Key Insights

The Russian mining machinery market is poised for significant expansion, projected to reach $160.19 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 8% from 2025 to 2033. This growth is propelled by escalating demand for mining equipment across metal, mineral, and coal extraction sectors. Increased surface and underground mining activities, bolstered by Russia's extensive mineral reserves and ongoing infrastructure development, are key drivers. Technological advancements, particularly the integration of electric powertrains, are fostering greater efficiency, reduced environmental impact, and enhanced operational safety, shaping market trends. The industry's segmentation, encompassing surface and underground equipment, mineral processing machinery, and diverse powertrain options, facilitates tailored solutions for varied operational requirements. Leading companies like Hitachi Construction Machinery, Uralmash, and Xinhai Mineral Processing EP are strategically positioned to leverage this growth through their established market presence and technological expertise. However, geopolitical factors and economic volatility present potential market restraints.

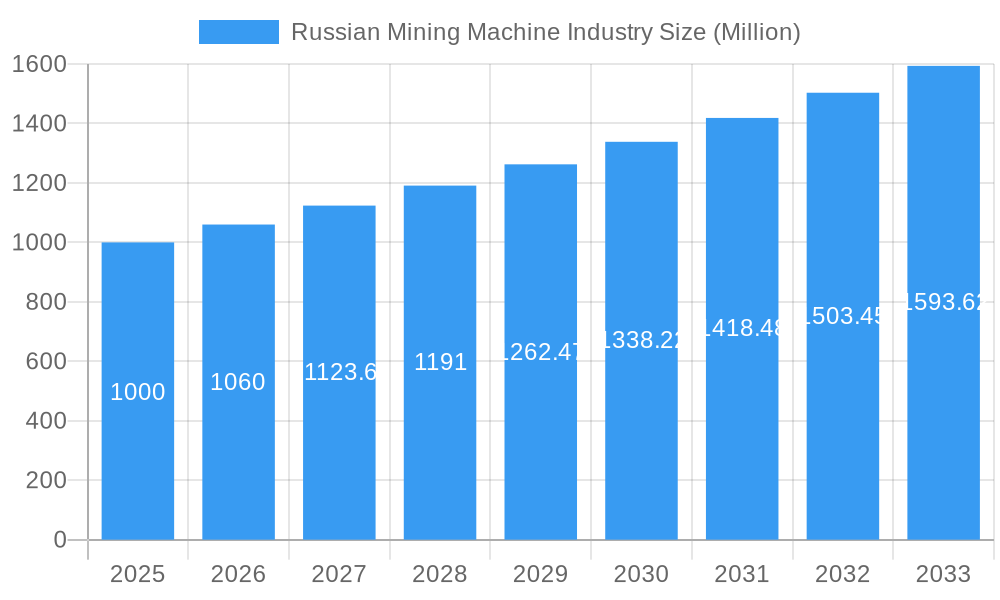

Russian Mining Machine Industry Market Size (In Billion)

Despite the promising growth, the sector navigates challenges including commodity price fluctuations and the impact of sanctions on investment and demand. Limited access to cutting-edge global technologies and potential supply chain disruptions also pose hurdles. Nevertheless, the Russian government's commitment to modernizing the mining sector, coupled with increased R&D investment, is expected to counterbalance these challenges. Growth is anticipated to be more pronounced in mining-intensive regions like Eastern and Southern Russia. The long-term outlook for the Russian mining machinery industry remains optimistic, contingent on sustained infrastructure investment, technological innovation, and economic stability.

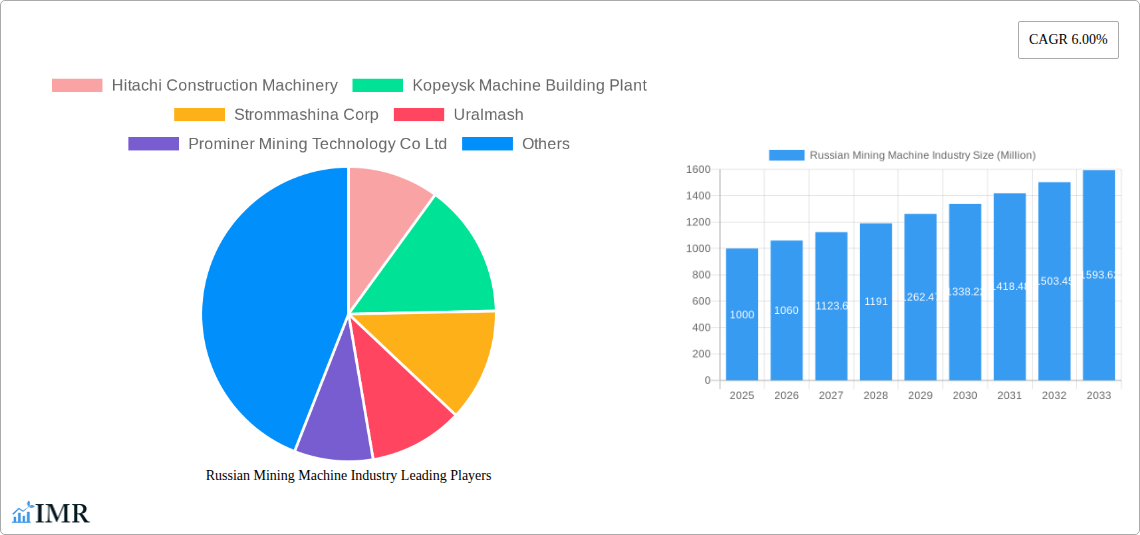

Russian Mining Machine Industry Company Market Share

Russian Mining Machine Industry: Market Analysis & Forecast 2019-2033

This comprehensive report delivers an in-depth analysis of the Russian mining machine industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The report provides crucial insights for industry professionals, investors, and policymakers seeking to navigate this dynamic market. It segments the market by Type (Surface Mining, Underground Mining, Mineral Processing Equipment) and Application (Metal Mining, Mineral Mining, Coal Mining) and Powertrain Type (IC Engines, Electric), offering granular market size estimations in million units.

Russian Mining Machine Industry Market Dynamics & Structure

The Russian mining machine industry is characterized by a moderate level of market concentration, with a few dominant players alongside numerous smaller, specialized companies. Technological innovation is driven by the need for increased efficiency, automation, and reduced environmental impact. Stringent regulatory frameworks influence equipment design and operations, while the availability of substitute technologies (e.g., alternative power sources) presents both opportunities and challenges. The end-user demographics are primarily comprised of large mining companies and government-owned enterprises. M&A activity has been relatively low in recent years, but strategic partnerships and collaborations are on the rise.

- Market Concentration: The top 5 players hold approximately xx% of the market share in 2025 (Estimated).

- Technological Innovation: Focus on automation, digitalization, and environmentally friendly solutions.

- Regulatory Framework: Stringent safety and environmental regulations impact equipment design and operation.

- Competitive Substitutes: The emergence of electric and hybrid powertrains is challenging the dominance of IC engines.

- End-User Demographics: Primarily large mining companies and state-owned enterprises.

- M&A Trends: Limited M&A activity, but increased strategic partnerships and joint ventures are observed. xx M&A deals were recorded between 2019 and 2024.

Russian Mining Machine Industry Growth Trends & Insights

The Russian mining machine industry experienced a period of moderate growth between 2019 and 2024, influenced by fluctuating commodity prices and economic conditions. The forecast period (2025-2033) anticipates a CAGR of xx%, driven by increasing mining activities, modernization efforts, and government investments in infrastructure development. Adoption of advanced technologies, particularly in automation and digitalization, is expected to accelerate. Shifting consumer preferences towards more efficient and sustainable mining practices will further shape market trends. The market size is projected to reach xx million units by 2033, up from xx million units in 2025. Market penetration of electric powertrains is expected to increase significantly by 2033, reaching an estimated xx%.

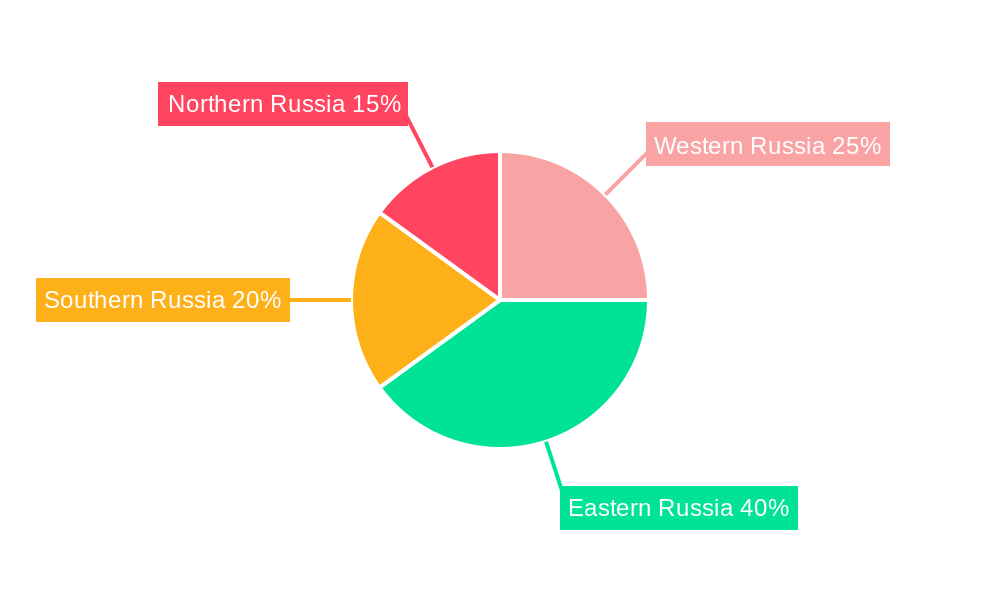

Dominant Regions, Countries, or Segments in Russian Mining Machine Industry

The Siberian Federal District and the Ural Federal District are the dominant regions for mining machine demand, owing to their rich mineral resources and established mining infrastructure. Within these regions, specific countries (not applicable here, as the report focuses on Russia) contribute significantly to market growth. The largest segments by type are Underground Mining and Mineral Processing Equipment, driven by continuous mining operations and the need for efficient mineral processing. Metal Mining remains the most significant application segment.

- Key Drivers: Government investments in mining infrastructure, increasing mining activities, and growing demand for minerals.

- Dominance Factors: Abundant mineral resources, established mining industry, and government support.

- Growth Potential: Expansion into new mining projects, technological advancements, and increasing environmental awareness are expected to drive growth.

Russian Mining Machine Industry Product Landscape

The Russian mining machine industry offers a diverse range of products, including excavators, loaders, drills, crushers, and other processing equipment. Recent innovations focus on enhancing efficiency, safety, and automation. Key advancements include the integration of advanced sensors, remote operation capabilities, and the adoption of electric and hybrid powertrains. Unique selling propositions often center around ruggedness, reliability, and adaptability to challenging operating conditions.

Key Drivers, Barriers & Challenges in Russian Mining Machine Industry

Key Drivers:

- Increasing mining activities fueled by global demand for minerals.

- Government initiatives promoting modernization and technological advancements within the mining sector.

- Investments in infrastructure development, supporting efficient mining operations.

Challenges & Restraints:

- Fluctuations in commodity prices create uncertainty in investment decisions.

- Sanctions and geopolitical factors can disrupt supply chains and access to advanced technologies.

- Competition from international players with advanced technologies poses a challenge to domestic manufacturers. This results in approximately xx% loss in market share annually (estimated).

Emerging Opportunities in Russian Mining Machine Industry

- Growing demand for environmentally friendly mining solutions presents opportunities for manufacturers of electric and hybrid equipment.

- Automation and digitalization offer significant potential for improving efficiency and productivity.

- Development of new mining projects and expansion into previously untapped regions can stimulate growth.

Growth Accelerators in the Russian Mining Machine Industry Industry

Technological breakthroughs in automation, electric powertrains, and digitalization are crucial growth catalysts. Strategic partnerships between domestic and international players facilitate knowledge transfer and access to advanced technologies. Government policies encouraging investment in the mining sector further accelerate market expansion.

Key Players Shaping the Russian Mining Machine Industry Market

- Hitachi Construction Machinery

- Kopeysk Machine Building Plant

- Strommashina Corp

- Uralmash

- Prominer Mining Technology Co Ltd

- Xinhai Mineral Processing EP

- UZTM Kartex Gazprombank Group

- DXN

- Mitsubishi Corporation (Russia) LLC

Notable Milestones in Russian Mining Machine Industry Sector

- 2020: Introduction of a new generation of electric excavators by Uralmash.

- 2022: Strategic partnership between Strommashina Corp and a foreign technology provider.

- 2023: Government announces funding for the development of innovative mining technologies.

In-Depth Russian Mining Machine Industry Market Outlook

The Russian mining machine industry is poised for significant growth in the coming years, driven by robust domestic demand and increasing international cooperation. Strategic investments in advanced technologies, coupled with supportive government policies, will further accelerate market expansion. The market offers lucrative opportunities for both domestic and international players, emphasizing efficiency, sustainability, and technological advancement.

Russian Mining Machine Industry Segmentation

-

1. Type

- 1.1. Surface Mining

- 1.2. Underground Mining

- 1.3. Mineral Processing Equipment

-

2. Application

- 2.1. Metal Mining

- 2.2. Mineral Mining

- 2.3. Coal Mining

-

3. Powertrain Type

- 3.1. IC Engines

- 3.2. Electric

Russian Mining Machine Industry Segmentation By Geography

- 1. Russia

Russian Mining Machine Industry Regional Market Share

Geographic Coverage of Russian Mining Machine Industry

Russian Mining Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The Growing Economy

- 3.2.2 Coupled with Rising Disposal Incomes and Urbanization

- 3.2.3 Fuels Demand for the Market

- 3.3. Market Restrains

- 3.3.1 Various Regulatory Changes

- 3.3.2 Safety Standards

- 3.3.3 and Taxation Policies by the Government may Hamper the Market

- 3.4. Market Trends

- 3.4.1. Electric Vehicles Segment Grows with High CAGR

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Russian Mining Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Surface Mining

- 5.1.2. Underground Mining

- 5.1.3. Mineral Processing Equipment

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Metal Mining

- 5.2.2. Mineral Mining

- 5.2.3. Coal Mining

- 5.3. Market Analysis, Insights and Forecast - by Powertrain Type

- 5.3.1. IC Engines

- 5.3.2. Electric

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Russia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Construction Machinery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kopeysk Machine Building Plant

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Strommashina Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Uralmash

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Prominer Mining Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Xinhai Mineral Processing EP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 UZTM Kartex Gazprombank Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DXN

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Corporation (Russia) LLC

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Hitachi Construction Machinery

List of Figures

- Figure 1: Russian Mining Machine Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Russian Mining Machine Industry Share (%) by Company 2025

List of Tables

- Table 1: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 4: Russian Mining Machine Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Russian Mining Machine Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 6: Russian Mining Machine Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Russian Mining Machine Industry Revenue billion Forecast, by Powertrain Type 2020 & 2033

- Table 8: Russian Mining Machine Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Russian Mining Machine Industry?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Russian Mining Machine Industry?

Key companies in the market include Hitachi Construction Machinery, Kopeysk Machine Building Plant, Strommashina Corp, Uralmash, Prominer Mining Technology Co Ltd, Xinhai Mineral Processing EP, UZTM Kartex Gazprombank Group, DXN, Mitsubishi Corporation (Russia) LLC.

3. What are the main segments of the Russian Mining Machine Industry?

The market segments include Type, Application, Powertrain Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 160.19 billion as of 2022.

5. What are some drivers contributing to market growth?

The Growing Economy. Coupled with Rising Disposal Incomes and Urbanization. Fuels Demand for the Market.

6. What are the notable trends driving market growth?

Electric Vehicles Segment Grows with High CAGR.

7. Are there any restraints impacting market growth?

Various Regulatory Changes. Safety Standards. and Taxation Policies by the Government may Hamper the Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Russian Mining Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Russian Mining Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Russian Mining Machine Industry?

To stay informed about further developments, trends, and reports in the Russian Mining Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence