Key Insights

The global Nano Paints & Coatings market is projected for substantial growth, driven by the inherent advantages of nanomaterials including enhanced durability, superior scratch resistance, self-cleaning properties, and improved aesthetics. Key sectors fueling this expansion include automotive, seeking advanced scratch-resistant and fuel-efficient coatings; aerospace, demanding lightweight and corrosion-resistant solutions; and electronics, requiring protective and functional layers. Further growth is attributed to the increasing demand for innovative food and packaging coatings that extend product shelf life and offer antimicrobial benefits, alongside the rising application of nano-coatings in biomedical devices for enhanced biocompatibility and anti-infective properties.

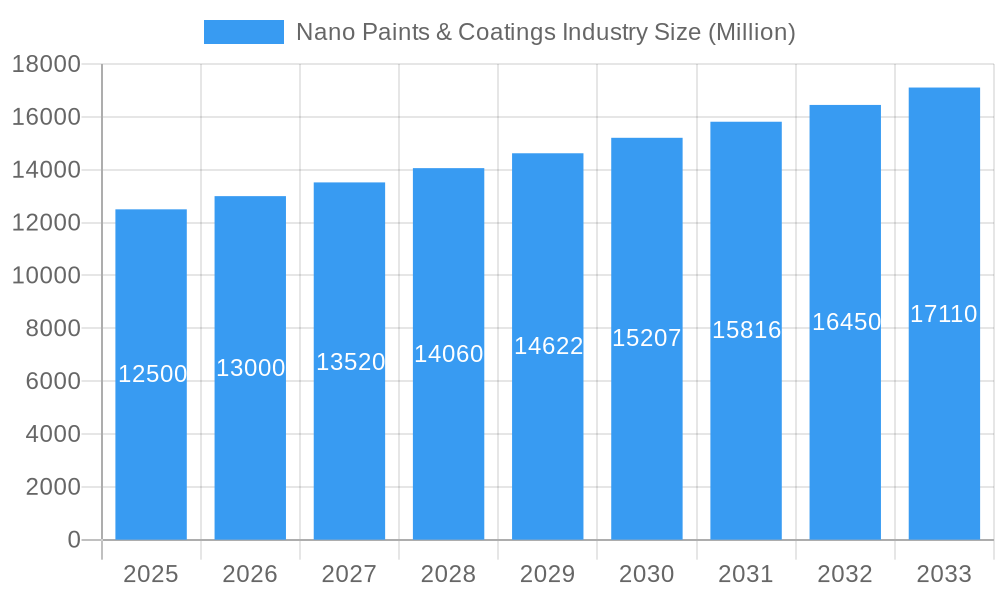

Nano Paints & Coatings Industry Market Size (In Billion)

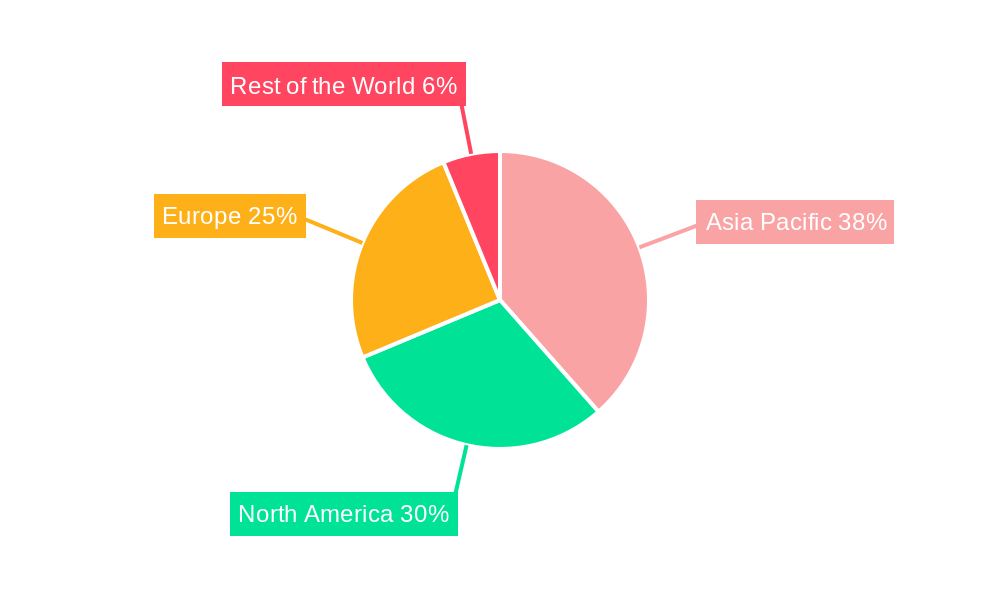

The market features a diverse range of nanomaterials, with Graphene and Carbon Nanotubes leading due to their exceptional mechanical and electrical characteristics. Nano-SiO2 and Nano-TiO2 are also gaining prominence for their photocatalytic and UV-blocking capabilities. Critical manufacturing techniques such as Electrospray, Electrospinning, Chemical Vapor Deposition (CVD), and Atomic Layer Deposition (ALD) are vital for precision application and scalability. Despite strong growth prospects, challenges such as high nanomaterial production costs and the necessity for robust regulatory frameworks concerning nanoparticle safety and environmental impact require careful consideration for widespread adoption. The Asia Pacific region is expected to spearhead market growth, supported by rapid industrialization and escalating R&D investments, with North America and Europe following closely.

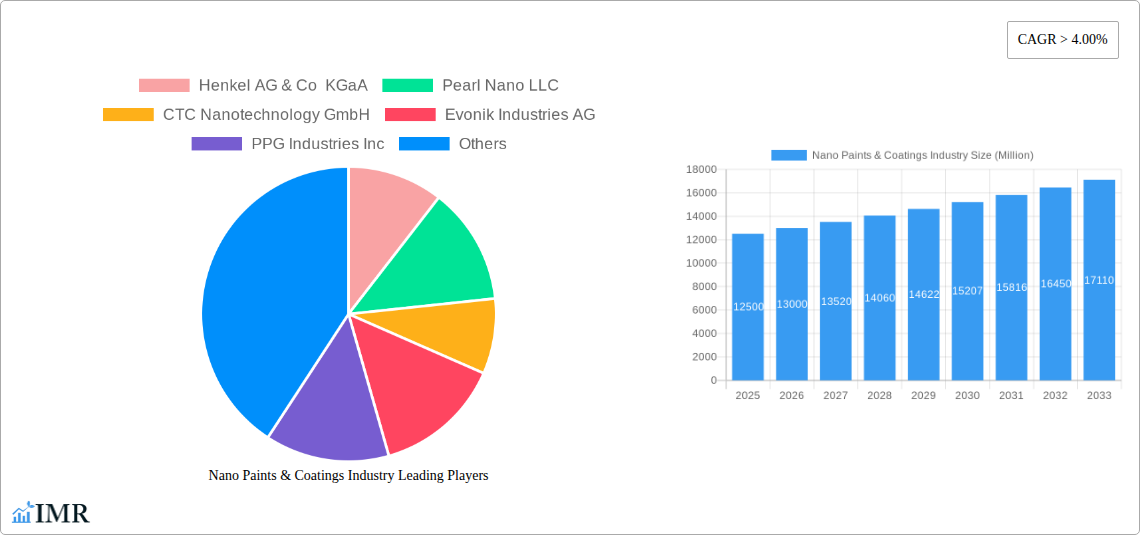

Nano Paints & Coatings Industry Company Market Share

This comprehensive report delivers an in-depth analysis of the global Nano Paints & Coatings industry, examining market dynamics, growth trajectories, regional leadership, product segmentation, key industry participants, and future projections. Harnessing advanced nanotechnology, this sector is fundamentally transforming surface protection and enhancement across a multitude of applications. Our research provides crucial insights for stakeholders navigating this dynamic market, covering the period from 2019 to 2033, with a base year of 2025, a projected market size of 7.46 billion, and a compelling CAGR of 15.15.

Nano Paints & Coatings Industry Market Dynamics & Structure

The Nano Paints & Coatings industry is characterized by a moderate to high market concentration, driven by significant technological advancements and substantial R&D investments. Innovation in nano-resins like Graphene, Carbon Nanotubes, Nano-SiO2, Nano Silver, Nano-TiO2, and Nano-ZNO is a primary growth driver, enabling enhanced properties such as superior scratch resistance, UV protection, self-cleaning capabilities, and antimicrobial efficacy. Regulatory frameworks, while still developing in some regions, are increasingly focused on the safe integration of nanomaterials, influencing product development and market access. Competitive product substitutes include traditional coatings, but nanocoatings offer distinct performance advantages that are gradually displacing older technologies. End-user demographics are expanding rapidly, with increasing demand from the Automobile, Aerospace & Defense, Electronics & Optics, and Biomedical sectors. Mergers & Acquisitions (M&A) activity, while not yet at its peak, is on an upward trajectory as larger chemical companies seek to acquire specialized nanotechnology firms and expand their portfolios. Barriers to entry include high initial R&D costs, the need for specialized manufacturing equipment, and the challenge of scaling production for certain nanomaterials.

- Market Concentration: Moderate to High, with a few key players holding significant market share.

- Technological Innovation Drivers: Enhanced durability, functionality (self-cleaning, anti-corrosion), and aesthetic appeal of nano-enhanced coatings.

- Regulatory Frameworks: Growing emphasis on safety, environmental impact, and standardized testing for nanomaterials.

- Competitive Product Substitutes: Traditional paints and coatings are being challenged by the superior performance of nanocoatings.

- End-User Demographics: Diversifying from industrial applications to consumer goods, healthcare, and advanced manufacturing.

- M&A Trends: Increasing strategic acquisitions by large corporations to gain access to novel nanotechnology and market expertise.

- Innovation Barriers: High R&D expenditure, complex synthesis processes, and the need for skilled personnel.

Nano Paints & Coatings Industry Growth Trends & Insights

The global Nano Paints & Coatings market is poised for significant expansion, projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 15.5% during the forecast period of 2025–2033. This robust growth is fueled by the relentless pursuit of enhanced material performance across a myriad of industries. The intrinsic properties of nanomaterials, such as their incredibly high surface area-to-volume ratio and unique quantum mechanical effects, allow for the creation of coatings with unprecedented durability, functionality, and sustainability. For instance, the incorporation of Nano-TiO2 is driving the development of self-cleaning and air-purifying surfaces, while Carbon Nanotubes offer exceptional strength and conductivity.

The adoption rates of nano-enhanced coatings are accelerating as end-users recognize the long-term cost savings and performance benefits, such as extended product lifecycles and reduced maintenance requirements. Technological disruptions are a constant feature, with ongoing research into novel nanomaterials and advanced deposition methods like Electrospray and Electro Spinning, Chemical Vapor Deposition (CVD), Physical Vapor Deposition (PVD), and Atomic Layer Deposition (ALD) continuously pushing the boundaries of what is possible. Consumer behavior is also shifting, with a growing demand for products that offer greater longevity, environmental friendliness, and advanced features. This is particularly evident in the automotive sector, where consumers increasingly expect durable, scratch-resistant, and easy-to-clean finishes. Similarly, the electronics industry benefits from nanocoatings that provide conductivity, insulation, and protection against environmental factors. The market penetration of nanocoatings is steadily increasing, moving beyond niche applications to become mainstream solutions for many industrial and consumer products. The market size evolution indicates a strong upward trajectory, transitioning from an estimated market value of $15,850 Million in 2025 to a projected $45,600 Million by 2033. This growth is supported by increasing investments in nanotechnology research and development, coupled with the growing awareness of the multifaceted advantages offered by these advanced materials.

Dominant Regions, Countries, or Segments in Nano Paints & Coatings Industry

The Automobile end-user industry segment is currently the most dominant driver of growth within the global Nano Paints & Coatings market. This dominance stems from the automotive sector's continuous innovation cycle, its emphasis on aesthetics, durability, and performance, and the sheer volume of vehicles produced globally. Nanocoatings offer a substantial upgrade over traditional automotive paints, providing enhanced scratch resistance, UV protection, corrosion resistance, and ease of cleaning, which are highly valued by both manufacturers and consumers. The market share within this segment is substantial, estimated to be around 25% of the total nano paints and coatings market in 2025.

Key drivers fueling this dominance include:

- Performance Enhancement: Nanocoatings significantly improve the longevity and visual appeal of vehicle exteriors, reducing the need for frequent repainting and maintenance. Technologies like Nano-SiO2 are crucial for creating highly durable and hydrophobic surfaces.

- Consumer Demand: Growing consumer expectations for premium finishes and long-lasting protection contribute to higher adoption rates.

- Regulatory Push for Lighter Vehicles: The trend towards lightweighting in the automotive industry encourages the use of advanced materials that can offer superior protection without adding significant weight, where nanocoatings play a crucial role.

- Technological Advancements in Application Methods: The refinement of techniques like Aerosol Coating and Sol-gel, alongside advancements in deposition methods such as PVD, makes the application of nanocoatings more efficient and cost-effective for automotive production lines.

- Industry Investments: Major automotive manufacturers are investing heavily in integrating advanced coating technologies to differentiate their products.

While the Automobile sector leads, other segments like Electronics & Optics and Aerospace & Defense are also exhibiting rapid growth due to their unique requirements for specialized, high-performance coatings. The demand for Nano-TiO2 for its photocatalytic and self-cleaning properties, and Carbon Nanotubes for their electrical conductivity and strength, are key indicators of innovation within these segments. The global market size for nano paints and coatings in the automobile sector is projected to reach approximately $3,960 Million in 2025, with a robust CAGR expected to continue its upward trend.

Nano Paints & Coatings Industry Product Landscape

The product landscape of the Nano Paints & Coatings industry is defined by a suite of innovative solutions engineered to impart superior properties to surfaces. These coatings are typically formulated with dispersed nanoparticles such as Nano-SiO2 for increased hardness and scratch resistance, Nano-TiO2 for photocatalytic and self-cleaning effects, and Graphene or Carbon Nanotubes for enhanced mechanical strength and electrical conductivity. Applications range from protective layers on consumer electronics and automotive finishes to anti-corrosive coatings for marine and aerospace applications. Unique selling propositions include extended lifespan, improved aesthetic appeal, and functional benefits like antimicrobial activity and UV shielding. Technological advancements in synthesis and dispersion techniques are key to achieving uniform nanoparticle distribution, ensuring consistent performance and unlocking novel functionalities previously unattainable with conventional coatings.

Key Drivers, Barriers & Challenges in Nano Paints & Coatings Industry

The Nano Paints & Coatings industry is propelled by several key drivers, including the escalating demand for high-performance, durable, and functional coatings across diverse end-user industries such as automotive, aerospace, and electronics. Technological advancements in nanomaterial synthesis and application methods, leading to enhanced scratch resistance, corrosion protection, and self-cleaning properties, are significant growth catalysts. Furthermore, increasing consumer awareness of the benefits of nanotechnology and government initiatives supporting advanced materials research and development contribute to market expansion.

Conversely, significant barriers and challenges exist. The high cost of nanomaterial production and the complexity of scaling up manufacturing processes remain major hurdles. Stringent regulatory frameworks regarding the safety and environmental impact of nanoparticles can also slow down market penetration and product adoption. Supply chain issues related to the consistent availability and quality of nanoparticles, coupled with the need for specialized application equipment and skilled labor, present further challenges. Competitive pressures from established traditional coating technologies and the ongoing need for extensive R&D to overcome performance limitations in specific environments also impact growth.

Emerging Opportunities in Nano Paints & Coatings Industry

Emerging opportunities within the Nano Paints & Coatings industry are vast and diverse, driven by evolving consumer preferences and technological breakthroughs. The biomedical sector presents a significant untapped market, with potential applications in antimicrobial coatings for medical devices and implants, as well as advanced wound dressings. The food and packaging industry is also showing increasing interest in nanocoatings for enhanced barrier properties, improved food safety, and extended shelf life. Furthermore, the development of "smart" coatings that can change color, conduct electricity, or self-heal in response to external stimuli opens up new avenues in construction, textiles, and wearable technology. The growing global focus on sustainability also creates opportunities for nanocoatings that offer eco-friendly alternatives, such as low-VOC formulations and coatings that reduce energy consumption through improved insulation or self-cleaning properties.

Growth Accelerators in the Nano Paints & Coatings Industry Industry

The long-term growth of the Nano Paints & Coatings industry is significantly accelerated by continuous technological breakthroughs in nanotechnology, leading to the development of novel nanoparticles with enhanced functionalities and improved cost-effectiveness. Strategic partnerships and collaborations between material manufacturers, coating formulators, and end-user industries are crucial for driving innovation and accelerating market adoption. For example, collaborations between nanotechnology firms and automotive giants can lead to the rapid integration of advanced nanocoatings into vehicle production lines. Market expansion strategies, including the exploration of new geographical regions and the development of specialized coating solutions for emerging industries, also act as significant growth accelerators. Furthermore, the increasing emphasis on circular economy principles and sustainable material solutions will further propel the adoption of nanocoatings that offer extended product lifespans and reduced environmental impact.

Key Players Shaping the Nano Paints & Coatings Industry Market

- Henkel AG & Co KGaA

- Pearl Nano LLC

- CTC Nanotechnology GmbH

- Evonik Industries AG

- PPG Industries Inc

- NanoShine Ltd

- Starshield Technologies Pvt Ltd

- icannanopaints com

- Nano-Z Coating Ltd

- Nanovere Technologies LLC

- Artekya Teknoloji

Notable Milestones in Nano Paints & Coatings Industry Sector

- 2019: Increased investment in R&D for graphene-based coatings, leading to enhanced conductivity and mechanical properties.

- 2020: Launch of new self-cleaning nanocoatings for architectural applications, improving building maintenance and energy efficiency.

- 2021: Advancements in Atomic Layer Deposition (ALD) techniques enabling more precise and uniform application of nanocoatings on complex geometries.

- 2022: Growing adoption of Nano-TiO2 based coatings in air purification systems and on public surfaces for enhanced hygiene.

- 2023: Strategic partnerships formed between major chemical companies and nanotechnology startups to accelerate commercialization of advanced nanocoatings.

- 2024: Introduction of novel biodegradable nanocoatings for food packaging, addressing environmental concerns.

In-Depth Nano Paints & Coatings Industry Market Outlook

The future outlook for the Nano Paints & Coatings industry is exceptionally promising, driven by an inherent demand for superior material performance and sustainable solutions. Growth accelerators such as continued innovation in nanomaterial science, the development of environmentally friendly nanocoating formulations, and the expanding application scope across burgeoning sectors like renewable energy and advanced manufacturing will fuel this expansion. Strategic opportunities lie in addressing the challenges of cost-effective scaled production and navigating evolving regulatory landscapes. The market is set to witness a substantial increase in value and penetration as nanocoatings transition from niche applications to mainstream solutions, promising enhanced durability, functionality, and sustainability for a wide array of products and industries.

Nano Paints & Coatings Industry Segmentation

-

1. Resin Type

- 1.1. Graphene

- 1.2. Carbon Nanotubes

- 1.3. Nano-SiO2 (Silicon Dioxide)

- 1.4. Nano Silver

- 1.5. Nano-TiO2 (Titanium Dioxide)

- 1.6. Nano-ZNO

-

2. Method

- 2.1. Electrospray and Electro Spinning

- 2.2. Chemical Vapor Deposition (CVD)

- 2.3. Physical Vapor Deposition (PVD)

- 2.4. Atomic Layer Deposition (ALD)

- 2.5. Aerosol Coating

- 2.6. Self-assembly

- 2.7. Sol-gel

-

3. End-user Industry

- 3.1. Biomedical

- 3.2. Food & Packaging

- 3.3. Aerospace & Defense

- 3.4. Marine

- 3.5. Electronics & Optics

- 3.6. Automobile

- 3.7. Oil & Gas

- 3.8. Others

Nano Paints & Coatings Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. Rest of the World

- 4.1. South America

- 4.2. Middle East

Nano Paints & Coatings Industry Regional Market Share

Geographic Coverage of Nano Paints & Coatings Industry

Nano Paints & Coatings Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.15% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand from the Aerospace & Defense Industry; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; High Price Bar of Conductive Textile Made Products; Other Restraints

- 3.4. Market Trends

- 3.4.1. Graphene to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Nano Paints & Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Graphene

- 5.1.2. Carbon Nanotubes

- 5.1.3. Nano-SiO2 (Silicon Dioxide)

- 5.1.4. Nano Silver

- 5.1.5. Nano-TiO2 (Titanium Dioxide)

- 5.1.6. Nano-ZNO

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Electrospray and Electro Spinning

- 5.2.2. Chemical Vapor Deposition (CVD)

- 5.2.3. Physical Vapor Deposition (PVD)

- 5.2.4. Atomic Layer Deposition (ALD)

- 5.2.5. Aerosol Coating

- 5.2.6. Self-assembly

- 5.2.7. Sol-gel

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Biomedical

- 5.3.2. Food & Packaging

- 5.3.3. Aerospace & Defense

- 5.3.4. Marine

- 5.3.5. Electronics & Optics

- 5.3.6. Automobile

- 5.3.7. Oil & Gas

- 5.3.8. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Asia Pacific Nano Paints & Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Graphene

- 6.1.2. Carbon Nanotubes

- 6.1.3. Nano-SiO2 (Silicon Dioxide)

- 6.1.4. Nano Silver

- 6.1.5. Nano-TiO2 (Titanium Dioxide)

- 6.1.6. Nano-ZNO

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Electrospray and Electro Spinning

- 6.2.2. Chemical Vapor Deposition (CVD)

- 6.2.3. Physical Vapor Deposition (PVD)

- 6.2.4. Atomic Layer Deposition (ALD)

- 6.2.5. Aerosol Coating

- 6.2.6. Self-assembly

- 6.2.7. Sol-gel

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Biomedical

- 6.3.2. Food & Packaging

- 6.3.3. Aerospace & Defense

- 6.3.4. Marine

- 6.3.5. Electronics & Optics

- 6.3.6. Automobile

- 6.3.7. Oil & Gas

- 6.3.8. Others

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. North America Nano Paints & Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Graphene

- 7.1.2. Carbon Nanotubes

- 7.1.3. Nano-SiO2 (Silicon Dioxide)

- 7.1.4. Nano Silver

- 7.1.5. Nano-TiO2 (Titanium Dioxide)

- 7.1.6. Nano-ZNO

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Electrospray and Electro Spinning

- 7.2.2. Chemical Vapor Deposition (CVD)

- 7.2.3. Physical Vapor Deposition (PVD)

- 7.2.4. Atomic Layer Deposition (ALD)

- 7.2.5. Aerosol Coating

- 7.2.6. Self-assembly

- 7.2.7. Sol-gel

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Biomedical

- 7.3.2. Food & Packaging

- 7.3.3. Aerospace & Defense

- 7.3.4. Marine

- 7.3.5. Electronics & Optics

- 7.3.6. Automobile

- 7.3.7. Oil & Gas

- 7.3.8. Others

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. Europe Nano Paints & Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Graphene

- 8.1.2. Carbon Nanotubes

- 8.1.3. Nano-SiO2 (Silicon Dioxide)

- 8.1.4. Nano Silver

- 8.1.5. Nano-TiO2 (Titanium Dioxide)

- 8.1.6. Nano-ZNO

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Electrospray and Electro Spinning

- 8.2.2. Chemical Vapor Deposition (CVD)

- 8.2.3. Physical Vapor Deposition (PVD)

- 8.2.4. Atomic Layer Deposition (ALD)

- 8.2.5. Aerosol Coating

- 8.2.6. Self-assembly

- 8.2.7. Sol-gel

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Biomedical

- 8.3.2. Food & Packaging

- 8.3.3. Aerospace & Defense

- 8.3.4. Marine

- 8.3.5. Electronics & Optics

- 8.3.6. Automobile

- 8.3.7. Oil & Gas

- 8.3.8. Others

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Rest of the World Nano Paints & Coatings Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Graphene

- 9.1.2. Carbon Nanotubes

- 9.1.3. Nano-SiO2 (Silicon Dioxide)

- 9.1.4. Nano Silver

- 9.1.5. Nano-TiO2 (Titanium Dioxide)

- 9.1.6. Nano-ZNO

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Electrospray and Electro Spinning

- 9.2.2. Chemical Vapor Deposition (CVD)

- 9.2.3. Physical Vapor Deposition (PVD)

- 9.2.4. Atomic Layer Deposition (ALD)

- 9.2.5. Aerosol Coating

- 9.2.6. Self-assembly

- 9.2.7. Sol-gel

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Biomedical

- 9.3.2. Food & Packaging

- 9.3.3. Aerospace & Defense

- 9.3.4. Marine

- 9.3.5. Electronics & Optics

- 9.3.6. Automobile

- 9.3.7. Oil & Gas

- 9.3.8. Others

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Henkel AG & Co KGaA

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Pearl Nano LLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 CTC Nanotechnology GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Evonik Industries AG

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 PPG Industries Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 NanoShine Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Starshield Technologies Pvt Ltd*List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 icannanopaints com ( Innovation Center for Applied Nanotechnology)

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Nano-Z Coating Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nanovere Technologies LLC

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Artekya Teknoloji

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Henkel AG & Co KGaA

List of Figures

- Figure 1: Global Nano Paints & Coatings Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Nano Paints & Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 3: Asia Pacific Nano Paints & Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 4: Asia Pacific Nano Paints & Coatings Industry Revenue (billion), by Method 2025 & 2033

- Figure 5: Asia Pacific Nano Paints & Coatings Industry Revenue Share (%), by Method 2025 & 2033

- Figure 6: Asia Pacific Nano Paints & Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Nano Paints & Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Nano Paints & Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Nano Paints & Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Nano Paints & Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 11: North America Nano Paints & Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 12: North America Nano Paints & Coatings Industry Revenue (billion), by Method 2025 & 2033

- Figure 13: North America Nano Paints & Coatings Industry Revenue Share (%), by Method 2025 & 2033

- Figure 14: North America Nano Paints & Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: North America Nano Paints & Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Nano Paints & Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Nano Paints & Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Nano Paints & Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 19: Europe Nano Paints & Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 20: Europe Nano Paints & Coatings Industry Revenue (billion), by Method 2025 & 2033

- Figure 21: Europe Nano Paints & Coatings Industry Revenue Share (%), by Method 2025 & 2033

- Figure 22: Europe Nano Paints & Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Europe Nano Paints & Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Nano Paints & Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Nano Paints & Coatings Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Nano Paints & Coatings Industry Revenue (billion), by Resin Type 2025 & 2033

- Figure 27: Rest of the World Nano Paints & Coatings Industry Revenue Share (%), by Resin Type 2025 & 2033

- Figure 28: Rest of the World Nano Paints & Coatings Industry Revenue (billion), by Method 2025 & 2033

- Figure 29: Rest of the World Nano Paints & Coatings Industry Revenue Share (%), by Method 2025 & 2033

- Figure 30: Rest of the World Nano Paints & Coatings Industry Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World Nano Paints & Coatings Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World Nano Paints & Coatings Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Nano Paints & Coatings Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 3: Global Nano Paints & Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 6: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 7: Global Nano Paints & Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 15: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 16: Global Nano Paints & Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 18: United States Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Canada Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Mexico Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 22: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 23: Global Nano Paints & Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 25: Germany Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: France Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 31: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Method 2020 & 2033

- Table 32: Global Nano Paints & Coatings Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Nano Paints & Coatings Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: South America Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Middle East Nano Paints & Coatings Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Nano Paints & Coatings Industry?

The projected CAGR is approximately 15.15%.

2. Which companies are prominent players in the Nano Paints & Coatings Industry?

Key companies in the market include Henkel AG & Co KGaA, Pearl Nano LLC, CTC Nanotechnology GmbH, Evonik Industries AG, PPG Industries Inc, NanoShine Ltd, Starshield Technologies Pvt Ltd*List Not Exhaustive, icannanopaints com ( Innovation Center for Applied Nanotechnology), Nano-Z Coating Ltd, Nanovere Technologies LLC, Artekya Teknoloji.

3. What are the main segments of the Nano Paints & Coatings Industry?

The market segments include Resin Type, Method, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.46 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand from the Aerospace & Defense Industry; Other Drivers.

6. What are the notable trends driving market growth?

Graphene to Dominate the Market.

7. Are there any restraints impacting market growth?

; High Price Bar of Conductive Textile Made Products; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Nano Paints & Coatings Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Nano Paints & Coatings Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Nano Paints & Coatings Industry?

To stay informed about further developments, trends, and reports in the Nano Paints & Coatings Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence