Key Insights

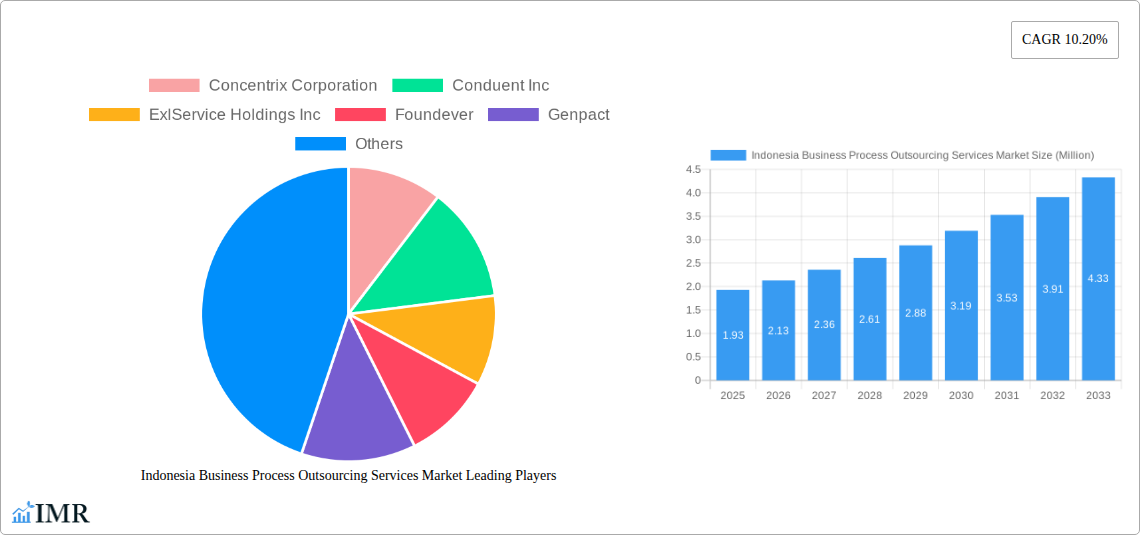

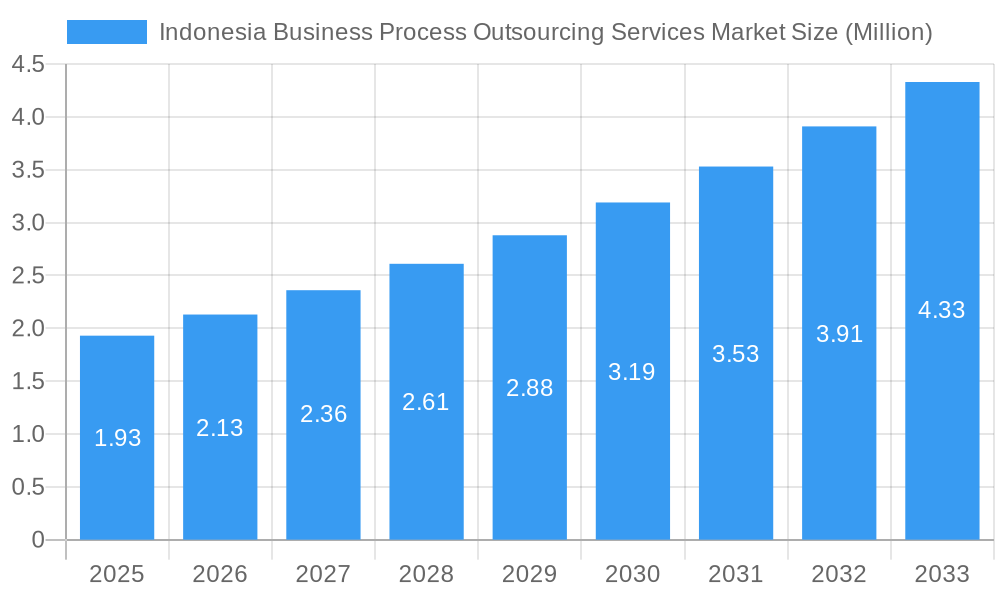

The Indonesia Business Process Outsourcing (BPO) Services Market is poised for significant expansion, projected to reach approximately USD 1.93 million in 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 10.20% through 2033. This robust growth is fueled by a confluence of factors, including the increasing adoption of digital technologies across industries and the strategic imperative for businesses to enhance operational efficiency and customer experience. The Indonesian government's proactive initiatives to foster a digitally-enabled economy and attract foreign investment further bolster the market's upward trajectory. Key drivers such as the demand for cost optimization, the need for specialized expertise in areas like customer care and IT support, and the growing acceptance of remote work models are propelling the market forward. These elements collectively contribute to a dynamic environment where BPO services are becoming indispensable for businesses seeking to remain competitive and agile in the rapidly evolving Indonesian landscape.

Indonesia Business Process Outsourcing Services Market Market Size (In Million)

The market is segmented across various processes, with Customer Care, Sales and Marketing, and HR functions emerging as dominant areas for BPO adoption. The BFSI, Telecom and IT, and Healthcare sectors are leading the charge in outsourcing, driven by the complex regulatory environments, the need for sophisticated data management, and the continuous demand for improved customer engagement. Emerging trends include the rise of intelligent automation, artificial intelligence (AI)-powered customer service solutions, and the increasing demand for omnichannel support. While the market exhibits strong growth potential, potential restraints could include challenges in skilled talent acquisition and retention, data security and privacy concerns, and the need for robust infrastructure development in certain regions. However, the overarching positive sentiment, coupled with strategic investments by global BPO players like Concentrix Corporation, Teleperformance, and WNS (Holdings) Ltd, indicates a promising future for the Indonesian BPO services market.

Indonesia Business Process Outsourcing Services Market Company Market Share

Indonesia Business Process Outsourcing Services Market: Comprehensive Report 2019–2033

This in-depth report offers a definitive analysis of the Indonesia Business Process Outsourcing (BPO) Services Market, a rapidly expanding sector crucial for the nation's digital transformation and economic growth. Spanning from 2019 to 2033, with a base year of 2025, this study provides granular insights into market dynamics, growth trends, regional dominance, product landscape, key players, and emerging opportunities. We meticulously examine the interplay of outsourcing solutions, digital transformation in Indonesia, call center services Indonesia, customer experience outsourcing, and IT outsourcing Indonesia, catering to industry professionals seeking strategic intelligence. The report leverages the latest data and expert analysis to deliver actionable insights for stakeholders navigating this dynamic market.

Indonesia Business Process Outsourcing Services Market Market Dynamics & Structure

The Indonesia BPO Services Market is characterized by a moderate market concentration, with a few large global players alongside a growing number of domestic providers. Technological innovation is a primary driver, fueled by the increasing adoption of AI in customer service and cloud-based BPO solutions. Regulatory frameworks, while evolving to support digital initiatives, also present some compliance considerations for BPO providers. Competitive product substitutes, primarily in-house service delivery and offshore BPO options, necessitate a focus on value-added services and specialized expertise. End-user demographics are increasingly sophisticated, demanding higher levels of customer engagement and efficient service delivery. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating to expand service portfolios, geographical reach, and technological capabilities.

- Market Concentration: Dominated by a mix of global BPO giants and agile local players, fostering a competitive yet collaborative ecosystem.

- Technological Innovation: Driven by advancements in AI, automation, and data analytics, transforming traditional BPO functions.

- Regulatory Landscape: Evolving policies aimed at fostering digital growth while ensuring data privacy and security.

- Competitive Landscape: Intense competition from in-house operations and international BPO providers.

- End-User Demands: Growing expectation for personalized customer experiences, seamless omnichannel support, and proactive service.

- M&A Activity: Strategic acquisitions to enhance capabilities, gain market share, and broaden service offerings.

Indonesia Business Process Outsourcing Services Market Growth Trends & Insights

The Indonesia BPO Services Market is on an upward trajectory, driven by a confluence of factors including the government's push for digital economy development and the increasing realization among Indonesian businesses of the strategic advantages of outsourcing. The market size is projected to witness substantial expansion, propelled by higher adoption rates of advanced BPO solutions across various industries. Digital transformation in Indonesia, particularly within the BFSI and Telecom & IT sectors, is a significant catalyst, encouraging companies to offload non-core functions to specialized BPO providers.

Technological disruptions, such as the integration of AI-powered customer support and robotic process automation (RPA), are reshaping service delivery models. These innovations enable BPO providers to offer more efficient, cost-effective, and enhanced customer experiences. Consumer behavior shifts, marked by a preference for digital channels and instant gratification, further amplify the demand for sophisticated customer care outsourcing and sales and marketing outsourcing. The CAGR for the forecast period is estimated to be robust, reflecting the market's immense potential. Penetration rates for specialized BPO services, such as HR outsourcing Indonesia and IT support outsourcing, are also on the rise as businesses recognize the value of expert management in these critical areas. The increasing demand for data-driven insights and analytics from BPO partners further fuels this growth, positioning the market for sustained expansion throughout the forecast period.

Dominant Regions, Countries, or Segments in Indonesia Business Process Outsourcing Services Market

The Customer Care segment emerges as the dominant force in the Indonesia BPO Services Market, driven by the escalating demand for exceptional customer experiences across all industries. This segment's supremacy is further bolstered by the burgeoning Telecom and IT sector, which consistently requires advanced customer support and technical assistance. Economic policies aimed at fostering business growth and digitalization have created a fertile ground for BPO services.

- Customer Care Dominance: As businesses increasingly prioritize customer satisfaction, outsourcing customer care functions becomes a strategic imperative. This includes managing inquiries, resolving issues, and building customer loyalty across multiple channels. The market share for customer care is substantial and expected to grow.

- Key Drivers:

- Rising consumer expectations for immediate and personalized support.

- The need for 24/7 availability across different time zones.

- The increasing complexity of products and services requiring specialized support.

- Cost-efficiency in managing large customer bases.

- Key Drivers:

- Telecom and IT Sector's Influence: The rapid expansion of the telecommunications and information technology sectors in Indonesia directly translates to a higher demand for BPO services, particularly in customer care and technical support.

- Key Drivers:

- High volume of customer inquiries and technical troubleshooting needs.

- The dynamic nature of technology requiring continuous service updates and support.

- Competitive pressure to offer superior customer service to retain subscribers.

- The growing adoption of digital services and platforms.

- Key Drivers:

- BFSI Sector's Growing Reliance: The Banking, Financial Services, and Insurance (BFSI) sector is a significant contributor, leveraging BPO for customer onboarding, claims processing, and customer service, driven by stringent regulatory requirements and the need for secure, efficient operations.

- Key Drivers:

- Regulatory compliance and data security demands.

- Need for scalable operations to handle transaction volumes.

- Customer demand for convenient digital banking and insurance services.

- Key Drivers:

- Growth Potential in Other Segments: While Customer Care leads, segments like HR and Sales & Marketing are also experiencing significant growth as businesses recognize the efficiency gains and specialized expertise that BPO providers can offer. The "Others" category, encompassing a range of specialized services, also indicates a diversifying market.

Indonesia Business Process Outsourcing Services Market Product Landscape

The Indonesia BPO Services Market product landscape is characterized by an increasing sophistication and integration of technology. Providers are moving beyond traditional transactional services to offer end-to-end solutions that leverage AI, automation, and advanced analytics. Key product innovations include AI-powered chatbots for instant customer support, predictive analytics for proactive issue resolution, and cloud-based platforms for seamless integration and scalability. Performance metrics are increasingly focused on customer satisfaction scores (CSAT), net promoter scores (NPS), average handling time (AHT), and first contact resolution (FCR). Unique selling propositions often revolve around customized solutions, multilingual capabilities, and adherence to international quality standards. The emphasis is on delivering not just cost savings but also significant improvements in customer experience and operational efficiency.

Key Drivers, Barriers & Challenges in Indonesia Business Process Outsourcing Services Market

Key Drivers: The primary forces propelling the Indonesia BPO Services Market include the nation's strategic focus on digital transformation and a growing young, tech-savvy workforce. Government initiatives like "Making Indonesia 4.0" and significant foreign investments, such as Microsoft's USD 1.7 billion pledge, are creating a conducive environment for BPO growth. The increasing demand for cost optimization and access to specialized skills among Indonesian businesses also acts as a significant driver. Furthermore, the continuous advancements in AI and automation are enabling BPO providers to offer more sophisticated and value-added services.

Barriers & Challenges: Despite the positive outlook, the market faces several challenges. Supply chain issues, though less pronounced for services, can impact the availability of necessary technological infrastructure and talent. Regulatory hurdles, while being streamlined, can still pose complexities for international players. Intense competitive pressures from both local and global BPO providers necessitate continuous innovation and cost-efficiency. A significant challenge is the talent gap in specialized digital skills, despite the large workforce. Bridging this gap through upskilling and training programs is crucial for sustained growth. Moreover, ensuring data security and privacy compliance remains a paramount concern for clients, requiring robust security protocols from BPO providers.

Emerging Opportunities in Indonesia Business Process Outsourcing Services Market

Emerging opportunities within the Indonesia BPO Services Market are abundant and stem from evolving business needs and technological advancements. The increasing adoption of cloud computing and the burgeoning e-commerce sector present significant avenues for growth in customer support and logistics-related BPO services. The government's focus on developing the digital economy and fostering innovation opens doors for specialized BPO services in areas like data analytics, cybersecurity, and digital marketing. Furthermore, the "Golden Indonesia 2045" vision highlights opportunities in upskilling the workforce for future-oriented roles, which BPO providers can leverage by offering training and development outsourcing. The growing demand for personalized customer experiences also creates a niche for highly specialized BPO services focusing on customer journey mapping and proactive engagement.

Growth Accelerators in the Indonesia Business Process Outsourcing Services Market Industry

Several catalysts are accelerating the growth of the Indonesia Business Process Outsourcing Services Market. Technological breakthroughs, particularly in Artificial Intelligence and Robotic Process Automation (RPA), are enabling BPO providers to offer highly efficient and innovative solutions. Strategic partnerships, such as TTEC Holdings Inc.'s collaboration with Google Cloud, are crucial for leveraging advanced technologies and expanding service offerings. Market expansion strategies, including the development of specialized service lines catering to specific industry verticals like Healthcare and Retail, are also driving growth. The increasing integration of BPO services into the core business strategies of Indonesian companies, rather than viewing them as mere cost-saving measures, signifies a deeper commitment to leveraging external expertise for competitive advantage. The ongoing digital transformation across all sectors ensures a sustained demand for flexible and scalable outsourcing solutions.

Key Players Shaping the Indonesia Business Process Outsourcing Services Market Market

- Concentrix Corporation

- Conduent Inc

- ExlService Holdings Inc

- Foundever

- Genpact

- KPSG

- Majorel

- Relia Inc

- Teleperformance

- TELUS

- Transcom

- Transcosmos Inc

- TTEC Holdings Inc

- VADS BERHAD

- WNS (Holdings) Lt

Notable Milestones in Indonesia Business Process Outsourcing Services Market Sector

- April 2024: Microsoft pledged a USD 1.7 billion investment over the next four years, underlining its commitment to bolster Indonesia's digital evolution. A key emphasis of this investment will be on upskilling 840,000 Indonesians, equipping them for roles in the burgeoning cloud and AI domains. This move resonates with Indonesia's broader vision outlined in the "Golden Indonesia 2045" initiative, which aspires to position the nation as a frontrunner in Southeast Asia's digital economy.

- January 2023: TTEC Holdings Inc. unveiled a strategic partnership with Google Cloud to assist customers in leveraging Google's AI-powered Contact Center-as-a-Service capabilities. This collaboration seeks to streamline real-time interactions with customers across all live channels, enhancing customer engagement and service delivery.

In-Depth Indonesia Business Process Outsourcing Services Market Market Outlook

The future outlook for the Indonesia Business Process Outsourcing Services Market is exceptionally promising, driven by sustained digital transformation and evolving business needs. Growth accelerators such as advanced AI integration, strategic vendor partnerships, and a continuous focus on enhancing customer experience will propel the market forward. The government's proactive stance on digital economy development, coupled with significant foreign investments, creates an environment ripe for innovation and expansion. Companies that can offer specialized, technology-driven BPO solutions, coupled with a deep understanding of the local market dynamics, are poised for significant success. The trend towards outcome-based pricing and value-added services will become more prevalent, shifting the BPO paradigm from cost arbitrage to strategic partnership. The market's trajectory indicates strong potential for increased penetration across all end-user industries and segments.

Indonesia Business Process Outsourcing Services Market Segmentation

-

1. Process

- 1.1. HR

- 1.2. Sales and Marketing

- 1.3. Customer Care

- 1.4. Others

-

2. End User

- 2.1. BFSI

- 2.2. Telecom and IT

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Others

Indonesia Business Process Outsourcing Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Business Process Outsourcing Services Market Regional Market Share

Geographic Coverage of Indonesia Business Process Outsourcing Services Market

Indonesia Business Process Outsourcing Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.3. Market Restrains

- 3.3.1. Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations

- 3.4. Market Trends

- 3.4.1. Customer Care to Hold Major Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Business Process Outsourcing Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Process

- 5.1.1. HR

- 5.1.2. Sales and Marketing

- 5.1.3. Customer Care

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. BFSI

- 5.2.2. Telecom and IT

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Process

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Concentrix Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Conduent Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 ExlService Holdings Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Foundever

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Genpact

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 KPSG

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Majorel

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Relia Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Teleperformance

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TELUS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Transcom

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Transcosmos Inc

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 TTEC Holdings Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 VADS BERHAD

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 WNS (Holdings) Lt

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Concentrix Corporation

List of Figures

- Figure 1: Indonesia Business Process Outsourcing Services Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Business Process Outsourcing Services Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 2: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2020 & 2033

- Table 3: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Process 2020 & 2033

- Table 8: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Process 2020 & 2033

- Table 9: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Indonesia Business Process Outsourcing Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Indonesia Business Process Outsourcing Services Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Business Process Outsourcing Services Market?

The projected CAGR is approximately 10.20%.

2. Which companies are prominent players in the Indonesia Business Process Outsourcing Services Market?

Key companies in the market include Concentrix Corporation, Conduent Inc, ExlService Holdings Inc, Foundever, Genpact, KPSG, Majorel, Relia Inc, Teleperformance, TELUS, Transcom, Transcosmos Inc, TTEC Holdings Inc, VADS BERHAD, WNS (Holdings) Lt.

3. What are the main segments of the Indonesia Business Process Outsourcing Services Market?

The market segments include Process , End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.93 Million as of 2022.

5. What are some drivers contributing to market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

6. What are the notable trends driving market growth?

Customer Care to Hold Major Market Share.

7. Are there any restraints impacting market growth?

Need for Streamlined Operations with Extended Focus on Core Operations; Lack of In-house Expertise in All Simultaneous Operations.

8. Can you provide examples of recent developments in the market?

April 2024 - Microsoft pledged a USD 1.7 billion investment over the next four years, underlining its commitment to bolster Indonesia's digital evolution. A key emphasis of this investment will be on upskilling 840,000 Indonesians, equipping them for roles in the burgeoning cloud and AI domains. This move resonates with Indonesia's broader vision outlined in the "Golden Indonesia 2045" initiative, which aspires to position the nation as a frontrunner in Southeast Asia's digital economy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Business Process Outsourcing Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Business Process Outsourcing Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Business Process Outsourcing Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Business Process Outsourcing Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence