equipment)

-

1.1. Earthmoving and Road Construction Equipment

-

2. Drive Type

- 2.1. Hydraulic

- 2.2. Electric/Hybrid

India Construction Equipment Market Segmentation By Geography

- 1. India

India Construction Equipment Market Regional Market Share

Geographic Coverage of India Construction Equipment Market

India Construction Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Government Spending on Construction and Infrastructure Development; Others

- 3.3. Market Restrains

- 3.3.1. High Cost Associated with Maintaining and Replacing Construction Equipment

- 3.4. Market Trends

- 3.4.1. Increasing Government Spending on Construction and Infrastructure Development

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Construction Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Earthmoving and Road Construction Equipment

- 5.1.1.1. Excavator

- 5.1.1.2. Backhoe Loader

- 5.1.1.3. Wheeled Loader

- 5.1.1.4. Motor Grader

- 5.1.1.5. Other Ea

- 5.1.2. Material Handling Equipment

- 5.1.2.1. Crane

- 5.1.2.2. Forklift & Telescopic Handler

- 5.1.2.3. Other Ma

- 5.1.3. Concrete Equipment

- 5.1.3.1. Asphalt Finishers

- 5.1.3.2. Transit Mixers

- 5.1.3.3. Other Co

- 5.1.4. Material Processing Equipment (Crushing Equipment)

- 5.1.1. Earthmoving and Road Construction Equipment

- 5.2. Market Analysis, Insights and Forecast - by Drive Type

- 5.2.1. Hydraulic

- 5.2.2. Electric/Hybrid

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 XCMG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Liebherr

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kobelco

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CAS

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 JCB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Volvo Construction Equipment

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Zoomlion

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hyundai Construction Equipment

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tata Hitachi Construction Machinery

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Komatsu

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Action Construction Equipment

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BEML

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Caterpillar

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 SANY

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Terex

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 XCMG

List of Figures

- Figure 1: India Construction Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Construction Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: India Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: India Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 3: India Construction Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Construction Equipment Market Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: India Construction Equipment Market Revenue Million Forecast, by Drive Type 2020 & 2033

- Table 6: India Construction Equipment Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Construction Equipment Market?

The projected CAGR is approximately 8.30%.

2. Which companies are prominent players in the India Construction Equipment Market?

Key companies in the market include XCMG, Liebherr, Kobelco, CAS, JCB, Volvo Construction Equipment, Zoomlion, Hyundai Construction Equipment, Tata Hitachi Construction Machinery, Komatsu, Action Construction Equipment, BEML, Caterpillar, SANY, Terex.

3. What are the main segments of the India Construction Equipment Market?

The market segments include Equipment Type, Drive Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Government Spending on Construction and Infrastructure Development; Others.

6. What are the notable trends driving market growth?

Increasing Government Spending on Construction and Infrastructure Development.

7. Are there any restraints impacting market growth?

High Cost Associated with Maintaining and Replacing Construction Equipment.

8. Can you provide examples of recent developments in the market?

August 2023: SANY India, a leading manufacturer of construction equipment, announced the delivery of 8 units of the SANY SCC7500A 750 Ton crawler cranes in the first quarter of the financial year 2023-24, to Sanghvi Movers Limited, one of the largest crane rental company in India.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Construction Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Construction Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Construction Equipment Market?

To stay informed about further developments, trends, and reports in the India Construction Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence