Key Insights

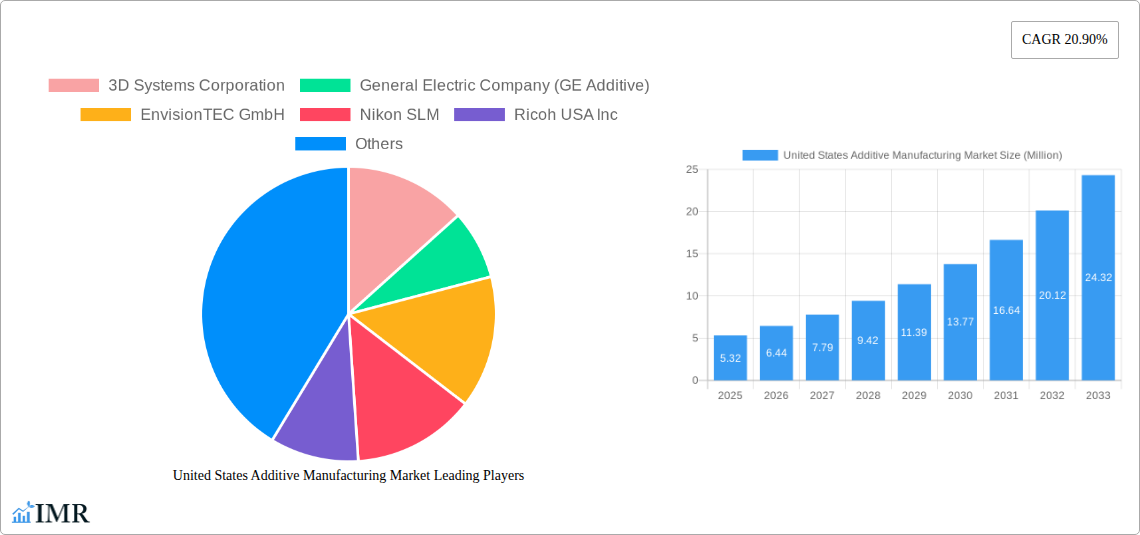

The United States Additive Manufacturing Market is poised for remarkable expansion, with a current market size estimated at $5.32 million. This impressive valuation is projected to surge at a Compound Annual Growth Rate (CAGR) of 20.90% over the forecast period. This robust growth trajectory is fueled by a confluence of factors, including the increasing adoption of advanced 3D printing technologies across diverse industries, the development of novel materials like advanced polymers and metals, and the growing demand for customized and complex product designs. The market is segmented into key areas: Components encompassing hardware (desktop and industrial 3D printers), software (design, inspection, and scanning), and services; Materials including polymers, metals, and ceramics; and Technologies such as Stereo Lithography (SLA), Selective Laser Sintering (SLS), Fused Deposition Modeling (FDM), and Binder Jetting Printing. End-user verticals like Automotive, Aerospace and Defense, Healthcare, Consumer Electronics, and Dentistry are significant contributors to this market dynamism, each leveraging additive manufacturing for rapid prototyping, on-demand production, and intricate component creation. Leading companies such as 3D Systems Corporation, General Electric Company (GE Additive), Stratasys Ltd., and SLM Solutions Group AG are at the forefront, driving innovation and market penetration.

United States Additive Manufacturing Market Market Size (In Million)

Looking ahead, the United States Additive Manufacturing Market is expected to witness accelerated adoption driven by government initiatives supporting advanced manufacturing, increasing investments in research and development, and the inherent advantages of additive manufacturing in reducing lead times, minimizing waste, and enabling unprecedented design freedom. The integration of AI and machine learning with 3D printing processes will further enhance efficiency and product quality. While the market is characterized by strong growth, potential restraints include the high initial cost of industrial-grade equipment, the need for skilled labor to operate and maintain these sophisticated systems, and evolving regulatory frameworks. However, the continuous innovation in material science and the expanding range of applications, from personalized medical implants to lightweight aerospace components, strongly indicate a future where additive manufacturing becomes an indispensable pillar of the US industrial landscape. The market's trajectory is firmly set for significant value creation and technological advancement.

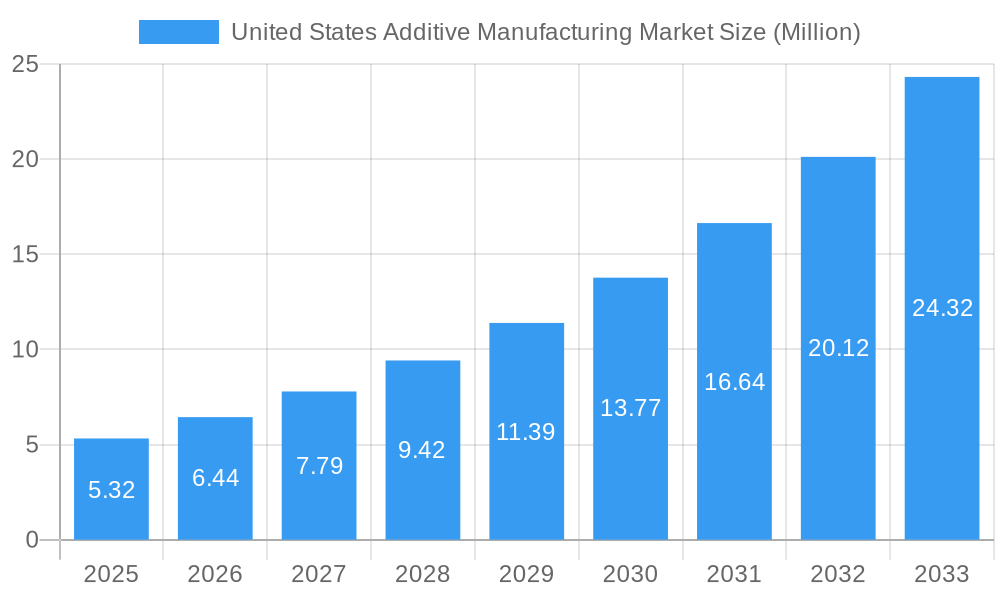

United States Additive Manufacturing Market Company Market Share

United States Additive Manufacturing Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report offers a detailed examination of the United States Additive Manufacturing (AM) market, encompassing its current dynamics, growth trajectory, and future potential. We delve into critical segments, including Additive Manufacturing Hardware (Desktop 3D Printers, Industrial 3D Printers), Additive Manufacturing Software (Design Software, Inspection Software, Scanning Software), Additive Manufacturing Services, and a wide array of Additive Manufacturing Materials (Polymer, Metal, Ceramic). Furthermore, the report analyzes key Additive Manufacturing Technologies such as Stereo Lithography, Selective Laser Sintering, Fused Deposition Modeling, Binder Jetting Printing, and Other Technologies. Our comprehensive analysis extends to major Additive Manufacturing End-user Verticals, including Automotive, Aerospace and Defense, Healthcare, Consumer Electronics, Power and Energy, Fashion and Jewelry, and Dentistry. With a study period from 2019 to 2033, a base year of 2025, and a forecast period from 2025 to 2033, this report provides actionable insights for stakeholders seeking to navigate and capitalize on this rapidly evolving industry.

United States Additive Manufacturing Market Market Dynamics & Structure

The United States Additive Manufacturing market is characterized by a dynamic and evolving landscape, driven by relentless technological innovation and a growing appetite for customized, on-demand production. Market concentration, while present, is fragmented across various specialized players and larger conglomerates investing heavily in AM capabilities. Key drivers of technological innovation include advancements in material science, enabling the creation of more durable and functional parts, and the development of sophisticated software for design optimization and process control. Regulatory frameworks are gradually adapting to support the widespread adoption of AM, particularly in critical sectors like aerospace and healthcare, focusing on standardization and quality assurance. Competitive product substitutes are emerging, but the unique advantages of AM, such as rapid prototyping, complex geometries, and reduced waste, continue to solidify its position. End-user demographics are shifting, with a growing demand from both industrial giants and emerging startups seeking agile manufacturing solutions. Mergers and acquisitions (M&A) are a significant trend, as established companies acquire innovative startups to expand their technological portfolios and market reach.

- Technological Innovation Drivers: Advancements in material formulations, higher printing speeds, improved resolution, and integration of AI for process optimization.

- Regulatory Frameworks: Evolving standards for material certification, part qualification, and intellectual property protection in AM.

- Competitive Product Substitutes: Traditional subtractive manufacturing methods and advanced molding techniques are being challenged by AM's agility.

- End-user Demographics: Increasing adoption by SMEs, research institutions, and a growing interest from sectors previously hesitant to embrace AM.

- M&A Trends: Consolidation aimed at acquiring niche technologies, expanding service offerings, and increasing market share.

- Market Concentration: A mix of large, diversified players and numerous specialized small-to-medium enterprises.

United States Additive Manufacturing Market Growth Trends & Insights

The United States Additive Manufacturing market is projected for robust growth, fueled by increasing investments in research and development, a burgeoning demand for personalized products, and the inherent advantages of AM in streamlining supply chains. The market size is expected to witness a significant expansion, driven by higher adoption rates across various industries. Technological disruptions are continuously redefining the capabilities of AM, from the introduction of multi-material printing to the development of advanced post-processing techniques. Consumer behavior shifts towards sustainability and customization are also playing a pivotal role, as AM offers reduced material waste and the ability to produce highly tailored products. The integration of AM into mainstream manufacturing processes is accelerating, moving beyond prototyping to serial production of end-use parts. This transition is supported by the development of more efficient and reliable AM systems, coupled with the growing availability of specialized AM expertise. Furthermore, the ongoing digitalization of manufacturing, often referred to as Industry 4.0, seamlessly integrates AM as a core technology, enabling smart factories and highly agile production environments. The demand for complex geometries and lightweight components, particularly in the aerospace and automotive sectors, continues to be a primary growth engine.

The adoption rate of additive manufacturing in the United States is steadily increasing, as businesses recognize its potential to reduce lead times, lower production costs, and enable the creation of innovative designs. The market is expected to exhibit a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Market penetration is deepening across diverse sectors, with healthcare and aerospace leading the charge due to the critical need for precise, customized, and rapidly produced components. The development of novel AM materials, such as high-performance polymers and advanced metal alloys, is expanding the application scope of the technology. Consumer electronics manufacturers are increasingly leveraging AM for rapid prototyping and the production of specialized components. The shift from traditional manufacturing methods to additive manufacturing is becoming more pronounced as the technology matures and its economic viability for mass production becomes clearer. The development of distributed manufacturing models, facilitated by AM, is also contributing to market expansion, allowing for localized production closer to the point of need.

Dominant Regions, Countries, or Segments in United States Additive Manufacturing Market

The United States Additive Manufacturing market exhibits dominance across several key segments and end-user verticals, driven by a confluence of economic policies, infrastructure development, and innovation ecosystems. Within the Component segment, Industrial 3D Printers command a significant market share due to their advanced capabilities and suitability for high-volume production and complex applications. This is closely followed by Additive Manufacturing Services, which provide crucial expertise and manufacturing capacity for companies lacking in-house AM capabilities. In terms of Materials, Polymer materials continue to lead, owing to their versatility, cost-effectiveness, and wide range of applications, though Metal additive manufacturing is rapidly gaining traction due to its use in high-value industries like aerospace and automotive.

Among Technologies, Selective Laser Sintering (SLS) and Fused Deposition Modeling (FDM) remain dominant due to their established track records and accessibility, while Binder Jetting Printing is emerging as a powerful force for high-speed metal part production. The End-user Vertical landscape is significantly shaped by the Aerospace and Defense sector, which has historically been an early adopter of AM for its demand for lightweight, high-strength, and complex components. The Healthcare sector, particularly in applications like prosthetics, implants, and surgical guides, also represents a substantial and growing market. The Automotive industry is increasingly embracing AM for prototyping, tooling, and increasingly, for the production of end-use parts, especially in electric vehicles.

- Dominant Components: Industrial 3D Printers, Additive Manufacturing Services.

- Key Material Trends: Continued dominance of Polymers, with rapid growth in Metal AM.

- Leading Technologies: FDM and SLS, with significant growth in Binder Jetting.

- Primary End-user Verticals: Aerospace and Defense, Healthcare, Automotive.

- Growth Potential: Significant untapped potential in Consumer Electronics and Power & Energy sectors.

- Regional Dominance: While the entire US is active, regions with strong manufacturing bases and research institutions often lead in adoption.

United States Additive Manufacturing Market Product Landscape

The product landscape of the United States Additive Manufacturing market is characterized by a relentless stream of innovations aimed at enhancing speed, precision, material compatibility, and scalability. Manufacturers are continuously introducing new generations of 3D printers with higher build volumes, faster printing speeds, and expanded material palettes, catering to a diverse range of industrial applications. Software solutions are becoming increasingly sophisticated, integrating AI-powered design optimization, real-time process monitoring, and advanced simulation tools to streamline the entire AM workflow. Novel material formulations, including advanced metal alloys, high-performance polymers, and specialized ceramics, are enabling the production of parts with enhanced mechanical properties, thermal resistance, and biocompatibility. The application spectrum is broadening, with AM now being utilized for everything from intricate dental implants and personalized fashion accessories to critical aerospace components and large-scale industrial tooling.

Key Drivers, Barriers & Challenges in United States Additive Manufacturing Market

The United States Additive Manufacturing market is propelled by several key drivers, including the increasing demand for rapid prototyping and customization, the pursuit of supply chain resilience, and advancements in material science and printer technology. Government initiatives supporting advanced manufacturing and the growing adoption of Industry 4.0 principles also act as significant catalysts. For instance, the push for domestic production of critical components in defense and healthcare directly fuels AM adoption.

However, the market faces certain barriers and challenges. High initial investment costs for industrial-grade AM equipment can be a deterrent for smaller businesses. The need for specialized skills and training to operate and maintain AM systems remains a bottleneck. Regulatory hurdles, particularly concerning standardization and certification for critical applications, can slow down widespread adoption. Supply chain issues related to raw material availability and consistency can also impact production. Furthermore, the scalability of certain AM processes for mass production is still an area of ongoing development, and competition from established manufacturing methods persists.

- Key Drivers:

- Demand for customization and on-demand production.

- Supply chain diversification and reshoring efforts.

- Technological advancements in hardware, software, and materials.

- Government incentives for advanced manufacturing.

- Growing integration with Industry 4.0 concepts.

- Barriers & Challenges:

- High capital investment for industrial equipment.

- Shortage of skilled workforce.

- Evolving regulatory frameworks and standardization needs.

- Raw material availability and quality control.

- Scalability for mass production.

- Competition from traditional manufacturing.

Emerging Opportunities in United States Additive Manufacturing Market

Emerging opportunities in the United States Additive Manufacturing market lie in the expansion of decentralized manufacturing networks, the development of novel bio-compatible materials for advanced medical applications, and the integration of AM with artificial intelligence for fully automated production lines. The growing interest in sustainable manufacturing practices also presents a significant opportunity, as AM inherently reduces material waste and can enable localized production, shortening transportation distances. Furthermore, the development of large-format AM for infrastructure and construction applications, as well as the increasing use of AM in the fashion and jewelry sectors for intricate, bespoke designs, represent untapped markets. The demand for highly specialized components in emerging industries like space exploration and renewable energy will also drive new avenues for AM.

Growth Accelerators in the United States Additive Manufacturing Market Industry

Several key factors are accelerating the growth of the United States Additive Manufacturing market. Technological breakthroughs, such as the development of new printing materials with superior properties and the refinement of high-speed printing technologies, are expanding the capabilities and applications of AM. Strategic partnerships between technology providers, material suppliers, and end-users are fostering innovation and driving adoption. For example, collaborations focused on developing industry-specific AM solutions are proving highly effective. Market expansion strategies, including the development of robust service bureaus and the establishment of training programs, are making AM more accessible and user-friendly. The increasing investment from venture capital and private equity firms in AM startups further fuels innovation and market penetration.

Key Players Shaping the United States Additive Manufacturing Market Market

- 3D Systems Corporation

- General Electric Company (GE Additive)

- EnvisionTEC GmbH

- Nikon SLM

- Ricoh USA Inc

- EOS GmbH

- Exone Company

- MCOR Technology Ltd

- Materialise NV

- Optomec Inc

- Stratasys Ltd

- SLM Solutions Group AG

Notable Milestones in United States Additive Manufacturing Market Sector

- June 2024: Nikon SLM Solutions AG commenced the production of its NXG XII 600 metal Additive Manufacturing machine in the United States, offering an 'American Made' solution to meet growing demand in aerospace, defense, automotive, and energy.

- June 2024: Ricoh USA Inc. launched RICOH All-In 3D Print, a comprehensive XaaS solution for additive manufacturing, streamlining prototype production with hardware, software, labor, and supplies.

- April 2024: Meltio and Accufacture introduced the Alchemist 1, a large-scale robotic DED 3D printing work cell made in the United States, utilizing Meltio’s LMD technology for producing large, dense metal parts and designed for easy integration into existing production lines.

In-Depth United States Additive Manufacturing Market Market Outlook

The United States Additive Manufacturing market is poised for continued expansion, driven by an unwavering commitment to innovation and the inherent advantages of AM in an increasingly complex global manufacturing landscape. Future growth will be shaped by advancements in multi-material printing, the development of highly specialized AM materials, and the maturation of AI-driven design and production processes. Strategic opportunities lie in further penetrating high-growth sectors like healthcare, aerospace, and defense, while also exploring new frontiers in areas such as sustainable construction and personalized consumer goods. The ongoing digitalization of manufacturing and the global trend towards localized production will further solidify AM's role as a cornerstone of future industrial ecosystems, presenting a promising outlook for sustained growth and value creation.

United States Additive Manufacturing Market Segmentation

-

1. Component

-

1.1. Hardware

- 1.1.1. Desktop 3D Printer

- 1.1.2. Industrial 3D Printer

-

1.2. Software

- 1.2.1. Design Software

- 1.2.2. Inspection Software

- 1.2.3. Scanning Software

- 1.3. Services

-

1.1. Hardware

-

2. Material

- 2.1. Polymer

- 2.2. Metal

- 2.3. Ceramic

-

3. Technology

- 3.1. Stereo Lithography

- 3.2. Selective Laser Sintering

- 3.3. Fused Deposition Modelling

- 3.4. Binder Jetting Printing

- 3.5. Other Technologies

-

4. End-user Vertical

- 4.1. Automotive

- 4.2. Aerospace and Defense

- 4.3. Healthcare

- 4.4. Consumer Electronics

- 4.5. Power and Energy

- 4.6. Fashion and Jewelry

- 4.7. Dentistry

- 4.8. Other End-user Verticals

United States Additive Manufacturing Market Segmentation By Geography

- 1. United States

United States Additive Manufacturing Market Regional Market Share

Geographic Coverage of United States Additive Manufacturing Market

United States Additive Manufacturing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Customization

- 3.2.2 Personalization

- 3.2.3 Complex Geometries

- 3.2.4 and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation

- 3.3. Market Restrains

- 3.3.1 Customization

- 3.3.2 Personalization

- 3.3.3 Complex Geometries

- 3.3.4 and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation

- 3.4. Market Trends

- 3.4.1. The Selective Laser Sintering Segment is Expected to Hold a Significant Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Additive Manufacturing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.1.1. Desktop 3D Printer

- 5.1.1.2. Industrial 3D Printer

- 5.1.2. Software

- 5.1.2.1. Design Software

- 5.1.2.2. Inspection Software

- 5.1.2.3. Scanning Software

- 5.1.3. Services

- 5.1.1. Hardware

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polymer

- 5.2.2. Metal

- 5.2.3. Ceramic

- 5.3. Market Analysis, Insights and Forecast - by Technology

- 5.3.1. Stereo Lithography

- 5.3.2. Selective Laser Sintering

- 5.3.3. Fused Deposition Modelling

- 5.3.4. Binder Jetting Printing

- 5.3.5. Other Technologies

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. Automotive

- 5.4.2. Aerospace and Defense

- 5.4.3. Healthcare

- 5.4.4. Consumer Electronics

- 5.4.5. Power and Energy

- 5.4.6. Fashion and Jewelry

- 5.4.7. Dentistry

- 5.4.8. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 3D Systems Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Electric Company (GE Additive)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 EnvisionTEC GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nikon SLM

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ricoh USA Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EOS GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Exone Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MCOR Technology Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Materialise NV

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Optomec Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Stratasys Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SLM Solutions Group AG*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 3D Systems Corporation

List of Figures

- Figure 1: United States Additive Manufacturing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Additive Manufacturing Market Share (%) by Company 2025

List of Tables

- Table 1: United States Additive Manufacturing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 2: United States Additive Manufacturing Market Volume Billion Forecast, by Component 2020 & 2033

- Table 3: United States Additive Manufacturing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 4: United States Additive Manufacturing Market Volume Billion Forecast, by Material 2020 & 2033

- Table 5: United States Additive Manufacturing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: United States Additive Manufacturing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 7: United States Additive Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 8: United States Additive Manufacturing Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 9: United States Additive Manufacturing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: United States Additive Manufacturing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: United States Additive Manufacturing Market Revenue Million Forecast, by Component 2020 & 2033

- Table 12: United States Additive Manufacturing Market Volume Billion Forecast, by Component 2020 & 2033

- Table 13: United States Additive Manufacturing Market Revenue Million Forecast, by Material 2020 & 2033

- Table 14: United States Additive Manufacturing Market Volume Billion Forecast, by Material 2020 & 2033

- Table 15: United States Additive Manufacturing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 16: United States Additive Manufacturing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 17: United States Additive Manufacturing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: United States Additive Manufacturing Market Volume Billion Forecast, by End-user Vertical 2020 & 2033

- Table 19: United States Additive Manufacturing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: United States Additive Manufacturing Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Additive Manufacturing Market?

The projected CAGR is approximately 20.90%.

2. Which companies are prominent players in the United States Additive Manufacturing Market?

Key companies in the market include 3D Systems Corporation, General Electric Company (GE Additive), EnvisionTEC GmbH, Nikon SLM, Ricoh USA Inc, EOS GmbH, Exone Company, MCOR Technology Ltd, Materialise NV, Optomec Inc, Stratasys Ltd, SLM Solutions Group AG*List Not Exhaustive.

3. What are the main segments of the United States Additive Manufacturing Market?

The market segments include Component, Material, Technology, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Customization. Personalization. Complex Geometries. and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation.

6. What are the notable trends driving market growth?

The Selective Laser Sintering Segment is Expected to Hold a Significant Share of the Market.

7. Are there any restraints impacting market growth?

Customization. Personalization. Complex Geometries. and Design Freedom; Rapid Prototyping and Time to Market; Increasing Adoption of Industry 4.0 and Digital Transformation.

8. Can you provide examples of recent developments in the market?

June 2024: Nikon SLM Solutions AG commenced the production of its NXG XII 600 metal Additive Manufacturing machine in the United States. The expansion of its manufacturing capabilities provides North American customers with a fully ‘American Made’ metal AM machine. The manufacturing unit has the ability to meet the increasing demand for its metal additive manufacturing solutions across key industries, including aerospace, defense, automotive, and energy.June 2024: Ricoh USA Inc. announced the launch of its fully managed on-site 3D printing solution, RICOH All-In 3D Print. Designed to streamline the production of 3D-printed product prototypes and other additive manufacturing uses, this complete XaaS solution for additive manufacturing includes necessary components, such as printing hardware, advanced 3D production software, specialized Ricoh labor, and essential supplies to propel businesses’ manufacturing capabilities forward with the power of rapid prototyping.April 2024: Meltio, a 3D printer manufacturer, and Accufacture, a Michigan-based industrial automation company, introduced the Alchemist 1, a new large-scale robotic DED 3D printing work cell made in the United States. Powered by Meltio’s laser metal deposition (LMD) 3D printing technology, Alchemist 1 is optimized for producing large-scale, fully dense metal parts. The robotic additive manufacturing work cell is also designed to be easily integrated into existing production lines.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Additive Manufacturing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Additive Manufacturing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Additive Manufacturing Market?

To stay informed about further developments, trends, and reports in the United States Additive Manufacturing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence