Key Insights

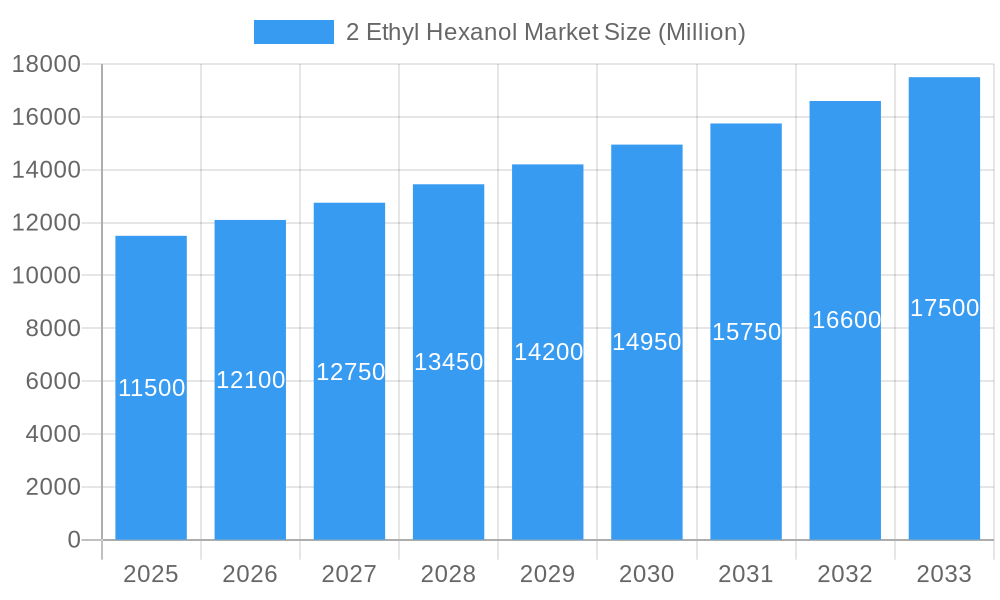

The global 2-Ethyl Hexanol (2-EH) market is poised for robust growth, projected to surpass USD 15,000 million by 2033, driven by a compelling Compound Annual Growth Rate (CAGR) exceeding 5.00%. This expansion is largely fueled by the escalating demand for plasticizers, a primary application for 2-EH, particularly in the burgeoning paint and coatings and adhesives sectors. The increasing adoption of PVC in construction, automotive, and consumer goods worldwide necessitates a consistent supply of plasticizers, directly benefiting the 2-EH market. Furthermore, 2-EH's versatility extends to its use in the production of acrylates, nitrates, and various industrial chemicals, broadening its application spectrum and contributing to its sustained market traction. Emerging economies, especially in the Asia Pacific region, are anticipated to lead this growth trajectory, owing to rapid industrialization, increasing disposable incomes, and significant investments in infrastructure development.

2 Ethyl Hexanol Market Market Size (In Billion)

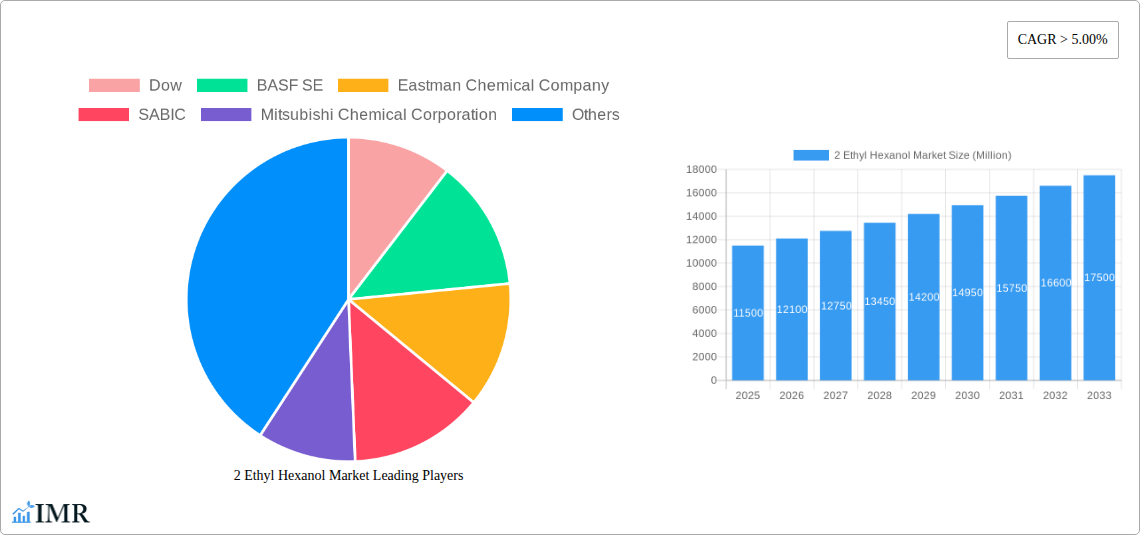

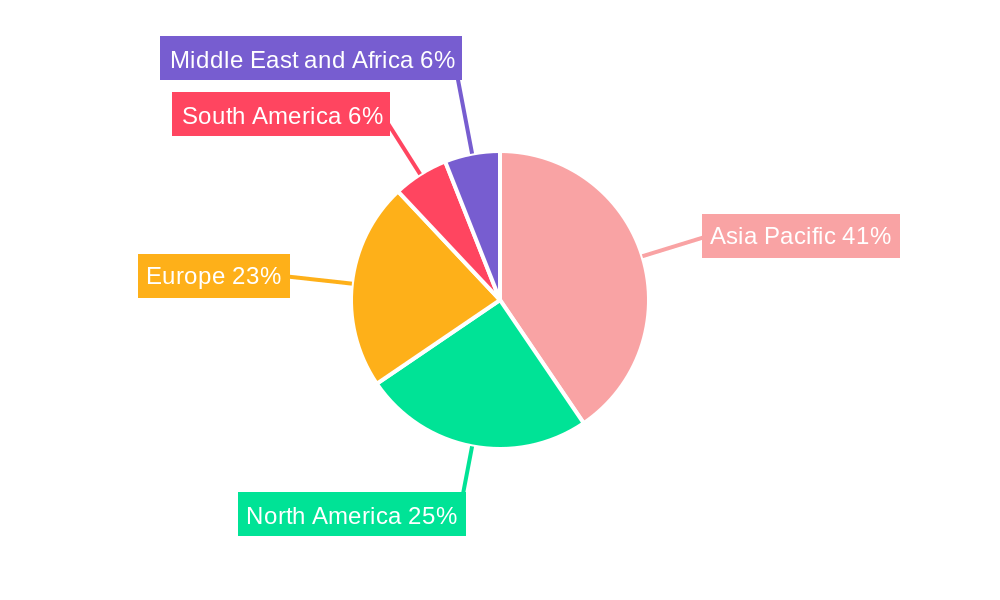

Despite a generally positive outlook, the 2-EH market is not without its challenges. Fluctuations in raw material prices, particularly propylene and n-butyraldehyde, can impact production costs and, consequently, market pricing. Stringent environmental regulations concerning volatile organic compounds (VOCs) in certain applications might also influence demand patterns. However, ongoing research and development efforts focused on enhancing production efficiency, exploring sustainable feedstock alternatives, and developing new high-performance applications are expected to mitigate these restraints. Key players like Dow, BASF SE, and Eastman Chemical Company are actively engaged in strategic expansions, technological innovations, and collaborations to strengthen their market positions and capitalize on evolving market dynamics. The market's regional segmentation highlights Asia Pacific as the dominant force, followed by North America and Europe, with significant growth potential also evident in South America and the Middle East & Africa.

2 Ethyl Hexanol Market Company Market Share

This in-depth report delivers a definitive analysis of the global 2-Ethylhexanol (2-EH) market, a crucial intermediate chemical with widespread applications, particularly in the production of plasticizers. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this study offers unparalleled insights into market dynamics, segmentation, key players, and future opportunities. Our research encompasses a detailed examination of oxo alcohols, plasticizer intermediates, and related industrial chemicals, providing a holistic view of this vital sector. Values are presented in Million units.

2-Ethylhexanol Market Market Dynamics & Structure

The global 2-Ethylhexanol (2-EH) market is characterized by a moderately concentrated structure, with a few major players dominating production and supply. Technological innovation remains a significant driver, particularly in optimizing production processes and developing new applications. Stringent environmental regulations and safety standards worldwide influence manufacturing practices and product development, pushing for more sustainable and less hazardous alternatives. The plasticizers market, a primary end-user for 2-EH, is experiencing shifts driven by consumer demand for safer products, leading to increased research into phthalate-free alternatives, impacting the demand for 2-EH derivatives. Competitive product substitutes, though present, are often application-specific, with 2-EH holding a strong position in many key areas. End-user demographics are evolving, with increasing demand from developing economies and a growing focus on the performance and sustainability of materials used in construction, automotive, and consumer goods. Mergers and acquisitions (M&A) are a notable trend, as companies seek to consolidate market positions, expand their product portfolios, and enhance vertical integration. For instance, the increasing demand for DOTP plasticizers is prompting strategic investments in 2-EH production capacity.

- Market Concentration: Dominated by a handful of global chemical giants, with significant regional production hubs.

- Technological Innovation: Focus on process efficiency, cost reduction, and development of high-performance derivatives.

- Regulatory Frameworks: Increasing emphasis on REACH compliance and sustainability initiatives influencing production and usage.

- Competitive Landscape: While alternatives exist, 2-EH maintains a strong foothold due to its versatility and cost-effectiveness in core applications.

- End-User Evolution: Growing demand from Asia-Pacific and Latin America, coupled with a rising preference for eco-friendly plasticizers.

- M&A Activity: Strategic acquisitions to secure feedstock, expand market reach, and integrate value chains.

2-Ethylhexanol Market Growth Trends & Insights

The 2-Ethylhexanol (2-EH) market is poised for robust growth, driven by the insatiable demand for downstream products such as plasticizers, which are indispensable in the manufacturing of flexible PVC products. The plasticizer market segment, in particular, is witnessing significant expansion, fueled by its extensive use in construction materials, automotive interiors, and consumer goods. The compound annual growth rate (CAGR) is projected to remain healthy throughout the forecast period, indicating sustained market expansion. Technological disruptions, such as advancements in oxo-alcohol production processes, are contributing to improved efficiency and cost-effectiveness, further stimulating market penetration. Consumer behavior shifts towards greater demand for durable and flexible materials in everyday products directly translate into increased consumption of 2-EH. The burgeoning paint and coatings industry and the adhesives sector also represent substantial growth avenues for 2-EH derivatives like 2-EH acrylate, showcasing its broad utility. As economies develop, particularly in emerging markets, the adoption rates for products utilizing 2-EH are expected to accelerate, underscoring the market's positive trajectory. The ongoing infrastructure development projects globally will further augment the demand for construction chemicals where 2-EH plays a vital role. Furthermore, the increasing awareness and adoption of advanced materials in various industrial applications are opening new avenues for 2-EH consumption, solidifying its position as a critical chemical intermediate. The projected market size for 2-EH is set to experience a significant uplift, driven by these multifaceted growth factors and a consistent demand from its diverse end-user industries.

Dominant Regions, Countries, or Segments in 2-Ethylhexanol Market

The plasticizers segment, within the broader 2-Ethylhexanol market, stands out as the dominant driver of market growth. This is primarily attributed to the pervasive use of plasticizers in the manufacturing of flexible Polyvinyl Chloride (PVC) products, which are ubiquitous across numerous industries. The construction sector, with its continuous demand for PVC in pipes, flooring, roofing membranes, and wire insulation, represents a colossal consumer of plasticizers, and consequently, 2-EH. Similarly, the automotive industry relies heavily on plasticizers for interior components, cable insulation, and coatings, further bolstering demand. The Paint and Coatings end-user segment also exhibits significant growth, driven by the demand for durable, weather-resistant, and aesthetically pleasing finishes in both residential and commercial applications. 2-EH is a key component in the production of acrylic esters, which are essential monomers for high-performance coatings.

Asia-Pacific has emerged as the leading region in the 2-Ethylhexanol market. This dominance is fueled by rapid industrialization, a burgeoning manufacturing base, and substantial infrastructure development across countries like China, India, and Southeast Asian nations. The region's vast population and increasing disposable incomes also contribute to a higher demand for consumer goods and construction materials, directly translating into greater consumption of 2-EH and its derivatives.

- Dominant Segment (Applications): Plasticizers, accounting for the largest share due to extensive use in PVC production for construction, automotive, and consumer goods.

- Key End-User Drivers:

- Paint and Coatings: Demand for durable and high-performance coatings in construction and industrial applications.

- Adhesives: Growing use in construction and packaging adhesives for enhanced flexibility and performance.

- Industrial Chemicals: Broad application as a solvent and intermediate in various chemical synthesis processes.

- Dominant Region: Asia-Pacific, driven by rapid industrial growth, infrastructure development, and a large manufacturing sector in countries like China and India.

- Growth Potential in Leading Countries: China's extensive manufacturing capabilities and substantial domestic consumption, coupled with India's ongoing infrastructure expansion, are key contributors to regional dominance.

2-Ethylhexanol Market Product Landscape

The 2-Ethylhexanol (2-EH) product landscape is defined by its versatile nature as a key intermediate chemical. Its primary role is in the synthesis of various esters, most notably dioctyl phthalate (DOP) and more recently, dioctyl terephthalate (DOTP), which are vital plasticizers. Beyond plasticizers, 2-EH is crucial for producing 2-EH Acrylate, a monomer essential for the production of acrylic resins used in paints, coatings, adhesives, and textiles, offering excellent weatherability and UV resistance. It also finds application in the production of 2-EH Nitrate, a cetane improver for diesel fuels. The performance metrics of 2-EH derivatives are characterized by their ability to impart flexibility, durability, and enhanced processing characteristics to a wide range of materials, making them indispensable in modern manufacturing.

Key Drivers, Barriers & Challenges in 2-Ethylhexanol Market

Key Drivers:

- Growing Demand for Plasticizers: The booming construction and automotive sectors globally are primary drivers, increasing the need for flexible PVC products.

- Expanding Applications in Paints and Coatings: 2-EH acrylate's role in high-performance coatings contributes to sustained market expansion.

- Industrial Growth in Emerging Economies: Rapid industrialization in Asia-Pacific and other developing regions fuels demand for 2-EH in various manufacturing processes.

- Technological Advancements: Innovations in oxo-alcohol production efficiency and derivative synthesis enhance product performance and cost-effectiveness.

Barriers & Challenges:

- Environmental and Health Concerns: Regulatory scrutiny around certain phthalate plasticizers necessitates the development and adoption of safer alternatives, impacting traditional 2-EH applications.

- Volatility in Raw Material Prices: Fluctuations in the prices of propylene and synthesis gas, key feedstocks for 2-EH production, can impact profitability.

- Supply Chain Disruptions: Geopolitical events, natural disasters, and logistical challenges can disrupt the availability of raw materials and finished products.

- Intensifying Competition: The presence of multiple global and regional manufacturers leads to price pressures and the need for continuous innovation.

Emerging Opportunities in 2-Ethylhexanol Market

Emerging opportunities in the 2-Ethylhexanol (2-EH) market lie in the development of bio-based 2-EH as a sustainable alternative, catering to the growing environmental consciousness of consumers and industries. The increasing demand for specialized plasticizers with enhanced performance characteristics, such as those offering improved low-temperature flexibility or flame retardancy, presents a significant avenue for innovation. Furthermore, the expanding use of 2-EH in niche applications like specialty lubricants, solvents, and intermediates for pharmaceuticals and agrochemicals offers diversification opportunities. The growing adoption of electric vehicles and the associated demand for advanced battery components and lightweight materials could also unlock new applications for 2-EH derivatives.

Growth Accelerators in the 2-Ethylhexanol Market Industry

The long-term growth of the 2-Ethylhexanol (2-EH) market is propelled by several accelerating factors. Continued global economic development, particularly in emerging markets, will drive sustained demand for construction materials, automotive components, and consumer goods that rely on 2-EH-based products. Technological breakthroughs in catalytic processes for oxo-alcohol production are leading to more efficient and cost-effective manufacturing, enhancing the competitiveness of 2-EH. Strategic partnerships and joint ventures between chemical manufacturers and downstream users are fostering innovation and market penetration. The increasing focus on circular economy principles and the development of recyclable and biodegradable materials could also present opportunities for tailored 2-EH applications.

Key Players Shaping the 2-Ethylhexanol Market Market

- Dow

- BASF SE

- Eastman Chemical Company

- SABIC

- Mitsubishi Chemical Corporation

- LG Chem

- INEOS

- NAN YA PLASTICS CORPORATION

- OQ Chemicals GmbH

- Elekeiroz

Notable Milestones in 2-Ethylhexanol Market Sector

- December 2022: Saudi Basic Industries Corporation (SABIC) inaugurated a new industrial chemicals facility in Jeddah. This expansion is significant as it strengthens Saudi Arabia's position as a key supplier of safe plasticizers. The new facility is the first in the Kingdom to utilize SABIC's ethyl hexanol (2-EH) for producing dioctyl terephthalate (DOTP), a critical ingredient in plasticizer manufacturing, thereby boosting the supply and application of DOTP-based plasticizers.

- September 2022: Anqing Shuguang Petrochemical Oxo (Anqing) secured a license from Johnson Matthey (JM) and Dow. This license allows for the production of approximately 200 kilotons per annum (kta) of 2-ethyl hexanol and 25 kta of iso-butyraldehyde. This marks the second LP Oxo Licence for Anqing in China and the 23rd globally, signifying a strategic move to expand its oxo business within the expanding oxo alcohol market. The plant is anticipated to commence operations in 2024. Anqing had previously operated LP Oxo Technology, starting in 2016, producing 100 kta of 2-ethyl hexanol, 115 kta of normal butanol, and 23 kta of iso butanol, demonstrating a consistent growth trajectory in its oxo alcohol portfolio.

In-Depth 2-Ethylhexanol Market Market Outlook

The 2-Ethylhexanol (2-EH) market is projected for sustained and substantial growth, underpinned by robust demand from its primary applications as a precursor to plasticizers and acrylic esters. The ongoing global infrastructure development, coupled with the expansive growth in the automotive and construction industries, will continue to be the primary catalysts for this expansion. Furthermore, the increasing focus on developing high-performance and eco-friendlier chemical intermediates presents significant opportunities for innovation and market diversification. Strategic investments in production capacity, coupled with a proactive approach to regulatory changes and a commitment to sustainable practices, will be crucial for market players to capitalize on the promising future outlook of the 2-EH market. The projected growth signifies a strong and evolving market with considerable potential for both established and emerging players.

2 Ethyl Hexanol Market Segmentation

-

1. Applications

- 1.1. Plasticizers

- 1.2. 2-EH Acrylate

- 1.3. 2-EH Nitrate

- 1.4. Other Applications

-

2. End-User

- 2.1. Paint and Coatings

- 2.2. Adhesives

- 2.3. Industrial Chemicals

- 2.4. Other End-Users

2 Ethyl Hexanol Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Spain

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Aregentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

2 Ethyl Hexanol Market Regional Market Share

Geographic Coverage of 2 Ethyl Hexanol Market

2 Ethyl Hexanol Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 5.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for 2-EH Acrylate; Increasing Consumption of Plasticizers

- 3.3. Market Restrains

- 3.3.1. Growing Demand for 2-EH Acrylate; Increasing Consumption of Plasticizers

- 3.4. Market Trends

- 3.4.1. Increasing Demand for 2-EH Acrylate to Propel the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global 2 Ethyl Hexanol Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 5.1.1. Plasticizers

- 5.1.2. 2-EH Acrylate

- 5.1.3. 2-EH Nitrate

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Paint and Coatings

- 5.2.2. Adhesives

- 5.2.3. Industrial Chemicals

- 5.2.4. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.3.2. North America

- 5.3.3. Europe

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Applications

- 6. Asia Pacific 2 Ethyl Hexanol Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 6.1.1. Plasticizers

- 6.1.2. 2-EH Acrylate

- 6.1.3. 2-EH Nitrate

- 6.1.4. Other Applications

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Paint and Coatings

- 6.2.2. Adhesives

- 6.2.3. Industrial Chemicals

- 6.2.4. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Applications

- 7. North America 2 Ethyl Hexanol Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 7.1.1. Plasticizers

- 7.1.2. 2-EH Acrylate

- 7.1.3. 2-EH Nitrate

- 7.1.4. Other Applications

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Paint and Coatings

- 7.2.2. Adhesives

- 7.2.3. Industrial Chemicals

- 7.2.4. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Applications

- 8. Europe 2 Ethyl Hexanol Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 8.1.1. Plasticizers

- 8.1.2. 2-EH Acrylate

- 8.1.3. 2-EH Nitrate

- 8.1.4. Other Applications

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Paint and Coatings

- 8.2.2. Adhesives

- 8.2.3. Industrial Chemicals

- 8.2.4. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Applications

- 9. South America 2 Ethyl Hexanol Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 9.1.1. Plasticizers

- 9.1.2. 2-EH Acrylate

- 9.1.3. 2-EH Nitrate

- 9.1.4. Other Applications

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Paint and Coatings

- 9.2.2. Adhesives

- 9.2.3. Industrial Chemicals

- 9.2.4. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Applications

- 10. Middle East and Africa 2 Ethyl Hexanol Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Applications

- 10.1.1. Plasticizers

- 10.1.2. 2-EH Acrylate

- 10.1.3. 2-EH Nitrate

- 10.1.4. Other Applications

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Paint and Coatings

- 10.2.2. Adhesives

- 10.2.3. Industrial Chemicals

- 10.2.4. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Applications

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dow

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Eastman Chemical Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SABIC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mitsubishi Chemical Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LG Chem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 INEOS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 NAN YA PLASTICS CORPORATION

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 OQ Chemicals GmbH

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Elekeiroz*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dow

List of Figures

- Figure 1: Global 2 Ethyl Hexanol Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific 2 Ethyl Hexanol Market Revenue (Million), by Applications 2025 & 2033

- Figure 3: Asia Pacific 2 Ethyl Hexanol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 4: Asia Pacific 2 Ethyl Hexanol Market Revenue (Million), by End-User 2025 & 2033

- Figure 5: Asia Pacific 2 Ethyl Hexanol Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: Asia Pacific 2 Ethyl Hexanol Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific 2 Ethyl Hexanol Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: North America 2 Ethyl Hexanol Market Revenue (Million), by Applications 2025 & 2033

- Figure 9: North America 2 Ethyl Hexanol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 10: North America 2 Ethyl Hexanol Market Revenue (Million), by End-User 2025 & 2033

- Figure 11: North America 2 Ethyl Hexanol Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: North America 2 Ethyl Hexanol Market Revenue (Million), by Country 2025 & 2033

- Figure 13: North America 2 Ethyl Hexanol Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe 2 Ethyl Hexanol Market Revenue (Million), by Applications 2025 & 2033

- Figure 15: Europe 2 Ethyl Hexanol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 16: Europe 2 Ethyl Hexanol Market Revenue (Million), by End-User 2025 & 2033

- Figure 17: Europe 2 Ethyl Hexanol Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Europe 2 Ethyl Hexanol Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe 2 Ethyl Hexanol Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America 2 Ethyl Hexanol Market Revenue (Million), by Applications 2025 & 2033

- Figure 21: South America 2 Ethyl Hexanol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 22: South America 2 Ethyl Hexanol Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: South America 2 Ethyl Hexanol Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: South America 2 Ethyl Hexanol Market Revenue (Million), by Country 2025 & 2033

- Figure 25: South America 2 Ethyl Hexanol Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa 2 Ethyl Hexanol Market Revenue (Million), by Applications 2025 & 2033

- Figure 27: Middle East and Africa 2 Ethyl Hexanol Market Revenue Share (%), by Applications 2025 & 2033

- Figure 28: Middle East and Africa 2 Ethyl Hexanol Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: Middle East and Africa 2 Ethyl Hexanol Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: Middle East and Africa 2 Ethyl Hexanol Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa 2 Ethyl Hexanol Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 2: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 5: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Rest of Asia Pacific 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 13: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 14: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United States 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Mexico 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 19: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 20: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Germany 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: France 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Spain 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Rest of Europe 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 28: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 29: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 30: Brazil 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Aregentina 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of South America 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Applications 2020 & 2033

- Table 34: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 35: Global 2 Ethyl Hexanol Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: United Arab Emirates 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Saudi Arabia 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: South Africa 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Middle East and Africa 2 Ethyl Hexanol Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the 2 Ethyl Hexanol Market?

The projected CAGR is approximately > 5.00%.

2. Which companies are prominent players in the 2 Ethyl Hexanol Market?

Key companies in the market include Dow, BASF SE, Eastman Chemical Company, SABIC, Mitsubishi Chemical Corporation, LG Chem, INEOS, NAN YA PLASTICS CORPORATION, OQ Chemicals GmbH, Elekeiroz*List Not Exhaustive.

3. What are the main segments of the 2 Ethyl Hexanol Market?

The market segments include Applications, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for 2-EH Acrylate; Increasing Consumption of Plasticizers.

6. What are the notable trends driving market growth?

Increasing Demand for 2-EH Acrylate to Propel the Market.

7. Are there any restraints impacting market growth?

Growing Demand for 2-EH Acrylate; Increasing Consumption of Plasticizers.

8. Can you provide examples of recent developments in the market?

December 2022: Saudi Basic Industries Corporation (SABIC) opened a new industrial chemicals facility in Jeddah. The new factory will contribute to strengthening Saudi Arabia's position as a source of safe plasticizers, which are widely used in manufacturing processes and plastic applications. The Saudi Industrial Chemicals Factory is the first factory in the Kingdom of Saudi Arabia to use SABIC's ethyl hexanol (2-EH) to produce dioctyl terephthalate (DOTP) is a key ingredient in the manufacture of plasticizers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "2 Ethyl Hexanol Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the 2 Ethyl Hexanol Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the 2 Ethyl Hexanol Market?

To stay informed about further developments, trends, and reports in the 2 Ethyl Hexanol Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence