Key Insights

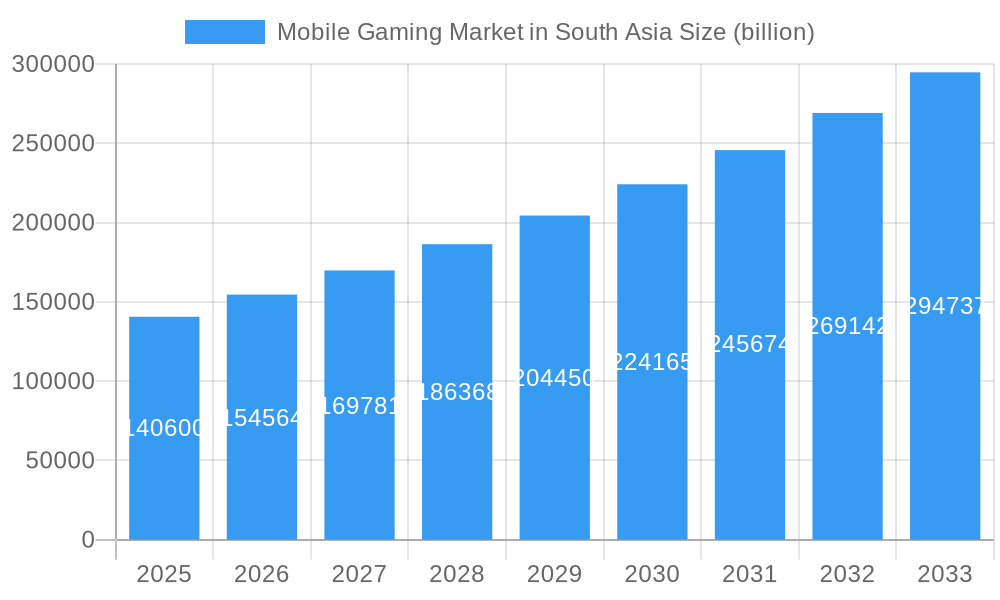

The South Asian mobile gaming market is poised for remarkable expansion, driven by a burgeoning youth population, increasing smartphone penetration, and the widespread availability of affordable mobile data. This dynamic landscape is projected to reach an estimated market size of $140.6 billion by 2025, showcasing a robust CAGR of 9.95% through 2033. The accessibility and affordability of gaming on mobile devices, coupled with the rising disposable incomes in key economies like India and Pakistan, are transforming mobile gaming from a niche pastime into a mainstream form of entertainment. The increasing sophistication of mobile games, offering immersive experiences akin to console gaming, further fuels this growth trajectory. Furthermore, the rapid digitalization initiatives across the region are enhancing internet infrastructure, facilitating smoother gameplay and larger downloads, which are critical for the adoption of high-fidelity mobile games. This creates a fertile ground for both local and international game developers and publishers to tap into a vast and engaged consumer base.

Mobile Gaming Market in South Asia Market Size (In Billion)

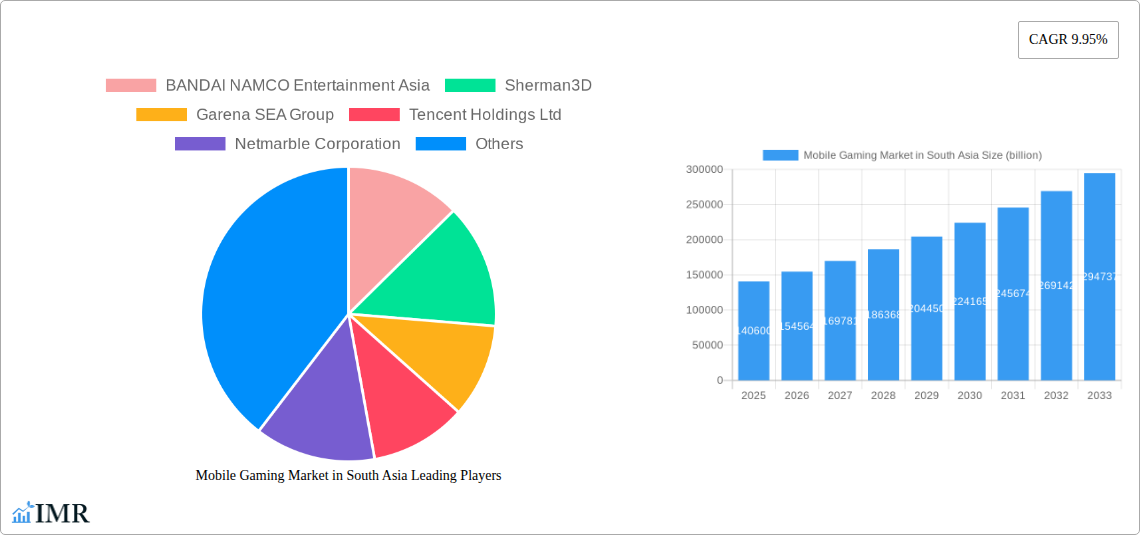

The growth of the South Asian mobile gaming market is further amplified by evolving consumer preferences and the introduction of innovative gaming models. The surge in esports and competitive mobile gaming has fostered a dedicated community, driving engagement and monetization. Additionally, the adoption of free-to-play (F2P) models, supported by in-app purchases and advertising, has democratized access to a wide array of games, making them appealing to a broad demographic. While the market benefits from strong drivers like a young demographic and increasing smartphone adoption, challenges such as varying internet speeds in rural areas and the need for localized content remain. However, the sheer scale of the potential audience and the ongoing technological advancements in mobile hardware are expected to outweigh these restraints. Companies like Tencent Holdings, BANDAI NAMCO Entertainment, and Garena SEA Group are actively investing in the region, introducing popular global titles and developing region-specific content to capture market share. This competitive environment is expected to spur further innovation and cater to the diverse tastes of South Asian gamers.

Mobile Gaming Market in South Asia Company Market Share

Mobile Gaming Market in South Asia: Comprehensive Report

Unlock the dynamic growth potential of the South Asian mobile gaming industry with this in-depth market analysis. This report offers a crucial overview of market size, trends, and key players, designed for industry leaders, investors, and strategists seeking to capitalize on this rapidly expanding sector. Covering a forecast period of 2025–2033, with a base year of 2025, this study delves into historical data from 2019–2024, providing actionable insights and forecasting future trajectories.

Keywords: South Asia Mobile Gaming Market, Mobile Game Market South Asia, Android Gaming South Asia, iOS Gaming South Asia, South Asia Esports, Mobile Game Development South Asia, Gaming Investment South Asia, South Asia Digital Entertainment, Mobile Game Revenue South Asia, South Asia Gaming Trends, Mobile Gaming Market Size, South Asia Gaming Forecast, Parent Market Mobile Gaming, Child Market Mobile Gaming.

Mobile Gaming Market in South Asia Market Dynamics & Structure

The South Asian mobile gaming market is characterized by a vibrant and evolving ecosystem, driven by increasing smartphone penetration and a burgeoning young demographic. Market concentration is moderately fragmented, with both global giants and agile local developers vying for market share. Technological innovation is a primary driver, fueled by advancements in mobile hardware, 5G network expansion, and the increasing sophistication of game development tools. However, regulatory frameworks are still maturing, with varying policies across countries impacting content guidelines and monetization strategies. Competitive product substitutes, including other forms of digital entertainment and offline activities, exert pressure, but the accessibility and affordability of mobile gaming continue to foster strong user engagement. End-user demographics showcase a wide spectrum, with a significant youth population driving demand for hyper-casual, action, and multiplayer online battle arena (MOBA) games. Mergers and acquisitions (M&A) trends are on the rise as larger entities seek to acquire promising local talent and expand their regional footprint.

- Market Concentration: Moderate fragmentation with a mix of international publishers and local studios.

- Technological Innovation Drivers: Smartphone affordability, 5G rollout, AR/VR integration, cloud gaming advancements.

- Regulatory Frameworks: Evolving, with country-specific nuances in content moderation and in-app purchase regulations.

- Competitive Product Substitutes: Streaming services, social media, short-form video content.

- End-User Demographics: Predominantly young, tech-savvy population with diverse gaming preferences.

- M&A Trends: Increasing activity as larger players seek strategic acquisitions for market access and talent acquisition.

Mobile Gaming Market in South Asia Growth Trends & Insights

The South Asian mobile gaming market is poised for exponential growth, driven by a confluence of socio-economic and technological factors. Market size evolution indicates a steady upward trajectory, projected to reach significant valuations in billion units by the forecast period. Adoption rates are soaring, propelled by the increasing affordability of smartphones and accessible mobile data plans, making gaming a mainstream entertainment form. Technological disruptions, such as the integration of AI in game design and the rise of cloud gaming, are further enhancing the player experience and expanding the accessible game library. Consumer behavior shifts are evident, with a growing preference for immersive, social, and competitive gaming experiences. The rise of esports and its increasing integration into mainstream sports events in the region are attracting significant attention and investment, further bolstering growth.

- Market Size Evolution: Projecting a substantial increase in market revenue and user base.

- Adoption Rates: High and accelerating, driven by demographic trends and digital inclusion initiatives.

- Technological Disruptions: AI-powered game mechanics, advanced graphics, and seamless cross-platform play.

- Consumer Behavior Shifts: Increased demand for multiplayer games, social gaming features, and skill-based competitions.

- CAGR (Compound Annual Growth Rate): Anticipated to be robust, reflecting the market's high growth potential.

- Market Penetration: Expected to deepen across urban and semi-urban areas, with increasing reach into rural regions.

Dominant Regions, Countries, or Segments in Mobile Gaming Market in South Asia

Within the South Asian mobile gaming market, the Android platform currently dominates, driven by its widespread accessibility and the prevalence of affordable Android-powered devices across the region. This platform's open ecosystem allows for a broader range of game developers and publishers to distribute their titles, contributing to a diverse and competitive game library. Economic policies in countries like India, Pakistan, and Bangladesh have fostered a conducive environment for digital consumption, including mobile gaming, through initiatives aimed at increasing digital literacy and connectivity. Infrastructure development, particularly the expansion of affordable mobile internet services, plays a crucial role in enabling seamless gaming experiences for a larger user base.

Key drivers for Android's dominance include:

- Device Affordability: The vast majority of smartphones in South Asia are Android-based and fall within budget-friendly price ranges, making them accessible to a wider population.

- Content Availability: A vast library of free-to-play games and a lower barrier to entry for developers contribute to a rich and varied gaming landscape on Android.

- Growing Internet Penetration: The increasing availability of affordable mobile data plans, especially 4G and the upcoming 5G, fuels the download and play of data-intensive mobile games.

- Localized Content: Developers are increasingly creating games with local themes, languages, and cultural relevance, which resonate strongly with the South Asian audience on Android.

- Emergence of Mobile Esports: The popularity of esports titles on Android has further boosted engagement and platform preference.

While iOS holds a significant segment, its market share is comparatively smaller due to the higher cost of Apple devices. However, the iOS segment is characterized by higher average revenue per user (ARPU) and a propensity for premium gaming experiences.

Mobile Gaming Market in South Asia Product Landscape

The product landscape of the South Asian mobile gaming market is defined by its diversity and rapid evolution. From hyper-casual games designed for quick bursts of entertainment to immersive role-playing games (RPGs) and competitive multiplayer online battle arenas (MOBAs), there is a game for every taste and skill level. Innovations in gameplay mechanics, such as advanced AI-driven opponents and dynamic game environments, are enhancing player engagement. Performance metrics are constantly being pushed, with developers optimizing games for a wide range of devices, ensuring accessibility and smooth gameplay even on lower-end hardware. Unique selling propositions often revolve around localized content, culturally relevant narratives, and community-driven features that foster player interaction and loyalty. Technological advancements in graphics rendering and network optimization are crucial for delivering high-quality experiences.

Key Drivers, Barriers & Challenges in Mobile Gaming Market in South Asia

Key Drivers:

- Technological: Rapid smartphone adoption, expanding 4G/5G networks, advancements in mobile processing power.

- Economic: Growing disposable income, increasing urbanization, favorable government policies promoting digital economies.

- Demographic: Large, young, and tech-savvy population with a high propensity for digital entertainment.

- Cultural: Growing acceptance and enthusiasm for gaming and esports as a legitimate form of entertainment and competition.

Barriers & Challenges:

- Supply Chain: Limited availability of high-end gaming devices for a segment of the market.

- Regulatory Hurdles: Inconsistent and evolving regulations concerning in-app purchases, data privacy, and content moderation across different countries.

- Competitive Pressures: Intense competition from global and local players, requiring continuous innovation and effective marketing.

- Monetization Challenges: Balancing free-to-play models with sustainable revenue generation, especially in price-sensitive markets.

- Infrastructure Gaps: Uneven internet connectivity in remote areas, impacting the accessibility and quality of online gaming experiences.

Emerging Opportunities in Mobile Gaming Market in South Asia

Emerging opportunities in the South Asian mobile gaming market are abundant. The untapped potential in Tier-2 and Tier-3 cities presents significant growth prospects as internet penetration and smartphone ownership rise. Innovative applications of augmented reality (AR) and virtual reality (VR) in gaming are expected to gain traction, offering more immersive experiences. Evolving consumer preferences are leaning towards games with strong social integration, cooperative gameplay, and personalized experiences, creating demand for new game designs. The increasing acceptance of esports also opens avenues for tournament organization, content creation, and the development of specialized gaming peripherals. Furthermore, the demand for localized and culturally relevant games continues to be a significant opportunity for developers who can tap into regional narratives and languages.

Growth Accelerators in the Mobile Gaming Market in South Asia Industry

Several catalysts are accelerating the growth of the South Asian mobile gaming industry. Technological breakthroughs in mobile chipsets and graphics rendering are enabling the creation of more sophisticated and visually appealing games. Strategic partnerships between global publishers and local developers are facilitating market entry and content localization. The expansion of 5G networks promises lower latency and higher bandwidth, paving the way for cloud gaming and more data-intensive multiplayer experiences. Furthermore, the increasing investment in esports infrastructure and the growing number of professional esports teams and players are creating a self-sustaining ecosystem that attracts more players and viewers. Market expansion strategies, including targeted marketing campaigns and community-building initiatives, are further propelling user acquisition and retention.

Key Players Shaping the Mobile Gaming Market in South Asia Market

- BANDAI NAMCO Entertainment Asia

- Sherman3D

- Garena SEA Group

- Tencent Holdings Ltd

- Netmarble Corporation

- IGG Inc

- Sony Corporation

- Asiasoft Corporation Public Company Limited

- Nintendo Co Ltd

Notable Milestones in Mobile Gaming Market in South Asia Sector

- Dec 2021: Toge Productions announced a funding initiative for South Asian game creators, with the first six grantees to be announced. UNIQX Studio is the first to have their game, Ngopi, Yuk, released.

- May 2022: The Philippines won its 38th gold medal at the 31st Southeast Asian (SEA) Games in Vietnam late Wednesday night in the esports Legends: Wild Rift (mobile) women's team event.

In-Depth Mobile Gaming Market in South Asia Market Outlook

The future outlook for the South Asian mobile gaming market is exceptionally promising, fueled by a combination of sustained technological advancement and a rapidly growing, engaged user base. Growth accelerators such as the widespread adoption of 5G, the increasing sophistication of mobile hardware, and the burgeoning esports ecosystem will continue to drive market expansion. Strategic opportunities lie in catering to the diverse preferences of the South Asian audience through localized content and innovative monetization models. The market's potential for significant revenue generation through in-app purchases and advertising remains high, particularly as disposable incomes rise. Investing in emerging technologies like cloud gaming and AR/VR within the mobile gaming space presents a strong avenue for future growth and market leadership. The continuous evolution of the competitive gaming landscape will also necessitate a focus on community building and player engagement strategies.

Mobile Gaming Market in South Asia Segmentation

-

1. Platform

- 1.1. Android

- 1.2. iOS

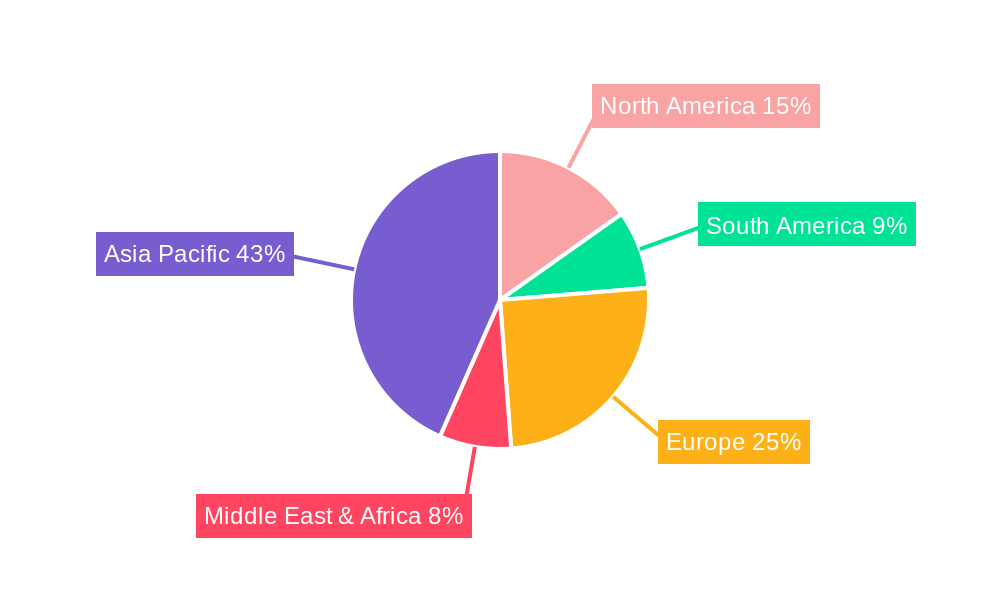

Mobile Gaming Market in South Asia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mobile Gaming Market in South Asia Regional Market Share

Geographic Coverage of Mobile Gaming Market in South Asia

Mobile Gaming Market in South Asia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The growth of eSports in the region4.2.2 5G network and increasing usage of smartphones

- 3.3. Market Restrains

- 3.3.1. User retention for mobile gaming

- 3.4. Market Trends

- 3.4.1. The growth of eSports in the region is driving the Mobile Gaming Market in South Asia Region.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Android

- 5.1.2. iOS

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Android

- 6.1.2. iOS

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. South America Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Android

- 7.1.2. iOS

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Europe Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Android

- 8.1.2. iOS

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Middle East & Africa Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Android

- 9.1.2. iOS

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Asia Pacific Mobile Gaming Market in South Asia Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Android

- 10.1.2. iOS

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 BANDAI NAMCO Entertainment Asia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sherman3D

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Garena SEA Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tencent Holdings Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Netmarble Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 IGG Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sony Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Asiasoft Corporation Public Company Limited

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nintendo Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 BANDAI NAMCO Entertainment Asia

List of Figures

- Figure 1: Mobile Gaming Market in South Asia Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Mobile Gaming Market in South Asia Share (%) by Company 2025

List of Tables

- Table 1: Mobile Gaming Market in South Asia Revenue billion Forecast, by Platform 2020 & 2033

- Table 2: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2020 & 2033

- Table 3: Mobile Gaming Market in South Asia Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Mobile Gaming Market in South Asia Revenue billion Forecast, by Platform 2020 & 2033

- Table 6: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2020 & 2033

- Table 7: Mobile Gaming Market in South Asia Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: United States Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: United States Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 11: Canada Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Canada Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 13: Mexico Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Mexico Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Mobile Gaming Market in South Asia Revenue billion Forecast, by Platform 2020 & 2033

- Table 16: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2020 & 2033

- Table 17: Mobile Gaming Market in South Asia Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2020 & 2033

- Table 19: Brazil Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Brazil Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Argentina Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Argentina Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Rest of South America Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Mobile Gaming Market in South Asia Revenue billion Forecast, by Platform 2020 & 2033

- Table 26: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2020 & 2033

- Table 27: Mobile Gaming Market in South Asia Revenue billion Forecast, by Country 2020 & 2033

- Table 28: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2020 & 2033

- Table 29: United Kingdom Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: United Kingdom Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Germany Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Germany Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: France Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: France Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Italy Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Italy Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Spain Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Spain Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 39: Russia Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Russia Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 41: Benelux Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Benelux Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 43: Nordics Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: Nordics Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Rest of Europe Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Europe Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Mobile Gaming Market in South Asia Revenue billion Forecast, by Platform 2020 & 2033

- Table 48: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2020 & 2033

- Table 49: Mobile Gaming Market in South Asia Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Turkey Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Turkey Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Israel Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Israel Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: GCC Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 56: GCC Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: North Africa Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 58: North Africa Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: South Africa Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 60: South Africa Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Middle East & Africa Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: Rest of Middle East & Africa Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Mobile Gaming Market in South Asia Revenue billion Forecast, by Platform 2020 & 2033

- Table 64: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Platform 2020 & 2033

- Table 65: Mobile Gaming Market in South Asia Revenue billion Forecast, by Country 2020 & 2033

- Table 66: Mobile Gaming Market in South Asia Volume K Unit Forecast, by Country 2020 & 2033

- Table 67: China Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 68: China Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 69: India Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 70: India Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 71: Japan Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 72: Japan Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: South Korea Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: South Korea Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: ASEAN Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: ASEAN Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Oceania Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Oceania Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: Rest of Asia Pacific Mobile Gaming Market in South Asia Revenue (billion) Forecast, by Application 2020 & 2033

- Table 80: Rest of Asia Pacific Mobile Gaming Market in South Asia Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mobile Gaming Market in South Asia?

The projected CAGR is approximately 9.95%.

2. Which companies are prominent players in the Mobile Gaming Market in South Asia?

Key companies in the market include BANDAI NAMCO Entertainment Asia, Sherman3D, Garena SEA Group, Tencent Holdings Ltd, Netmarble Corporation, IGG Inc, Sony Corporation, Asiasoft Corporation Public Company Limited, Nintendo Co Ltd.

3. What are the main segments of the Mobile Gaming Market in South Asia?

The market segments include Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 140.6 billion as of 2022.

5. What are some drivers contributing to market growth?

The growth of eSports in the region4.2.2 5G network and increasing usage of smartphones.

6. What are the notable trends driving market growth?

The growth of eSports in the region is driving the Mobile Gaming Market in South Asia Region..

7. Are there any restraints impacting market growth?

User retention for mobile gaming.

8. Can you provide examples of recent developments in the market?

Dec 2021: Toge Productions announced a funding initiative for South Asian game creators, with the first six grantees to be announced. UNIQX Studio is the first to have their game, Ngopi, Yuk, released.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mobile Gaming Market in South Asia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mobile Gaming Market in South Asia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mobile Gaming Market in South Asia?

To stay informed about further developments, trends, and reports in the Mobile Gaming Market in South Asia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence