Key Insights

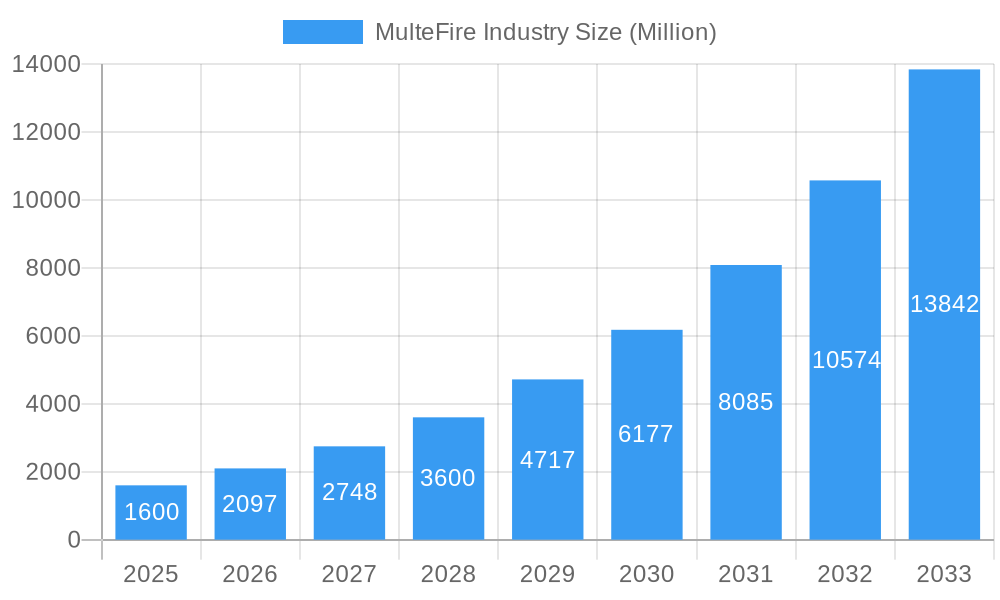

The MulteFire market is poised for explosive growth, projected to reach \$1.60 billion in 2025 with an astonishing Compound Annual Growth Rate (CAGR) of 31.04%. This robust expansion is fueled by several key drivers, including the increasing demand for private cellular networks in enterprise environments, the proliferation of IoT devices requiring dedicated and secure connectivity, and the growing need for enhanced indoor wireless coverage in public venues and commercial buildings. The technology's ability to leverage unlicensed spectrum offers a cost-effective and flexible alternative to traditional licensed spectrum deployments, making it particularly attractive for businesses seeking to control their wireless infrastructure. The market is segmented across crucial equipment types such as Small Cells, Switches, and Controllers, with significant adoption anticipated in end-user verticals like Commercial & Institutional Buildings, Supply Chain and Distribution, Retail, Hospitality, Public Venues, and Healthcare. Companies like Telefonaktiebolaget LM Ericsson, Huawei Technologies Co Ltd, and Nokia Corporation are leading the charge in innovation and deployment, indicating a competitive yet rapidly maturing landscape.

MulteFire Industry Market Size (In Billion)

Looking ahead, the MulteFire market is expected to witness continued innovation in areas such as enhanced mobile broadband (eMBB) capabilities for private networks and the integration of AI for network management and optimization. Emerging trends point towards the development of specialized MulteFire solutions for industrial automation and smart cities, further broadening its applicability. However, the market may face certain restraints, including the need for greater standardization and interoperability across different vendor solutions, and potential regulatory hurdles in specific regions regarding the use of unlicensed spectrum. Despite these challenges, the overwhelming demand for high-performance, private wireless solutions, coupled with the inherent advantages of MulteFire technology, positions it for sustained and significant growth throughout the forecast period of 2025-2033.

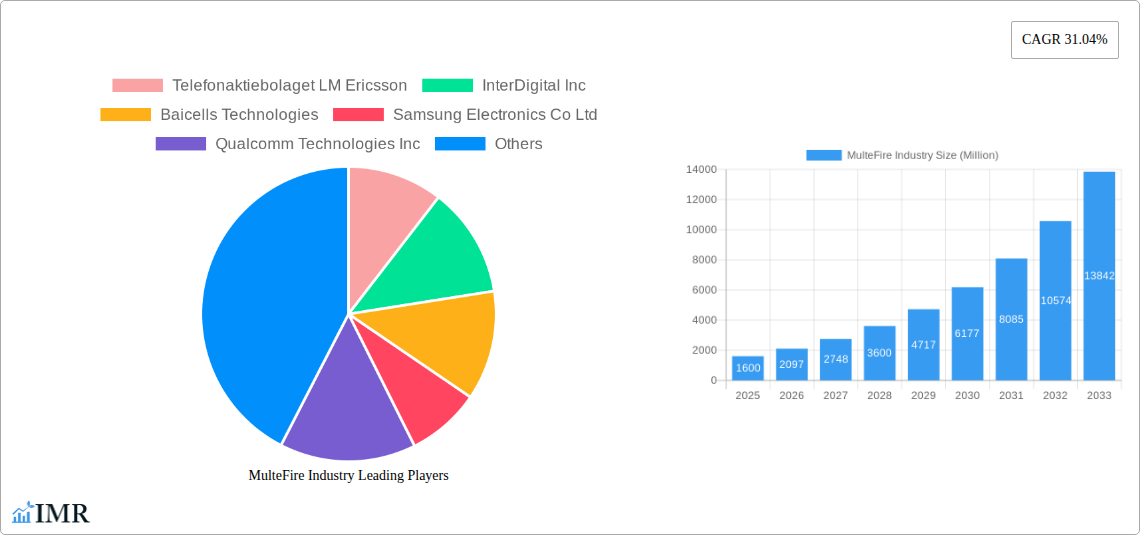

MulteFire Industry Company Market Share

This in-depth report provides a definitive analysis of the MulteFire industry, forecasting its trajectory from 2019 to 2033. We delve into market dynamics, growth trends, regional dominance, product innovations, key players, and emerging opportunities, offering actionable insights for industry professionals. The report leverages high-traffic keywords such as "MulteFire," "private LTE," "5G private networks," "small cells," "enterprise wireless," and "licensed shared spectrum" to ensure maximum search engine visibility. This report focuses on the parent market of enterprise wireless solutions and its child market, MulteFire, a crucial component for private network deployments.

MulteFire Industry Market Dynamics & Structure

The MulteFire industry exhibits a moderately consolidated market structure, driven by continuous technological innovation and a growing demand for private wireless networks. Key drivers include the need for enhanced capacity, improved reliability, and secure connectivity in enterprise environments. Regulatory frameworks, particularly those concerning licensed shared spectrum (LSS), play a pivotal role in shaping market access and deployment strategies. Competitive product substitutes, such as Wi-Fi 6E and other private cellular solutions, present a dynamic competitive landscape. End-user demographics are rapidly shifting towards enterprises seeking dedicated networks for critical applications. Mergers and acquisitions (M&A) trends are expected to intensify as larger players seek to consolidate their market position and expand their MulteFire portfolios.

- Market Concentration: Moderate, with a few key players dominating specialized segments.

- Technological Innovation Drivers: Demand for high-bandwidth, low-latency applications, IoT proliferation, and the need for spectrum efficiency.

- Regulatory Frameworks: Essential for defining spectrum access and operational guidelines for licensed shared spectrum.

- Competitive Product Substitutes: Wi-Fi 6E, other private LTE/5G solutions.

- End-User Demographics: Increasing adoption by enterprises across various verticals seeking private network solutions.

- M&A Trends: Expected to increase as companies aim for market consolidation and expanded offerings.

MulteFire Industry Growth Trends & Insights

The MulteFire industry is poised for substantial growth, projected to expand significantly over the forecast period (2025–2033). This expansion is fueled by the increasing enterprise adoption of private LTE and 5G networks, driven by the demand for dedicated, high-performance wireless connectivity. The market size evolution will be characterized by a steady upward trend as more organizations recognize the benefits of MulteFire, including improved operational efficiency, enhanced security, and support for advanced applications like real-time data analytics and industrial automation. Adoption rates for MulteFire solutions are expected to accelerate, particularly in sectors like manufacturing, logistics, and public safety, where mission-critical communication is paramount.

Technological disruptions, such as advancements in small cell technology and integrated access and backhaul (IAB) solutions, will further propel market growth. Consumer behavior shifts, particularly within the enterprise segment, are leaning towards solutions that offer greater control over network performance, security, and data privacy. This shift directly benefits MulteFire, which provides these advantages over public networks. The compound annual growth rate (CAGR) for the MulteFire market is anticipated to be robust, reflecting the increasing penetration of these private wireless networks into diverse business operations. The estimated market size for MulteFire in the base year 2025 is projected to be in the range of 250 million units, with a projected CAGR of approximately 18% during the forecast period.

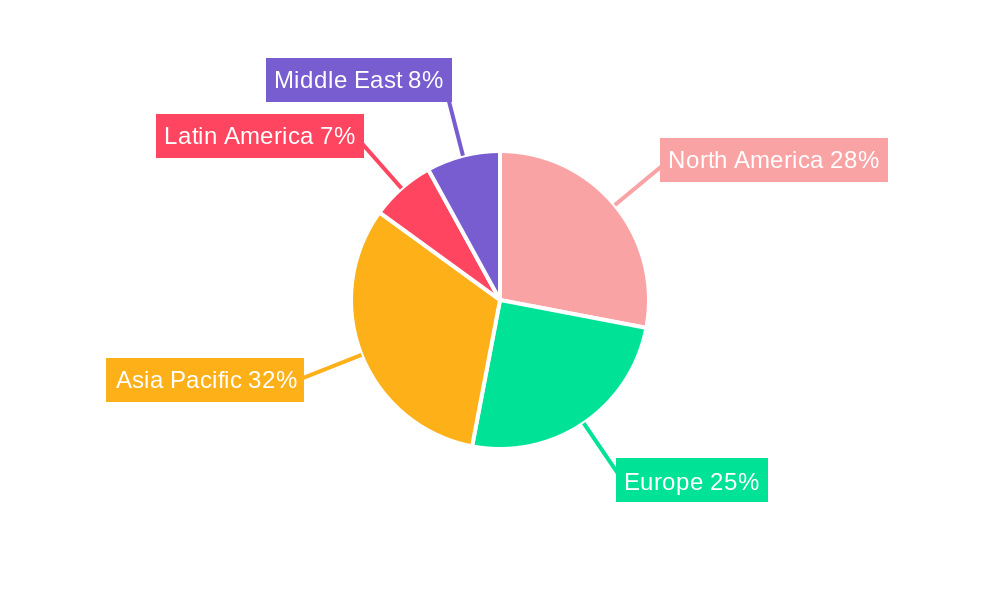

Dominant Regions, Countries, or Segments in MulteFire Industry

North America is anticipated to emerge as a dominant region in the MulteFire industry, driven by strong economic policies, advanced technological infrastructure, and a high concentration of enterprises actively exploring private wireless solutions. The United States, in particular, will lead this dominance due to early adoption of 5G technologies and a robust ecosystem of mobile network operators and enterprise solution providers. Economic policies that encourage private network deployments and the availability of licensed shared spectrum further bolster growth.

From an Equipment Type perspective, Small Cells will be the dominant segment. This is attributed to their crucial role in providing localized, high-capacity wireless coverage essential for private enterprise networks. Their scalability and ease of deployment in various environments make them ideal for MulteFire applications.

In terms of End User Verticals, Commercial & Institutional Buildings are expected to exhibit the highest adoption. This encompasses a broad range of sectors including corporate offices, educational institutions, and government facilities, all of which require secure, reliable, and high-performance wireless connectivity for their operations. The need for enhanced communication within these environments, supporting everything from employee productivity to building management systems, positions them as a prime market for MulteFire.

- Leading Region: North America, with the United States at the forefront.

- Key Drivers: Favorable economic policies, advanced technological infrastructure, strong enterprise demand, early 5G adoption.

- Dominant Equipment Type: Small Cells.

- Growth Potential: High due to their critical role in providing localized coverage and capacity for private networks.

- Dominant End User Vertical: Commercial & Institutional Buildings.

- Market Share: Significant and growing, driven by the need for secure and high-performance enterprise wireless.

- Growth Potential: Excellent, as these sectors increasingly rely on private networks for operational efficiency.

MulteFire Industry Product Landscape

The MulteFire product landscape is characterized by innovative small cell solutions designed for private LTE and 5G deployments. These products offer enhanced performance metrics such as reduced latency, increased throughput, and improved spectral efficiency, crucial for demanding enterprise applications. Key innovations include compact, easily deployable small cell units that integrate seamlessly into existing infrastructure, offering flexible deployment options. Applications range from providing dedicated wireless coverage in factories and warehouses to enabling critical communications in ports and airports. Unique selling propositions often revolve around ease of integration, cost-effectiveness compared to public network upgrades, and robust security features tailored for enterprise needs. Technological advancements are also focused on simplified network management and integration with IT infrastructure.

Key Drivers, Barriers & Challenges in MulteFire Industry

Key Drivers:

- Growing Demand for Private Wireless Networks: Enterprises increasingly seek dedicated, secure, and high-performance connectivity solutions.

- Technological Advancements: Evolution of 5G and LTE technologies, coupled with improvements in small cell capabilities, drives adoption.

- IoT Proliferation: The massive increase in IoT devices requires robust and scalable wireless infrastructure.

- Spectrum Availability: Licensed Shared Spectrum (LSS) models provide a viable path for enterprises to deploy their own networks.

- Enhanced Security and Control: Private networks offer superior data security and control compared to public networks.

Barriers & Challenges:

- Spectrum Regulation Complexity: Navigating regulatory frameworks for LSS can be challenging.

- Integration with Existing Infrastructure: Seamless integration with existing IT and operational technology (OT) systems can be complex and costly.

- Skilled Workforce Shortage: A lack of skilled professionals for deployment, management, and maintenance of private networks.

- Initial Deployment Costs: While cost-effective in the long run, initial investment in hardware and deployment can be a barrier for some SMEs.

- Interoperability and Standardization: Ensuring interoperability between different vendors' equipment remains a concern.

Emerging Opportunities in MulteFire Industry

Emerging opportunities in the MulteFire industry lie in the expansion of private wireless networks into underserved industrial sectors, such as agriculture and mining, where reliable connectivity is critical for automation and data collection. Innovative applications like real-time asset tracking, predictive maintenance powered by AI and edge computing, and enhanced worker safety solutions present significant growth avenues. Evolving consumer preferences within the enterprise space point towards fully managed private network-as-a-service (NaaS) models, reducing upfront investment and operational burden for businesses. Furthermore, the integration of MulteFire with public 5G networks through network slicing offers hybrid solutions for enterprises with diverse connectivity needs.

Growth Accelerators in the MulteFire Industry Industry

Catalysts driving long-term growth in the MulteFire industry include significant technological breakthroughs in cellular technology, particularly in 5G NR (New Radio) capabilities that enhance capacity and reduce latency for enterprise applications. Strategic partnerships between mobile network operators, infrastructure vendors, and vertical-specific solution providers are crucial for accelerating market penetration and developing tailored offerings. Market expansion strategies, such as targeting new industry verticals and geographies, coupled with the development of simplified deployment and management tools, will further fuel growth. The ongoing commitment to research and development in areas like AI-driven network optimization and advanced security protocols will also act as key growth accelerators.

Key Players Shaping the MulteFire Industry Market

- Telefonaktiebolaget LM Ericsson

- InterDigital Inc

- Baicells Technologies

- Samsung Electronics Co Ltd

- Qualcomm Technologies Inc

- DEKRA India Private Limited

- Huawei Technologies Co Ltd

- Nokia Corporation

- Intel Corporation

- Sony Corporation

Notable Milestones in MulteFire Industry Sector

- February 2023: Verana Networks, a mmWave small cells startup, published parameters of a new trial with Verizon, making Verizon a strategic investor. Verana's mmWave small cells, enabling Integrated Access and Backhaul, are undergoing field tests.

In-Depth MulteFire Industry Market Outlook

The future market potential for the MulteFire industry is exceptionally bright, driven by the irreversible trend towards private wireless solutions for enterprises. Growth accelerators will continue to empower this expansion, with technological breakthroughs in 5G and beyond, coupled with strategic partnerships, creating a fertile ground for innovation. Market expansion strategies, including the development of simplified, subscription-based service models and a focus on emerging industrial applications, will broaden the appeal of MulteFire. Strategic opportunities abound for vendors who can offer end-to-end solutions, from spectrum management to device integration and ongoing network support, catering to the increasing demand for robust, secure, and high-performance private networks across all industry verticals. The estimated market size in 2025 is 250 million units, projected to grow significantly through 2033.

MulteFire Industry Segmentation

-

1. Equipment Type

- 1.1. Small Cells

- 1.2. Switches

- 1.3. Controllers

-

2. End User Vertical

- 2.1. Commercial & Institutional Buildings

- 2.2. Supply Chain and Distribution

- 2.3. Retail

- 2.4. Hospitality

- 2.5. Public Venues

- 2.6. Healthcare

- 2.7. Others

MulteFire Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

- 5. Middle East

-

6. United Arab Emirates

- 6.1. Saudi Arabia

- 6.2. Rest of Middle East

MulteFire Industry Regional Market Share

Geographic Coverage of MulteFire Industry

MulteFire Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Shared and Unlicensed Spectrum Bands; Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications; Low Cost of Deployment that doesn't Require Spectrum License

- 3.3. Market Restrains

- 3.3.1. Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel; Delay in Decision-Making Regarding Use of Shared Spectrum

- 3.4. Market Trends

- 3.4.1. Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 5.1.1. Small Cells

- 5.1.2. Switches

- 5.1.3. Controllers

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Commercial & Institutional Buildings

- 5.2.2. Supply Chain and Distribution

- 5.2.3. Retail

- 5.2.4. Hospitality

- 5.2.5. Public Venues

- 5.2.6. Healthcare

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East

- 5.3.6. United Arab Emirates

- 5.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6. North America MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 6.1.1. Small Cells

- 6.1.2. Switches

- 6.1.3. Controllers

- 6.2. Market Analysis, Insights and Forecast - by End User Vertical

- 6.2.1. Commercial & Institutional Buildings

- 6.2.2. Supply Chain and Distribution

- 6.2.3. Retail

- 6.2.4. Hospitality

- 6.2.5. Public Venues

- 6.2.6. Healthcare

- 6.2.7. Others

- 6.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7. Europe MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 7.1.1. Small Cells

- 7.1.2. Switches

- 7.1.3. Controllers

- 7.2. Market Analysis, Insights and Forecast - by End User Vertical

- 7.2.1. Commercial & Institutional Buildings

- 7.2.2. Supply Chain and Distribution

- 7.2.3. Retail

- 7.2.4. Hospitality

- 7.2.5. Public Venues

- 7.2.6. Healthcare

- 7.2.7. Others

- 7.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8. Asia Pacific MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 8.1.1. Small Cells

- 8.1.2. Switches

- 8.1.3. Controllers

- 8.2. Market Analysis, Insights and Forecast - by End User Vertical

- 8.2.1. Commercial & Institutional Buildings

- 8.2.2. Supply Chain and Distribution

- 8.2.3. Retail

- 8.2.4. Hospitality

- 8.2.5. Public Venues

- 8.2.6. Healthcare

- 8.2.7. Others

- 8.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9. Latin America MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 9.1.1. Small Cells

- 9.1.2. Switches

- 9.1.3. Controllers

- 9.2. Market Analysis, Insights and Forecast - by End User Vertical

- 9.2.1. Commercial & Institutional Buildings

- 9.2.2. Supply Chain and Distribution

- 9.2.3. Retail

- 9.2.4. Hospitality

- 9.2.5. Public Venues

- 9.2.6. Healthcare

- 9.2.7. Others

- 9.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10. Middle East MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 10.1.1. Small Cells

- 10.1.2. Switches

- 10.1.3. Controllers

- 10.2. Market Analysis, Insights and Forecast - by End User Vertical

- 10.2.1. Commercial & Institutional Buildings

- 10.2.2. Supply Chain and Distribution

- 10.2.3. Retail

- 10.2.4. Hospitality

- 10.2.5. Public Venues

- 10.2.6. Healthcare

- 10.2.7. Others

- 10.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11. United Arab Emirates MulteFire Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 11.1.1. Small Cells

- 11.1.2. Switches

- 11.1.3. Controllers

- 11.2. Market Analysis, Insights and Forecast - by End User Vertical

- 11.2.1. Commercial & Institutional Buildings

- 11.2.2. Supply Chain and Distribution

- 11.2.3. Retail

- 11.2.4. Hospitality

- 11.2.5. Public Venues

- 11.2.6. Healthcare

- 11.2.7. Others

- 11.1. Market Analysis, Insights and Forecast - by Equipment Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Telefonaktiebolaget LM Ericsson

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 InterDigital Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Baicells Technologies

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Samsung Electronics Co Ltd

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Qualcomm Technologies Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 DEKRA India Private Limited*List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Huawei Technologies Co Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nokia Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Intel Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Sony Corporation

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Telefonaktiebolaget LM Ericsson

List of Figures

- Figure 1: Global MulteFire Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 3: North America MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 4: North America MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 5: North America MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 6: North America MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 9: Europe MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 10: Europe MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 11: Europe MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 12: Europe MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 15: Asia Pacific MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 16: Asia Pacific MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 17: Asia Pacific MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 18: Asia Pacific MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 21: Latin America MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 22: Latin America MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 23: Latin America MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 24: Latin America MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 27: Middle East MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 28: Middle East MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 29: Middle East MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 30: Middle East MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East MulteFire Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: United Arab Emirates MulteFire Industry Revenue (Million), by Equipment Type 2025 & 2033

- Figure 33: United Arab Emirates MulteFire Industry Revenue Share (%), by Equipment Type 2025 & 2033

- Figure 34: United Arab Emirates MulteFire Industry Revenue (Million), by End User Vertical 2025 & 2033

- Figure 35: United Arab Emirates MulteFire Industry Revenue Share (%), by End User Vertical 2025 & 2033

- Figure 36: United Arab Emirates MulteFire Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: United Arab Emirates MulteFire Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 2: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 3: Global MulteFire Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 5: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 6: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 10: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 11: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Germany MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: United Kingdom MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: France MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of Europe MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 17: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 18: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: India MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: China MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Japan MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Rest of Asia Pacific MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 24: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 25: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Brazil MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Argentina MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Latin America MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 30: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 31: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global MulteFire Industry Revenue Million Forecast, by Equipment Type 2020 & 2033

- Table 33: Global MulteFire Industry Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 34: Global MulteFire Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 35: Saudi Arabia MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East MulteFire Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the MulteFire Industry?

The projected CAGR is approximately 31.04%.

2. Which companies are prominent players in the MulteFire Industry?

Key companies in the market include Telefonaktiebolaget LM Ericsson, InterDigital Inc, Baicells Technologies, Samsung Electronics Co Ltd, Qualcomm Technologies Inc, DEKRA India Private Limited*List Not Exhaustive, Huawei Technologies Co Ltd, Nokia Corporation, Intel Corporation, Sony Corporation.

3. What are the main segments of the MulteFire Industry?

The market segments include Equipment Type, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.60 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Shared and Unlicensed Spectrum Bands; Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications; Low Cost of Deployment that doesn't Require Spectrum License.

6. What are the notable trends driving market growth?

Growing Demand for Better and More Scalable Network Connectivity for Industrial Internet of Things (IIoT) Applications.

7. Are there any restraints impacting market growth?

Disadvantage Compared to Wi-Fi Technologies in Accessing the Channel; Delay in Decision-Making Regarding Use of Shared Spectrum.

8. Can you provide examples of recent developments in the market?

February 2023 - Verana Networks, a mmWave small cells startup that The Mobile Network (TMN) profiled last year, has published parameters of a new trial with Verizon and made Verizon a strategic investor in the startup public for the initial time. Verana's mmWave small cells, installed to enable Integrated Access and Backhaul, will be put through field tests.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "MulteFire Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the MulteFire Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the MulteFire Industry?

To stay informed about further developments, trends, and reports in the MulteFire Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence