Key Insights

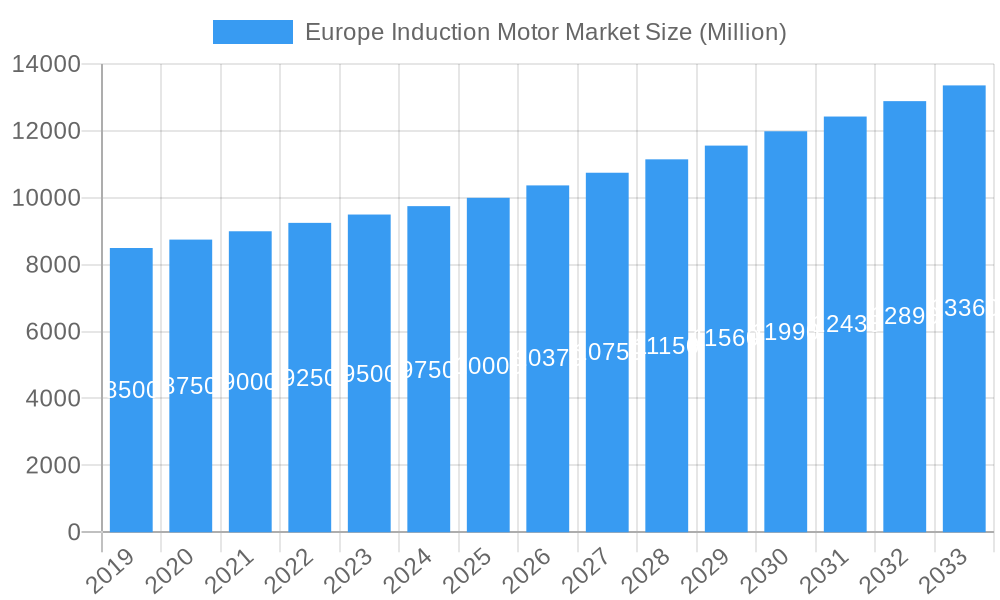

The European Induction Motor Market is projected to expand significantly, reaching an estimated size of $24,652.8 million by 2025. This growth is underpinned by a Compound Annual Growth Rate (CAGR) of 7.2% anticipated between 2025 and 2033. Key growth catalysts include the widespread adoption of energy-efficient motors driven by environmental regulations and cost-reduction imperatives across the Power Generation, Water & Wastewater, and Chemical & Petrochemical industries. Furthermore, industrial automation and Industry 4.0 advancements necessitate sophisticated motor solutions for modern manufacturing. Infrastructure modernization within the Oil & Gas and Metal & Mining sectors also sustains demand for new induction motor installations and replacements.

Europe Induction Motor Market Market Size (In Billion)

The market showcases a dynamic landscape prioritizing technological innovation and specialized applications. Single-phase induction motors are anticipated to see strong demand in smaller machinery and appliance sectors, while three-phase motors will remain dominant in heavy-duty industrial operations. The integration of Variable Frequency Drives (VFDs) with induction motors for enhanced control and energy efficiency represents a significant emerging trend. Challenges include the initial cost of high-efficiency models and competition from alternative motor technologies in niche segments. Despite these factors, the indispensable role of induction motors in core European industries ensures continued market relevance and expansion. Key market contributors include ABB, WEG, and Nidec Motor Corporation.

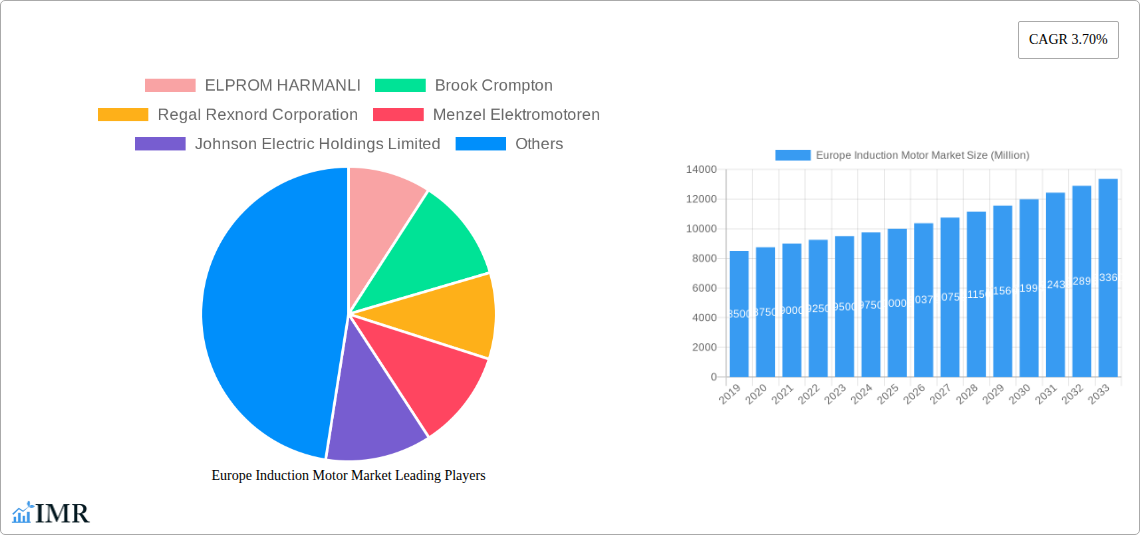

Europe Induction Motor Market Company Market Share

Europe Induction Motor Market Report: Driving Efficiency and Sustainability in Industrial Applications

This comprehensive report offers an in-depth analysis of the Europe Induction Motor Market, providing critical insights into market dynamics, growth trends, competitive landscape, and future outlook. With a detailed focus on single-phase induction motors and three-phase induction motors, the report examines their applications across key end-user industries including Oil & Gas, Chemical & Petrochemical, Power Generation, Water & Wastewater, Metal & Mining, Food & Beverage, and Discrete Industries. The study encompasses the historical period of 2019–2024, a base year of 2025, and a robust forecast period of 2025–2033, offering a projected CAGR and market size in Million units. Optimize your strategy with data-driven insights on this vital industrial component.

Europe Induction Motor Market Market Dynamics & Structure

The Europe Induction Motor Market is characterized by a dynamic interplay of factors influencing its structure and growth. Market concentration is moderately fragmented, with established global players and regional specialists vying for market share. Technological innovation remains a primary driver, fueled by the relentless pursuit of higher energy efficiency, reduced operational costs, and compliance with stringent environmental regulations. Regulatory frameworks, particularly those mandating energy-efficient motor standards and promoting electrification, significantly shape market entry and product development. Competitive product substitutes, though present in niche applications, are largely overshadowed by the versatility and cost-effectiveness of induction motors. End-user demographics are evolving, with increasing demand from sectors embracing automation and renewable energy integration. Mergers and acquisitions (M&A) are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities.

- Market Concentration: Moderately fragmented with both global and regional players.

- Technological Innovation Drivers: Energy efficiency, cost reduction, automation, zero-emission technologies.

- Regulatory Frameworks: Stringent energy efficiency standards (e.g., IE ratings), environmental regulations.

- Competitive Product Substitutes: Limited in most core applications, but niche alternatives exist.

- End-User Demographics: Growing demand from renewables, automation, and electrification initiatives.

- M&A Trends: Strategic acquisitions to enhance market position and technology access.

- Innovation Barriers: High R&D costs, complex integration challenges in legacy systems.

Europe Induction Motor Market Growth Trends & Insights

The Europe Induction Motor Market is on an upward trajectory, driven by a confluence of technological advancements, evolving industrial demands, and a strong emphasis on sustainability. The market size is projected to experience significant growth from 2019 to 2033, with the base year of 2025 showing a substantial market penetration of induction motors across various sectors. Adoption rates for high-efficiency motors, particularly those meeting IE4 and IE5 standards, are escalating as industries strive to reduce energy consumption and operational expenditures. Technological disruptions, such as the integration of advanced materials and intelligent control systems, are enhancing motor performance, reliability, and lifespan. Consumer behavior is shifting towards prioritizing lifecycle costs and environmental impact, making energy-efficient induction motors a preferred choice. The forecast period of 2025–2033 is expected to witness a robust Compound Annual Growth Rate (CAGR), reflecting sustained demand from core industrial sectors and emerging applications.

The increasing electrification of industrial processes, coupled with the broader transition towards renewable energy sources, directly fuels the demand for robust and efficient electric motors. For instance, the integration of electric powertrains in construction machinery, as highlighted by ABB's zero-emission building projects, exemplifies the expanding application scope. Furthermore, the rising energy costs across Europe have intensified the need for energy-efficient pumping equipment, prompting manufacturers like Nidec Motor Corp. to develop innovative solutions such as the SynRA motor, which offers superior efficiency and reduced maintenance costs through modular component replacement. This focus on operational efficiency and sustainability is a key differentiator for induction motors in the current market landscape. The continuous investment in smart grid technologies and industrial automation further propends the adoption of advanced induction motor solutions. The report will detail market size evolution in Million units for each segment and sub-segment, providing a granular view of growth patterns and investment opportunities within the European region.

Dominant Regions, Countries, or Segments in Europe Induction Motor Market

Within the Europe Induction Motor Market, Three-phase Induction Motors stand out as the dominant segment, driven by their superior performance, efficiency, and robustness essential for heavy-duty industrial applications. This dominance is particularly pronounced in energy-intensive sectors such as Power Generation, Chemical & Petrochemical, and Metal & Mining. The continuous expansion and modernization of infrastructure in these industries, coupled with stringent operational demands, necessitate the reliability and power output offered by three-phase motors. Consequently, regions and countries with a strong industrial base and significant investments in these sectors are leading the market growth.

Germany, with its powerhouse manufacturing sector, particularly in automotive and machinery, remains a pivotal country. Its robust Discrete Industries segment, encompassing automotive manufacturing, electronics production, and general machinery, relies heavily on three-phase induction motors for automation and production lines. The country's unwavering commitment to energy efficiency and its leadership in developing and adopting advanced manufacturing technologies further bolster the demand for high-performance induction motors.

The Chemical & Petrochemical sector, across major industrial hubs in Germany, France, and the Netherlands, is another significant contributor to the dominance of three-phase induction motors. The continuous operation requirements and the need for precise control in chemical processing plants demand reliable and efficient motor solutions. Similarly, the Power Generation sector, encompassing both traditional and renewable energy sources like wind and solar farms, increasingly employs three-phase induction motors for turbines, pumps, and other critical equipment, driving substantial market share.

Emerging trends in the Water & Wastewater sector, driven by stricter environmental regulations and infrastructure upgrades across Europe, also present a growing opportunity. Efficient pumping systems, powered by three-phase induction motors, are crucial for effective water management. While single-phase induction motors hold importance in smaller applications and residential settings, their market share pales in comparison to the industrial might of their three-phase counterparts. The report will delve into specific market shares and growth potential for each segment and key country within Europe.

- Dominant Segment: Three-phase Induction Motor.

- Key End-User Industries Driving Dominance: Power Generation, Chemical & Petrochemical, Metal & Mining, Discrete Industries.

- Leading Country: Germany, owing to its strong manufacturing base and focus on advanced industries.

- Key Drivers for Dominance:

- Superior performance and efficiency for industrial applications.

- Robustness and reliability in demanding operational environments.

- Increasing automation and electrification across industries.

- Stringent operational requirements in energy-intensive sectors.

- Growth Potential in Other Segments: Water & Wastewater sector showing increasing demand.

Europe Induction Motor Market Product Landscape

The product landscape of the Europe Induction Motor Market is characterized by continuous innovation aimed at enhancing energy efficiency, durability, and smart capabilities. Manufacturers are increasingly focusing on motors that meet higher IE efficiency classes (IE4 and IE5), reducing operational costs for end-users and complying with sustainability mandates. Advanced materials, such as high-performance insulation and advanced magnetic alloys, are being integrated to improve performance metrics and extend motor lifespan. Furthermore, the integration of variable frequency drives (VFDs) with induction motors is becoming standard, allowing for precise speed control, further optimizing energy consumption and reducing wear and tear. These advancements cater to diverse applications, from powering intricate machinery in discrete industries to driving large pumps in oil and gas operations, with unique selling propositions revolving around energy savings, reduced maintenance, and enhanced operational flexibility.

Key Drivers, Barriers & Challenges in Europe Induction Motor Market

Key Drivers: The Europe Induction Motor Market is propelled by a robust demand for energy-efficient industrial solutions, driven by rising energy costs and stringent environmental regulations across the continent. The ongoing trend of industrial automation and the electrification of various sectors, including transportation and manufacturing, significantly boosts the adoption of induction motors. Technological advancements in motor design and control systems, leading to higher efficiency ratings (IE4, IE5) and increased reliability, further accelerate market growth. Government initiatives promoting sustainable energy and reducing carbon footprints also act as powerful catalysts.

Key Barriers & Challenges: Despite the positive outlook, the market faces several hurdles. The initial capital investment for high-efficiency motors and associated control systems can be a deterrent for some small and medium-sized enterprises. Fluctuations in raw material prices, such as copper and steel, can impact manufacturing costs and profit margins. Intense competition among established players and emerging manufacturers exerts downward pressure on pricing. Furthermore, the integration of advanced motor technologies into legacy industrial infrastructure can present significant technical challenges and require substantial retrofitting efforts. Supply chain disruptions, as experienced in recent years, can also affect production timelines and material availability.

Emerging Opportunities in Europe Induction Motor Market

Emerging opportunities within the Europe Induction Motor Market lie in the burgeoning demand for smart and connected motor solutions. The integration of IoT capabilities and AI-powered diagnostics enables predictive maintenance, optimizing uptime and reducing unplanned downtime for end-users. The growing adoption of electric vehicles (EVs) and the expansion of charging infrastructure present a significant, albeit evolving, opportunity for specialized induction motor technologies. Furthermore, the increasing focus on circular economy principles is driving innovation in motor design for enhanced recyclability and the use of sustainable materials. Untapped potential exists in niche industrial segments and developing economies within Europe that are undergoing industrial modernization.

Growth Accelerators in the Europe Induction Motor Market Industry

Several catalysts are accelerating long-term growth in the Europe Induction Motor Market. The unwavering commitment to decarbonization targets by European governments is a major driver, mandating the replacement of less efficient motors with advanced, energy-saving alternatives. Technological breakthroughs in areas like permanent magnet synchronous motors (PMSM) and advanced control algorithms are pushing the boundaries of efficiency and performance, creating new market segments and driving innovation. Strategic partnerships between motor manufacturers, drive solution providers, and end-users are fostering collaborative development and accelerating the adoption of integrated, optimized systems. Market expansion strategies, focusing on specialized applications and emerging industrial trends like Industry 5.0, are further fueling growth.

Key Players Shaping the Europe Induction Motor Market Market

- ELPROM HARMANLI

- Brook Crompton

- Regal Rexnord Corporation

- Menzel Elektromotoren

- Johnson Electric Holdings Limited

- AC-MOTOREN GmbH

- CG Power & Industrial Solutions Ltd

- WEG

- Nidec Motor Corporation

- ABB

Notable Milestones in Europe Induction Motor Market Sector

- June 2022: ABB announced that its electric motors can achieve a prolonged lifespan of up to 50,000 hours. The company is advancing its commitment to zero-emission technology by integrating electric motors, drives, energy management systems, batteries, and charging solutions into their first zero-emissions building project, providing crucial electric powertrain components and technical guidance.

- April 2022: Amidst rising energy costs, Nidec Motor Corp. launched its innovative SynRA motor, offering exceptional energy efficiency for commercial pumping and HVAC equipment, achieving IE 4 and IE 5 ratings. The SynRA's unique design allows for individual component replacement, significantly reducing maintenance costs and enhancing suitability for various applications.

In-Depth Europe Induction Motor Market Market Outlook

The Europe Induction Motor Market is poised for sustained and robust growth, driven by a fundamental shift towards energy efficiency and industrial modernization. The strategic focus on electrifying industrial processes, coupled with stringent environmental regulations, will continue to propel the demand for advanced induction motors. Growth accelerators such as technological innovations in motor design, the integration of smart technologies for predictive maintenance, and strategic collaborations among industry stakeholders will further solidify market expansion. The evolving consumer preference for lifecycle cost optimization and sustainability underscores the long-term potential for induction motors that offer superior energy performance and reduced environmental impact, creating significant opportunities for market players to innovate and capture value.

Europe Induction Motor Market Segmentation

-

1. Type

- 1.1. Single-phase Induction Motor

- 1.2. Three-phase Induction Motor

-

2. End-user Industry

- 2.1. Oil & Gas

- 2.2. Chemical & Petrochemical

- 2.3. Power Generation

- 2.4. Water & Wastewater

- 2.5. Metal & Mining

- 2.6. Food & Beverage

- 2.7. Discrete Industries

- 2.8. Other End-user Industries

Europe Induction Motor Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

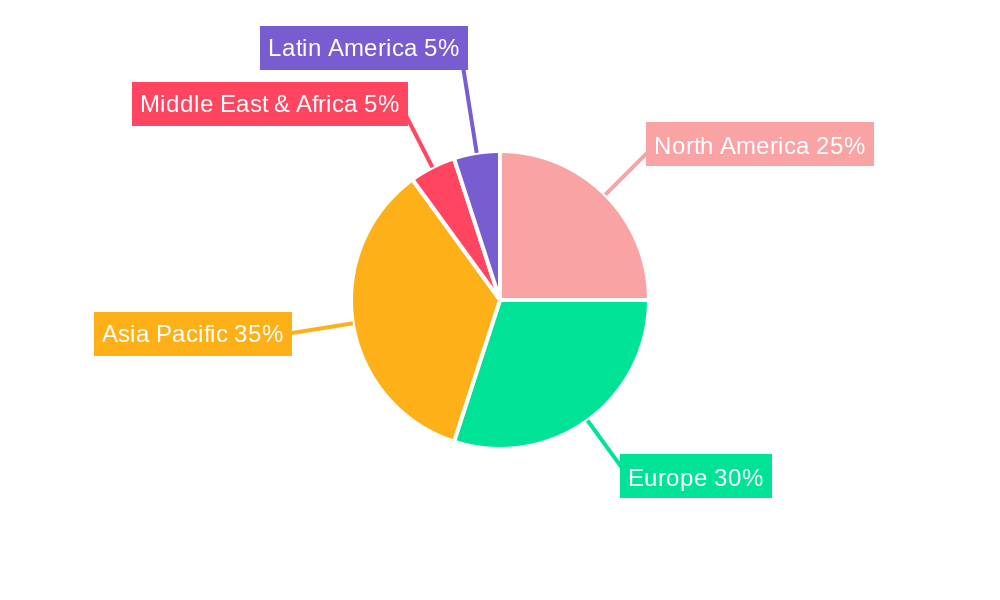

Europe Induction Motor Market Regional Market Share

Geographic Coverage of Europe Induction Motor Market

Europe Induction Motor Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Elevated Requirement of Power Savings in Residential and Industrial Sectors; Increasing Application in Electric Vehicles

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Amongst Non-data Center Applications

- 3.4. Market Trends

- 3.4.1. Energy-Efficient Motors Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Induction Motor Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Single-phase Induction Motor

- 5.1.2. Three-phase Induction Motor

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Oil & Gas

- 5.2.2. Chemical & Petrochemical

- 5.2.3. Power Generation

- 5.2.4. Water & Wastewater

- 5.2.5. Metal & Mining

- 5.2.6. Food & Beverage

- 5.2.7. Discrete Industries

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ELPROM HARMANLI

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Brook Crompton

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Regal Rexnord Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Menzel Elektromotoren

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Johnson Electric Holdings Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AC-MOTOREN GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CG Power & Industrial Solutions Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 WEG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nidec Motor Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ABB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ELPROM HARMANLI

List of Figures

- Figure 1: Europe Induction Motor Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Induction Motor Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Induction Motor Market Revenue million Forecast, by Type 2020 & 2033

- Table 2: Europe Induction Motor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Induction Motor Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Europe Induction Motor Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 5: Europe Induction Motor Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Europe Induction Motor Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Europe Induction Motor Market Revenue million Forecast, by Type 2020 & 2033

- Table 8: Europe Induction Motor Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 9: Europe Induction Motor Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 10: Europe Induction Motor Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 11: Europe Induction Motor Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Europe Induction Motor Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United Kingdom Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Germany Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Germany Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: France Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: France Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Italy Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Italy Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Spain Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Spain Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Netherlands Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Netherlands Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Belgium Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Belgium Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Sweden Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Sweden Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Norway Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Norway Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Poland Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Poland Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Denmark Europe Induction Motor Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: Denmark Europe Induction Motor Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Induction Motor Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Europe Induction Motor Market?

Key companies in the market include ELPROM HARMANLI, Brook Crompton, Regal Rexnord Corporation, Menzel Elektromotoren, Johnson Electric Holdings Limited, AC-MOTOREN GmbH, CG Power & Industrial Solutions Ltd, WEG, Nidec Motor Corporation, ABB.

3. What are the main segments of the Europe Induction Motor Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 24652.8 million as of 2022.

5. What are some drivers contributing to market growth?

Elevated Requirement of Power Savings in Residential and Industrial Sectors; Increasing Application in Electric Vehicles.

6. What are the notable trends driving market growth?

Energy-Efficient Motors Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness Amongst Non-data Center Applications.

8. Can you provide examples of recent developments in the market?

June 2022 - The electric motors from ABB can have a prolonged life of up to 50,000 hours. Energy efficiency principles can be applied to any motor-driven application, including heavy-duty construction machinery. The company is meeting future goals through zero-emission technology. The company's first zero-emissions building project includes fitting an electric motor and drive, an energy management system, a battery and charging solution, and a power connection. ABB supplies the electric powertrain components and provides technical advice.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Induction Motor Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Induction Motor Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Induction Motor Market?

To stay informed about further developments, trends, and reports in the Europe Induction Motor Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence