Key Insights

The APAC Wireless Audio Industry is projected to experience significant growth, reaching a market size of 34371.3 million by 2024, with a compelling CAGR of 26.1%. This expansion is largely attributed to the widespread adoption of smartphones and smart devices across the region, serving as primary controllers for wireless audio products. A growing middle class and increasing disposable income are also fueling demand for sophisticated wireless audio solutions, including smart speakers and True Wireless Stereo (TWS) earbuds, aligning with the dynamic lifestyles in APAC. Rapid technological advancements in sound quality, active noise cancellation, and battery life are continually introducing new product categories and broadening consumer appeal, reinforcing the industry's upward trajectory.

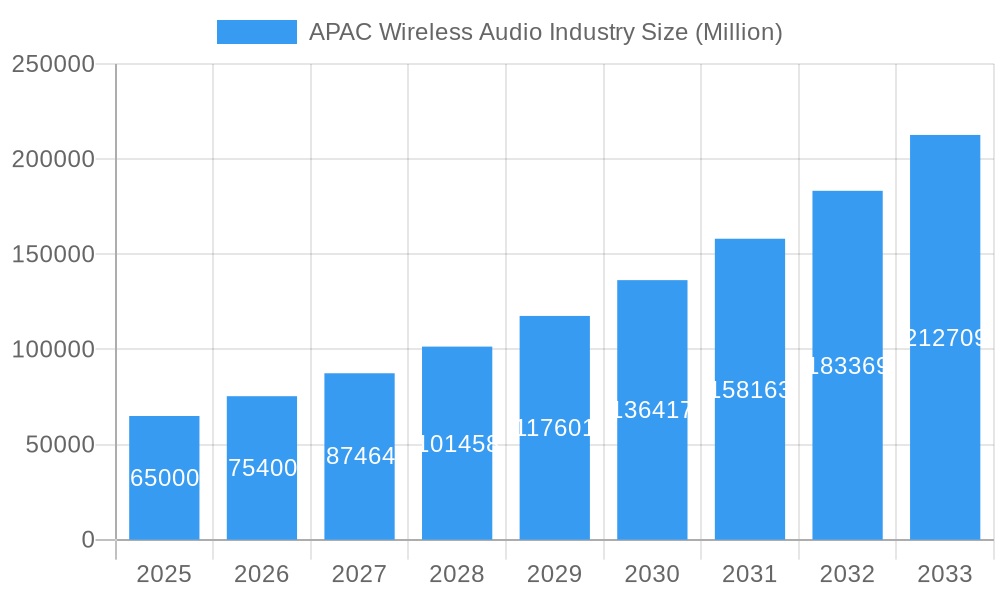

APAC Wireless Audio Industry Market Size (In Billion)

Key market players include global giants like Apple Inc., Samsung Electronics Co. Ltd., and Sony Corporation, alongside prominent regional competitors such as Xiaomi Corp. and Huawei Device Co. Ltd. The industry is segmented into Wireless Speakers (Bluetooth-Only, Smart Speakers, Wi-Fi Speakers), Wireless Earphones, Wireless Headsets, and True Wireless Stereo (TWS) devices. TWS earbuds are anticipated to see exceptional growth due to their compact design and enhanced user experience. While the market presents substantial opportunities, stakeholders must navigate challenges such as intense price competition and the imperative for continuous innovation to mitigate technological obsolescence. Nevertheless, the pervasive trends of urbanization, digitalization, and a rising preference for immersive audio experiences in entertainment and communication will continue to drive the APAC Wireless Audio Industry toward remarkable expansion.

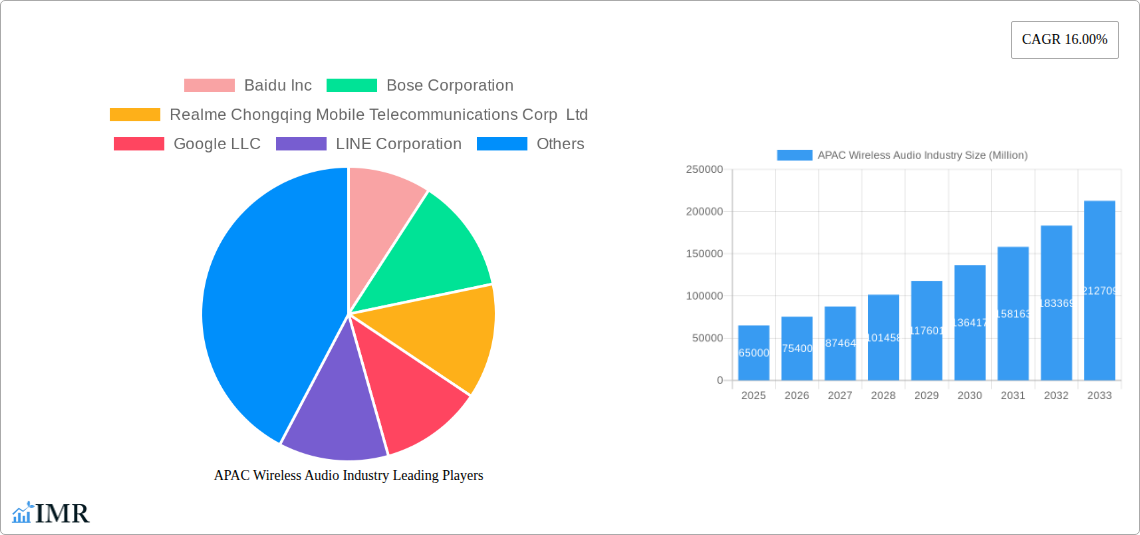

APAC Wireless Audio Industry Company Market Share

APAC Wireless Audio Industry: Comprehensive Market Analysis & Growth Outlook 2019-2033

This in-depth report offers a complete analysis of the APAC Wireless Audio Industry, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and future outlook. With a detailed forecast period from 2025-2033, including historical data from 2019-2024 and a base year of 2025, this report provides critical insights for stakeholders seeking to navigate this rapidly evolving market. We present all values in Million Units and integrate high-traffic keywords to ensure maximum SEO visibility and engagement with industry professionals, covering both parent and child markets.

APAC Wireless Audio Industry Market Dynamics & Structure

The APAC Wireless Audio Industry is characterized by a dynamic and evolving market structure. Market concentration varies across segments, with the true wireless stereo (TWS) segment exhibiting higher competition and rapid innovation. Technological innovation drivers are primarily fueled by advancements in Bluetooth connectivity (e.g., Bluetooth 5.3), active noise cancellation (ANC) capabilities, longer battery life, and the integration of AI-powered features for enhanced user experience. Regulatory frameworks, while generally supportive of technological adoption, can pose challenges related to import tariffs and regional certifications. Competitive product substitutes are abundant, ranging from wired audio solutions to lower-cost wireless alternatives, necessitating continuous product differentiation for market leaders. End-user demographics are increasingly segmented, with a growing demand from younger, tech-savvy consumers and a rising disposable income in emerging economies. M&A trends indicate a strategic consolidation among key players to acquire technological expertise, expand product portfolios, and gain market share.

- Market Concentration: Moderate to High in TWS, moderate in wireless earphones and headsets, and fragmented in wireless speakers.

- Technological Innovation Drivers: Advanced Bluetooth codecs, AI integration, personalized audio, multi-device connectivity.

- Regulatory Frameworks: Varies by country, with a focus on spectrum allocation, certification, and consumer protection.

- Competitive Product Substitutes: Wired headphones/earphones, portable speakers, and lower-tier wireless audio devices.

- End-User Demographics: Millennials and Gen Z, urban professionals, fitness enthusiasts, and audiophiles.

- M&A Trends: Strategic acquisitions for technology, market access, and brand consolidation. Notable deals in recent years involve smaller innovative startups being acquired by larger conglomerates. The volume of M&A deals in the historical period (2019-2024) reached approximately 15-20 significant transactions, with an estimated combined value in the billions of USD.

APAC Wireless Audio Industry Growth Trends & Insights

The APAC Wireless Audio Industry is experiencing robust growth, driven by a confluence of factors that are reshaping consumer behavior and technological adoption. The market size evolution has been remarkable, transitioning from a niche market to a mainstream consumer staple. The adoption rates for wireless audio devices, particularly true wireless stereo earbuds, have surged, propelled by their convenience, portability, and increasingly sophisticated features. Technological disruptions, such as the miniaturization of components, enhanced battery efficiency, and improved audio codecs, have been pivotal in driving this adoption. Consumer behavior shifts are evident, with a growing preference for wireless audio solutions across various use cases, from daily commutes and work to fitness activities and immersive entertainment. The demand for premium features like active noise cancellation, high-fidelity sound, and smart assistant integration continues to escalate, influencing product development and marketing strategies. The integration of wireless audio into the broader smart ecosystem, connecting with smart home devices and wearables, further accentuates its growth trajectory.

The CAGR of the APAC Wireless Audio Industry is projected to be approximately 12.5% during the forecast period (2025-2033). This impressive growth is underpinned by increasing disposable incomes across key APAC nations, a burgeoning middle class, and a youthful demographic that readily embraces new technologies. Market penetration is expected to reach over 65% by 2033, indicating that a significant majority of the population will own at least one wireless audio device. The wireless earphones segment, encompassing both standard wireless and TWS, is anticipated to remain the largest contributor to market revenue, projected to reach an estimated XX Billion Units by 2033. Smart speakers, though starting from a smaller base, are exhibiting a higher growth rate due to increasing smart home adoption and the expansion of AI capabilities. The historical period (2019-2024) saw the market size grow from an estimated XX Billion Units to XX Billion Units, demonstrating consistent upward momentum.

Key growth trends include the increasing demand for noise-cancelling wireless earphones, a segment that has seen exponential growth as consumers seek solace from noisy environments. Furthermore, the integration of advanced audio technologies like spatial audio and personalized sound profiles is creating new value propositions. The rise of esports and mobile gaming has also created a dedicated market for high-performance wireless gaming headsets, characterized by low latency and immersive sound. The adoption of Wi-Fi speakers is gradually increasing, particularly in the smart speaker category, driven by the desire for seamless multi-room audio experiences.

Key Metrics and Insights:

- Projected Market Size (2033): XX Billion Units

- Projected CAGR (2025-2033): 12.5%

- Market Penetration (2033): Over 65%

- Dominant Segment (Units): Wireless Earphones (including TWS)

- Highest Growth Segment: Smart Speakers and True Wireless Stereo

- Historical Growth (2019-2024): From XX Billion Units to XX Billion Units

This dynamic growth is supported by continuous innovation in battery technology, miniaturization, and enhanced connectivity standards, ensuring that wireless audio devices remain at the forefront of personal technology consumption in the APAC region.

Dominant Regions, Countries, or Segments in APAC Wireless Audio Industry

The APAC Wireless Audio Industry is a multifaceted market, with distinct regions, countries, and product segments vying for dominance. Among the Type of Device, Wireless Earphones, encompassing both True Wireless Stereo (TWS) and standard wireless earphone configurations, currently represent the most dominant segment in terms of unit sales and widespread adoption. This dominance is fueled by their unparalleled portability, versatility across various activities, and the increasing affordability of feature-rich models. Within the broader Wireless Earphones category, True Wireless Stereo devices have experienced explosive growth, driven by their complete freedom from wires and continuous technological advancements in miniaturization and battery life.

Several countries within the APAC region are key drivers of this market. China stands out as the dominant country due to its massive consumer base, advanced manufacturing capabilities, and a highly receptive market for new consumer electronics. The sheer volume of sales originating from China significantly influences overall APAC market trends. South Korea and Japan follow, characterized by a high disposable income, a strong consumer appetite for premium and innovative audio products, and a well-established culture of embracing advanced technology. India is an emerging powerhouse, with a rapidly growing middle class, increasing smartphone penetration, and a surging demand for affordable yet feature-rich wireless audio solutions, making it a critical growth market.

The dominance of Wireless Earphones is further amplified by their integration into the daily lives of consumers. They are essential for commuters utilizing public transport, fitness enthusiasts seeking untethered workout experiences, and professionals relying on them for hands-free communication and virtual meetings. The TWS segment, in particular, has benefited from advancements like active noise cancellation (ANC), transparency modes, and personalized sound profiles, appealing to a discerning consumer base willing to invest in superior audio experiences.

- Dominant Segment: Wireless Earphones (including True Wireless Stereo)

- Key Dominant Countries: China, South Korea, Japan, India

- Key Drivers of Dominance in Countries:

- China: Large population, manufacturing hub, strong domestic brands, high disposable income.

- South Korea & Japan: High disposable income, tech-savvy consumers, early adopters of premium products.

- India: Growing middle class, increasing smartphone penetration, demand for affordable innovation.

- Growth Potential of Other Segments:

- Smart Speakers: Significant growth potential driven by smart home adoption and AI integration.

- Wireless Speakers (Bluetooth-Only & Wi-Fi Sp): Steady growth, particularly in portable and multi-room audio solutions.

- Wireless Headsets: Strong performance in the gaming and professional communication segments.

- Market Share Snapshot (Estimated 2025):

- Wireless Earphones (incl. TWS): 55-60%

- Wireless Speakers: 25-30%

- Wireless Headsets: 10-15%

- Factors Contributing to Segment Dominance: Convenience, portability, technological advancements, price accessibility, and integration with mobile ecosystems.

The interplay of these regional strengths and segment preferences creates a dynamic landscape, with continuous innovation and strategic market penetration being crucial for sustained success within the APAC Wireless Audio Industry.

APAC Wireless Audio Industry Product Landscape

The APAC Wireless Audio Industry product landscape is defined by relentless innovation and a focus on enhancing user experience. True Wireless Stereo (TWS) earbuds are at the forefront, boasting miniaturized designs, exceptional battery life (often exceeding 6-8 hours per charge), and advanced features like adaptive Active Noise Cancellation (ANC) and high-fidelity audio codecs. Smart Speakers are increasingly integrating voice assistants with enhanced natural language processing and multi-room audio capabilities, providing seamless control of smart home ecosystems. Performance metrics such as sound quality (e.g., frequency response, distortion levels), Bluetooth connectivity range (up to 10-15 meters for advanced profiles), and water resistance ratings (IPX4 and above) are key differentiators. Unique selling propositions often revolve around personalized sound tuning, ergonomic comfort, and integration with proprietary AI platforms, catering to diverse consumer needs and preferences in the dynamic APAC market.

Key Drivers, Barriers & Challenges in APAC Wireless Audio Industry

Key Drivers:

The APAC Wireless Audio Industry is propelled by several significant drivers. Increasing disposable incomes across the region, particularly in emerging economies, directly translate to higher consumer spending on discretionary electronics. Technological advancements, such as improved battery efficiency, faster charging, superior Bluetooth connectivity, and enhanced audio quality (e.g., Hi-Res Audio support), continuously upgrade the product offering. The growing adoption of smartphones and smart devices creates a natural ecosystem for wireless audio accessories. Furthermore, a young and tech-savvy population with a strong preference for portable and convenient entertainment solutions is a primary demographic driver. Government initiatives promoting digital transformation and the growth of e-commerce platforms facilitate wider market access and distribution.

Key Barriers & Challenges:

Despite robust growth, the industry faces several challenges. Intense market competition from both established global brands and numerous local players leads to price erosion and thinner profit margins. Supply chain disruptions, exacerbated by geopolitical factors and manufacturing complexities, can impact production volumes and lead times, potentially affecting availability and increasing costs. Regulatory hurdles in different countries, including import duties, certification requirements, and data privacy regulations for smart devices, can add complexity and cost to market entry. Counterfeit products pose a significant threat, diluting brand value and consumer trust. Furthermore, environmental concerns related to battery disposal and e-waste are becoming increasingly important, necessitating sustainable product design and recycling initiatives. The cost of premium features, such as advanced ANC and high-fidelity audio, can still be a barrier for price-sensitive consumers in some APAC markets, limiting penetration in certain segments.

Emerging Opportunities in APAC Wireless Audio Industry

Emerging opportunities within the APAC Wireless Audio Industry are ripe for exploration. The expansion of the hearables market beyond basic audio presents a significant avenue, with integration of health and wellness features like fitness tracking, vital sign monitoring, and even real-time translation gaining traction. The growing demand for immersive audio experiences, fueled by the rise of virtual reality (VR) and augmented reality (AR) content, creates a niche for advanced spatial audio solutions and dedicated AR/VR audio accessories. Untapped markets in secondary cities and rural areas within large economies like India and Southeast Asia offer immense potential for affordable and durable wireless audio products. The increasing focus on sustainable and eco-friendly materials in product manufacturing and packaging represents a growing consumer preference and a competitive differentiator. Furthermore, the development of highly personalized audio profiles tailored to individual hearing characteristics and preferences is an evolving trend with significant growth potential.

Growth Accelerators in the APAC Wireless Audio Industry Industry

Several catalysts are accelerating the long-term growth of the APAC Wireless Audio Industry. The continuous evolution of Bluetooth technology, with advancements like Bluetooth LE Audio promising lower latency, higher audio quality, and improved power efficiency, will unlock new product capabilities and enhance user experience. Strategic partnerships between audio manufacturers and content providers (e.g., streaming services, gaming companies) are creating bundled offerings and exclusive features, driving adoption. The expansion of 5G networks across the region will enable faster data transfer and lower latency, further enhancing the performance of wireless audio devices, particularly for streaming high-fidelity content and real-time applications. Market expansion strategies focusing on emerging economies and underserved demographics will open up new customer bases. Innovations in battery technology, leading to longer playback times and faster charging, remain a critical growth accelerator, addressing a key consumer pain point.

Key Players Shaping the APAC Wireless Audio Industry Market

- Baidu Inc

- Bose Corporation

- Realme Chongqing Mobile Telecommunications Corp Ltd

- Google LLC

- LINE Corporation

- Apple Inc (Including Beats Electronics LLC)

- Samsung Electronics Co Ltd

- Xiaomi Corp

- Skullcandy Inc

- Amazon com Inc

- Alibaba Group

- GN Audio AS (Jabra)

- Harman International Industries Incorporated (JBL)

- Huawei Device Co Ltd

- Sony Corporation

Notable Milestones in APAC Wireless Audio Industry Sector

- 2019: Launch of Apple's AirPods Pro with active noise cancellation, setting a new benchmark for TWS earbuds.

- 2020: Significant increase in TWS adoption driven by remote work and online learning trends, with key players like Samsung and Xiaomi introducing competitive models.

- 2021: Major brands like Sony and Bose expand their high-fidelity wireless audio offerings, focusing on advanced noise cancellation and premium sound.

- 2022: Increased integration of AI and voice assistant capabilities in smart speakers and earbuds, enhancing user interaction and smart home control.

- 2023: Growing emphasis on sustainable materials and eco-friendly packaging in product launches from leading manufacturers.

- 2024: Introduction of Bluetooth 5.3 and early implementations of LE Audio, promising enhanced audio quality and power efficiency in new device releases.

In-Depth APAC Wireless Audio Industry Market Outlook

The APAC Wireless Audio Industry is poised for continued expansion, driven by a combination of technological innovation, evolving consumer preferences, and strategic market penetration. Growth accelerators such as the widespread adoption of advanced Bluetooth codecs, the integration of health monitoring features into hearables, and the development of immersive audio experiences for VR/AR content will fuel demand. The expansion of 5G networks will further enhance the performance and capabilities of wireless audio devices. Emerging markets within APAC, coupled with a youthful demographic’s embrace of technology, represent significant untapped potential. Companies that focus on delivering superior sound quality, enhanced convenience, personalized features, and sustainable solutions will be well-positioned to capitalize on the immense growth opportunities in this dynamic sector. The future of wireless audio in APAC is bright, promising a more connected, immersive, and personalized listening experience for millions.

APAC Wireless Audio Industry Segmentation

-

1. Type of Device

-

1.1. Wireless Speakers

- 1.1.1. Bluetooth-Only

- 1.1.2. Smart Speakers

- 1.1.3. Wi-Fi Sp

- 1.2. Wireless Earphones

- 1.3. Wireless Headsets

- 1.4. True Wireless Stereo

-

1.1. Wireless Speakers

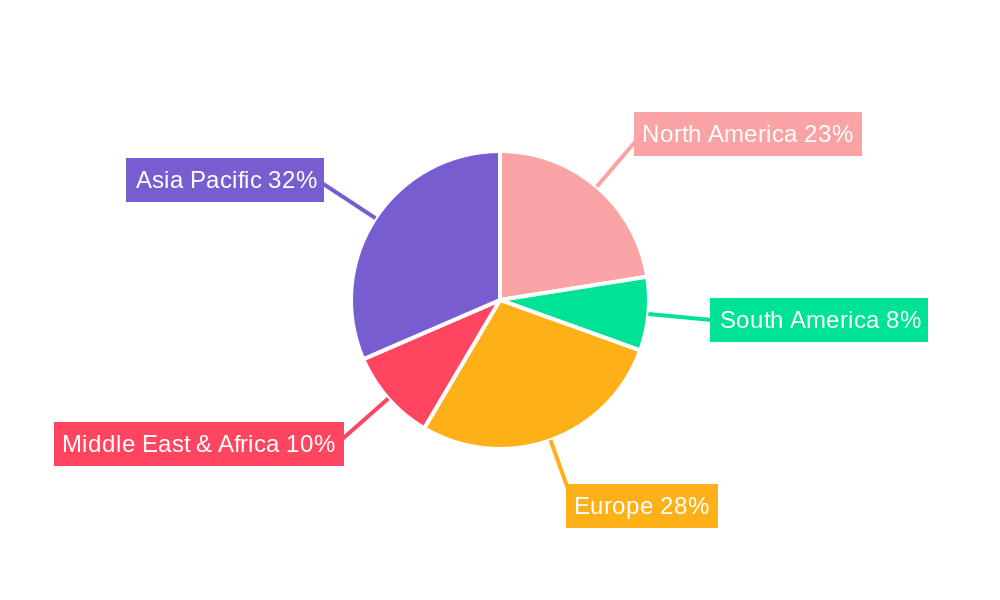

APAC Wireless Audio Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Wireless Audio Industry Regional Market Share

Geographic Coverage of APAC Wireless Audio Industry

APAC Wireless Audio Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development

- 3.3. Market Restrains

- 3.3.1. High costs associated with software and procurement

- 3.4. Market Trends

- 3.4.1. Bluetooth Speakers to Witness Higest Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Wireless Speakers

- 5.1.1.1. Bluetooth-Only

- 5.1.1.2. Smart Speakers

- 5.1.1.3. Wi-Fi Sp

- 5.1.2. Wireless Earphones

- 5.1.3. Wireless Headsets

- 5.1.4. True Wireless Stereo

- 5.1.1. Wireless Speakers

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Wireless Speakers

- 6.1.1.1. Bluetooth-Only

- 6.1.1.2. Smart Speakers

- 6.1.1.3. Wi-Fi Sp

- 6.1.2. Wireless Earphones

- 6.1.3. Wireless Headsets

- 6.1.4. True Wireless Stereo

- 6.1.1. Wireless Speakers

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. South America APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Wireless Speakers

- 7.1.1.1. Bluetooth-Only

- 7.1.1.2. Smart Speakers

- 7.1.1.3. Wi-Fi Sp

- 7.1.2. Wireless Earphones

- 7.1.3. Wireless Headsets

- 7.1.4. True Wireless Stereo

- 7.1.1. Wireless Speakers

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Europe APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Wireless Speakers

- 8.1.1.1. Bluetooth-Only

- 8.1.1.2. Smart Speakers

- 8.1.1.3. Wi-Fi Sp

- 8.1.2. Wireless Earphones

- 8.1.3. Wireless Headsets

- 8.1.4. True Wireless Stereo

- 8.1.1. Wireless Speakers

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East & Africa APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Wireless Speakers

- 9.1.1.1. Bluetooth-Only

- 9.1.1.2. Smart Speakers

- 9.1.1.3. Wi-Fi Sp

- 9.1.2. Wireless Earphones

- 9.1.3. Wireless Headsets

- 9.1.4. True Wireless Stereo

- 9.1.1. Wireless Speakers

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. Asia Pacific APAC Wireless Audio Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Wireless Speakers

- 10.1.1.1. Bluetooth-Only

- 10.1.1.2. Smart Speakers

- 10.1.1.3. Wi-Fi Sp

- 10.1.2. Wireless Earphones

- 10.1.3. Wireless Headsets

- 10.1.4. True Wireless Stereo

- 10.1.1. Wireless Speakers

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Baidu Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bose Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Realme Chongqing Mobile Telecommunications Corp Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Google LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 LINE Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Apple Inc (Including Beats Electronics LLC)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Samsung Electronics Co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Xiaomi Corp

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Skullcandy Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amazon com Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Alibaba Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 GN Audio AS (Jabra)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Harman International Industries Incorporated (JBL)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Huawei Device Co Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Sony Corporation

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Baidu Inc

List of Figures

- Figure 1: Global APAC Wireless Audio Industry Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 3: North America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 4: North America APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 5: North America APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 7: South America APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 8: South America APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 9: South America APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 11: Europe APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 12: Europe APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 13: Europe APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 15: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 16: Middle East & Africa APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 17: Middle East & Africa APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific APAC Wireless Audio Industry Revenue (million), by Type of Device 2025 & 2033

- Figure 19: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Type of Device 2025 & 2033

- Figure 20: Asia Pacific APAC Wireless Audio Industry Revenue (million), by Country 2025 & 2033

- Figure 21: Asia Pacific APAC Wireless Audio Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 2: Global APAC Wireless Audio Industry Revenue million Forecast, by Region 2020 & 2033

- Table 3: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 4: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 5: United States APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 6: Canada APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 7: Mexico APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 9: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 10: Brazil APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Argentina APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 14: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: France APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Italy APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Spain APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Russia APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Benelux APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Nordics APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 25: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 26: Turkey APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Israel APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: GCC APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: North Africa APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: South Africa APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Wireless Audio Industry Revenue million Forecast, by Type of Device 2020 & 2033

- Table 33: Global APAC Wireless Audio Industry Revenue million Forecast, by Country 2020 & 2033

- Table 34: China APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: India APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Japan APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: South Korea APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: Oceania APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific APAC Wireless Audio Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Wireless Audio Industry?

The projected CAGR is approximately 26.1%.

2. Which companies are prominent players in the APAC Wireless Audio Industry?

Key companies in the market include Baidu Inc, Bose Corporation, Realme Chongqing Mobile Telecommunications Corp Ltd, Google LLC, LINE Corporation, Apple Inc (Including Beats Electronics LLC), Samsung Electronics Co Ltd, Xiaomi Corp, Skullcandy Inc, Amazon com Inc, Alibaba Group, GN Audio AS (Jabra), Harman International Industries Incorporated (JBL), Huawei Device Co Ltd, Sony Corporation.

3. What are the main segments of the APAC Wireless Audio Industry?

The market segments include Type of Device.

4. Can you provide details about the market size?

The market size is estimated to be USD 34371.3 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing usage for IoT based connected devices; Increased 5G and advanced networks infrastructure development.

6. What are the notable trends driving market growth?

Bluetooth Speakers to Witness Higest Market Growth.

7. Are there any restraints impacting market growth?

High costs associated with software and procurement.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Wireless Audio Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Wireless Audio Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Wireless Audio Industry?

To stay informed about further developments, trends, and reports in the APAC Wireless Audio Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence