Key Insights

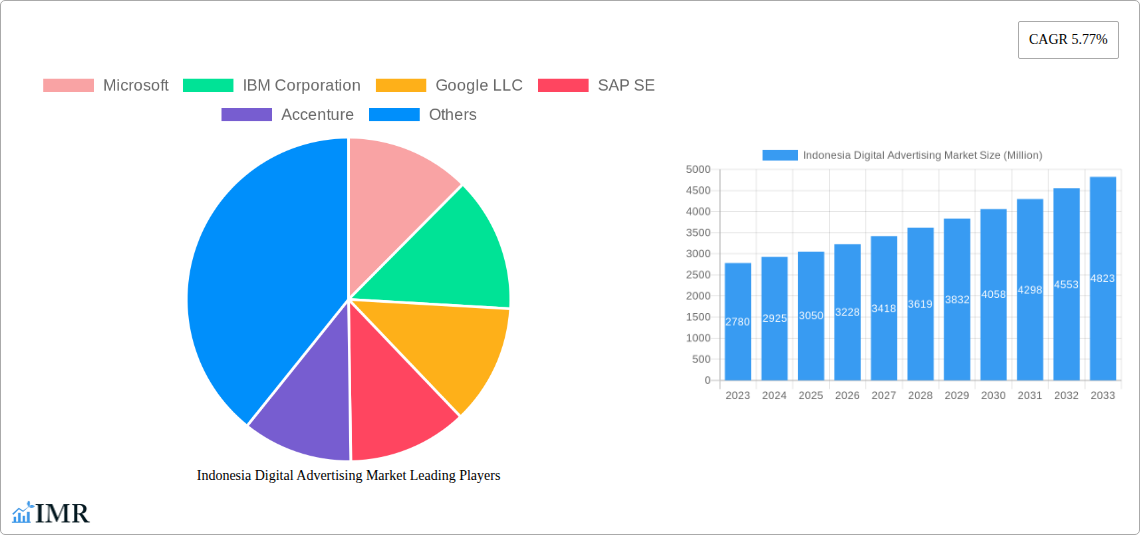

The Indonesian digital advertising market is poised for robust expansion, projected to reach a substantial size of approximately USD 3.05 billion. This growth trajectory is underpinned by a healthy Compound Annual Growth Rate (CAGR) of 5.77%, indicating sustained momentum throughout the forecast period of 2025-2033. The burgeoning digital infrastructure and increasing internet penetration across Indonesia are significant drivers, fostering a fertile ground for digital ad spend. Sectors such as Fast-Moving Consumer Goods (FMCG), Telecommunications, and Media & Entertainment are leading this charge, actively leveraging digital channels to reach a wider and more engaged audience. The shift towards mobile-first consumption of digital content further amplifies the importance of mobile advertising, which is expected to capture a significant market share. Influencer marketing and video advertising are also emerging as dominant forces, reflecting evolving consumer preferences for interactive and engaging content formats.

Indonesia Digital Advertising Market Market Size (In Billion)

Several key trends are shaping the Indonesian digital advertising landscape. The increasing adoption of sophisticated programmatic advertising platforms is enhancing targeting precision and campaign efficiency, allowing advertisers to optimize their spend for maximum ROI. Furthermore, the rise of e-commerce has created a symbiotic relationship with digital advertising, as businesses increasingly rely on online promotions to drive sales. Emerging technologies like Artificial Intelligence (AI) are being integrated into ad platforms to personalize ad delivery and optimize campaign performance. However, challenges such as evolving data privacy regulations and the need for skilled digital marketing professionals could present some constraints. Despite these, the overall outlook remains highly optimistic, driven by Indonesia's young, tech-savvy population and a rapidly expanding digital economy.

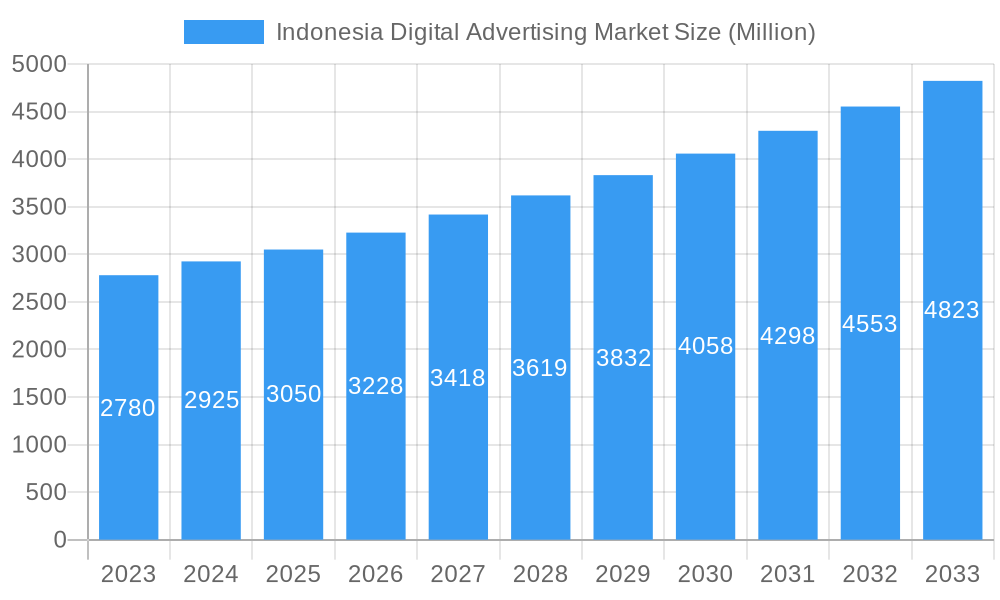

Indonesia Digital Advertising Market Company Market Share

Indonesia Digital Advertising Market: Comprehensive Analysis and Future Outlook (2019-2033)

Explore the dynamic landscape of the Indonesia Digital Advertising Market, a rapidly expanding sector driven by increasing internet penetration, a burgeoning digital economy, and evolving consumer behaviors. This in-depth report provides a crucial roadmap for stakeholders, offering expert insights into market size, growth drivers, competitive strategies, and future opportunities. Unlock the potential of this vibrant market with data-backed analysis and strategic foresight.

Indonesia Digital Advertising Market Market Dynamics & Structure

The Indonesia Digital Advertising Market is characterized by a moderate to high level of concentration, with global tech giants and prominent local players vying for market share. Technological innovation is the primary driver, fueled by advancements in AI, machine learning, and data analytics, enabling more targeted and personalized advertising campaigns. Regulatory frameworks are evolving to address data privacy and consumer protection, influencing advertising practices. Competitive product substitutes include traditional media, direct marketing, and emerging offline digital channels. End-user demographics are diverse, with a significant youth population and a growing middle class driving digital consumption. Mergers and acquisitions (M&A) trends are evident, as larger companies seek to consolidate their market position and acquire innovative technologies. For instance, in December 2023, Accenture's acquisition of Jixie demonstrated a strategic move to enhance marketing transformation capabilities. The market is also witnessing significant investment from global players looking to tap into Indonesia's vast consumer base. Key M&A activities are expected to continue as companies aim for vertical integration and expanded service offerings.

- Market Concentration: Dominated by a few key global and local players, with emerging niche providers gaining traction.

- Technological Innovation: Driven by AI, programmatic advertising, data analytics, and immersive ad formats.

- Regulatory Frameworks: Increasing focus on data privacy (e.g., personal data protection laws), impacting data collection and usage.

- Competitive Product Substitutes: Traditional media advertising (TV, print), direct sales, and experiential marketing.

- End-User Demographics: Young, digitally-savvy population, rapid urbanization, and a growing e-commerce consumer base.

- M&A Trends: Consolidation among agencies, acquisitions of ad-tech startups, and strategic partnerships to expand reach and capabilities.

Indonesia Digital Advertising Market Growth Trends & Insights

The Indonesia Digital Advertising Market is projected to experience robust growth, fueled by increasing internet and smartphone penetration across the archipelago. As of the base year 2025, the market size is estimated to be in the hundreds of millions of dollars, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is driven by a significant shift in advertising budgets from traditional media to digital channels, necessitated by changing consumer behavior. Indonesian consumers are spending more time online, engaging with social media platforms, streaming video content, and actively participating in e-commerce. This heightened digital engagement creates fertile ground for various digital advertising formats, including video advertising and influencer marketing, which are witnessing substantial adoption rates. Technological disruptions, such as the rise of 5G networks and the increasing sophistication of AI-powered ad platforms, are further enhancing the efficiency and effectiveness of digital campaigns, leading to higher ROI for advertisers. The adoption of programmatic advertising is also accelerating, allowing for real-time bidding and highly targeted ad placements.

Consumer behavior shifts are paramount, with a growing preference for personalized and interactive advertising experiences. Brands are increasingly leveraging data analytics to understand consumer preferences and deliver tailored messages. The impact of mobile advertising continues to dominate, given the high mobile-first internet usage in Indonesia. Furthermore, the integration of e-commerce with social media platforms, exemplified by ByteDance's investment in GoTo's Tokopedia, is creating new avenues for seamless purchasing journeys and direct response advertising. This trend is expected to drive significant growth in performance-based advertising models. The evolving media consumption habits, with a surge in over-the-top (OTT) services and online gaming, are opening up new inventory for digital ad placements. The report leverages [mention a hypothetical or placeholder for specific data source here, e.g., proprietary market intelligence, industry surveys, economic modeling] to deliver a comprehensive analysis of these growth trends.

Dominant Regions, Countries, or Segments in Indonesia Digital Advertising Market

Within the Indonesia Digital Advertising Market, Mobile advertising emerges as the overwhelmingly dominant platform, driving significant market growth. This dominance is attributed to Indonesia's status as a mobile-first nation, with a vast majority of the population accessing the internet primarily through smartphones. The ubiquity of mobile devices, coupled with affordable data plans, has fostered a culture of constant connectivity, making mobile the primary channel for information consumption, social interaction, and online transactions. As of the base year 2025, mobile advertising is estimated to capture over 70% of the digital ad spend.

The Media and Entertainment industry stands out as a key sector propelling this growth. This sector encompasses a wide array of digital content, including video streaming, online gaming, social media, and digital news platforms, all of which rely heavily on digital advertising for revenue generation. The rapid expansion of local and international media content creators, coupled with a growing appetite for digital entertainment among Indonesian consumers, has created a highly receptive environment for digital ad campaigns. The industry's willingness to experiment with innovative ad formats, such as in-stream video ads, playable ads in mobile games, and sponsored content, further amplifies its influence.

Among the advertising Types, Video Advertising and Influencer Advertising are experiencing particularly explosive growth. Video content consumption is at an all-time high, driven by platforms like YouTube, TikTok, and various OTT services. Advertisers are capitalizing on the engaging nature of video to convey their brand messages effectively. Simultaneously, influencer marketing has become a powerful tool for reaching specific demographics and building trust. Indonesian influencers, with their massive and dedicated followings, offer brands a direct and relatable way to connect with consumers.

- Dominant Platform: Mobile, accounting for a significant majority of digital ad spend due to high smartphone penetration and usage.

- Key Industry: Media and Entertainment, leveraging digital platforms for content distribution and advertising.

- High-Growth Segments (Type): Video Advertising due to increased content consumption, and Influencer Advertising for its reach and authenticity.

- Drivers of Dominance:

- Economic Policies: Government initiatives promoting digital literacy and digital economy growth.

- Infrastructure Development: Expanding mobile network coverage and faster internet speeds.

- Consumer Behavior: Young, tech-savvy population with high digital engagement and a preference for mobile-first experiences.

- E-commerce Growth: The symbiotic relationship between e-commerce and digital advertising fuels platform innovation and ad spend.

- Content Creation Boom: Proliferation of local and international digital content driving demand for advertising.

Indonesia Digital Advertising Market Product Landscape

The Indonesia Digital Advertising Market product landscape is characterized by a dynamic evolution of innovative solutions designed to capture user attention and deliver measurable results. Video advertising formats continue to dominate, with advancements in programmatic video and interactive video ad units offering enhanced engagement. Influencer marketing platforms are becoming more sophisticated, providing tools for campaign management, performance tracking, and authenticity verification. Search advertising remains a cornerstone, with ongoing optimization of algorithms and the introduction of new ad extensions to improve click-through rates and conversion. Banner advertising is evolving with rich media capabilities and dynamic content personalization. Audio advertising is gaining traction with the rise of podcasting and digital radio. Classifieds platforms are increasingly integrating rich media and video to enhance listings.

- Product Innovations: AI-powered ad targeting, programmatic audio advertising, interactive video ads, shoppable social media ads, and augmented reality (AR) advertising experiences.

- Applications: Brand awareness campaigns, lead generation, direct sales conversion, customer engagement, and audience segmentation.

- Performance Metrics: Emphasis on measurable KPIs such as reach, impressions, clicks, conversions, return on ad spend (ROAS), and customer lifetime value (CLTV).

- Unique Selling Propositions: Hyper-personalization, real-time optimization, cross-channel integration, and data-driven insights for enhanced campaign efficacy.

- Technological Advancements: Integration of machine learning for predictive analytics, blockchain for ad fraud prevention, and advanced analytics for audience profiling.

Key Drivers, Barriers & Challenges in Indonesia Digital Advertising Market

Key Drivers: The Indonesia Digital Advertising Market is propelled by several key drivers. The rapid increase in internet and smartphone penetration across the nation is a fundamental catalyst, expanding the addressable audience for digital campaigns. Growing disposable incomes and a burgeoning middle class are fueling consumer spending, leading to increased investment in advertising. Government initiatives promoting digital transformation and the digital economy further bolster the market. The rise of e-commerce and the increasing adoption of digital payment methods create a synergistic relationship with digital advertising, driving demand for performance-oriented campaigns. Technological advancements, including AI, machine learning, and programmatic advertising, enhance campaign efficiency and effectiveness, offering higher ROAS for businesses.

Barriers & Challenges: Despite the strong growth trajectory, the market faces several barriers and challenges. Regulatory uncertainty regarding data privacy and consumer protection can impact data collection and ad targeting strategies. Talent shortage in specialized digital marketing roles, such as data scientists and programmatic traders, can hinder the effective implementation of sophisticated campaigns. Ad fraud remains a persistent concern, leading to wasted ad spend and eroding advertiser confidence, with estimated losses of up to xx million dollars annually. Digital divide in remote or less developed regions can limit reach. Intense competition among numerous advertising platforms and agencies can lead to price wars and pressure on profit margins. Furthermore, budget allocation challenges for SMEs to effectively leverage digital advertising, often due to a lack of expertise or perceived high costs, present a significant restraint.

Emerging Opportunities in Indonesia Digital Advertising Market

Emerging opportunities in the Indonesia Digital Advertising Market lie in the burgeoning creator economy and the increasing demand for authentic, niche content. Influencer marketing, beyond macro-influencers, offers significant potential with micro and nano-influencers connecting with highly engaged, specific communities. The growth of short-form video content presents a fertile ground for interactive and engaging ad formats, as exemplified by TikTok's strategic moves. The expansion of Connected TV (CTV) and over-the-top (OTT) services opens new avenues for video advertising with advanced targeting capabilities. Furthermore, the increasing focus on sustainability and social impact by consumers presents opportunities for purpose-driven advertising campaigns. The development of innovative e-commerce integrations, allowing for seamless in-app purchases, will drive demand for performance marketing.

- Creator Economy Expansion: Leveraging micro and nano-influencers for targeted campaigns.

- Short-Form Video Innovation: Interactive and engaging ad formats for platforms like TikTok.

- Connected TV (CTV) Growth: Advanced targeting opportunities in streaming environments.

- Purpose-Driven Marketing: Aligning brand messages with consumer values and sustainability.

- E-commerce Integration: Seamless in-app shopping experiences driving performance marketing.

Growth Accelerators in the Indonesia Digital Advertising Market Industry

Several key catalysts are accelerating the growth of the Indonesia Digital Advertising Market. Technological breakthroughs in Artificial Intelligence and Machine Learning are enabling hyper-personalization of ads, leading to higher engagement and conversion rates. The increasing adoption of programmatic advertising platforms is streamlining ad buying processes and improving targeting accuracy, making digital advertising more efficient for businesses. Strategic partnerships between tech giants and local enterprises, such as ByteDance's collaboration with GoTo, are fostering innovation and expanding market reach. The ongoing expansion of 5G infrastructure promises faster mobile internet speeds, enabling richer media experiences and further driving mobile advertising. Furthermore, the continuous evolution of e-commerce platforms and their integration with social media are creating a powerful ecosystem that fuels digital ad spend.

- AI and Machine Learning Advancements: Driving hyper-personalization and predictive analytics.

- Programmatic Advertising Adoption: Enhancing efficiency and targeting capabilities.

- Strategic Partnerships and Collaborations: Expanding market reach and fostering innovation.

- 5G Infrastructure Rollout: Enabling richer media experiences and faster mobile access.

- E-commerce and Social Media Integration: Creating a synergistic ecosystem for digital advertising.

Key Players Shaping the Indonesia Digital Advertising Market Market

- Microsoft

- IBM Corporation

- Google LLC

- SAP SE

- Accenture

- Hewlett Packard Enterprise Development LP

- Amazon Web Services Inc

- Oracle

- Apple Inc

- Intel Corporation

Notable Milestones in Indonesia Digital Advertising Market Sector

- December 2023: Accenture announced the acquisition of the business of media and marketing technology company Jixie. Jixie’s digital marketing platform will be integrated into Accenture to strengthen its marketing transformation capabilities, helping Indonesian clients deliver more personalized experiences to enhance customer engagement for sustainable business growth.

- December 2023: ByteDance Ltd’s TikTok agreed to invest in a unit of Indonesia’s GoTo Group and cooperate on an online shopping service, pioneering a template for e-commerce. The Chinese-owned video service has agreed to work with GoTo’s Tokopedia across several areas. ByteDance aims to revive its online shopping service in Southeast Asia’s most significant retail arena.

In-Depth Indonesia Digital Advertising Market Market Outlook

The Indonesia Digital Advertising Market is poised for sustained and accelerated growth, driven by a confluence of factors. The increasing digital literacy and adoption rates across all demographics, coupled with expanding internet infrastructure, will continue to broaden the market's reach. Innovations in AI and data analytics will empower advertisers with unprecedented insights into consumer behavior, enabling highly effective and personalized campaigns. The burgeoning e-commerce sector will remain a significant engine of growth, fueled by strategic alliances and advancements in payment and logistics. Emerging opportunities in influencer marketing, short-form video, and connected TV advertising will provide new avenues for brands to engage with their target audiences. The market's future trajectory is also influenced by ongoing consolidation and strategic investments, as both global and local players seek to capture market share and drive innovation, promising a dynamic and lucrative landscape for stakeholders.

Indonesia Digital Advertising Market Segmentation

-

1. Type

- 1.1. Audio Advertising

- 1.2. Video Advertising

- 1.3. Influencer Advertising

- 1.4. Banner Advertising

- 1.5. Search Advertising

- 1.6. Classifieds

-

2. Platform

- 2.1. Desktop

- 2.2. Mobile

-

3. Industry

- 3.1. FMCG

- 3.2. Telecom

- 3.3. Healthcare

- 3.4. Media and Entertainment

- 3.5. Other Industries

Indonesia Digital Advertising Market Segmentation By Geography

- 1. Indonesia

Indonesia Digital Advertising Market Regional Market Share

Geographic Coverage of Indonesia Digital Advertising Market

Indonesia Digital Advertising Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift from Traditional to Online Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Lack of Communication Between Publisher and Advertiser

- 3.4. Market Trends

- 3.4.1. Video Advertising to Grow at a Significant Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Digital Advertising Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Audio Advertising

- 5.1.2. Video Advertising

- 5.1.3. Influencer Advertising

- 5.1.4. Banner Advertising

- 5.1.5. Search Advertising

- 5.1.6. Classifieds

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Desktop

- 5.2.2. Mobile

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. FMCG

- 5.3.2. Telecom

- 5.3.3. Healthcare

- 5.3.4. Media and Entertainment

- 5.3.5. Other Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Microsoft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 SAP SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Accenture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Hewlett Packard Enterprise Development LP

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon Web Services Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oracle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apple Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Intel Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Microsoft

List of Figures

- Figure 1: Indonesia Digital Advertising Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Digital Advertising Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Digital Advertising Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Indonesia Digital Advertising Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Indonesia Digital Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Indonesia Digital Advertising Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 5: Indonesia Digital Advertising Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Indonesia Digital Advertising Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 7: Indonesia Digital Advertising Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Indonesia Digital Advertising Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Indonesia Digital Advertising Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Indonesia Digital Advertising Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Indonesia Digital Advertising Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Indonesia Digital Advertising Market Volume K Unit Forecast, by Platform 2020 & 2033

- Table 13: Indonesia Digital Advertising Market Revenue Million Forecast, by Industry 2020 & 2033

- Table 14: Indonesia Digital Advertising Market Volume K Unit Forecast, by Industry 2020 & 2033

- Table 15: Indonesia Digital Advertising Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Indonesia Digital Advertising Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Digital Advertising Market?

The projected CAGR is approximately 5.77%.

2. Which companies are prominent players in the Indonesia Digital Advertising Market?

Key companies in the market include Microsoft, IBM Corporation, Google LLC, SAP SE, Accenture, Hewlett Packard Enterprise Development LP, Amazon Web Services Inc, Oracle, Apple Inc, Intel Corporation.

3. What are the main segments of the Indonesia Digital Advertising Market?

The market segments include Type, Platform, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift from Traditional to Online Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

Video Advertising to Grow at a Significant Rate.

7. Are there any restraints impacting market growth?

Lack of Communication Between Publisher and Advertiser.

8. Can you provide examples of recent developments in the market?

December 2023: Accenture announced the acquisition of the business of media and marketing technology company Jixie. Jixie’s digital marketing platform will be integrated into Accenture to strengthen its marketing transformation capabilities, helping Indonesian clients deliver more personalized experiences to enhance customer engagement for sustainable business growth.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Digital Advertising Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Digital Advertising Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Digital Advertising Market?

To stay informed about further developments, trends, and reports in the Indonesia Digital Advertising Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence