Key Insights

The United States contract packaging market is poised for significant expansion, fueled by escalating demand for bespoke packaging solutions, the pervasive growth of e-commerce, and the critical need for optimized supply chain efficiency and cost reduction. Key sectors driving this growth include food and beverage, pharmaceuticals, and personal care, as businesses increasingly leverage specialized contract packagers to concentrate on core operations. The rising consumer preference for convenient and sustainable flexible packaging formats is also a major contributor to the market's upward trajectory. Moreover, advancements in automation and packaging technology are boosting operational efficiency and lowering costs, making contract packaging an increasingly compelling proposition for businesses of all scales. With a projected compound annual growth rate (CAGR) of 5.23% and an estimated market size of $98.77 billion by 2025, the US market represents a substantial opportunity.

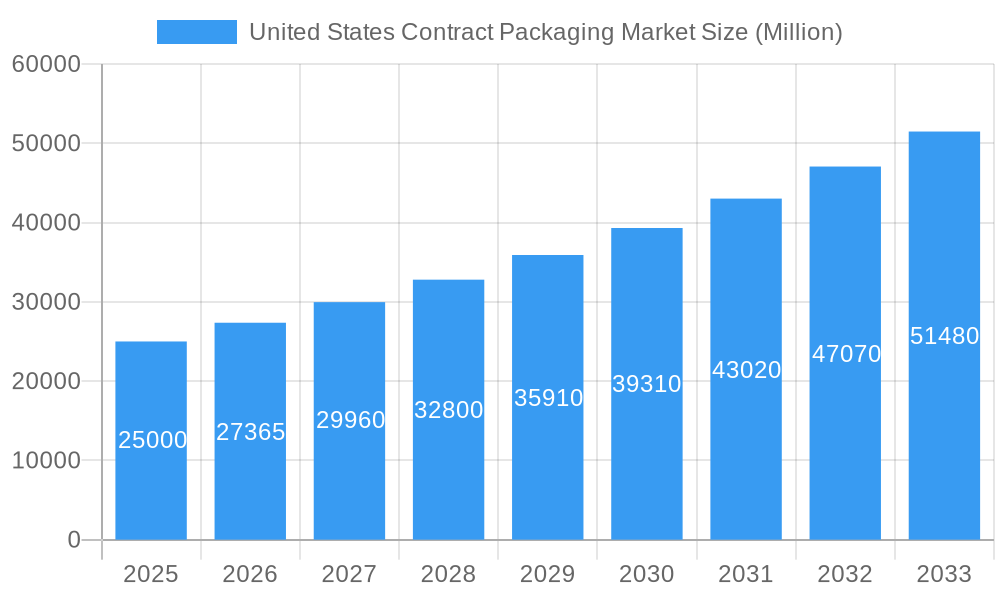

United States Contract Packaging Market Market Size (In Billion)

Looking ahead to 2033, the US contract packaging market is expected to sustain robust growth. This sustained expansion will be propelled by continued e-commerce penetration, shifting consumer preferences, and the growing imperative for regulatory compliance across diverse industries. The demand for innovative and eco-conscious packaging, encompassing sustainable materials and minimized waste, will present further avenues for contract packaging providers. Companies excelling in advanced automation and flexible packaging technologies are strategically positioned to benefit from this growth. While potential challenges such as volatile raw material costs and economic uncertainties may arise, the overarching market outlook remains highly favorable, signaling considerable potential for expansion and investment.

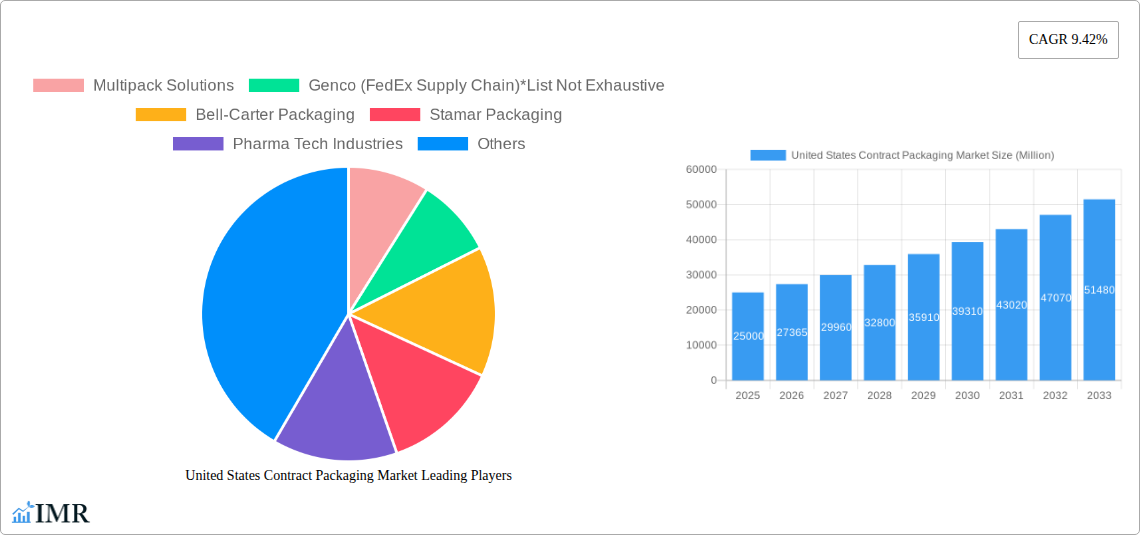

United States Contract Packaging Market Company Market Share

United States Contract Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States contract packaging market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. With a detailed examination spanning the period 2019-2033, this study offers a robust understanding of market dynamics, growth trends, and future prospects across various segments. The report incorporates extensive data analysis, including market sizing, segmentation, and competitive landscape, to deliver actionable intelligence for informed business strategies.

Keywords: United States Contract Packaging Market, Contract Packaging, Packaging Services, Primary Packaging, Secondary Packaging, Tertiary Packaging, Food Packaging, Pharmaceutical Packaging, Beverage Packaging, Home Care Packaging, Personal Care Packaging, Automotive Packaging, Market Size, Market Share, Market Growth, CAGR, Industry Analysis, Competitive Landscape, Market Trends, Market Opportunities, Market Challenges, Market Forecast.

United States Contract Packaging Market Market Dynamics & Structure

The US contract packaging market is characterized by moderate concentration, with a mix of large multinational companies and smaller, specialized players. Technological advancements, particularly in automation and sustainable packaging solutions, are key drivers. Stringent regulatory frameworks, especially within the pharmaceutical and food sectors, significantly influence market practices. Competitive pressures from alternative packaging solutions and evolving consumer preferences present ongoing challenges. Mergers and acquisitions (M&A) activity is moderate, reflecting consolidation and expansion strategies within the industry.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller firms. The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Automation, sustainable materials, and advanced packaging technologies are driving efficiency and product differentiation. However, high upfront investment can act as an innovation barrier for smaller firms.

- Regulatory Framework: Stringent FDA regulations (pharmaceutical and food sectors) significantly impact operational costs and compliance. Meeting sustainability standards adds another layer of complexity.

- Competitive Substitutes: Internal packaging operations of large companies represent a competitive pressure. Changes in consumer preferences toward eco-friendly packaging also influence the market.

- M&A Trends: Moderate M&A activity is observed, primarily focused on consolidation and expansion into new market segments. The number of deals annually averages approximately xx.

- End-User Demographics: The growing demand for convenience and customized packaging across various end-user industries drives market growth. Shifting consumer preferences towards sustainability is a significant factor.

United States Contract Packaging Market Growth Trends & Insights

The US contract packaging market exhibits robust growth, driven by increasing outsourcing by companies seeking to improve efficiency and focus on core competencies. Market size grew from $xx million in 2019 to an estimated $xx million in 2025, representing a CAGR of xx%. This growth is fuelled by rising demand across diverse end-user sectors, coupled with technological advancements in packaging materials and automation. The adoption of sustainable packaging practices is also gaining traction, further influencing market dynamics. Consumer behavior shifts towards convenience and personalized packaging contribute significantly to market expansion. Market penetration for contract packaging services is estimated at xx% in 2025, with significant growth potential in untapped segments.

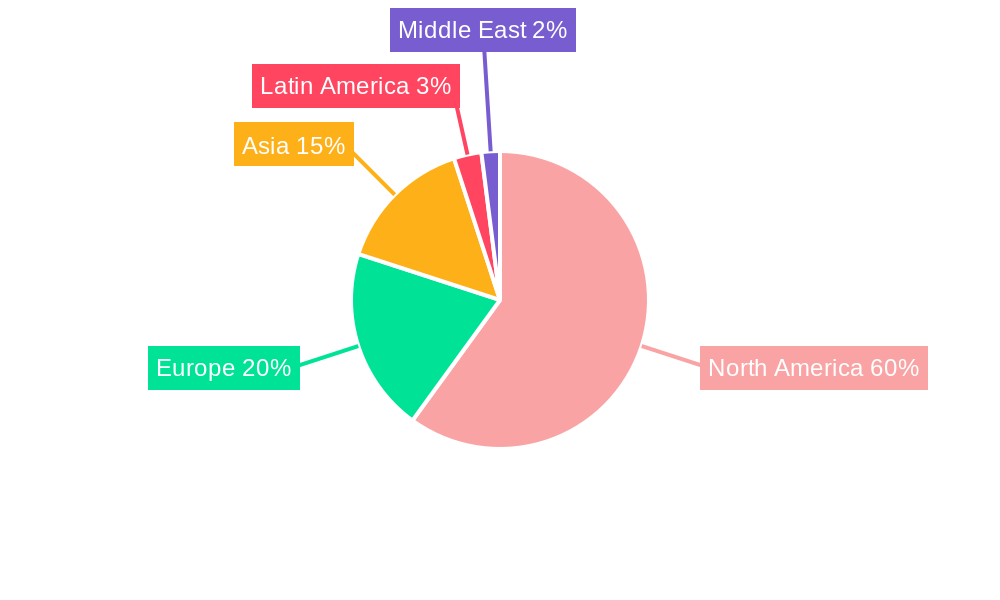

Dominant Regions, Countries, or Segments in United States Contract Packaging Market

The Northeast and West Coast regions dominate the US contract packaging market, driven by high concentrations of manufacturing and distribution facilities in these areas. Within packaging types, the secondary packaging segment holds the largest market share, reflecting the growing demand for attractive and protective secondary packaging solutions. The pharmaceutical and food sectors are the leading end-user industries due to their high volume of packaged products and stringent regulatory requirements.

- Leading Regions: Northeast and West Coast regions.

- Key Drivers (Northeast): High concentration of pharmaceutical and healthcare companies. Established logistics networks and skilled labor pool.

- Key Drivers (West Coast): Significant presence of food and beverage companies. Proximity to major ports and distribution centers.

- Dominant Packaging Type: Secondary Packaging, driven by increasing focus on branding and product protection.

- Dominant End-User Industries: Pharmaceutical and food & beverage, due to stringent regulations and high volume requirements.

United States Contract Packaging Market Product Landscape

The US contract packaging market offers a wide array of services, from primary to tertiary packaging, catering to diverse product types and end-user needs. Innovations focus on sustainable materials like recycled plastics and biodegradable alternatives, alongside automated packaging solutions boosting efficiency and minimizing waste. Key performance metrics include throughput, packaging speed, defect rates, and cost-effectiveness. Unique selling propositions (USPs) often center on specialized expertise, sustainable practices, and advanced technology.

Key Drivers, Barriers & Challenges in United States Contract Packaging Market

Key Drivers:

- Rising demand for outsourced packaging services across various industries.

- Increasing adoption of innovative packaging technologies.

- Growing emphasis on sustainability and eco-friendly packaging solutions.

- Stringent regulatory compliance demands driving outsourcing.

Key Challenges:

- Fluctuations in raw material costs impacting profitability.

- Intense competition among contract packaging providers.

- Maintaining consistent quality and meeting stringent regulatory standards.

- Supply chain disruptions impacting timely delivery and production. This has caused an estimated xx% increase in lead times for some packaging materials.

Emerging Opportunities in United States Contract Packaging Market

Emerging opportunities include:

- Expansion into niche markets such as medical devices and cosmetics.

- Growing demand for e-commerce-ready packaging.

- Increased focus on personalized and customized packaging solutions.

- Development of innovative packaging materials and technologies.

Growth Accelerators in the United States Contract Packaging Market Industry

The long-term growth of the US contract packaging market will be propelled by the ongoing shift towards outsourcing, the growing adoption of advanced automation and robotics in packaging processes, the development of sustainable and eco-friendly packaging solutions, and strategic partnerships between contract packagers and brand owners to develop innovative packaging designs and solutions.

Key Players Shaping the United States Contract Packaging Market Market

- Multipack Solutions

- Genco (FedEx Supply Chain)

- Bell-Carter Packaging

- Stamar Packaging

- Pharma Tech Industries

- Aaron Thomas Company

- Reed-Lane Inc

- UNICEP Packaging

- Jones Packaging Inc

- Sharp Packaging Services

Notable Milestones in United States Contract Packaging Market Sector

- February 2022: GenNx360 Capital Partners invests in Nutra-Med Packaging Inc., signaling growth in the pharmaceutical packaging segment.

- April 2022: GreenSeed Contract Packaging expands its facility, demonstrating growth and capacity increase within the CPG sector.

In-Depth United States Contract Packaging Market Market Outlook

The US contract packaging market is poised for continued growth driven by ongoing technological advancements, increasing demand for specialized packaging solutions, and a rising focus on sustainability. Strategic partnerships, expansion into new market segments, and investments in automation will shape future market dynamics. Opportunities exist in sustainable packaging solutions and personalized packaging, driving further market expansion and innovation in the coming years. The market is projected to reach $xx million by 2033, with a CAGR of xx% during the forecast period.

United States Contract Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Home Care and Personal Care

- 2.5. Automotive

- 2.6. Other End-user Industry

United States Contract Packaging Market Segmentation By Geography

- 1. United States

United States Contract Packaging Market Regional Market Share

Geographic Coverage of United States Contract Packaging Market

United States Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.23% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Rapid Technological Advancements; Development in the Retail Chain

- 3.3. Market Restrains

- 3.3.1. In-house Packaging; Increasing Lead Time and Logistics Cost

- 3.4. Market Trends

- 3.4.1. Rapidly Growing Pharmaceutical Industry is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Home Care and Personal Care

- 5.2.5. Automotive

- 5.2.6. Other End-user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Multipack Solutions

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Genco (FedEx Supply Chain)*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bell-Carter Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Stamar Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Pharma Tech Industries

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Aaron Thomas Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Reed-Lane Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 UNICEP Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jones Packaging Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sharp Packaging Services

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Multipack Solutions

List of Figures

- Figure 1: United States Contract Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: United States Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: United States Contract Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: United States Contract Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: United States Contract Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: United States Contract Packaging Market Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 5: United States Contract Packaging Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: United States Contract Packaging Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Contract Packaging Market?

The projected CAGR is approximately 5.23%.

2. Which companies are prominent players in the United States Contract Packaging Market?

Key companies in the market include Multipack Solutions, Genco (FedEx Supply Chain)*List Not Exhaustive, Bell-Carter Packaging, Stamar Packaging, Pharma Tech Industries, Aaron Thomas Company, Reed-Lane Inc, UNICEP Packaging, Jones Packaging Inc, Sharp Packaging Services.

3. What are the main segments of the United States Contract Packaging Market?

The market segments include Packaging Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 98.77 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Rapid Technological Advancements; Development in the Retail Chain.

6. What are the notable trends driving market growth?

Rapidly Growing Pharmaceutical Industry is Driving the Market.

7. Are there any restraints impacting market growth?

In-house Packaging; Increasing Lead Time and Logistics Cost.

8. Can you provide examples of recent developments in the market?

February 2022 - GenNx360 Capital Partners, a New York-based private equity firm, announced its investment in Nutra-Med Packaging Inc., a New Jersey-based contract packaging organization focused on packaging for the pharmaceutical, health & wellness, and medical devices markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Contract Packaging Market?

To stay informed about further developments, trends, and reports in the United States Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence