Key Insights

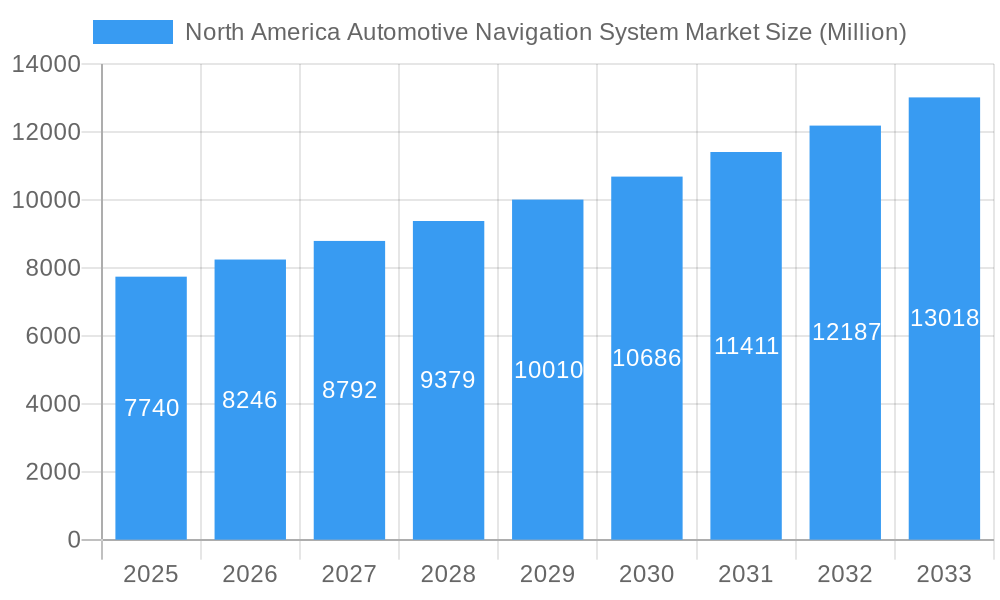

The North America automotive navigation system market, valued at $7.74 billion in 2025, is projected to experience robust growth, driven by increasing vehicle production, rising consumer demand for advanced driver-assistance systems (ADAS), and the integration of navigation systems with infotainment and connectivity features. The market's Compound Annual Growth Rate (CAGR) of 6.50% from 2025 to 2033 indicates a significant expansion. This growth is fueled by several key factors: the increasing adoption of connected cars, offering real-time traffic updates and improved route optimization; the rising popularity of smartphones and their seamless integration with in-car navigation systems; and the continuous advancements in mapping technology, providing more accurate and detailed navigation data. The increasing prevalence of autonomous driving features also indirectly contributes to the market's growth, as navigation systems become critical components of these systems. The OEM segment currently dominates the market, largely due to factory installations in new vehicles, but the aftermarket segment is poised for significant growth, driven by the increasing demand for upgrades and replacements in older vehicles. Passenger vehicles currently constitute the larger share of the market, but commercial vehicles are expected to witness increasing adoption due to logistical requirements. Within North America, the United States holds the largest market share due to higher vehicle sales and strong technological adoption.

North America Automotive Navigation System Market Market Size (In Billion)

Growth will be influenced by factors such as technological advancements in navigation technologies (e.g., augmented reality navigation), government regulations promoting road safety and autonomous driving, and the availability of high-speed internet connectivity. However, potential restraints include the increasing prevalence of smartphone navigation apps which offer free or low-cost alternatives and the challenges associated with accurate map data updates and maintenance in remote areas. The competitive landscape is characterized by major players such as Denso, Alpine, TomTom, and Bosch, constantly striving to offer innovative features and improve the user experience. The market segmentation by sales channel (OEM vs. Aftermarket), vehicle type (Passenger vs. Commercial), and country (US, Canada, Rest of North America) provides a detailed understanding of the market's diverse aspects, offering valuable insights for strategic decision-making by stakeholders.

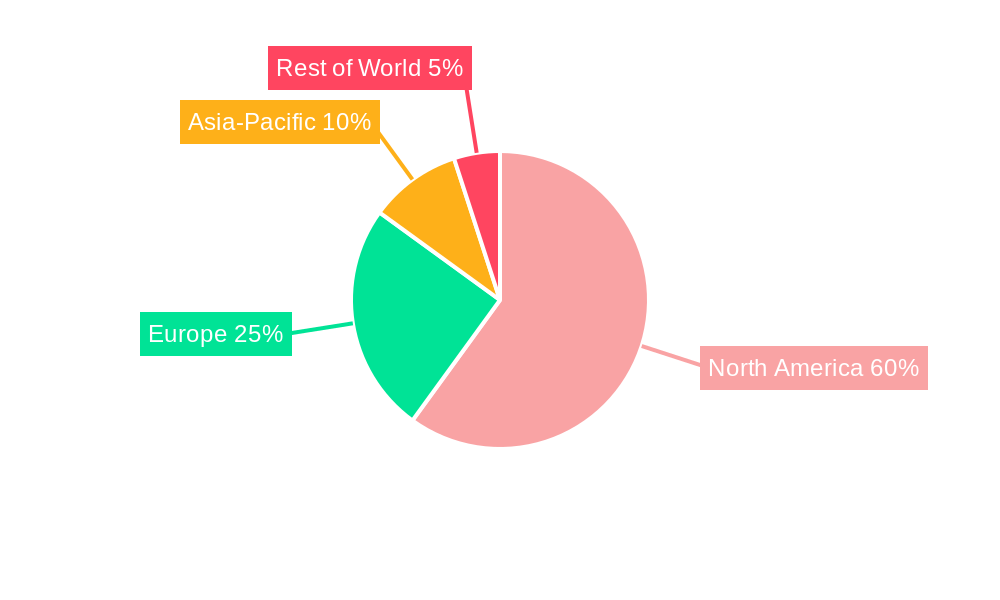

North America Automotive Navigation System Market Company Market Share

North America Automotive Navigation System Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America automotive navigation system market, covering the period from 2019 to 2033. It delves into market dynamics, growth trends, regional performance, key players, and future opportunities, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report segments the market by sales channel (OEM and Aftermarket), vehicle type (passenger vehicles and commercial cars), and country (United States, Canada, and Rest of North America). Market size is presented in million units.

North America Automotive Navigation System Market Dynamics & Structure

The North American automotive navigation system market exhibits a moderately consolidated structure, with several major players commanding significant market share. However, the emergence of innovative startups and technological advancements is fostering increased competition. Technological innovation, particularly in AI-powered navigation and integration with advanced driver-assistance systems (ADAS), is a key growth driver. Stringent government regulations concerning safety and data privacy are shaping market dynamics, while the availability of alternative navigation solutions (e.g., smartphone apps) presents a competitive challenge. The market is witnessing significant M&A activity, with larger players strategically acquiring smaller companies to expand their product portfolios and enhance their technological capabilities.

- Market Concentration: Moderately Consolidated (xx% market share held by top 5 players in 2024)

- Technological Innovation Drivers: AI-powered navigation, integration with ADAS, enhanced mapping capabilities.

- Regulatory Frameworks: Safety standards, data privacy regulations (e.g., CCPA, GDPR implications).

- Competitive Product Substitutes: Smartphone navigation apps, cloud-based services.

- End-User Demographics: Increasing adoption among younger demographics, higher demand in urban areas.

- M&A Trends: Significant increase in M&A activity in the last 5 years (xx deals completed between 2019-2024). Larger players acquiring smaller technology focused companies.

North America Automotive Navigation System Market Growth Trends & Insights

The North American automotive navigation system market experienced robust growth during the historical period (2019-2024), driven by increasing vehicle sales, rising disposable incomes, and the growing adoption of advanced in-vehicle infotainment systems. The market is projected to continue its expansion throughout the forecast period (2025-2033), although at a slightly moderated pace. Technological disruptions, such as the integration of AI and machine learning, are transforming consumer expectations and driving the demand for more sophisticated navigation solutions. Shifting consumer preferences towards connected cars and the increasing demand for enhanced safety features are further fueling market growth.

- Market Size (Million Units): 2019: xx, 2024: xx, 2025 (Estimated): xx, 2033 (Forecast): xx

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2024, projected to reach xx% by 2033.

- Key Growth Drivers: Increasing vehicle sales, rising adoption of connected car technologies, demand for advanced safety features.

Dominant Regions, Countries, or Segments in North America Automotive Navigation System Market

The United States dominates the North American automotive navigation system market, accounting for the largest market share due to its large vehicle sales volume, high technological adoption rate, and presence of major automotive manufacturers. The OEM sales channel holds a significantly larger share compared to the aftermarket, reflecting the increasing integration of navigation systems as standard features in new vehicles. Passenger vehicles account for the largest segment within the vehicle type category due to higher demand for advanced infotainment systems.

- Leading Region: United States

- Dominant Sales Channel: Original Equipment Manufacturer (OEM)

- Largest Vehicle Type Segment: Passenger Vehicles

- Key Drivers in the US: Strong automotive manufacturing base, high consumer spending on vehicle technology.

- Growth Potential in Canada: Increasing vehicle sales and government initiatives supporting connected car technologies.

North America Automotive Navigation System Market Product Landscape

The automotive navigation system market offers a wide range of products, from basic GPS navigation units to advanced systems integrating AI, augmented reality (AR), and voice control. Innovations focus on improving accuracy, enhancing user experience, and integrating with other vehicle systems. Unique selling propositions include real-time traffic updates, personalized route suggestions, and seamless integration with smartphone applications. Technological advancements center around improved map data, more intuitive user interfaces, and advanced driver-assistance capabilities.

Key Drivers, Barriers & Challenges in North America Automotive Navigation System Market

Key Drivers: The proliferation of connected car technologies continues to be a dominant force, driven by a growing consumer appetite for enhanced safety, convenience, and entertainment features. The widespread availability and increasing speeds of cellular and Wi-Fi networks are critical enablers for these advanced systems. Furthermore, evolving government mandates for integrated safety features, such as real-time hazard alerts and dynamic route planning, are acting as significant growth catalysts. The integration of subscription-based services offering real-time traffic updates, points of interest (POI) data, and over-the-air (OTA) updates further bolsters demand.

Key Barriers & Challenges: The substantial upfront cost associated with high-fidelity, integrated automotive navigation systems remains a considerable barrier for some consumer segments. Persistent concerns surrounding the security of sensitive user data and location privacy necessitate robust encryption and transparent data handling policies. The ubiquity and decreasing cost of sophisticated smartphone navigation applications present a strong competitive alternative, forcing OEMs to differentiate their in-car offerings. Lingering supply chain vulnerabilities, coupled with the intricate task of seamlessly integrating navigation systems with a growing array of vehicle electronics and ADAS (Advanced Driver-Assistance Systems), pose ongoing technical and logistical hurdles. Intense competition from both established Tier-1 suppliers and agile tech newcomers necessitates continuous innovation and value proposition refinement.

Emerging Opportunities in North America Automotive Navigation System Market

The landscape is ripe with opportunities for the development and integration of next-generation navigation solutions. The incorporation of artificial intelligence (AI) and machine learning (ML) promises highly personalized and predictive routing, anticipating user needs and preferences. Augmented reality (AR) overlays, projecting navigation cues and hazard information directly onto the windshield or camera feed, are poised to revolutionize driver awareness and reduce cognitive load. The expansion of advanced driver-assistance systems (ADAS) creates a synergy where navigation systems can actively contribute to vehicle safety, providing context-aware recommendations for adaptive cruise control and lane keeping. Untapped potential lies in serving underserved markets, including rural areas with limited connectivity and older demographics who may benefit from simplified and intuitive interfaces. The burgeoning electric vehicle (EV) market presents a unique avenue for specialized navigation, focusing on real-time battery range estimation, intelligent charging station identification, and optimized charging stop planning.

Growth Accelerators in the North America Automotive Navigation System Market Industry

The North American automotive navigation system market is experiencing accelerated growth fueled by strategic collaborations. Partnerships between automotive manufacturers, leading technology firms, and specialized mapping data providers are crucial for co-developing and integrating cutting-edge solutions. Continuous technological advancements, particularly in AI, ML, and the rollout of 5G networks, are enabling the creation of more intelligent, responsive, and feature-rich navigation experiences. The strategic expansion into new vehicle segments and the development of innovative applications, such as personalized route optimization based on driving style, environmental factors, and real-time event data, alongside immersive AR visualization capabilities, are paving the way for sustained long-term growth and market penetration.

Key Players Shaping the North America Automotive Navigation System Market Market

- Denso Corporation

- Alps Alpine Co Ltd

- TomTom International BV

- Aptiv PLC

- Harman International (A Samsung Company)

- Robert Bosch GmbH

- Marelli Holdings Co Ltd

- what3words Ltd

- Faurecia Clarion Electronics Co Ltd

- Pioneer Corporation

- Panasonic Holdings Corporation

- Alpine Electronics

- Google LLC (Android Automotive)

- Apple Inc. (CarPlay)

- HERE Technologies

- Garmin Ltd.

Notable Milestones in North America Automotive Navigation System Market Sector

- October 2023: Mapbox, Inc. launched MapGPT, an AI-powered voice navigation system, and Mapbox Autopilot Map for self-driving vehicles.

- September 2023: Qualcomm Technologies, Ltd. partnered with Mercedes-Benz AG to integrate Snapdragon Cockpit Platforms into the new E-Class Sedan, enhancing multimedia capabilities.

- September 2023: BMW Group and Qualcomm Technologies, Inc. expanded their partnership to utilize Snapdragon Digital Chassis solutions, improving safety and comfort features in new BMW vehicles.

In-Depth North America Automotive Navigation System Market Market Outlook

The North American automotive navigation system market is poised for significant growth over the next decade. Continuous technological advancements, the increasing demand for connected car features, and strategic collaborations will drive market expansion. Opportunities exist in developing advanced AI-powered systems, integrating seamless smartphone connectivity, and catering to specific consumer preferences. The market’s future success will depend on companies' ability to innovate and adapt to evolving consumer needs and technological disruptions.

North America Automotive Navigation System Market Segmentation

-

1. Sales Channel

- 1.1. Original Equipment Manufacturer (OEM)

- 1.2. Aftermarket

-

2. Vehicle Type

- 2.1. Passenger Vehicles

- 2.2. Commercial Cars

North America Automotive Navigation System Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Automotive Navigation System Market Regional Market Share

Geographic Coverage of North America Automotive Navigation System Market

North America Automotive Navigation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumer Trend Towards In-dash Navigation System

- 3.3. Market Restrains

- 3.3.1. High Cost of Installing Navigation System May Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Passenger Car Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Automotive Navigation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 5.1.1. Original Equipment Manufacturer (OEM)

- 5.1.2. Aftermarket

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Passenger Vehicles

- 5.2.2. Commercial Cars

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Sales Channel

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Denso Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alps Alpine Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 TomTom International BV

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aptiv PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Harman International

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Bosch GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Marelli Holdings Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 what3words Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Faurecia Clarion Electronics Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Pioneer Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Panasonic Holdings Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Alpine Electronics

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Denso Corporation

List of Figures

- Figure 1: North America Automotive Navigation System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Automotive Navigation System Market Share (%) by Company 2025

List of Tables

- Table 1: North America Automotive Navigation System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 2: North America Automotive Navigation System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: North America Automotive Navigation System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: North America Automotive Navigation System Market Revenue Million Forecast, by Sales Channel 2020 & 2033

- Table 5: North America Automotive Navigation System Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: North America Automotive Navigation System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico North America Automotive Navigation System Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Automotive Navigation System Market?

The projected CAGR is approximately 6.50%.

2. Which companies are prominent players in the North America Automotive Navigation System Market?

Key companies in the market include Denso Corporation, Alps Alpine Co Ltd, TomTom International BV, Aptiv PLC, Harman International, Robert Bosch GmbH, Marelli Holdings Co Ltd, what3words Ltd, Faurecia Clarion Electronics Co Ltd, Pioneer Corporation, Panasonic Holdings Corporation, Alpine Electronics.

3. What are the main segments of the North America Automotive Navigation System Market?

The market segments include Sales Channel, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumer Trend Towards In-dash Navigation System.

6. What are the notable trends driving market growth?

Passenger Car Hold Major Market Share.

7. Are there any restraints impacting market growth?

High Cost of Installing Navigation System May Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

In October 2023, Mapbox, Inc. introduced the MapGPT voice navigation system, that employs generative artificial intelligence (AI), as well as the Mapbox Autopilot Map position information system for self-driving vehicles. The MapGPT system incorporates real-time vehicle, destination, and environmental information into the company's location information service, delivering route and desired facility information.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Automotive Navigation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Automotive Navigation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Automotive Navigation System Market?

To stay informed about further developments, trends, and reports in the North America Automotive Navigation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence