Key Insights

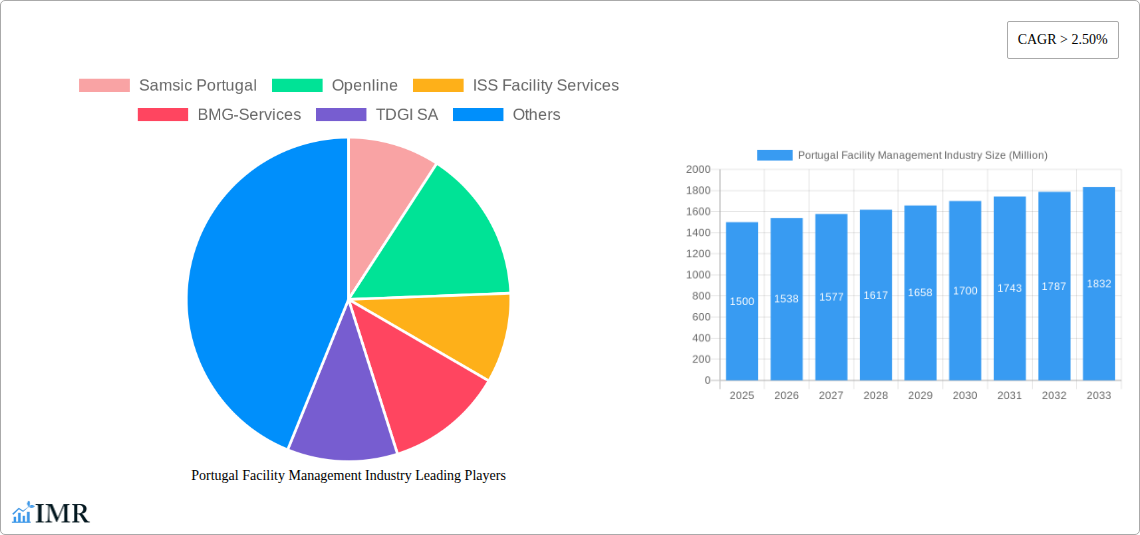

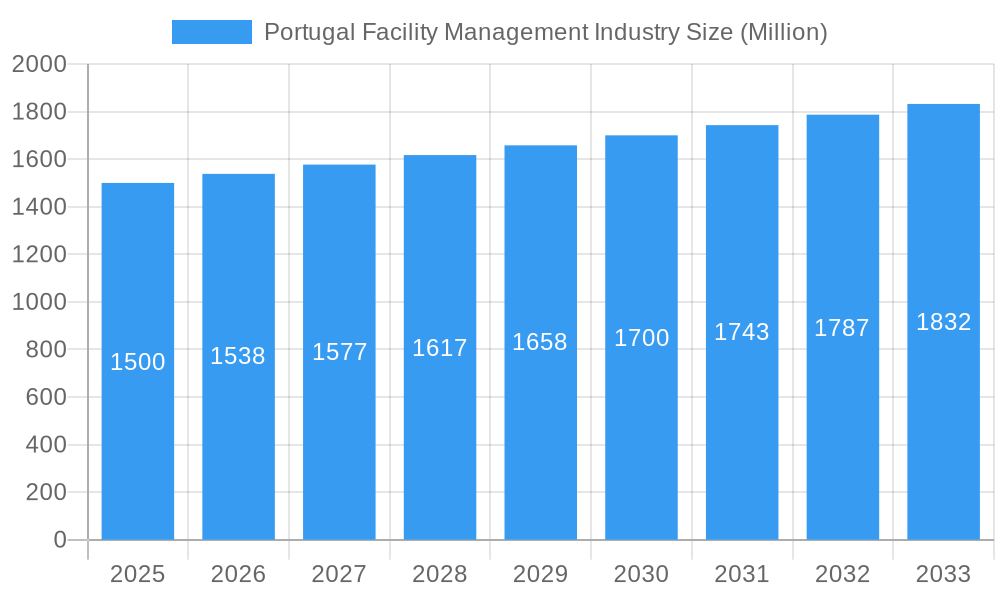

The Portugal Facility Management market is projected for robust expansion, driven by increasing outsourcing adoption and a rising demand for integrated and bundled services. The market is forecast to achieve a Compound Annual Growth Rate (CAGR) of 11.75%, growing from an estimated 1 billion in the base year of 2025 to over 1 billion by 2033. This growth is propelled by factors such as the increasing complexity of commercial and industrial properties, the ongoing need for cost optimization, and a heightened focus on sustainable and efficient building operations. The widespread adoption of digitized facility management solutions, integrating IoT and AI for predictive maintenance and improved operational efficiency, is a significant catalyst for market dynamism. Furthermore, the growing utilization of both hard and soft FM services across commercial, industrial, and public infrastructure sectors underpins this positive trajectory.

Portugal Facility Management Industry Market Size (In Billion)

The market is characterized by dynamic competition between in-house and outsourced facility management providers. Outsourced FM, including single, bundled, and integrated service models, is experiencing significant growth as organizations seek specialized expertise and operational efficiencies. The "Integrated FM" segment is anticipated to see substantial development as clients prioritize comprehensive, end-to-end solutions for streamlined operations and enhanced building performance. Leading entities such as ISS Facility Services, Samsic Portugal, and Apleona GmbH are pivotal in shaping the competitive environment through strategic initiatives and service advancements. While demand remains strong, potential challenges include the initial investment required for advanced technology implementation and the necessity of a skilled workforce to manage sophisticated FM operations. Nonetheless, the Portugal Facility Management sector presents a promising outlook, indicating a mature yet evolving industry with abundant opportunities.

Portugal Facility Management Industry Company Market Share

This report offers an in-depth analysis of the Portugal Facility Management Industry, detailing market structure, growth dynamics, competitive landscape, and future prospects. Covering the period from 2019 to 2033, with 2025 as the base year, this research provides critical intelligence for stakeholders including service providers, asset owners, investors, and technology developers. We examine parent and child market segments, illustrating the interdependencies driving industry growth, with all financial data presented in billions of Euros.

Portugal Facility Management Industry Market Dynamics & Structure

The Portugal Facility Management Industry is characterized by a moderately concentrated market, with key players increasingly vying for market share through service diversification and technological integration. Technological innovation is a significant driver, fueled by the growing demand for smart building solutions, predictive maintenance, and energy efficiency. The regulatory framework, while evolving, generally supports the growth of the FM sector by promoting standards for safety, sustainability, and service quality. Competitive product substitutes are emerging, particularly in areas like self-service platforms and specialized tech solutions that can automate or streamline certain FM tasks. End-user demographics are shifting, with an increasing emphasis on sustainability, occupant well-being, and cost optimization across commercial, institutional, and public sectors. Mergers and acquisitions (M&A) trends indicate a move towards consolidation, with larger entities acquiring smaller, specialized firms to broaden their service offerings and geographic reach. For instance, the acquisition of niche technology providers by established FM companies is a notable trend.

- Market Concentration: Moderately concentrated, with a few large players holding significant market share, but with growing competition from specialized providers.

- Technological Innovation Drivers: Demand for smart buildings, IoT integration, AI-powered predictive maintenance, and energy management solutions.

- Regulatory Frameworks: Increasingly focusing on sustainability, safety standards, and digital transformation within public procurement.

- Competitive Product Substitutes: Rise of DIY maintenance platforms, specialized software solutions for specific tasks, and in-house technology adoption by large organizations.

- End-User Demographics: Growing demand for integrated FM solutions, emphasis on ESG (Environmental, Social, and Governance) factors, and data-driven decision-making.

- M&A Trends: Consolidation through acquisitions of specialized technology firms and regional players to enhance service portfolios and expand market presence.

Portugal Facility Management Industry Growth Trends & Insights

The Portugal Facility Management Industry is poised for robust growth, driven by an increasing recognition of the strategic importance of FM in optimizing operational efficiency and enhancing asset value. The market size is projected to expand at a healthy CAGR, reflecting the evolving needs of businesses and institutions. Adoption rates for integrated FM solutions are on the rise, as organizations seek to streamline operations, reduce costs, and improve occupant satisfaction. Technological disruptions, particularly the integration of Artificial Intelligence (AI), Internet of Things (IoT), and Building Information Modeling (BIM), are transforming service delivery models, enabling predictive maintenance, energy optimization, and enhanced space utilization. Consumer behavior shifts are evident, with clients demanding more sophisticated, data-driven, and sustainable FM services. This includes a greater emphasis on occupant well-being, digital integration for service requests and performance monitoring, and a focus on reducing the environmental footprint of facilities. The market is moving beyond traditional reactive maintenance towards proactive and predictive management strategies. The ongoing digital transformation across various sectors in Portugal is a key enabler for the widespread adoption of advanced FM technologies and services. The forecast period (2025–2033) anticipates significant market penetration of smart FM solutions.

- Market Size Evolution: Expected to witness substantial growth, driven by increased outsourcing and demand for integrated services.

- Adoption Rates: Increasing adoption of bundled and integrated FM models, alongside a growing interest in technology-enabled solutions.

- Technological Disruptions: AI, IoT, and data analytics are reshaping service delivery, from predictive maintenance to energy efficiency.

- Consumer Behavior Shifts: Clients are demanding more strategic, sustainable, and technologically advanced FM solutions that focus on occupant experience and operational excellence.

- CAGR Projection: Estimated to be XX% during the forecast period.

- Market Penetration: Forecasted to reach XX% by 2033 for integrated FM solutions.

Dominant Regions, Countries, or Segments in Portugal Facility Management Industry

Within the Portugal Facility Management Industry, Outsourced Facility Management emerges as the dominant segment, significantly outpacing Inhouse Facility Management. This dominance is further amplified by the rise of Integrated FM, which offers a holistic approach to managing all aspects of a facility's operations, from hard services like building maintenance and energy management to soft services such as cleaning, security, and catering. The Commercial and Institutional end-user segments are the primary drivers of this growth, with large corporations, retail spaces, healthcare facilities, and educational institutions increasingly recognizing the strategic value of outsourcing their FM needs to specialized providers. Public/Infrastructure and Industrial sectors also contribute significantly, albeit with specific requirements and tendering processes.

The leading segment within Outsourced Facility Management is Integrated FM. This model allows organizations to consolidate their FM contracts with a single provider, simplifying management, improving communication, and achieving greater cost efficiencies through economies of scale. The growth in Integrated FM is propelled by several factors:

- Economic Policies: Government initiatives promoting efficient resource management and private sector involvement in public services encourage outsourcing.

- Infrastructure Development: Ongoing investment in new commercial and institutional infrastructure creates a continuous demand for FM services.

- Focus on Core Competencies: Businesses are increasingly choosing to focus on their core operations, delegating non-core FM functions to experts.

- Technological Advancements: The integration of technology in FM, such as smart building management systems, makes integrated solutions more appealing and manageable.

- Market Share: Integrated FM is projected to hold approximately XX% of the outsourced FM market by 2033.

- Growth Potential: High growth potential due to its ability to deliver comprehensive and cost-effective solutions.

Within Offering Type, both Hard FM and Soft FM are crucial, but their integration under an Integrated FM model drives greater value. Hard FM services, encompassing technical building maintenance, HVAC, and electrical systems, are increasingly reliant on technology for predictive maintenance and energy optimization. Soft FM services, including cleaning, security, and catering, benefit from streamlined management and improved service quality through integrated contracts.

The Commercial end-user segment, encompassing offices, retail outlets, and hospitality, is a significant contributor due to the high demand for consistent operational standards, occupant comfort, and an appealing customer environment. The Institutional segment, including hospitals, schools, and government buildings, requires specialized FM expertise to meet stringent regulatory requirements, ensure occupant safety, and maintain operational continuity.

Portugal Facility Management Industry Product Landscape

The Portugal Facility Management Industry product landscape is characterized by the evolution of technology-driven solutions that enhance service delivery and operational efficiency. Innovations in Building Information Modeling (BIM) integrated with FM software allow for a digital twin of buildings, facilitating better asset management, space planning, and maintenance scheduling. IoT sensors are enabling real-time monitoring of environmental conditions, equipment performance, and energy consumption, feeding data into intelligent platforms for proactive intervention. AI-powered analytics are transforming predictive maintenance by identifying potential equipment failures before they occur, thereby minimizing downtime and reducing repair costs. Mobile applications are empowering FM teams with on-demand task management, communication tools, and data logging capabilities, improving responsiveness and accountability. These advancements are not just about efficiency but also about creating safer, more sustainable, and user-friendly environments for building occupants.

Key Drivers, Barriers & Challenges in Portugal Facility Management Industry

The Portugal Facility Management Industry is propelled by several key drivers, including the increasing demand for cost optimization, the growing focus on sustainability and energy efficiency, and the need to maintain high standards of occupant comfort and safety. Technological advancements, such as IoT and AI, are crucial enablers, allowing for more predictive and efficient service delivery. Furthermore, a supportive regulatory environment and growing awareness of the strategic value of FM are fostering market growth.

However, the industry faces significant barriers and challenges. Supply chain disruptions can impact the availability of essential materials and spare parts, leading to project delays and increased costs. Regulatory hurdles, particularly in public procurement, can be complex and time-consuming. Intense competitive pressures, with a crowded market of both large established players and agile smaller firms, can lead to price wars and pressure on profit margins. A shortage of skilled FM professionals also poses a significant challenge, impacting the quality and consistency of services.

Emerging Opportunities in Portugal Facility Management Industry

Emerging opportunities in the Portugal Facility Management Industry lie in the increasing demand for smart building integration and the adoption of sustainable FM practices. The "green building" movement is creating a significant market for energy-efficient retrofits and sustainable facility operations. There's also a growing niche for specialized FM services catering to specific sectors like data centers, life sciences, and advanced manufacturing, which have unique operational requirements. The expansion of remote working models presents opportunities for FM providers to offer enhanced services for hybrid work environments, focusing on space utilization, occupant well-being, and flexible office solutions. Furthermore, the digitalization of FM services, including advanced data analytics for performance optimization and tenant experience management, represents a fertile ground for innovation and market growth.

Growth Accelerators in the Portugal Facility Management Industry Industry

Growth in the Portugal Facility Management Industry is significantly accelerated by the ongoing digital transformation across businesses and public institutions. The widespread adoption of cloud-based FM software, AI-driven analytics for predictive maintenance, and IoT sensors for real-time building monitoring are enhancing efficiency and service quality. Strategic partnerships between FM providers and technology companies are fostering innovation and the development of integrated solutions. Furthermore, increased governmental focus on energy efficiency targets and sustainable building practices is driving demand for green FM services. Market expansion strategies by leading companies, including mergers and acquisitions, are consolidating the industry and creating larger, more capable service providers.

Key Players Shaping the Portugal Facility Management Industry Market

- Samsic Portugal

- Openline

- ISS Facility Services

- BMG-Services

- TDGI SA

- Clime

- Infraspeak

- NextBITT

- Apleona GmbH

- PLM Facility Management

- Interlimpe Facility Services SA

Notable Milestones in Portugal Facility Management Industry Sector

- December 2021: Porto-based Infraspeak received Euro 10 million funding for its pioneering intelligence platform for maintenance and facility management by Indico Capital and Knight Capital and joined by existing investors Innovation Nest and Caixa Capital.

In-Depth Portugal Facility Management Industry Market Outlook

The outlook for the Portugal Facility Management Industry is exceptionally positive, fueled by several key growth accelerators. The continuous integration of smart technologies, including AI, IoT, and advanced analytics, is transforming service delivery, enabling predictive maintenance, optimized energy consumption, and enhanced occupant experiences. Strategic partnerships between FM providers and technology innovators are fostering a dynamic ecosystem of cutting-edge solutions. The strong governmental and corporate push towards sustainability and ESG compliance is creating significant demand for green FM services and energy-efficient building management. Furthermore, ongoing market consolidation through M&A activities is expected to create more robust and comprehensive service offerings, capable of meeting the increasingly complex needs of clients. This synergistic combination of technological advancement, strategic alliances, and evolving market demands positions the Portugal FM industry for sustained and accelerated growth in the coming years.

Portugal Facility Management Industry Segmentation

-

1. Type of Facility Management

- 1.1. Inhouse Facility Management

-

1.2. Outsourced Facility Management

- 1.2.1. Single FM

- 1.2.2. Bundled FM

- 1.2.3. Integrated FM

-

2. Offering Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial

- 3.2. Institutional

- 3.3. Public/Infrastructure

- 3.4. Industrial

- 3.5. Others End Users

Portugal Facility Management Industry Segmentation By Geography

- 1. Portugal

Portugal Facility Management Industry Regional Market Share

Geographic Coverage of Portugal Facility Management Industry

Portugal Facility Management Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of Smart and Sustainable Buildings; Growing Demand for Energy Management

- 3.3. Market Restrains

- 3.3.1. Integration of Technology in Cost Efficient Way

- 3.4. Market Trends

- 3.4.1. Soft Facility Management Services is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Portugal Facility Management Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 5.1.1. Inhouse Facility Management

- 5.1.2. Outsourced Facility Management

- 5.1.2.1. Single FM

- 5.1.2.2. Bundled FM

- 5.1.2.3. Integrated FM

- 5.2. Market Analysis, Insights and Forecast - by Offering Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial

- 5.3.2. Institutional

- 5.3.3. Public/Infrastructure

- 5.3.4. Industrial

- 5.3.5. Others End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Portugal

- 5.1. Market Analysis, Insights and Forecast - by Type of Facility Management

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsic Portugal

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Openline

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ISS Facility Services

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 BMG-Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 TDGI SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Clime

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Infraspeak

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NextBITT

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Apleona GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PLM Facility Management

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Interlimpe Facility Services SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Samsic Portugal

List of Figures

- Figure 1: Portugal Facility Management Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Portugal Facility Management Industry Share (%) by Company 2025

List of Tables

- Table 1: Portugal Facility Management Industry Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 2: Portugal Facility Management Industry Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 3: Portugal Facility Management Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Portugal Facility Management Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Portugal Facility Management Industry Revenue billion Forecast, by Type of Facility Management 2020 & 2033

- Table 6: Portugal Facility Management Industry Revenue billion Forecast, by Offering Type 2020 & 2033

- Table 7: Portugal Facility Management Industry Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Portugal Facility Management Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Portugal Facility Management Industry?

The projected CAGR is approximately 11.75%.

2. Which companies are prominent players in the Portugal Facility Management Industry?

Key companies in the market include Samsic Portugal, Openline, ISS Facility Services, BMG-Services, TDGI SA, Clime, Infraspeak, NextBITT, Apleona GmbH, PLM Facility Management, Interlimpe Facility Services SA.

3. What are the main segments of the Portugal Facility Management Industry?

The market segments include Type of Facility Management, Offering Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1 billion as of 2022.

5. What are some drivers contributing to market growth?

Growth of Smart and Sustainable Buildings; Growing Demand for Energy Management.

6. What are the notable trends driving market growth?

Soft Facility Management Services is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Integration of Technology in Cost Efficient Way.

8. Can you provide examples of recent developments in the market?

December 2021 - Porto-based Infraspeak received Euro 10 million funding for its pioneering intelligence platform for maintenance and facility management by Indico Capital and Knight Capital and joined by existing investors Innovation Nest and Caixa Capital.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Portugal Facility Management Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Portugal Facility Management Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Portugal Facility Management Industry?

To stay informed about further developments, trends, and reports in the Portugal Facility Management Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence