Key Insights

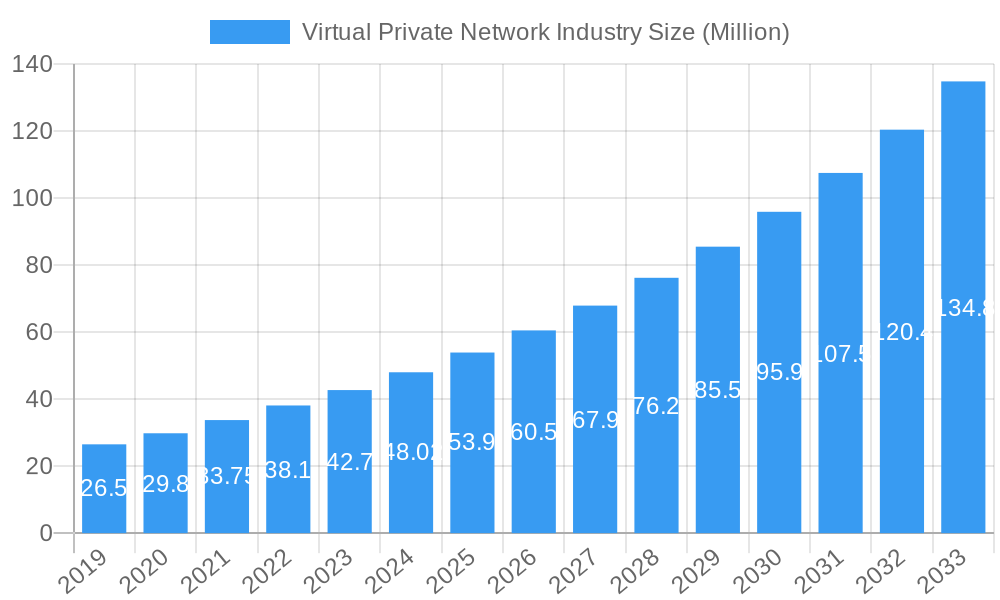

The Virtual Private Network (VPN) industry is experiencing robust growth, projected to reach a market size of $48.02 billion in 2024, with a compelling Compound Annual Growth Rate (CAGR) of 12.61%. This expansion is primarily fueled by the escalating need for enhanced data security and privacy across both individual and enterprise sectors. The increasing prevalence of remote work, coupled with a rise in cyber threats and stringent data protection regulations, are significant drivers propelling market adoption. Businesses are investing heavily in secure connectivity solutions to protect sensitive information, while consumers are increasingly aware of the benefits of VPNs for safeguarding their online activities, accessing geo-restricted content, and ensuring anonymity. The market is further stimulated by advancements in VPN technology, offering faster speeds, improved reliability, and more user-friendly interfaces.

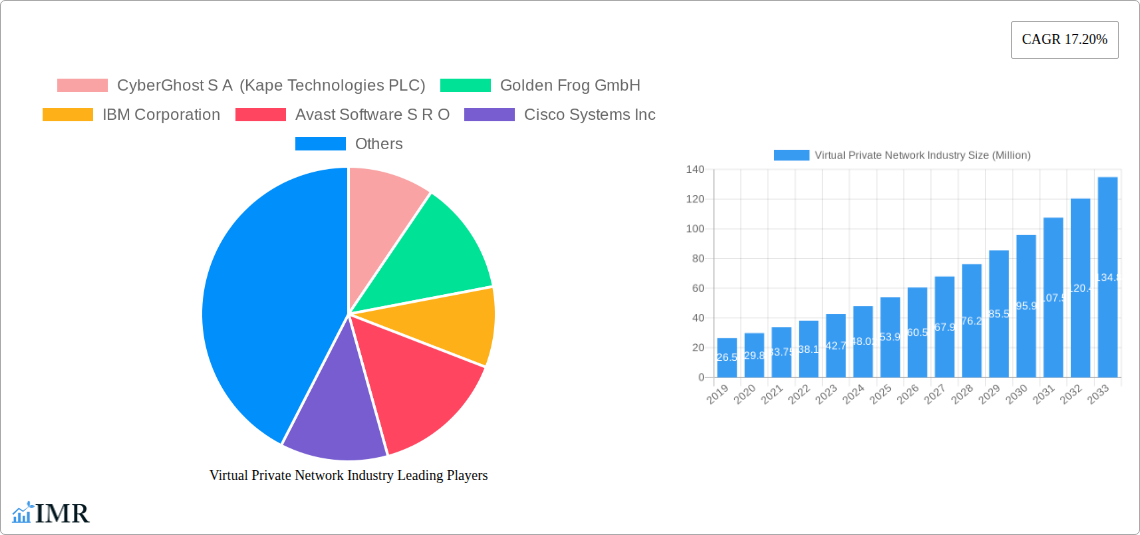

Virtual Private Network Industry Market Size (In Million)

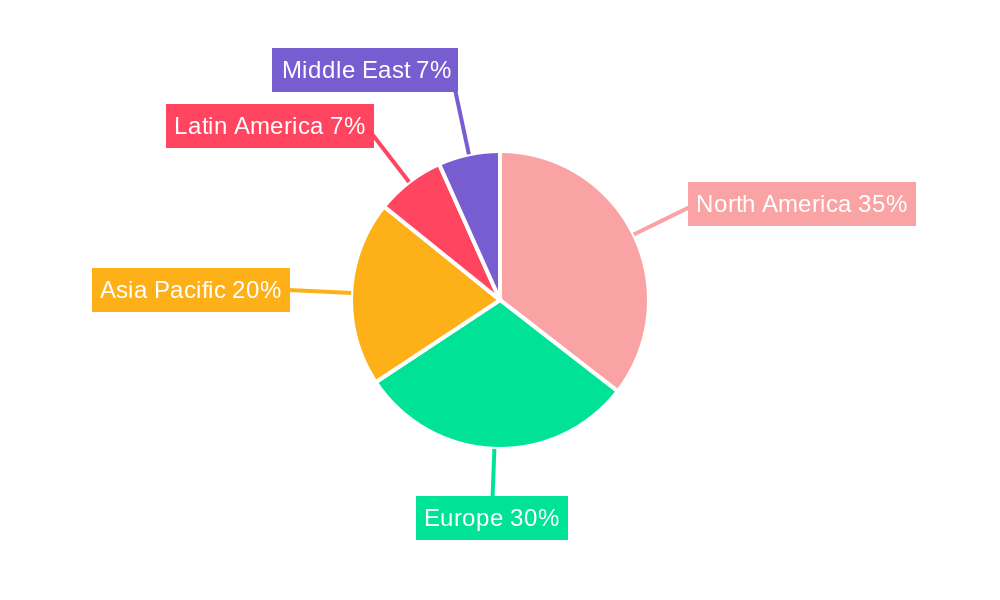

The VPN market is characterized by a dynamic segmentation across components, types, end-user industries, and geographic regions. Hardware, software, and services collectively contribute to the market's breadth, with hosted, IP, MPLS, cloud, and mobile VPN types catering to diverse connectivity needs. Key end-user industries like BFSI, Healthcare, IT, Government, and Manufacturing are major adopters, leveraging VPNs for secure communication and data transfer. Geographically, North America and Europe are leading markets, driven by high digital adoption and strong regulatory frameworks. However, the Asia Pacific region is witnessing substantial growth due to rapid digitalization and increasing cybersecurity concerns. Despite the optimistic outlook, potential restraints such as the complexity of implementation for some solutions and concerns regarding VPN speed limitations for bandwidth-intensive applications warrant strategic attention from market players to sustain this impressive growth trajectory.

Virtual Private Network Industry Company Market Share

Unleash Secure Connectivity: The Comprehensive Virtual Private Network Industry Report

Gain unparalleled insights into the dynamic Virtual Private Network (VPN) market with our in-depth report. Spanning 2019–2033, this essential resource offers a complete analysis of market size, growth trends, technological advancements, and competitive strategies. Essential for industry professionals, C-suite executives, market strategists, and investors, this report deciphers the complexities of the VPN landscape, including critical parent and child market trends.

The global VPN market is projected to reach an estimated USD XXX billion in 2025, experiencing robust growth throughout the forecast period of 2025–2033. This analysis delves into the intricate market dynamics, from core infrastructure to specialized solutions, providing actionable intelligence for strategic decision-making.

Virtual Private Network Industry Market Dynamics & Structure

The Virtual Private Network (VPN) industry is characterized by a moderately concentrated market structure, with established players and emerging innovators vying for market share. Technological innovation serves as a primary driver, fueled by the escalating demand for enhanced online privacy, data security, and secure remote access. Regulatory frameworks, particularly concerning data protection and privacy laws like GDPR and CCPA, significantly shape market development, mandating robust security solutions. Competitive product substitutes, including secure web gateways and zero-trust network access solutions, present a constant challenge, compelling VPN providers to continuously innovate and differentiate their offerings. End-user demographics are increasingly diverse, with a growing reliance on digital services across all age groups and professional sectors. Mergers and acquisitions (M&A) remain a key trend, with larger entities acquiring smaller, specialized VPN providers to expand their service portfolios and geographic reach. For instance, recent M&A activities indicate a strategic consolidation to capture a larger share of the burgeoning cybersecurity market. The market concentration is estimated to be around XX%, with the top players holding a significant portion of the market share. The volume of M&A deals in the VPN sector has seen a XX% increase over the historical period (2019-2024), reflecting industry consolidation and strategic expansion. Innovation barriers include high research and development costs and the need for continuous adaptation to evolving cyber threats.

- Market Concentration: Moderately concentrated, with a mix of large enterprises and niche players.

- Technological Innovation Drivers: Growing cybersecurity threats, remote work expansion, and privacy concerns.

- Regulatory Frameworks: Data protection laws (GDPR, CCPA) driving demand for compliance-ready VPN solutions.

- Competitive Product Substitutes: Secure Web Gateways, Zero Trust Network Access (ZTNA).

- End-User Demographics: Broad spectrum, from individual consumers to large enterprises across various sectors.

- M&A Trends: Strategic acquisitions for market expansion and portfolio enhancement.

Virtual Private Network Industry Growth Trends & Insights

The Virtual Private Network (VPN) industry is poised for substantial growth, driven by a confluence of factors including the exponential rise in remote work, increasing cyber threats, and a heightened global awareness of digital privacy. The market size is projected to expand significantly from its base year of 2025, with a robust Compound Annual Growth Rate (CAGR) of XX% anticipated over the forecast period (2025–2033). This growth trajectory is fueled by escalating adoption rates across both consumer and enterprise segments. As more individuals and organizations embrace cloud computing and mobile workforces, the necessity for secure, encrypted connections becomes paramount. Technological disruptions, such as the integration of VPN functionalities into operating systems and browsers, are democratizing access to VPN services, further accelerating market penetration. Consumer behavior is shifting towards prioritizing online security and privacy, leading to a greater demand for reliable VPN solutions. The child market segments, particularly mobile VPNs and cloud-based VPN services, are experiencing even more rapid expansion due to the ubiquitous nature of smartphones and the increasing adoption of Software-as-a-Service (SaaS) models. The BFSI and Healthcare sectors, due to their sensitive data handling, are also significant contributors to this growth. The market penetration for VPN services is expected to reach XX% by 2033, up from XX% in 2019. The market size, valued at USD XXX billion in 2025, is forecasted to reach USD XXX billion by 2033. Key drivers include the increasing prevalence of remote work, which necessitates secure connections for employees accessing corporate networks, and the rising tide of cyberattacks targeting individuals and businesses alike. This sustained demand ensures a dynamic and evolving market landscape.

Dominant Regions, Countries, or Segments in Virtual Private Network Industry

The Software & Services segment within the Virtual Private Network (VPN) industry is demonstrating exceptional dominance, projected to be the primary growth engine throughout the forecast period. This dominance stems from the inherent nature of VPN solutions, which are largely software-driven and delivered as services, enabling scalability and flexibility for end-users. The increasing reliance on cloud infrastructure further bolsters the growth of cloud-based VPN services, a significant sub-segment within the Software & Services category. North America, particularly the United States, remains a leading region due to its advanced technological infrastructure, high adoption rate of digital services, and stringent data security regulations. The robust presence of major IT and BFSI sectors in this region drives substantial demand for enterprise-grade VPN solutions.

- Dominant Segment: Software & Services, encompassing cloud-based VPNs, managed VPN services, and VPN client software.

- Key Drivers: Scalability, flexibility, cost-effectiveness, and ease of deployment for businesses.

- Market Share: Expected to hold over XX% of the total VPN market by 2033.

- Leading Region: North America.

- Dominance Factors: High digital adoption, strong cybersecurity awareness, presence of major technology hubs, and stringent regulatory compliance requirements.

- Market Share: Accounted for approximately XX% of the global VPN market in 2025.

- Growth Potential: Driven by continued expansion of remote work and increasing adoption of advanced cybersecurity measures in enterprises.

- Key End-User Industries:

- BFSI: High demand for secure transaction processing and data protection.

- IT: Essential for secure remote access and network segmentation.

- Government: Crucial for secure communication and data integrity.

- Healthcare: Mandated for patient data privacy and secure access to electronic health records.

Virtual Private Network Industry Product Landscape

The VPN product landscape is rapidly evolving, moving beyond basic encryption to encompass advanced features like dedicated IP addresses, split tunneling, kill switches, and robust multi-factor authentication. Innovations are heavily focused on enhancing user experience and providing tailored solutions for diverse needs. Cloud VPNs are gaining traction for their seamless integration with cloud environments, while mobile VPNs are optimized for on-the-go security. Performance metrics such as connection speed, server uptime, and geographical server availability are critical differentiators. The integration of AI for threat detection and automated security responses is a notable technological advancement, offering proactive protection for users.

Key Drivers, Barriers & Challenges in Virtual Private Network Industry

The Virtual Private Network (VPN) industry is propelled by several key drivers. The escalating global cybersecurity threats, including ransomware and data breaches, create a persistent demand for secure connectivity solutions. The widespread adoption of remote and hybrid work models necessitates secure access to corporate resources from any location. Growing awareness and concern about online privacy and data surveillance further fuel consumer VPN adoption. Regulatory mandates for data protection and compliance also play a significant role.

Conversely, the industry faces several barriers and challenges. The perception of VPNs as primarily for illicit activities can hinder wider legitimate adoption. Intense competition among providers leads to price wars, impacting profitability. The complexity of managing large VPN networks and ensuring consistent performance across diverse geographic locations presents operational challenges. Supply chain issues, particularly for hardware components in some VPN solutions, can impact availability. Furthermore, navigating diverse and evolving international regulations regarding VPN usage can be a significant hurdle for global providers.

Emerging Opportunities in Virtual Private Network Industry

Emerging opportunities in the VPN industry lie in the burgeoning Internet of Things (IoT) security sector, where connected devices require robust encryption. The increasing demand for secure gaming VPNs, offering low latency and protection against DDoS attacks, presents a significant niche. Furthermore, the development of specialized VPN solutions for specific industries, such as industrial IoT (IIoT) in manufacturing, offers untapped market potential. The growing trend of decentralized internet architectures and the demand for privacy-preserving technologies also open new avenues for VPN innovation.

Growth Accelerators in the Virtual Private Network Industry Industry

Several catalysts are accelerating the growth of the VPN industry. The ongoing expansion of 5G networks promises faster and more reliable connections, enhancing the performance of VPN services and enabling new use cases. Strategic partnerships between VPN providers and cybersecurity firms are crucial for integrating advanced threat intelligence and enhancing security offerings. Market expansion into emerging economies, where digital adoption is rapidly increasing, presents significant growth potential. The development of user-friendly, intuitive VPN interfaces and seamless integration with existing digital ecosystems are also critical growth accelerators.

Key Players Shaping the Virtual Private Network Industry Market

- CyberGhost S A (Kape Technologies PLC)

- Golden Frog GmbH

- IBM Corporation

- Avast Software S R O

- Cisco Systems Inc

- Microsoft Corporation

- Radio IP Software Inc

- Array Networks Inc

- NetMotion Software Inc

- Check Point Software Technologies Limited

- Citrix Systems Inc

Notable Milestones in Virtual Private Network Industry Sector

- January 2023: In collaboration with Huawei Technologies, Etisalat UAE announced the deployment and testing of 5G portable private network multi-access edge computing (MEC) functionality. Etisalat would offer a 5G-based replacement for traditional VPN as part of the stand-alone 5G and MEC commercialization program, enhancing remote work experiences for UAE companies.

- May 2022: Microsoft planned to introduce a built-in VPN feature with its Edge browser. This new VPN would be powered by Cloudflare and offer limited free data to the users. The new feature would serve as a dedicated browser VPN. Its security functionalities include encrypting browser traffic even when visiting HTTP websites and changing IP addresses and online locations.

- February 2022: Nokia announced the world's first commercial deployment of 5G Edge Slicing with mobile operators Cellcom and Telia. Nokia's innovative Edge Slicing solution enables operators to provide next-generation, secure, reliable, and high-performance VPN services to enterprise customers over commercial 4G and 5G networks.

In-Depth Virtual Private Network Industry Market Outlook

The future of the Virtual Private Network industry is exceptionally promising, characterized by continuous innovation and expanding market reach. The integration of advanced security protocols and AI-powered threat detection will elevate the effectiveness of VPN solutions. The growth of the mobile and cloud VPN segments is expected to outpace the overall market, driven by evolving work patterns and digital consumption habits. Strategic collaborations and the development of industry-specific VPN solutions will unlock new revenue streams and market penetration opportunities. As global data privacy regulations become more stringent, the demand for compliant and secure VPN services will only intensify, solidifying the VPN industry's position as a critical component of the modern digital infrastructure.

Virtual Private Network Industry Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software & Services

-

2. Type

- 2.1. Hosted

- 2.2. IP

- 2.3. MPLS

- 2.4. Cloud

- 2.5. Mobile

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. IT

- 3.4. Government

- 3.5. Manufacturing

- 3.6. Other End-user Industries

Virtual Private Network Industry Segmentation By Geography

-

1. North America

- 1.1. The United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

Virtual Private Network Industry Regional Market Share

Geographic Coverage of Virtual Private Network Industry

Virtual Private Network Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of Cyber-Attacks; Increasing Adoption of VPN Solutions Across Multiple Business Verticals

- 3.3. Market Restrains

- 3.3.1. Lack of VPN Standardization and Data Protection

- 3.4. Market Trends

- 3.4.1. Growing Number of Cyberattacks to Increase Demand for VPN

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtual Private Network Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software & Services

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hosted

- 5.2.2. IP

- 5.2.3. MPLS

- 5.2.4. Cloud

- 5.2.5. Mobile

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. IT

- 5.3.4. Government

- 5.3.5. Manufacturing

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.4.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Virtual Private Network Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Hardware

- 6.1.2. Software & Services

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Hosted

- 6.2.2. IP

- 6.2.3. MPLS

- 6.2.4. Cloud

- 6.2.5. Mobile

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. BFSI

- 6.3.2. Healthcare

- 6.3.3. IT

- 6.3.4. Government

- 6.3.5. Manufacturing

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Virtual Private Network Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Hardware

- 7.1.2. Software & Services

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Hosted

- 7.2.2. IP

- 7.2.3. MPLS

- 7.2.4. Cloud

- 7.2.5. Mobile

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. BFSI

- 7.3.2. Healthcare

- 7.3.3. IT

- 7.3.4. Government

- 7.3.5. Manufacturing

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Virtual Private Network Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Hardware

- 8.1.2. Software & Services

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Hosted

- 8.2.2. IP

- 8.2.3. MPLS

- 8.2.4. Cloud

- 8.2.5. Mobile

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. BFSI

- 8.3.2. Healthcare

- 8.3.3. IT

- 8.3.4. Government

- 8.3.5. Manufacturing

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Virtual Private Network Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Hardware

- 9.1.2. Software & Services

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Hosted

- 9.2.2. IP

- 9.2.3. MPLS

- 9.2.4. Cloud

- 9.2.5. Mobile

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. BFSI

- 9.3.2. Healthcare

- 9.3.3. IT

- 9.3.4. Government

- 9.3.5. Manufacturing

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East Virtual Private Network Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Hardware

- 10.1.2. Software & Services

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Hosted

- 10.2.2. IP

- 10.2.3. MPLS

- 10.2.4. Cloud

- 10.2.5. Mobile

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. BFSI

- 10.3.2. Healthcare

- 10.3.3. IT

- 10.3.4. Government

- 10.3.5. Manufacturing

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. United Arab Emirates Virtual Private Network Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component

- 11.1.1. Hardware

- 11.1.2. Software & Services

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Hosted

- 11.2.2. IP

- 11.2.3. MPLS

- 11.2.4. Cloud

- 11.2.5. Mobile

- 11.3. Market Analysis, Insights and Forecast - by End-user Industry

- 11.3.1. BFSI

- 11.3.2. Healthcare

- 11.3.3. IT

- 11.3.4. Government

- 11.3.5. Manufacturing

- 11.3.6. Other End-user Industries

- 11.1. Market Analysis, Insights and Forecast - by Component

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 CyberGhost S A (Kape Technologies PLC)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Golden Frog GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Avast Software S R O

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cisco Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Microsoft Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Radio IP Software Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Array Networks Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 NetMotion Software Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Check Point Software Technologies Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Citrix Systems Inc *List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 CyberGhost S A (Kape Technologies PLC)

List of Figures

- Figure 1: Global Virtual Private Network Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Virtual Private Network Industry Revenue (undefined), by Component 2025 & 2033

- Figure 3: North America Virtual Private Network Industry Revenue Share (%), by Component 2025 & 2033

- Figure 4: North America Virtual Private Network Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: North America Virtual Private Network Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America Virtual Private Network Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 7: North America Virtual Private Network Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Virtual Private Network Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Virtual Private Network Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Virtual Private Network Industry Revenue (undefined), by Component 2025 & 2033

- Figure 11: Europe Virtual Private Network Industry Revenue Share (%), by Component 2025 & 2033

- Figure 12: Europe Virtual Private Network Industry Revenue (undefined), by Type 2025 & 2033

- Figure 13: Europe Virtual Private Network Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: Europe Virtual Private Network Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 15: Europe Virtual Private Network Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Virtual Private Network Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Virtual Private Network Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Virtual Private Network Industry Revenue (undefined), by Component 2025 & 2033

- Figure 19: Asia Pacific Virtual Private Network Industry Revenue Share (%), by Component 2025 & 2033

- Figure 20: Asia Pacific Virtual Private Network Industry Revenue (undefined), by Type 2025 & 2033

- Figure 21: Asia Pacific Virtual Private Network Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Asia Pacific Virtual Private Network Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Virtual Private Network Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Virtual Private Network Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Virtual Private Network Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Virtual Private Network Industry Revenue (undefined), by Component 2025 & 2033

- Figure 27: Latin America Virtual Private Network Industry Revenue Share (%), by Component 2025 & 2033

- Figure 28: Latin America Virtual Private Network Industry Revenue (undefined), by Type 2025 & 2033

- Figure 29: Latin America Virtual Private Network Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Latin America Virtual Private Network Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 31: Latin America Virtual Private Network Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Virtual Private Network Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Virtual Private Network Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Virtual Private Network Industry Revenue (undefined), by Component 2025 & 2033

- Figure 35: Middle East Virtual Private Network Industry Revenue Share (%), by Component 2025 & 2033

- Figure 36: Middle East Virtual Private Network Industry Revenue (undefined), by Type 2025 & 2033

- Figure 37: Middle East Virtual Private Network Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Middle East Virtual Private Network Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 39: Middle East Virtual Private Network Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East Virtual Private Network Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East Virtual Private Network Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: United Arab Emirates Virtual Private Network Industry Revenue (undefined), by Component 2025 & 2033

- Figure 43: United Arab Emirates Virtual Private Network Industry Revenue Share (%), by Component 2025 & 2033

- Figure 44: United Arab Emirates Virtual Private Network Industry Revenue (undefined), by Type 2025 & 2033

- Figure 45: United Arab Emirates Virtual Private Network Industry Revenue Share (%), by Type 2025 & 2033

- Figure 46: United Arab Emirates Virtual Private Network Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 47: United Arab Emirates Virtual Private Network Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 48: United Arab Emirates Virtual Private Network Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: United Arab Emirates Virtual Private Network Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Virtual Private Network Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 2: Global Virtual Private Network Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global Virtual Private Network Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Virtual Private Network Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Virtual Private Network Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 6: Global Virtual Private Network Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 7: Global Virtual Private Network Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Virtual Private Network Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: The United States Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Virtual Private Network Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 12: Global Virtual Private Network Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 13: Global Virtual Private Network Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 14: Global Virtual Private Network Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Germany Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Virtual Private Network Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 20: Global Virtual Private Network Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 21: Global Virtual Private Network Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 22: Global Virtual Private Network Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 23: China Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Japan Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Australia Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Virtual Private Network Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 29: Global Virtual Private Network Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global Virtual Private Network Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 31: Global Virtual Private Network Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Mexico Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: Brazil Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Virtual Private Network Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 36: Global Virtual Private Network Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 37: Global Virtual Private Network Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 38: Global Virtual Private Network Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: Global Virtual Private Network Industry Revenue undefined Forecast, by Component 2020 & 2033

- Table 40: Global Virtual Private Network Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 41: Global Virtual Private Network Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 42: Global Virtual Private Network Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 43: Saudi Arabia Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: Rest of Middle East Virtual Private Network Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Private Network Industry?

The projected CAGR is approximately 12.61%.

2. Which companies are prominent players in the Virtual Private Network Industry?

Key companies in the market include CyberGhost S A (Kape Technologies PLC), Golden Frog GmbH, IBM Corporation, Avast Software S R O, Cisco Systems Inc, Microsoft Corporation, Radio IP Software Inc, Array Networks Inc, NetMotion Software Inc, Check Point Software Technologies Limited, Citrix Systems Inc *List Not Exhaustive.

3. What are the main segments of the Virtual Private Network Industry?

The market segments include Component, Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Cyber-Attacks; Increasing Adoption of VPN Solutions Across Multiple Business Verticals.

6. What are the notable trends driving market growth?

Growing Number of Cyberattacks to Increase Demand for VPN.

7. Are there any restraints impacting market growth?

Lack of VPN Standardization and Data Protection.

8. Can you provide examples of recent developments in the market?

January 2023: In collaboration with Huawei Technologies, Etisalat UAE announced the deployment and testing of 5G portable private network multi-access edge computing (MEC) functionality. Etisalat would offer a 5G-based replacement for traditional VPN as part of the stand-alone 5G and MEC commercialization program, enhancing remote work experiences for UAE companies.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtual Private Network Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtual Private Network Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtual Private Network Industry?

To stay informed about further developments, trends, and reports in the Virtual Private Network Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence