Key Insights

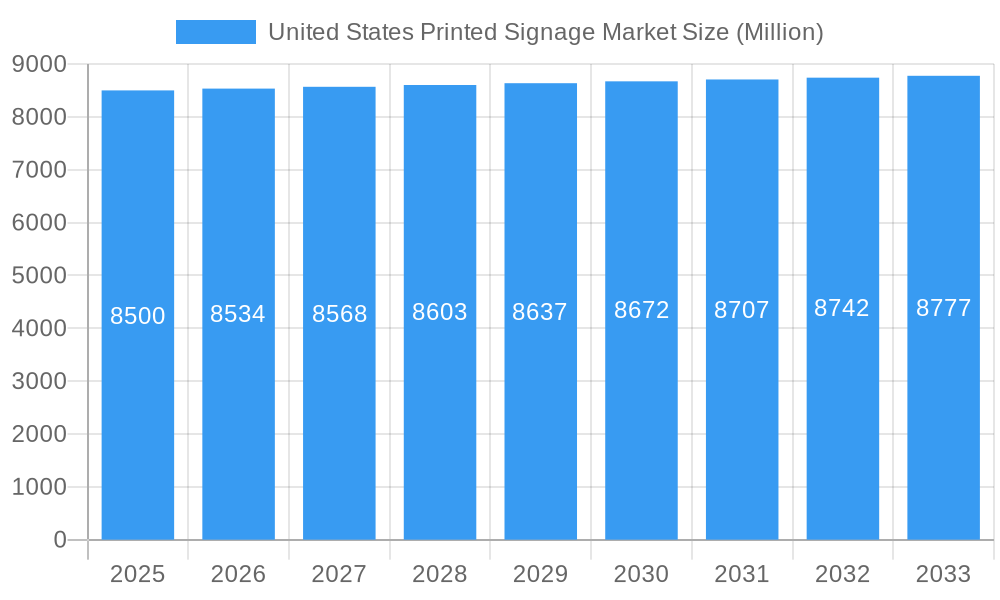

The United States printed signage market, a significant segment of the broader global signage industry, is experiencing steady growth, driven by the increasing need for effective brand building and targeted advertising across diverse sectors. While the provided CAGR of 0.40% might seem modest, this likely reflects a mature market experiencing consistent, albeit not explosive, expansion. Key drivers include the rising popularity of outdoor advertising campaigns, particularly in high-traffic urban areas, and the ongoing demand for visually appealing indoor signage in retail spaces and corporate environments. The increasing adoption of digital printing technologies offers greater design flexibility and cost-effectiveness, further stimulating market growth. Segmentation reveals strong demand across various product types, with billboards, backlit displays, and pop displays remaining popular choices. The retail, BFSI (Banking, Financial Services, and Insurance), and transportation & logistics sectors are major end-users, reflecting their reliance on effective signage for branding, wayfinding, and promotional activities. While specific market size figures for the US are missing, considering a global market size (XX million) and assuming the US holds a significant share (estimated at 30-40%), a reasonable estimate for the 2025 US market size would be in the range of $7-10 billion. This estimate is further supported by the presence of numerous prominent players, such as Avery Dennison and Vistaprint, indicating a sizeable and competitive market. Future growth will likely be influenced by factors such as economic conditions and technological advancements in signage materials and printing techniques.

United States Printed Signage Market Market Size (In Billion)

The market's relatively low CAGR suggests a degree of market saturation, but continued innovation, such as the integration of digital technologies and interactive elements into printed signage, presents opportunities for growth and market diversification. The competitive landscape is populated by both large multinational corporations and smaller regional businesses, suggesting opportunities for both large-scale production and niche market specialization. The ongoing need for clear and effective communication in various commercial and public spaces ensures continued demand for printed signage solutions in the US. Continued growth in the retail and e-commerce sectors is likely to have a positive effect on demand for printed signage. Challenges may include evolving consumer preferences and increasing competition from digital advertising platforms. Strategic focus on sustainability and environmentally friendly signage materials could also contribute to growth, aligning with broader environmental concerns.

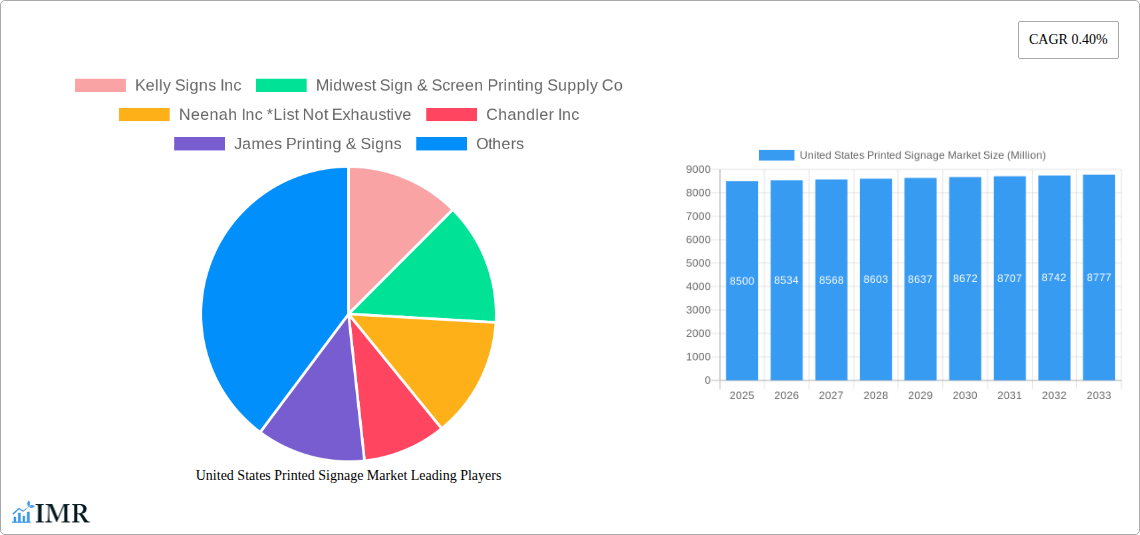

United States Printed Signage Market Company Market Share

United States Printed Signage Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the United States Printed Signage Market, encompassing market dynamics, growth trends, dominant segments, and key players. The study covers the period from 2019 to 2033, with 2025 as the base year and a forecast period from 2025 to 2033. The market is segmented by product (Billboards, Backlit Displays, Pop Displays, Banners, Flags & Backdrops, Corporate Graphics, Exhibition & Trade Show Materials, Others), type (Indoor, Outdoor), and end-user vertical (BFSI, Retail, Sports & Leisure, Entertainment, Transportation & Logistics, Healthcare, Others). The market size is valued in million units.

United States Printed Signage Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory influences, and market trends within the US printed signage industry. The market is moderately fragmented, with several key players and a number of smaller, regional businesses. Technological innovation, particularly in digital printing and materials science, is a key driver, while regulatory changes related to environmental sustainability and advertising regulations present both challenges and opportunities. Mergers and acquisitions (M&A) activity has been moderate, with larger companies seeking to expand their market share through acquisitions of smaller, specialized firms.

- Market Concentration: Moderately fragmented, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Digital printing, LED backlighting, and sustainable materials are driving innovation.

- Regulatory Framework: Advertising regulations and environmental concerns influence market growth.

- Competitive Substitutes: Digital signage and other forms of advertising pose competition.

- End-User Demographics: Market growth is driven by diverse end-user needs across various sectors.

- M&A Trends: Moderate M&A activity, with xx deals recorded between 2019 and 2024.

United States Printed Signage Market Growth Trends & Insights

The US printed signage market experienced steady growth from 2019 to 2024, driven by increasing demand from retail, BFSI, and entertainment sectors. The market size in 2024 was estimated at xx million units. The adoption of digital printing technologies has significantly improved efficiency and reduced costs, fostering market expansion. Changing consumer behavior, with a preference for visually appealing and engaging signage, also fuels growth. However, the rise of digital signage presents a challenge, as some businesses shift advertising budgets. The market is projected to experience a CAGR of xx% from 2025 to 2033, reaching xx million units by 2033. Market penetration is currently at xx%, with significant potential for future growth in untapped segments.

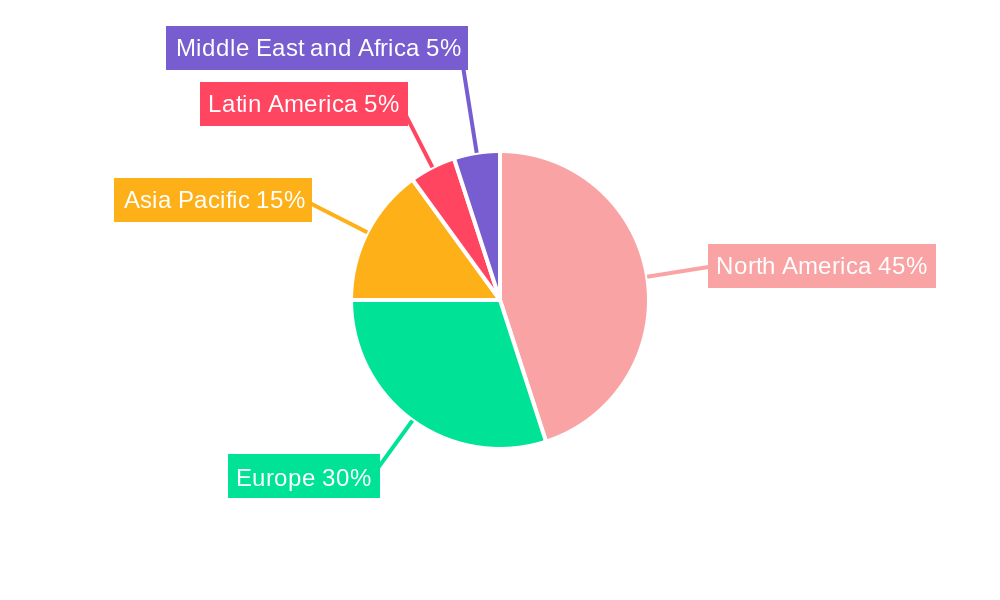

Dominant Regions, Countries, or Segments in United States Printed Signage Market

The report identifies key regions, countries, and segments driving market growth. California and New York are leading states, benefiting from high population density and strong commercial activity. Within product segments, billboards and backlit displays currently hold the largest market share due to their high visibility and impact. The retail and BFSI sectors remain the largest end-users of printed signage.

- Leading Regions: California, New York, Texas, Florida.

- Key Product Segments: Billboards (xx million units), Backlit Displays (xx million units).

- Dominant End-user Verticals: Retail (xx million units), BFSI (xx million units).

- Growth Drivers: Strong economic activity in key regions, increasing brand awareness initiatives.

United States Printed Signage Market Product Landscape

The US printed signage market offers a wide range of products catering to various applications and requirements. Recent innovations include sustainable materials, improved durability, and interactive displays. Companies are increasingly focusing on customization and providing integrated solutions to meet the evolving needs of their clients. The emphasis is on high-quality printing, vibrant colors, and long-lasting materials, ensuring brand visibility and message clarity.

Key Drivers, Barriers & Challenges in United States Printed Signage Market

Key Drivers:

- Increased marketing and advertising budgets.

- Growing demand from retail and entertainment sectors.

- Technological advancements in printing and materials.

Challenges and Restraints:

- Competition from digital signage.

- Fluctuations in raw material prices.

- Environmental regulations impacting material choices. The impact of these challenges is estimated to reduce market growth by xx% over the forecast period.

Emerging Opportunities in United States Printed Signage Market

Emerging trends include the integration of smart technologies into signage, the use of sustainable and eco-friendly materials, and the growth of personalized signage solutions. Untapped markets exist in smaller cities and towns, as well as niche sectors like healthcare and education. The focus on experiential marketing offers significant opportunities for innovative signage applications.

Growth Accelerators in the United States Printed Signage Market Industry

Long-term growth will be fueled by technological advancements, strategic partnerships, and expansion into new markets. Investment in R&D, especially in sustainable materials and interactive signage, will play a crucial role. Collaborations between signage companies and technology providers will create innovative solutions. Market expansion efforts, targeting untapped regions and sectors, will further enhance market growth.

Key Players Shaping the United States Printed Signage Market Market

- Kelly Signs Inc

- Midwest Sign & Screen Printing Supply Co

- Neenah Inc

- Chandler Inc

- James Printing & Signs

- Sabre Digital Marketing

- Vistaprint (Cimpress plc)

- AJ Printing & Graphics Inc

- Avery Dennison Corporation

- RJ Courtney LLC

- Southwest Printing Co

- 3A Composites USA Inc

Notable Milestones in United States Printed Signage Market Sector

- 2020: Introduction of recyclable billboard materials by several key players.

- 2022: Several mergers and acquisitions consolidating the market.

- 2023: Increased adoption of digital printing technologies by small businesses.

- 2024: Launch of several interactive signage solutions by leading technology companies.

In-Depth United States Printed Signage Market Market Outlook

The US printed signage market is poised for continued growth, driven by a combination of factors. The adoption of sustainable materials and advanced technologies will create new opportunities, while strategic partnerships will foster innovation and expansion. The long-term outlook is positive, with substantial growth potential in various sectors and regions. The market is expected to reach xx million units by 2033, presenting significant opportunities for both established and emerging players.

United States Printed Signage Market Segmentation

-

1. Product

- 1.1. Billboards

- 1.2. Backlit Displays

- 1.3. Pop Displays

- 1.4. Banners, Flags, and Backdrops

- 1.5. Corporat

- 1.6. Others Products

-

2. Type

- 2.1. Indoor Printed Signage

- 2.2. Outdoor Printed Signage

-

3. End-user Vertical

- 3.1. BFSI

- 3.2. Retail

- 3.3. Sports & Leisure

- 3.4. Entertainment

- 3.5. Transportation & Logistics

- 3.6. Healthcare

- 3.7. Other end-user verticals

United States Printed Signage Market Segmentation By Geography

- 1. United States

United States Printed Signage Market Regional Market Share

Geographic Coverage of United States Printed Signage Market

United States Printed Signage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Cost Effectiveness of Printed Signage

- 3.3. Market Restrains

- 3.3.1 Lack of Ubiquitous Standards

- 3.3.2 Safety Concerns

- 3.3.3 and Inability to withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Printed Billboards are Expected to Witness Downfall

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Printed Signage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Billboards

- 5.1.2. Backlit Displays

- 5.1.3. Pop Displays

- 5.1.4. Banners, Flags, and Backdrops

- 5.1.5. Corporat

- 5.1.6. Others Products

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Indoor Printed Signage

- 5.2.2. Outdoor Printed Signage

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. Sports & Leisure

- 5.3.4. Entertainment

- 5.3.5. Transportation & Logistics

- 5.3.6. Healthcare

- 5.3.7. Other end-user verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kelly Signs Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Midwest Sign & Screen Printing Supply Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Neenah Inc *List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Chandler Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 James Printing & Signs

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sabre Digital Marketing

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistaprint ( Cimpress plc)

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 AJ Printing & Graphics Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Avery Dennison Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 RJ Courtney LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Southwest Printing Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3A Composites USA Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Kelly Signs Inc

List of Figures

- Figure 1: United States Printed Signage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Printed Signage Market Share (%) by Company 2025

List of Tables

- Table 1: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 3: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: United States Printed Signage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Printed Signage Market Revenue Million Forecast, by Product 2020 & 2033

- Table 6: United States Printed Signage Market Revenue Million Forecast, by Type 2020 & 2033

- Table 7: United States Printed Signage Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: United States Printed Signage Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Printed Signage Market?

The projected CAGR is approximately 0.40%.

2. Which companies are prominent players in the United States Printed Signage Market?

Key companies in the market include Kelly Signs Inc, Midwest Sign & Screen Printing Supply Co, Neenah Inc *List Not Exhaustive, Chandler Inc, James Printing & Signs, Sabre Digital Marketing, Vistaprint ( Cimpress plc), AJ Printing & Graphics Inc, Avery Dennison Corporation, RJ Courtney LLC, Southwest Printing Co, 3A Composites USA Inc.

3. What are the main segments of the United States Printed Signage Market?

The market segments include Product, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Cost Effectiveness of Printed Signage.

6. What are the notable trends driving market growth?

Printed Billboards are Expected to Witness Downfall.

7. Are there any restraints impacting market growth?

Lack of Ubiquitous Standards. Safety Concerns. and Inability to withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Printed Signage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Printed Signage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Printed Signage Market?

To stay informed about further developments, trends, and reports in the United States Printed Signage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence