Key Insights

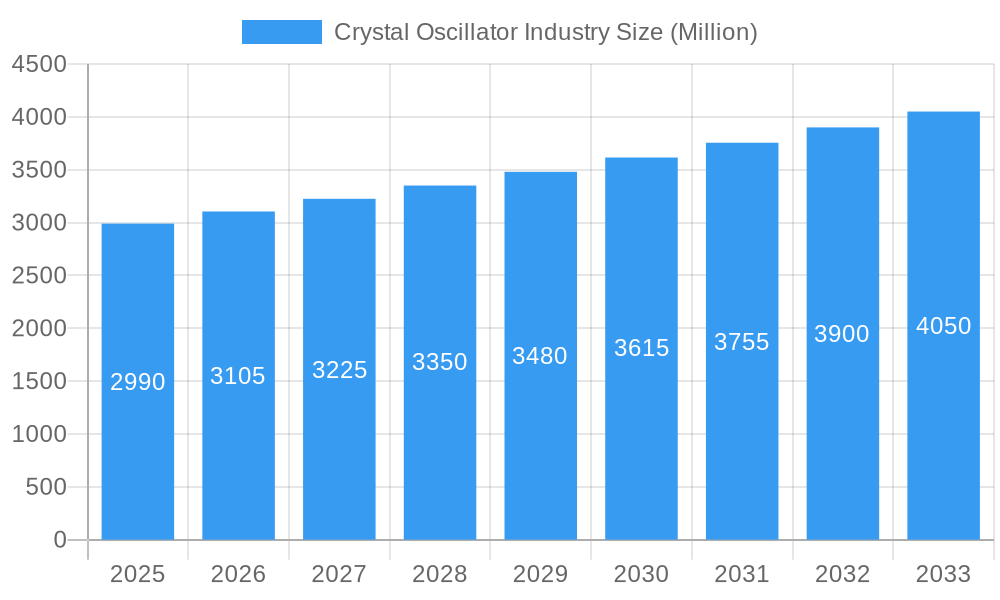

The global Crystal Oscillator market is poised for significant expansion, projected to reach a substantial valuation of USD 2.99 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 3.80% anticipated over the forecast period of 2025-2033. This growth is primarily propelled by the escalating demand for high-frequency and precise timing solutions across a multitude of rapidly evolving industries. The burgeoning consumer electronics sector, with its insatiable appetite for advanced smartphones, wearables, and home entertainment systems, represents a major growth engine. Concurrently, the automotive industry's transition towards sophisticated driver-assistance systems (ADAS), electric vehicles (EVs), and in-car infotainment requires increasingly reliable and accurate frequency control. Furthermore, the expansion of 5G infrastructure and the proliferation of IoT devices are creating a sustained demand for high-performance crystal oscillators to ensure seamless connectivity and data transmission.

Crystal Oscillator Industry Market Size (In Billion)

The market is characterized by a diverse range of crystal oscillator types, catering to specific application needs. Temperature Compensated Crystal Oscillators (TCXOs) and Simple Packaged Crystal Oscillators (SPXOs) continue to dominate due to their versatility and cost-effectiveness in numerous consumer and industrial applications. Voltage Controlled Crystal Oscillators (VCXOs) and Frequency Controlled Crystal Oscillators (FCXOs) are crucial for applications requiring frequency tuning and modulation, particularly in telecommunications and specialized industrial equipment. Oven Controlled Crystal Oscillators (OCXOs), renowned for their exceptional stability and accuracy, are indispensable in demanding sectors like aerospace, defense, and precision scientific instrumentation. The increasing preference for compact and integrated designs favors Surface Mount (SMD) crystal oscillators, while Thru-hole variants maintain relevance in legacy systems and certain industrial settings. Key players like Kyocera Corporation, Seiko Epson Corporation, and Murata Manufacturing Co Ltd are actively investing in research and development to innovate and expand their product portfolios, focusing on miniaturization, lower power consumption, and enhanced performance to meet the dynamic requirements of these growth sectors.

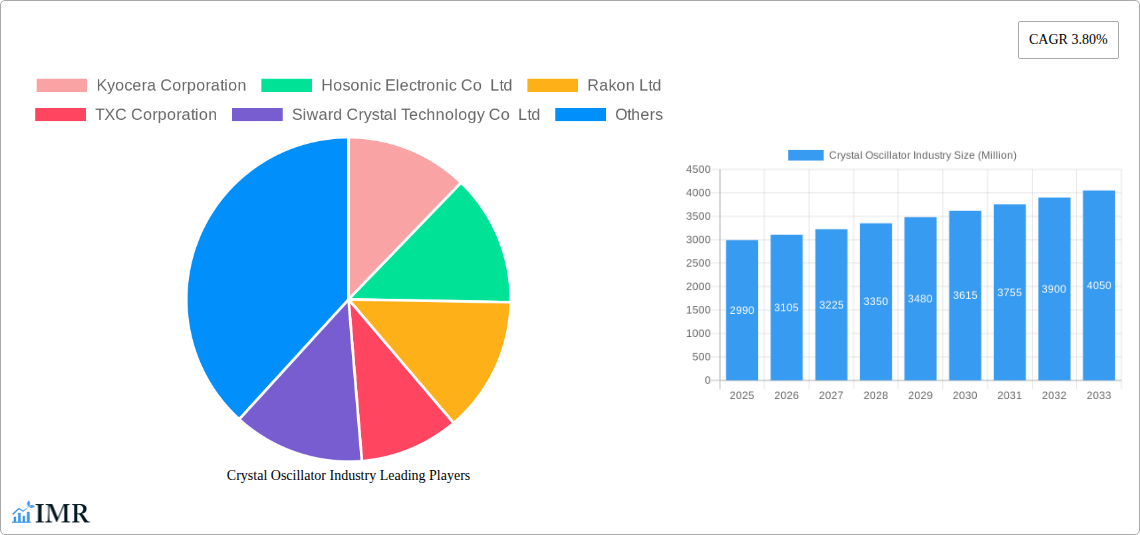

Crystal Oscillator Industry Company Market Share

Comprehensive Crystal Oscillator Industry Report: Market Dynamics, Growth Trends, and Key Player Analysis (2019-2033)

Unlock critical insights into the global crystal oscillator market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market segmentation, growth drivers, competitive landscape, and future opportunities within the vital semiconductor component sector. This report provides a granular view of market evolution, parent and child market interdependencies, and strategic outlooks for industry professionals, including manufacturers, suppliers, investors, and end-users. All quantitative data is presented in Million Units, offering a clear perspective on market scale.

Crystal Oscillator Industry Market Dynamics & Structure

The global crystal oscillator market exhibits a moderate to high level of concentration, with a few dominant players accounting for a significant portion of the market share. Technological innovation serves as a primary driver, fueled by the increasing demand for miniaturization, enhanced frequency stability, and lower power consumption across various end-user industries. Regulatory frameworks, particularly concerning component compliance and electromagnetic interference (EMI), also shape market dynamics. Competitive product substitutes, such as MEMS oscillators, present a growing challenge, necessitating continuous innovation and cost optimization from crystal oscillator manufacturers. End-user demographics are shifting, with a pronounced increase in demand from the automotive and telecom sectors, driven by autonomous driving technologies and the rollout of 5G infrastructure, respectively. Mergers and acquisitions (M&A) trends indicate consolidation within the industry as companies seek to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by key players, but with room for niche specialists.

- Technological Innovation Drivers: Miniaturization, frequency stability, power efficiency, low phase noise.

- Regulatory Frameworks: RoHS, REACH, FCC compliance impacting product development.

- Competitive Product Substitutes: MEMS oscillators are gaining traction, especially in cost-sensitive applications.

- End-User Demographics: Surging demand from Automotive and Telecom & Networking.

- M&A Trends: Strategic acquisitions to gain technology, market access, and production capacity.

Crystal Oscillator Industry Growth Trends & Insights

The global crystal oscillator market is poised for robust growth over the forecast period (2025–2033), driven by the pervasive integration of electronic components across a multitude of applications. The increasing complexity and functionality of modern devices necessitate highly accurate and reliable timing solutions, making crystal oscillators indispensable. Adoption rates are accelerating, particularly in emerging markets and for advanced technologies such as the Internet of Things (IoT), Artificial Intelligence (AI), and edge computing, which rely on precise synchronization. Technological disruptions, including advancements in materials science for improved performance and the integration of oscillators with other functionalities, are shaping market evolution. Consumer behavior shifts towards connected devices and increased reliance on real-time data further bolster demand. The market size is projected to expand significantly, with a Compound Annual Growth Rate (CAGR) of approximately 6.8% during the forecast period. Market penetration is high in established sectors like consumer electronics and telecom, with substantial growth potential in the expanding automotive and industrial automation segments.

Dominant Regions, Countries, or Segments in Crystal Oscillator Industry

The Telecom and Networking segment, driven by the relentless expansion of 5G infrastructure and the growing demand for high-speed data transmission, is a dominant force in the global crystal oscillator market. This segment's growth is further amplified by the proliferation of data centers and the increasing adoption of cloud computing services, all of which require precise and stable frequency control for network synchronization and data integrity. Within this segment, Temperature Compensated Crystal Oscillators (TCXO) and Simple Packaged Crystal Oscillators (SPXO) command a significant market share due to their balance of performance, cost-effectiveness, and reliability.

The Automotive end-user industry is emerging as a powerful growth accelerator, fueled by the rapid advancements in autonomous driving systems, Advanced Driver-Assistance Systems (ADAS), and in-car infotainment. These applications require a vast number of highly reliable oscillators for critical functions like sensor data processing, engine control, and communication modules. The Surface Mount mounting type continues to dominate across most segments due to its compatibility with automated manufacturing processes, enabling smaller device footprints and higher production efficiencies.

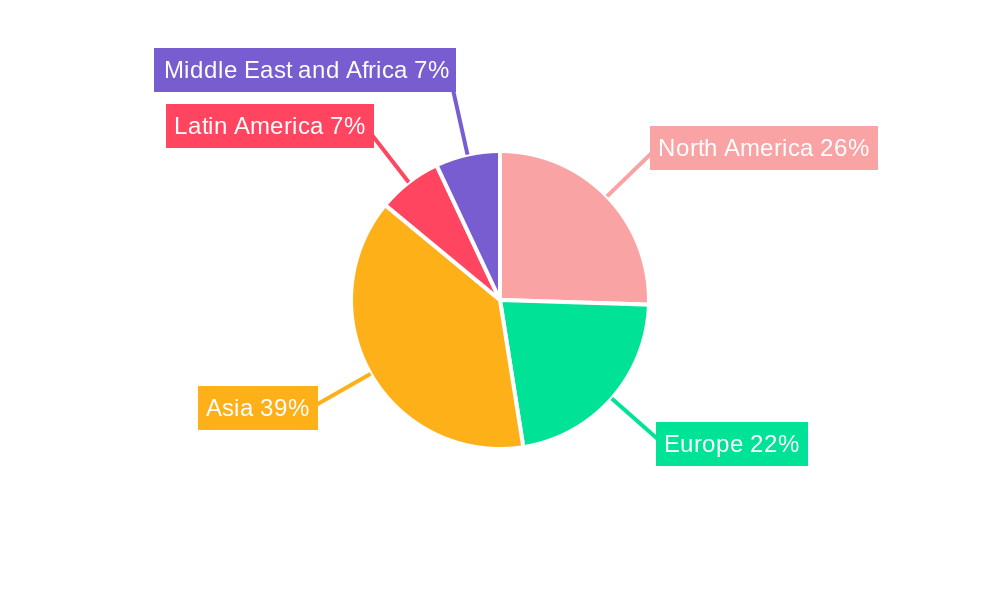

Asia Pacific is the leading region, primarily driven by China, South Korea, and Japan, which are major hubs for electronics manufacturing and innovation. Strong government support for technological advancement, a large consumer base, and the presence of key semiconductor manufacturers contribute to the region's dominance. Economic policies favoring investment in high-tech industries and robust infrastructure development further solidify Asia Pacific's leading position. The ongoing digital transformation across various industries within this region underpins the sustained demand for crystal oscillators.

- Dominant Segment: Telecom and Networking, supported by 5G deployment and data center growth.

- Key Product Types: TCXO and SPXO are widely adopted for their performance and cost.

- Leading Mounting Type: Surface Mount, crucial for miniaturization and efficient manufacturing.

- Dominant Region: Asia Pacific, led by China, South Korea, and Japan, due to strong manufacturing capabilities and technological adoption.

- Key Drivers: 5G expansion, autonomous driving, IoT proliferation, and digital transformation initiatives.

Crystal Oscillator Industry Product Landscape

The crystal oscillator industry is characterized by continuous product innovation aimed at enhancing performance and catering to evolving application needs. Key advancements include the development of smaller form-factor oscillators with improved frequency stability across wider temperature ranges, crucial for demanding environments. Innovations also focus on reduced power consumption, supporting battery-operated and portable devices. The integration of oscillators with other functionalities, such as synchronization circuits or voltage regulators, is also on the rise. Applications span from the core timing functions in consumer electronics like smartphones and wearables to mission-critical systems in automotive, aerospace, and defense. Performance metrics like phase jitter, pullability, and aging rates are continually being optimized to meet stringent industry requirements.

Key Drivers, Barriers & Challenges in Crystal Oscillator Industry

Key Drivers:

- Technological Advancements: Miniaturization, higher frequency stability, and lower power consumption are essential for modern electronics.

- 5G Network Deployment: The rollout of 5G necessitates precise timing across base stations and user equipment.

- Automotive Electrification & Autonomy: Increased electronic content in vehicles drives demand for reliable oscillators.

- IoT Expansion: The proliferation of connected devices requires cost-effective and efficient timing solutions.

- Industrial Automation: Smart factories and Industry 4.0 initiatives rely on synchronized operations.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors and material shortages can impact production and lead times.

- Intense Competition: Price wars and margin pressures are prevalent, especially in high-volume segments.

- Emergence of MEMS Oscillators: MEMS technology offers a viable alternative in certain cost-sensitive applications.

- Stringent Quality and Reliability Standards: Meeting the rigorous demands of automotive and aerospace sectors requires significant investment.

- Lead Time for Advanced Products: Developing and certifying highly specialized oscillators can be a lengthy process.

Emerging Opportunities in Crystal Oscillator Industry

Emerging opportunities lie in the growing demand for highly integrated and specialized timing solutions. The expansion of IoT ecosystems, particularly in smart home, industrial IoT, and wearable technology, presents a vast untapped market for low-power and miniaturized crystal oscillators. Furthermore, the increasing adoption of edge computing requires localized, high-performance timing components. The development of novel materials and manufacturing techniques that enable even greater frequency precision and environmental robustness will open new avenues. Opportunities also exist in providing customized oscillator solutions for niche applications in areas like medical devices and advanced research instrumentation.

Growth Accelerators in the Crystal Oscillator Industry Industry

Long-term growth in the crystal oscillator industry will be significantly accelerated by continued advancements in semiconductor technology that enable more integrated and intelligent timing solutions. Strategic partnerships between oscillator manufacturers and system-level designers will foster co-creation and tailor-made products for emerging applications. The ongoing expansion of wireless communication technologies beyond 5G, such as 6G, will create a sustained demand for high-performance timing components. Market expansion into developing economies, driven by increasing digitalization and industrialization, will also serve as a crucial growth accelerator.

Key Players Shaping the Crystal Oscillator Industry Market

- Kyocera Corporation

- Hosonic Electronic Co Ltd

- Rakon Ltd

- TXC Corporation

- Siward Crystal Technology Co Ltd

- SiTime Corporation

- Vectron International Inc (Microchip Technology)

- Seiko Epson Corporation

- Daishinku Corp

- Nihon Dempa Kogyo (NDK) Co Ltd

- Murata Manufacturing Co Ltd

Notable Milestones in Crystal Oscillator Industry Sector

- October 2023: Kyocera AVX planned a new production facility in Knowledge Park at Penn State Behrend, serving as a headquarters and manufacturing base for a new division following its acquisition of Bliley Technologies, a specialist in crystal oscillators for aerospace, defense, and commercial satellite industries.

- January 2023: Epson launched new Real Time Clock (RTC) modules (RX4901CE, RX8901CE for commercial/industrial and RA4000CE, RA8000CE for automotive), integrating crystal units and ICs for simplified implementation in various applications.

In-Depth Crystal Oscillator Industry Market Outlook

The future outlook for the crystal oscillator industry remains exceptionally strong, driven by an unceasing wave of technological innovation and increasing electronic content across all sectors. The industry is well-positioned to capitalize on the expansion of 5G and the nascent 6G landscape, the rapid growth of the automotive sector towards electrification and autonomy, and the pervasive adoption of IoT devices. Strategic collaborations and continued investment in R&D for next-generation timing solutions, including those with enhanced programmability and reduced form factors, will be key to sustained market leadership. The industry's ability to adapt to evolving supply chain dynamics and to offer cost-effective, high-performance components will be crucial for capturing the vast opportunities in both established and emerging markets.

Crystal Oscillator Industry Segmentation

-

1. Type

- 1.1. Temperature Compensated Crystal Oscillator (TCXO)

- 1.2. Simple Packaged Crystal Oscillator (SPXO)

- 1.3. Voltage Controlled Crystal Oscillator (VCXO)

- 1.4. Frequency Controlled Crystal Oscillator (FCXO)

- 1.5. Oven Controlled Crystal Oscillator (OCXO)

- 1.6. Other Types

-

2. Mounting Type

- 2.1. Surface Mount

- 2.2. Thru-hole

-

3. End-user Industry

- 3.1. Consumer Electronics

- 3.2. Automotive

- 3.3. Telecom and Networking

- 3.4. Aerospace and Defense

- 3.5. Research and Measurement

- 3.6. Industrial

- 3.7. Other End-user Industries

Crystal Oscillator Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Crystal Oscillator Industry Regional Market Share

Geographic Coverage of Crystal Oscillator Industry

Crystal Oscillator Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing 5G Adoption Across the World; Rising Demand From Advanced Automotive Applications

- 3.3. Market Restrains

- 3.3.1. Lack of New Improvements in Addition to the Technology Getting Matured with Substitutes; COVID-19 Outbreak Influencing the Electronics Industry

- 3.4. Market Trends

- 3.4.1. Consumer Electronics Segment is Expected to Hold the Prominent Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crystal Oscillator Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Temperature Compensated Crystal Oscillator (TCXO)

- 5.1.2. Simple Packaged Crystal Oscillator (SPXO)

- 5.1.3. Voltage Controlled Crystal Oscillator (VCXO)

- 5.1.4. Frequency Controlled Crystal Oscillator (FCXO)

- 5.1.5. Oven Controlled Crystal Oscillator (OCXO)

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Mounting Type

- 5.2.1. Surface Mount

- 5.2.2. Thru-hole

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Consumer Electronics

- 5.3.2. Automotive

- 5.3.3. Telecom and Networking

- 5.3.4. Aerospace and Defense

- 5.3.5. Research and Measurement

- 5.3.6. Industrial

- 5.3.7. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Crystal Oscillator Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Temperature Compensated Crystal Oscillator (TCXO)

- 6.1.2. Simple Packaged Crystal Oscillator (SPXO)

- 6.1.3. Voltage Controlled Crystal Oscillator (VCXO)

- 6.1.4. Frequency Controlled Crystal Oscillator (FCXO)

- 6.1.5. Oven Controlled Crystal Oscillator (OCXO)

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Mounting Type

- 6.2.1. Surface Mount

- 6.2.2. Thru-hole

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Consumer Electronics

- 6.3.2. Automotive

- 6.3.3. Telecom and Networking

- 6.3.4. Aerospace and Defense

- 6.3.5. Research and Measurement

- 6.3.6. Industrial

- 6.3.7. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Crystal Oscillator Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Temperature Compensated Crystal Oscillator (TCXO)

- 7.1.2. Simple Packaged Crystal Oscillator (SPXO)

- 7.1.3. Voltage Controlled Crystal Oscillator (VCXO)

- 7.1.4. Frequency Controlled Crystal Oscillator (FCXO)

- 7.1.5. Oven Controlled Crystal Oscillator (OCXO)

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Mounting Type

- 7.2.1. Surface Mount

- 7.2.2. Thru-hole

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Consumer Electronics

- 7.3.2. Automotive

- 7.3.3. Telecom and Networking

- 7.3.4. Aerospace and Defense

- 7.3.5. Research and Measurement

- 7.3.6. Industrial

- 7.3.7. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Crystal Oscillator Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Temperature Compensated Crystal Oscillator (TCXO)

- 8.1.2. Simple Packaged Crystal Oscillator (SPXO)

- 8.1.3. Voltage Controlled Crystal Oscillator (VCXO)

- 8.1.4. Frequency Controlled Crystal Oscillator (FCXO)

- 8.1.5. Oven Controlled Crystal Oscillator (OCXO)

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Mounting Type

- 8.2.1. Surface Mount

- 8.2.2. Thru-hole

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Consumer Electronics

- 8.3.2. Automotive

- 8.3.3. Telecom and Networking

- 8.3.4. Aerospace and Defense

- 8.3.5. Research and Measurement

- 8.3.6. Industrial

- 8.3.7. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Crystal Oscillator Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Temperature Compensated Crystal Oscillator (TCXO)

- 9.1.2. Simple Packaged Crystal Oscillator (SPXO)

- 9.1.3. Voltage Controlled Crystal Oscillator (VCXO)

- 9.1.4. Frequency Controlled Crystal Oscillator (FCXO)

- 9.1.5. Oven Controlled Crystal Oscillator (OCXO)

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Mounting Type

- 9.2.1. Surface Mount

- 9.2.2. Thru-hole

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Consumer Electronics

- 9.3.2. Automotive

- 9.3.3. Telecom and Networking

- 9.3.4. Aerospace and Defense

- 9.3.5. Research and Measurement

- 9.3.6. Industrial

- 9.3.7. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Crystal Oscillator Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Temperature Compensated Crystal Oscillator (TCXO)

- 10.1.2. Simple Packaged Crystal Oscillator (SPXO)

- 10.1.3. Voltage Controlled Crystal Oscillator (VCXO)

- 10.1.4. Frequency Controlled Crystal Oscillator (FCXO)

- 10.1.5. Oven Controlled Crystal Oscillator (OCXO)

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Mounting Type

- 10.2.1. Surface Mount

- 10.2.2. Thru-hole

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Consumer Electronics

- 10.3.2. Automotive

- 10.3.3. Telecom and Networking

- 10.3.4. Aerospace and Defense

- 10.3.5. Research and Measurement

- 10.3.6. Industrial

- 10.3.7. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Kyocera Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hosonic Electronic Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rakon Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 TXC Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Siward Crystal Technology Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SiTime Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Vectron International Inc (Microchip Technology)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Seiko Epson Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Daishinku Corp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Nihon Dempa Kogyo (NDK) Co Ltd*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Murata Manufacturing Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Kyocera Corporation

List of Figures

- Figure 1: Global Crystal Oscillator Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Crystal Oscillator Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Crystal Oscillator Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Crystal Oscillator Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 5: North America Crystal Oscillator Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 6: North America Crystal Oscillator Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Crystal Oscillator Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Crystal Oscillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Crystal Oscillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Crystal Oscillator Industry Revenue (Million), by Type 2025 & 2033

- Figure 11: Europe Crystal Oscillator Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: Europe Crystal Oscillator Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 13: Europe Crystal Oscillator Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 14: Europe Crystal Oscillator Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Crystal Oscillator Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Crystal Oscillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Crystal Oscillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Crystal Oscillator Industry Revenue (Million), by Type 2025 & 2033

- Figure 19: Asia Crystal Oscillator Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Asia Crystal Oscillator Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 21: Asia Crystal Oscillator Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 22: Asia Crystal Oscillator Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Crystal Oscillator Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Crystal Oscillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Crystal Oscillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Crystal Oscillator Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Crystal Oscillator Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Crystal Oscillator Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 29: Latin America Crystal Oscillator Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 30: Latin America Crystal Oscillator Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Crystal Oscillator Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Crystal Oscillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Crystal Oscillator Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Crystal Oscillator Industry Revenue (Million), by Type 2025 & 2033

- Figure 35: Middle East and Africa Crystal Oscillator Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Middle East and Africa Crystal Oscillator Industry Revenue (Million), by Mounting Type 2025 & 2033

- Figure 37: Middle East and Africa Crystal Oscillator Industry Revenue Share (%), by Mounting Type 2025 & 2033

- Figure 38: Middle East and Africa Crystal Oscillator Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Crystal Oscillator Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Crystal Oscillator Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Crystal Oscillator Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Crystal Oscillator Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Crystal Oscillator Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 3: Global Crystal Oscillator Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Crystal Oscillator Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Crystal Oscillator Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 6: Global Crystal Oscillator Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 7: Global Crystal Oscillator Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Crystal Oscillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Crystal Oscillator Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Crystal Oscillator Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 11: Global Crystal Oscillator Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Crystal Oscillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Crystal Oscillator Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Crystal Oscillator Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 15: Global Crystal Oscillator Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Crystal Oscillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Crystal Oscillator Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 18: Global Crystal Oscillator Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 19: Global Crystal Oscillator Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Crystal Oscillator Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Crystal Oscillator Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 22: Global Crystal Oscillator Industry Revenue Million Forecast, by Mounting Type 2020 & 2033

- Table 23: Global Crystal Oscillator Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Crystal Oscillator Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crystal Oscillator Industry?

The projected CAGR is approximately 3.80%.

2. Which companies are prominent players in the Crystal Oscillator Industry?

Key companies in the market include Kyocera Corporation, Hosonic Electronic Co Ltd, Rakon Ltd, TXC Corporation, Siward Crystal Technology Co Ltd, SiTime Corporation, Vectron International Inc (Microchip Technology), Seiko Epson Corporation, Daishinku Corp, Nihon Dempa Kogyo (NDK) Co Ltd*List Not Exhaustive, Murata Manufacturing Co Ltd.

3. What are the main segments of the Crystal Oscillator Industry?

The market segments include Type, Mounting Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing 5G Adoption Across the World; Rising Demand From Advanced Automotive Applications.

6. What are the notable trends driving market growth?

Consumer Electronics Segment is Expected to Hold the Prominent Share.

7. Are there any restraints impacting market growth?

Lack of New Improvements in Addition to the Technology Getting Matured with Substitutes; COVID-19 Outbreak Influencing the Electronics Industry .

8. Can you provide examples of recent developments in the market?

October 2023 - Kyocera AVX, one of the global manufacturers of advanced electronic components, planned to build an approximately 50,000-square-foot production facility in Knowledge Park at Penn State Behrend. The facility would serve as a corporate headquarters and manufacturing base for a new division created by Kyocera's purchase of Bliley Technologies. This Erie-based company manufactures crystal oscillators and low-noise frequency-control products for the aerospace, defense, and commercial satellite industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crystal Oscillator Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crystal Oscillator Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crystal Oscillator Industry?

To stay informed about further developments, trends, and reports in the Crystal Oscillator Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence