Key Insights

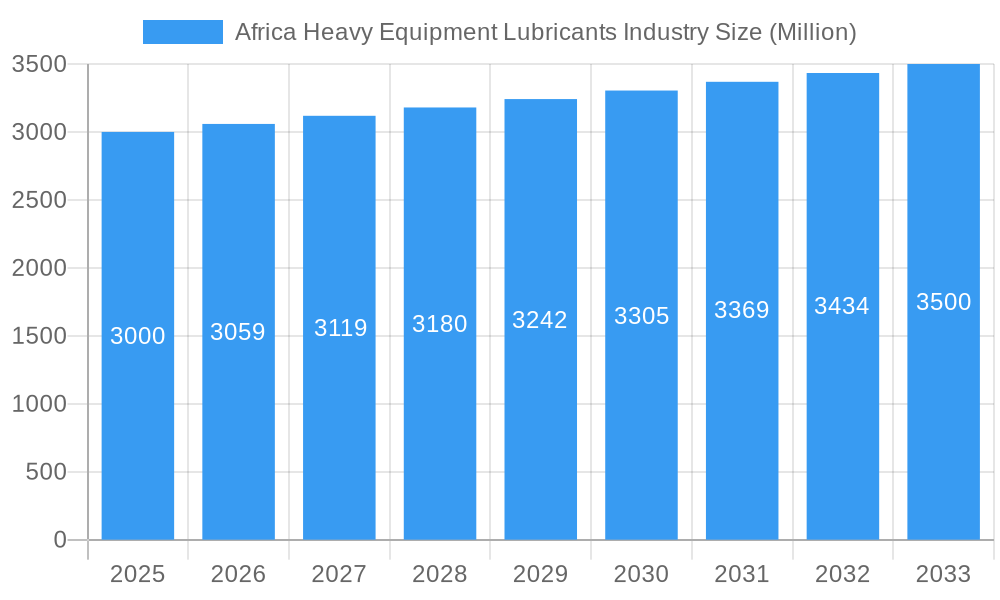

The Africa Heavy Equipment Lubricants Market is poised for steady expansion, projected to reach approximately USD 3,500 million by 2033, driven by a Compound Annual Growth Rate (CAGR) exceeding 1.97% from 2025 to 2033. This growth is significantly fueled by robust investments in infrastructure development across key African nations, particularly in the construction, mining, and oil and gas sectors. The increasing demand for heavy machinery in these industries necessitates a consistent supply of high-performance lubricants to ensure operational efficiency, extend equipment lifespan, and minimize downtime. Furthermore, the burgeoning agricultural sector, with its growing mechanization, also contributes to the escalating demand for specialized lubricants. The market is characterized by a diverse product portfolio, with engine oils, transmission and hydraulic fluids, and general industrial oils representing the largest segments due to their widespread application in various heavy equipment.

Africa Heavy Equipment Lubricants Industry Market Size (In Billion)

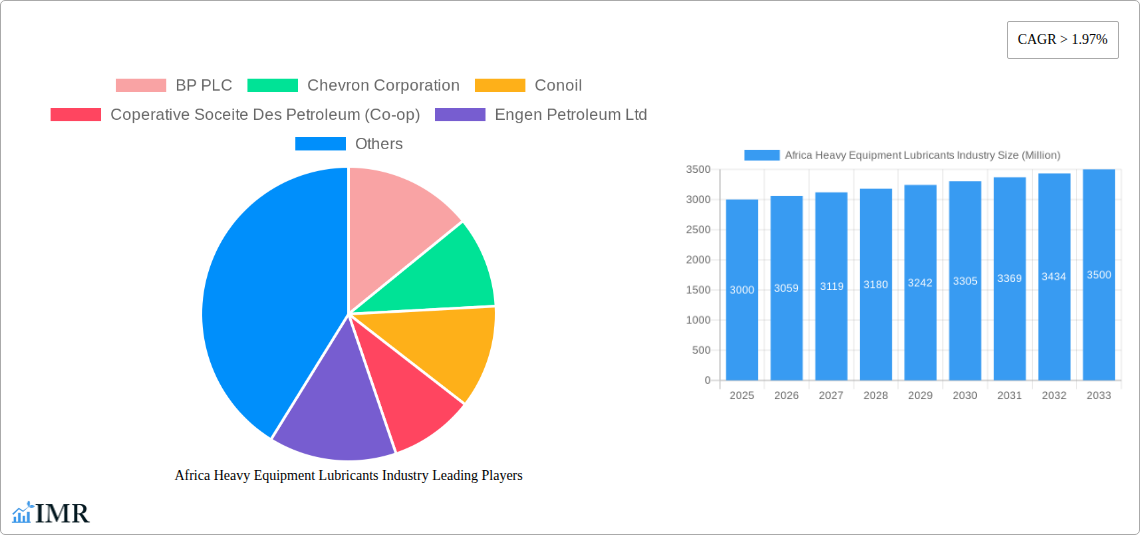

The competitive landscape is shaped by the presence of major global players such as BP PLC, Chevron Corporation, Exxon Mobil Corporation, Royal Dutch Shell PLC, and Total, alongside established regional companies like Engen Petroleum Ltd and Sasol. These companies are actively engaged in product innovation, focusing on developing advanced formulations that offer enhanced protection against wear, corrosion, and extreme operating conditions prevalent in Africa. Strategic collaborations, mergers, and acquisitions are also key strategies employed by these companies to expand their market reach and product offerings across the continent. While the market presents significant opportunities, restraints such as fluctuating commodity prices impacting mining and oil & gas activities, and the presence of counterfeit products, pose challenges. However, the increasing adoption of stricter environmental regulations and the demand for fuel-efficient lubricants are expected to drive further market evolution. Key geographies like Egypt, South Africa, Nigeria, and Algeria are expected to remain dominant due to their established industrial bases and ongoing development projects.

Africa Heavy Equipment Lubricants Industry Company Market Share

Africa Heavy Equipment Lubricants Industry: Market Analysis, Growth Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the Africa Heavy Equipment Lubricants Industry, a critical sector supporting the continent's burgeoning infrastructure, mining, and oil & gas operations. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and the strategic outlook for this vital industry. With a focus on high-traffic keywords such as "Africa heavy equipment lubricants," "construction lubricants Africa," "mining lubricants Nigeria," "agricultural lubricants South Africa," and "oil & gas lubricants Egypt," this report aims to maximize search engine visibility and engage industry professionals. It provides quantitative insights in millions of units and qualitative analysis to deliver actionable intelligence.

Africa Heavy Equipment Lubricants Industry Market Dynamics & Structure

The Africa Heavy Equipment Lubricants Industry exhibits a moderate market concentration, with a mix of global major players and regional contenders vying for market share. Technological innovation remains a significant driver, particularly in the development of high-performance, fuel-efficient, and environmentally friendly lubricant formulations. Regulatory frameworks, while evolving, can present a complex landscape for market entrants, with varying standards across different African nations. Competitive product substitutes, such as alternative lubrication technologies and extended drain intervals, also influence market dynamics. End-user demographics are increasingly sophisticated, demanding tailored solutions for specific operational challenges and equipment types. Mergers and acquisitions (M&A) activity is a notable trend, as larger companies seek to expand their geographical reach and product portfolios across the continent.

- Market Concentration: Dominated by a few key global players, but with significant room for regional specialists.

- Technological Innovation: Focus on extended drain intervals, fuel efficiency, and bio-based lubricants.

- Regulatory Frameworks: Varying standards and compliance requirements across countries influence product development and market access.

- Competitive Substitutes: Growing interest in synthetic lubricants and advanced additive technologies.

- End-User Demographics: Increasing demand for specialized lubricants for diverse heavy equipment applications.

- M&A Trends: Strategic acquisitions to bolster market presence and distribution networks across Africa.

Africa Heavy Equipment Lubricants Industry Growth Trends & Insights

The Africa Heavy Equipment Lubricants Industry is poised for robust growth, driven by ongoing infrastructure development, expansion in the mining sector, and continued investment in the oil and gas industry. The Africa heavy equipment lubricants market size is projected to witness a significant Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). Adoption rates for advanced lubricant technologies, including synthetic and semi-synthetic formulations, are on the rise, reflecting a growing awareness of their benefits in terms of equipment longevity, reduced maintenance costs, and improved operational efficiency. Technological disruptions are emerging, with innovations in lubricant additives and smart lubrication systems beginning to influence the market. Consumer behavior shifts are also evident, with end-users increasingly prioritizing performance, reliability, and sustainability in their lubricant choices.

- Market Size Evolution: Expected to reach USD XX Billion by 2033, from USD XX Billion in 2025.

- CAGR: Projected at XX% for the forecast period.

- Adoption Rates: Increasing preference for synthetic and semi-synthetic lubricants.

- Technological Disruptions: Advancements in additive technology and predictive maintenance solutions.

- Consumer Behavior Shifts: Growing emphasis on total cost of ownership, equipment lifespan, and environmental impact.

- Market Penetration: Expanding into previously underserved rural and remote areas.

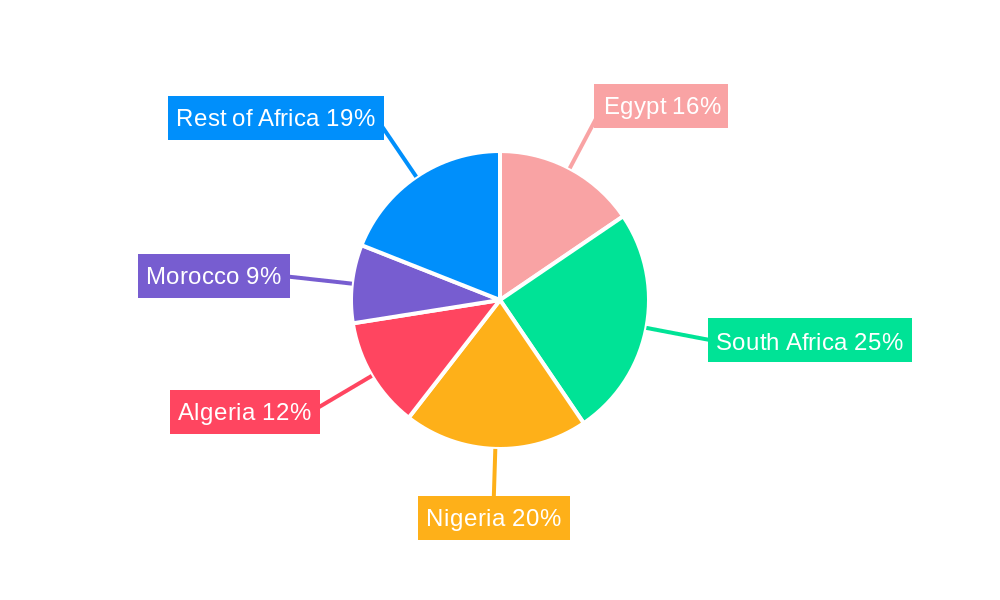

Dominant Regions, Countries, or Segments in Africa Heavy Equipment Lubricants Industry

South Africa and Nigeria emerge as dominant regions within the Africa Heavy Equipment Lubricants Industry, driven by their well-established mining and oil & gas sectors, respectively. The construction lubricants Africa segment is experiencing significant expansion, fueled by large-scale infrastructure projects across the continent. Within product types, engine oil and transmission and hydraulic fluid are expected to maintain their leading positions due to their widespread application in virtually all heavy equipment. However, growth in gear oil and grease is also anticipated, particularly in specialized mining and industrial applications.

Key Drivers for Dominance:

- South Africa: Mature mining industry, significant automotive sector, and robust industrial base. High demand for mining lubricants and specialized industrial oils. Market size estimated at USD XX Million in 2025.

- Nigeria: Leading oil and gas producer in Africa, driving substantial demand for lubricants in exploration, extraction, and refining. Estimated market size of USD XX Million in 2025.

- Construction Industry: Significant government investment in infrastructure projects like roads, railways, and ports across various African nations. This segment is projected to grow at a CAGR of XX%.

- Engine Oil: Ubiquitous in all heavy-duty engines, representing the largest product segment.

- Transmission and Hydraulic Fluid: Crucial for the operation of complex machinery in construction and mining.

Africa Heavy Equipment Lubricants Industry Product Landscape

The Africa Heavy Equipment Lubricants Industry is characterized by a diverse product landscape catering to the stringent demands of heavy machinery. Innovations are focused on enhancing performance under extreme operating conditions, such as high temperatures and heavy loads. Engine oils are increasingly formulated with advanced additive packages to improve wear protection, reduce emissions, and extend drain intervals. Transmission and hydraulic fluids are optimized for improved shear stability and thermal resistance, ensuring smooth operation and component longevity. General industrial oils are seeing developments in biodegradability and reduced environmental impact. Unique selling propositions often lie in the ability to withstand harsh African climates and prolonged service intervals, reducing downtime and operational costs for end-users.

Key Drivers, Barriers & Challenges in Africa Heavy Equipment Lubricants Industry

Key Drivers:

- Infrastructure Development: Government and private sector investments in roads, railways, ports, and real estate are propelling demand for lubricants.

- Mining Sector Expansion: Increased exploration and extraction activities, especially for strategic minerals, drive lubricant consumption.

- Oil and Gas Exploration & Production: Ongoing upstream and downstream activities in key African nations necessitate a steady supply of specialized lubricants.

- Growing Fleet Size: The increasing number of heavy equipment units across various sectors directly translates to higher lubricant demand.

- Technological Advancements: Development of higher-performance lubricants that offer extended drain intervals and better equipment protection.

Barriers & Challenges:

- Supply Chain and Logistics: Inefficient transportation networks and import challenges can lead to stockouts and increased costs.

- Counterfeit Products: The prevalence of substandard and counterfeit lubricants erodes market trust and can damage equipment.

- Price Volatility of Raw Materials: Fluctuations in crude oil prices impact the cost of base oils and finished lubricant products.

- Regulatory Complexities: Diverse and sometimes inconsistent regulatory environments across different African countries pose compliance hurdles.

- Skilled Labor Shortage: Lack of trained personnel for proper lubricant application and maintenance can hinder optimal performance.

- Economic Instability: Currency fluctuations and economic downturns in some regions can impact purchasing power.

Emerging Opportunities in Africa Heavy Equipment Lubricants Industry

Emerging opportunities in the Africa Heavy Equipment Lubricants Industry lie in the increasing demand for environmentally friendly lubricants, driven by growing global and local awareness of sustainability. The development and adoption of bio-based and biodegradable lubricants present a significant untapped market. Furthermore, the expansion of the agricultural sector in several African nations creates a growing demand for specialized lubricants for tractors and other farm machinery. Smart lubrication solutions, incorporating IoT sensors for real-time monitoring and predictive maintenance, offer a pathway for value-added services and differentiated product offerings. The "Rest of Africa" segment, encompassing rapidly developing economies beyond the major players, represents a frontier for market penetration and growth.

Growth Accelerators in the Africa Heavy Equipment Lubricants Industry Industry

Long-term growth in the Africa Heavy Equipment Lubricants Industry will be significantly accelerated by ongoing digitalization and automation within the heavy equipment sector, necessitating lubricants that can perform under more demanding and digitally monitored conditions. Strategic partnerships between lubricant manufacturers and original equipment manufacturers (OEMs) will be crucial for developing co-branded and OEM-approved lubricants, ensuring optimal performance and warranty adherence. Market expansion strategies focused on establishing robust distribution networks in remote and underserved regions will unlock new customer bases. Furthermore, the increasing adoption of advanced additive technologies, such as nanotechnology and extended life formulations, will drive demand for premium lubricant products, pushing the overall market value upwards.

Key Players Shaping the Africa Heavy Equipment Lubricants Industry Market

- BP PLC

- Chevron Corporation

- Conoil

- Coperative Soceite Des Petroleum (Co-op)

- Engen Petroleum Ltd

- Exxon Mobil Corporation

- FUCHS

- Hasspetroleum

- Kenolkobil Limited

- Puma Energy

- Royal Dutch Shell PLC

- Sasol

Notable Milestones in Africa Heavy Equipment Lubricants Industry Sector

- 2019: Major global lubricant manufacturer launches a new line of high-performance, fuel-efficient engine oils for African mining operations.

- 2020: Several African nations announce ambitious infrastructure development plans, boosting demand for construction lubricants.

- 2021: Increased M&A activity as international players acquire smaller, regional lubricant distributors to expand their footprint.

- 2022: Growing awareness and regulatory push towards environmentally friendly lubricants prompts R&D investment in bio-based alternatives.

- 2023: Significant increase in oil and gas exploration activities in East and West Africa, driving demand for specialized drilling and production lubricants.

- 2024: Introduction of advanced additive technologies leading to extended drain intervals for hydraulic fluids in heavy construction equipment.

- 2025 (Estimated): Launch of new synthetic gear oils designed to withstand extreme temperatures in African mining environments.

- 2026 (Forecast): Expected wider adoption of digital lubricant monitoring systems in major industrial applications.

- 2028 (Forecast): Potential emergence of local manufacturing hubs for specialized lubricants in key African economic centers.

- 2030 (Forecast): Increased market penetration of biodegradable lubricants in sensitive environmental zones.

- 2032 (Forecast): Emergence of strategic alliances for the development of sustainable lubricant solutions tailored for African conditions.

- 2033 (Forecast): Anticipated significant market share growth for premium and specialized lubricant products.

In-Depth Africa Heavy Equipment Lubricants Industry Market Outlook

The future of the Africa Heavy Equipment Lubricants Industry is exceptionally promising, underpinned by sustained economic growth and ongoing industrialization across the continent. Growth accelerators such as technological innovation in advanced additive formulations and the increasing adoption of OEM-approved lubricants will continue to drive market value. Strategic partnerships with key stakeholders, including equipment manufacturers and large industrial consumers, will foster product development and market penetration. The expansion into untapped markets within "Rest of Africa" and the growing demand for sustainable lubricant solutions are poised to further propel the industry's growth trajectory. This comprehensive outlook suggests a dynamic and expanding market for heavy equipment lubricants, offering substantial opportunities for stakeholders.

Africa Heavy Equipment Lubricants Industry Segmentation

-

1. Product Type

- 1.1. Engine Oil

- 1.2. Transmission and Hydraulic Fluid

- 1.3. General Industrial Oil

- 1.4. Gear Oil

- 1.5. Grease

- 1.6. Process Oil

- 1.7. Other Product Types

-

2. End-user Industry

- 2.1. Construction

- 2.2. Mining

- 2.3. Agriculture

- 2.4. Oil and Gas

-

3. Geography

- 3.1. Egypt

- 3.2. South Africa

- 3.3. Nigeria

- 3.4. Algeria

- 3.5. Morocco

- 3.6. Rest of Africa

Africa Heavy Equipment Lubricants Industry Segmentation By Geography

- 1. Egypt

- 2. South Africa

- 3. Nigeria

- 4. Algeria

- 5. Morocco

- 6. Rest of Africa

Africa Heavy Equipment Lubricants Industry Regional Market Share

Geographic Coverage of Africa Heavy Equipment Lubricants Industry

Africa Heavy Equipment Lubricants Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from the End-user Industries; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand from the End-user Industries; Other Drivers

- 3.4. Market Trends

- 3.4.1. Mining Industry to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Engine Oil

- 5.1.2. Transmission and Hydraulic Fluid

- 5.1.3. General Industrial Oil

- 5.1.4. Gear Oil

- 5.1.5. Grease

- 5.1.6. Process Oil

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Construction

- 5.2.2. Mining

- 5.2.3. Agriculture

- 5.2.4. Oil and Gas

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Egypt

- 5.3.2. South Africa

- 5.3.3. Nigeria

- 5.3.4. Algeria

- 5.3.5. Morocco

- 5.3.6. Rest of Africa

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Egypt

- 5.4.2. South Africa

- 5.4.3. Nigeria

- 5.4.4. Algeria

- 5.4.5. Morocco

- 5.4.6. Rest of Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Egypt Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Engine Oil

- 6.1.2. Transmission and Hydraulic Fluid

- 6.1.3. General Industrial Oil

- 6.1.4. Gear Oil

- 6.1.5. Grease

- 6.1.6. Process Oil

- 6.1.7. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Construction

- 6.2.2. Mining

- 6.2.3. Agriculture

- 6.2.4. Oil and Gas

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Egypt

- 6.3.2. South Africa

- 6.3.3. Nigeria

- 6.3.4. Algeria

- 6.3.5. Morocco

- 6.3.6. Rest of Africa

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South Africa Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Engine Oil

- 7.1.2. Transmission and Hydraulic Fluid

- 7.1.3. General Industrial Oil

- 7.1.4. Gear Oil

- 7.1.5. Grease

- 7.1.6. Process Oil

- 7.1.7. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Construction

- 7.2.2. Mining

- 7.2.3. Agriculture

- 7.2.4. Oil and Gas

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Egypt

- 7.3.2. South Africa

- 7.3.3. Nigeria

- 7.3.4. Algeria

- 7.3.5. Morocco

- 7.3.6. Rest of Africa

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Nigeria Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Engine Oil

- 8.1.2. Transmission and Hydraulic Fluid

- 8.1.3. General Industrial Oil

- 8.1.4. Gear Oil

- 8.1.5. Grease

- 8.1.6. Process Oil

- 8.1.7. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Construction

- 8.2.2. Mining

- 8.2.3. Agriculture

- 8.2.4. Oil and Gas

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Egypt

- 8.3.2. South Africa

- 8.3.3. Nigeria

- 8.3.4. Algeria

- 8.3.5. Morocco

- 8.3.6. Rest of Africa

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Algeria Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Engine Oil

- 9.1.2. Transmission and Hydraulic Fluid

- 9.1.3. General Industrial Oil

- 9.1.4. Gear Oil

- 9.1.5. Grease

- 9.1.6. Process Oil

- 9.1.7. Other Product Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Construction

- 9.2.2. Mining

- 9.2.3. Agriculture

- 9.2.4. Oil and Gas

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. Egypt

- 9.3.2. South Africa

- 9.3.3. Nigeria

- 9.3.4. Algeria

- 9.3.5. Morocco

- 9.3.6. Rest of Africa

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Morocco Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Engine Oil

- 10.1.2. Transmission and Hydraulic Fluid

- 10.1.3. General Industrial Oil

- 10.1.4. Gear Oil

- 10.1.5. Grease

- 10.1.6. Process Oil

- 10.1.7. Other Product Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Construction

- 10.2.2. Mining

- 10.2.3. Agriculture

- 10.2.4. Oil and Gas

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. Egypt

- 10.3.2. South Africa

- 10.3.3. Nigeria

- 10.3.4. Algeria

- 10.3.5. Morocco

- 10.3.6. Rest of Africa

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Rest of Africa Africa Heavy Equipment Lubricants Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Engine Oil

- 11.1.2. Transmission and Hydraulic Fluid

- 11.1.3. General Industrial Oil

- 11.1.4. Gear Oil

- 11.1.5. Grease

- 11.1.6. Process Oil

- 11.1.7. Other Product Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Construction

- 11.2.2. Mining

- 11.2.3. Agriculture

- 11.2.4. Oil and Gas

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. Egypt

- 11.3.2. South Africa

- 11.3.3. Nigeria

- 11.3.4. Algeria

- 11.3.5. Morocco

- 11.3.6. Rest of Africa

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 BP PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Chevron Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Conoil

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Coperative Soceite Des Petroleum (Co-op)

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Engen Petroleum Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Exxon Mobil Corporation

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 FUCHS

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hasspetroleum

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Kenolkobil Limited

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Puma Energy

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Royal Dutch Shell PLC

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Sasol

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Total*List Not Exhaustive

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.1 BP PLC

List of Figures

- Figure 1: Global Africa Heavy Equipment Lubricants Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 7: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: Egypt Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: Egypt Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 13: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 15: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: South Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: South Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Nigeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Nigeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 31: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Algeria Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: Algeria Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 35: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 37: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Morocco Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Morocco Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Product Type 2025 & 2033

- Figure 43: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 44: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 45: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 47: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Rest of Africa Africa Heavy Equipment Lubricants Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 14: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 18: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 22: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global Africa Heavy Equipment Lubricants Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Heavy Equipment Lubricants Industry?

The projected CAGR is approximately 3.43%.

2. Which companies are prominent players in the Africa Heavy Equipment Lubricants Industry?

Key companies in the market include BP PLC, Chevron Corporation, Conoil, Coperative Soceite Des Petroleum (Co-op), Engen Petroleum Ltd, Exxon Mobil Corporation, FUCHS, Hasspetroleum, Kenolkobil Limited, Puma Energy, Royal Dutch Shell PLC, Sasol, Total*List Not Exhaustive.

3. What are the main segments of the Africa Heavy Equipment Lubricants Industry?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from the End-user Industries; Other Drivers.

6. What are the notable trends driving market growth?

Mining Industry to Dominate the market.

7. Are there any restraints impacting market growth?

; Growing Demand from the End-user Industries; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Heavy Equipment Lubricants Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Heavy Equipment Lubricants Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Heavy Equipment Lubricants Industry?

To stay informed about further developments, trends, and reports in the Africa Heavy Equipment Lubricants Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence