Key Insights

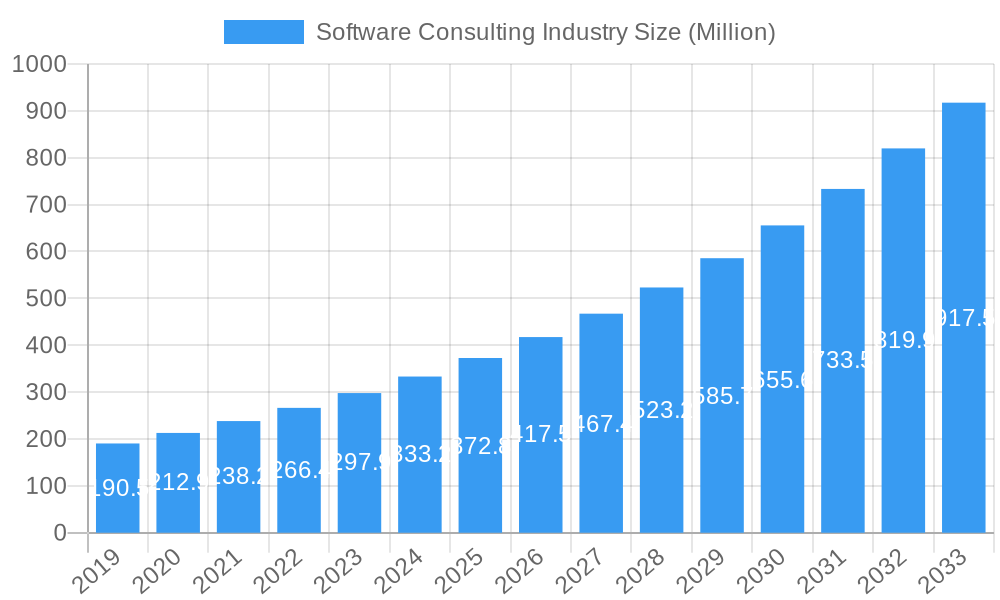

The global Software Consulting Industry is projected to achieve a market size of 759.6 billion by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 3.2% through 2033. This significant expansion is propelled by the escalating demand for specialized digital transformation services across diverse sectors. Key growth accelerators include businesses' imperative to implement advanced technologies like Cloud Computing, Data Analytics, and Artificial Intelligence (AI) to enhance operational efficiency and secure a competitive advantage. The growing need for robust Cybersecurity consulting further supports market growth as organizations address evolving cyber threats. Application development remains a core service, with companies continually seeking innovative software solutions tailored to their specific business requirements.

Software Consulting Industry Market Size (In Billion)

The market exhibits robust growth in segments such as Cloud Computing, driven by businesses migrating to cloud-based infrastructure for scalability and cost-effectiveness. AI consulting is another prominent growth area, as enterprises utilize AI for predictive analytics, automation, and enhanced customer experiences. The Financial Services and Healthcare sectors are at the forefront of adopting software consulting services, followed by Manufacturing and Retail, all focused on optimizing processes and customer engagement through technology. Small and Medium-sized Businesses (SMBs) increasingly recognize the strategic value of expert software consulting to compete effectively. Market dynamics are influenced by leading industry players actively shaping the landscape with comprehensive service offerings. Potential challenges include a shortage of skilled software consultants and the initial investment costs for new technology adoption.

Software Consulting Industry Company Market Share

This report provides an in-depth analysis of the dynamic Software Consulting Industry, examining market trends, growth projections, and competitive landscapes. Covering the period from the base year 2025 to 2033, this report offers critical insights for stakeholders navigating and capitalizing on the evolving IT consulting services market. We meticulously analyze key segments including application development, cloud computing, data analytics, AI, and cybersecurity consulting, alongside their adoption across vital industries such as financial services, healthcare, manufacturing, and technology. The report also examines the impact of software consulting for SMBs versus enterprise and government IT consulting.

Software Consulting Industry Market Dynamics & Structure

The software consulting market is characterized by moderate to high concentration, driven by the significant market share held by major players like Accenture PLC, IBM, and Cognizant. Technological innovation serves as a primary engine, with advancements in AI, cloud computing, and data analytics continuously reshaping service offerings and client demands. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR, CCPA) and cybersecurity, significantly influence service delivery and compliance strategies. Competitive product substitutes are emerging in the form of automated consulting platforms and in-house development teams, posing a challenge to traditional consulting models. End-user demographics range from tech-savvy startups to large enterprises with complex legacy systems, each requiring tailored solutions. Mergers and Acquisitions (M&A) remain a crucial strategy for market expansion and capability enhancement.

- Market Concentration: Dominated by a few large players with significant global reach and specialized expertise.

- Technological Innovation Drivers: AI-driven insights, cloud migration, IoT integration, and advanced analytics are paramount.

- Regulatory Frameworks: Data protection, cybersecurity mandates, and industry-specific compliance standards are critical.

- Competitive Product Substitutes: Rise of low-code/no-code platforms, SaaS solutions, and internal IT development capabilities.

- End-User Demographics: Diverse, from agile startups to risk-averse financial institutions and healthcare providers.

- M&A Trends: Strategic acquisitions to bolster AI, cloud, and cybersecurity portfolios; focus on niche expertise.

Software Consulting Industry Growth Trends & Insights

The global software consulting market is poised for robust expansion, driven by the accelerating digital transformation initiatives across all industries. Market size is projected to witness a substantial Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates for specialized services like AI consulting and cybersecurity consulting are surging as businesses prioritize data-driven decision-making and robust threat mitigation. Technological disruptions, including the pervasive adoption of cloud-native architectures and the increasing sophistication of AI algorithms, are redefining the scope and impact of software consulting. Consumer behavior shifts are evident in the growing demand for agile, outcome-based consulting engagements and a preference for providers with proven track records in delivering measurable business value. The integration of DevOps consulting and agile software development methodologies further enhances service delivery efficiency.

- Market Size Evolution: Significant growth driven by digital transformation and technology adoption.

- Adoption Rates: High for cloud, data analytics, AI, and cybersecurity services.

- Technological Disruptions: Cloud computing, AI/ML, big data, and automation are key disruptors.

- Consumer Behavior Shifts: Demand for agile, outcome-driven, and value-focused consulting solutions.

- CAGR: Projected at XX% for the forecast period.

- Market Penetration: Deepening across all industry verticals, with increasing focus on specialized niche areas.

Dominant Regions, Countries, or Segments in Software Consulting Industry

The North America software consulting market stands out as a dominant region, fueled by its advanced technological infrastructure, a high concentration of innovative technology companies, and substantial investments in R&D. The United States, in particular, leads due to its strong demand for cloud computing consulting and AI consulting from its thriving technology and financial services sectors. Within the service segments, application development continues to be a cornerstone, but cloud computing and data analytics are experiencing exponential growth, reflecting the imperative for businesses to modernize their IT landscapes and leverage data for strategic advantage. Cybersecurity consulting is also witnessing unparalleled demand due to escalating cyber threats.

In terms of industries, the financial services sector remains a major consumer of software consulting services, driven by regulatory pressures, the need for digital innovation, and robust data management. The healthcare industry is increasingly adopting software consulting for electronic health records, telemedicine platforms, and data analytics to improve patient care and operational efficiency. For company sizes, large enterprises represent the largest segment, owing to their complex IT needs and substantial budgets. However, small and medium-sized businesses (SMBs) are increasingly recognizing the value of specialized software consulting to compete effectively in the digital age. Government agencies are also significant clients, particularly for cybersecurity consulting and the modernization of public services.

- Leading Region: North America, specifically the United States.

- Key Service Segments: Application development, Cloud computing, Data analytics, AI consulting, Cybersecurity consulting.

- Dominant Industries: Financial services, Healthcare, Technology.

- Company Size Dominance: Large enterprises, followed by SMBs and Government agencies.

- Growth Potential: High in emerging economies and specialized service niches.

- Drivers of Dominance: Innovation hubs, skilled talent pools, government initiatives, and strong investment in technology.

Software Consulting Industry Product Landscape

The software consulting industry's product landscape is characterized by a sophisticated array of services designed to address complex business challenges. These include custom application development, cloud migration strategies, big data analytics solutions, AI-powered automation tools, and comprehensive cybersecurity frameworks. Performance metrics revolve around delivering tangible business outcomes such as increased operational efficiency, improved customer engagement, enhanced data-driven decision-making, and strengthened security postures. Unique selling propositions often lie in specialized industry expertise, proprietary methodologies, and the ability to integrate cutting-edge technologies like blockchain and IoT into client solutions. Technological advancements are continuously pushing the boundaries, enabling more predictive and prescriptive analytics, hyper-personalized user experiences, and proactive threat detection and response.

Key Drivers, Barriers & Challenges in Software Consulting Industry

The software consulting industry is propelled by several key drivers. The accelerating pace of digital transformation across all sectors is paramount, necessitating expert guidance in adopting new technologies. The increasing complexity of IT infrastructures and the growing demand for specialized skills in areas like AI and cloud computing further fuel demand. Government initiatives promoting digital adoption and cybersecurity are also significant accelerators. Furthermore, the competitive pressure to innovate and optimize operations drives businesses to seek external expertise.

However, the industry faces notable barriers and challenges. The shortage of highly skilled IT professionals, particularly in niche areas, can hamper service delivery. Intense competition from both established players and newer, specialized firms can lead to price erosion. Additionally, clients' resistance to change and the perceived high cost of consulting services can act as restraints. Supply chain issues for certain hardware or cloud infrastructure components can indirectly affect project timelines. Regulatory hurdles, especially in data-intensive industries, require constant vigilance and adaptation.

- Key Drivers: Digital transformation imperative, demand for specialized expertise, government support, competitive pressures.

- Barriers & Challenges: Talent shortages, intense competition, client resistance to change, perceived high costs, regulatory compliance complexities.

- Quantifiable Impacts: Talent shortages can lead to extended project timelines, impacting revenue and client satisfaction. Regulatory changes can necessitate significant rework and additional consulting hours.

Emerging Opportunities in Software Consulting Industry

Emerging opportunities in the software consulting industry are abundant and ripe for exploration. The growing adoption of AI consulting for hyper-automation and intelligent process optimization presents a significant growth avenue. The ongoing expansion of cloud-native development and multi-cloud strategies creates continuous demand for expert guidance in cloud architecture, migration, and management. Furthermore, the increasing focus on sustainability and ESG (Environmental, Social, and Governance) goals is opening doors for specialized consulting services in green IT and sustainable software development. The metaverse and Web3 technologies also represent nascent but rapidly developing areas where software consulting will play a crucial role in developing immersive experiences and decentralized applications.

Growth Accelerators in the Software Consulting Industry Industry

Several catalysts are accelerating the growth of the software consulting industry. The rapid evolution of artificial intelligence and machine learning technologies provides constant opportunities for consulting firms to develop and implement innovative solutions for their clients, driving significant demand for AI consulting services. Strategic partnerships between consulting firms and major technology providers, such as the collaboration between Accenture and Google Cloud, enhance service offerings and market reach, fostering significant growth. The increasing globalization of businesses also necessitates cross-border IT consulting expertise, expanding the addressable market. Furthermore, the continuous push for digital transformation across all industry verticals, from healthcare software consulting to manufacturing software consulting, ensures a sustained demand for specialized software consulting services.

Key Players Shaping the Software Consulting Industry Market

- Accenture PLC

- Cognizant

- Rapport IT

- Atos SE

- Oracle Corporation

- Capgemini

- Clearfind

- IBM

- CGI Group Inc

- SAP SE

Notable Milestones in Software Consulting Industry Sector

- October 2022: Capgemini signed an agreement to acquire Quantmetry to strengthen France's AI and data consulting capabilities.

- October 2022: CGI and Aktia have established a strategic agreement under which CGI will be responsible for a significant portion of Aktia's banking IT services, including the development and uptake of 150 mission-critical applications.

- August 2022: Accenture partnered with Google Cloud to develop new solutions using data and AI and providing enhanced support to help clients to build a strong digital core and reinvent their enterprises on the cloud.

- November 2022: Cognizant collaborated with Microsoft, working more closely to develop a new solution that will speed up digital and sustainability transitions.

In-Depth Software Consulting Industry Market Outlook

The future outlook for the software consulting industry is exceptionally promising, characterized by sustained high growth and evolving service demands. Key growth accelerators will include the deeper integration of AI and machine learning across all business functions, the continued migration to and optimization of cloud environments, and the ever-increasing importance of robust cybersecurity solutions. Emerging opportunities in areas like quantum computing and the industrial metaverse will further diversify the consulting landscape. Strategic partnerships and a focus on niche specializations will remain critical for market leaders. The industry is expected to play an indispensable role in helping businesses navigate technological complexities and achieve strategic objectives in an increasingly digital-first world.

Software Consulting Industry Segmentation

-

1. Service

- 1.1. Application development

- 1.2. Cloud computing

- 1.3. Data analytics

- 1.4. AI consulting

- 1.5. Cybersecurity consulting

- 1.6. Other specialized services

-

2. Industry

- 2.1. Financial services

- 2.2. Healthcare

- 2.3. Manufacturing

- 2.4. Retail

- 2.5. Technology

- 2.6. Other industry verticals

-

3. Company size

- 3.1. Small and medium-sized businesses (SMBs)

- 3.2. Large enterprises

- 3.3. Government agencies

Software Consulting Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Software Consulting Industry Regional Market Share

Geographic Coverage of Software Consulting Industry

Software Consulting Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shifting technology preference toward cloud computing and data analytics; Growing adoption of software consulting for improving operational efficiency

- 3.3. Market Restrains

- 3.3.1. Growing concerns over cybersecurity

- 3.4. Market Trends

- 3.4.1. Increasing demad for digital solutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Software Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Application development

- 5.1.2. Cloud computing

- 5.1.3. Data analytics

- 5.1.4. AI consulting

- 5.1.5. Cybersecurity consulting

- 5.1.6. Other specialized services

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Financial services

- 5.2.2. Healthcare

- 5.2.3. Manufacturing

- 5.2.4. Retail

- 5.2.5. Technology

- 5.2.6. Other industry verticals

- 5.3. Market Analysis, Insights and Forecast - by Company size

- 5.3.1. Small and medium-sized businesses (SMBs)

- 5.3.2. Large enterprises

- 5.3.3. Government agencies

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Software Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Application development

- 6.1.2. Cloud computing

- 6.1.3. Data analytics

- 6.1.4. AI consulting

- 6.1.5. Cybersecurity consulting

- 6.1.6. Other specialized services

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Financial services

- 6.2.2. Healthcare

- 6.2.3. Manufacturing

- 6.2.4. Retail

- 6.2.5. Technology

- 6.2.6. Other industry verticals

- 6.3. Market Analysis, Insights and Forecast - by Company size

- 6.3.1. Small and medium-sized businesses (SMBs)

- 6.3.2. Large enterprises

- 6.3.3. Government agencies

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Software Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Application development

- 7.1.2. Cloud computing

- 7.1.3. Data analytics

- 7.1.4. AI consulting

- 7.1.5. Cybersecurity consulting

- 7.1.6. Other specialized services

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Financial services

- 7.2.2. Healthcare

- 7.2.3. Manufacturing

- 7.2.4. Retail

- 7.2.5. Technology

- 7.2.6. Other industry verticals

- 7.3. Market Analysis, Insights and Forecast - by Company size

- 7.3.1. Small and medium-sized businesses (SMBs)

- 7.3.2. Large enterprises

- 7.3.3. Government agencies

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Software Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Application development

- 8.1.2. Cloud computing

- 8.1.3. Data analytics

- 8.1.4. AI consulting

- 8.1.5. Cybersecurity consulting

- 8.1.6. Other specialized services

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Financial services

- 8.2.2. Healthcare

- 8.2.3. Manufacturing

- 8.2.4. Retail

- 8.2.5. Technology

- 8.2.6. Other industry verticals

- 8.3. Market Analysis, Insights and Forecast - by Company size

- 8.3.1. Small and medium-sized businesses (SMBs)

- 8.3.2. Large enterprises

- 8.3.3. Government agencies

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Software Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Application development

- 9.1.2. Cloud computing

- 9.1.3. Data analytics

- 9.1.4. AI consulting

- 9.1.5. Cybersecurity consulting

- 9.1.6. Other specialized services

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Financial services

- 9.2.2. Healthcare

- 9.2.3. Manufacturing

- 9.2.4. Retail

- 9.2.5. Technology

- 9.2.6. Other industry verticals

- 9.3. Market Analysis, Insights and Forecast - by Company size

- 9.3.1. Small and medium-sized businesses (SMBs)

- 9.3.2. Large enterprises

- 9.3.3. Government agencies

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Software Consulting Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Application development

- 10.1.2. Cloud computing

- 10.1.3. Data analytics

- 10.1.4. AI consulting

- 10.1.5. Cybersecurity consulting

- 10.1.6. Other specialized services

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Financial services

- 10.2.2. Healthcare

- 10.2.3. Manufacturing

- 10.2.4. Retail

- 10.2.5. Technology

- 10.2.6. Other industry verticals

- 10.3. Market Analysis, Insights and Forecast - by Company size

- 10.3.1. Small and medium-sized businesses (SMBs)

- 10.3.2. Large enterprises

- 10.3.3. Government agencies

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accenture PLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Cognizant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rapport IT

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Atos SE

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oracle Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Capgemini

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Clearfind

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 IBM

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CGI Group Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 SAP SE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accenture PLC

List of Figures

- Figure 1: Global Software Consulting Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Software Consulting Industry Revenue (billion), by Service 2025 & 2033

- Figure 3: North America Software Consulting Industry Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Software Consulting Industry Revenue (billion), by Industry 2025 & 2033

- Figure 5: North America Software Consulting Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Software Consulting Industry Revenue (billion), by Company size 2025 & 2033

- Figure 7: North America Software Consulting Industry Revenue Share (%), by Company size 2025 & 2033

- Figure 8: North America Software Consulting Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Software Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Software Consulting Industry Revenue (billion), by Service 2025 & 2033

- Figure 11: Europe Software Consulting Industry Revenue Share (%), by Service 2025 & 2033

- Figure 12: Europe Software Consulting Industry Revenue (billion), by Industry 2025 & 2033

- Figure 13: Europe Software Consulting Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 14: Europe Software Consulting Industry Revenue (billion), by Company size 2025 & 2033

- Figure 15: Europe Software Consulting Industry Revenue Share (%), by Company size 2025 & 2033

- Figure 16: Europe Software Consulting Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Software Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Software Consulting Industry Revenue (billion), by Service 2025 & 2033

- Figure 19: Asia Pacific Software Consulting Industry Revenue Share (%), by Service 2025 & 2033

- Figure 20: Asia Pacific Software Consulting Industry Revenue (billion), by Industry 2025 & 2033

- Figure 21: Asia Pacific Software Consulting Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 22: Asia Pacific Software Consulting Industry Revenue (billion), by Company size 2025 & 2033

- Figure 23: Asia Pacific Software Consulting Industry Revenue Share (%), by Company size 2025 & 2033

- Figure 24: Asia Pacific Software Consulting Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Software Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Software Consulting Industry Revenue (billion), by Service 2025 & 2033

- Figure 27: Latin America Software Consulting Industry Revenue Share (%), by Service 2025 & 2033

- Figure 28: Latin America Software Consulting Industry Revenue (billion), by Industry 2025 & 2033

- Figure 29: Latin America Software Consulting Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Latin America Software Consulting Industry Revenue (billion), by Company size 2025 & 2033

- Figure 31: Latin America Software Consulting Industry Revenue Share (%), by Company size 2025 & 2033

- Figure 32: Latin America Software Consulting Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Latin America Software Consulting Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Software Consulting Industry Revenue (billion), by Service 2025 & 2033

- Figure 35: Middle East and Africa Software Consulting Industry Revenue Share (%), by Service 2025 & 2033

- Figure 36: Middle East and Africa Software Consulting Industry Revenue (billion), by Industry 2025 & 2033

- Figure 37: Middle East and Africa Software Consulting Industry Revenue Share (%), by Industry 2025 & 2033

- Figure 38: Middle East and Africa Software Consulting Industry Revenue (billion), by Company size 2025 & 2033

- Figure 39: Middle East and Africa Software Consulting Industry Revenue Share (%), by Company size 2025 & 2033

- Figure 40: Middle East and Africa Software Consulting Industry Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Software Consulting Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Software Consulting Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Global Software Consulting Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 3: Global Software Consulting Industry Revenue billion Forecast, by Company size 2020 & 2033

- Table 4: Global Software Consulting Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Software Consulting Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 6: Global Software Consulting Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 7: Global Software Consulting Industry Revenue billion Forecast, by Company size 2020 & 2033

- Table 8: Global Software Consulting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Software Consulting Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 10: Global Software Consulting Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 11: Global Software Consulting Industry Revenue billion Forecast, by Company size 2020 & 2033

- Table 12: Global Software Consulting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Software Consulting Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 14: Global Software Consulting Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 15: Global Software Consulting Industry Revenue billion Forecast, by Company size 2020 & 2033

- Table 16: Global Software Consulting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Software Consulting Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 18: Global Software Consulting Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 19: Global Software Consulting Industry Revenue billion Forecast, by Company size 2020 & 2033

- Table 20: Global Software Consulting Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Global Software Consulting Industry Revenue billion Forecast, by Service 2020 & 2033

- Table 22: Global Software Consulting Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 23: Global Software Consulting Industry Revenue billion Forecast, by Company size 2020 & 2033

- Table 24: Global Software Consulting Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Software Consulting Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Software Consulting Industry?

Key companies in the market include Accenture PLC, Cognizant, Rapport IT, Atos SE, Oracle Corporation, Capgemini, Clearfind, IBM, CGI Group Inc, SAP SE.

3. What are the main segments of the Software Consulting Industry?

The market segments include Service , Industry, Company size .

4. Can you provide details about the market size?

The market size is estimated to be USD 759.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Shifting technology preference toward cloud computing and data analytics; Growing adoption of software consulting for improving operational efficiency.

6. What are the notable trends driving market growth?

Increasing demad for digital solutions.

7. Are there any restraints impacting market growth?

Growing concerns over cybersecurity.

8. Can you provide examples of recent developments in the market?

October 2022 - Capgemini signed an agreement to acquire Quantmetry to strengthen France's AI and data consulting capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Software Consulting Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Software Consulting Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Software Consulting Industry?

To stay informed about further developments, trends, and reports in the Software Consulting Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence