Key Insights

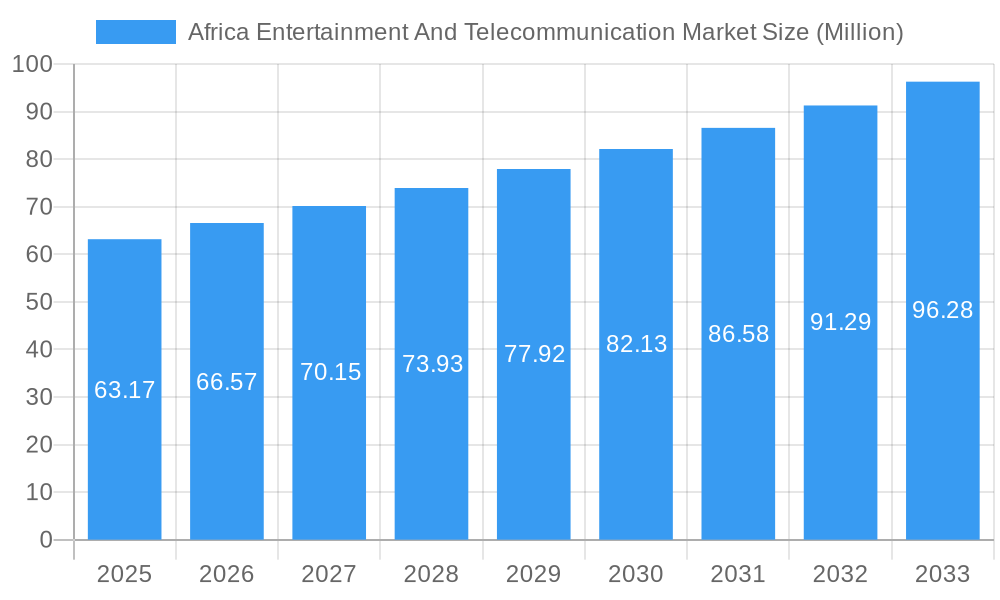

The African entertainment and telecommunication market is poised for robust expansion, projected to reach a substantial USD 63.17 million in 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 5.44%, indicating sustained momentum throughout the forecast period of 2025-2033. A primary driver of this expansion is the escalating adoption of digital platforms across the continent. The proliferation of smartphones, coupled with increasing internet penetration and affordability, is democratizing access to entertainment content and telecommunication services. Gaming consoles are also emerging as significant contributors, fueled by a growing youth population and a desire for interactive digital experiences. Downloaded/boxed PC content and browser-based PC platforms, while perhaps more mature, continue to hold their ground, catering to specific user preferences and professional needs. The increasing availability of high-speed internet, including the rollout of 5G networks in select regions, will further accelerate the consumption of data-intensive entertainment like video streaming and online gaming.

Africa Entertainment And Telecommunication Market Market Size (In Million)

The market's trajectory is further shaped by evolving consumer behaviors and technological advancements. Streaming services, both local and international, are gaining significant traction, displacing traditional media consumption patterns. E-sports and online gaming communities are burgeoning, creating new revenue streams and fostering digital economies. Mobile telecommunication remains the backbone, facilitating not only communication but also access to a vast array of digital services, from mobile banking to social media and entertainment apps. Despite these promising trends, certain restraints may temper the pace of growth. Infrastructure limitations in some rural areas, coupled with the affordability of high-end devices and data plans, can pose challenges. However, the sheer demographic advantage of Africa, characterized by a young and increasingly connected population, coupled with proactive government initiatives to boost digital literacy and infrastructure, are strong counterbalances. Key players are strategically investing in content creation, network expansion, and localized service offerings to capture this dynamic market.

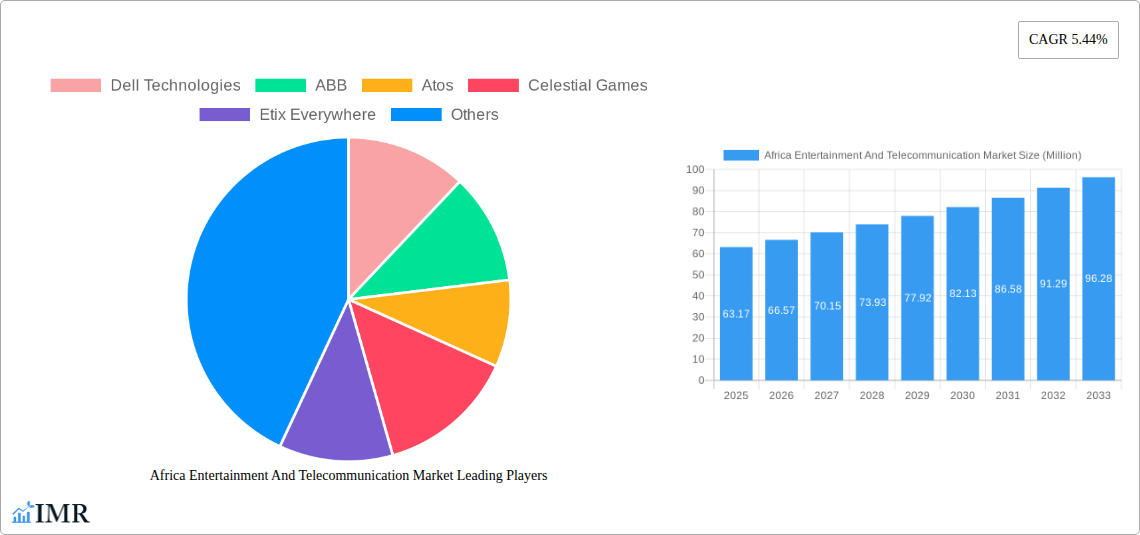

Africa Entertainment And Telecommunication Market Company Market Share

This comprehensive report offers an in-depth analysis of the Africa Entertainment and Telecommunication Market, providing critical insights and data for stakeholders. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period of 2025–2033, this study delves into market dynamics, growth trends, dominant regions, product landscape, key players, and future outlook. Keywords like "Africa telecom market," "African entertainment industry," "mobile gaming Africa," "broadband Africa," and "digital transformation Africa" are integrated to maximize search visibility. We explore parent and child market segments to provide a granular understanding of market opportunities. All values are presented in Million units.

Africa Entertainment And Telecommunication Market Market Dynamics & Structure

The Africa Entertainment and Telecommunication Market is characterized by a dynamic interplay of forces shaping its trajectory. Market concentration varies across segments, with telecommunications infrastructure generally dominated by a few major players, while the entertainment sector exhibits a more fragmented landscape, especially in digital content creation and distribution. Technological innovation is a paramount driver, with the rapid adoption of 4G and increasing rollout of 5G networks significantly enhancing mobile entertainment and communication capabilities. Regulatory frameworks, while evolving, can still present challenges, although initiatives aimed at fostering digital economies are gaining momentum. Competitive product substitutes are abundant, ranging from traditional media to burgeoning over-the-top (OTT) platforms and mobile gaming apps. End-user demographics are increasingly young, tech-savvy, and urbanized, driving demand for data-intensive entertainment services and robust connectivity. Mergers and acquisitions (M&A) trends are notable as larger entities seek to consolidate their market positions and expand their service offerings.

- Market Concentration: Telecom infrastructure is highly concentrated, with significant market share held by a few major operators. The entertainment sector, particularly digital content, shows increasing fragmentation with the rise of local content creators.

- Technological Innovation Drivers: 5G deployment, affordable smartphone penetration, and advancements in content streaming technologies are key innovation drivers.

- Regulatory Frameworks: Government initiatives promoting digital infrastructure investment and data privacy are crucial. Spectrum allocation policies directly impact telecom expansion.

- Competitive Product Substitutes: OTT services compete with traditional broadcasting; mobile gaming competes with console gaming; and various communication apps offer alternatives to traditional voice and SMS.

- End-User Demographics: A young, digitally native population in urban centers is a primary consumer base. Growing middle class fuels discretionary spending on entertainment.

- M&A Trends: Consolidation in the telecom sector and strategic partnerships in the digital entertainment space are observed. For instance, the acquisition of smaller content platforms by larger media houses.

Africa Entertainment And Telecommunication Market Growth Trends & Insights

The Africa Entertainment and Telecommunication Market is poised for substantial growth, driven by a confluence of factors that are reshaping consumer behavior and technological adoption. The market size is projected to expand significantly as internet penetration deepens and the affordability of digital devices increases across the continent. Adoption rates for mobile-based entertainment, including streaming services and mobile gaming, are escalating rapidly, fueled by increased disposable incomes and a growing youth population. Technological disruptions, such as the ongoing rollout of 5G networks and the proliferation of affordable smartphones, are creating new avenues for immersive entertainment experiences and more sophisticated telecommunication services. Consumer behavior is shifting dramatically, with a marked preference for on-demand content, social media integration, and interactive digital experiences. This transformation is not merely about access but also about the quality and diversity of content available. The increasing availability of localized content is further accelerating adoption and engagement. Economic development in various African nations is directly correlating with increased spending on both entertainment and telecommunication services. The digital divide, while still present, is narrowing, bringing more consumers into the digital fold. This evolving landscape presents unprecedented opportunities for innovation and investment. The penetration of broadband services, both fixed and mobile, is a critical indicator of market health and future potential. As more users gain reliable access, the demand for higher bandwidth services, crucial for high-definition streaming and online gaming, will surge. The report analyzes these trends with specific metrics, illustrating the rapid evolution of this vibrant market. The forecast period is expected to witness a compound annual growth rate (CAGR) of approximately 15.5% for the broader entertainment and telecommunication market, with specific segments like mobile gaming experiencing even higher growth rates, potentially exceeding 20% CAGR. Market penetration for smartphones is expected to reach 65% by 2030, up from approximately 45% in 2025, directly impacting the consumption of digital entertainment.

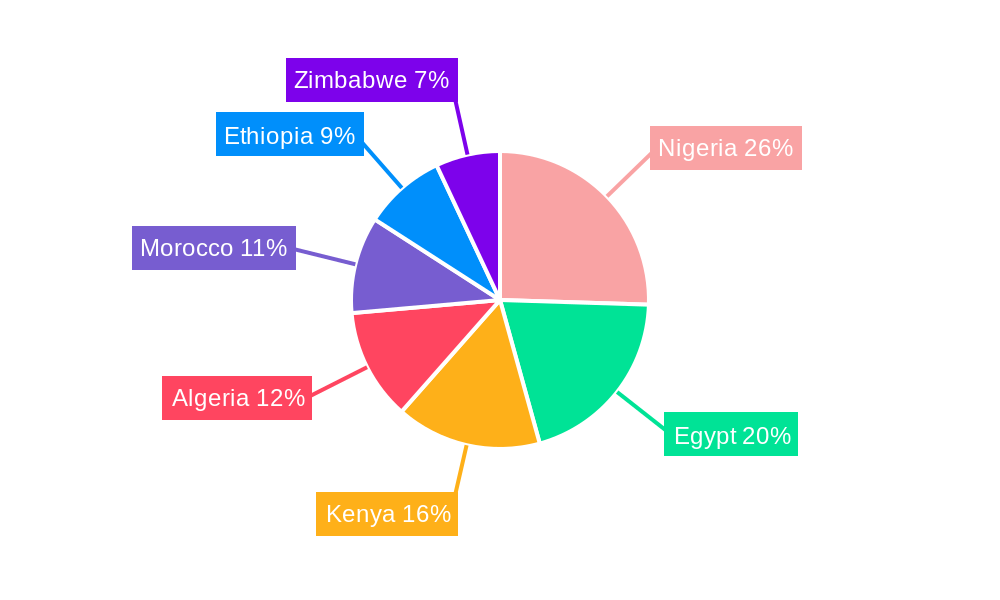

Dominant Regions, Countries, or Segments in Africa Entertainment And Telecommunication Market

Several regions and countries are emerging as significant powerhouses within the Africa Entertainment and Telecommunication Market, driving overall growth and setting trends. Nigeria stands out as a dominant force, fueled by its large, youthful population, rapidly expanding digital infrastructure, and a vibrant creative industry. The country's economic diversification and increasing internet penetration have made it a fertile ground for both telecommunication service providers and entertainment content creators. Its substantial mobile user base, estimated at over 100 million active subscriptions, directly translates into a massive addressable market for mobile gaming, streaming services, and digital communication platforms. Key drivers in Nigeria include government support for the digital economy, substantial foreign investment in telecommunications, and a burgeoning tech startup ecosystem.

Egypt is another key player, benefiting from its strategic location, a substantial population, and ongoing investments in telecommunications infrastructure, including significant fiber optic network expansion. The Egyptian government's focus on digital transformation and e-governance initiatives has fostered a conducive environment for the growth of both entertainment and telecommunication services. Egypt's market share within the broader North African telecommunication sector is considerable, and its growing demand for digital entertainment, particularly video-on-demand and online gaming, is a significant growth catalyst.

Kenya is recognized for its pioneering role in mobile money and its robust mobile telecommunication network. This has paved the way for innovative digital entertainment solutions and expanded access to communication services. The country's relatively high smartphone penetration and an increasingly tech-savvy populace are driving demand for sophisticated digital content and services. Kenya's dominance is further bolstered by a supportive regulatory environment that encourages innovation and investment in the technology sector.

When examining market segments, the Smartphone platform is unequivocally dominant, acting as the primary gateway for entertainment and telecommunication services across Africa. Its widespread adoption, affordability, and versatility make it the cornerstone of the market. Following closely, Browser PC and Downloaded/Box PC represent significant segments, particularly in professional settings and for more intensive gaming experiences, though their reach is more concentrated. The Gaming Console segment, while smaller in market share, is experiencing rapid growth due to increasing disposable incomes and the introduction of more affordable gaming devices.

- Nigeria: Largest population, highest mobile subscriptions, booming digital content creation, significant investment in 5G. Market share of mobile data consumption is estimated at over 35% of the continent's total.

- Egypt: Strong telecommunication infrastructure, government digital transformation push, growing demand for VOD and online gaming. Estimated to contribute over 20% to the North African telecom market.

- Kenya: Leader in mobile money innovation, high smartphone penetration, robust mobile network coverage, supportive regulatory environment. Mobile penetration rate stands at approximately 90%.

- Dominant Platform: Smartphone: Over 60% of digital content consumption occurs via smartphones. Expected to grow by 12% annually.

- Growing Segment: Gaming Console: Despite lower initial penetration, the gaming console market is projected to grow at a CAGR of 18% over the forecast period, driven by increasing disposable income.

- Key Drivers: Economic growth, increasing internet penetration, youthful demographics, government digital initiatives, and infrastructure development are common threads across these dominant regions and segments.

Africa Entertainment And Telecommunication Market Product Landscape

The Africa Entertainment and Telecommunication Market's product landscape is rapidly evolving, characterized by an increasing demand for integrated digital experiences. Innovations are centered around enhancing connectivity, improving content delivery, and creating more engaging user interfaces across various platforms. Key product developments include the widespread deployment of affordable 4G and the nascent rollout of 5G networks, enabling higher bandwidth and lower latency for streaming and online gaming. Smartphone applications are becoming more sophisticated, offering a rich tapestry of entertainment options, from interactive games developed by local studios like Celestial Games and Kucheza, to diverse video-on-demand services. Telecommunication companies are also innovating in their service offerings, moving beyond basic connectivity to bundle entertainment packages and digital services. The performance metrics are improving, with faster download speeds and more reliable network coverage becoming standard expectations. Companies like Huawei and Cisco Systems are instrumental in building the infrastructure that supports these advancements.

Key Drivers, Barriers & Challenges in Africa Entertainment And Telecommunication Market

Key Drivers:

- Demographic Dividend: Africa's young and rapidly growing population is a significant driver, with a high propensity for adopting new technologies and digital entertainment.

- Increasing Internet Penetration: The continuous expansion of mobile networks and decreasing data costs are making internet access more widespread, fueling demand for digital services.

- Affordable Smartphone Growth: The availability of increasingly affordable smartphones serves as the primary device for accessing entertainment and communication.

- Government Digitalization Initiatives: Many African governments are actively promoting digital transformation, investing in infrastructure, and creating favorable policies for the tech sector.

Barriers & Challenges:

- Infrastructure Gaps: Despite improvements, significant disparities in internet access and quality persist, particularly in rural areas, limiting widespread adoption of high-bandwidth services. The cost of deploying advanced infrastructure like 5G remains a challenge.

- Affordability of Devices and Data: While prices are decreasing, the cost of smartphones and data plans can still be prohibitive for a substantial portion of the population.

- Regulatory Hurdles and Policy Inconsistencies: Varying regulatory frameworks across different countries can create complexities for businesses operating regionally. Spectrum allocation and licensing can also be challenging.

- Cybersecurity Concerns: As digital services proliferate, ensuring robust cybersecurity measures and protecting user data becomes increasingly critical.

- Limited Local Content Production Capacity: While growing, the capacity for local content creation in high-quality formats still needs significant investment and development.

Emerging Opportunities in Africa Entertainment And Telecommunication Market

Emerging opportunities in the Africa Entertainment and Telecommunication Market are abundant and multifaceted. The burgeoning demand for localized and culturally relevant digital content presents a significant avenue for growth, with opportunities for creators in mobile gaming, short-form video, and interactive storytelling. The expansion of digital payment systems, coupled with increasing smartphone penetration, opens doors for innovative e-commerce and fintech integrations with entertainment platforms. Furthermore, the rollout of 5G networks will unlock opportunities for immersive experiences like augmented reality (AR) and virtual reality (VR) gaming and entertainment. The untapped potential of rural markets, with targeted strategies for affordability and access, represents a vast frontier for service providers. The development of educational technology (ed-tech) and health-tech solutions, leveraging telecommunication infrastructure, also presents significant opportunities for social impact and commercial growth.

Growth Accelerators in the Africa Entertainment And Telecommunication Market Industry

Several catalysts are accelerating the growth of the Africa Entertainment and Telecommunication Market. The relentless pace of technological innovation, particularly in mobile connectivity and device affordability, is a primary accelerator. Strategic partnerships between telecommunication giants and content providers, as well as local tech startups, are crucial for expanding service offerings and market reach. Government policies that prioritize digital infrastructure development, create enabling regulatory environments, and foster digital literacy are vital growth accelerators. Furthermore, the increasing venture capital investment flowing into African tech startups is fueling innovation and the development of new digital services and platforms. The growing demand for mobile-first solutions across all sectors, from education to finance, directly benefits the telecommunication and entertainment industries.

Key Players Shaping the Africa Entertainment And Telecommunication Market Market

- Dell Technologies

- ABB

- Atos

- Celestial Games

- Etix Everywhere

- Eaton Corporation

- Kucheza

- NetApp

- IBM Corporation

- Kuluya

- Callaghan Engineering

- Lupp Group

- Arup Group

- Hewlett Packard Enterprise

- Kagiso Interactive

- Broadcom Inc

- Arista Networks

- Huawei

- Gamesole

- Chopup

- Nyamakop

- Cisco Systems

- Clockwork Acorn

Notable Milestones in Africa Entertainment And Telecommunication Market Sector

- November 2023: MTN South Africa paid R1.9 billion to ICASA to settle outstanding spectrum fees, facilitating expanded spectrum deployment.

- October 2023: ICASA granted MTN, Vodacom, and Telkom an extended deadline for spectrum fee payments, demonstrating a flexible regulatory approach to infrastructure development.

- 2023: Huawei announced significant investments in 5G network expansion across various African nations, promising faster speeds and enhanced connectivity for entertainment and communication services.

- 2022-2023: Increased M&A activity within the African digital entertainment space, with larger media conglomerates acquiring smaller streaming platforms and content studios to consolidate market share.

- 2021-2023: Steady growth in smartphone shipments across Africa, with brands like Tecno and Infinix gaining significant market share due to their focus on affordability and feature-rich devices for the African market.

In-Depth Africa Entertainment And Telecommunication Market Market Outlook

The Africa Entertainment and Telecommunication Market is set for an unprecedented period of growth and transformation. Key growth accelerators, including continued advancements in mobile technology, the increasing affordability of devices, and supportive government policies, will continue to propel the market forward. The burgeoning youth population, coupled with rising internet penetration, will fuel sustained demand for digital entertainment and communication services. Strategic investments in infrastructure, particularly 5G deployment, and a focus on fostering local content creation will unlock new revenue streams and enhance user experiences. The market presents significant opportunities for innovation in areas such as mobile gaming, OTT streaming, and digital commerce, making it a highly attractive landscape for both local and international investors. The future outlook is exceptionally positive, with the market expected to become a global leader in digital adoption and innovation.

Africa Entertainment And Telecommunication Market Segmentation

-

1. Platform

- 1.1. PC

- 1.2. Smartphone

- 1.3. Tablets

- 1.4. Gaming Console

- 1.5. Downloaded/Box PC

- 1.6. Browser PC

-

2. Geography

- 2.1. Nigeria

- 2.2. Ethipia

- 2.3. Egypt

- 2.4. Morocco

- 2.5. Kenya

- 2.6. Algeria

- 2.7. Zimbabwe

Africa Entertainment And Telecommunication Market Segmentation By Geography

- 1. Nigeria

- 2. Ethipia

- 3. Egypt

- 4. Morocco

- 5. Kenya

- 6. Algeria

- 7. Zimbabwe

Africa Entertainment And Telecommunication Market Regional Market Share

Geographic Coverage of Africa Entertainment And Telecommunication Market

Africa Entertainment And Telecommunication Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.44% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Disposable Income; Improvement in Technology and Internet Network Access

- 3.3. Market Restrains

- 3.3.1 Issues Such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Data Access and Availability of Internet Access to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. PC

- 5.1.2. Smartphone

- 5.1.3. Tablets

- 5.1.4. Gaming Console

- 5.1.5. Downloaded/Box PC

- 5.1.6. Browser PC

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Nigeria

- 5.2.2. Ethipia

- 5.2.3. Egypt

- 5.2.4. Morocco

- 5.2.5. Kenya

- 5.2.6. Algeria

- 5.2.7. Zimbabwe

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Nigeria

- 5.3.2. Ethipia

- 5.3.3. Egypt

- 5.3.4. Morocco

- 5.3.5. Kenya

- 5.3.6. Algeria

- 5.3.7. Zimbabwe

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. Nigeria Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. PC

- 6.1.2. Smartphone

- 6.1.3. Tablets

- 6.1.4. Gaming Console

- 6.1.5. Downloaded/Box PC

- 6.1.6. Browser PC

- 6.2. Market Analysis, Insights and Forecast - by Geography

- 6.2.1. Nigeria

- 6.2.2. Ethipia

- 6.2.3. Egypt

- 6.2.4. Morocco

- 6.2.5. Kenya

- 6.2.6. Algeria

- 6.2.7. Zimbabwe

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Ethipia Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. PC

- 7.1.2. Smartphone

- 7.1.3. Tablets

- 7.1.4. Gaming Console

- 7.1.5. Downloaded/Box PC

- 7.1.6. Browser PC

- 7.2. Market Analysis, Insights and Forecast - by Geography

- 7.2.1. Nigeria

- 7.2.2. Ethipia

- 7.2.3. Egypt

- 7.2.4. Morocco

- 7.2.5. Kenya

- 7.2.6. Algeria

- 7.2.7. Zimbabwe

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Egypt Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. PC

- 8.1.2. Smartphone

- 8.1.3. Tablets

- 8.1.4. Gaming Console

- 8.1.5. Downloaded/Box PC

- 8.1.6. Browser PC

- 8.2. Market Analysis, Insights and Forecast - by Geography

- 8.2.1. Nigeria

- 8.2.2. Ethipia

- 8.2.3. Egypt

- 8.2.4. Morocco

- 8.2.5. Kenya

- 8.2.6. Algeria

- 8.2.7. Zimbabwe

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Morocco Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. PC

- 9.1.2. Smartphone

- 9.1.3. Tablets

- 9.1.4. Gaming Console

- 9.1.5. Downloaded/Box PC

- 9.1.6. Browser PC

- 9.2. Market Analysis, Insights and Forecast - by Geography

- 9.2.1. Nigeria

- 9.2.2. Ethipia

- 9.2.3. Egypt

- 9.2.4. Morocco

- 9.2.5. Kenya

- 9.2.6. Algeria

- 9.2.7. Zimbabwe

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Kenya Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. PC

- 10.1.2. Smartphone

- 10.1.3. Tablets

- 10.1.4. Gaming Console

- 10.1.5. Downloaded/Box PC

- 10.1.6. Browser PC

- 10.2. Market Analysis, Insights and Forecast - by Geography

- 10.2.1. Nigeria

- 10.2.2. Ethipia

- 10.2.3. Egypt

- 10.2.4. Morocco

- 10.2.5. Kenya

- 10.2.6. Algeria

- 10.2.7. Zimbabwe

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Algeria Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 11.1.1. PC

- 11.1.2. Smartphone

- 11.1.3. Tablets

- 11.1.4. Gaming Console

- 11.1.5. Downloaded/Box PC

- 11.1.6. Browser PC

- 11.2. Market Analysis, Insights and Forecast - by Geography

- 11.2.1. Nigeria

- 11.2.2. Ethipia

- 11.2.3. Egypt

- 11.2.4. Morocco

- 11.2.5. Kenya

- 11.2.6. Algeria

- 11.2.7. Zimbabwe

- 11.1. Market Analysis, Insights and Forecast - by Platform

- 12. Zimbabwe Africa Entertainment And Telecommunication Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Platform

- 12.1.1. PC

- 12.1.2. Smartphone

- 12.1.3. Tablets

- 12.1.4. Gaming Console

- 12.1.5. Downloaded/Box PC

- 12.1.6. Browser PC

- 12.2. Market Analysis, Insights and Forecast - by Geography

- 12.2.1. Nigeria

- 12.2.2. Ethipia

- 12.2.3. Egypt

- 12.2.4. Morocco

- 12.2.5. Kenya

- 12.2.6. Algeria

- 12.2.7. Zimbabwe

- 12.1. Market Analysis, Insights and Forecast - by Platform

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Dell Technologies

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 ABB

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Atos

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Celestial Games

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Etix Everywhere

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Eaton Corporation

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Kucheza

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 NetApp

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 IBM Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Kuluya

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Callaghan Engineering

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Lupp Group

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Arup Group

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Hewlett Packard Enterprise

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kagiso Interactive

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Broadcom Inc

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 Arista Networks

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 Huawei

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.19 Gamesole

- 13.2.19.1. Overview

- 13.2.19.2. Products

- 13.2.19.3. SWOT Analysis

- 13.2.19.4. Recent Developments

- 13.2.19.5. Financials (Based on Availability)

- 13.2.20 Chopup

- 13.2.20.1. Overview

- 13.2.20.2. Products

- 13.2.20.3. SWOT Analysis

- 13.2.20.4. Recent Developments

- 13.2.20.5. Financials (Based on Availability)

- 13.2.21 Nyamakop

- 13.2.21.1. Overview

- 13.2.21.2. Products

- 13.2.21.3. SWOT Analysis

- 13.2.21.4. Recent Developments

- 13.2.21.5. Financials (Based on Availability)

- 13.2.22 Cisco Systems

- 13.2.22.1. Overview

- 13.2.22.2. Products

- 13.2.22.3. SWOT Analysis

- 13.2.22.4. Recent Developments

- 13.2.22.5. Financials (Based on Availability)

- 13.2.23 Clockwork Acorn

- 13.2.23.1. Overview

- 13.2.23.2. Products

- 13.2.23.3. SWOT Analysis

- 13.2.23.4. Recent Developments

- 13.2.23.5. Financials (Based on Availability)

- 13.2.1 Dell Technologies

List of Figures

- Figure 1: Africa Entertainment And Telecommunication Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Africa Entertainment And Telecommunication Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 5: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 9: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 11: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 12: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 14: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 17: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 18: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 20: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 21: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 23: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 24: Africa Entertainment And Telecommunication Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Entertainment And Telecommunication Market?

The projected CAGR is approximately 5.44%.

2. Which companies are prominent players in the Africa Entertainment And Telecommunication Market?

Key companies in the market include Dell Technologies, ABB, Atos, Celestial Games, Etix Everywhere, Eaton Corporation, Kucheza, NetApp, IBM Corporation, Kuluya, Callaghan Engineering, Lupp Group, Arup Group, Hewlett Packard Enterprise, Kagiso Interactive, Broadcom Inc, Arista Networks, Huawei, Gamesole, Chopup, Nyamakop, Cisco Systems, Clockwork Acorn.

3. What are the main segments of the Africa Entertainment And Telecommunication Market?

The market segments include Platform, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 63.17 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in Disposable Income; Improvement in Technology and Internet Network Access.

6. What are the notable trends driving market growth?

Data Access and Availability of Internet Access to Drive the Growth.

7. Are there any restraints impacting market growth?

Issues Such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

November 2023 - MTN South Africa has paid the Independent Communications Authority of South Africa (ICASA) R1.9 billion to settle outstanding spectrum fees. While ICASA granted MTN and other telecom companies, such as Vodacom and Telkom, until October 2023 to pay their bills, MTN said it would make its R1.9 billion payment to expand the country's spectrum deployment in the second half of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Entertainment And Telecommunication Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Entertainment And Telecommunication Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Entertainment And Telecommunication Market?

To stay informed about further developments, trends, and reports in the Africa Entertainment And Telecommunication Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence