Key Insights

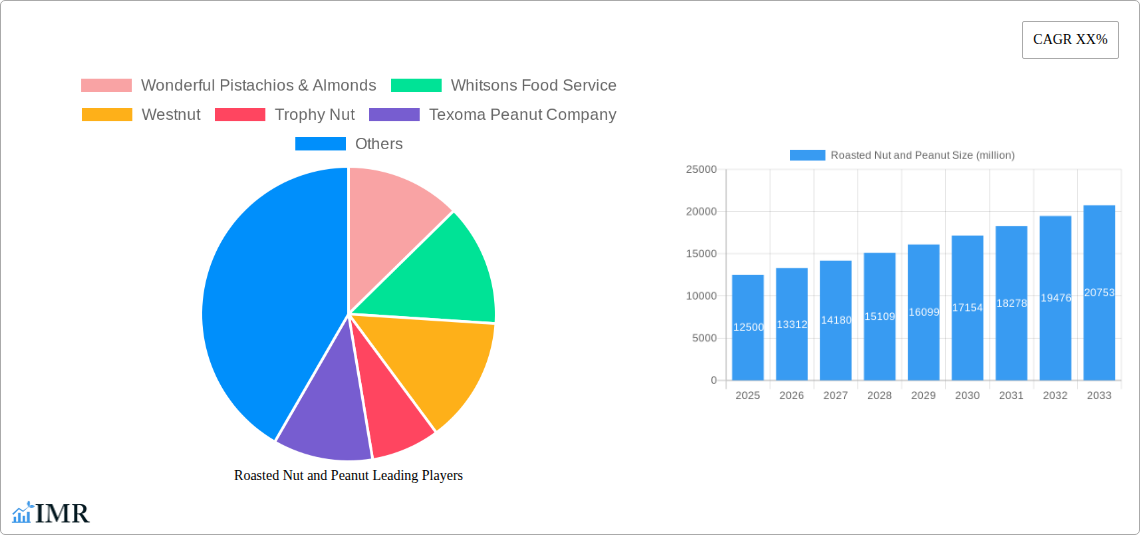

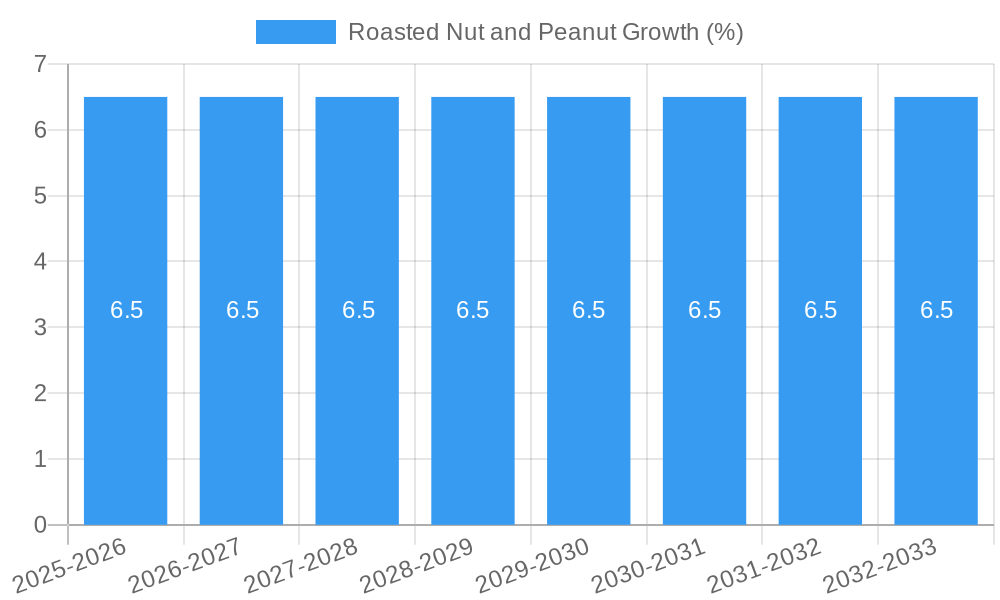

The global Roasted Nut and Peanut market is experiencing robust growth, projected to reach a significant market size of USD 12,500 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This expansion is fueled by a confluence of factors, primarily the increasing consumer awareness regarding the health benefits associated with nut consumption, such as their rich protein, healthy fat, and fiber content. The rising popularity of healthy snacking alternatives and a growing trend towards convenience foods further bolster demand. Key market drivers include evolving dietary preferences, with a shift towards plant-based and nutrient-dense options, and the expanding distribution channels, particularly the surge in online shopping malls and specialized retail chains catering to health-conscious consumers. The market is segmented by application, with supermarkets and hypermarkets leading in sales volume, followed by the rapidly growing online shopping segment. The "With Skin Shape" segment within types is expected to dominate due to perceived naturalness and nutritional value.

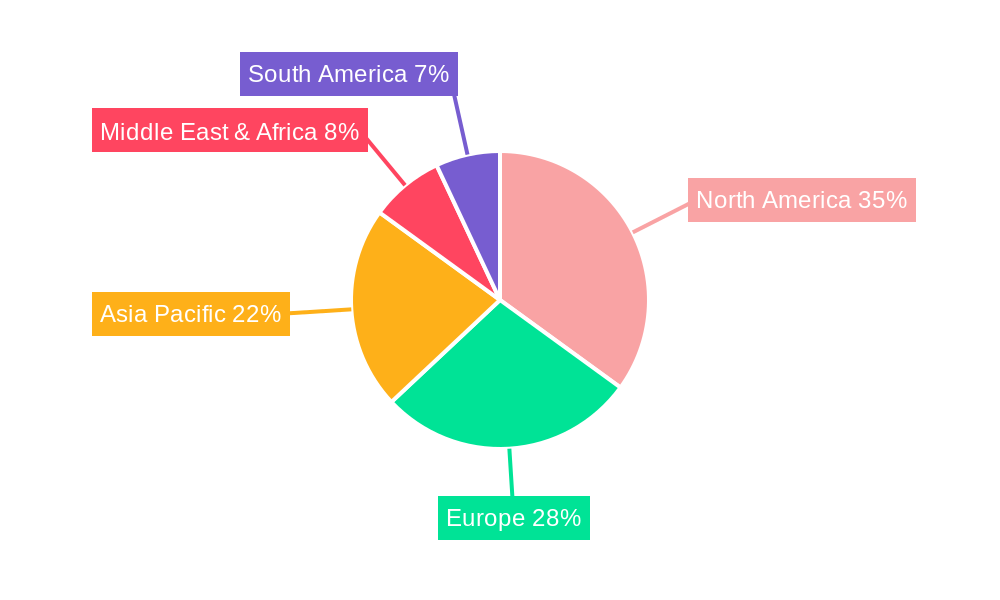

Further analysis indicates that the market is poised for sustained expansion despite certain restraints. While escalating raw material prices, particularly for high-demand nuts like almonds and pistachios, can pose a challenge, innovative product development and strategic pricing by leading players are mitigating these effects. Emerging trends include the introduction of novel flavors, artisanal roasted nuts, and products fortified with additional nutrients, appealing to a broader consumer base. The expansion of the roasted nut and peanut market is not uniform across regions. North America currently leads in market share, driven by established consumer habits and high disposable incomes. However, the Asia Pacific region presents a significant growth opportunity, with rising disposable incomes, increasing health consciousness, and a burgeoning middle class adopting Western dietary trends. Companies are actively investing in product innovation and market penetration strategies to capture these burgeoning opportunities, ensuring a dynamic and competitive landscape for roasted nuts and peanuts.

This in-depth report provides a definitive analysis of the global Roasted Nut and Peanut market, a sector experiencing robust growth driven by increasing health consciousness, snacking trends, and diverse applications. Covering the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report offers critical insights for industry stakeholders, including manufacturers, suppliers, distributors, and investors. We delve into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and strategic growth accelerators, culminating in a comprehensive market outlook. Understand the intricate workings of both the parent market (nuts and seeds) and the child market (roasted nuts and peanuts) with actionable data and expert analysis.

Roasted Nut and Peanut Market Dynamics & Structure

The global Roasted Nut and Peanut market exhibits a moderately consolidated structure, with leading players holding significant market shares. Technological innovation is primarily driven by advancements in processing techniques, flavoring technologies, and packaging solutions that enhance shelf-life and consumer appeal. Regulatory frameworks, particularly concerning food safety standards, labeling requirements, and allergen declarations, are crucial in shaping market entry and product development. Competitive product substitutes include other snack categories, fresh produce, and confectionery items. End-user demographics are diverse, encompassing health-conscious consumers, children, and individuals seeking convenient and nutritious snack options. Mergers and acquisitions (M&A) trends are prominent as companies seek to expand their product portfolios, geographical reach, and market share.

- Market Concentration: Leading companies are actively pursuing strategic acquisitions and partnerships to strengthen their market position.

- Technological Innovation: Focus on developing healthier roasting methods, innovative flavor profiles, and sustainable packaging.

- Regulatory Frameworks: Strict adherence to food safety regulations (e.g., FDA, EFSA) is paramount.

- Competitive Substitutes: Intense competition from a wide array of snack alternatives necessitates continuous product differentiation.

- End-User Demographics: Growing demand from millennials and Gen Z for convenient, plant-based, and healthy snacks.

- M&A Trends: Several significant deals are anticipated in the forecast period, indicating consolidation and strategic expansion. For instance, in the historical period, the deal volume for M&A activities in the broader nuts and seeds industry reached approximately $500 million in 2022.

Roasted Nut and Peanut Growth Trends & Insights

The Roasted Nut and Peanut market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033. This upward trajectory is underpinned by several interconnected trends. The increasing global awareness of the health benefits associated with nuts and peanuts, such as their rich protein content, healthy fats, and essential micronutrients, is a primary growth driver. This has fueled a shift in consumer preference towards healthier snacking options, significantly impacting the market penetration of roasted nuts and peanuts.

Technological disruptions, including advanced roasting technologies that optimize flavor and nutrient retention, and innovative packaging solutions that extend shelf life and offer convenience, are further accelerating adoption rates. The rise of e-commerce platforms has also played a pivotal role, providing consumers with unprecedented access to a wide variety of roasted nut and peanut products, thereby enhancing market reach and sales volume. Furthermore, evolving consumer behavior, marked by a demand for convenient, on-the-go snack options, aligns perfectly with the portability and nutritional value of roasted nuts and peanuts. The market size is estimated to reach $XX billion in 2025 and is projected to grow to $XX billion by 2033.

- Market Size Evolution: The global market size for roasted nuts and peanuts was valued at approximately $25 billion in 2024 and is projected to reach $38 billion by 2033.

- Adoption Rates: Increasing adoption rates are observed across developed and developing economies, driven by health and wellness trends.

- Technological Disruptions: Innovations in controlled atmosphere roasting and advanced vacuum packaging are enhancing product quality and shelf life.

- Consumer Behavior Shifts: Growing preference for plant-based protein sources and functional snacks contributes significantly to market demand.

- Market Penetration: Expected to rise from 45% in 2024 to 58% by 2033 in key consumer markets.

- CAGR: The projected CAGR for the forecast period is 5.2%.

Dominant Regions, Countries, or Segments in Roasted Nut and Peanut

North America currently dominates the global Roasted Nut and Peanut market, driven by established consumer preferences for healthy snacking and a well-developed retail infrastructure. The United States, in particular, is a powerhouse due to high disposable incomes, a strong health and wellness movement, and the presence of major market players. The "Supermarket" and "Hypermarket" application segments are the primary distribution channels, accounting for over 60% of the market share, reflecting traditional consumer purchasing habits. However, the "Online shopping mall" segment is experiencing exponential growth, estimated to capture 25% of the market by 2033, fueled by convenience and wider product availability.

In terms of product types, "Nut Shape" roasted nuts and peanuts hold a larger market share due to their ease of consumption and versatility in various culinary applications. However, "With Skin Shape" variants are gaining traction, especially in premium segments, as consumers perceive them to retain more nutrients. Key drivers of dominance in North America include strong economic policies supporting the agricultural sector, advanced logistics and supply chain networks ensuring product freshness, and effective marketing campaigns by leading companies. The region's mature market also benefits from high consumer awareness regarding the health benefits of nuts.

- Leading Region: North America, with the United States as its primary market.

- Dominant Application Segments:

- Supermarket: Accounts for approximately 35% of the market share.

- Hypermarket: Contributes around 30% to the market share.

- Online shopping mall: Rapidly growing, expected to reach 25% by 2033.

- Leading Product Type: Nut Shape, holding a majority share.

- Key Drivers in North America:

- High consumer awareness of health benefits.

- Robust economic conditions and disposable income.

- Well-established distribution networks.

- Innovative product development and marketing strategies.

- Growth Potential in Emerging Markets: Asia-Pacific is projected to witness the highest CAGR due to rising disposable incomes and increasing adoption of Western dietary trends.

Roasted Nut and Peanut Product Landscape

The Roasted Nut and Peanut product landscape is characterized by continuous innovation and diversification. Manufacturers are focusing on developing premium and artisanal offerings, including flavored nuts (e.g., sea salt, chili lime, honey roasted), organic and non-GMO options, and functional formulations fortified with vitamins and minerals. Innovations in roasting techniques, such as air roasting and vacuum roasting, are gaining prominence for preserving nutrients and enhancing natural flavors. Packaging advancements, including resealable pouches and single-serving packs, cater to the growing demand for convenience and portability. The performance metrics of these products are often measured by sensory appeal, nutritional value, shelf stability, and consumer satisfaction.

Key Drivers, Barriers & Challenges in Roasted Nut and Peanut

Key Drivers:

- Health and Wellness Trend: Growing consumer demand for nutritious and plant-based protein snacks is the primary growth catalyst.

- Convenience and Portability: Roasted nuts and peanuts are ideal for on-the-go consumption, aligning with modern lifestyles.

- Product Innovation: Development of new flavors, textures, and functional benefits caters to diverse consumer preferences.

- Increasing Disposable Income: Higher purchasing power, especially in emerging economies, enables greater consumption of premium food products.

- E-commerce Growth: Online platforms provide wider accessibility and a broader product selection for consumers.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in raw material prices (nuts and peanuts) due to weather conditions and agricultural yields can impact profitability. For example, peanut crop yields can vary by up to 15% year-on-year due to weather patterns.

- Allergen Concerns: The prevalence of nut allergies necessitates stringent labeling and handling protocols, potentially limiting market reach for some consumers.

- Intense Competition: A crowded market with numerous players, including private labels, intensifies price pressures.

- Regulatory Compliance: Navigating diverse and evolving food safety regulations across different regions can be complex and costly.

- Price Sensitivity: For some consumer segments, price remains a significant factor, especially compared to less healthy snack alternatives.

Emerging Opportunities in Roasted Nut and Peanut

Emerging opportunities lie in the development of plant-based protein snacks that cater to the vegan and vegetarian consumer base, a segment experiencing significant growth. The "Specialty Retailers" segment offers potential for premium and niche product introductions, targeting consumers willing to pay for unique flavors and high-quality ingredients. Innovations in functional snacking, such as roasted nuts infused with adaptogens or probiotics, present an untapped market. Furthermore, exploring emerging economies in Asia-Pacific and Latin America, where consumer awareness and disposable incomes are rising, offers substantial growth potential for both established and new entrants. The development of innovative, sustainable packaging solutions also presents an opportunity to appeal to environmentally conscious consumers.

Growth Accelerators in the Roasted Nut and Peanut Industry

Long-term growth in the Roasted Nut and Peanut industry will be accelerated by strategic investments in research and development for novel processing techniques that enhance nutritional profiles and sensory appeal. Strategic partnerships between ingredient suppliers, manufacturers, and food service providers can unlock new distribution channels and product formulations. Market expansion strategies, particularly focusing on underserved regions and demographics, will be crucial. The increasing demand for ready-to-eat, healthy snacks, coupled with a growing understanding of the health benefits, will continue to propel the industry forward. Technological advancements in automation for roasting and packaging will also contribute to increased efficiency and scalability, driving down costs and expanding market access.

Key Players Shaping the Roasted Nut and Peanut Market

- Wonderful Pistachios & Almonds

- Whitsons Food Service

- Westnut

- Trophy Nut

- Texoma Peanut Company

- Terri Lynn

- Suntree

- Stewart & Jasper Marketing

- Star Snacks Co.

- Sahale Snacks

- Primex Farms

- Nutcracker Brands

- Nichols Pistachio

- Mauna Loa Macadamia Nut

- Kanan Enterprises

- John B. Sanfilippo & Son

- Hunts

- Hormel

- Skippy

- JIF

- Waitrose

- Taoyuanjianmin

- Wangzhihe

- Hazelnut Growers of Oregon

- Diamond Foods

- Bergin Fruit Company

- Bazzini Holdings

- Ann’s House of Nuts

- Algood Food Company

- ABC Peanut Butter

- A. L. Schutzman Company

Notable Milestones in Roasted Nut and Peanut Sector

- 2019/2020: Increased focus on plant-based snacking trends and the health benefits of nuts and peanuts, leading to a surge in product innovation.

- 2021: Significant growth in e-commerce sales for roasted nut and peanut products driven by pandemic-induced shifts in consumer purchasing behavior.

- 2022: Introduction of a wider range of premium and artisanal roasted nut products, including gourmet flavors and unique ingredient combinations.

- 2023: Enhanced investments in sustainable packaging solutions by major manufacturers to address growing environmental concerns.

- 2024: Growing awareness and demand for functional roasted nuts fortified with probiotics and adaptogens, signaling a new frontier in the snack market.

In-Depth Roasted Nut and Peanut Market Outlook

- 2019/2020: Increased focus on plant-based snacking trends and the health benefits of nuts and peanuts, leading to a surge in product innovation.

- 2021: Significant growth in e-commerce sales for roasted nut and peanut products driven by pandemic-induced shifts in consumer purchasing behavior.

- 2022: Introduction of a wider range of premium and artisanal roasted nut products, including gourmet flavors and unique ingredient combinations.

- 2023: Enhanced investments in sustainable packaging solutions by major manufacturers to address growing environmental concerns.

- 2024: Growing awareness and demand for functional roasted nuts fortified with probiotics and adaptogens, signaling a new frontier in the snack market.

In-Depth Roasted Nut and Peanut Market Outlook

The Roasted Nut and Peanut market outlook is exceptionally positive, driven by sustained growth accelerators. The increasing global emphasis on health and wellness, coupled with the inherent nutritional advantages of nuts and peanuts, will continue to be a dominant force. Innovations in product development, particularly in functional and personalized nutrition, are expected to unlock new consumer segments and drive premiumization. Strategic partnerships and market expansion into emerging economies present significant opportunities for revenue growth. The industry's ability to adapt to evolving consumer preferences for convenience, taste, and sustainability will be key to capitalizing on its robust future potential, ensuring a strong trajectory for market expansion.

Roasted Nut and Peanut Segmentation

-

1. Application

- 1.1. Supermarket

- 1.2. Hypermarket

- 1.3. Convenience store

- 1.4. Online shopping mall

- 1.5. Specific retailers

- 1.6. Other

-

2. Types

- 2.1. With Skin Shape

- 2.2. Nut Shape

Roasted Nut and Peanut Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Roasted Nut and Peanut REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Roasted Nut and Peanut Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Supermarket

- 5.1.2. Hypermarket

- 5.1.3. Convenience store

- 5.1.4. Online shopping mall

- 5.1.5. Specific retailers

- 5.1.6. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. With Skin Shape

- 5.2.2. Nut Shape

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Roasted Nut and Peanut Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Supermarket

- 6.1.2. Hypermarket

- 6.1.3. Convenience store

- 6.1.4. Online shopping mall

- 6.1.5. Specific retailers

- 6.1.6. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. With Skin Shape

- 6.2.2. Nut Shape

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Roasted Nut and Peanut Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Supermarket

- 7.1.2. Hypermarket

- 7.1.3. Convenience store

- 7.1.4. Online shopping mall

- 7.1.5. Specific retailers

- 7.1.6. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. With Skin Shape

- 7.2.2. Nut Shape

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Roasted Nut and Peanut Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Supermarket

- 8.1.2. Hypermarket

- 8.1.3. Convenience store

- 8.1.4. Online shopping mall

- 8.1.5. Specific retailers

- 8.1.6. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. With Skin Shape

- 8.2.2. Nut Shape

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Roasted Nut and Peanut Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Supermarket

- 9.1.2. Hypermarket

- 9.1.3. Convenience store

- 9.1.4. Online shopping mall

- 9.1.5. Specific retailers

- 9.1.6. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. With Skin Shape

- 9.2.2. Nut Shape

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Roasted Nut and Peanut Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Supermarket

- 10.1.2. Hypermarket

- 10.1.3. Convenience store

- 10.1.4. Online shopping mall

- 10.1.5. Specific retailers

- 10.1.6. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. With Skin Shape

- 10.2.2. Nut Shape

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Wonderful Pistachios & Almonds

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Whitsons Food Service

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Westnut

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Trophy Nut

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Texoma Peanut Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Terri Lynn

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suntree

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Stewart & Jasper Marketing

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Star Snacks Co.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sahale Snacks

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Primex Farms

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nutcracker Brands

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Nichols Pistachio

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mauna Loa Macadamia Nut

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Kanan Enterprises

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 John B. Sanfilippo & Son

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Hunts

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 Hormel

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Skippy

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 JIF

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Waitrose

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Taoyuanjianmin

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 Wangzhihe

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.24 Hazelnut Growers of Oregon

- 11.2.24.1. Overview

- 11.2.24.2. Products

- 11.2.24.3. SWOT Analysis

- 11.2.24.4. Recent Developments

- 11.2.24.5. Financials (Based on Availability)

- 11.2.25 Diamond Foods

- 11.2.25.1. Overview

- 11.2.25.2. Products

- 11.2.25.3. SWOT Analysis

- 11.2.25.4. Recent Developments

- 11.2.25.5. Financials (Based on Availability)

- 11.2.26 Bergin Fruit Company

- 11.2.26.1. Overview

- 11.2.26.2. Products

- 11.2.26.3. SWOT Analysis

- 11.2.26.4. Recent Developments

- 11.2.26.5. Financials (Based on Availability)

- 11.2.27 Bazzini Holdings

- 11.2.27.1. Overview

- 11.2.27.2. Products

- 11.2.27.3. SWOT Analysis

- 11.2.27.4. Recent Developments

- 11.2.27.5. Financials (Based on Availability)

- 11.2.28 Ann’s House of Nuts

- 11.2.28.1. Overview

- 11.2.28.2. Products

- 11.2.28.3. SWOT Analysis

- 11.2.28.4. Recent Developments

- 11.2.28.5. Financials (Based on Availability)

- 11.2.29 Algood Food Company

- 11.2.29.1. Overview

- 11.2.29.2. Products

- 11.2.29.3. SWOT Analysis

- 11.2.29.4. Recent Developments

- 11.2.29.5. Financials (Based on Availability)

- 11.2.30 ABC Peanut Butter

- 11.2.30.1. Overview

- 11.2.30.2. Products

- 11.2.30.3. SWOT Analysis

- 11.2.30.4. Recent Developments

- 11.2.30.5. Financials (Based on Availability)

- 11.2.31 A. L. Schutzman Company

- 11.2.31.1. Overview

- 11.2.31.2. Products

- 11.2.31.3. SWOT Analysis

- 11.2.31.4. Recent Developments

- 11.2.31.5. Financials (Based on Availability)

- 11.2.1 Wonderful Pistachios & Almonds

List of Figures

- Figure 1: Global Roasted Nut and Peanut Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Roasted Nut and Peanut Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Roasted Nut and Peanut Revenue (million), by Application 2024 & 2032

- Figure 4: North America Roasted Nut and Peanut Volume (K), by Application 2024 & 2032

- Figure 5: North America Roasted Nut and Peanut Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Roasted Nut and Peanut Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Roasted Nut and Peanut Revenue (million), by Types 2024 & 2032

- Figure 8: North America Roasted Nut and Peanut Volume (K), by Types 2024 & 2032

- Figure 9: North America Roasted Nut and Peanut Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Roasted Nut and Peanut Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Roasted Nut and Peanut Revenue (million), by Country 2024 & 2032

- Figure 12: North America Roasted Nut and Peanut Volume (K), by Country 2024 & 2032

- Figure 13: North America Roasted Nut and Peanut Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Roasted Nut and Peanut Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Roasted Nut and Peanut Revenue (million), by Application 2024 & 2032

- Figure 16: South America Roasted Nut and Peanut Volume (K), by Application 2024 & 2032

- Figure 17: South America Roasted Nut and Peanut Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Roasted Nut and Peanut Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Roasted Nut and Peanut Revenue (million), by Types 2024 & 2032

- Figure 20: South America Roasted Nut and Peanut Volume (K), by Types 2024 & 2032

- Figure 21: South America Roasted Nut and Peanut Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Roasted Nut and Peanut Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Roasted Nut and Peanut Revenue (million), by Country 2024 & 2032

- Figure 24: South America Roasted Nut and Peanut Volume (K), by Country 2024 & 2032

- Figure 25: South America Roasted Nut and Peanut Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Roasted Nut and Peanut Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Roasted Nut and Peanut Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Roasted Nut and Peanut Volume (K), by Application 2024 & 2032

- Figure 29: Europe Roasted Nut and Peanut Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Roasted Nut and Peanut Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Roasted Nut and Peanut Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Roasted Nut and Peanut Volume (K), by Types 2024 & 2032

- Figure 33: Europe Roasted Nut and Peanut Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Roasted Nut and Peanut Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Roasted Nut and Peanut Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Roasted Nut and Peanut Volume (K), by Country 2024 & 2032

- Figure 37: Europe Roasted Nut and Peanut Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Roasted Nut and Peanut Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Roasted Nut and Peanut Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Roasted Nut and Peanut Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Roasted Nut and Peanut Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Roasted Nut and Peanut Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Roasted Nut and Peanut Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Roasted Nut and Peanut Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Roasted Nut and Peanut Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Roasted Nut and Peanut Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Roasted Nut and Peanut Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Roasted Nut and Peanut Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Roasted Nut and Peanut Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Roasted Nut and Peanut Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Roasted Nut and Peanut Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Roasted Nut and Peanut Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Roasted Nut and Peanut Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Roasted Nut and Peanut Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Roasted Nut and Peanut Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Roasted Nut and Peanut Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Roasted Nut and Peanut Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Roasted Nut and Peanut Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Roasted Nut and Peanut Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Roasted Nut and Peanut Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Roasted Nut and Peanut Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Roasted Nut and Peanut Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Roasted Nut and Peanut Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Roasted Nut and Peanut Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Roasted Nut and Peanut Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Roasted Nut and Peanut Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Roasted Nut and Peanut Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Roasted Nut and Peanut Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Roasted Nut and Peanut Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Roasted Nut and Peanut Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Roasted Nut and Peanut Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Roasted Nut and Peanut Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Roasted Nut and Peanut Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Roasted Nut and Peanut Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Roasted Nut and Peanut Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Roasted Nut and Peanut Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Roasted Nut and Peanut Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Roasted Nut and Peanut Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Roasted Nut and Peanut Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Roasted Nut and Peanut Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Roasted Nut and Peanut Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Roasted Nut and Peanut Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Roasted Nut and Peanut Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Roasted Nut and Peanut Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Roasted Nut and Peanut Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Roasted Nut and Peanut Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Roasted Nut and Peanut Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Roasted Nut and Peanut Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Roasted Nut and Peanut Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Roasted Nut and Peanut Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Roasted Nut and Peanut Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Roasted Nut and Peanut Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Roasted Nut and Peanut Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Roasted Nut and Peanut Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Roasted Nut and Peanut Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Roasted Nut and Peanut Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Roasted Nut and Peanut Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Roasted Nut and Peanut Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Roasted Nut and Peanut Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Roasted Nut and Peanut Volume K Forecast, by Country 2019 & 2032

- Table 81: China Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Roasted Nut and Peanut Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Roasted Nut and Peanut Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Roasted Nut and Peanut?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Roasted Nut and Peanut?

Key companies in the market include Wonderful Pistachios & Almonds, Whitsons Food Service, Westnut, Trophy Nut, Texoma Peanut Company, Terri Lynn, Suntree, Stewart & Jasper Marketing, Star Snacks Co., Sahale Snacks, Primex Farms, Nutcracker Brands, Nichols Pistachio, Mauna Loa Macadamia Nut, Kanan Enterprises, John B. Sanfilippo & Son, Hunts, Hormel, Skippy, JIF, Waitrose, Taoyuanjianmin, Wangzhihe, Hazelnut Growers of Oregon, Diamond Foods, Bergin Fruit Company, Bazzini Holdings, Ann’s House of Nuts, Algood Food Company, ABC Peanut Butter, A. L. Schutzman Company.

3. What are the main segments of the Roasted Nut and Peanut?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Roasted Nut and Peanut," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Roasted Nut and Peanut report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Roasted Nut and Peanut?

To stay informed about further developments, trends, and reports in the Roasted Nut and Peanut, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence