Key Insights

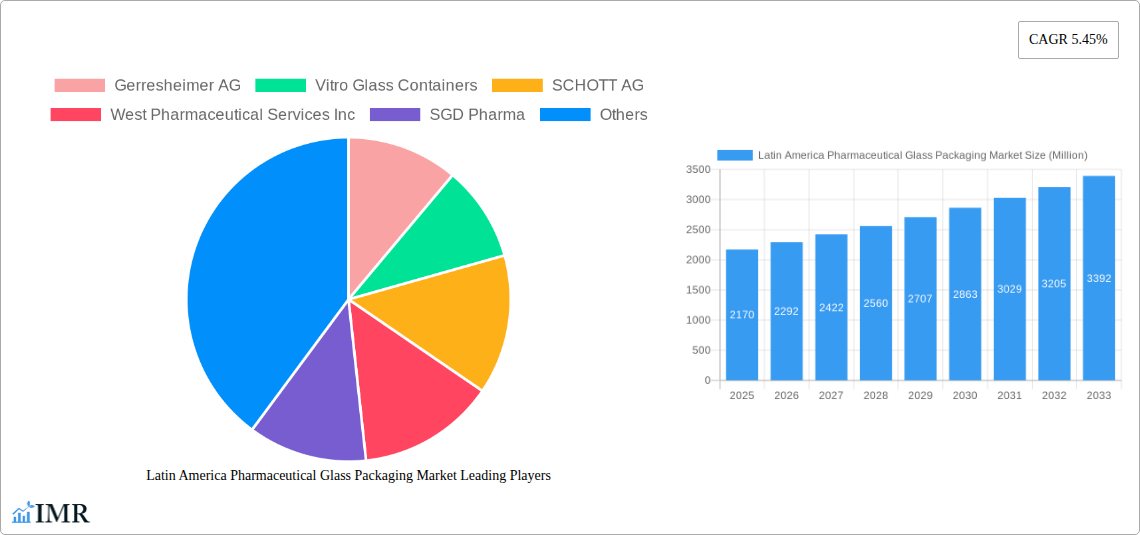

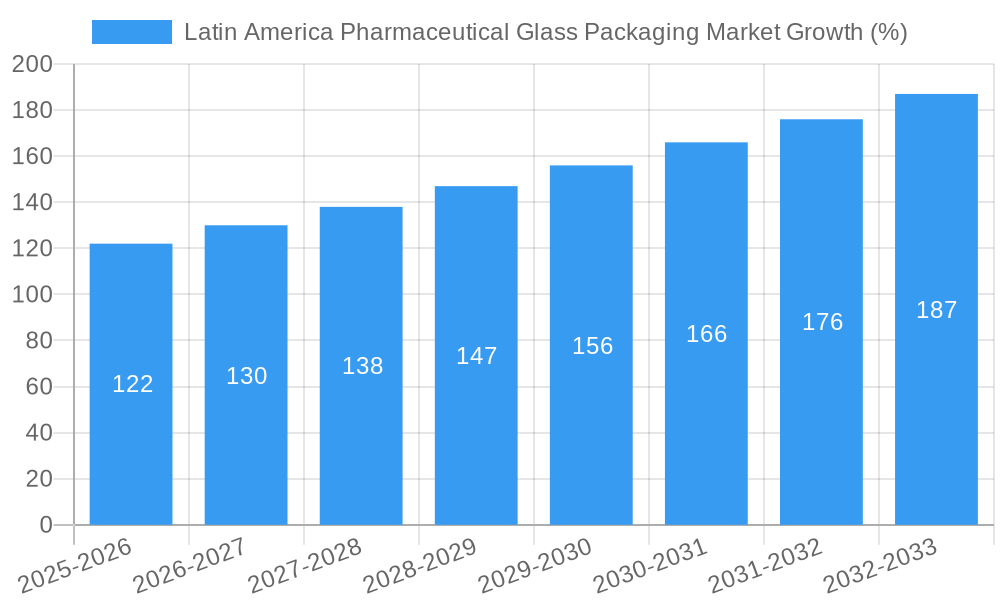

The Latin America Pharmaceutical Glass Packaging Market is experiencing robust growth, projected to reach $2.17 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.45% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases across the region necessitates a higher demand for pharmaceutical products, directly impacting the need for reliable and safe packaging solutions. Secondly, the growing pharmaceutical industry in Latin America, driven by both domestic production and imports, is creating a significant market opportunity for glass packaging providers. Stringent regulatory requirements regarding drug safety and efficacy further propel the adoption of high-quality glass containers, ensuring product integrity and patient safety. Finally, the region's expanding healthcare infrastructure and rising disposable incomes are contributing to increased pharmaceutical consumption, thereby boosting market demand.

However, the market also faces certain challenges. Fluctuations in raw material prices, primarily silica sand, can impact production costs and profitability for manufacturers. Furthermore, competition from alternative packaging materials like plastics, albeit posing a smaller threat due to the inherent advantages of glass for pharmaceutical applications (barrier properties, inertness, recyclability), necessitates ongoing innovation and competitive pricing strategies. Despite these challenges, the long-term outlook for the Latin American Pharmaceutical Glass Packaging Market remains positive, driven by sustained growth in the pharmaceutical sector and a growing preference for glass packaging in the region, particularly for sensitive pharmaceuticals. Key players such as Gerresheimer AG, Vitro Glass Containers, and Schott AG are well-positioned to benefit from this market expansion through strategic investments in capacity expansion, innovation in packaging design, and the development of sustainable solutions.

This comprehensive report provides an in-depth analysis of the Latin America Pharmaceutical Glass Packaging Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Spanning the period from 2019 to 2033 (Study Period), with a focus on 2025 (Base Year and Estimated Year), and forecasting to 2033 (Forecast Period), this report meticulously examines the market's historical performance (Historical Period: 2019-2024) and future trajectory. It delves into market dynamics, growth trends, regional dominance, product landscapes, key challenges, and emerging opportunities, providing a complete picture of this crucial sector within the broader Latin American pharmaceutical industry (Parent Market). The child market being the focus is pharmaceutical glass packaging.

Latin America Pharmaceutical Glass Packaging Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Latin American pharmaceutical glass packaging market. We examine market concentration, identifying key players and their market share percentages (xx%), exploring the impact of technological innovations on manufacturing processes and product development, and assessing the influence of regulatory frameworks on market growth. Furthermore, we analyze the prevalence of competitive substitutes, the influence of end-user demographics on demand patterns, and the dynamics of mergers and acquisitions (M&A) activity within the sector. Data on M&A deal volumes will be included, with an estimation of xx deals completed within the last 5 years. Qualitative factors, such as barriers to innovation and their impact on market evolution, will also be addressed.

- Market Concentration: Analysis of market share held by key players (details within the report).

- Technological Innovation: Examination of advancements in glass manufacturing, container design, and sterilization techniques.

- Regulatory Framework: Evaluation of regulatory compliance requirements and their influence on market dynamics.

- Competitive Substitutes: Assessment of alternative packaging materials (e.g., plastic, etc.) and their impact on market share.

- End-User Demographics: Analysis of the influence of factors such as patient populations and healthcare infrastructure on demand.

- M&A Trends: Review of recent merger and acquisition activity and its effect on market consolidation.

Latin America Pharmaceutical Glass Packaging Market Growth Trends & Insights

This section presents a comprehensive analysis of the Latin America Pharmaceutical Glass Packaging Market's growth trajectory, utilizing detailed quantitative data and qualitative observations. We will detail the market's size evolution, providing historical data (2019-2024) and projecting future growth (2025-2033). The report will analyze adoption rates of various glass packaging types across different pharmaceutical segments. Further analysis includes the impact of technological disruptions on market dynamics, and an assessment of shifts in consumer behavior and preferences among end-users, including hospitals, clinics, and pharmacies. This section incorporates key performance indicators like CAGR and market penetration rates to provide a clear picture of growth drivers and potential challenges. The expected CAGR for the forecast period (2025-2033) is estimated at xx%.

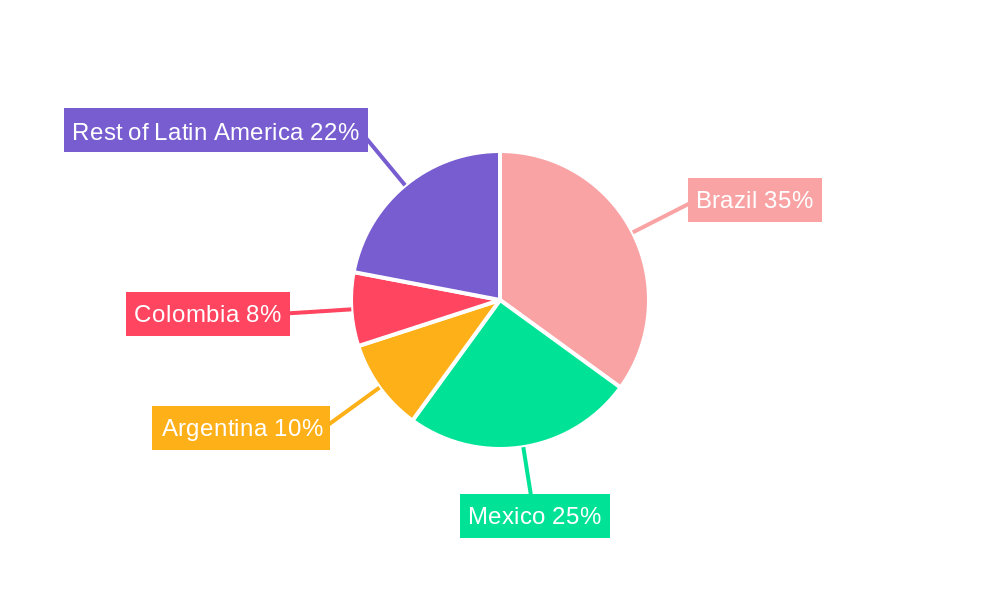

Dominant Regions, Countries, or Segments in Latin America Pharmaceutical Glass Packaging Market

This section identifies the leading regions and countries driving growth within the Latin America Pharmaceutical Glass Packaging Market. We explore the factors behind the dominance of specific regions, evaluating economic policies, infrastructure development, and healthcare investment. The analysis will delve into the market share and growth potential of individual countries within the region, highlighting key drivers and market dynamics specific to each nation. The key countries that will be extensively discussed are Brazil, Mexico, Argentina, and Colombia.

- Brazil: High pharmaceutical manufacturing capacity, robust healthcare infrastructure, and growing demand for pharmaceuticals.

- Mexico: Large population, growing pharmaceutical industry, and increasing adoption of advanced glass packaging technologies.

- Argentina: Growing government investment in healthcare and increasing demand for specialized pharmaceutical packaging.

- Colombia: Expanding healthcare sector and increasing demand for high-quality pharmaceutical packaging.

- Other Countries: Analysis of smaller markets and their growth trajectory.

Latin America Pharmaceutical Glass Packaging Market Product Landscape

This section offers a detailed overview of the product landscape, including descriptions of various types of glass packaging used in the pharmaceutical industry in Latin America. The discussion will encompass different types of glass vials, ampoules, bottles, and syringes, highlighting their unique selling propositions and specific applications (e.g., injectables, oral medications, etc.). This also includes an assessment of advancements in glass manufacturing techniques, focusing on improvements in quality, durability, and sterility.

Key Drivers, Barriers & Challenges in Latin America Pharmaceutical Glass Packaging Market

This section analyzes the key drivers and challenges influencing the Latin American Pharmaceutical Glass Packaging Market. Drivers include factors such as increasing demand for pharmaceuticals, growing investments in healthcare infrastructure, and technological advancements in glass manufacturing and packaging. We will present quantitative data wherever possible. Challenges will include supply chain disruptions, regulatory hurdles, and competitive pressures from alternative packaging materials, affecting profitability and market expansion.

Key Drivers:

- Growing pharmaceutical market in Latin America (xx Million units growth projected between 2025 and 2033)

- Government investment in healthcare infrastructure (xx Million USD investment projected between 2025 and 2033)

- Technological advancements in glass manufacturing (xx% increase in production efficiency projected)

Key Challenges:

- Supply chain disruptions due to geopolitical factors (estimated xx% impact on production)

- Stringent regulatory requirements and compliance costs (estimated xx% increase in compliance costs)

- Competition from alternative packaging materials (estimated xx% market share captured by competitors)

Emerging Opportunities in Latin America Pharmaceutical Glass Packaging Market

This section highlights emerging trends and opportunities within the market, including untapped market segments, innovative applications of glass packaging, and evolving consumer preferences. We will analyze the potential for growth in specialized pharmaceutical segments (e.g., biologics, injectables, etc.), opportunities for sustainable and eco-friendly glass packaging, and the development of smart packaging solutions.

Growth Accelerators in the Latin America Pharmaceutical Glass Packaging Market Industry

Long-term growth in the Latin America Pharmaceutical Glass Packaging Market is driven by several key factors. Technological breakthroughs in glass manufacturing and sterilization processes are enhancing the quality and efficiency of production. Strategic partnerships between glass packaging manufacturers and pharmaceutical companies are leading to the development of innovative solutions. Market expansion strategies, including focusing on underserved markets and increasing export capabilities, are contributing to significant growth.

Key Players Shaping the Latin America Pharmaceutical Glass Packaging Market Market

- Gerresheimer AG

- Vitro Glass Containers

- SCHOTT AG

- West Pharmaceutical Services Inc

- SGD Pharma

- Aptar Group Inc

- Becton Dickinson & Company

- Corning Incorporated

- *List Not Exhaustive

Notable Milestones in Latin America Pharmaceutical Glass Packaging Market Sector

- October 2023: Argentina's HST authorities sign an agreement with PAHO to bolster mRNA vaccine production, stimulating demand for specialized glass packaging.

- July 2023: Nerveaxpharm's expansion into Brazil and Mexico significantly increases the demand for pharmaceutical glass packaging in these key markets.

In-Depth Latin America Pharmaceutical Glass Packaging Market Outlook

The Latin America Pharmaceutical Glass Packaging Market is poised for significant growth in the coming years. The confluence of factors such as increasing pharmaceutical production, investment in healthcare infrastructure, and technological advancements presents substantial opportunities for market participants. Strategic investments in manufacturing capacity, innovation, and sustainable packaging solutions will be crucial for companies seeking to capitalize on this growth. Expanding into underserved markets and fostering strategic partnerships will further enhance market positioning and long-term success.

Latin America Pharmaceutical Glass Packaging Market Segmentation

-

1. End-User Industry

- 1.1. Bottles

- 1.2. Vials

- 1.3. Ampoules

- 1.4. Cartridges

- 1.5. Syringes (Pre-filled)

Latin America Pharmaceutical Glass Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Pharmaceutical Glass Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.45% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Pharmaceutical Export; Increase Government Spending In The Region

- 3.3. Market Restrains

- 3.3.1. Increasing Pharmaceutical Export; Increase Government Spending In The Region

- 3.4. Market Trends

- 3.4.1. Brazil is Anticipated to have a Significant Share During The Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Pharmaceutical Glass Packaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 5.1.1. Bottles

- 5.1.2. Vials

- 5.1.3. Ampoules

- 5.1.4. Cartridges

- 5.1.5. Syringes (Pre-filled)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by End-User Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Gerresheimer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Vitro Glass Containers

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SCHOTT AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 West Pharmaceutical Services Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SGD Pharma

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aptar Group Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Becton Dickinson & Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Corning Incorporated*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Gerresheimer AG

List of Figures

- Figure 1: Latin America Pharmaceutical Glass Packaging Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Latin America Pharmaceutical Glass Packaging Market Share (%) by Company 2024

List of Tables

- Table 1: Latin America Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Latin America Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Latin America Pharmaceutical Glass Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Latin America Pharmaceutical Glass Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 5: Latin America Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Latin America Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Latin America Pharmaceutical Glass Packaging Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 8: Latin America Pharmaceutical Glass Packaging Market Volume Billion Forecast, by End-User Industry 2019 & 2032

- Table 9: Latin America Pharmaceutical Glass Packaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Latin America Pharmaceutical Glass Packaging Market Volume Billion Forecast, by Country 2019 & 2032

- Table 11: Brazil Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Brazil Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 13: Argentina Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Argentina Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 15: Chile Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Chile Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 17: Colombia Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Colombia Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 19: Mexico Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 21: Peru Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Peru Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 23: Venezuela Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Venezuela Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 25: Ecuador Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Ecuador Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 27: Bolivia Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Bolivia Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

- Table 29: Paraguay Latin America Pharmaceutical Glass Packaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Paraguay Latin America Pharmaceutical Glass Packaging Market Volume (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Pharmaceutical Glass Packaging Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Latin America Pharmaceutical Glass Packaging Market?

Key companies in the market include Gerresheimer AG, Vitro Glass Containers, SCHOTT AG, West Pharmaceutical Services Inc, SGD Pharma, Aptar Group Inc, Becton Dickinson & Company, Corning Incorporated*List Not Exhaustive.

3. What are the main segments of the Latin America Pharmaceutical Glass Packaging Market?

The market segments include End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Pharmaceutical Export; Increase Government Spending In The Region.

6. What are the notable trends driving market growth?

Brazil is Anticipated to have a Significant Share During The Forecast Period.

7. Are there any restraints impacting market growth?

Increasing Pharmaceutical Export; Increase Government Spending In The Region.

8. Can you provide examples of recent developments in the market?

October 2023: Health, Science, and Technology (HST) authorities in Argentina have signed a new Agreement with the Director of PAHO, Dr. Jarlbas Barbosa, to strengthen and expand their capacity to develop and produce mRNA vaccines suitable for regional applications. This agreement will facilitate the development and expansion of the mRNA vaccine manufacturing ecosystem, thus increasing the sustainability of Argentina's PAHO /WHO technology transfer program. Furthermore, the country's future development of mRNA vaccines will reduce the region's dependency on external sources of this technology.July 2023: Nerveaxpharm, a top European specialty pharma company specializing in treating central nervous system disorders, has just announced its expansion into two of Latin America's most significant pharmaceutical markets - Brazil and Mexico. It's the first step in expanding its reach beyond Europe. The company acquired Libber Pharma, which can help them spread their products nationwide. They've also developed Sanofi's product portfolio in Brazil, including a neuroleptic and three antipsychotics, and will be part of their product expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Pharmaceutical Glass Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Pharmaceutical Glass Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Pharmaceutical Glass Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Pharmaceutical Glass Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence