Key Insights

The Nordic rigid plastic packaging market is poised for substantial growth, projected to reach a market size of 220.2 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 3.6%. This expansion is fueled by escalating demand for robust and convenient packaging across food & beverage, pharmaceutical, and consumer goods industries. Key drivers include the adoption of sustainable practices, such as recycled plastics and lightweight designs, alongside stringent regulatory frameworks and evolving consumer preferences for eco-friendly solutions.

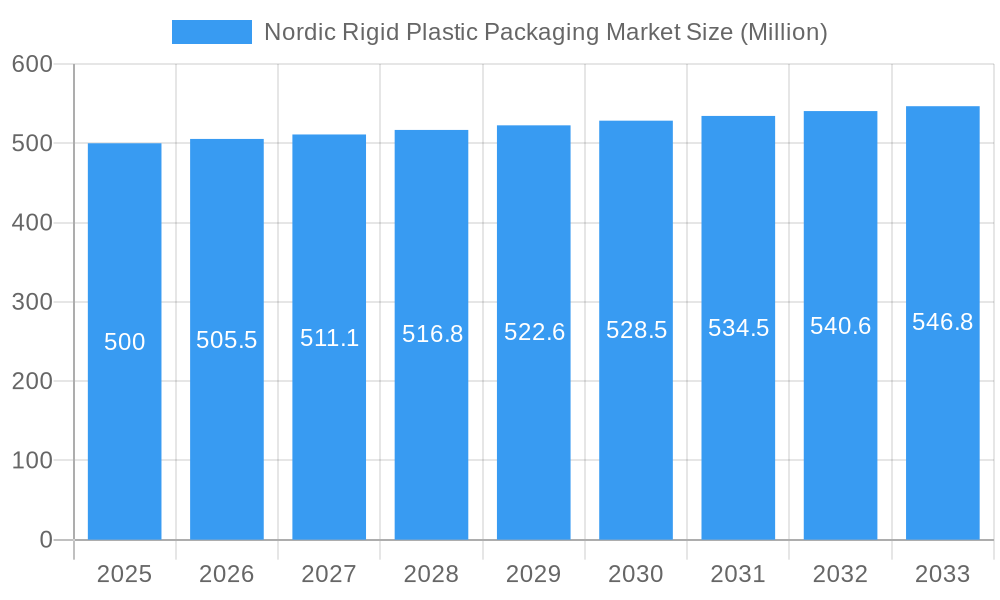

Nordic Rigid Plastic Packaging Market Market Size (In Billion)

The region's emphasis on hygiene and safety in food processing and medical applications further elevates the demand for premium rigid plastic packaging. The competitive environment is characterized by a blend of established manufacturers and agile new entrants focusing on specialized applications and innovative solutions. This dynamic landscape spurs continuous innovation and supply chain optimization.

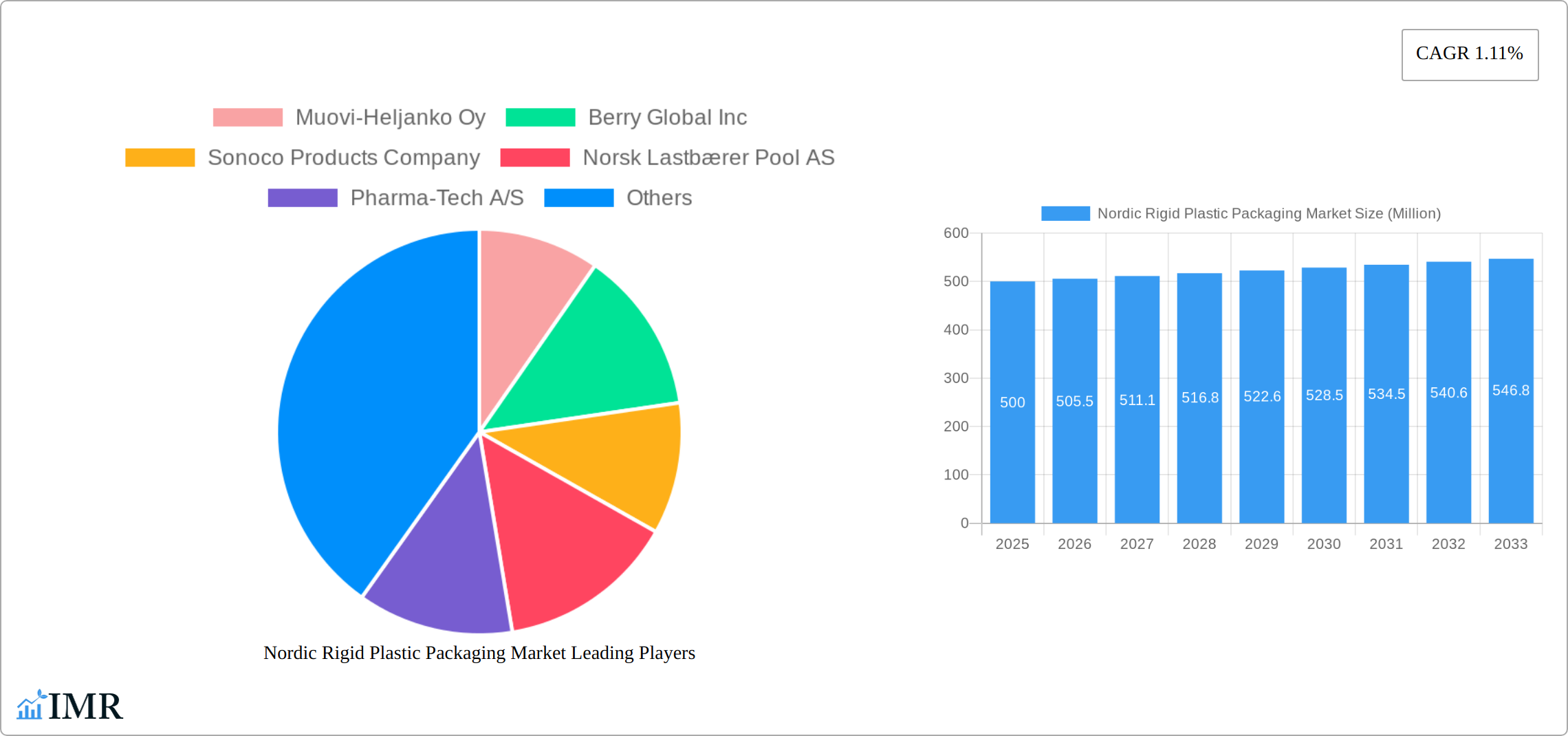

Nordic Rigid Plastic Packaging Market Company Market Share

Future growth trajectory, from 2025 to 2033, will be shaped by macroeconomic trends in Nordic economies, advancements in plastic material science, and concerted efforts to minimize plastic waste. Market segmentation likely encompasses diverse rigid plastic formats like bottles, containers, and tubs, addressing varied consumer requirements. Leading industry players, including Muovi-Heljanko Oy, Berry Global Inc., and Sonoco Products Company, are expected to retain significant market share through their robust distribution channels and brand equity. However, the rise of smaller, sustainability-focused companies presents both challenges and opportunities for incumbents to innovate and adapt. The overall market outlook is optimistic, underpinned by sustained consumption patterns and the imperative for efficient, safe, and environmentally conscious packaging solutions within the Nordic region.

Nordic Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Nordic rigid plastic packaging market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans 2019-2033, with 2025 serving as the base and estimated year. The report utilizes a robust methodology, including heat map analysis and competitor analysis (emerging vs. established players), to deliver actionable insights for industry professionals. The market is segmented by [ insert specific segments here, e.g., material type (PET, HDPE, PP), application (food, beverages, pharmaceuticals), packaging type (bottles, containers, tubs) ], providing a granular understanding of the market landscape. The total market size is projected to reach xx Million units by 2033.

Nordic Rigid Plastic Packaging Market Dynamics & Structure

The Nordic rigid plastic packaging market exhibits a moderately concentrated structure, with key players holding significant market shares. Technological innovation, driven by sustainability concerns and evolving consumer preferences, is a major driver. Stringent regulatory frameworks regarding recyclability and material composition significantly influence market dynamics. Competitive product substitutes, such as alternative packaging materials (e.g., paperboard, glass), present challenges. The end-user demographics are diverse, encompassing the food & beverage, pharmaceutical, and industrial sectors. M&A activity has been relatively moderate in recent years, with xx deals recorded between 2019 and 2024, representing a xx% market share change.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on lightweighting, improved barrier properties, and sustainable materials (rPET).

- Regulatory Framework: Strict regulations on recyclability and plastic waste management.

- Competitive Substitutes: Growing adoption of alternative packaging materials.

- End-User Demographics: Food & beverage, pharmaceuticals, chemicals, and industrial goods.

- M&A Trends: Moderate activity, with xx deals recorded between 2019 and 2024. Innovation barriers include high R&D costs and regulatory approvals.

Nordic Rigid Plastic Packaging Market Growth Trends & Insights

The Nordic rigid plastic packaging market demonstrated robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of [Insert Historical CAGR Here, e.g., 5.2%], reaching an estimated [Insert Historical Market Size Here, e.g., 1.5 Billion units] in 2024. This expansion was primarily propelled by a confluence of factors including the escalating consumption of pre-packaged goods, a significant surge in e-commerce activities, and a heightened consumer preference for convenient and readily available packaged products. Furthermore, transformative technological advancements, such as the widespread adoption of cutting-edge recycling technologies and the development of advanced material science, are fundamentally reshaping the industry's landscape. A pivotal influence on market dynamics is the discernible shift in consumer behavior, with a strong and growing inclination towards sustainable and eco-friendly packaging alternatives. Consequently, the market penetration of recycled content within rigid plastic packaging is projected to experience a substantial increase, rising from an estimated [Insert 2025 Recycled Content % Here, e.g., 25%] in 2025 to a target of [Insert 2033 Recycled Content % Here, e.g., 60%] by 2033. The forecast period (2025-2033) anticipates a continued CAGR of [Insert Forecast CAGR Here, e.g., 6.5%], primarily driven by the increasing demand within the food & beverage and pharmaceutical sectors, coupled with supportive government incentives for adopting circular economy principles and sustainable packaging solutions.

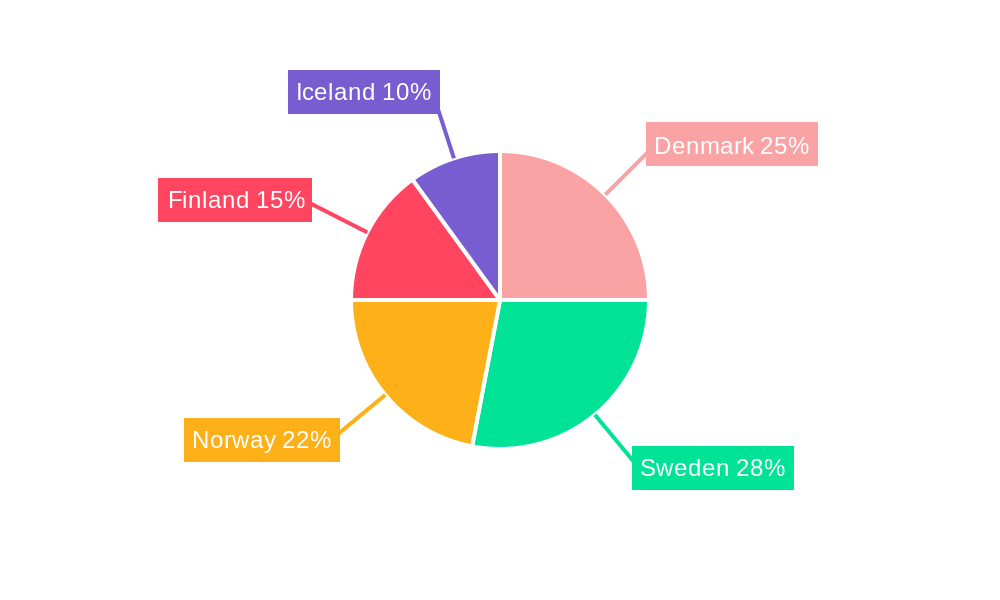

Dominant Regions, Countries, or Segments in Nordic Rigid Plastic Packaging Market

[ Insert name of dominant region/country/segment here, e.g., Sweden ] is currently the leading market for rigid plastic packaging in the Nordic region, accounting for approximately xx% of the total market share in 2024. Its dominance is attributed to a combination of factors.

- Strong Economic Growth: Consistent economic growth has fuelled demand for packaged goods.

- Developed Infrastructure: Efficient logistics and distribution networks support packaging industry growth.

- Favorable Regulatory Environment: Supportive policies promote sustainable packaging solutions.

- High Consumer Spending: Increased disposable incomes drive demand for convenience and packaged goods.

Other Nordic countries such as [ insert other relevant countries here, e.g., Norway, Finland, Denmark ] also exhibit significant growth potential, driven by factors such as [ insert specific growth drivers for each country here ]. The [ insert name of dominant segment here, e.g., food & beverage ] segment holds a significant market share, driven by [ insert specific drivers for that segment here ].

Nordic Rigid Plastic Packaging Market Product Landscape

The Nordic rigid plastic packaging market is characterized by a dynamic and innovative product landscape, marked by continuous advancements in material science, sophisticated design aesthetics, and enhanced functional capabilities. Products are meticulously engineered to meet the specific demands of diverse end-use applications, with a paramount emphasis on achieving superior barrier properties for extended shelf life, maximizing recyclability in alignment with circular economy goals, and achieving significant lightweighting to reduce material usage and transportation costs. Key innovation trajectories include the escalating integration of post-consumer recycled (PCR) content, the pioneering development and application of bio-based and biodegradable plastics, and the refinement of advanced barrier technologies to effectively preserve product integrity and freshness. The competitive advantage and unique selling propositions within this market are increasingly derived from verifiable sustainability credentials, demonstrably enhanced performance characteristics that surpass conventional options, and a compelling cost-effectiveness that balances premium features with market affordability.

Key Drivers, Barriers & Challenges in Nordic Rigid Plastic Packaging Market

Key Drivers:

- Expanding Consumer Base & Packaged Goods Demand: Persistent growth in the demand for conveniently packaged goods across essential sectors such as food & beverage, pharmaceuticals, and personal care.

- E-commerce Proliferation: The continuous rise of online retail necessitates robust, protective, and efficiently designed packaging solutions for safe and timely product delivery.

- Stringent Environmental Regulations & Policy Support: Increasingly robust environmental legislation and proactive government initiatives are actively promoting the adoption of sustainable, recyclable, and circular packaging solutions, creating a favorable market environment.

- Technological Advancements in Recycling & Material Science: Significant progress in chemical and mechanical recycling technologies, alongside innovations in material composition, are enhancing the sustainability profile and performance of rigid plastic packaging.

- Consumer Demand for Sustainability: A growing segment of environmentally conscious consumers actively seeks out products with sustainable packaging, influencing brand choices and driving industry innovation.

Key Barriers & Challenges:

- Volatile Raw Material Prices: Fluctuations in the cost of virgin plastic resins and recycled feedstocks can significantly impact manufacturing profitability and product pricing strategies.

- Environmental Concerns & Public Perception: Ongoing public discourse and concern surrounding plastic waste accumulation and its environmental impact present a persistent challenge for the industry, necessitating proactive communication and demonstrable sustainability efforts.

- Regulatory Complexity & Compliance Costs: Navigating diverse and evolving national and international regulations related to packaging content, recyclability, and waste management can incur substantial compliance costs for manufacturers.

- Competition from Alternative Packaging Materials: The market faces competition from traditional materials like glass and paperboard, as well as emerging biodegradable and compostable alternatives, requiring continuous innovation to maintain market share.

- Infrastructure for Collection & Recycling: The availability and efficiency of collection, sorting, and recycling infrastructure across the Nordic region can influence the successful integration and uptake of recycled content. These combined challenges are estimated to exert a [Insert % Impact Here, e.g., 15-20%] impact on the overall market growth trajectory.

Emerging Opportunities in Nordic Rigid Plastic Packaging Market

- Growing demand for sustainable and eco-friendly packaging solutions.

- Increased adoption of lightweighting technologies to reduce material consumption.

- Development of innovative barrier technologies to enhance product shelf life.

- Exploration of new materials, such as bio-based plastics and recycled content.

Growth Accelerators in the Nordic Rigid Plastic Packaging Market Industry

Technological breakthroughs in recycling technologies, coupled with strategic partnerships between packaging companies and recycling firms, are key drivers of long-term market growth. Expanding into new markets and applications, along with developing innovative packaging solutions to meet evolving consumer needs and preferences, are also crucial growth strategies.

Key Players Shaping the Nordic Rigid Plastic Packaging Market Market

- Muovi-Heljanko Oy

- Berry Global Inc

- Sonoco Products Company

- Norsk Lastbærer Pool AS

- Pharma-Tech A/S

- Creopack AB

- Maro Fabriken AB

- Berling Packaging

- Europak Oy

Notable Milestones in Nordic Rigid Plastic Packaging Market Sector

- July 2024: Plast Nordic and Norner partner to implement alkaline hydrolysis for PET recycling, boosting rPET supply and creating new employment opportunities.

- June 2024: Nordic Plast SIA (LTD) invests EUR 1.7 million (USD 1.83 million) in expanding recycled pellet production capacity, signifying increased demand for recycled materials in rigid plastic packaging.

In-Depth Nordic Rigid Plastic Packaging Market Market Outlook

The Nordic rigid plastic packaging market is strategically positioned for substantial and sustained growth in the forthcoming years. This positive outlook is underpinned by a powerful combination of robust demand across a multitude of vital end-use sectors, coupled with an unwavering and intensifying commitment to environmental sustainability and the principles of a circular economy. Key growth enablers include strategic collaborations and partnerships aimed at enhancing innovation and supply chain efficiencies, pioneering technological advancements in material science and manufacturing processes, and a highly supportive regulatory framework that incentivizes sustainable practices. Significant opportunities are emerging for forward-thinking companies that are adept at developing and offering packaging solutions that are not only sustainable and environmentally responsible but also highly innovative, performant, and economically viable. The market is poised to witness robust expansion, driven by the continuous adoption of advanced sustainable practices, the circular economy paradigm, and ongoing technological breakthroughs that are redefining the capabilities and environmental footprint of rigid plastic packaging.

Nordic Rigid Plastic Packaging Market Segmentation

-

1. Product Type

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Product Types

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene Terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Rigid Plastic Packaging Materials

-

2.1. Polyethylene (PE)

-

3. End-Use Industries

-

3.1. Food**

- 3.1.1. Candy & Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, And Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Food Products

-

3.2. Foodservice**

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End-uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industrial

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food**

Nordic Rigid Plastic Packaging Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Nordic Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Nordic Rigid Plastic Packaging Market

Nordic Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options

- 3.3. Market Restrains

- 3.3.1. Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options

- 3.4. Market Trends

- 3.4.1. Polyethylene Terephthalate (PET) To Witness Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene Terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Rigid Plastic Packaging Materials

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 5.3.1. Food**

- 5.3.1.1. Candy & Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, And Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Food Products

- 5.3.2. Foodservice**

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End-uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industrial

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food**

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bottles and Jars

- 6.1.2. Trays and Containers

- 6.1.3. Caps and Closures

- 6.1.4. Intermediate Bulk Containers (IBCs)

- 6.1.5. Drums

- 6.1.6. Pallets

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Polyethylene (PE)

- 6.2.1.1. LDPE & LLDPE

- 6.2.1.2. HDPE

- 6.2.2. Polyethylene Terephthalate (PET)

- 6.2.3. Polypropylene (PP)

- 6.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 6.2.5. Polyvinyl chloride (PVC)

- 6.2.6. Other Rigid Plastic Packaging Materials

- 6.2.1. Polyethylene (PE)

- 6.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 6.3.1. Food**

- 6.3.1.1. Candy & Confectionery

- 6.3.1.2. Frozen Foods

- 6.3.1.3. Fresh Produce

- 6.3.1.4. Dairy Products

- 6.3.1.5. Dry Foods

- 6.3.1.6. Meat, Poultry, And Seafood

- 6.3.1.7. Pet Food

- 6.3.1.8. Other Food Products

- 6.3.2. Foodservice**

- 6.3.2.1. Quick Service Restaurants (QSRs)

- 6.3.2.2. Full-Service Restaurants (FSRs)

- 6.3.2.3. Coffee and Snack Outlets

- 6.3.2.4. Retail Establishments

- 6.3.2.5. Institutional

- 6.3.2.6. Hospitality

- 6.3.2.7. Other Foodservice End-uses

- 6.3.3. Beverage

- 6.3.4. Healthcare

- 6.3.5. Cosmetics and Personal Care

- 6.3.6. Industrial

- 6.3.7. Building and Construction

- 6.3.8. Automotive

- 6.3.9. Other En

- 6.3.1. Food**

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bottles and Jars

- 7.1.2. Trays and Containers

- 7.1.3. Caps and Closures

- 7.1.4. Intermediate Bulk Containers (IBCs)

- 7.1.5. Drums

- 7.1.6. Pallets

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Polyethylene (PE)

- 7.2.1.1. LDPE & LLDPE

- 7.2.1.2. HDPE

- 7.2.2. Polyethylene Terephthalate (PET)

- 7.2.3. Polypropylene (PP)

- 7.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 7.2.5. Polyvinyl chloride (PVC)

- 7.2.6. Other Rigid Plastic Packaging Materials

- 7.2.1. Polyethylene (PE)

- 7.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 7.3.1. Food**

- 7.3.1.1. Candy & Confectionery

- 7.3.1.2. Frozen Foods

- 7.3.1.3. Fresh Produce

- 7.3.1.4. Dairy Products

- 7.3.1.5. Dry Foods

- 7.3.1.6. Meat, Poultry, And Seafood

- 7.3.1.7. Pet Food

- 7.3.1.8. Other Food Products

- 7.3.2. Foodservice**

- 7.3.2.1. Quick Service Restaurants (QSRs)

- 7.3.2.2. Full-Service Restaurants (FSRs)

- 7.3.2.3. Coffee and Snack Outlets

- 7.3.2.4. Retail Establishments

- 7.3.2.5. Institutional

- 7.3.2.6. Hospitality

- 7.3.2.7. Other Foodservice End-uses

- 7.3.3. Beverage

- 7.3.4. Healthcare

- 7.3.5. Cosmetics and Personal Care

- 7.3.6. Industrial

- 7.3.7. Building and Construction

- 7.3.8. Automotive

- 7.3.9. Other En

- 7.3.1. Food**

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bottles and Jars

- 8.1.2. Trays and Containers

- 8.1.3. Caps and Closures

- 8.1.4. Intermediate Bulk Containers (IBCs)

- 8.1.5. Drums

- 8.1.6. Pallets

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Polyethylene (PE)

- 8.2.1.1. LDPE & LLDPE

- 8.2.1.2. HDPE

- 8.2.2. Polyethylene Terephthalate (PET)

- 8.2.3. Polypropylene (PP)

- 8.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 8.2.5. Polyvinyl chloride (PVC)

- 8.2.6. Other Rigid Plastic Packaging Materials

- 8.2.1. Polyethylene (PE)

- 8.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 8.3.1. Food**

- 8.3.1.1. Candy & Confectionery

- 8.3.1.2. Frozen Foods

- 8.3.1.3. Fresh Produce

- 8.3.1.4. Dairy Products

- 8.3.1.5. Dry Foods

- 8.3.1.6. Meat, Poultry, And Seafood

- 8.3.1.7. Pet Food

- 8.3.1.8. Other Food Products

- 8.3.2. Foodservice**

- 8.3.2.1. Quick Service Restaurants (QSRs)

- 8.3.2.2. Full-Service Restaurants (FSRs)

- 8.3.2.3. Coffee and Snack Outlets

- 8.3.2.4. Retail Establishments

- 8.3.2.5. Institutional

- 8.3.2.6. Hospitality

- 8.3.2.7. Other Foodservice End-uses

- 8.3.3. Beverage

- 8.3.4. Healthcare

- 8.3.5. Cosmetics and Personal Care

- 8.3.6. Industrial

- 8.3.7. Building and Construction

- 8.3.8. Automotive

- 8.3.9. Other En

- 8.3.1. Food**

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bottles and Jars

- 9.1.2. Trays and Containers

- 9.1.3. Caps and Closures

- 9.1.4. Intermediate Bulk Containers (IBCs)

- 9.1.5. Drums

- 9.1.6. Pallets

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Polyethylene (PE)

- 9.2.1.1. LDPE & LLDPE

- 9.2.1.2. HDPE

- 9.2.2. Polyethylene Terephthalate (PET)

- 9.2.3. Polypropylene (PP)

- 9.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 9.2.5. Polyvinyl chloride (PVC)

- 9.2.6. Other Rigid Plastic Packaging Materials

- 9.2.1. Polyethylene (PE)

- 9.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 9.3.1. Food**

- 9.3.1.1. Candy & Confectionery

- 9.3.1.2. Frozen Foods

- 9.3.1.3. Fresh Produce

- 9.3.1.4. Dairy Products

- 9.3.1.5. Dry Foods

- 9.3.1.6. Meat, Poultry, And Seafood

- 9.3.1.7. Pet Food

- 9.3.1.8. Other Food Products

- 9.3.2. Foodservice**

- 9.3.2.1. Quick Service Restaurants (QSRs)

- 9.3.2.2. Full-Service Restaurants (FSRs)

- 9.3.2.3. Coffee and Snack Outlets

- 9.3.2.4. Retail Establishments

- 9.3.2.5. Institutional

- 9.3.2.6. Hospitality

- 9.3.2.7. Other Foodservice End-uses

- 9.3.3. Beverage

- 9.3.4. Healthcare

- 9.3.5. Cosmetics and Personal Care

- 9.3.6. Industrial

- 9.3.7. Building and Construction

- 9.3.8. Automotive

- 9.3.9. Other En

- 9.3.1. Food**

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Nordic Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bottles and Jars

- 10.1.2. Trays and Containers

- 10.1.3. Caps and Closures

- 10.1.4. Intermediate Bulk Containers (IBCs)

- 10.1.5. Drums

- 10.1.6. Pallets

- 10.1.7. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Polyethylene (PE)

- 10.2.1.1. LDPE & LLDPE

- 10.2.1.2. HDPE

- 10.2.2. Polyethylene Terephthalate (PET)

- 10.2.3. Polypropylene (PP)

- 10.2.4. Polystyrene (PS) and Expanded polystyrene (EPS

- 10.2.5. Polyvinyl chloride (PVC)

- 10.2.6. Other Rigid Plastic Packaging Materials

- 10.2.1. Polyethylene (PE)

- 10.3. Market Analysis, Insights and Forecast - by End-Use Industries

- 10.3.1. Food**

- 10.3.1.1. Candy & Confectionery

- 10.3.1.2. Frozen Foods

- 10.3.1.3. Fresh Produce

- 10.3.1.4. Dairy Products

- 10.3.1.5. Dry Foods

- 10.3.1.6. Meat, Poultry, And Seafood

- 10.3.1.7. Pet Food

- 10.3.1.8. Other Food Products

- 10.3.2. Foodservice**

- 10.3.2.1. Quick Service Restaurants (QSRs)

- 10.3.2.2. Full-Service Restaurants (FSRs)

- 10.3.2.3. Coffee and Snack Outlets

- 10.3.2.4. Retail Establishments

- 10.3.2.5. Institutional

- 10.3.2.6. Hospitality

- 10.3.2.7. Other Foodservice End-uses

- 10.3.3. Beverage

- 10.3.4. Healthcare

- 10.3.5. Cosmetics and Personal Care

- 10.3.6. Industrial

- 10.3.7. Building and Construction

- 10.3.8. Automotive

- 10.3.9. Other En

- 10.3.1. Food**

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Muovi-Heljanko Oy

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Berry Global Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sonoco Products Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Norsk Lastbærer Pool AS

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Pharma-Tech A/S

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Creopack AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Maro Fabriken AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Berling Packaging

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Europak Oy8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Muovi-Heljanko Oy

List of Figures

- Figure 1: Global Nordic Rigid Plastic Packaging Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 5: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 6: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 7: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 8: North America Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 13: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 14: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 15: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 16: South America Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 21: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 22: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 23: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 24: Europe Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 29: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 30: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 31: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 32: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Product Type 2025 & 2033

- Figure 35: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Material 2025 & 2033

- Figure 37: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Material 2025 & 2033

- Figure 38: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by End-Use Industries 2025 & 2033

- Figure 39: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by End-Use Industries 2025 & 2033

- Figure 40: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Nordic Rigid Plastic Packaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 3: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 4: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 7: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 8: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 13: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 14: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 15: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 20: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 21: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 22: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 33: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 34: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 35: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 43: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Material 2020 & 2033

- Table 44: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by End-Use Industries 2020 & 2033

- Table 45: Global Nordic Rigid Plastic Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Nordic Rigid Plastic Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nordic Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Nordic Rigid Plastic Packaging Market?

Key companies in the market include Muovi-Heljanko Oy, Berry Global Inc, Sonoco Products Company, Norsk Lastbærer Pool AS, Pharma-Tech A/S, Creopack AB, Maro Fabriken AB, Berling Packaging, Europak Oy8 2 Heat Map Analysis8 3 Competitor Analysis - Emerging vs Established Player.

3. What are the main segments of the Nordic Rigid Plastic Packaging Market?

The market segments include Product Type, Material, End-Use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 220.2 billion as of 2022.

5. What are some drivers contributing to market growth?

Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options.

6. What are the notable trends driving market growth?

Polyethylene Terephthalate (PET) To Witness Growth.

7. Are there any restraints impacting market growth?

Demand for Convenient and Ease of Use Packaging; Consumer Demand for Single-Serve Packaging Options.

8. Can you provide examples of recent developments in the market?

July 2024 - Plast Nordic and Norner partnered to implement alkaline hydrolysis to recycle 97% of PET waste in the Nordics back into raw materials. Their target markets for the 'virgin-quality' rPET resin are the packaging and other industries. The partners are set to recycle around 97% of this waste into raw materials. It believes advanced recycling is the 'only' technology that can achieve circularity without compromising the quality of the recyclate. This initiative is poised to enhance access to recycled materials, reduce transportation needs, and generate new employment opportunities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nordic Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nordic Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nordic Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Nordic Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence