Key Insights

The Middle East & Africa (MEA) biomedical sensors market is poised for significant expansion, projected to reach a substantial valuation in the coming years. Driven by increasing healthcare expenditure, a rising prevalence of chronic diseases, and the growing adoption of advanced medical devices, the market is anticipated to witness robust growth. Key drivers include government initiatives to enhance healthcare infrastructure, technological advancements in sensor technology, and a heightened awareness among the populace regarding proactive health monitoring. The expanding geriatric population and the increasing demand for home healthcare solutions further bolster the market's upward trajectory. Furthermore, the burgeoning medical tourism sector in several MEA countries is expected to spur the demand for sophisticated diagnostic and monitoring equipment, directly benefiting the biomedical sensors market.

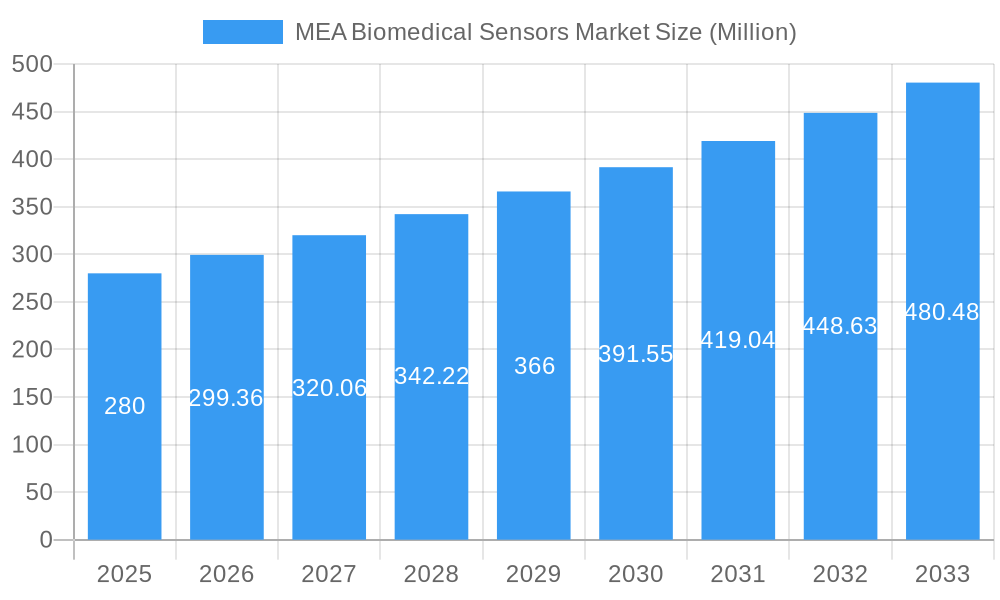

MEA Biomedical Sensors Market Market Size (In Million)

The market segmentation reveals a dynamic landscape. The Wireless segment is expected to dominate due to its inherent advantages in patient comfort and mobility, facilitating continuous monitoring and remote patient care. Among sensor types, Temperature and Pressure sensors are foundational and widely utilized, while Image Sensors are gaining prominence with the advancements in medical imaging technologies. The integration of advanced biochemical and inertial sensors is critical for sophisticated diagnostics and personalized medicine. Within industries, the Pharmaceutical sector's reliance on sensors for drug development and quality control, coupled with the extensive use in Healthcare for diagnostics, monitoring, and treatment, are the primary growth enablers. Leading companies are actively investing in research and development to introduce innovative solutions, catering to the specific needs of the MEA region, thereby shaping a competitive yet promising market environment.

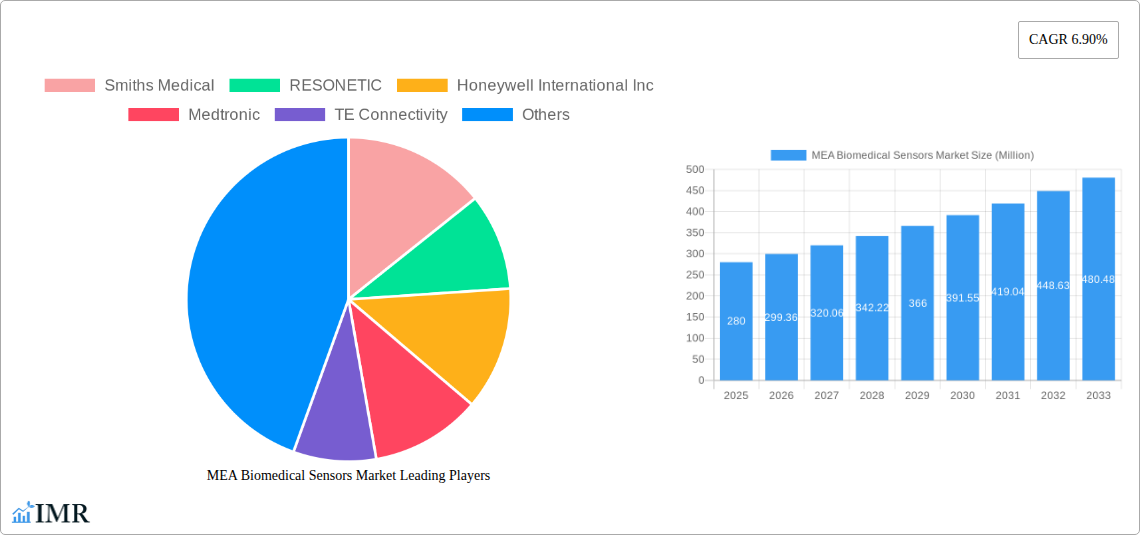

MEA Biomedical Sensors Market Company Market Share

This in-depth report provides a granular analysis of the MEA Biomedical Sensors Market, a critical and rapidly evolving sector within the healthcare and pharmaceutical industries. Delve into the intricate dynamics, growth trajectories, and competitive landscape of this vital market, encompassing both parent and child market segments to offer a holistic understanding. Our research covers the extensive study period from 2019–2033, with a base and estimated year of 2025 and a detailed forecast period of 2025–2033, supported by historical data from 2019–2024. All values are presented in Million units.

MEA Biomedical Sensors Market Dynamics & Structure

The MEA Biomedical Sensors Market is characterized by a moderately concentrated structure, with key players like Medtronic, GE HealthCare Technologies Inc, and Smiths Medical holding significant market shares. Technological innovation is the primary driver, fueled by continuous advancements in miniaturization, enhanced sensitivity, and wireless connectivity. Regulatory frameworks in the Middle East and Africa (MEA) are progressively maturing, albeit with regional variations, influencing product development and market access. Competitive product substitutes exist, particularly in traditional diagnostic methods, but the superior accuracy and real-time monitoring capabilities of advanced biomedical sensors are increasingly driving adoption. End-user demographics are shifting towards an aging population and a growing prevalence of chronic diseases, creating a robust demand for sophisticated healthcare monitoring solutions. Mergers and acquisitions (M&A) trends are active as larger companies seek to expand their product portfolios and geographical reach within the MEA region. For instance, the past two years have seen an estimated 15-20 M&A deals in the broader global biomedical sensor space, with a growing focus on MEA-specific acquisitions. Innovation barriers include the high cost of R&D and stringent regulatory approval processes.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation: Driven by miniaturization, wireless integration, and enhanced sensor accuracy.

- Regulatory Landscape: Maturing but with significant regional disparities.

- Competitive Substitutes: Traditional diagnostic methods are present but losing ground to sensor technology.

- End-User Demographics: Growing demand from aging populations and chronic disease patients.

- M&A Trends: Increasing activity as companies seek regional expansion.

- Innovation Barriers: High R&D costs and lengthy regulatory pathways.

MEA Biomedical Sensors Market Growth Trends & Insights

The MEA Biomedical Sensors Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 8.5% from 2025 to 2033. This robust growth is underpinned by increasing healthcare expenditure across the region, a rising awareness of preventive healthcare, and the growing adoption of advanced medical devices. The market size, estimated at USD 1,200 Million in 2025, is expected to reach USD 2,200 Million by 2033. Technological disruptions, such as the integration of artificial intelligence (AI) and machine learning (ML) with sensor data for predictive diagnostics, are significantly influencing adoption rates. Consumer behavior is shifting towards personalized medicine and remote patient monitoring, creating a demand for sophisticated wearable and implantable biomedical sensors. The increasing prevalence of chronic diseases like diabetes, cardiovascular conditions, and respiratory ailments further fuels the demand for continuous monitoring solutions. Market penetration of advanced sensors in primary healthcare settings is also on an upward trajectory, driven by government initiatives to improve healthcare accessibility and quality. The demand for wireless biomedical sensors, particularly for remote patient monitoring and wearable devices, is outpacing that of wired counterparts due to their convenience and enhanced patient mobility.

Dominant Regions, Countries, or Segments in MEA Biomedical Sensors Market

Within the MEA region, United Arab Emirates (UAE) and Saudi Arabia are emerging as dominant countries in the Biomedical Sensors Market, collectively accounting for an estimated 45% of the regional market share in 2025. This dominance is driven by significant government investments in healthcare infrastructure, a strong focus on medical tourism, and the rapid adoption of cutting-edge medical technologies. Economic policies are favorable, with initiatives aimed at fostering innovation and attracting foreign investment in the healthcare sector. The presence of advanced research institutions and a skilled workforce further bolsters their leadership.

Among the sensor types, Temperature Sensors and Pressure Sensors currently represent the largest segments, driven by their widespread use in critical care, diagnostics, and therapeutic devices. The Biochemical Sensors segment, however, is exhibiting the fastest growth, fueled by advancements in point-of-care diagnostics and personalized medicine.

In terms of device type, Wireless Biomedical Sensors are experiencing a significant surge in demand, projected to grow at a CAGR of 10.2% during the forecast period. This is attributed to the increasing adoption of wearable health trackers, remote patient monitoring systems, and the growing preference for non-invasive monitoring solutions. The convenience, patient mobility, and ease of data integration offered by wireless technology are key differentiators.

- Dominant Countries: United Arab Emirates, Saudi Arabia

- Key Drivers:

- Significant government investment in healthcare infrastructure.

- Focus on medical tourism and advanced technology adoption.

- Favorable economic policies and innovation incentives.

- Presence of advanced research institutions.

- Dominant Segments (Sensor Type): Temperature Sensors, Pressure Sensors

- Fastest-Growing Segment (Sensor Type): Biochemical Sensors

- Dominant Segment (Device Type): Wireless Biomedical Sensors

- Growth Potential: High due to increasing demand for remote monitoring and wearables.

MEA Biomedical Sensors Market Product Landscape

The MEA Biomedical Sensors Market is witnessing a surge in innovative product developments, focusing on enhanced accuracy, miniaturization, and seamless integration with digital health platforms. Companies are actively developing novel MEMS (Micro-Electro-Mechanical Systems) pressure sensors, such as Millar's upcoming TiSense platform, designed for chronic pressure measurement, promising greater precision and longer-term reliability in implantable devices. Advancements in biochemical sensors are enabling faster and more accurate diagnostics for a range of conditions, from glucose monitoring to infectious disease detection. Image sensors are becoming more sophisticated, supporting advanced medical imaging techniques and minimally invasive procedures. The performance metrics of these sensors are continuously improving, with higher resolution, lower power consumption, and enhanced biocompatibility becoming standard.

Key Drivers, Barriers & Challenges in MEA Biomedical Sensors Market

Key Drivers:

- Rising Healthcare Expenditure: Governments and private entities are investing heavily in improving healthcare infrastructure and services across MEA.

- Increasing Prevalence of Chronic Diseases: The growing burden of conditions like diabetes, cardiovascular diseases, and respiratory disorders necessitates continuous monitoring.

- Technological Advancements: Innovations in sensor technology, AI, and IoT are enabling more accurate, portable, and intelligent medical devices.

- Government Initiatives and Supportive Policies: Many MEA countries are implementing policies to promote healthcare innovation and adoption of advanced medical technologies.

Barriers & Challenges:

- High Cost of Advanced Sensors and Devices: The initial investment can be a significant barrier, especially in resource-constrained healthcare settings.

- Regulatory Hurdles and Compliance: Navigating diverse and evolving regulatory landscapes across different MEA countries can be complex and time-consuming.

- Limited Skilled Workforce: A shortage of trained professionals for the development, deployment, and maintenance of advanced biomedical sensor systems exists in certain areas.

- Data Security and Privacy Concerns: Robust cybersecurity measures are crucial to protect sensitive patient data collected by biomedical sensors.

- Supply Chain Disruptions: Global and regional supply chain vulnerabilities can impact the availability and cost of essential sensor components.

Emerging Opportunities in MEA Biomedical Sensors Market

Emerging opportunities in the MEA Biomedical Sensors Market lie in the burgeoning field of remote patient monitoring (RPM) and telehealth. The increasing adoption of wearable devices for chronic disease management presents a significant untapped market. Furthermore, the development of low-cost, high-accuracy diagnostic sensors for point-of-care applications in underserved rural areas holds immense potential. Investments in personalized medicine, where sensors play a crucial role in tailoring treatments, are also expected to drive market expansion. The growing focus on preventive healthcare and wellness applications also opens doors for consumer-grade biomedical sensors integrated into smart devices.

Growth Accelerators in the MEA Biomedical Sensors Market Industry

Several catalysts are propelling the long-term growth of the MEA Biomedical Sensors Market. Technological breakthroughs in areas like flexible electronics, biodegradable sensors, and non-invasive sensing techniques are set to revolutionize patient care. Strategic partnerships between sensor manufacturers, medical device companies, and healthcare providers are accelerating product development and market penetration. Government-backed initiatives promoting digital health and innovation hubs are fostering a conducive ecosystem for growth. Furthermore, the increasing trend of outsourcing manufacturing and R&D to the MEA region by global players is expected to boost local capabilities and market presence.

Key Players Shaping the MEA Biomedical Sensors Market Market

- Smiths Medical

- RESONETIC

- Honeywell International Inc

- Medtronic

- TE Connectivity

- NXP Semiconductors

- Pinnacle Technology Inc

- STMicroelectronics NV

- Sensirion AG

- Analog Devices Inc

- GE HealthCare Technologies Inc

Notable Milestones in MEA Biomedical Sensors Market Sector

- October 2023: Millar, an OEM solutions partner and player in MEMS pressure sensor integration, announced the official unveiling of its groundbreaking chronic pressure measurement technology platform, TiSense, at the MD&M tradeshow in Minneapolis, signaling potential advancements in long-term implantable monitoring.

- September 2023: Superior Sensor Technology launched two new CP series pressure sensors for positive airway pressure (PAP) devices. These sensors, designed for COPD, sleep apnea, home ventilators, and asthma applications, integrate a closed-loop control feature to potentially reduce pressure response time by 50%, alleviate sleep disturbances, and improve patient comfort by enhancing the coupling between PAP devices and individual breathing patterns.

In-Depth MEA Biomedical Sensors Market Market Outlook

The MEA Biomedical Sensors Market is on a trajectory of significant expansion, driven by a convergence of favorable factors. The increasing focus on preventive healthcare, coupled with the escalating burden of chronic diseases, creates a sustained demand for advanced monitoring solutions. Technological advancements in areas such as AI-powered diagnostics, miniaturization, and wireless connectivity are set to unlock new frontiers in patient care. Strategic investments in healthcare infrastructure and supportive government policies further reinforce market growth. The burgeoning opportunities in remote patient monitoring, personalized medicine, and point-of-care diagnostics position the MEA region as a key growth hub for biomedical sensors. The market outlook is highly optimistic, promising substantial returns for stakeholders who can effectively navigate the evolving landscape and capitalize on these burgeoning opportunities.

MEA Biomedical Sensors Market Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. Sensor Type

- 2.1. Temperature

- 2.2. Pressure

- 2.3. Image Sensors

- 2.4. Biochemical

- 2.5. Inertial Sensors

- 2.6. Motion Sensors

- 2.7. Electrocardiogram (ECG)

-

3. Industry

- 3.1. Pharmaceutical

- 3.2. Healthcare

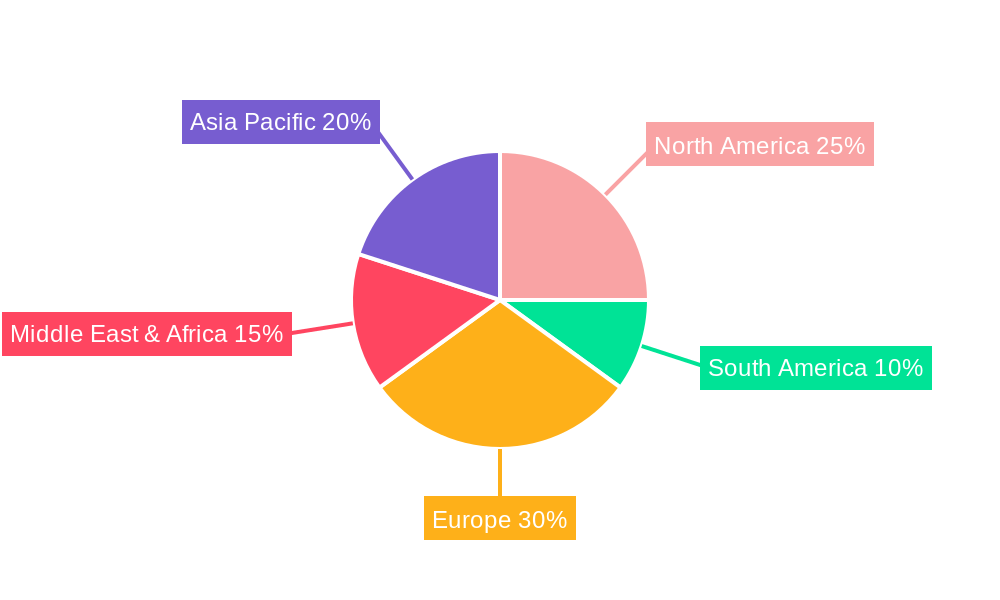

MEA Biomedical Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

MEA Biomedical Sensors Market Regional Market Share

Geographic Coverage of MEA Biomedical Sensors Market

MEA Biomedical Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Fitness Devices; Increasing Spending on Diagnostics

- 3.3. Market Restrains

- 3.3.1. High Costs of the Systems

- 3.4. Market Trends

- 3.4.1. Growing Demand for Fitness Devices to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MEA Biomedical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Temperature

- 5.2.2. Pressure

- 5.2.3. Image Sensors

- 5.2.4. Biochemical

- 5.2.5. Inertial Sensors

- 5.2.6. Motion Sensors

- 5.2.7. Electrocardiogram (ECG)

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Healthcare

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America MEA Biomedical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Wired

- 6.1.2. Wireless

- 6.2. Market Analysis, Insights and Forecast - by Sensor Type

- 6.2.1. Temperature

- 6.2.2. Pressure

- 6.2.3. Image Sensors

- 6.2.4. Biochemical

- 6.2.5. Inertial Sensors

- 6.2.6. Motion Sensors

- 6.2.7. Electrocardiogram (ECG)

- 6.3. Market Analysis, Insights and Forecast - by Industry

- 6.3.1. Pharmaceutical

- 6.3.2. Healthcare

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America MEA Biomedical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Wired

- 7.1.2. Wireless

- 7.2. Market Analysis, Insights and Forecast - by Sensor Type

- 7.2.1. Temperature

- 7.2.2. Pressure

- 7.2.3. Image Sensors

- 7.2.4. Biochemical

- 7.2.5. Inertial Sensors

- 7.2.6. Motion Sensors

- 7.2.7. Electrocardiogram (ECG)

- 7.3. Market Analysis, Insights and Forecast - by Industry

- 7.3.1. Pharmaceutical

- 7.3.2. Healthcare

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe MEA Biomedical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Wired

- 8.1.2. Wireless

- 8.2. Market Analysis, Insights and Forecast - by Sensor Type

- 8.2.1. Temperature

- 8.2.2. Pressure

- 8.2.3. Image Sensors

- 8.2.4. Biochemical

- 8.2.5. Inertial Sensors

- 8.2.6. Motion Sensors

- 8.2.7. Electrocardiogram (ECG)

- 8.3. Market Analysis, Insights and Forecast - by Industry

- 8.3.1. Pharmaceutical

- 8.3.2. Healthcare

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa MEA Biomedical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Wired

- 9.1.2. Wireless

- 9.2. Market Analysis, Insights and Forecast - by Sensor Type

- 9.2.1. Temperature

- 9.2.2. Pressure

- 9.2.3. Image Sensors

- 9.2.4. Biochemical

- 9.2.5. Inertial Sensors

- 9.2.6. Motion Sensors

- 9.2.7. Electrocardiogram (ECG)

- 9.3. Market Analysis, Insights and Forecast - by Industry

- 9.3.1. Pharmaceutical

- 9.3.2. Healthcare

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific MEA Biomedical Sensors Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Wired

- 10.1.2. Wireless

- 10.2. Market Analysis, Insights and Forecast - by Sensor Type

- 10.2.1. Temperature

- 10.2.2. Pressure

- 10.2.3. Image Sensors

- 10.2.4. Biochemical

- 10.2.5. Inertial Sensors

- 10.2.6. Motion Sensors

- 10.2.7. Electrocardiogram (ECG)

- 10.3. Market Analysis, Insights and Forecast - by Industry

- 10.3.1. Pharmaceutical

- 10.3.2. Healthcare

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Smiths Medical

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RESONETIC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Honeywell International Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Medtronic

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 TE Connectivity

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NXP Semiconductors

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pinnacle Technology Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 STMicroelectronics NV

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sensirion AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Analog Devices Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GE HealthCare Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Smiths Medical

List of Figures

- Figure 1: Global MEA Biomedical Sensors Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MEA Biomedical Sensors Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America MEA Biomedical Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America MEA Biomedical Sensors Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 5: North America MEA Biomedical Sensors Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 6: North America MEA Biomedical Sensors Market Revenue (Million), by Industry 2025 & 2033

- Figure 7: North America MEA Biomedical Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 8: North America MEA Biomedical Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America MEA Biomedical Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America MEA Biomedical Sensors Market Revenue (Million), by Type 2025 & 2033

- Figure 11: South America MEA Biomedical Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 12: South America MEA Biomedical Sensors Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 13: South America MEA Biomedical Sensors Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 14: South America MEA Biomedical Sensors Market Revenue (Million), by Industry 2025 & 2033

- Figure 15: South America MEA Biomedical Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 16: South America MEA Biomedical Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America MEA Biomedical Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe MEA Biomedical Sensors Market Revenue (Million), by Type 2025 & 2033

- Figure 19: Europe MEA Biomedical Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 20: Europe MEA Biomedical Sensors Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 21: Europe MEA Biomedical Sensors Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 22: Europe MEA Biomedical Sensors Market Revenue (Million), by Industry 2025 & 2033

- Figure 23: Europe MEA Biomedical Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 24: Europe MEA Biomedical Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe MEA Biomedical Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa MEA Biomedical Sensors Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East & Africa MEA Biomedical Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East & Africa MEA Biomedical Sensors Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 29: Middle East & Africa MEA Biomedical Sensors Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 30: Middle East & Africa MEA Biomedical Sensors Market Revenue (Million), by Industry 2025 & 2033

- Figure 31: Middle East & Africa MEA Biomedical Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 32: Middle East & Africa MEA Biomedical Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa MEA Biomedical Sensors Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific MEA Biomedical Sensors Market Revenue (Million), by Type 2025 & 2033

- Figure 35: Asia Pacific MEA Biomedical Sensors Market Revenue Share (%), by Type 2025 & 2033

- Figure 36: Asia Pacific MEA Biomedical Sensors Market Revenue (Million), by Sensor Type 2025 & 2033

- Figure 37: Asia Pacific MEA Biomedical Sensors Market Revenue Share (%), by Sensor Type 2025 & 2033

- Figure 38: Asia Pacific MEA Biomedical Sensors Market Revenue (Million), by Industry 2025 & 2033

- Figure 39: Asia Pacific MEA Biomedical Sensors Market Revenue Share (%), by Industry 2025 & 2033

- Figure 40: Asia Pacific MEA Biomedical Sensors Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific MEA Biomedical Sensors Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 3: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 4: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 7: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 8: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 13: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 14: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 15: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 21: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 22: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 33: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 34: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 35: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Type 2020 & 2033

- Table 43: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2020 & 2033

- Table 44: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 45: Global MEA Biomedical Sensors Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific MEA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MEA Biomedical Sensors Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the MEA Biomedical Sensors Market?

Key companies in the market include Smiths Medical, RESONETIC, Honeywell International Inc, Medtronic, TE Connectivity, NXP Semiconductors, Pinnacle Technology Inc, STMicroelectronics NV, Sensirion AG, Analog Devices Inc, GE HealthCare Technologies Inc.

3. What are the main segments of the MEA Biomedical Sensors Market?

The market segments include Type, Sensor Type, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.28 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Fitness Devices; Increasing Spending on Diagnostics.

6. What are the notable trends driving market growth?

Growing Demand for Fitness Devices to Drive the Market.

7. Are there any restraints impacting market growth?

High Costs of the Systems.

8. Can you provide examples of recent developments in the market?

October 2023 - Millar, an OEM solutions partner and player in MEMS pressure sensor integration, announced that it would officially unveil its groundbreaking chronic pressure measurement technology platform, TiSense, at the upcoming MD&M tradeshow in Minneapolis. Given its prominence in the medical device industry, this event may serve as the perfect stage for Millar to introduce TiSense to the world.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MEA Biomedical Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MEA Biomedical Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MEA Biomedical Sensors Market?

To stay informed about further developments, trends, and reports in the MEA Biomedical Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence