Key Insights

The Saudi Arabia Plastic Components Market is projected for substantial growth, driven by robust sector expansion and strategic government diversification initiatives. Forecasted to reach $4.8 billion by 2024, the market is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% through 2033. Key growth drivers include the thriving building and construction sector, increased demand for consumer goods, and the expanding life sciences sector. Vision 2030's focus on industrial development and localization further supports market expansion and innovation.

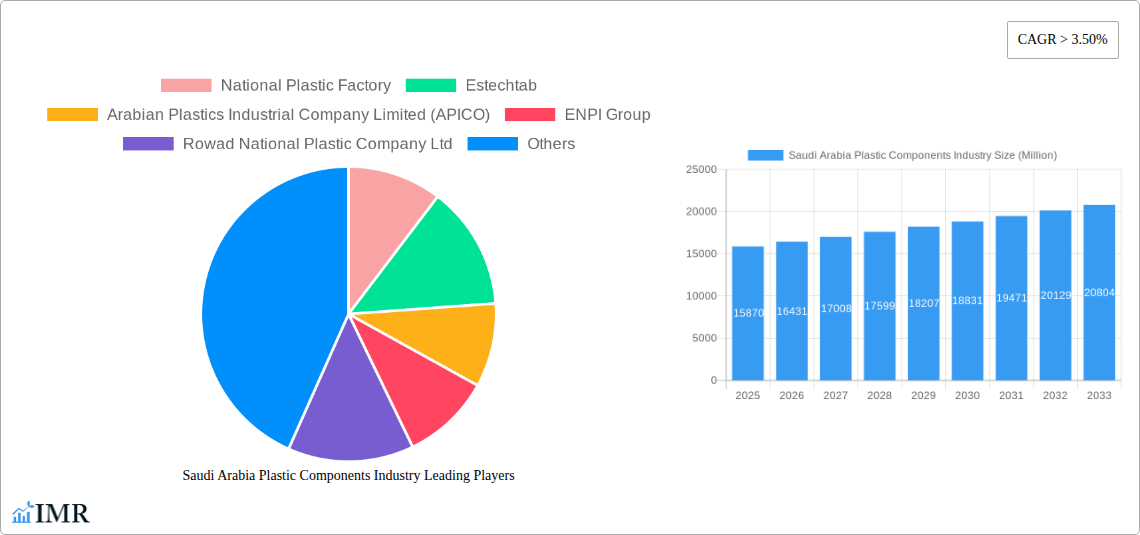

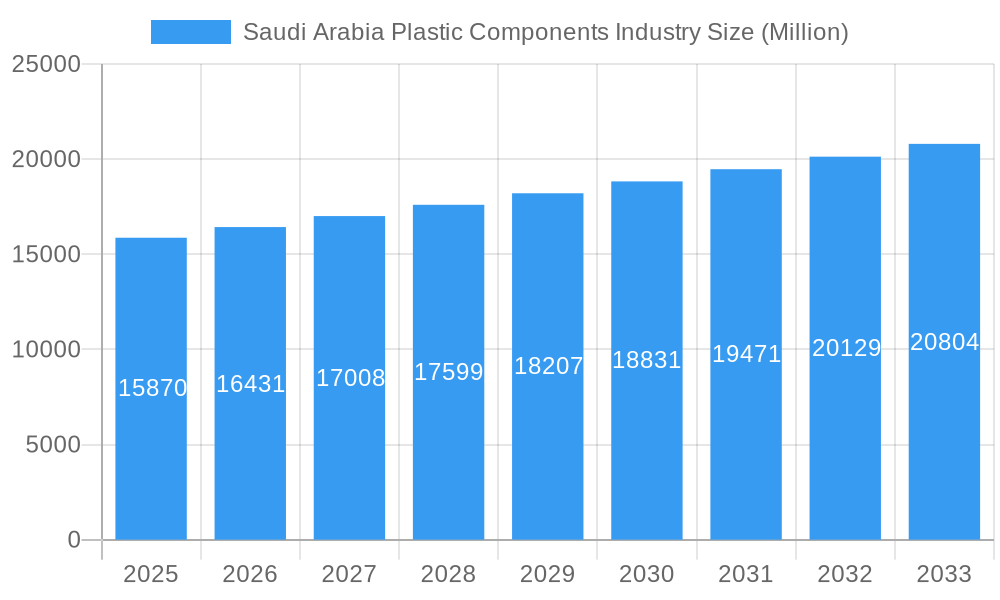

Saudi Arabia Plastic Components Industry Market Size (In Billion)

Dominant product segments include sheets, film, plates, tubes, containers, and household articles, serving diverse end-user industries. While raw material price volatility and environmental regulations pose challenges, investments in advanced manufacturing and sustainable solutions are mitigating these concerns. Leading players are investing in capacity and innovation, leveraging the region's petrochemical resources for a competitive advantage and reinforcing Saudi Arabia's global market position.

Saudi Arabia Plastic Components Industry Company Market Share

Saudi Arabia Plastic Components Industry Market Dynamics & Structure

The Saudi Arabia plastic components industry is characterized by a moderate market concentration, with key players like National Plastic Factory, Estechtab, Arabian Plastics Industrial Company Limited (APICO), ENPI Group, Rowad National Plastic Company Ltd, Zamil Plastics Industries Limited, Tamam Plastic Factory, Takween Advanced Industries, Saudi Can Co Ltd, PCC, Al Watania Plastics, Rayan Plastic Factory Company, and Saudi Plastic Products Company Ltd holding significant market share. Technological innovation is a crucial driver, fueled by increasing demand for advanced materials, lightweight components, and sustainable solutions across diverse end-user industries. The Kingdom's Vision 2030 initiatives, promoting industrial diversification and localization, are creating a favorable regulatory framework, encouraging investment and domestic manufacturing.

- Market Concentration: Moderate, with a mix of large established players and emerging SMEs.

- Technological Innovation Drivers: Demand for high-performance plastics, smart manufacturing, and sustainable materials.

- Regulatory Frameworks: Supportive government policies for industrial growth, localization, and environmental standards.

- Competitive Product Substitutes: Metal, glass, and wood continue to be alternatives, but advancements in plastic properties are narrowing the gap.

- End-user Demographics: Growing middle class and increasing disposable income drive demand for consumer goods and household articles.

- M&A Trends: Limited but increasing, with potential for consolidation to enhance competitiveness and market reach. Estimated M&A deal volume in the historical period (2019-2024) is approximately 15-20 million units in value, primarily focused on technology acquisition and capacity expansion.

Saudi Arabia Plastic Components Industry Growth Trends & Insights

The Saudi Arabia plastic components industry is poised for substantial growth, driven by robust demand across its burgeoning child markets of packaging, construction, and consumer goods. Over the study period (2019–2033), the market is projected to experience a healthy Compound Annual Growth Rate (CAGR) of approximately 6.8%. This expansion is underpinned by several key trends. Firstly, the increasing demand for lightweight and durable plastic components in the Building and Construction sector, particularly for applications like pipes, insulation, and decorative elements, is a significant growth engine. The Kingdom's ambitious infrastructure development projects, aligned with Vision 2030, are directly fueling this demand.

Secondly, the Consumer Goods segment, encompassing household articles and packaging solutions, continues to exhibit strong growth. Rising disposable incomes and evolving consumer preferences for convenient and aesthetically pleasing products are key influencers. The Food and Beverage industry's reliance on sophisticated plastic packaging for product preservation and extended shelf life further bolsters this segment. Furthermore, technological advancements are playing a pivotal role. The adoption of advanced manufacturing techniques, such as 3D printing and automation, is enhancing production efficiency and enabling the creation of more complex and customized plastic components. The development of bio-based and recyclable plastics is also gaining traction, driven by growing environmental consciousness and stricter regulations, aligning with global sustainability trends. Consumer behavior shifts towards sustainable consumption are also influencing product design and material choices, pushing manufacturers to innovate. Market penetration of specialized plastic components in niche applications like Aerospace and Life Sciences is expected to increase, albeit from a smaller base, as technological capabilities mature and demand for high-performance materials grows. The estimated market size in the base year of 2025 is projected to be around 1.2 billion units, with a projected surge to over 2.0 billion units by the forecast year of 2033. Adoption rates for advanced and sustainable plastic solutions are accelerating, with an estimated increase of 25-30% in the adoption of recycled and bio-based plastics within the forecast period. Technological disruptions, including the integration of AI in product design and predictive maintenance in manufacturing, are expected to further optimize the industry's output and product quality.

Dominant Regions, Countries, or Segments in Saudi Arabia Plastic Components Industry

The Building and Construction end-user industry is undeniably the dominant force driving growth within the Saudi Arabia plastic components market. This segment's prominence is intrinsically linked to the Kingdom's ambitious infrastructure development agenda and the transformative Vision 2030 initiative, which prioritizes massive construction projects. These projects encompass new cities, urban redevelopment, and the expansion of transportation networks, all of which heavily rely on a wide array of plastic components.

- Key Drivers in Building and Construction:

- Gigaprojects: Initiatives like NEOM, Red Sea Project, and Diriyah Gate are massive undertakings requiring vast quantities of plastic components for plumbing, electrical conduits, insulation, window frames, and decorative elements.

- Urbanization and Population Growth: Increasing population density necessitates modern housing and infrastructure, boosting demand for durable and cost-effective plastic building materials.

- Government Investment: Sustained government spending on infrastructure projects provides a stable and significant demand stream for plastic components.

- Technological Adoption: The construction sector is increasingly adopting advanced plastic solutions for their lightweight, corrosion-resistant, and insulating properties, outperforming traditional materials in many applications.

The Sheets, Film, and Plates product type segment is also a significant contributor, serving as a foundational category that feeds into numerous other applications within construction and packaging. The Containers segment, another substantial pillar, is driven by the Food and Beverage and Consumer Goods industries, which are experiencing robust expansion. The Household Articles segment benefits directly from rising disposable incomes and a growing consumer base. While Aerospace and Life Sciences represent niche but high-growth areas, their current market share is considerably smaller compared to the dominant sectors. The estimated market share of the Building and Construction segment in the base year of 2025 is projected to be around 35%, with a growth potential of an additional 10-15% by 2033. The Sheets, Film, and Plates segment is estimated to hold approximately 25% of the market share, followed by Containers at around 20%. The dominance of the Building and Construction sector is further amplified by its direct contribution to Saudi Arabia's economic diversification goals, making it a strategic focus for both government support and private investment. The increasing demand for sustainable and energy-efficient building materials also favors advanced plastic solutions within this sector.

Saudi Arabia Plastic Components Industry Product Landscape

The Saudi Arabia plastic components industry is characterized by a diverse and evolving product landscape driven by innovation and market demand. Key product categories include high-performance Sheets, Film, and Plates utilized in construction and industrial applications, and versatile Tubes essential for plumbing and fluid transfer systems. The Containers segment is a major contributor, encompassing rigid and flexible packaging solutions for Food and Beverage and various consumer goods. Household Articles are widely produced, catering to the growing domestic market. Specialized segments like Floor Cover and Wall Cover are witnessing innovation in terms of durability and aesthetics. While Textile Fabrics made from plastics are a smaller segment, advancements in material science are leading to more functional and sustainable options. The "Other Products" category is broad, encompassing components for automotive, electronics, and industrial machinery. Innovations focus on enhancing material properties, such as increased strength, heat resistance, and chemical inertness, alongside a growing emphasis on recycled and bio-based materials to meet sustainability mandates. Unique selling propositions often lie in customized solutions, cost-effectiveness, and adherence to stringent quality standards required by sectors like life sciences and aerospace.

Key Drivers, Barriers & Challenges in Saudi Arabia Plastic Components Industry

The Saudi Arabia plastic components industry is propelled by several significant drivers. The Vision 2030 initiative, with its focus on industrial diversification and infrastructure development, acts as a primary catalyst, creating immense demand for construction-related plastic components. Government incentives for local manufacturing and foreign investment further bolster the sector. Growing domestic consumption, fueled by a young and expanding population, drives demand for consumer goods, packaging, and household articles. Technological advancements in material science and manufacturing processes enable the production of more sophisticated and high-performance plastic components.

- Key Drivers:

- Vision 2030 infrastructure projects.

- Increasing consumer demand.

- Technological advancements in plastics.

- Government support for localization.

Conversely, the industry faces several barriers and challenges. Fluctuations in raw material prices, particularly crude oil derivatives, can significantly impact production costs and profitability. Stricter environmental regulations regarding plastic waste and sustainability are necessitating investment in new technologies and materials. Intense competition, both domestically and internationally, puts pressure on profit margins. Developing and scaling up the production of advanced and specialized plastic components requires significant capital investment and skilled labor.

- Key Barriers & Challenges:

- Volatility in raw material prices.

- Increasing environmental regulations and sustainability demands.

- Intense domestic and international competition.

- Need for substantial investment in R&D and skilled workforce development.

- Supply chain disruptions impacting raw material availability and delivery times (estimated impact of 5-10% on production schedules in the historical period).

Emerging Opportunities in Saudi Arabia Plastic Components Industry

Emerging opportunities within the Saudi Arabia plastic components industry are predominantly centered around sustainability and advanced applications. The growing global and local emphasis on circular economy principles presents a significant opportunity for manufacturers to invest in and develop robust recycling infrastructure and produce high-quality recycled plastic components. The demand for lightweight, durable, and eco-friendly materials in the Building and Construction sector is creating a niche for innovative bio-based and biodegradable plastics. Furthermore, the expansion of the Life Sciences and Aerospace sectors within Saudi Arabia will drive demand for highly specialized, precision-engineered plastic components with superior performance characteristics. The integration of smart technologies, such as IoT sensors within plastic packaging and components, also represents an untapped market for value-added solutions.

Growth Accelerators in the Saudi Arabia Plastic Components Industry Industry

Several key catalysts are poised to accelerate long-term growth in the Saudi Arabia plastic components industry. The sustained commitment to mega-infrastructure projects under Vision 2030 will continue to provide a robust baseline demand for a wide array of plastic components, particularly in construction and packaging. Strategic partnerships and collaborations between local manufacturers and international technology providers are expected to drive the adoption of cutting-edge manufacturing processes and material innovations, enhancing competitiveness and product quality. The increasing focus on research and development, supported by government initiatives and academic institutions, will foster the creation of novel plastic materials and applications, opening up new market avenues and driving premiumization. Market expansion strategies, including the exploration of export opportunities within the GCC region and beyond, will further contribute to overall industry growth.

Key Players Shaping the Saudi Arabia Plastic Components Industry Market

- National Plastic Factory

- Estechtab

- Arabian Plastics Industrial Company Limited (APICO)

- ENPI Group

- Rowad National Plastic Company Ltd

- Zamil Plastics Industries Limited

- Tamam Plastic Factory

- Takween Advanced Industries

- Saudi Can Co Ltd

- PCC

- Al Watania Plastics

- Rayan Plastic Factory Company

- Saudi Plastic Products Company Ltd

Notable Milestones in Saudi Arabia Plastic Components Industry Sector

- 2021: Zamil Plastics Industries Limited announces expansion of its manufacturing capabilities to cater to increased demand from the construction sector.

- 2022: Takween Advanced Industries invests in new technologies for producing sustainable and recyclable plastic packaging solutions.

- 2023: ENPI Group secures a significant contract for supplying plastic components for a major infrastructure project in the Eastern Province.

- 2024 (Q1): Estechtab introduces a new range of advanced plastic sheets with enhanced fire-retardant properties for the construction market.

- 2024 (Q2): Rowad National Plastic Company Ltd expands its product portfolio to include specialized plastic components for the automotive aftermarket.

- 2024 (Q3): Arabian Plastics Industrial Company Limited (APICO) establishes a new research and development center focused on bio-plastic innovations.

- 2024 (Q4): Al Watania Plastics collaborates with a global leader in recycling technology to enhance its plastic waste management and reprocessing capabilities.

In-Depth Saudi Arabia Plastic Components Industry Market Outlook

The future outlook for the Saudi Arabia plastic components industry is exceptionally promising, driven by a confluence of strategic initiatives and evolving market demands. The sustained investment in ambitious infrastructure projects under Vision 2030 will continue to act as a primary growth accelerator, ensuring a robust demand for diverse plastic components across the Building and Construction and Consumer Goods sectors. The increasing emphasis on localization within manufacturing, coupled with government incentives, will foster domestic production capabilities and attract further foreign investment, thereby enhancing the industry's competitiveness. Strategic partnerships and technological collaborations are expected to be crucial in driving innovation, particularly in areas of sustainable materials and advanced manufacturing techniques. The growing awareness of environmental concerns will further propel the adoption of recycled and bio-based plastics, creating new market segments and opportunities for businesses that embrace circular economy principles. Overall, the industry is well-positioned for significant expansion, with a projected market size increase of over 60% by 2033, fueled by innovation, sustainability, and strategic market development.

Saudi Arabia Plastic Components Industry Segmentation

-

1. Product Type

- 1.1. Sheets, Film, and Plates

- 1.2. Tubes

- 1.3. Containers

- 1.4. Household Articles

- 1.5. Floor Cover and Wall Cover

- 1.6. Textile Fabrics

- 1.7. Other Products

-

2. End-user Industry

- 2.1. Building and Construction

- 2.2. Consumer Goods

- 2.3. Life Sciences

- 2.4. Aerospace

- 2.5. Food and Beverage

- 2.6. Other Applications

Saudi Arabia Plastic Components Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Plastic Components Industry Regional Market Share

Geographic Coverage of Saudi Arabia Plastic Components Industry

Saudi Arabia Plastic Components Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Government Spending on Construction Activities; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak

- 3.4. Market Trends

- 3.4.1 Sheets

- 3.4.2 Film

- 3.4.3 and Plates to Dominate the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Plastic Components Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Sheets, Film, and Plates

- 5.1.2. Tubes

- 5.1.3. Containers

- 5.1.4. Household Articles

- 5.1.5. Floor Cover and Wall Cover

- 5.1.6. Textile Fabrics

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Building and Construction

- 5.2.2. Consumer Goods

- 5.2.3. Life Sciences

- 5.2.4. Aerospace

- 5.2.5. Food and Beverage

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Plastic Factory

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Estechtab

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arabian Plastics Industrial Company Limited (APICO)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ENPI Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Rowad National Plastic Company Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zamil Plastics Industries Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Tamam Plastic Factory

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takween Advanced Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi Can Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PCC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Al Watania Plastics

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rayan Plastic Factory Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Saudi Plastic Products Company Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 National Plastic Factory

List of Figures

- Figure 1: Saudi Arabia Plastic Components Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Plastic Components Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 5: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 10: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by End-user Industry 2020 & 2033

- Table 11: Saudi Arabia Plastic Components Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Saudi Arabia Plastic Components Industry Volume K Units Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Plastic Components Industry?

The projected CAGR is approximately 6.2%.

2. Which companies are prominent players in the Saudi Arabia Plastic Components Industry?

Key companies in the market include National Plastic Factory, Estechtab, Arabian Plastics Industrial Company Limited (APICO), ENPI Group, Rowad National Plastic Company Ltd, Zamil Plastics Industries Limited, Tamam Plastic Factory, Takween Advanced Industries, Saudi Can Co Ltd, PCC, Al Watania Plastics, Rayan Plastic Factory Company, Saudi Plastic Products Company Ltd.

3. What are the main segments of the Saudi Arabia Plastic Components Industry?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Government Spending on Construction Activities; Other Drivers.

6. What are the notable trends driving market growth?

Sheets. Film. and Plates to Dominate the market.

7. Are there any restraints impacting market growth?

; Slowdown in Automotive Industry Growth; Unfavorable Conditions Arising Due to COVID-19 Outbreak.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3,950, USD 4,950, and USD 6,950 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Plastic Components Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Plastic Components Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Plastic Components Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabia Plastic Components Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence