Key Insights

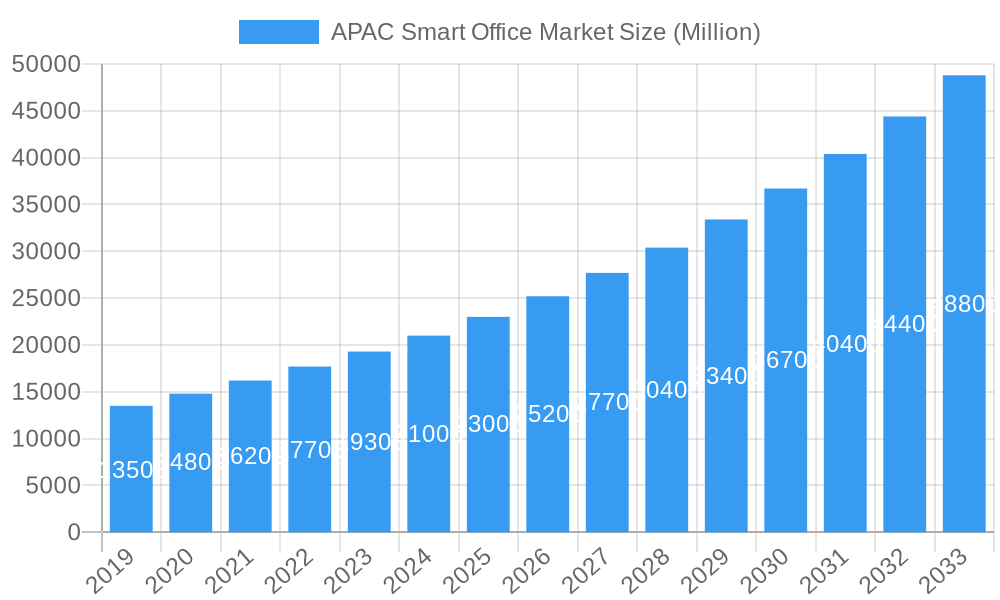

The APAC Smart Office Market is projected for substantial growth, propelled by rapid technological advancements and a heightened emphasis on developing more efficient, secure, and sustainable workplaces. With an estimated market size of $60.36 billion and a robust Compound Annual Growth Rate (CAGR) of 14.1% from the 2025 base year through 2033, the region is experiencing a significant transition toward integrated smart solutions. Key growth catalysts include the widespread adoption of the Internet of Things (IoT), Artificial Intelligence (AI) for predictive maintenance and optimized resource allocation, and the increasing demand for enhanced employee comfort and productivity via intelligent environmental controls. Furthermore, government initiatives promoting smart city development and a growing preference for energy-efficient buildings are significantly bolstering market expansion. The market is defined by a dynamic landscape where innovation in product segments such as Smart Office Lighting, Security and Access Control Systems, and Energy Management Systems is transforming the modern office experience.

APAC Smart Office Market Market Size (In Billion)

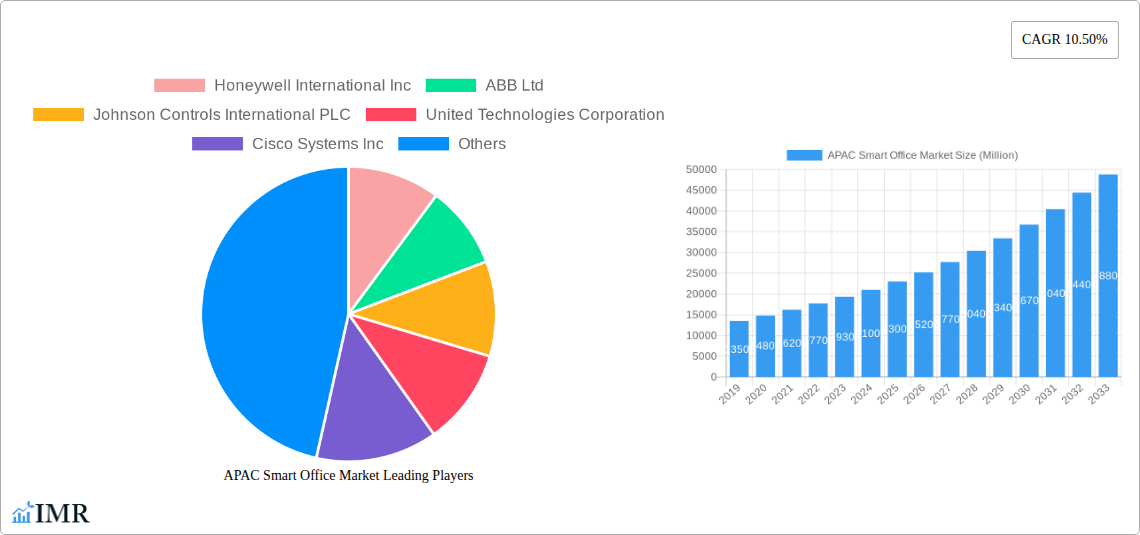

The competitive environment is dynamic, featuring established global leaders like Honeywell International Inc., ABB Ltd, and Siemens AG, alongside specialized innovators such as Enlighted Inc. These companies are pivotal in shaping the market through their continuous development of cutting-edge technologies and integrated solutions for both new constructions and retrofitted existing buildings. Current trends underscore a strong focus on cybersecurity within smart office infrastructure and a growing interest in flexible, adaptable office spaces with dynamic management capabilities. However, significant restraints persist, including the high initial investment required for advanced smart office technology implementation and the necessity for standardized protocols to ensure seamless integration across diverse systems. Despite these challenges, the overarching trajectory for the APAC Smart Office Market points toward sustained and impressive growth, driven by the persistent pursuit of smarter, greener, and more human-centric work environments throughout the region.

APAC Smart Office Market Company Market Share

This comprehensive report delivers a definitive analysis of the APAC Smart Office Market, providing critical insights into market dynamics, growth trends, dominant segments, and the competitive landscape from 2019 to 2033. Designed for industry professionals, investors, and stakeholders, this report utilizes high-impact keywords and a structured format to deliver actionable intelligence.

APAC Smart Office Market Market Dynamics & Structure

The APAC Smart Office Market is characterized by a dynamic interplay of technological advancements, evolving workplace demands, and robust economic growth across the region. Market concentration varies across sub-segments, with leading players like Honeywell International Inc, ABB Ltd, Johnson Controls International PLC, and Siemens AG exhibiting strong footholds in core areas such as energy management systems and security and access control systems. Technological innovation is a primary driver, fueled by the increasing adoption of IoT, AI, and machine learning for enhanced building automation, occupant comfort, and operational efficiency. Regulatory frameworks, while still developing in some nations, are increasingly supportive of green building initiatives and energy efficiency standards, thereby promoting the adoption of smart office solutions. Competitive product substitutes exist, particularly in traditional building management systems, but the superior integration and data-driven insights offered by smart solutions are creating a significant competitive advantage. End-user demographics are shifting towards younger, tech-savvy workforces who expect connected and responsive work environments. Mergers and acquisitions (M&A) are playing a crucial role in market consolidation and portfolio expansion. For instance, in March 2020, ABB acquired Cylon Controls, significantly bolstering its commercial building solutions and emphasizing energy optimization and comfort innovations. The historical period (2019-2024) saw a steady increase in pilot projects and early adoption, laying the groundwork for the accelerated growth projected in the forecast period (2025-2033). The base year of 2025 serves as a critical benchmark for understanding current market penetration and future expansion potential.

- Market Concentration: Moderate to high in established smart building segments, with increasing fragmentation in emerging areas.

- Technological Innovation Drivers: IoT integration, AI-powered analytics, cloud computing, enhanced cybersecurity protocols.

- Regulatory Frameworks: Increasing focus on energy efficiency mandates, data privacy laws, and smart city initiatives.

- Competitive Product Substitutes: Traditional Building Management Systems (BMS), standalone security solutions.

- End-User Demographics: Millennial and Gen Z workforce, growing demand for flexible and technology-enabled workspaces.

- M&A Trends: Strategic acquisitions to expand product portfolios and geographical reach, consolidation of niche technology providers.

APAC Smart Office Market Growth Trends & Insights

The APAC Smart Office Market is poised for significant expansion, driven by a confluence of factors that are reshaping commercial real estate and workplace strategies. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-18% during the forecast period (2025–2033), reaching an estimated value of XX Million units by 2033. This robust growth is underpinned by increasing corporate investments in upgrading existing office spaces (retrofits) and constructing future-ready new buildings. The adoption rates for various smart office technologies, including smart office lighting, security and access control systems, and energy management systems, are accelerating rapidly. Businesses are recognizing the tangible benefits of these solutions, such as reduced operational costs through intelligent energy consumption, enhanced employee productivity and well-being via optimized environments, and improved building security. Technological disruptions are continuously enhancing the capabilities of smart office solutions. The integration of AI is enabling predictive maintenance, personalized environmental controls, and more sophisticated data analytics for building performance optimization. Furthermore, the growing emphasis on sustainability and corporate social responsibility (CSR) initiatives is compelling organizations to adopt energy-efficient technologies, making smart HVAC control systems and energy management systems indispensable. Consumer behavior shifts are also playing a pivotal role. Employees are increasingly expecting smart and connected workplaces that offer convenience, flexibility, and a healthy working environment. This demand is pushing building owners and occupiers to invest in integrated smart office solutions that can deliver a seamless user experience. The evolution from basic automation to intelligent, data-driven building management signifies a maturation of the market. The historical period (2019-2024) laid the foundation by showcasing the potential of these technologies, with a steady increase in pilot projects and the development of a more comprehensive understanding of their ROI. The base year of 2025 marks a tipping point, where the market is transitioning from early adoption to mainstream integration. The estimated year of 2025 is projected to see the market reach XX Million units, setting the stage for the substantial growth anticipated in the subsequent years.

Dominant Regions, Countries, or Segments in APAC Smart Office Market

Within the expansive APAC Smart Office Market, certain regions, countries, and product segments stand out as key growth engines. China is emerging as a dominant country, propelled by its rapid urbanization, massive investments in smart city infrastructure, and a burgeoning tech-savvy corporate sector. Government initiatives promoting technological innovation and energy efficiency further bolster its position. Coupled with China's ascendance, Southeast Asian countries, particularly Singapore and South Korea, are also exhibiting significant growth due to their advanced technological adoption rates, strong economic performance, and proactive smart building policies.

Among the product types, the Energy Management System segment is demonstrating exceptional dominance. This is largely driven by increasing energy costs, stringent environmental regulations, and a growing corporate focus on sustainability and reducing carbon footprints. Companies are actively seeking solutions that can optimize energy consumption, leading to substantial cost savings and improved operational efficiency. Following closely, the Security and Access Control System segment is experiencing robust growth, fueled by rising security concerns and the need for sophisticated, integrated solutions that can manage building access, monitor surveillance, and enhance overall safety. The Smart Office Lighting segment is also a significant contributor, with advancements in LED technology, smart controls, and occupancy sensing enabling energy savings and improved occupant comfort and productivity.

In terms of building types, Retrofits represent a substantial market opportunity. As organizations increasingly look to modernize their existing office spaces to attract talent and improve efficiency, investing in smart building technologies for older structures is becoming a strategic imperative. This segment is driven by the need to upgrade outdated infrastructure and comply with evolving building standards, offering a considerable market for integrated smart solutions. Simultaneously, New Buildings are being designed from the ground up with smart technologies, allowing for seamless integration and optimal performance from inception.

- Dominant Country (Example): China - driven by smart city initiatives, large-scale infrastructure projects, and government support for tech adoption.

- Key Region (Example): Southeast Asia (Singapore, South Korea) - characterized by high technology adoption, supportive government policies, and a focus on sustainable development.

- Dominant Product Segment: Energy Management System - driven by cost savings, environmental regulations, and corporate sustainability goals.

- High-Growth Product Segment: Security and Access Control System - influenced by rising security concerns and the demand for integrated safety solutions.

- Emerging Product Segment: Smart Office Lighting - benefiting from energy efficiency gains and improved occupant experience.

- Dominant Building Type: Retrofits - driven by the need to upgrade existing infrastructure and enhance property value.

- Growth Driver (New Buildings): Integrated design from inception, enabling optimal smart technology deployment.

APAC Smart Office Market Product Landscape

The APAC Smart Office Market product landscape is marked by continuous innovation, focusing on seamless integration and user-centric design. Smart office lighting solutions are moving beyond simple illumination to incorporate dynamic lighting controls that adjust based on occupancy, natural light availability, and even occupant preferences, contributing significantly to energy savings and well-being. Security and access control systems are integrating advanced biometrics, AI-powered threat detection, and cloud-based management for enhanced safety and convenience. Energy management systems are leveraging IoT sensors and machine learning algorithms to provide real-time energy consumption data, predictive analytics for optimization, and automated adjustments for peak efficiency. Smart HVAC control systems are designed to learn occupancy patterns and external weather conditions to maintain optimal indoor temperatures and air quality while minimizing energy usage. Audio-video conferencing systems are evolving with higher resolutions, immersive audio, and AI-driven features like automatic transcription and participant tracking, facilitating seamless remote collaboration. Fire and safety control systems are becoming more intelligent, with integrated sensors and early warning systems that communicate with building management platforms for faster response times. The overarching trend is towards interoperability, allowing disparate systems to communicate and function as a cohesive whole, thereby maximizing the benefits of a truly smart office environment.

Key Drivers, Barriers & Challenges in APAC Smart Office Market

Key Drivers:

- Technological Advancements: The rapid evolution of IoT, AI, 5G, and cloud computing are enabling more sophisticated and integrated smart office solutions.

- Cost Savings & Efficiency: Businesses are increasingly investing in smart technologies to reduce operational expenses through optimized energy consumption, predictive maintenance, and improved resource allocation.

- Enhanced Employee Experience: Demand for comfortable, productive, and flexible work environments drives the adoption of smart systems that personalize lighting, temperature, and other environmental factors.

- Sustainability & ESG Goals: Growing corporate focus on environmental, social, and governance (ESG) principles is pushing for energy-efficient and sustainable building solutions.

- Government Initiatives: Supportive policies, smart city development plans, and energy efficiency mandates in various APAC countries are accelerating market adoption.

Key Barriers & Challenges:

- High Initial Investment Costs: The upfront cost of implementing comprehensive smart office solutions can be a significant barrier for some businesses, especially SMEs.

- Data Security & Privacy Concerns: The collection and management of vast amounts of data raise concerns about cybersecurity vulnerabilities and the privacy of occupant information.

- Integration Complexity: Integrating diverse smart technologies from various vendors can be complex and may require specialized expertise, leading to interoperability issues.

- Lack of Skilled Workforce: A shortage of trained professionals capable of installing, maintaining, and managing advanced smart building systems can hinder widespread adoption.

- Regulatory Uncertainty: In some emerging markets, inconsistent or evolving regulations related to data management, cybersecurity, and building standards can create uncertainty for investors and adopters.

- Legacy Infrastructure: The presence of older, non-integrated building systems in many existing offices presents challenges for seamless upgrade and modernization.

Emerging Opportunities in the APAC Smart Office Market

Emerging opportunities within the APAC Smart Office Market lie in the increasing demand for hyper-personalized employee experiences and the integration of smart building technology with broader urban ecosystems. The development of AI-powered predictive analytics for proactive building maintenance and energy optimization presents a significant growth area. Untapped markets in developing APAC nations are showing potential as they begin to prioritize technological adoption and urban development. Innovative applications like occupant well-being monitoring that uses sensor data to provide feedback on air quality, lighting, and acoustics are gaining traction. The evolving consumer preferences lean towards flexible workspaces, driving demand for smart solutions that can dynamically reconfigure office layouts and environmental controls. Furthermore, the integration of smart office platforms with smart city infrastructure offers opportunities for enhanced urban mobility, energy grid management, and public safety.

Growth Accelerators in the APAC Smart Office Market Industry

Several catalysts are driving the long-term growth of the APAC Smart Office Market. Technological breakthroughs in areas like edge computing for faster data processing, advanced AI algorithms for smarter decision-making, and enhanced sensor technology for more accurate data collection are foundational. Strategic partnerships between technology providers, building developers, and system integrators are crucial for creating comprehensive and scalable solutions. Market expansion strategies, including the development of affordable and modular smart office solutions tailored for SMEs and developing economies, will further fuel growth. The increasing focus on circular economy principles in building design and technology will also drive demand for sustainable and long-lasting smart solutions. The growing adoption of the hybrid work model necessitates smart office technologies that can seamlessly manage shared workspaces and support flexible employee needs.

Key Players Shaping the APAC Smart Office Market Market

- Honeywell International Inc

- ABB Ltd

- Johnson Controls International PLC

- United Technologies Corporation

- Cisco Systems Inc

- Lutron Electronics Co Inc

- Siemens AG

- Schneider Electric SE

- Koninklijke Philips NV

- Enlighted Inc

- Crestron Electronics Inc

- FogHorn Systems Inc

Notable Milestones in the APAC Smart Office Market Sector

- March 2020: ABB acquired the Irish company Cylon Controls to expand its presence in the smart building segment. The acquisition will expand the portfolio of commercial building solutions, emphasizing delivering innovations in energy optimization and comfort.

In-Depth APAC Smart Office Market Market Outlook

The future outlook for the APAC Smart Office Market is exceptionally promising, driven by sustained technological innovation, increasing corporate focus on sustainability and operational efficiency, and evolving employee expectations. Growth accelerators such as advancements in AI for predictive building management, the widespread adoption of 5G for seamless connectivity, and the development of integrated smart city ecosystems will continue to propel market expansion. Strategic partnerships and the increasing demand for flexible, hybrid work environments will further solidify the need for intelligent, adaptable office spaces. The market is expected to transition towards more data-driven, user-centric solutions, with a strong emphasis on occupant well-being and environmental responsibility. This sustained momentum underscores the critical role of smart office technologies in shaping the future of work and urban development across the APAC region.

APAC Smart Office Market Segmentation

-

1. Product Type

- 1.1. Smart Office Lighting

- 1.2. Security and Access Control System

- 1.3. Energy Management System

- 1.4. Smart HVAC Control System

- 1.5. Audio-video Conferencing System

- 1.6. Fire and Safety Control System

-

2. Building Type

- 2.1. Retrofits

- 2.2. New Buildings

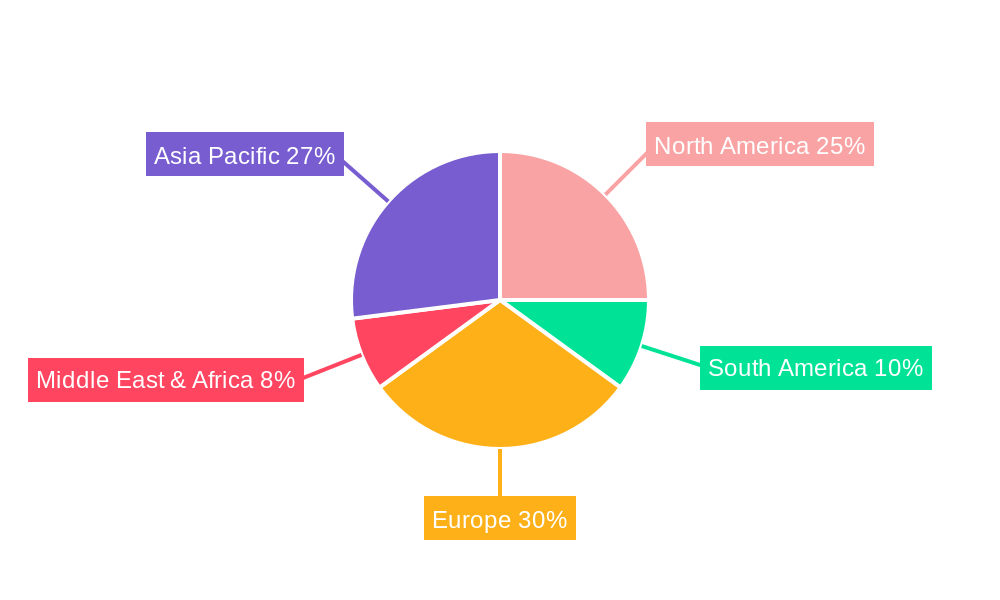

APAC Smart Office Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Smart Office Market Regional Market Share

Geographic Coverage of APAC Smart Office Market

APAC Smart Office Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Energy Efficient Solutions; Growing Need for Automation of Security Systems

- 3.3. Market Restrains

- 3.3.1. High Cost of Connected Systems

- 3.4. Market Trends

- 3.4.1. Security and Access Control to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Smart Office Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Smart Office Lighting

- 5.1.2. Security and Access Control System

- 5.1.3. Energy Management System

- 5.1.4. Smart HVAC Control System

- 5.1.5. Audio-video Conferencing System

- 5.1.6. Fire and Safety Control System

- 5.2. Market Analysis, Insights and Forecast - by Building Type

- 5.2.1. Retrofits

- 5.2.2. New Buildings

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America APAC Smart Office Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Smart Office Lighting

- 6.1.2. Security and Access Control System

- 6.1.3. Energy Management System

- 6.1.4. Smart HVAC Control System

- 6.1.5. Audio-video Conferencing System

- 6.1.6. Fire and Safety Control System

- 6.2. Market Analysis, Insights and Forecast - by Building Type

- 6.2.1. Retrofits

- 6.2.2. New Buildings

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America APAC Smart Office Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Smart Office Lighting

- 7.1.2. Security and Access Control System

- 7.1.3. Energy Management System

- 7.1.4. Smart HVAC Control System

- 7.1.5. Audio-video Conferencing System

- 7.1.6. Fire and Safety Control System

- 7.2. Market Analysis, Insights and Forecast - by Building Type

- 7.2.1. Retrofits

- 7.2.2. New Buildings

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe APAC Smart Office Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Smart Office Lighting

- 8.1.2. Security and Access Control System

- 8.1.3. Energy Management System

- 8.1.4. Smart HVAC Control System

- 8.1.5. Audio-video Conferencing System

- 8.1.6. Fire and Safety Control System

- 8.2. Market Analysis, Insights and Forecast - by Building Type

- 8.2.1. Retrofits

- 8.2.2. New Buildings

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa APAC Smart Office Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Smart Office Lighting

- 9.1.2. Security and Access Control System

- 9.1.3. Energy Management System

- 9.1.4. Smart HVAC Control System

- 9.1.5. Audio-video Conferencing System

- 9.1.6. Fire and Safety Control System

- 9.2. Market Analysis, Insights and Forecast - by Building Type

- 9.2.1. Retrofits

- 9.2.2. New Buildings

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific APAC Smart Office Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Smart Office Lighting

- 10.1.2. Security and Access Control System

- 10.1.3. Energy Management System

- 10.1.4. Smart HVAC Control System

- 10.1.5. Audio-video Conferencing System

- 10.1.6. Fire and Safety Control System

- 10.2. Market Analysis, Insights and Forecast - by Building Type

- 10.2.1. Retrofits

- 10.2.2. New Buildings

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ABB Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Johnson Controls International PLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 United Technologies Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Cisco Systems Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lutron Electronics Co Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Siemens AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Schneider Electric SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Koninklijke Philips NV

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Enlighted Inc *List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Crestron Electronics Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FogHorn Systems Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global APAC Smart Office Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America APAC Smart Office Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America APAC Smart Office Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America APAC Smart Office Market Revenue (billion), by Building Type 2025 & 2033

- Figure 5: North America APAC Smart Office Market Revenue Share (%), by Building Type 2025 & 2033

- Figure 6: North America APAC Smart Office Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America APAC Smart Office Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America APAC Smart Office Market Revenue (billion), by Product Type 2025 & 2033

- Figure 9: South America APAC Smart Office Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: South America APAC Smart Office Market Revenue (billion), by Building Type 2025 & 2033

- Figure 11: South America APAC Smart Office Market Revenue Share (%), by Building Type 2025 & 2033

- Figure 12: South America APAC Smart Office Market Revenue (billion), by Country 2025 & 2033

- Figure 13: South America APAC Smart Office Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe APAC Smart Office Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Europe APAC Smart Office Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Europe APAC Smart Office Market Revenue (billion), by Building Type 2025 & 2033

- Figure 17: Europe APAC Smart Office Market Revenue Share (%), by Building Type 2025 & 2033

- Figure 18: Europe APAC Smart Office Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Europe APAC Smart Office Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa APAC Smart Office Market Revenue (billion), by Product Type 2025 & 2033

- Figure 21: Middle East & Africa APAC Smart Office Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: Middle East & Africa APAC Smart Office Market Revenue (billion), by Building Type 2025 & 2033

- Figure 23: Middle East & Africa APAC Smart Office Market Revenue Share (%), by Building Type 2025 & 2033

- Figure 24: Middle East & Africa APAC Smart Office Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East & Africa APAC Smart Office Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific APAC Smart Office Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Asia Pacific APAC Smart Office Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Asia Pacific APAC Smart Office Market Revenue (billion), by Building Type 2025 & 2033

- Figure 29: Asia Pacific APAC Smart Office Market Revenue Share (%), by Building Type 2025 & 2033

- Figure 30: Asia Pacific APAC Smart Office Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Asia Pacific APAC Smart Office Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Smart Office Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Smart Office Market Revenue billion Forecast, by Building Type 2020 & 2033

- Table 3: Global APAC Smart Office Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global APAC Smart Office Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global APAC Smart Office Market Revenue billion Forecast, by Building Type 2020 & 2033

- Table 6: Global APAC Smart Office Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Global APAC Smart Office Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 11: Global APAC Smart Office Market Revenue billion Forecast, by Building Type 2020 & 2033

- Table 12: Global APAC Smart Office Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Brazil APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Argentina APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Global APAC Smart Office Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 17: Global APAC Smart Office Market Revenue billion Forecast, by Building Type 2020 & 2033

- Table 18: Global APAC Smart Office Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United Kingdom APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Germany APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: France APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Italy APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Spain APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Russia APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Benelux APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Nordics APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Global APAC Smart Office Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 29: Global APAC Smart Office Market Revenue billion Forecast, by Building Type 2020 & 2033

- Table 30: Global APAC Smart Office Market Revenue billion Forecast, by Country 2020 & 2033

- Table 31: Turkey APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Israel APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: GCC APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: North Africa APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: South Africa APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Global APAC Smart Office Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 38: Global APAC Smart Office Market Revenue billion Forecast, by Building Type 2020 & 2033

- Table 39: Global APAC Smart Office Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: China APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: India APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Japan APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 43: South Korea APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: ASEAN APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: Oceania APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific APAC Smart Office Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Smart Office Market?

The projected CAGR is approximately 14.1%.

2. Which companies are prominent players in the APAC Smart Office Market?

Key companies in the market include Honeywell International Inc, ABB Ltd, Johnson Controls International PLC, United Technologies Corporation, Cisco Systems Inc, Lutron Electronics Co Inc, Siemens AG, Schneider Electric SE, Koninklijke Philips NV, Enlighted Inc *List Not Exhaustive, Crestron Electronics Inc, FogHorn Systems Inc.

3. What are the main segments of the APAC Smart Office Market?

The market segments include Product Type, Building Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Energy Efficient Solutions; Growing Need for Automation of Security Systems.

6. What are the notable trends driving market growth?

Security and Access Control to Witness Significant Growth.

7. Are there any restraints impacting market growth?

High Cost of Connected Systems.

8. Can you provide examples of recent developments in the market?

March 2020 - ABB acquired the Irish company Cylon Controls to expand its presence in the smart building segment. The acquisition will expand the portfolio of commercial building solutions, emphasizing delivering innovations in energy optimization and comfort.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Smart Office Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Smart Office Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Smart Office Market?

To stay informed about further developments, trends, and reports in the APAC Smart Office Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence