Key Insights

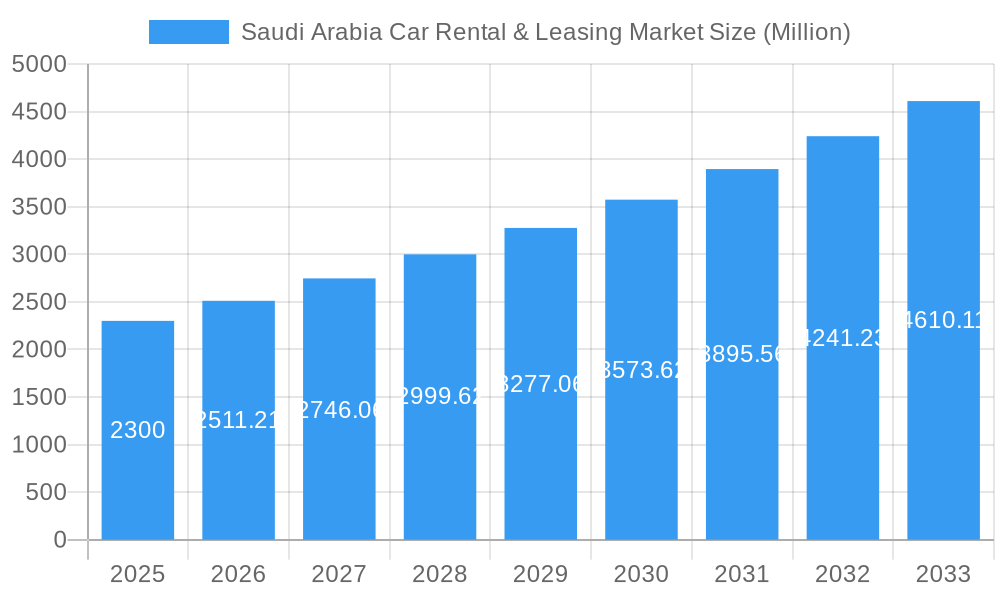

The Saudi Arabia car rental and leasing market, valued at $2.30 billion in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.21% from 2025 to 2033. This surge is driven by several factors. Firstly, the burgeoning tourism sector and increasing disposable incomes within the Kingdom are fueling demand for convenient transportation solutions. Secondly, the government's Vision 2030 initiatives, focused on infrastructure development and economic diversification, are further stimulating the market. The rise of online booking platforms and the expanding presence of international rental companies are also contributing significantly. The market is segmented by lease duration (short-term and long-term), vehicle type (economy/budget, premium/luxury), body type (hatchback, sedan, MUV, SUV), and booking method (online and offline). Competition is fierce, with both international players like Hertz and Avis Budget Group and local companies like Bin Hadi and Theeb Rent A Car vying for market share. Growth will be particularly strong in urban centers, driven by rising population density and increased business activity. However, potential restraints include fluctuating fuel prices and the ongoing impact of global economic uncertainties. The long-term outlook remains positive, with continued growth expected across all market segments, particularly within the premium and SUV categories.

Saudi Arabia Car Rental & Leasing Market Market Size (In Billion)

The diverse range of vehicle types caters to a broad spectrum of customer needs, from budget-conscious travelers to luxury-seeking individuals. The increasing preference for online bookings reflects the broader shift towards digitalization in Saudi Arabia. Regional variations in demand are expected, with metropolitan areas such as Riyadh and Jeddah likely to exhibit higher growth rates compared to less populated regions. Companies are constantly innovating to enhance customer experience, introducing features like mobile apps and enhanced insurance options. Strategic partnerships and acquisitions are also anticipated as major players seek to consolidate their market position and expand their service offerings. A focus on sustainable practices and the adoption of electric vehicle fleets are also emerging trends within the industry, aligned with Saudi Arabia's broader sustainability goals.

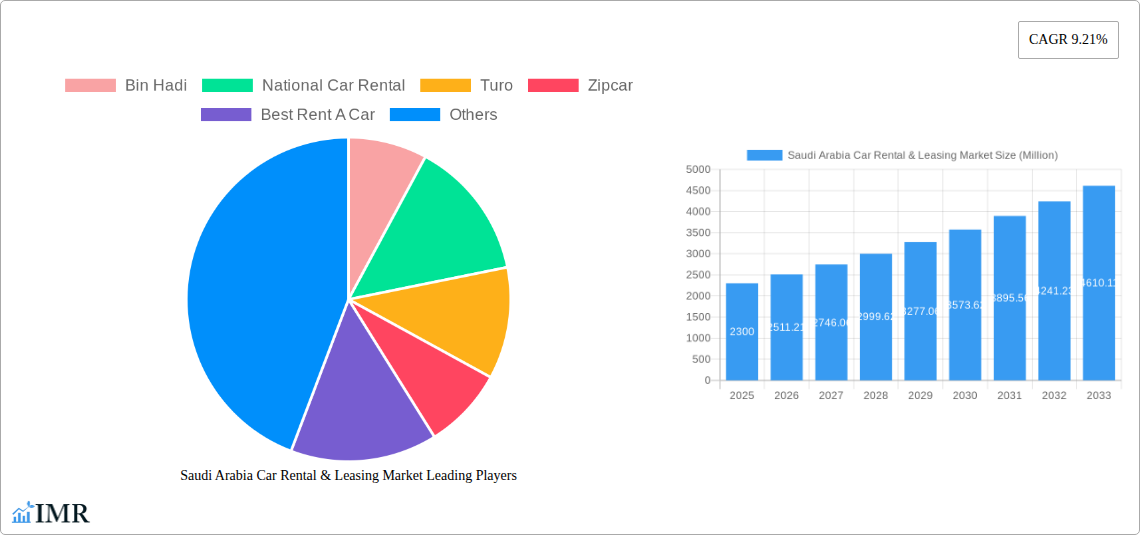

Saudi Arabia Car Rental & Leasing Market Company Market Share

Saudi Arabia Car Rental & Leasing Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Saudi Arabia car rental and leasing market, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), offering invaluable insights for industry professionals, investors, and strategic decision-makers. The total market size is projected to reach xx Million units by 2033.

Saudi Arabia Car Rental & Leasing Market Market Dynamics & Structure

The Saudi Arabian car rental and leasing market is experiencing significant growth driven by factors such as increasing tourism, expanding infrastructure, and a burgeoning young population. Market concentration is moderate, with both large multinational corporations and smaller local players vying for market share. Technological advancements, particularly in online booking platforms and fleet management systems, are transforming the industry. Government regulations, including those related to vehicle licensing and insurance, play a crucial role in shaping the market landscape. The rise of ride-hailing services and car-sharing platforms presents a competitive threat.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on digitalization, telematics, and autonomous vehicle integration.

- Regulatory Framework: Stringent regulations impacting licensing, insurance, and fleet operations.

- Competitive Substitutes: Ride-hailing services (e.g., Uber, Careem), car-sharing platforms.

- End-User Demographics: Predominantly young professionals and tourists.

- M&A Trends: xx number of M&A deals recorded between 2019-2024, with a projected xx increase by 2033 driven by market consolidation and expansion efforts.

Saudi Arabia Car Rental & Leasing Market Growth Trends & Insights

The Saudi Arabia car rental and leasing market exhibits strong growth momentum, propelled by the nation's expanding economy, rising disposable incomes, and increasing urbanization. The market size is projected to register a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million units by 2033. This growth is being further accelerated by the government's Vision 2030 initiatives, aimed at diversifying the economy and boosting tourism. Technological disruptions, such as the rise of online booking platforms and the adoption of connected car technologies, are transforming consumer preferences and driving efficiency gains for rental companies. Consumer behavior is shifting towards greater convenience and transparency, favouring companies offering seamless digital experiences and flexible rental options.

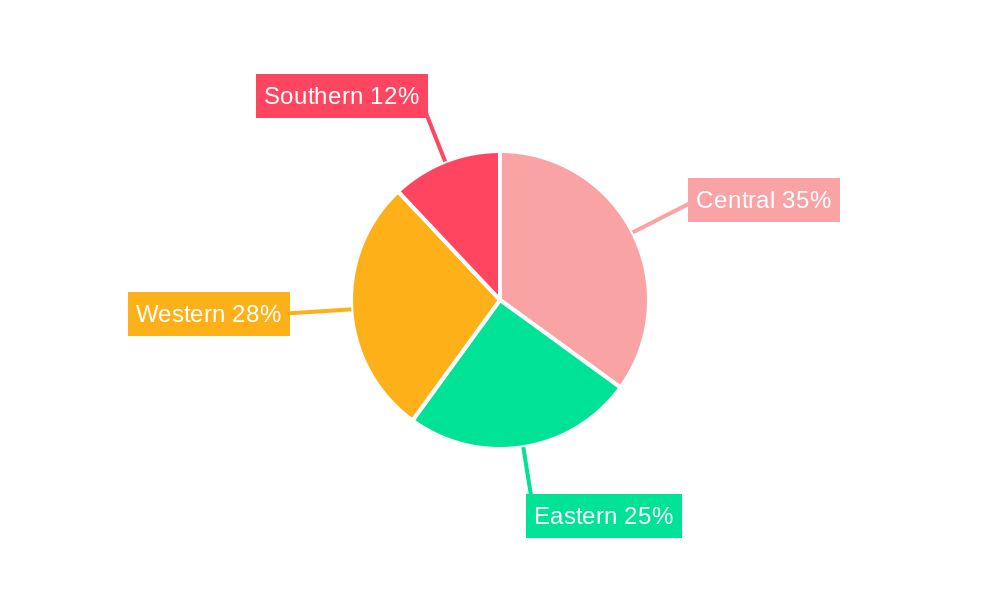

Dominant Regions, Countries, or Segments in Saudi Arabia Car Rental & Leasing Market

The major cities of Riyadh, Jeddah, and Dammam drive the majority of the market's growth. The long-term leasing segment is experiencing faster growth compared to short-term due to increased corporate demand. Within vehicle types, SUVs and Premium/Luxury segments are showing remarkable growth, reflecting changing consumer preferences and the rising disposable incomes among the Saudi population. Online booking is gaining traction, indicating a broader acceptance of digital channels.

- Key Drivers:

- Economic Growth and Rising Disposable Incomes

- Tourism Industry Expansion

- Government Infrastructure Development (Vision 2030)

- Increased Corporate Demand for Long-Term Leasing

- Preference for Premium and SUV Vehicle Types

- Dominant Segments: Long-term leasing (xx% market share in 2025), SUV (xx% of total vehicle rentals), Online booking (xx% of total bookings).

Saudi Arabia Car Rental & Leasing Market Product Landscape

The market offers a diverse range of vehicles, from economy cars to luxury models, catering to diverse needs. Innovation focuses on improving fleet management systems, offering personalized services, and incorporating advanced technologies such as telematics and connected car features. Companies are increasingly offering bundled services including insurance and roadside assistance to enhance customer experience. Unique selling propositions (USPs) often centre around convenience, affordability, and quality of service.

Key Drivers, Barriers & Challenges in Saudi Arabia Car Rental & Leasing Market

Key Drivers: Government initiatives promoting tourism and infrastructure development, increasing disposable incomes among the Saudi population, and the growing adoption of online booking platforms are driving market growth.

Key Challenges: Intense competition, fluctuating fuel prices, and potential regulatory changes pose significant challenges. Supply chain disruptions and the cost of maintaining a large fleet also impact profitability. The market faces challenges in the form of high operational costs, insurance expenses, and potentially volatile fuel prices which impact profitability. Competition from ride-hailing services also contributes to market pressure. Estimates suggest that these factors collectively reduce profit margins by an estimated xx% in 2025.

Emerging Opportunities in Saudi Arabia Car Rental & Leasing Market

Untapped potential lies in expanding into smaller cities and towns, catering to specific niche markets (e.g., eco-friendly vehicles, luxury chauffeur services), and leveraging technological advancements to offer enhanced customer experiences. The introduction of subscription-based car rental models could also significantly alter the market landscape. Growing corporate demand for long-term leasing agreements offers significant opportunities for providers with robust fleet management solutions.

Growth Accelerators in the Saudi Arabia Car Rental & Leasing Market Industry

Strategic partnerships with hotels, airlines, and corporate clients will further fuel market expansion. Investment in innovative technologies such as AI-powered customer service and predictive maintenance will enhance operational efficiency and profitability. Expanding into new geographic areas and diversifying vehicle offerings (e.g., electric vehicles) will attract new customer segments.

Key Players Shaping the Saudi Arabia Car Rental & Leasing Market Market

- Bin Hadi

- National Car Rental

- Turo

- Zipcar

- Best Rent A Car

- Hanco Automotive

- Budget Rent-A-Car

- Auto Rent

- Theeb Rent A Car

- Ejaro

- Key Car Rental

- Strong Rent a Car

- Yelo Corporation (Al Wefaq)

- Hertz Corporation

- Sixt SE

- Samara Land Transportation Services

- Autoworld (Al-Jazira Equipment Company Limited)

- Esar International Group

- Europcar Mobility Group

- Avis Budget Group Inc

Notable Milestones in Saudi Arabia Car Rental & Leasing Market Sector

- November 2023: Budget Saudi secured a SAR 39.8 million (USD 10.6 million) four-year leasing deal with SABIC.

- June 2023: Lumi Rental Company signed a SAR 42 million (USD 11.2 million) agreement with Saudi Post for 855 vehicles.

- April 2023: ALTAWKILAT Premium partnered with PEAX to supply 100 Hongqi Ousado cars.

- October 2022: Lumi opened its first used car showroom in Riyadh.

In-Depth Saudi Arabia Car Rental & Leasing Market Market Outlook

The Saudi Arabia car rental and leasing market is poised for sustained growth, driven by a confluence of factors including government initiatives, economic expansion, and evolving consumer preferences. Strategic investments in technology, expansion into underserved markets, and the development of innovative service offerings will be crucial for companies seeking to capitalize on the market's immense potential. The market's long-term growth trajectory is strongly positive, indicating substantial opportunities for both established players and new entrants.

Saudi Arabia Car Rental & Leasing Market Segmentation

-

1. Duration

- 1.1. Short-term Leasing

- 1.2. Long-term Leasing

-

2. Vehicle Type

- 2.1. Economy/Budget

- 2.2. Premium/Luxury

-

3. Body Type

- 3.1. Hatchback

- 3.2. Sedan

- 3.3. Multi Utility Vehicle and Sports Utility Vehicle

-

4. Booking Type

- 4.1. Online

- 4.2. Offline

Saudi Arabia Car Rental & Leasing Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Car Rental & Leasing Market Regional Market Share

Geographic Coverage of Saudi Arabia Car Rental & Leasing Market

Saudi Arabia Car Rental & Leasing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.21% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market

- 3.3. Market Restrains

- 3.3.1. Impact of Inflation on Costs and Consumer Spending is a Key Challenge

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Sports Utility Vehicles to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Car Rental & Leasing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 5.1.1. Short-term Leasing

- 5.1.2. Long-term Leasing

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Economy/Budget

- 5.2.2. Premium/Luxury

- 5.3. Market Analysis, Insights and Forecast - by Body Type

- 5.3.1. Hatchback

- 5.3.2. Sedan

- 5.3.3. Multi Utility Vehicle and Sports Utility Vehicle

- 5.4. Market Analysis, Insights and Forecast - by Booking Type

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Duration

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bin Hadi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 National Car Rental

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Turo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Zipcar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Best Rent A Car

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hanco Automotive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Budget Rent-A-Car

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Auto Rent

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Theeb Rent A Car

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ejaro

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Key Car Rental

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Strong Rent a Car

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Yelo Corporation (Al Wefaq)

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Hertz Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Sixt SE

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Samara Land Transportation Services

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Autoworld (Al-Jazira Equipment Company Limited

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Esar International Group

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Europcar Mobility Group

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Avis Budget Group Inc

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Bin Hadi

List of Figures

- Figure 1: Saudi Arabia Car Rental & Leasing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Car Rental & Leasing Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2020 & 2033

- Table 2: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2020 & 2033

- Table 4: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 5: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Duration 2020 & 2033

- Table 7: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 8: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Body Type 2020 & 2033

- Table 9: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Booking Type 2020 & 2033

- Table 10: Saudi Arabia Car Rental & Leasing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Car Rental & Leasing Market?

The projected CAGR is approximately 9.21%.

2. Which companies are prominent players in the Saudi Arabia Car Rental & Leasing Market?

Key companies in the market include Bin Hadi, National Car Rental, Turo, Zipcar, Best Rent A Car, Hanco Automotive, Budget Rent-A-Car, Auto Rent, Theeb Rent A Car, Ejaro, Key Car Rental, Strong Rent a Car, Yelo Corporation (Al Wefaq), Hertz Corporation, Sixt SE, Samara Land Transportation Services, Autoworld (Al-Jazira Equipment Company Limited, Esar International Group, Europcar Mobility Group, Avis Budget Group Inc.

3. What are the main segments of the Saudi Arabia Car Rental & Leasing Market?

The market segments include Duration, Vehicle Type, Body Type, Booking Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Growth in the Logistics and E-commerce Industries and Establishment of New Corporate Offices Driving the Market.

6. What are the notable trends driving market growth?

Increasing Demand for Sports Utility Vehicles to Drive the Market.

7. Are there any restraints impacting market growth?

Impact of Inflation on Costs and Consumer Spending is a Key Challenge.

8. Can you provide examples of recent developments in the market?

November 2023: The United International Transportation Company, Budget Saudi, secured a long-term deal with Saudi Basic Industries Corp. (SABIC) for leasing the transport firm’s 263 vehicles. The contract, valued at SAR 39.8 million (USD 10.6 million), is for four years. The leasing deal will be automatically renewed for 12 months at the end of the initial term.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Car Rental & Leasing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Car Rental & Leasing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Car Rental & Leasing Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Car Rental & Leasing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence