Key Insights

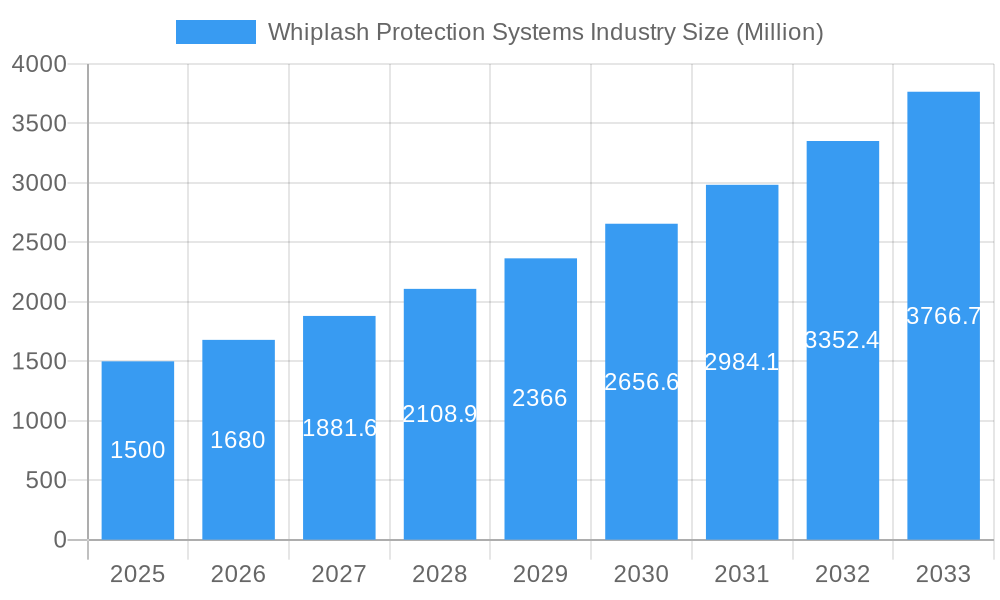

The global Whiplash Protection Systems market is poised for substantial expansion, driven by increasing vehicle production, evolving safety mandates, and heightened consumer awareness of whiplash injuries. The market, valued at approximately $8.93 billion in the base year 2025, is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.42%. Key growth drivers include the widespread adoption of Advanced Driver-Assistance Systems (ADAS) and the integration of proactive head restraints. Escalating road accident rates and their associated whiplash injuries are compelling manufacturers to prioritize advanced protection technologies. The passenger car segment currently leads, but the commercial vehicle segment is anticipated to experience significant growth due to emerging regulatory requirements for fleet safety. Among system types, proactive head restraints are favored for their enhanced efficacy in mitigating whiplash trauma. Industry leaders such as Denso Corporation, Autoliv Inc., and Bosch are spearheading innovation and technological progress.

Whiplash Protection Systems Industry Market Size (In Billion)

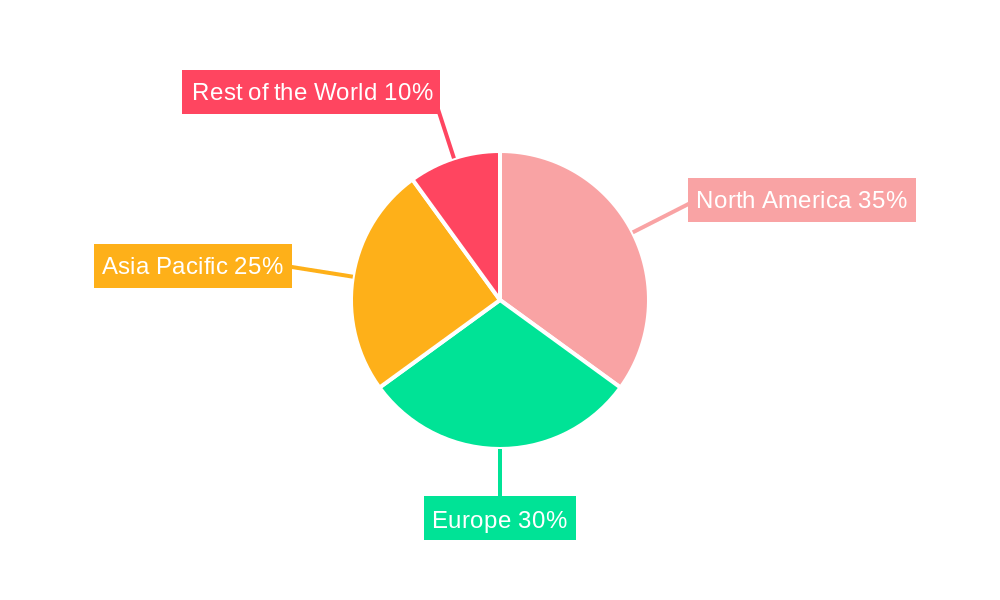

Geographically, North America and Europe exhibit strong market presence due to high vehicle ownership and stringent safety standards. The Asia-Pacific region, particularly China and India, offers considerable growth potential, fueled by rapid urbanization, rising vehicle sales, and developing safety regulations. Sustained technological innovation, stricter global safety mandates, and an increasing emphasis on passenger well-being will propel market growth throughout the forecast period. Intensifying competition among key players is expected to foster further innovation and market accessibility.

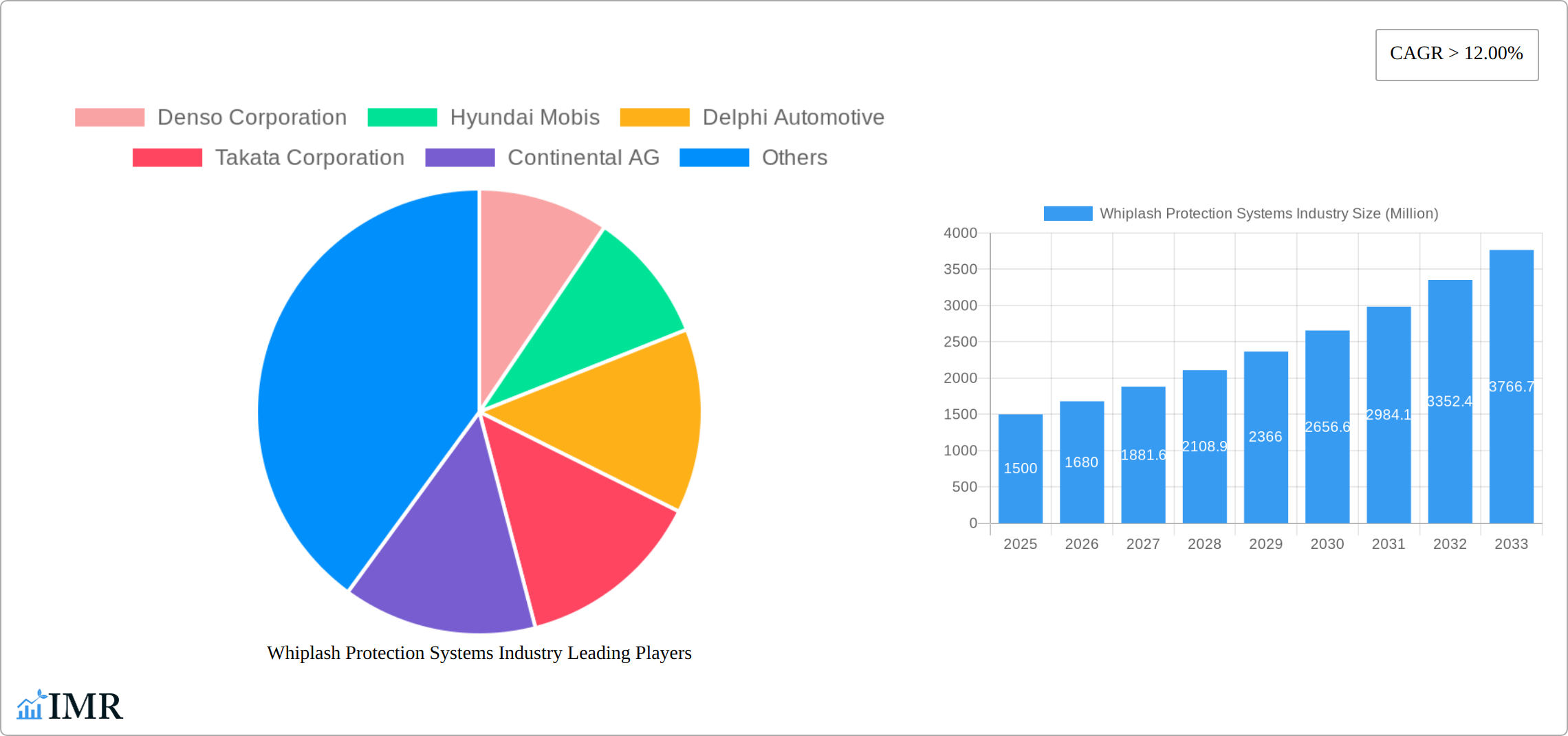

Whiplash Protection Systems Industry Company Market Share

Whiplash Protection Systems Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the global Whiplash Protection Systems industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033, and utilizes 2025 as the base year. Market values are presented in million units. The analysis encompasses key market segments including Passenger Cars and Commercial Vehicles, and System Types such as Reactive Head Restraint, Proactive Head Restraint, and Others. Leading companies like Denso Corporation, Hyundai Mobis, Delphi Automotive, Takata Corporation, Continental AG, Autoliv Inc, Robert Bosch GmbH, Lear Corporation, Wabco, Grammer AG and others are profiled.

Whiplash Protection Systems Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the Whiplash Protection Systems industry. We delve into market concentration, examining market share distribution among key players. The analysis also explores the impact of technological innovations (e.g., advancements in sensor technology and material science) and evolving safety regulations on market growth. Furthermore, we investigate the presence of substitute products and their impact on market dynamics. End-user demographics and their influence on demand are also considered. Finally, the report examines mergers and acquisitions (M&A) activity within the industry, providing quantitative data on deal volumes and qualitative assessments of their impact.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Advancements in lightweight materials and sensor technologies are driving innovation, leading to more effective and compact systems.

- Regulatory Framework: Stringent safety regulations, particularly in developed markets, are a key growth driver.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, with a significant increase projected during the forecast period.

- Competitive Substitutes: The primary substitutes are alternative seating designs and improved vehicle structures, posing a moderate threat.

- Innovation Barriers: High R&D costs and stringent safety certifications present significant barriers to entry.

Whiplash Protection Systems Industry Growth Trends & Insights

The Whiplash Protection Systems (WPS) industry is experiencing robust expansion, fueled by a confluence of escalating safety mandates, heightened consumer demand for advanced vehicle protection, and continuous technological innovation. This section provides a deep dive into the market's growth trajectory, analyzing key metrics such as market size evolution, adoption rates across diverse vehicle segments (including passenger cars, commercial vehicles, and emerging mobility solutions), and the transformative impact of technological disruptions. Our analysis is underpinned by proprietary data and comprehensive market research, offering a granular view of growth dynamics, including precise Compound Annual Growth Rate (CAGR) projections and evolving market penetration rates. Furthermore, we meticulously examine the profound influence of shifting consumer preferences towards enhanced safety features, which are acting as a significant demand catalyst. The interplay of global economic conditions, regulatory landscapes, and the varying rates of technological adoption across different geographical regions are also critically evaluated to present a holistic market perspective.

- Market Size: The global market was valued at approximately [Insert Specific Value] million units in 2024 and is projected to reach approximately [Insert Specific Value] million units by 2033, demonstrating substantial volumetric growth.

- CAGR: The market is anticipated to experience a significant Compound Annual Growth Rate (CAGR) of approximately [Insert Specific Percentage]% during the forecast period, indicating a steady and strong expansionary trend.

- Adoption Rates: Adoption rates for whiplash protection systems are notably higher in the passenger car segment, driven by consumer awareness and OEM integration. While adoption in commercial vehicles is growing, it lags behind, presenting a key area for future market penetration.

- Technological Disruptions: The seamless integration of Advanced Driver-Assistance Systems (ADAS) and smart cabin technologies is a pivotal factor. These integrated systems are designed to anticipate potential collision scenarios, thereby enhancing the effectiveness and necessity of advanced whiplash protection solutions.

Dominant Regions, Countries, or Segments in Whiplash Protection Systems Industry

This section identifies the leading regions, countries, and segments driving market growth within the Whiplash Protection Systems industry. The analysis focuses on regional variations in demand, technological adoption, and regulatory landscapes. The leading regions and their key growth drivers are highlighted. Key factors contributing to regional dominance, such as economic strength, infrastructure development, and consumer preferences, are discussed in detail. Quantitative data on market share and growth potential will be presented for each identified region/segment.

- Leading Region: North America is projected to dominate the market due to high vehicle production and stringent safety regulations.

- Key Drivers (North America): Strong automotive industry, high disposable income, and increased consumer awareness of safety features.

- Leading Segment: Passenger cars account for a significant majority of the market share owing to higher sales volume compared to commercial vehicles.

- Key Drivers (Passenger Cars): Growing demand for advanced safety features and rising sales of passenger cars globally.

Whiplash Protection Systems Industry Product Landscape

This section provides a concise overview of the various product types within the Whiplash Protection Systems market. It details innovative product features, applications across different vehicle segments, and crucial performance metrics. Unique selling propositions (USPs) of leading products and significant technological advancements contributing to superior performance are highlighted.

The industry showcases a range of products, from basic reactive head restraints to advanced proactive systems incorporating sensors and actuators for optimized protection during impacts. Innovation focuses on lightweight materials, improved comfort, and seamless integration with existing vehicle safety systems. Key performance indicators include impact force reduction percentages and crash test ratings.

Key Drivers, Barriers & Challenges in Whiplash Protection Systems Industry

This section meticulously identifies and critically analyzes the pivotal factors propelling the growth of the Whiplash Protection Systems industry, alongside the significant obstacles and challenges that potentially impede its expansion. Understanding these dynamics is crucial for stakeholders to navigate the market effectively.

Key Drivers: The primary growth engines include the ever-increasing global vehicle production volumes, coupled with the proliferation of stringent government regulations and international safety standards that mandate the inclusion of advanced safety features. Simultaneously, a significant rise in consumer awareness regarding the severity and prevalence of whiplash injuries is directly translating into higher demand for protective systems. Furthermore, groundbreaking advancements in sensor technology, including sophisticated impact detection systems, and the development of innovative, lighter, and more resilient materials are also contributing substantially to market expansion.

Challenges & Restraints: The industry faces considerable hurdles, including the high initial capital investment required for manufacturers to develop and implement advanced WPS technologies. The intricate and often globalized nature of supply chains introduces vulnerabilities to disruptions, impacting production timelines and costs. Intense competition among established automotive safety suppliers also presents a continuous pressure point. Moreover, the imperative for sustained and substantial investment in Research and Development (R&D) to keep pace with rapid technological advancements and evolving safety requirements adds another layer of complexity and financial strain.

Emerging Opportunities in Whiplash Protection Systems Industry

This section delves into the nascent trends and largely untapped opportunities that are shaping the future landscape of the Whiplash Protection Systems market. We pinpoint potential avenues for strategic expansion, encompassing novel applications, cutting-edge technological advancements, and the exploration of underserved emerging markets. The primary focus is on identifying evolving consumer preferences and the expanding adoption of new mobility paradigms that are poised to drive future growth. The accelerating integration and adoption of autonomous vehicles (AVs) and advanced vehicle architectures present a particularly significant and transformative opportunity for the development and seamless integration of more sophisticated and proactive whiplash protection systems.

Growth Accelerators in the Whiplash Protection Systems Industry Industry

This section highlights the major catalysts that will drive long-term growth within the Whiplash Protection Systems industry. Technological innovations, strategic partnerships, and effective market expansion strategies are all crucial. The development and adoption of new lightweight and high-performance materials will play a vital role in expanding the market.

Key Players Shaping the Whiplash Protection Systems Industry Market

Notable Milestones in Whiplash Protection Systems Industry Sector

- 2020: Introduction of a new proactive head restraint system by Autoliv Inc.

- 2022: Merger between two smaller players in the industry resulting in expanded market share.

- 2023: Launch of a lightweight head restraint system by Denso Corporation utilizing advanced composite materials. (Further milestones can be added based on actual data)

In-Depth Whiplash Protection Systems Industry Market Outlook

The Whiplash Protection Systems market is firmly positioned for remarkable and sustained growth in the coming years. This expansion is primarily attributed to the intensifying global push for enhanced vehicle safety, driven by progressively stringent safety regulations from regulatory bodies worldwide. Concurrently, rapid technological advancements in automotive safety, including smart materials and intelligent sensor networks, are continually improving the performance and scope of WPS. Furthermore, a palpable and growing demand from consumers for vehicles equipped with superior safety features is a significant market stimulant. To maintain a competitive edge and foster continued success within this rapidly evolving and highly specialized industry, strategic partnerships and substantial, focused investments in Research and Development (R&D) will be paramount. The deep and synergistic integration of whiplash protection systems with advanced driver-assistance systems (ADAS) and upcoming in-cabin sensing technologies represents a particularly promising frontier for future innovation, market differentiation, and substantial market expansion.

Whiplash Protection Systems Industry Segmentation

-

1. Vehicle Type

- 1.1. Passenger Cars

- 1.2. Commercial Vehicle

-

2. System Type

- 2.1. Reactive Head Restraint

- 2.2. Proactive Head Restraint

- 2.3. Others

Whiplash Protection Systems Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Rest of the World

- 4.1. Brazil

- 4.2. Mexico

- 4.3. South Africa

- 4.4. Other Countries

Whiplash Protection Systems Industry Regional Market Share

Geographic Coverage of Whiplash Protection Systems Industry

Whiplash Protection Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others

- 3.3. Market Restrains

- 3.3.1. RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others

- 3.4. Market Trends

- 3.4.1. Technological Developments Will Help This Market Grow

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.1.1. Passenger Cars

- 5.1.2. Commercial Vehicle

- 5.2. Market Analysis, Insights and Forecast - by System Type

- 5.2.1. Reactive Head Restraint

- 5.2.2. Proactive Head Restraint

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6. North America Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 6.1.1. Passenger Cars

- 6.1.2. Commercial Vehicle

- 6.2. Market Analysis, Insights and Forecast - by System Type

- 6.2.1. Reactive Head Restraint

- 6.2.2. Proactive Head Restraint

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7. Europe Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 7.1.1. Passenger Cars

- 7.1.2. Commercial Vehicle

- 7.2. Market Analysis, Insights and Forecast - by System Type

- 7.2.1. Reactive Head Restraint

- 7.2.2. Proactive Head Restraint

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8. Asia Pacific Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 8.1.1. Passenger Cars

- 8.1.2. Commercial Vehicle

- 8.2. Market Analysis, Insights and Forecast - by System Type

- 8.2.1. Reactive Head Restraint

- 8.2.2. Proactive Head Restraint

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9. Rest of the World Whiplash Protection Systems Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 9.1.1. Passenger Cars

- 9.1.2. Commercial Vehicle

- 9.2. Market Analysis, Insights and Forecast - by System Type

- 9.2.1. Reactive Head Restraint

- 9.2.2. Proactive Head Restraint

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Vehicle Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Denso Corporation

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Hyundai Mobis

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Delphi Automotive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Takata Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Continental AG

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Autoliv Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Robert Bosch GmbH

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Lear Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wabco*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Grammer AG

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Denso Corporation

List of Figures

- Figure 1: Global Whiplash Protection Systems Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 3: North America Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 4: North America Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 5: North America Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 6: North America Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 9: Europe Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 10: Europe Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 11: Europe Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 12: Europe Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 15: Asia Pacific Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 16: Asia Pacific Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 17: Asia Pacific Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 18: Asia Pacific Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Whiplash Protection Systems Industry Revenue (billion), by Vehicle Type 2025 & 2033

- Figure 21: Rest of the World Whiplash Protection Systems Industry Revenue Share (%), by Vehicle Type 2025 & 2033

- Figure 22: Rest of the World Whiplash Protection Systems Industry Revenue (billion), by System Type 2025 & 2033

- Figure 23: Rest of the World Whiplash Protection Systems Industry Revenue Share (%), by System Type 2025 & 2033

- Figure 24: Rest of the World Whiplash Protection Systems Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Whiplash Protection Systems Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 2: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 3: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 5: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 6: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 11: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 12: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Germany Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: France Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 19: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 20: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: India Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: China Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: South Korea Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Vehicle Type 2020 & 2033

- Table 27: Global Whiplash Protection Systems Industry Revenue billion Forecast, by System Type 2020 & 2033

- Table 28: Global Whiplash Protection Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Brazil Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Mexico Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: South Africa Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Other Countries Whiplash Protection Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Whiplash Protection Systems Industry?

The projected CAGR is approximately 8.42%.

2. Which companies are prominent players in the Whiplash Protection Systems Industry?

Key companies in the market include Denso Corporation, Hyundai Mobis, Delphi Automotive, Takata Corporation, Continental AG, Autoliv Inc, Robert Bosch GmbH, Lear Corporation, Wabco*List Not Exhaustive, Grammer AG.

3. What are the main segments of the Whiplash Protection Systems Industry?

The market segments include Vehicle Type, System Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.93 billion as of 2022.

5. What are some drivers contributing to market growth?

ADOPTION OF STEER-BY-WIRE SYSTEM AIDING MARKET GROWTH; Others.

6. What are the notable trends driving market growth?

Technological Developments Will Help This Market Grow.

7. Are there any restraints impacting market growth?

RAW MATERIAL PRICE INCREASES ARE EXPECTED TO STIFLE MARKET GROWTH; Others.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Whiplash Protection Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Whiplash Protection Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Whiplash Protection Systems Industry?

To stay informed about further developments, trends, and reports in the Whiplash Protection Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence