Key Insights

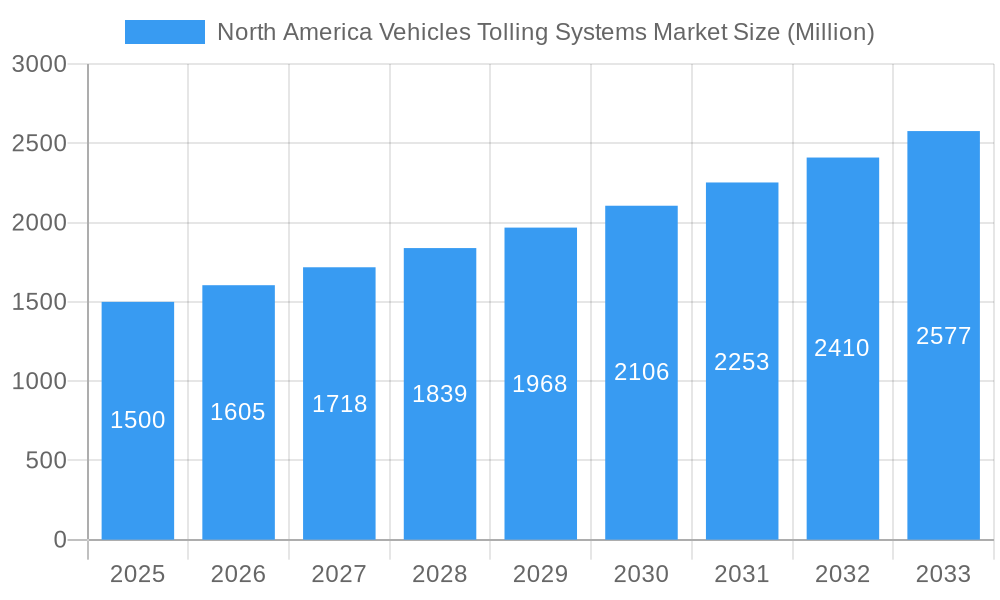

The North American Vehicle Tolling Systems Market is poised for substantial growth, driven by increasing traffic volumes and the imperative for efficient transportation management. The widespread adoption of Electronic Toll Collection (ETC) systems, offering a streamlined and convenient alternative to traditional barrier tolls, is a key market driver. Government initiatives supporting infrastructure development and smart city projects further propel market expansion. The shift towards ETC is particularly prominent across the United States and Canada, with significant investments in ITS modernization. Bridges, roads, and tunnels represent key application areas experiencing rising demand for integrated tolling solutions. While initial infrastructure investment and cybersecurity concerns present challenges, the long-term benefits of optimized traffic flow and enhanced revenue generation are paramount. Key industry players include Mitsubishi Heavy Industries, Thales Group, and Nedap NV. With a projected CAGR of 8.3% and a 2025 market size of $10334.9 million, the market is expected to witness continued significant expansion through 2033, fueled by technological advancements and ongoing infrastructure investments.

North America Vehicles Tolling Systems Market Market Size (In Billion)

Within the North American Vehicle Tolling Systems Market, Electronic Toll Collection (ETC) is the leading segment, outpacing barrier and entry/exit methods due to its superior efficiency and congestion reduction capabilities. The United States, Canada, and Mexico are the primary regional markets, with the United States anticipated to maintain dominance due to its extensive highway network and increasing urbanization. The forecast period from 2025 to 2033 presents considerable opportunities for market expansion, influenced by escalating public and private sector investments in Intelligent Transportation Systems (ITS) and smart city initiatives. Market participants are prioritizing the development of advanced, interoperable ETC systems and integration with other ITS components to optimize traffic management and elevate the user experience. This strategic focus on innovation and integration is vital for sustained growth in this dynamic market segment.

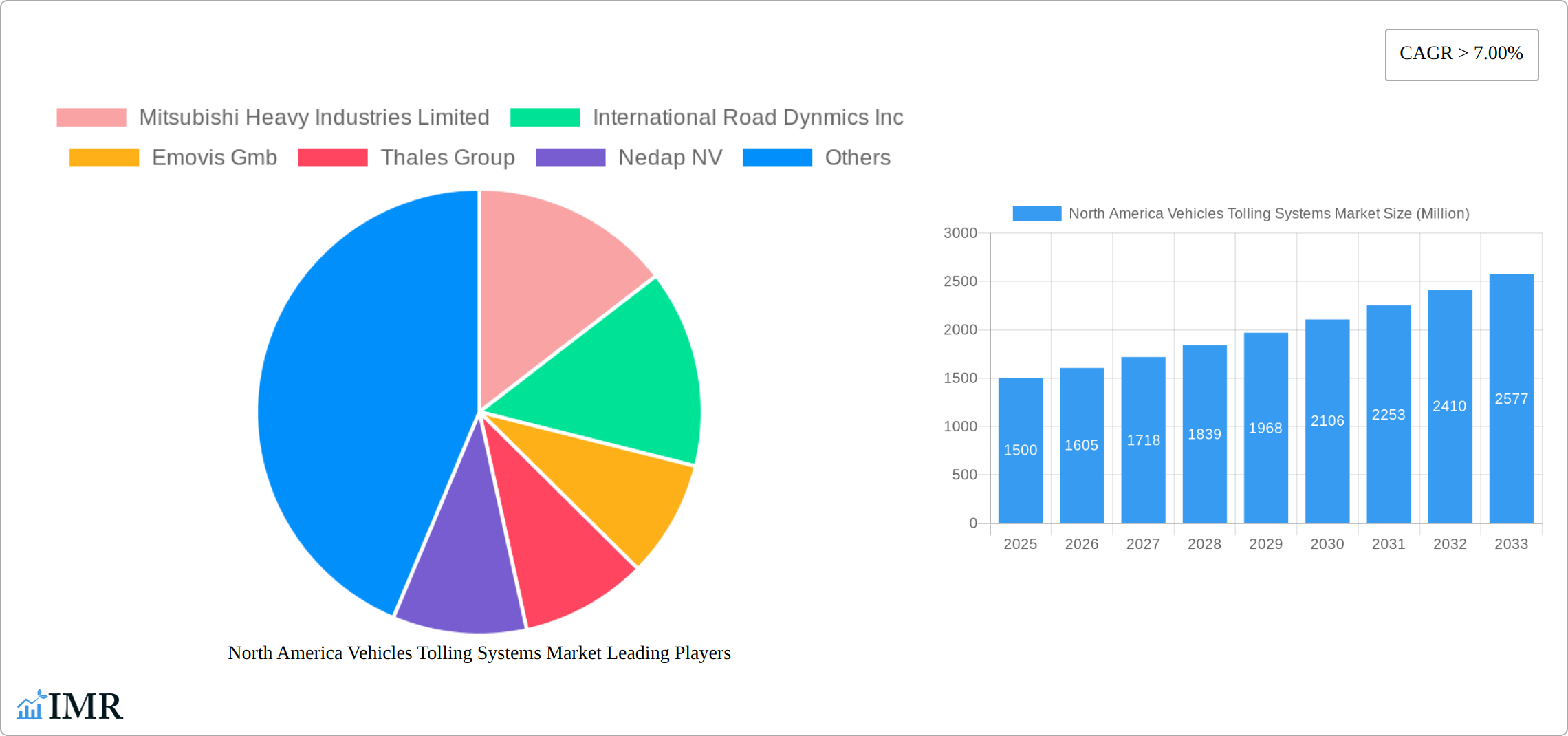

North America Vehicles Tolling Systems Market Company Market Share

This comprehensive report delivers an in-depth analysis of the North America Vehicle Tolling Systems Market, covering market dynamics, growth trajectories, regional insights, product offerings, key participants, and future projections. The analysis spans the period from 2019-2033, with 2025 designated as the base and estimated year, and a forecast period extending from 2025-2033. This report is an essential resource for industry professionals, investors, and stakeholders seeking a thorough understanding of this rapidly evolving market. The parent market is the North American Transportation Infrastructure Market, with Electronic Toll Collection Systems as the child market. The market size is projected at $10334.9 million in 2025.

North America Vehicles Tolling Systems Market Market Dynamics & Structure

The North America Vehicles Tolling Systems Market is characterized by a dynamic and evolving landscape, shaped by technological advancements, evolving regulatory frameworks, and shifting end-user preferences. The market is moderately concentrated, with leading players actively investing in innovation to capture market share. A significant driver is the continuous evolution of Electronic Toll Collection (ETC) systems, moving towards more seamless, contactless, and interoperable solutions. Stringent regulatory environments, particularly concerning data privacy and security, play a crucial role in shaping operational strategies and technology adoption. Competitive pressures arise not only from within the tolling sector but also from the emergence of alternative mobility solutions and the growing integration of comprehensive mobility management systems. End-user demographics, including rising vehicle ownership and increasing urbanization, continue to fuel demand for efficient and sophisticated tolling infrastructure. Mergers and acquisitions are also a notable trend, as companies seek to consolidate their market positions, expand their service portfolios, and achieve greater geographical reach.

- Market Concentration: The market exhibits a moderate concentration, with a significant portion of the market share held by a few key players. Projections indicate that the top 5 players may command approximately [Insert estimated percentage]% of the market share by 2025, highlighting the competitive intensity.

- Technological Innovation: The focus is sharply on advancing ETC technologies, including the integration of Artificial Intelligence (AI) for enhanced efficiency and accuracy, and the development of robust interoperability standards to ensure seamless travel across diverse tolling systems.

- Regulatory Framework: Compliance with evolving data privacy regulations, such as GDPR and CCPA, is paramount. Furthermore, efforts towards inter-state toll system harmonization are ongoing to simplify cross-border tolling experiences.

- Competitive Substitutes: The market faces competition from alternative transportation modes, including enhanced public transit systems, and the increasing exploration and implementation of sophisticated congestion pricing strategies in urban areas.

- End-User Demographics: The persistent trend of increasing urbanization and a growing vehicle parc directly contribute to a higher demand for efficient, automated, and user-friendly tolling solutions.

- M&A Trends: A notable trend is the consolidation within the toll operator and technology provider segments. This is driven by a desire to achieve economies of scale, expand service offerings, and strengthen competitive positions. An estimated [Insert estimated number] M&A deals were recorded between 2019 and 2024, underscoring this strategic consolidation.

North America Vehicles Tolling Systems Market Growth Trends & Insights

The North America Vehicles Tolling Systems Market experienced significant growth between 2019 and 2024, driven by increasing traffic congestion in major urban areas and the need for efficient revenue generation for infrastructure development. The market is characterized by a shift from traditional barrier toll collection towards ETC systems, offering greater convenience and efficiency. Technological advancements, including the implementation of 5G networks and advanced sensor technologies, are further fueling market expansion. Changing consumer behavior, favoring contactless and digital payment methods, is also a key growth driver. The market is expected to witness a CAGR of xx% during the forecast period (2025-2033), with market penetration of ETC systems reaching xx% by 2033.

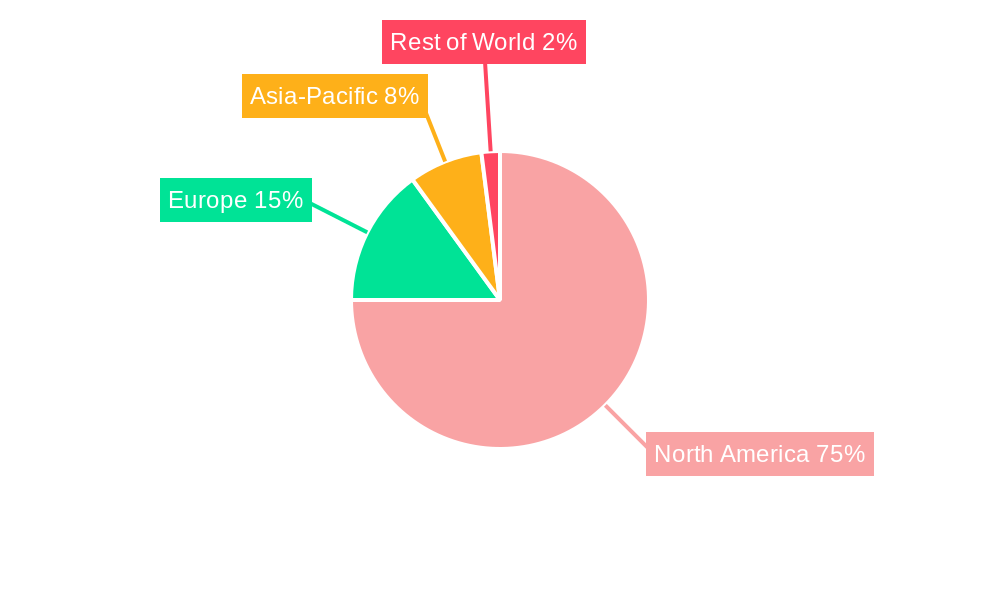

Dominant Regions, Countries, or Segments in North America Vehicles Tolling Systems Market

The Electronic Toll Collection (ETC) segment is the dominant driver of market growth, fueled by the increasing adoption of transponders and mobile payment options. Among applications, Roads constitutes the largest segment due to the extensive road network across North America. Geographically, the Northeastern United States and California are leading regions, owing to robust infrastructure investments and high traffic volumes.

- Key Drivers: Government initiatives promoting smart infrastructure, investments in highway expansions, and the increasing adoption of cashless payment systems.

- Dominance Factors: High traffic density, existing infrastructure, and supportive government policies for ETC adoption contribute to the dominance of specific regions and segments.

- Growth Potential: Expansion of ETC networks into underserved areas, integration with other intelligent transportation systems, and the introduction of new technologies present significant growth opportunities.

North America Vehicles Tolling Systems Market Product Landscape

The market offers a diverse range of products, including barrier toll systems, ETC systems (using RFID, GPS, and ANPR technologies), and integrated tolling platforms. Recent innovations focus on improving system interoperability, enhancing data analytics capabilities, and integrating with other intelligent transportation systems. Key features include high-speed processing, accurate vehicle identification, secure payment gateways, and real-time traffic management functionalities. Many systems now offer value-added services like personalized travel information and loyalty programs.

Key Drivers, Barriers & Challenges in North America Vehicles Tolling Systems Market

Key Drivers:

- Increasing traffic congestion and the need for efficient traffic management.

- Government initiatives promoting smart city infrastructure and sustainable transportation.

- Growing adoption of ETC systems driven by convenience and efficiency.

Key Challenges and Restraints:

- High initial investment costs associated with ETC system implementation.

- Cybersecurity concerns related to data security and system vulnerabilities.

- Interoperability challenges between different toll systems across jurisdictions.

- xx% of ETC systems experience occasional failures leading to customer frustration.

Emerging Opportunities in North America Vehicles Tolling Systems Market

The North America Vehicles Tolling Systems Market is ripe with emerging opportunities, particularly in the realm of integrated smart city initiatives. The seamless integration of tolling systems with other urban mobility solutions, such as smart parking, real-time traffic monitoring, and public transit information, presents a significant growth avenue. Expansion into underserved rural areas, which often require tailored and cost-effective tolling solutions, also offers considerable potential. Furthermore, the development and implementation of innovative pricing models, including dynamic tolling and advanced congestion pricing strategies, are gaining traction as cities seek to manage traffic flow and generate revenue. The increasing demand for multi-modal transportation solutions and the anticipated widespread adoption of autonomous vehicles will necessitate sophisticated and adaptable tolling systems, creating new avenues for growth. Additionally, a growing emphasis on personalized customer experiences is driving the demand for user-friendly interfaces, mobile payment options, and transparent account management, offering opportunities for service providers to enhance customer loyalty and convenience.

Growth Accelerators in the North America Vehicles Tolling Systems Market Industry

Technological breakthroughs in artificial intelligence, machine learning, and data analytics are driving growth. Strategic partnerships between technology providers and toll operators are crucial for integrating innovative solutions and achieving economies of scale. Market expansion into under-served regions and international markets provides further avenues for accelerated growth.

Key Players Shaping the North America Vehicles Tolling Systems Market Market

- Mitsubishi Heavy Industries Limited

- International Road Dynamics Inc.

- Emovis GmbH

- Thales Group

- Nedap NV

- TransCore Atlantic LLC

- Cintra

- Magnetic Autocontrol GmbH

Notable Milestones in North America Vehicles Tolling Systems Market Sector

- 2020: California achieved a significant milestone with the launch of its unified, statewide Electronic Toll Collection (ETC) system, enhancing interoperability and user convenience.

- 2022: Several states across North America actively implemented and refined dynamic pricing strategies for their toll roads, responding to real-time traffic conditions and optimizing traffic flow.

- 2023: The sector witnessed major advancements in AI-powered toll violation detection systems, leading to improved enforcement efficiency and reduced operational costs.

- 2024: The industry saw a significant strategic merger between key players in the ETC technology provider sector, aiming to leverage combined expertise and market reach.

In-Depth North America Vehicles Tolling Systems Market Market Outlook

The North America Vehicles Tolling Systems Market is projected for substantial and sustained growth, propelled by a confluence of factors including rapid technological evolution, accelerating urbanization, and proactive government initiatives aimed at improving transportation infrastructure. The definitive shift towards Electronic Toll Collection (ETC) systems, coupled with the integration of tolling infrastructure with broader smart city ecosystems, will act as primary catalysts for market expansion. The ongoing development and adoption of innovative pricing models, such as congestion pricing and dynamic tolling, are expected to further drive market penetration and efficiency. Strategic alliances, collaborative partnerships, and continuous technological innovation will be pivotal in shaping the competitive landscape, fostering new solutions and enhancing existing ones. The market presents compelling opportunities for technology providers, toll operators, and discerning investors seeking long-term, robust returns within the dynamic and rapidly transforming transportation sector.

North America Vehicles Tolling Systems Market Segmentation

-

1. Toll Collection Type

- 1.1. Barrier Toll Collection

- 1.2. Entry/ExiT Toll Collection

- 1.3. Electronic Toll Collection

-

2. Application Type

- 2.1. Bridges

- 2.2. Roads

- 2.3. Tunnels

-

3. Geography

-

3.1. North America

- 3.1.1. United States Of America

- 3.1.2. Canada

- 3.1.3. Rest of North America

-

3.1. North America

North America Vehicles Tolling Systems Market Segmentation By Geography

-

1. North America

- 1.1. United States Of America

- 1.2. Canada

- 1.3. Rest of North America

North America Vehicles Tolling Systems Market Regional Market Share

Geographic Coverage of North America Vehicles Tolling Systems Market

North America Vehicles Tolling Systems Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives to Promote Sales of Electric Vehicle

- 3.3. Market Restrains

- 3.3.1. High Initial Investment for Installing Electric Vehicle Charging Infrastructure

- 3.4. Market Trends

- 3.4.1. Electronic Toll Collection is Expected to Witness the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Vehicles Tolling Systems Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 5.1.1. Barrier Toll Collection

- 5.1.2. Entry/ExiT Toll Collection

- 5.1.3. Electronic Toll Collection

- 5.2. Market Analysis, Insights and Forecast - by Application Type

- 5.2.1. Bridges

- 5.2.2. Roads

- 5.2.3. Tunnels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. North America

- 5.3.1.1. United States Of America

- 5.3.1.2. Canada

- 5.3.1.3. Rest of North America

- 5.3.1. North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Toll Collection Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Heavy Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 International Road Dynmics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Emovis Gmb

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thales Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Nedap NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TansCore Atlantic LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cintra

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Magnetic Autocontrol GmbH

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: North America Vehicles Tolling Systems Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: North America Vehicles Tolling Systems Market Share (%) by Company 2025

List of Tables

- Table 1: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 2: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 3: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 4: North America Vehicles Tolling Systems Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: North America Vehicles Tolling Systems Market Revenue million Forecast, by Toll Collection Type 2020 & 2033

- Table 6: North America Vehicles Tolling Systems Market Revenue million Forecast, by Application Type 2020 & 2033

- Table 7: North America Vehicles Tolling Systems Market Revenue million Forecast, by Geography 2020 & 2033

- Table 8: North America Vehicles Tolling Systems Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Of America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Rest of North America North America Vehicles Tolling Systems Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Vehicles Tolling Systems Market?

The projected CAGR is approximately 8.3%.

2. Which companies are prominent players in the North America Vehicles Tolling Systems Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, International Road Dynmics Inc, Emovis Gmb, Thales Group, Nedap NV, TansCore Atlantic LLC, Cintra, Magnetic Autocontrol GmbH.

3. What are the main segments of the North America Vehicles Tolling Systems Market?

The market segments include Toll Collection Type, Application Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 10334.9 million as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives to Promote Sales of Electric Vehicle.

6. What are the notable trends driving market growth?

Electronic Toll Collection is Expected to Witness the Highest Growth Rate.

7. Are there any restraints impacting market growth?

High Initial Investment for Installing Electric Vehicle Charging Infrastructure.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Vehicles Tolling Systems Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Vehicles Tolling Systems Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Vehicles Tolling Systems Market?

To stay informed about further developments, trends, and reports in the North America Vehicles Tolling Systems Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence