Key Insights

The European biocides market is projected to reach $7.37 billion by 2025, exhibiting a strong Compound Annual Growth Rate (CAGR) of 15.24% through 2033. This expansion is driven by the escalating demand for effective microbial control solutions across diverse industrial sectors. Key growth catalysts include stringent regulatory frameworks that mandate safe and responsible biocide utilization, alongside heightened public health and hygiene awareness, particularly in water treatment and pharmaceutical applications. The personal care industry also represents a substantial growth opportunity, with consumers increasingly favoring preservative-enhanced products. Additionally, the persistent need for material preservation in paints, coatings, and wood applications to prevent degradation and enhance product longevity will continue to fuel market growth.

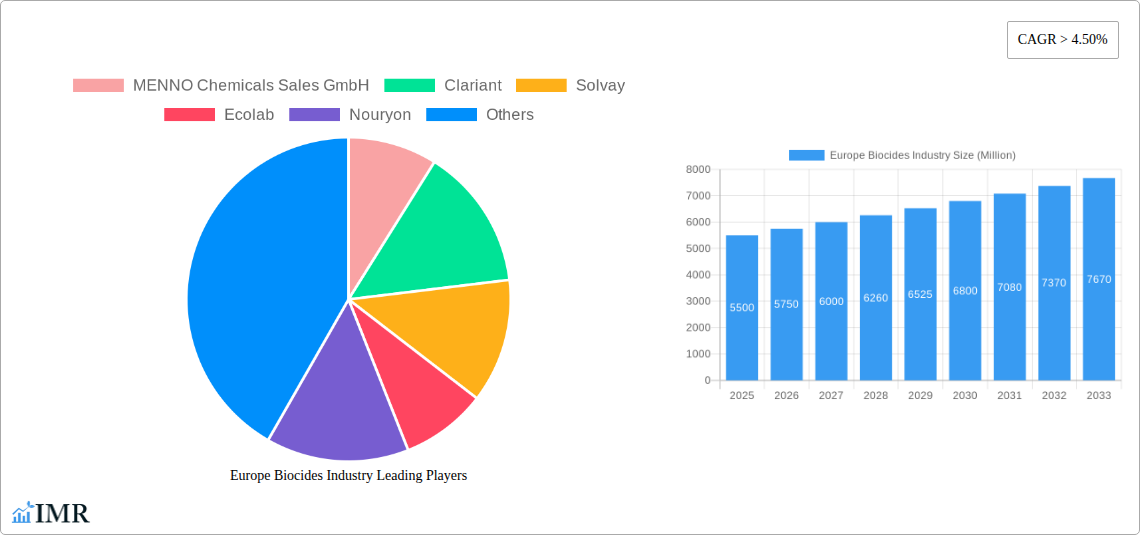

Europe Biocides Industry Market Size (In Billion)

Europe's sophisticated industrial landscape and robust regulatory oversight foster a conducive environment for the biocides market. Leading companies are prioritizing research and development to introduce novel, eco-friendly biocide formulations that align with evolving consumer preferences and regulatory demands for sustainable solutions. While these drivers propel the market forward, potential challenges such as rising raw material costs and the emergence of microbial resistance necessitate strategic management. The market is segmented by biocide type, including Halogen Compounds, Metallic Compounds, Organosulfurs, Organic Acids, and Phenolics, each addressing specific application requirements in water treatment, pharmaceuticals, personal care, wood preservation, and paints & coatings. Prominent industry players, including BASF SE, Dow Chemical Company, and Ecolab, are spearheading innovation and market expansion.

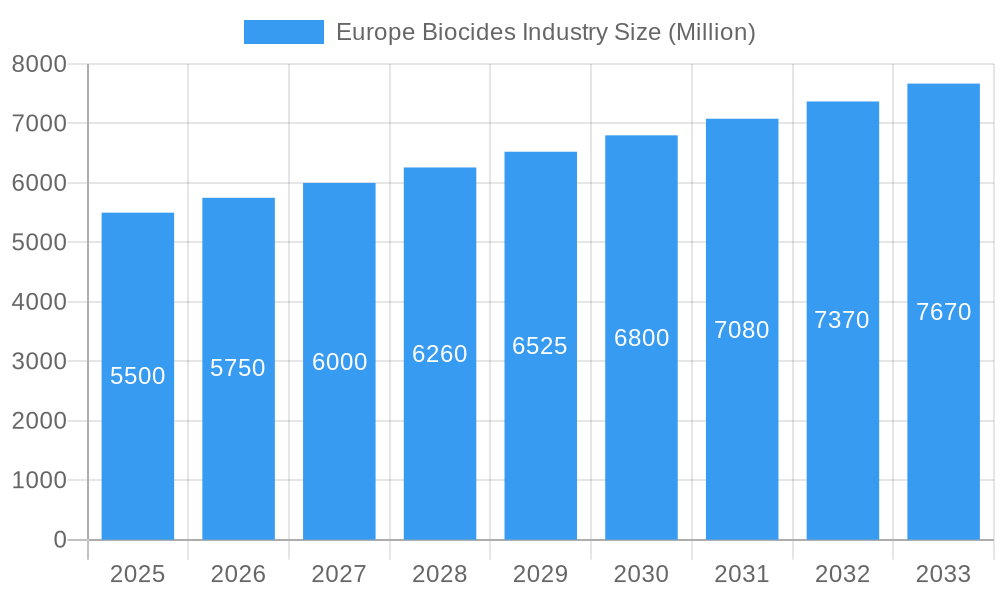

Europe Biocides Industry Company Market Share

Europe Biocides Industry Market Dynamics & Structure

The Europe biocides industry exhibits a moderately concentrated market structure, driven by a handful of global chemical giants and specialized players. Key players like BASF SE, LANXESS, Dow Chemical Company, and Lonza Group Ltd. hold significant market shares, leveraging economies of scale and extensive R&D capabilities. Technological innovation is a primary driver, focusing on developing more sustainable, efficient, and targeted biocidal formulations to meet stringent environmental regulations and growing consumer demand for greener products. Regulatory frameworks, particularly the EU Biocidal Products Regulation (BPR), significantly shape market dynamics by dictating product approvals, usage restrictions, and efficacy standards, leading to a continuous push for innovation and compliance. Competitive product substitutes, such as natural antimicrobials and advanced preservation techniques, pose a growing challenge, forcing traditional biocide manufacturers to adapt and differentiate their offerings. End-user demographics are shifting, with increased demand from sectors like water treatment, pharmaceuticals, and personal care, which prioritize safety and efficacy. Mergers and acquisitions (M&A) remain a strategic tool for market consolidation and portfolio expansion. For instance, the acquisition of INTACE SAS by LANXESS in January 2021 signifies a trend of larger players acquiring niche capabilities to strengthen their market position. The volume of M&A deals, while not explicitly quantifiable here, indicates a dynamic competitive landscape where companies strategically invest to gain market access and technological expertise. Barriers to innovation include the lengthy and costly regulatory approval processes for new biocidal active substances and the societal perception challenges associated with chemical preservatives.

Europe Biocides Industry Growth Trends & Insights

The Europe biocides industry is poised for robust growth, driven by a confluence of factors including escalating demand across diverse end-use sectors and an increasing emphasis on public health and environmental safety. The market size is projected to witness a steady expansion, with an estimated Compound Annual Growth Rate (CAGR) of approximately 5.2% from 2025 to 2033. This growth trajectory is underpinned by the rising adoption rates of biocides in critical applications such as water treatment to combat microbial contamination in industrial and municipal water systems, and in the pharmaceutical and personal care sectors where microbial control is paramount for product integrity and consumer safety. Technological disruptions are playing a crucial role, with ongoing research and development efforts focused on creating novel biocidal agents that offer enhanced efficacy against a broader spectrum of microorganisms, reduced environmental impact, and improved biodegradability. This includes advancements in microencapsulation technologies for controlled release and the exploration of bio-based biocides derived from renewable resources. Consumer behavior shifts are also influencing the market; consumers are increasingly aware of hygiene standards and are demanding products that are not only effective but also safe for human health and the environment. This has led to a greater preference for biocides with favorable toxicological profiles and those that contribute to product longevity, thereby reducing waste. The penetration of advanced biocide solutions is expected to deepen across industries like paints and coatings, where they are essential for preventing microbial spoilage and extending product shelf life, and in wood preservation, where they protect against fungal decay and insect infestation. The market is also seeing a rise in demand for in-can preservation solutions, crucial for the stability of paints, adhesives, and household products. The overall market penetration of biocides is expected to increase as industries continue to recognize their indispensable role in ensuring product quality, safety, and operational efficiency across the European landscape.

Dominant Regions, Countries, or Segments in Europe Biocides Industry

The Water Treatment application segment stands out as a dominant force driving growth within the Europe biocides industry. This segment’s significance is propelled by stringent regulations concerning water quality, increasing industrialization, and a growing population that necessitates advanced and reliable water purification solutions. The demand for biocides in this sector is crucial for preventing the proliferation of harmful microorganisms, such as bacteria, algae, and fungi, which can compromise water safety for potable, industrial, and recreational purposes.

- Market Share & Growth Potential: The water treatment segment consistently captures a substantial market share, estimated to be around 25-30% of the total Europe biocides market. Its growth potential remains exceptionally high, projected to expand at a CAGR of approximately 5.5% during the forecast period.

- Key Drivers:

- Regulatory Compliance: Strict EU directives and national water quality standards mandate the use of effective biocides to ensure microbial control in various water systems, including cooling towers, wastewater treatment plants, and swimming pools.

- Industrial Demand: Sectors like power generation, manufacturing, and petrochemicals rely heavily on treated water, making them significant consumers of biocides to prevent biofouling and maintain operational efficiency.

- Urbanization & Population Growth: Increased demand for safe drinking water and effective wastewater management in growing urban centers fuels the need for robust biocidal treatments.

- Technological Advancements: Development of specialized biocides for specific water challenges, such as resistance management and reduced environmental impact, further bolsters adoption.

Among the Type segments, Halogen Compounds continue to hold a significant position due to their broad-spectrum efficacy and cost-effectiveness in various applications, particularly in water treatment and industrial disinfection. However, an increasing trend is observed towards more sustainable and less persistent biocides, leading to growth in Organic Acids and Other Types that encompass newer, environmentally friendly formulations.

- Dominance Factors (Halogen Compounds):

- Proven Efficacy: Historically established effectiveness against a wide range of microorganisms.

- Cost-Effectiveness: Generally lower production costs compared to some advanced biocides.

- Widespread Application: Used extensively in water treatment, paper manufacturing, and industrial sanitation.

- Emerging Trends (Organic Acids & Other Types):

- Environmental Consciousness: Growing preference for biodegradable and less toxic alternatives.

- Innovation in Formulations: Development of novel biocides with targeted action and improved sustainability profiles.

- Regulatory Influence: Shifting regulatory landscape favoring greener chemical solutions.

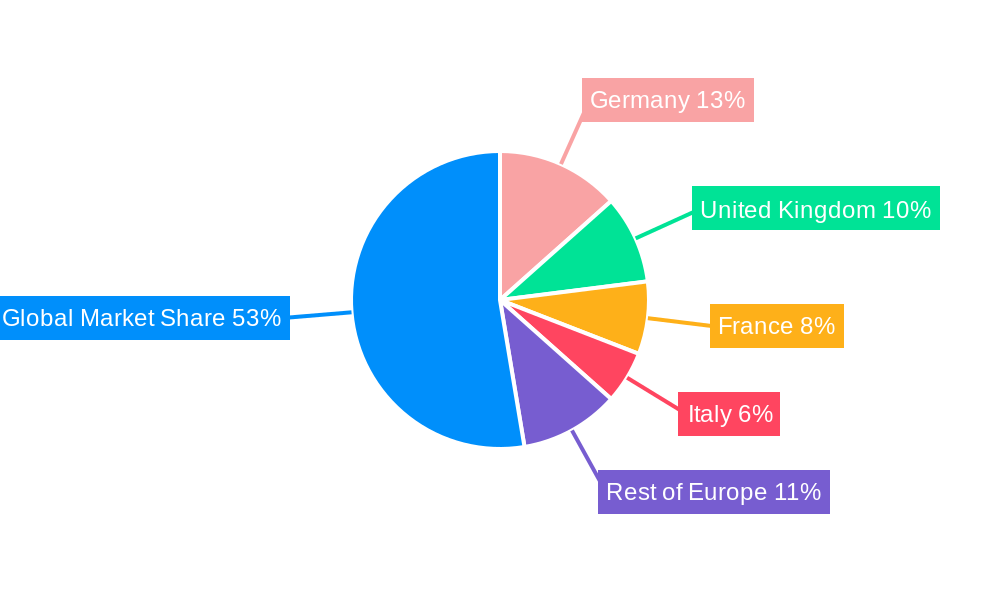

Geographically, Germany and France are anticipated to lead the market within Europe, driven by their robust industrial base, significant investments in water infrastructure, and strong adherence to environmental regulations.

Europe Biocides Industry Product Landscape

The Europe biocides industry is characterized by continuous product innovation focused on enhancing efficacy, sustainability, and application specificity. Halogen compounds like chlorine and bromine derivatives remain prevalent, particularly in water treatment, while organic acids such as benzoic acid and sorbic acid are gaining traction in food and beverage preservation due to their safety profile. Metallic compounds and organosulfurs are employed in specialized applications like wood preservation. A significant trend is the development of biocidal formulations with reduced environmental impact and improved biodegradability, driven by regulatory pressures and consumer demand. Companies are investing in advanced delivery systems, such as microencapsulation, to ensure targeted release and prolonged protection, thereby optimizing performance and minimizing usage. Unique selling propositions revolve around broader spectrum activity, faster kill rates, and enhanced compatibility with various matrices, including paints, coatings, and personal care products.

Key Drivers, Barriers & Challenges in Europe Biocides Industry

Key Drivers:

- Stringent Health and Environmental Regulations: The EU Biocidal Products Regulation (BPR) and similar national legislations are a major impetus for developing compliant and effective biocide solutions, driving innovation towards safer alternatives.

- Growing Demand for Hygiene and Preservation: Increased awareness regarding hygiene standards in public spaces, healthcare, and food production, coupled with the need to extend product shelf-life, fuels the demand for biocides across various sectors like pharmaceuticals, personal care, and food and beverage.

- Technological Advancements in Formulation: Innovations in controlled-release technologies, synergistic combinations of biocidal agents, and the development of bio-based biocides are expanding application possibilities and enhancing performance.

- Industrial Growth and Infrastructure Development: Expansion in water treatment, construction, and manufacturing sectors necessitates effective microbial control to maintain operational efficiency and product integrity.

Barriers & Challenges:

- Lengthy and Costly Regulatory Approval Processes: The rigorous approval process for new biocidal active substances under the BPR can be time-consuming and expensive, hindering rapid market entry for novel products.

- Development of Microbial Resistance: The continuous use of biocides can lead to the development of resistant microbial strains, necessitating ongoing research for new or combination treatments.

- Public Perception and Environmental Concerns: Negative public perception surrounding chemical preservatives and concerns about potential environmental impact can lead to market resistance and the demand for "chemical-free" alternatives.

- Supply Chain Volatility and Raw Material Costs: Fluctuations in the availability and cost of key raw materials, influenced by geopolitical factors and global supply chain disruptions, can impact production costs and profitability.

Emerging Opportunities in Europe Biocides Industry

Emerging opportunities within the Europe biocides industry lie in the development and adoption of sustainable and bio-based biocidal solutions. The increasing demand for biodegradable and environmentally friendly preservatives in sectors like food packaging, cosmetics, and textiles presents a significant growth avenue. Furthermore, advancements in targeted delivery systems, such as smart packaging incorporating antimicrobial agents, offer novel applications. The growing concern over antimicrobial resistance is driving research into synergistic biocide formulations and novel modes of action, opening doors for specialized market segments. Untapped potential exists in niche applications within industrial processes, such as in the oil and gas sector for microbial control in drilling fluids, and in the development of advanced antifouling coatings for maritime applications.

Growth Accelerators in the Europe Biocides Industry Industry

The Europe biocides industry is being propelled by significant growth accelerators, including continued regulatory evolution that favors safer and more sustainable chemistries, pushing innovation towards greener alternatives. Strategic partnerships and joint ventures, such as the collaboration between LANXESS and Matrìca for sustainable biocide preservatives, are crucial for expanding market reach and technological capabilities. The increasing focus on circular economy principles is also fostering the development of bio-based biocides derived from renewable resources. Furthermore, the ongoing digitalization of R&D processes and manufacturing is leading to more efficient product development and optimized production, thereby accelerating market expansion.

Key Players Shaping the Europe Biocides Industry Market

- MENNO Chemicals Sales GmbH

- Clariant

- Solvay

- Ecolab

- Nouryon

- Stockmeier Group

- Merck KGaA

- Henkel AG & Co KGaA

- Evonik Industries AG

- LANXESS

- BASF SE

- Lonza Group Ltd

- Clavatis GmbH

- Diversey Holdings LTD

- Dow Chemical Company

Notable Milestones in Europe Biocides Industry Sector

- February 2022: LANXESS and Matrìca, a joint venture between Versalis (Eni) and Novamont, partnered to produce sustainable biocide preservatives from renewable raw materials, signaling a move towards eco-friendly solutions.

- January 2021: LANXESS, a specialty chemical company, acquired French company INTACE SAS, a strategic move that significantly expanded LANXESS's position as a leading global manufacturer of biocides and antimicrobials.

In-Depth Europe Biocides Industry Market Outlook

The Europe biocides industry is set for sustained growth, driven by a strategic focus on sustainability and advanced technology. The increasing adoption of bio-based and biodegradable biocidal agents, fueled by stringent environmental regulations and consumer preferences, represents a significant market opportunity. Investments in R&D for novel formulations that combat antimicrobial resistance and offer enhanced efficacy without compromising safety will be key growth accelerators. Strategic alliances and acquisitions, like those seen with LANXESS, will continue to shape the market landscape, enabling companies to expand their product portfolios and global reach. The industry's future hinges on its ability to innovate, adapt to evolving regulatory demands, and meet the growing global need for effective and environmentally responsible microbial control solutions.

Europe Biocides Industry Segmentation

-

1. Type

- 1.1. Halogen Compounds

- 1.2. Metallic Compounds

- 1.3. Organosulfurs

- 1.4. Organic Acids

- 1.5. Phenolics

- 1.6. Other Types

-

2. Application

- 2.1. Water Treatment

- 2.2. Pharmaceutical and Personal Care

- 2.3. Wood Preservation

- 2.4. Food and Beverage

- 2.5. Paints and Coatings

- 2.6. Other Applications

Europe Biocides Industry Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Biocides Industry Regional Market Share

Geographic Coverage of Europe Biocides Industry

Europe Biocides Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.24% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Water Treatment; Other drivers

- 3.3. Market Restrains

- 3.3.1. Government Regulations; Other Restraints

- 3.4. Market Trends

- 3.4.1. Increasing Demand from Water Treatment Application

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Biocides Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Halogen Compounds

- 5.1.2. Metallic Compounds

- 5.1.3. Organosulfurs

- 5.1.4. Organic Acids

- 5.1.5. Phenolics

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Water Treatment

- 5.2.2. Pharmaceutical and Personal Care

- 5.2.3. Wood Preservation

- 5.2.4. Food and Beverage

- 5.2.5. Paints and Coatings

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Biocides Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Halogen Compounds

- 6.1.2. Metallic Compounds

- 6.1.3. Organosulfurs

- 6.1.4. Organic Acids

- 6.1.5. Phenolics

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Water Treatment

- 6.2.2. Pharmaceutical and Personal Care

- 6.2.3. Wood Preservation

- 6.2.4. Food and Beverage

- 6.2.5. Paints and Coatings

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. United Kingdom Europe Biocides Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Halogen Compounds

- 7.1.2. Metallic Compounds

- 7.1.3. Organosulfurs

- 7.1.4. Organic Acids

- 7.1.5. Phenolics

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Water Treatment

- 7.2.2. Pharmaceutical and Personal Care

- 7.2.3. Wood Preservation

- 7.2.4. Food and Beverage

- 7.2.5. Paints and Coatings

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. France Europe Biocides Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Halogen Compounds

- 8.1.2. Metallic Compounds

- 8.1.3. Organosulfurs

- 8.1.4. Organic Acids

- 8.1.5. Phenolics

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Water Treatment

- 8.2.2. Pharmaceutical and Personal Care

- 8.2.3. Wood Preservation

- 8.2.4. Food and Beverage

- 8.2.5. Paints and Coatings

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Italy Europe Biocides Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Halogen Compounds

- 9.1.2. Metallic Compounds

- 9.1.3. Organosulfurs

- 9.1.4. Organic Acids

- 9.1.5. Phenolics

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Water Treatment

- 9.2.2. Pharmaceutical and Personal Care

- 9.2.3. Wood Preservation

- 9.2.4. Food and Beverage

- 9.2.5. Paints and Coatings

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of Europe Europe Biocides Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Halogen Compounds

- 10.1.2. Metallic Compounds

- 10.1.3. Organosulfurs

- 10.1.4. Organic Acids

- 10.1.5. Phenolics

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Water Treatment

- 10.2.2. Pharmaceutical and Personal Care

- 10.2.3. Wood Preservation

- 10.2.4. Food and Beverage

- 10.2.5. Paints and Coatings

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 MENNO Chemicals Sales GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Clariant

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Solvay

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ecolab

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Nouryon

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Stockmeier Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Merck KGaA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Henkel AG & Co KGaA

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Evonik Industries AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 LANXESS

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 BASF SE

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Lonza Group Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Clavatis GmbH

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Diversey Holdings LTD

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Dow Chemical Company

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 MENNO Chemicals Sales GmbH

List of Figures

- Figure 1: Europe Biocides Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Biocides Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Biocides Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Europe Biocides Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: Europe Biocides Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 4: Europe Biocides Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: Europe Biocides Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Europe Biocides Industry Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: Europe Biocides Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Europe Biocides Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: Europe Biocides Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 10: Europe Biocides Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: Europe Biocides Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Europe Biocides Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 13: Europe Biocides Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Europe Biocides Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 15: Europe Biocides Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 16: Europe Biocides Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 17: Europe Biocides Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: Europe Biocides Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 19: Europe Biocides Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 20: Europe Biocides Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 21: Europe Biocides Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 22: Europe Biocides Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 23: Europe Biocides Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Europe Biocides Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 25: Europe Biocides Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 26: Europe Biocides Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 27: Europe Biocides Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 28: Europe Biocides Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 29: Europe Biocides Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Europe Biocides Industry Volume K Tons Forecast, by Country 2020 & 2033

- Table 31: Europe Biocides Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 32: Europe Biocides Industry Volume K Tons Forecast, by Type 2020 & 2033

- Table 33: Europe Biocides Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Europe Biocides Industry Volume K Tons Forecast, by Application 2020 & 2033

- Table 35: Europe Biocides Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Europe Biocides Industry Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Biocides Industry?

The projected CAGR is approximately 15.24%.

2. Which companies are prominent players in the Europe Biocides Industry?

Key companies in the market include MENNO Chemicals Sales GmbH, Clariant, Solvay, Ecolab, Nouryon, Stockmeier Group, Merck KGaA, Henkel AG & Co KGaA, Evonik Industries AG, LANXESS, BASF SE, Lonza Group Ltd, Clavatis GmbH, Diversey Holdings LTD, Dow Chemical Company.

3. What are the main segments of the Europe Biocides Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.37 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Water Treatment; Other drivers.

6. What are the notable trends driving market growth?

Increasing Demand from Water Treatment Application.

7. Are there any restraints impacting market growth?

Government Regulations; Other Restraints.

8. Can you provide examples of recent developments in the market?

February 2022: LANXESS, and Matrìca, a joint venture between Versalis (Eni) and Novamont, partnered to produce sustainable biocide preservatives from renewable raw materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Biocides Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Biocides Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Biocides Industry?

To stay informed about further developments, trends, and reports in the Europe Biocides Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence