Key Insights

The South American draught beer market is projected to reach $46.51 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.6% from 2025 to 2033. This robust growth is propelled by increasing disposable incomes in key markets like Brazil and Argentina, driving demand for premium beverages. A growing young adult demographic and the rising popularity of craft beers, alongside a wider product selection beyond traditional lagers, are further stimulating market expansion. While off-trade channels currently lead in market share, the on-trade sector, especially in urban nightlife hubs, is anticipated to grow. The market is characterized by intense competition among global giants such as Heineken and Anheuser-Busch InBev, alongside prominent local brewers and emerging craft breweries.

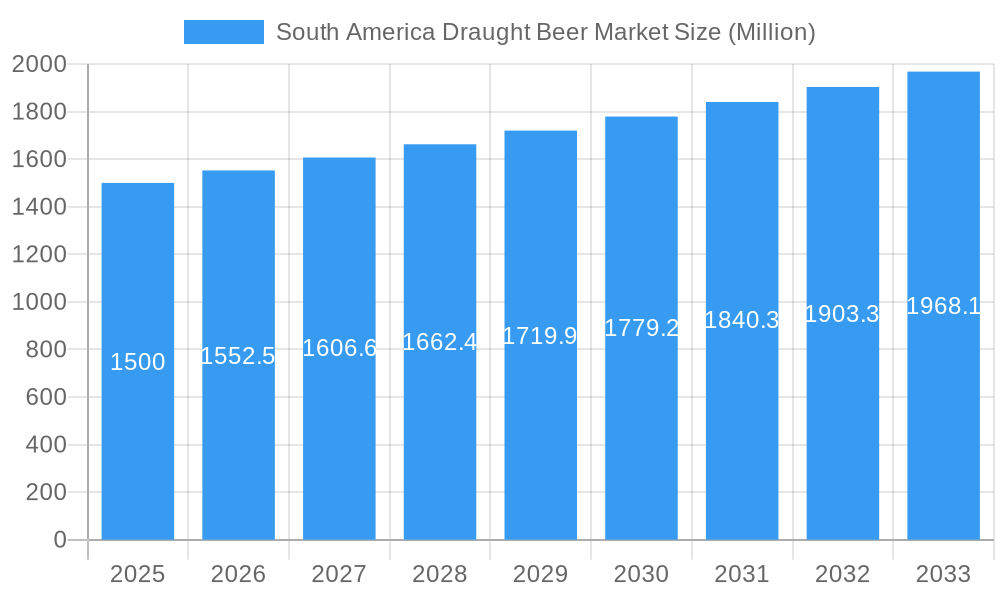

South America Draught Beer Market Market Size (In Billion)

Potential market growth may be tempered by regional economic volatility, particularly in Argentina, and government regulations concerning alcohol consumption and pricing. Increasing health consciousness among consumers also presents a challenge. While lagers remain dominant, the rise of craft ales and diverse beer styles offers significant opportunities for innovation and market penetration. Brazil and Argentina are identified as the primary growth drivers within the South American draught beer sector, supported by extensive distribution networks and strong consumer appetite. Future market success will hinge on product innovation, strategic alliances, and effective management of economic and regulatory landscapes.

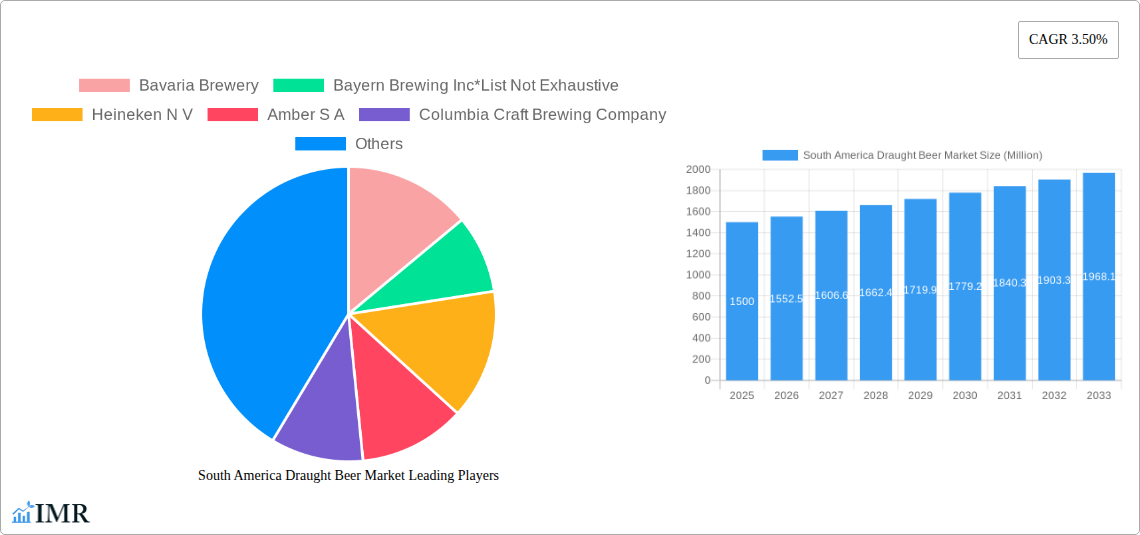

South America Draught Beer Market Company Market Share

South America Draught Beer Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the South America draught beer market, encompassing market dynamics, growth trends, regional performance, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report is invaluable for industry professionals, investors, and anyone seeking to understand this dynamic market. Millions of units are used throughout the report.

South America Draught Beer Market Dynamics & Structure

This section analyzes the South American draught beer market's structure, encompassing market concentration, technological advancements, regulatory landscapes, competitive substitutes, consumer demographics, and merger & acquisition (M&A) activities. The analysis combines quantitative data (market share, M&A deal volumes) with qualitative insights (innovation barriers). The highly fragmented nature of the market is assessed, along with the influence of changing consumer preferences and government regulations. Technological advancements, such as improved brewing techniques and efficient distribution systems, are explored, alongside their impact on market competitiveness.

- Market Concentration: xx% market share held by top 5 players. High fragmentation among smaller breweries.

- Technological Innovation: Focus on craft brewing, premiumization, and sustainable practices. Investment in automation and digital technologies.

- Regulatory Framework: Varying regulations across countries impacting production, distribution, and marketing. Alcohol tax policies and licensing requirements analyzed.

- Competitive Substitutes: Competition from non-alcoholic beverages, spirits, and ready-to-drink cocktails.

- End-User Demographics: Growing young adult population driving demand for craft beers. Shifting consumer preferences towards premiumization.

- M&A Trends: xx M&A deals recorded in the last 5 years; mostly smaller acquisitions aimed at market expansion.

South America Draught Beer Market Growth Trends & Insights

This section delves into the evolution of the South American draught beer market size, adoption rates, technological disruptions, and shifting consumer behavior. It leverages comprehensive market research and data analytics to provide in-depth insights, including Compound Annual Growth Rate (CAGR) and market penetration rates. The influence of economic factors, social trends, and technological advancements on market growth is analyzed. The changing preferences of consumers towards health-conscious options and unique flavor profiles also will be investigated.

- Market Size Evolution: The market is predicted to reach xx million units by 2033, exhibiting a CAGR of xx%.

- Adoption Rates: Steady growth in the adoption of premium and craft beers. Increased preference for draught beer among specific demographics.

- Technological Disruptions: Advancements in brewing technologies and distribution processes have streamlined production and expanded reach.

- Consumer Behavior Shifts: Growing demand for artisanal and organic products, impacting preferences within the market.

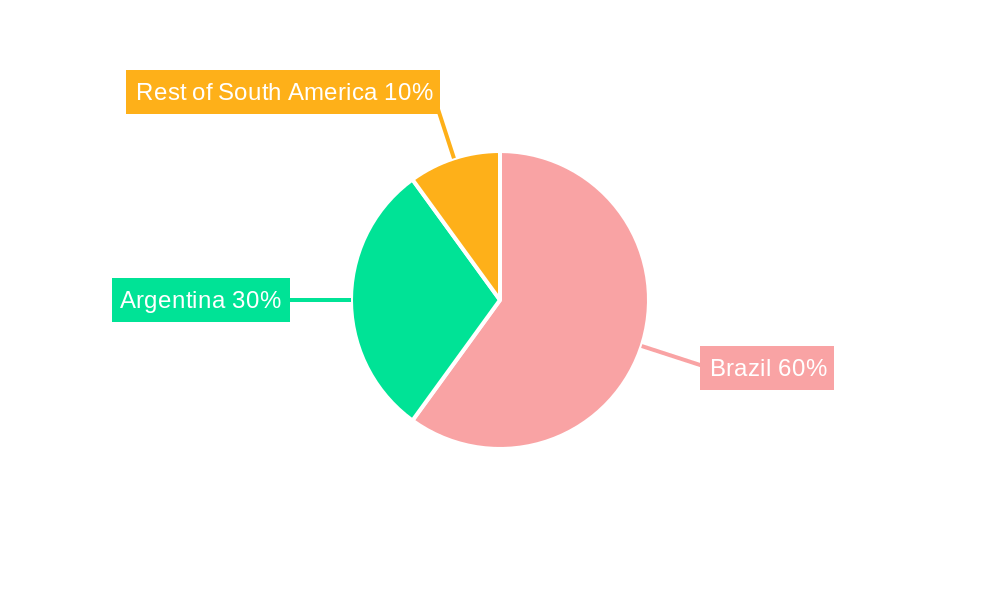

Dominant Regions, Countries, or Segments in South America Draught Beer Market

This section identifies the leading regions, countries, and segments (product type and distribution channel) driving market growth. It explores the underlying factors behind this dominance, such as economic policies, infrastructure development, and consumer preferences. Market share and growth potential analysis are included for each dominant segment.

- Leading Region: Brazil, due to its large population and established brewing industry.

- Leading Country: Brazil, due to its large population and well-developed infrastructure.

- Leading Product Type: Lager, due to its widespread popularity and affordability.

- Leading Distribution Channel: On-trade channel (bars and restaurants), due to its strong social appeal.

- Key Drivers: Growing disposable income, increasing urbanization, and rising tourism.

South America Draught Beer Market Product Landscape

This section details the innovation, applications, and performance metrics of draught beer products. It examines the unique selling propositions (USPs) of different brands and highlights the technological advancements that are shaping the market.

The market is characterized by a diverse range of products, from traditional lagers to innovative craft brews. Product innovation focuses on unique flavors, brewing techniques, and packaging, catering to evolving consumer preferences. Technological advancements include improvements in brewing efficiency, sustainability initiatives, and enhanced quality control measures. The market also sees the emergence of premium and specialized beer varieties.

Key Drivers, Barriers & Challenges in South America Draught Beer Market

This section identifies the primary forces driving market growth and the challenges hindering expansion. It analyzes technological, economic, and regulatory factors.

Key Drivers:

- Rising disposable incomes.

- Increasing urbanization.

- Growing tourism.

- Changing consumer preferences.

Key Challenges:

- Economic instability in some countries.

- Stringent alcohol regulations.

- Intense competition.

- Supply chain disruptions. xx% increase in raw material prices observed in 2024.

Emerging Opportunities in South America Draught Beer Market

This section highlights emerging trends and untapped opportunities in the market. It focuses on new market segments, innovative applications, and shifts in consumer preferences.

- Growth in craft beer segment.

- Increased demand for premium and imported beers.

- Growing interest in sustainable and organic products.

- Opportunities in e-commerce and direct-to-consumer sales.

Growth Accelerators in the South America Draught Beer Market Industry

This section discusses the catalysts propelling long-term growth, including technological advancements, strategic partnerships, and market expansion strategies.

Long-term growth will be fueled by continuous product innovation, strategic alliances, and expansion into new markets. Investment in efficient production processes and sustainable practices will be crucial for maintaining competitiveness. The market will benefit from rising tourism, increased disposable incomes, and favorable government policies.

Key Players Shaping the South America Draught Beer Market Market

- Bavaria Brewery

- Bayern Brewing Inc

- Heineken N V

- Amber S A

- Columbia Craft Brewing Company

- Brahma

- Carlsberg Group

- Anheuser-Busch InBev

- Novo Brazil Brewing Company

- Muller Inc

Notable Milestones in South America Draught Beer Market Sector

- September 2021: River North Brewery launched its Socorro Chile Lager beer.

- November 2021: Novo Brazil Brewing Company launched its TRES beer collection.

- May 2022: Compania Cervecerias Unidas (CCU) invested USD 23 million to expand beer production in Argentina.

In-Depth South America Draught Beer Market Market Outlook

The South American draught beer market presents substantial growth potential driven by several factors, including the increasing adoption of craft beer, premiumization trends, and the rising disposable incomes among consumers. Strategic partnerships and investments in innovative brewing techniques will further enhance market expansion. The market is set for steady growth driven by both local and international players. Companies focusing on sustainable practices and targeted marketing will gain a competitive edge.

South America Draught Beer Market Segmentation

-

1. Product Type

- 1.1. Lager

- 1.2. Ale

- 1.3. Other Beer types

-

2. distribution channel

-

2.1. Off trade Channel

- 2.1.1. Online Retail Channel

- 2.1.2. Offline Retail Channel

- 2.2. On Trade Channel

-

2.1. Off trade Channel

-

3. Geography

-

3.1. South America

- 3.1.1. Brazil

- 3.1.2. Argentina

- 3.1.3. Rest of South America

-

3.1. South America

South America Draught Beer Market Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Rest of South America

South America Draught Beer Market Regional Market Share

Geographic Coverage of South America Draught Beer Market

South America Draught Beer Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend

- 3.3. Market Restrains

- 3.3.1. Stringent Government Regulations and Product Guidelines

- 3.4. Market Trends

- 3.4.1. Growing microbreweries leading to increased consumption.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Draught Beer Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Lager

- 5.1.2. Ale

- 5.1.3. Other Beer types

- 5.2. Market Analysis, Insights and Forecast - by distribution channel

- 5.2.1. Off trade Channel

- 5.2.1.1. Online Retail Channel

- 5.2.1.2. Offline Retail Channel

- 5.2.2. On Trade Channel

- 5.2.1. Off trade Channel

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. South America

- 5.3.1.1. Brazil

- 5.3.1.2. Argentina

- 5.3.1.3. Rest of South America

- 5.3.1. South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bavaria Brewery

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bayern Brewing Inc*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Heineken N V

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amber S A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Columbia Craft Brewing Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Brahma

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carlsberg Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Anheuser-Bushch InBev

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Novo Brazil Brewing Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Muller Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bavaria Brewery

List of Figures

- Figure 1: South America Draught Beer Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: South America Draught Beer Market Share (%) by Company 2025

List of Tables

- Table 1: South America Draught Beer Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: South America Draught Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 3: South America Draught Beer Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 4: South America Draught Beer Market Volume liter Forecast, by distribution channel 2020 & 2033

- Table 5: South America Draught Beer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: South America Draught Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 7: South America Draught Beer Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: South America Draught Beer Market Volume liter Forecast, by Region 2020 & 2033

- Table 9: South America Draught Beer Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: South America Draught Beer Market Volume liter Forecast, by Product Type 2020 & 2033

- Table 11: South America Draught Beer Market Revenue billion Forecast, by distribution channel 2020 & 2033

- Table 12: South America Draught Beer Market Volume liter Forecast, by distribution channel 2020 & 2033

- Table 13: South America Draught Beer Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: South America Draught Beer Market Volume liter Forecast, by Geography 2020 & 2033

- Table 15: South America Draught Beer Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: South America Draught Beer Market Volume liter Forecast, by Country 2020 & 2033

- Table 17: Brazil South America Draught Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Brazil South America Draught Beer Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 19: Argentina South America Draught Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Argentina South America Draught Beer Market Volume (liter ) Forecast, by Application 2020 & 2033

- Table 21: Rest of South America South America Draught Beer Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Rest of South America South America Draught Beer Market Volume (liter ) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Draught Beer Market?

The projected CAGR is approximately 5.6%.

2. Which companies are prominent players in the South America Draught Beer Market?

Key companies in the market include Bavaria Brewery, Bayern Brewing Inc*List Not Exhaustive, Heineken N V, Amber S A, Columbia Craft Brewing Company, Brahma, Carlsberg Group, Anheuser-Bushch InBev, Novo Brazil Brewing Company, Muller Inc.

3. What are the main segments of the South America Draught Beer Market?

The market segments include Product Type, distribution channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 46.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Nutricosmetics Among Millennials; Growing Beauty and Wellness Trend.

6. What are the notable trends driving market growth?

Growing microbreweries leading to increased consumption..

7. Are there any restraints impacting market growth?

Stringent Government Regulations and Product Guidelines.

8. Can you provide examples of recent developments in the market?

In May 2022, Compania Cervecerias Unidas (CCU) invested about USD 23 million to expand its beer production capacity in Argentina. The company aims to strengthen its footprints across the region with increasing production and logistic capacity to reach maximum consumers in the market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in liter .

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Draught Beer Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Draught Beer Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Draught Beer Market?

To stay informed about further developments, trends, and reports in the South America Draught Beer Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence