Key Insights

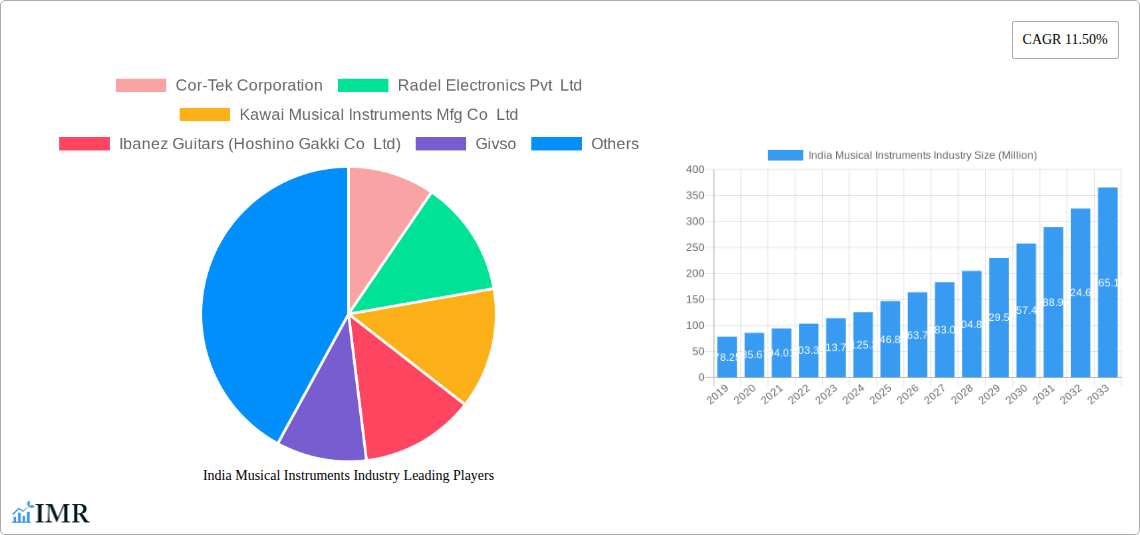

The Indian musical instruments market is poised for significant expansion, projected to reach USD 146.86 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 11.50% throughout the forecast period (2025-2033). This impressive growth is fueled by a confluence of factors, including rising disposable incomes, a burgeoning youth population with a keen interest in music education and hobbies, and the increasing accessibility of musical instruments through both online and offline retail channels. The "Make in India" initiative and government support for the arts and culture sectors are further bolstering domestic manufacturing and consumption. Enthusiasts are increasingly investing in a diverse range of instruments, from traditional Indian stringed instruments to modern electronic keyboards and guitars, reflecting a dynamic and evolving musical landscape. The proliferation of online music learning platforms and content creators has also played a pivotal role in democratizing music education and inspiring a new generation of musicians, thereby creating sustained demand for musical instruments.

India Musical Instruments Industry Market Size (In Million)

The market segmentation highlights the diverse nature of demand within India. Electronic Musical Instruments are expected to witness substantial growth due to technological advancements and their popularity among contemporary musicians. Stringed Musical Instruments, encompassing both traditional Indian and Western varieties, continue to hold a significant market share due to their cultural relevance and widespread appeal. The distribution channel analysis indicates a balanced approach, with both online and offline channels contributing to market penetration. While offline retail provides a tangible experience for potential buyers, the convenience and wider reach of e-commerce platforms are making them increasingly dominant, especially in Tier 1 and Tier 2 cities. Key players like Yamaha Corporation, Roland Corporation, and Fender Musical Instruments Corporation are actively competing, alongside emerging Indian brands like Kadence, to capture this growing market. The focus on quality, affordability, and innovative product offerings will be crucial for sustained success in this vibrant and expanding market.

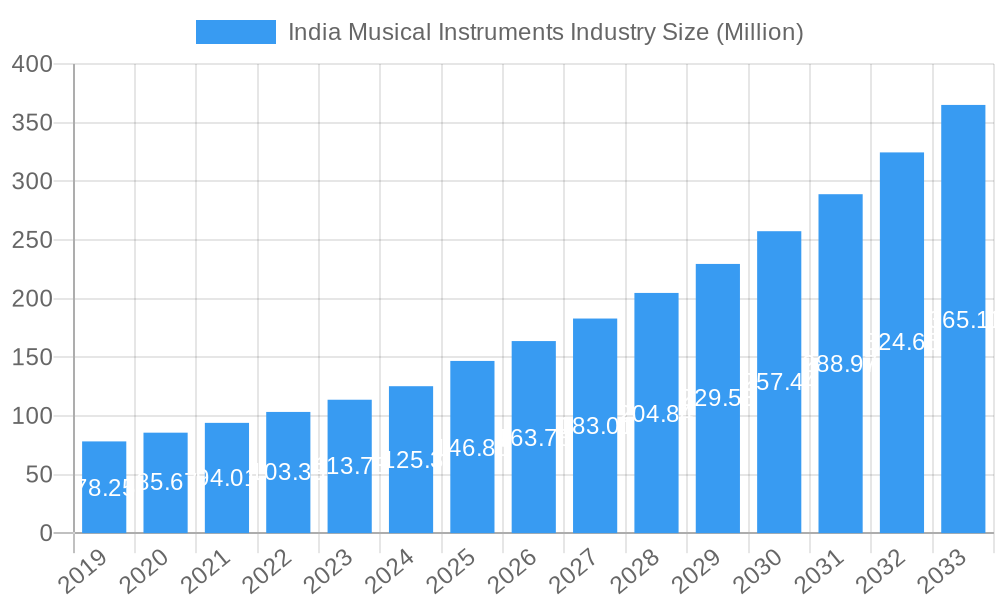

India Musical Instruments Industry Company Market Share

Comprehensive Report: India Musical Instruments Industry Market Analysis & Forecast (2019-2033)

This in-depth report provides a detailed analysis of the India Musical Instruments Industry, offering critical insights into market dynamics, growth trends, and future outlook. Leveraging extensive research, this report targets industry professionals, manufacturers, distributors, and investors seeking to understand the evolving landscape of musical instrument production and consumption in India. With a Study Period spanning from 2019 to 2033, and a Base Year of 2025, the report meticulously analyzes historical data from 2019-2024 and provides an Estimated Year analysis for 2025, followed by a robust Forecast Period (2025-2033). Gain actionable intelligence on segments like Electronic Musical Instruments, Stringed Musical Instruments, Wind Instruments, Acoustic Pianos and Stringed Keyboard Instruments, Percussion Instruments, and Other Musical Instruments (Parts and Accessories), alongside an examination of Online and Offline distribution channels.

India Musical Instruments Industry Market Dynamics & Structure

The India Musical Instruments Industry is characterized by a dynamic market structure influenced by a confluence of factors including technological innovation, evolving consumer preferences, and a growing appreciation for music education. Market concentration varies across segments; for instance, the Electronic Musical Instruments segment sees higher competition among global giants and emerging domestic players, while the Stringed Musical Instruments segment retains a significant presence of traditional artisans and smaller manufacturers. Technological innovation acts as a primary driver, with advancements in digital synthesis, smart instrument features, and portable audio technology significantly shaping product development. Regulatory frameworks, primarily concerning import duties and manufacturing standards, play a crucial role in influencing domestic production and market accessibility. Competitive product substitutes are increasingly prevalent, especially in the Electronic Musical Instruments and Acoustic Pianos and Stringed Keyboard Instruments segments, where digital alternatives offer greater versatility and affordability. End-user demographics are expanding beyond traditional musicians to include a growing segment of hobbyists, students, and educators, driven by increased disposable income and the proliferation of online music learning platforms. Merger and acquisition (M&A) trends, while currently moderate, are expected to witness an uptick as larger players seek to expand their market reach and acquire niche technologies. The estimated market share for Electronic Musical Instruments is projected to be around 35% by 2025, with Stringed Musical Instruments following closely at 30%. Barriers to innovation are primarily associated with high R&D costs and the need for specialized technical expertise, particularly for sophisticated electronic instruments. The estimated volume of M&A deals in the historical period (2019-2024) was approximately 5 transactions, with an estimated value of $50 Million units.

India Musical Instruments Industry Growth Trends & Insights

The India Musical Instruments Industry is poised for substantial growth, driven by a combination of macroeconomic factors and evolving societal engagement with music. The market size has witnessed a steady upward trajectory, with an estimated CAGR of 12.5% during the historical period (2019-2024). This growth is fueled by increasing disposable incomes, a burgeoning youth population, and a heightened emphasis on holistic education that includes music. The adoption rates for various instrument types are experiencing a significant shift, with Electronic Musical Instruments demonstrating robust growth due to their affordability, versatility, and ease of use for beginners. Technological disruptions, such as the integration of AI in music learning apps and the development of more intuitive digital interfaces, are further accelerating adoption. Consumer behavior is shifting towards a greater demand for digital and portable musical instruments, reflecting a lifestyle that values convenience and multi-functional products. The market penetration for Stringed Musical Instruments remains strong, particularly in regional markets where traditional music forms are prevalent. The estimated market size in the base year 2025 is projected to reach $800 Million units.

- Market Size Evolution: The India Musical Instruments Industry is projected to grow from an estimated $700 Million units in 2024 to over $1,800 Million units by 2033, reflecting a sustained growth trajectory.

- Adoption Rates: Electronic Musical Instruments are expected to witness the highest adoption rates, projected to grow by 15% annually. Acoustic Pianos and Stringed Keyboard Instruments are also seeing renewed interest due to the resurgence of classical music education.

- Technological Disruptions: The rise of smart instruments, such as those with built-in learning aids and connectivity features, is transforming the market. Augmented reality applications for instrument practice are also emerging.

- Consumer Behavior Shifts: Consumers are increasingly seeking value-for-money products with enhanced features. The preference for online purchases is steadily increasing, accounting for an estimated 40% of total sales by 2025. The demand for personalized and customized instruments is also on the rise.

Dominant Regions, Countries, or Segments in India Musical Instruments Industry

Within the India Musical Instruments Industry, the Electronic Musical Instruments segment stands out as a dominant force, consistently driving market growth. This dominance is attributable to a multitude of factors including technological advancements, affordability, and widespread appeal across various demographics. The segment's market share in 2025 is estimated to be approximately 35% of the total industry revenue, translating to an estimated $280 Million units. The widespread availability of advanced digital synthesizers, digital pianos, electronic drums, and MIDI controllers, coupled with their integration with music production software, has made them indispensable tools for both aspiring musicians and seasoned professionals.

- Electronic Musical Instruments:

- Key Drivers: Rapid technological innovation, affordability compared to acoustic counterparts, versatility in sound production and recording capabilities, and strong adoption by educational institutions for modern music pedagogy.

- Market Share: Estimated at 35% of the total industry in 2025.

- Growth Potential: High growth potential driven by continuous product development and increasing demand for home-based music production setups. The volume of units sold is projected to reach 5 Million units in 2025.

- Leading Companies: Yamaha Corporation, Roland Corporation, and Cor-Tek Corporation are key players investing heavily in R&D and expanding their product portfolios.

The Stringed Musical Instruments segment, while traditionally strong, is the second-largest contributor, holding an estimated 30% market share, or $240 Million units in 2025. This segment includes guitars, violins, and traditional Indian string instruments like the sitar and sarod. The enduring popularity of these instruments in classical and folk music, combined with a growing interest in Western music genres, sustains its market presence.

- Stringed Musical Instruments:

- Key Drivers: Cultural significance, strong demand from traditional music circles and educational institutions, and the accessibility of entry-level instruments.

- Market Share: Estimated at 30% of the total industry in 2025.

- Growth Potential: Steady growth fueled by increasing participation in music education and the export market. The volume of units sold is projected to reach 6 Million units in 2025.

- Leading Companies: Fender Musical Instruments Corporation, Ibanez Guitars (Hoshino Gakki Co Ltd), Givso, and Kadence are prominent players, with a growing number of domestic manufacturers catering to regional tastes.

Other significant segments include Wind Instruments (estimated 15% market share, $120 Million units in 2025) and Acoustic Pianos and Stringed Keyboard Instruments (estimated 10% market share, $80 Million units in 2025). Percussion Instruments and Other Musical Instruments (Parts and Accessories) collectively account for the remaining 10% market share. The Online distribution channel is rapidly gaining prominence, projected to account for 40% of sales in 2025, driven by e-commerce growth and convenience.

India Musical Instruments Industry Product Landscape

The India Musical Instruments Industry is witnessing a surge in product innovation, with manufacturers focusing on enhanced playability, digital integration, and ergonomic designs. Electronic Musical Instruments are at the forefront, featuring advanced sound engines, intuitive user interfaces, and connectivity options for seamless integration with digital audio workstations (DAWs). For instance, Roland Corporation's recent unveiling of the RD-08 stage piano, boasting over 3,000 tones and extensive effects, exemplifies this trend. Applications range from professional stage performances and studio recordings to educational tools that facilitate interactive learning. Performance metrics are increasingly being evaluated based on sound fidelity, responsiveness, and ease of use. Stringed Musical Instruments are seeing innovations in materials and construction for improved tone and durability, while Acoustic Pianos and Stringed Keyboard Instruments are benefiting from hybrid technologies that blend acoustic feel with digital capabilities. The unique selling proposition often lies in offering professional-grade features at accessible price points.

Key Drivers, Barriers & Challenges in India Musical Instruments Industry

Key Drivers:

- Growing Music Education Sector: Increased enrollment in music schools and private tuitions drives demand for instruments across all categories.

- Rising Disposable Income: A growing middle class with higher disposable income can afford to invest in musical instruments, both for leisure and professional pursuits.

- Influence of Digital Media & Social Platforms: Exposure to global music trends and artists via online platforms inspires greater interest in learning and playing musical instruments.

- Government Initiatives for Arts & Culture: Supportive government policies and funding for cultural activities can indirectly boost instrument sales.

- Technological Advancements: Innovations in electronic instruments and digital interfaces make music creation more accessible and engaging.

Barriers & Challenges:

- High Import Duties & Taxes: Affecting the cost of imported instruments and components, impacting affordability.

- Counterfeit Products: The prevalence of counterfeit instruments dilutes brand value and impacts sales of genuine products.

- Infrastructure Gaps: Limited reach in remote areas and logistical challenges in distribution can hinder market penetration.

- Skilled Labor Shortage: A scarcity of trained technicians for servicing and repair, particularly for complex electronic instruments.

- Economic Volatility: Fluctuations in currency exchange rates and economic slowdowns can impact consumer spending on discretionary items like musical instruments. The estimated impact of counterfeit products on the market is a loss of 10% in potential revenue.

Emerging Opportunities in India Musical Instruments Industry

The India Musical Instruments Industry presents a fertile ground for emerging opportunities. The burgeoning interest in regional and folk music genres presents a niche market for traditional instruments. Furthermore, the increasing adoption of music therapy and its integration into wellness programs opens avenues for specialized instruments and therapeutic sound devices. The "Make in India" initiative, coupled with government incentives for manufacturing, creates an opportune environment for domestic production and export.

- Untapped Markets: Rural and Tier-2/3 cities represent significant untapped potential for affordable and accessible musical instruments.

- Innovative Applications: Development of smart instruments for educational purposes, interactive learning platforms, and instruments tailored for music therapy.

- Evolving Consumer Preferences: Growing demand for sustainable and eco-friendly instrument materials. The rise of online influencers and content creators advocating for specific instruments presents a new marketing frontier.

Growth Accelerators in the India Musical Instruments Industry Industry

Several catalysts are poised to accelerate the growth of the India Musical Instruments Industry. Technological breakthroughs, particularly in the realm of artificial intelligence and virtual reality, are set to revolutionize music education and performance. Strategic partnerships between manufacturers, educational institutions, and content creators will foster ecosystem development and market expansion. The increasing focus on music as a skill development and career option will further drive demand.

- Technological Breakthroughs: AI-powered learning tools, advanced digital audio interfaces, and compact, high-fidelity portable instruments.

- Strategic Partnerships: Collaborations for product development, distribution networks, and joint marketing campaigns.

- Market Expansion Strategies: Targeting emerging demographics, expanding into new geographical regions, and developing customized product lines for specific user groups. The estimated volume of strategic partnerships is expected to increase by 20% in the forecast period.

Key Players Shaping the India Musical Instruments Industry Market

- Cor-Tek Corporation

- Radel Electronics Pvt Ltd

- Kawai Musical Instruments Mfg Co Ltd

- Ibanez Guitars (Hoshino Gakki Co Ltd)

- Givso

- Kadence

- Steinway & Sons

- Yamaha Corporation

- Roland Corporation

- Fender Musical Instruments Corporation

Notable Milestones in India Musical Instruments Industry Sector

- March 2024: Roland unveils the RD-08 stage piano, featuring 100 scenes, over 3,000 tones, and extensive effects, enhancing its professional keyboard lineup.

- February 2024: Kawai's CA901 digital piano receives "Editor's Choice" at the 2024 NAMM Show from Music Inc. magazine, highlighting its premium quality and innovation in digital pianos.

In-Depth India Musical Instruments Industry Market Outlook

The future of the India Musical Instruments Industry appears exceptionally promising, fueled by a confluence of sustained economic growth, evolving cultural paradigms, and relentless technological innovation. The market is expected to be a significant contributor to the global musical instruments landscape. Growth accelerators such as the increasing emphasis on music in education, coupled with a rising middle class with greater purchasing power, will continue to propel demand across all instrument categories. Strategic partnerships and the "Make in India" initiative will foster domestic manufacturing capabilities and reduce reliance on imports, potentially leading to more competitive pricing and increased product availability. The market's outlook is characterized by a robust trajectory, with a projected Compound Annual Growth Rate (CAGR) of 13% for the forecast period (2025-2033), indicating substantial future potential and presenting lucrative opportunities for stakeholders to capitalize on this dynamic and expanding market.

India Musical Instruments Industry Segmentation

-

1. Type

- 1.1. Electronic Musical Instruments

- 1.2. Stringed Musical Instruments

- 1.3. Wind Instruments

- 1.4. Acoustic Pianos and Stringed Keyboard Instruments

- 1.5. Percussion Instruments

- 1.6. Other Musical Instruments (Parts and Accessories)

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

India Musical Instruments Industry Segmentation By Geography

- 1. India

India Musical Instruments Industry Regional Market Share

Geographic Coverage of India Musical Instruments Industry

India Musical Instruments Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Live Concerts and Performances; Increasing Technological Advancements in Musical Instruments

- 3.3. Market Restrains

- 3.3.1. High Cost of Instruments

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Live Concerts and Performances to Witness the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Musical Instruments Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Electronic Musical Instruments

- 5.1.2. Stringed Musical Instruments

- 5.1.3. Wind Instruments

- 5.1.4. Acoustic Pianos and Stringed Keyboard Instruments

- 5.1.5. Percussion Instruments

- 5.1.6. Other Musical Instruments (Parts and Accessories)

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cor-Tek Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Radel Electronics Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kawai Musical Instruments Mfg Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ibanez Guitars (Hoshino Gakki Co Ltd)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Givso

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kadence

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Steinway & Sons

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Yamaha Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Roland Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fender Musical Instruments Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Cor-Tek Corporation

List of Figures

- Figure 1: India Musical Instruments Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Musical Instruments Industry Share (%) by Company 2025

List of Tables

- Table 1: India Musical Instruments Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Musical Instruments Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Musical Instruments Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Musical Instruments Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: India Musical Instruments Industry Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Musical Instruments Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Musical Instruments Industry?

The projected CAGR is approximately 11.50%.

2. Which companies are prominent players in the India Musical Instruments Industry?

Key companies in the market include Cor-Tek Corporation, Radel Electronics Pvt Ltd, Kawai Musical Instruments Mfg Co Ltd, Ibanez Guitars (Hoshino Gakki Co Ltd), Givso, Kadence, Steinway & Sons, Yamaha Corporation, Roland Corporation, Fender Musical Instruments Corporation.

3. What are the main segments of the India Musical Instruments Industry?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 146.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Live Concerts and Performances; Increasing Technological Advancements in Musical Instruments.

6. What are the notable trends driving market growth?

Growing Popularity of Live Concerts and Performances to Witness the Growth.

7. Are there any restraints impacting market growth?

High Cost of Instruments.

8. Can you provide examples of recent developments in the market?

March 2024 - Roland recently unveiled its newest addition to the RD stage piano lineup, the RD-08. Boasting an impressive array of features, the RD-08 stands out with its 100 scenes, over 3,000 tones, and an extensive selection of effects. The piano offers hands-on control through assignable pitch bend and modulation wheels, along with four control knobs. Additionally, it provides inputs for a damper pedal and two other assignable pedals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Musical Instruments Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Musical Instruments Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Musical Instruments Industry?

To stay informed about further developments, trends, and reports in the India Musical Instruments Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence