Key Insights

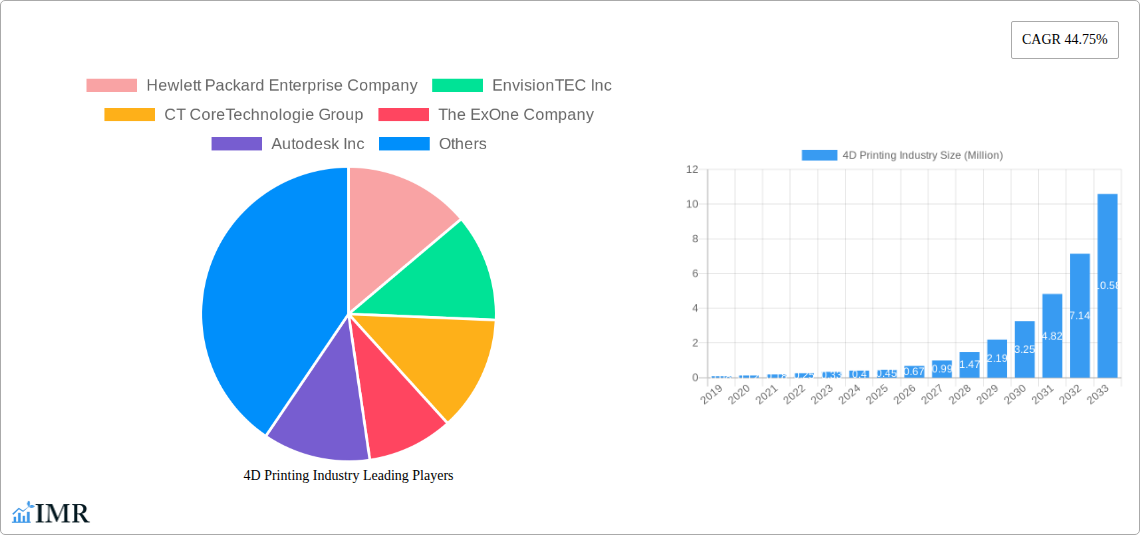

The global 4D printing market is poised for explosive growth, projected to reach an estimated \$0.45 million in 2025 and expand at an astonishing Compound Annual Growth Rate (CAGR) of 44.75% through 2033. This rapid expansion is fueled by significant advancements in programmable materials, including carbon fiber, textiles, and biomaterials, which enable printed objects to change shape, properties, or functionality over time in response to external stimuli like temperature, pH, or light. The medical sector is emerging as a dominant end-user, leveraging 4D printing for responsive implants, smart drug delivery systems, and personalized prosthetics. Aerospace and defense are also significant adopters, utilizing its potential for adaptive structures and lightweight, self-assembling components. The automotive industry is exploring 4D printing for smart interiors and components that can adapt to varying conditions. Key companies like Hewlett Packard Enterprise, Autodesk, and Stratasys are at the forefront of developing innovative materials and printing technologies, driving the market forward.

4D Printing Industry Market Size (In Million)

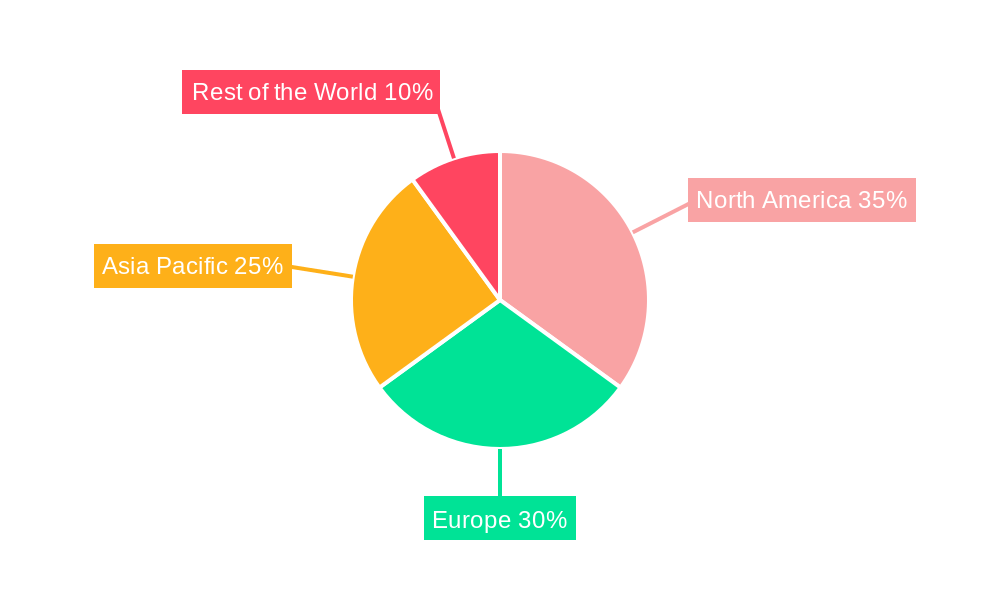

While the market exhibits immense promise, certain restraints need to be addressed. The high cost of specialized programmable materials and the complexity of manufacturing processes can impede widespread adoption. Furthermore, the need for rigorous testing and standardization for critical applications, especially in the medical and aerospace sectors, presents a developmental hurdle. However, ongoing research into novel materials and more efficient printing techniques, coupled with increasing investments in R&D, are expected to mitigate these challenges. Emerging trends such as the integration of AI and machine learning for material design and performance prediction, alongside the development of multi-material 4D printing, will further accelerate market penetration. Regions like North America and Europe are currently leading the adoption due to their robust research infrastructure and early investment in advanced manufacturing technologies. The Asia Pacific region is anticipated to witness substantial growth owing to increasing government initiatives supporting additive manufacturing and a burgeoning technology sector.

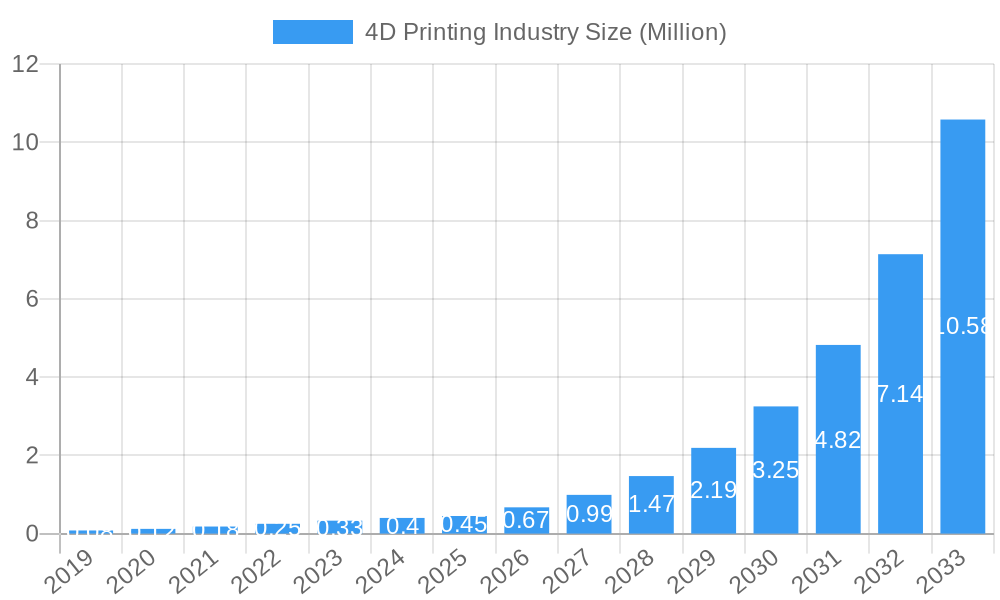

4D Printing Industry Company Market Share

This comprehensive report delves into the dynamic 4D printing industry, exploring its intricate market structure, growth trajectories, dominant segments, and the pivotal role of key players. With a focus on programmable materials, smart structures, and transformative applications, this analysis provides actionable insights for stakeholders navigating this rapidly evolving technological landscape. The study covers the historical period (2019–2024), base year (2025), and projects the forecast period (2025–2033), offering a detailed outlook on market evolution.

4D Printing Industry Market Dynamics & Structure

The 4D printing industry is characterized by a high degree of technological innovation, driving its rapid expansion. Market concentration is currently moderate, with a few key players investing heavily in research and development, alongside a growing number of startups focusing on niche applications. Technological innovation is primarily fueled by advancements in programmable materials, including programmable carbon fiber, programmable textiles, programmable bio material, and programmable wood, enabling materials to change shape, properties, or function over time in response to external stimuli. Regulatory frameworks are still nascent, presenting both opportunities for pioneering companies and potential hurdles for widespread adoption. Competitive product substitutes are limited, as 4D printing offers unique functionalities not replicable by traditional manufacturing methods. End-user demographics are diverse, with the medical, aerospace and defense, and automotive sectors showing significant early adoption. Mergers and acquisitions (M&A) are on the rise as larger companies seek to integrate 4D printing capabilities into their portfolios.

- Market Concentration: Moderate, with increasing R&D investment from established players and emerging startups.

- Technological Innovation Drivers: Advancements in stimuli-responsive polymers, smart materials, and advanced manufacturing processes.

- Regulatory Frameworks: Emerging, with a focus on material safety, standardization, and intellectual property protection.

- Competitive Product Substitutes: Limited, with 4D printing offering unique "smart" functionalities.

- End-User Demographics: Growing adoption in high-value sectors like healthcare, aerospace, and automotive, with increasing interest from consumer goods.

- M&A Trends: Active consolidation to acquire specialized expertise and intellectual property.

4D Printing Industry Growth Trends & Insights

The 4D printing industry is poised for substantial growth, driven by its inherent ability to create dynamic and responsive products. The market size is projected to expand significantly, transitioning from approximately $150 million in 2025 to an estimated $850 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 23.5%. Adoption rates are steadily increasing as industries recognize the potential of self-assembling, self-repairing, and shape-changing components. Technological disruptions are at the core of this growth, with continuous innovation in programmable materials enabling more complex functionalities and wider application scopes. Consumer behavior shifts are also playing a role, with a growing demand for personalized, adaptive, and sustainable products that 4D printing can facilitate. Early market penetration is observed in high-tech sectors, with significant potential for broader consumer applications as costs decrease and accessibility increases. The development of advanced software for designing and simulating 4D printed objects, coupled with improvements in printing hardware and material science, are crucial factors accelerating market penetration. Furthermore, the increasing focus on sustainable manufacturing practices aligns well with the potential for 4D printed products to reduce waste and enhance product lifecycles through adaptive functionality.

Dominant Regions, Countries, or Segments in 4D Printing Industry

The 4D printing industry is witnessing significant regional and segment-specific growth. North America, particularly the United States, is currently a dominant region due to its strong research and development ecosystem, substantial government funding for advanced manufacturing, and the presence of leading technology companies like Hewlett Packard Enterprise Company and Autodesk Inc. The medical segment, driven by applications in personalized medicine, prosthetics, and regenerative tissue engineering, is a leading end-user, projected to account for approximately 35% of the market by 2025. Within the Type of Programmable Material, programmable bio material is experiencing rapid growth due to its transformative potential in healthcare, with an estimated market share of 30% by 2025. The aerospace and defense sector is another key driver, with its demand for lightweight, adaptive components and structures, contributing an estimated 25% to the market in 2025.

- Leading Region: North America, propelled by innovation hubs and R&D investments.

- Dominant End User Segment: Medical applications, due to advancements in personalized healthcare and bio-printing.

- Market Share (2025): ~35%

- Key Drivers: Regenerative medicine, advanced prosthetics, smart drug delivery systems.

- Dominant Programmable Material Type: Programmable Bio material, enabling groundbreaking advancements in healthcare and biotechnology.

- Market Share (2025): ~30%

- Key Drivers: Biocompatibility, cellular integration, complex biological structures.

- Significant End User Segment: Aerospace and Defense, focusing on lightweight, adaptive, and high-performance components.

- Market Share (2025): ~25%

- Key Drivers: Adaptive structures, fuel efficiency, advanced robotics for space.

- Growing End User Segment: Automotive, for lightweighting, adaptive interiors, and smart components.

- Market Share (2025): ~10%

- Key Drivers: Vehicle customization, improved safety features, energy efficiency.

4D Printing Industry Product Landscape

The 4D printing industry is characterized by groundbreaking product innovations that move beyond static 3D printed objects to create dynamic and responsive structures. Products are designed to change their form, properties, or function over time in response to specific environmental triggers such as temperature, moisture, light, or pH. Key applications include self-assembling medical implants that adapt to the body, self-deploying aerospace components, and adaptive automotive interiors. The performance metrics of these products are evaluated not just on their initial physical attributes but also on their dynamic response capabilities, longevity of actuation, and integration with smart technologies.

Key Drivers, Barriers & Challenges in 4D Printing Industry

The 4D printing industry is propelled by several key drivers:

- Technological Advancements: Continuous innovation in smart materials and printing processes.

- Demand for Smart Products: Growing consumer and industry desire for adaptive and responsive functionality.

- High-Value Applications: Significant adoption in sectors like medical and aerospace where unique capabilities are critical.

- R&D Investment: Substantial funding from both private and public sectors for next-generation manufacturing.

However, the industry faces significant challenges and barriers:

- Material Science Limitations: Developing materials with predictable and repeatable actuation is complex.

- Scalability and Cost: High production costs and challenges in scaling up for mass manufacturing.

- Standardization and Testing: Lack of established industry standards for testing and validation.

- Regulatory Hurdles: Evolving regulations for novel materials and applications, particularly in the medical field.

- Supply Chain Complexities: Ensuring consistent quality and availability of specialized programmable materials.

- Skilled Workforce Gap: Need for specialized expertise in design, material science, and printing for 4D applications.

Emerging Opportunities in 4D Printing Industry

Emerging opportunities in the 4D printing industry lie in the development of novel applications for sustainable manufacturing, such as self-repairing infrastructure and waste-reducing adaptive packaging. The expansion into consumer electronics with self-configuring devices and the creation of smart textiles for wearable technology present untapped markets. Furthermore, the integration of artificial intelligence and machine learning for optimizing 4D print design and material behavior will unlock new possibilities. The growing demand for personalized and on-demand manufacturing in niche sectors also offers significant growth avenues.

Growth Accelerators in the 4D Printing Industry Industry

The long-term growth of the 4D printing industry is being accelerated by significant technological breakthroughs in material science, leading to more diverse and reliable programmable materials. Strategic partnerships between material manufacturers, printing companies, and end-users are fostering innovation and market adoption. For instance, collaborations to develop specialized programmable bio material for the medical field are crucial. Market expansion strategies, including the development of more accessible printing hardware and user-friendly design software, are crucial for broadening the industry's reach beyond early adopters. The increasing focus on sustainable solutions also acts as a powerful accelerator, as 4D printing offers inherent advantages in product longevity and reduced material waste.

Key Players Shaping the 4D Printing Industry Market

- Hewlett Packard Enterprise Company

- EnvisionTEC Inc

- CT CoreTechnologie Group

- The ExOne Company

- Autodesk Inc

- Organovo Holdings Inc

- Materialise NV

- Dassault Systemes SA

- Stratasys Ltd

Notable Milestones in 4D Printing Industry Sector

- June 2023: Zortrax, in cooperation with ESA, developed 4D printing technology for space applications using their M300 Dual FDM printer and a modified Z-SUITE software to print structures from shape memory polymers and electrically conductive materials.

In-Depth 4D Printing Industry Market Outlook

The future outlook for the 4D printing industry is exceptionally promising, driven by its capacity to revolutionize product design and functionality across multiple sectors. Growth accelerators, including continued advancements in stimuli-responsive materials, increased investment in R&D by key players like Stratasys Ltd and EnvisionTEC Inc, and the expanding adoption in high-value markets like medical and aerospace and defense, are setting a strong trajectory. Strategic partnerships and the development of more integrated design-to-manufacturing workflows will further unlock market potential. The industry is on the cusp of significant expansion, moving from niche applications to more widespread integration as technological maturity and cost-effectiveness improve, promising a future of intelligent, adaptive, and sustainable products.

4D Printing Industry Segmentation

-

1. Type of Programmable Material

- 1.1. Programmable Carbon Fiber

- 1.2. Programmable Textiles

- 1.3. Programmable Bio material

- 1.4. Programmable Wood

-

2. End User

- 2.1. Medical

- 2.2. Aerospace and Defense

- 2.3. Automotive

- 2.4. Other End Users

4D Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

4D Printing Industry Regional Market Share

Geographic Coverage of 4D Printing Industry

4D Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 44.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for Industry 4.0 and Emergence of Industry 5.0

- 3.3. Market Restrains

- 3.3.1. Wide Availability of Open Source CAM Software

- 3.4. Market Trends

- 3.4.1. Increase in Demand for Industry 4.0 and Emergence of Industry 5.0 to Drive the 4D Printing Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 5.1.1. Programmable Carbon Fiber

- 5.1.2. Programmable Textiles

- 5.1.3. Programmable Bio material

- 5.1.4. Programmable Wood

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Medical

- 5.2.2. Aerospace and Defense

- 5.2.3. Automotive

- 5.2.4. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 6. North America 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 6.1.1. Programmable Carbon Fiber

- 6.1.2. Programmable Textiles

- 6.1.3. Programmable Bio material

- 6.1.4. Programmable Wood

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Medical

- 6.2.2. Aerospace and Defense

- 6.2.3. Automotive

- 6.2.4. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 7. Europe 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 7.1.1. Programmable Carbon Fiber

- 7.1.2. Programmable Textiles

- 7.1.3. Programmable Bio material

- 7.1.4. Programmable Wood

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Medical

- 7.2.2. Aerospace and Defense

- 7.2.3. Automotive

- 7.2.4. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 8. Asia Pacific 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 8.1.1. Programmable Carbon Fiber

- 8.1.2. Programmable Textiles

- 8.1.3. Programmable Bio material

- 8.1.4. Programmable Wood

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Medical

- 8.2.2. Aerospace and Defense

- 8.2.3. Automotive

- 8.2.4. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 9. Rest of the World 4D Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 9.1.1. Programmable Carbon Fiber

- 9.1.2. Programmable Textiles

- 9.1.3. Programmable Bio material

- 9.1.4. Programmable Wood

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Medical

- 9.2.2. Aerospace and Defense

- 9.2.3. Automotive

- 9.2.4. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Programmable Material

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Hewlett Packard Enterprise Company

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 EnvisionTEC Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 CT CoreTechnologie Group

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 The ExOne Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Autodesk Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Organovo Holdings Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Materialise NV

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Dassault Systemes SA

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Stratasys Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Hewlett Packard Enterprise Company

List of Figures

- Figure 1: Global 4D Printing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 3: North America 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 4: North America 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 5: North America 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 9: Europe 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 10: Europe 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 11: Europe 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 15: Asia Pacific 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 16: Asia Pacific 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 17: Asia Pacific 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World 4D Printing Industry Revenue (Million), by Type of Programmable Material 2025 & 2033

- Figure 21: Rest of the World 4D Printing Industry Revenue Share (%), by Type of Programmable Material 2025 & 2033

- Figure 22: Rest of the World 4D Printing Industry Revenue (Million), by End User 2025 & 2033

- Figure 23: Rest of the World 4D Printing Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Rest of the World 4D Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World 4D Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 2: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Global 4D Printing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 5: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 8: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 9: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 11: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 12: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global 4D Printing Industry Revenue Million Forecast, by Type of Programmable Material 2020 & 2033

- Table 14: Global 4D Printing Industry Revenue Million Forecast, by End User 2020 & 2033

- Table 15: Global 4D Printing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 4D Printing Industry?

The projected CAGR is approximately 44.75%.

2. Which companies are prominent players in the 4D Printing Industry?

Key companies in the market include Hewlett Packard Enterprise Company, EnvisionTEC Inc, CT CoreTechnologie Group, The ExOne Company, Autodesk Inc, Organovo Holdings Inc, Materialise NV, Dassault Systemes SA, Stratasys Ltd.

3. What are the main segments of the 4D Printing Industry?

The market segments include Type of Programmable Material, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for Industry 4.0 and Emergence of Industry 5.0.

6. What are the notable trends driving market growth?

Increase in Demand for Industry 4.0 and Emergence of Industry 5.0 to Drive the 4D Printing Market.

7. Are there any restraints impacting market growth?

Wide Availability of Open Source CAM Software.

8. Can you provide examples of recent developments in the market?

June 2023 - Zortrax has developed 4D printing technology in cooperation with ESA. For space applications, use the M300 Dual FDM printer and a modified version of Z-SUITE to 3D print structures made of shape memory polymers and electrically conductive materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "4D Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 4D Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 4D Printing Industry?

To stay informed about further developments, trends, and reports in the 4D Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence