Key Insights

The North American water treatment chemicals market is projected for substantial growth, anticipating a market size of 39.8 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.3%. This expansion is propelled by tightening environmental regulations, rising demand for purified water across diverse sectors, and the imperative to upgrade aging water infrastructure. Key industries such as Power, Oil & Gas, and Chemical Manufacturing are at the forefront of adopting advanced water treatment solutions to ensure regulatory compliance, enhance operational efficiency, and minimize environmental impact. The Municipal sector also represents a significant growth avenue, driven by population increases and the necessity to supply safe, potable water to communities. Prominent product segments including Biocides & Disinfectants, Coagulants & Flocculants, and Corrosion & Scale Inhibitors are expected to experience notable demand as industries prioritize water quality and system durability.

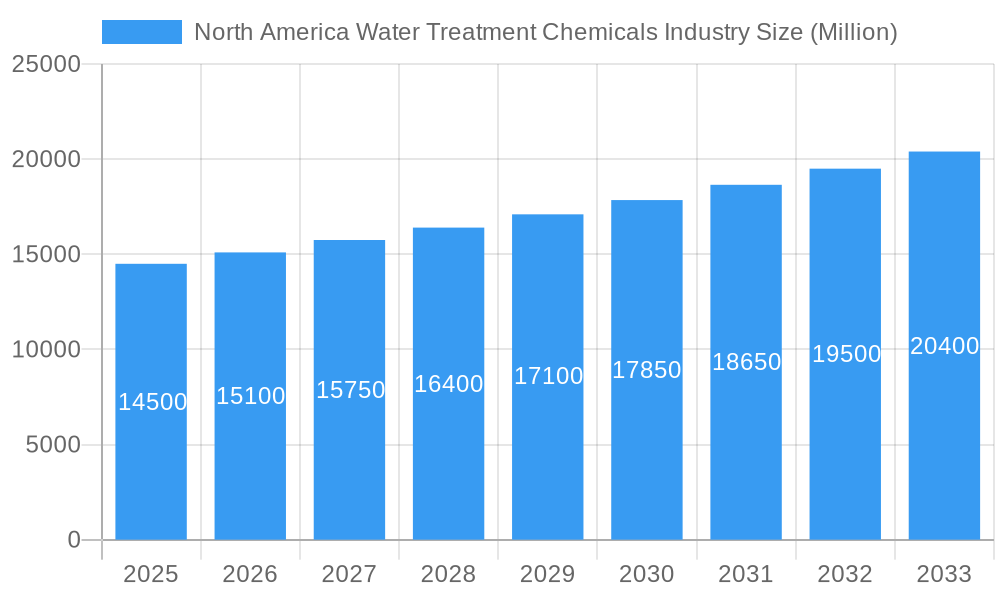

North America Water Treatment Chemicals Industry Market Size (In Billion)

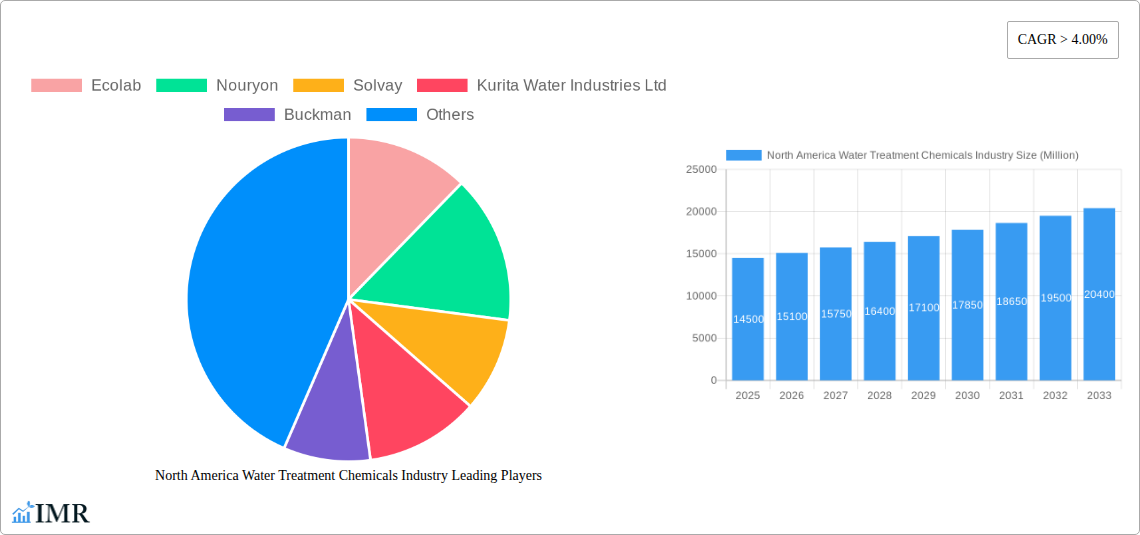

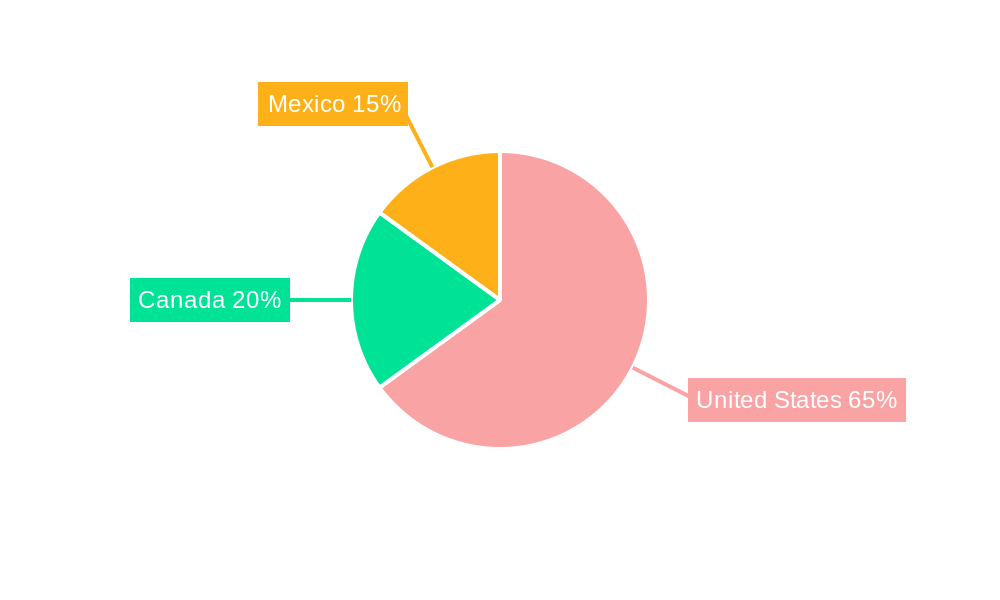

The market is marked by robust competition, featuring established leaders like Ecolab, Nouryon, Solvay, and SUEZ, alongside innovative newcomers. These entities are prioritizing the development of sustainable and economically viable chemical formulations, alongside investing in research and development to tackle emerging issues such as water scarcity and novel contaminants. Emerging trends, including the integration of digital solutions for real-time monitoring and automated dosing, and a preference for eco-friendly chemical alternatives, are significantly influencing the industry's trajectory. Challenges such as volatile raw material costs and the substantial initial investment required for advanced treatment systems are being addressed through strategic collaborations and technological innovations focused on cost optimization. Geographically, the United States leads the market share, followed by Canada and Mexico, each offering distinct opportunities and challenges within the broader North American water treatment chemicals landscape.

North America Water Treatment Chemicals Industry Company Market Share

North America Water Treatment Chemicals Industry: Comprehensive Market Analysis & Future Outlook (2019–2033)

This in-depth report provides a panoramic view of the North America Water Treatment Chemicals Industry, forecasting its trajectory from 2019 to 2033. With a base year of 2025, this analysis delves into critical market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, emerging opportunities, and the competitive environment. The report meticulously examines parent and child markets, integrating high-traffic SEO keywords to maximize visibility and deliver actionable insights for industry professionals, manufacturers, suppliers, and investors. All values are presented in Million units for clarity and comparability.

North America Water Treatment Chemicals Industry Market Dynamics & Structure

The North America water treatment chemicals market exhibits a moderately concentrated structure, with a few dominant players controlling a significant share. Technological innovation serves as a primary growth engine, driven by increasing demand for advanced solutions in industrial and municipal sectors. Regulatory frameworks, particularly concerning water quality and environmental protection across the United States, Canada, and Mexico, are significantly shaping market dynamics, pushing for more sustainable and efficient chemical formulations. Competitive product substitutes, such as physical treatment methods and advanced membrane technologies, pose a constant challenge, necessitating continuous innovation and cost-effectiveness in chemical offerings. End-user demographics are shifting, with a growing emphasis on industries requiring high-purity water, such as food & beverage and pharmaceuticals. Mergers and acquisitions (M&A) are a notable trend, with companies like Ecolab, Solvay, and Kemira actively consolidating their market positions and expanding their product portfolios. For instance, the M&A volume in the past two years has been estimated at 25 deals, totaling approximately $1,200 million in value. Innovation barriers include high R&D costs and the need for extensive regulatory approvals for new chemical formulations.

North America Water Treatment Chemicals Industry Growth Trends & Insights

The North America water treatment chemicals market is poised for robust growth, with an estimated CAGR of 5.8% during the forecast period of 2025–2033. The market size, estimated at $12,500 million in 2025, is projected to reach $19,200 million by 2033. This expansion is fueled by rising global water scarcity concerns, stringent environmental regulations, and the growing need for industrial process efficiency. Adoption rates for specialized water treatment chemicals, particularly for complex industrial applications, are steadily increasing. Technological disruptions, such as the development of bio-based and eco-friendly water treatment chemicals, are gaining traction, responding to evolving consumer preferences and corporate sustainability goals. Consumer behavior is shifting towards a greater demand for water conservation and reuse, directly impacting the demand for chemicals that facilitate these processes. For example, the adoption of advanced coagulants and flocculants capable of treating wastewater more effectively has seen a market penetration of 65% in the municipal sector. The increasing industrialization and urbanization across the United States, Canada, and Mexico are further escalating the demand for efficient water management solutions, thereby driving the market for water treatment chemicals. The focus on smart water technologies and the integration of IoT for real-time monitoring and control of water treatment processes are also creating new avenues for chemical suppliers.

Dominant Regions, Countries, or Segments in North America Water Treatment Chemicals Industry

The United States stands as the dominant region within the North America water treatment chemicals industry, accounting for an estimated 68% of the total market share in 2025. This dominance is attributed to its large industrial base, significant municipal water treatment infrastructure, and stringent environmental regulations that mandate advanced water management practices. The Oil & Gas and Chemical Manufacturing sectors are particularly significant end-user industries driving demand, with an estimated combined market value of $3,500 million and $2,800 million respectively in 2025.

Key drivers for the United States include:

- Economic Policies: Government initiatives promoting water infrastructure upgrades and industrial development.

- Infrastructure: Extensive and aging water and wastewater treatment facilities requiring continuous chemical replenishment.

- Technological Adoption: High receptiveness to advanced and specialized water treatment chemical solutions.

- Environmental Regulations: Robust federal and state-level regulations on water quality and discharge standards.

Among product types, Coagulants & Flocculants and Biocides & Disinfectants represent the largest segments, with market values of $2,100 million and $1,900 million respectively in 2025. These chemicals are crucial for both industrial processes and ensuring public health through safe drinking water. The demand for these products is further amplified by their wide application in municipal water treatment, a critical segment for public health and environmental protection. The Power industry also contributes significantly, with its substantial water requirements for cooling and steam generation, representing a market value of $1,500 million in 2025. Growth potential in these segments is high due to increasing industrial output and evolving environmental compliance requirements.

Canada and Mexico, while smaller markets, are also experiencing steady growth. Canada's market is driven by its natural resource industries and focus on environmental sustainability, while Mexico's growth is linked to its expanding manufacturing sector and increasing focus on urban water management. The Municipal segment across North America is a consistent and growing demand driver, ensuring consistent revenue streams for water treatment chemical providers.

North America Water Treatment Chemicals Industry Product Landscape

The North America water treatment chemicals market is characterized by a dynamic product landscape with a strong emphasis on performance, sustainability, and efficiency. Innovations are prevalent across all product categories, including advanced Biocides & Disinfectants offering broad-spectrum efficacy with reduced environmental impact, and novel Coagulants & Flocculants that enhance solid-liquid separation in wastewater treatment. Corrosion & Scale Inhibitors are being developed with improved longevity and compatibility with various industrial systems. The demand for eco-friendly and biodegradable formulations is a significant trend, driving R&D in areas like bio-based coagulants and reduced-toxicity biocides. Applications range from ensuring potable water quality in Municipal sectors to optimizing processes in Oil & Gas, Chemical Manufacturing, and Pulp & Paper industries. Key selling propositions include tailored chemical solutions for specific industrial challenges, enhanced operational efficiency, and compliance with increasingly stringent environmental regulations. Technological advancements are focused on delivering higher treatment efficiencies at lower dosage rates, thereby reducing chemical consumption and overall treatment costs.

Key Drivers, Barriers & Challenges in North America Water Treatment Chemicals Industry

Key Drivers:

- Increasing Water Scarcity: Growing global demand for freshwater necessitates efficient water treatment and reuse, driving demand for chemicals.

- Stringent Environmental Regulations: Evolving governmental policies on wastewater discharge and water quality standards compel industries to adopt advanced treatment solutions.

- Industrial Growth: Expansion in key sectors like Chemical Manufacturing, Oil & Gas, and Food & Beverage leads to increased water usage and treatment requirements.

- Technological Advancements: Development of high-performance, eco-friendly, and cost-effective water treatment chemicals.

- Aging Infrastructure: The need to upgrade and maintain existing water and wastewater treatment facilities in the United States, Canada, and Mexico.

Barriers & Challenges:

- High R&D Costs: Significant investment is required for developing and testing new, compliant chemical formulations.

- Regulatory Hurdles: Long and complex approval processes for new chemicals can delay market entry.

- Price Sensitivity: In certain sectors, cost remains a primary consideration, leading to competition from lower-cost alternatives.

- Supply Chain Disruptions: Global events can impact the availability and cost of raw materials for chemical production.

- Competition from Alternative Technologies: Growing adoption of non-chemical water treatment methods like membrane filtration and advanced oxidation processes.

- Fluctuating Raw Material Prices: Volatility in the cost of key chemical precursors impacts profit margins.

Emerging Opportunities in North America Water Treatment Chemicals Industry

Emerging opportunities in the North America water treatment chemicals industry lie in the growing demand for sustainable and bio-based solutions. The push towards a circular economy is fostering innovation in chemicals that enable effective water reuse and resource recovery from wastewater. Untapped markets include advanced treatment solutions for microplastics and emerging contaminants, a significant concern for both municipal and industrial water sources. Innovative applications in sectors like data centers and advanced manufacturing, which require ultra-pure water, are creating niche market opportunities. Evolving consumer preferences for bottled water and beverages with verifiable water purity are also influencing the demand for specialized treatment chemicals in the Food & Beverage industry. The development of digital solutions integrated with chemical treatment, such as smart dosing systems and predictive analytics, presents a significant growth avenue for chemical providers. The increasing focus on industrial water footprint reduction also creates opportunities for highly efficient, low-dose chemical solutions.

Growth Accelerators in the North America Water Treatment Chemicals Industry Industry

Catalysts for long-term growth in the North America water treatment chemicals industry include significant technological breakthroughs in areas like nanotechnology for enhanced contaminant removal and biodegradable chelating agents. Strategic partnerships between chemical manufacturers and technology providers are accelerating the development and deployment of integrated water treatment solutions. Market expansion strategies are focusing on emerging economies within North America and catering to specialized industrial needs. The increasing emphasis on water resilience and security, particularly in light of climate change impacts, is a powerful growth accelerator, driving investment in advanced water treatment technologies and chemicals. Furthermore, the growing adoption of the Industrial Internet of Things (IIoT) in water management systems creates opportunities for data-driven chemical optimization and enhanced process control. The development of specialized chemicals for niche applications, such as those in the electronics and pharmaceutical industries, will also contribute to sustained growth.

Key Players Shaping the North America Water Treatment Chemicals Industry Market

- Ecolab

- Nouryon

- Solvay

- Kurita Water Industries Ltd

- Buckman

- Italmatch Chemicals SpA

- SUEZ

- Kemira

- Dow

- ChemTreat Inc

- Solenis

- Albemarle Corporation

- Veolia Water Technologies

Notable Milestones in North America Water Treatment Chemicals Industry Sector

- 2023: Launch of a new line of sustainable biocides by a leading chemical manufacturer, addressing growing demand for eco-friendly solutions.

- 2023: Acquisition of a specialized coagulant producer by a major water treatment solutions provider, expanding its product portfolio and market reach.

- 2022: Introduction of advanced scale inhibitors with enhanced longevity, reducing maintenance costs for industrial clients.

- 2022: Significant investment in R&D for bio-based water treatment chemicals by a key industry player, signaling a shift towards green chemistry.

- 2021: Increased regulatory scrutiny on PFAS compounds leading to a surge in demand for specialized removal technologies and associated chemicals.

- 2021: Development of smart dosing systems that integrate with IoT platforms for optimized chemical application in industrial settings.

- 2020: A major merger between two prominent water treatment chemical companies, creating a larger entity with enhanced market leverage.

- 2019: Growing adoption of online monitoring systems in municipal water treatment plants, influencing demand for chemicals compatible with real-time adjustments.

In-Depth North America Water Treatment Chemicals Industry Market Outlook

The outlook for the North America water treatment chemicals industry is exceptionally positive, driven by persistent demand for clean water and the ongoing need for industrial process optimization. Growth accelerators, including technological innovation in sustainable chemistries and the expanding digital integration within water management systems, will continue to propel the market forward. Strategic partnerships and a focus on emerging contaminants will unlock new revenue streams and solidify market leadership for innovative players. The industry is well-positioned to capitalize on the global imperative for water security and resource efficiency, making it a resilient and attractive sector for investment and development. Future market potential lies in addressing increasingly complex water challenges with smarter, more sustainable chemical solutions.

North America Water Treatment Chemicals Industry Segmentation

-

1. Product Type

- 1.1. Biocides & Disinfectants

- 1.2. Coagulants & Flocculants

- 1.3. Corrosion & Scale Inhibitors

- 1.4. Defoamers & Defoaming Agents

- 1.5. pH & Adjuster & Softener

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Power

- 2.2. Oil & Gas

- 2.3. Chemical Manufacturing

- 2.4. Mining & Mineral Processing

- 2.5. Municipal

- 2.6. Food & Beverage

- 2.7. Pulp & Paper

- 2.8. Other End-user Industries

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

North America Water Treatment Chemicals Industry Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

North America Water Treatment Chemicals Industry Regional Market Share

Geographic Coverage of North America Water Treatment Chemicals Industry

North America Water Treatment Chemicals Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Stringent Regulatory Requirements to Control the Wastewater Disposal from both Municipal and Industrial sources; Growing Demand from the Power Industry

- 3.3. Market Restrains

- 3.3.1. ; Increasing Popularity for Chlorine Alternatives for Cooling Water Treatment Serves as one of the Stumbling Blocks in the Growth of the Market Studied.; Other Restraints

- 3.4. Market Trends

- 3.4.1. Municipal Segment to Dominate the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Biocides & Disinfectants

- 5.1.2. Coagulants & Flocculants

- 5.1.3. Corrosion & Scale Inhibitors

- 5.1.4. Defoamers & Defoaming Agents

- 5.1.5. pH & Adjuster & Softener

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power

- 5.2.2. Oil & Gas

- 5.2.3. Chemical Manufacturing

- 5.2.4. Mining & Mineral Processing

- 5.2.5. Municipal

- 5.2.6. Food & Beverage

- 5.2.7. Pulp & Paper

- 5.2.8. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Biocides & Disinfectants

- 6.1.2. Coagulants & Flocculants

- 6.1.3. Corrosion & Scale Inhibitors

- 6.1.4. Defoamers & Defoaming Agents

- 6.1.5. pH & Adjuster & Softener

- 6.1.6. Other Product Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power

- 6.2.2. Oil & Gas

- 6.2.3. Chemical Manufacturing

- 6.2.4. Mining & Mineral Processing

- 6.2.5. Municipal

- 6.2.6. Food & Beverage

- 6.2.7. Pulp & Paper

- 6.2.8. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Biocides & Disinfectants

- 7.1.2. Coagulants & Flocculants

- 7.1.3. Corrosion & Scale Inhibitors

- 7.1.4. Defoamers & Defoaming Agents

- 7.1.5. pH & Adjuster & Softener

- 7.1.6. Other Product Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power

- 7.2.2. Oil & Gas

- 7.2.3. Chemical Manufacturing

- 7.2.4. Mining & Mineral Processing

- 7.2.5. Municipal

- 7.2.6. Food & Beverage

- 7.2.7. Pulp & Paper

- 7.2.8. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Water Treatment Chemicals Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Biocides & Disinfectants

- 8.1.2. Coagulants & Flocculants

- 8.1.3. Corrosion & Scale Inhibitors

- 8.1.4. Defoamers & Defoaming Agents

- 8.1.5. pH & Adjuster & Softener

- 8.1.6. Other Product Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power

- 8.2.2. Oil & Gas

- 8.2.3. Chemical Manufacturing

- 8.2.4. Mining & Mineral Processing

- 8.2.5. Municipal

- 8.2.6. Food & Beverage

- 8.2.7. Pulp & Paper

- 8.2.8. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 Ecolab

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Nouryon

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 Solvay

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Kurita Water Industries Ltd

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Buckman

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Italmatch Chemicals SpA

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 SUEZ

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Kemira

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 Dow

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 ChemTreat Inc

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.11 Solenis

- 9.2.11.1. Overview

- 9.2.11.2. Products

- 9.2.11.3. SWOT Analysis

- 9.2.11.4. Recent Developments

- 9.2.11.5. Financials (Based on Availability)

- 9.2.12 Albemarle Corporation

- 9.2.12.1. Overview

- 9.2.12.2. Products

- 9.2.12.3. SWOT Analysis

- 9.2.12.4. Recent Developments

- 9.2.12.5. Financials (Based on Availability)

- 9.2.13 Veolia Water Technologies

- 9.2.13.1. Overview

- 9.2.13.2. Products

- 9.2.13.3. SWOT Analysis

- 9.2.13.4. Recent Developments

- 9.2.13.5. Financials (Based on Availability)

- 9.2.1 Ecolab

List of Figures

- Figure 1: North America Water Treatment Chemicals Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: North America Water Treatment Chemicals Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 3: North America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 5: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 6: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 7: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 8: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 9: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 11: North America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 13: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 14: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 15: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 17: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 19: North America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 21: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 22: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 23: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 26: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Product Type 2020 & 2033

- Table 27: North America Water Treatment Chemicals Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 28: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by End-user Industry 2020 & 2033

- Table 29: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Geography 2020 & 2033

- Table 31: North America Water Treatment Chemicals Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: North America Water Treatment Chemicals Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Water Treatment Chemicals Industry?

The projected CAGR is approximately 6.3%.

2. Which companies are prominent players in the North America Water Treatment Chemicals Industry?

Key companies in the market include Ecolab, Nouryon, Solvay, Kurita Water Industries Ltd, Buckman, Italmatch Chemicals SpA, SUEZ, Kemira, Dow, ChemTreat Inc, Solenis, Albemarle Corporation, Veolia Water Technologies.

3. What are the main segments of the North America Water Treatment Chemicals Industry?

The market segments include Product Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Stringent Regulatory Requirements to Control the Wastewater Disposal from both Municipal and Industrial sources; Growing Demand from the Power Industry.

6. What are the notable trends driving market growth?

Municipal Segment to Dominate the Market Demand.

7. Are there any restraints impacting market growth?

; Increasing Popularity for Chlorine Alternatives for Cooling Water Treatment Serves as one of the Stumbling Blocks in the Growth of the Market Studied.; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Water Treatment Chemicals Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Water Treatment Chemicals Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Water Treatment Chemicals Industry?

To stay informed about further developments, trends, and reports in the North America Water Treatment Chemicals Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence