Key Insights

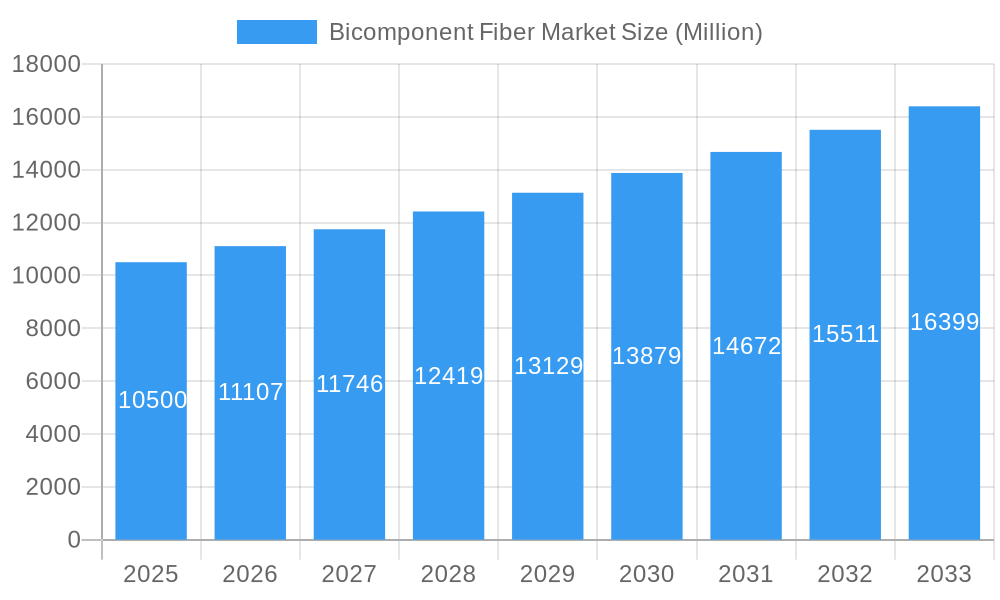

The global Bicomponent Fiber Market is set for substantial growth, driven by its adaptability and increasing integration across diverse industries. Projecting a market size of $0.86 million in the base year 2025, the market is anticipated to expand at a Compound Annual Growth Rate (CAGR) of 5.64% through 2033. This expansion is fueled by the rising demand for lightweight, durable, and high-performance materials in key sectors, including automotive, hygiene, and non-woven textiles. Advancements in fiber technology, offering enhanced strength, softness, and thermal insulation, are significant growth catalysts. The automotive sector's adoption of bicomponent fibers for interior components aids in reducing vehicle weight and improving fuel efficiency. Concurrently, heightened awareness of hygiene and sanitation is driving increased use in disposable products, further boosting market expansion.

Bicomponent Fiber Market Market Size (In Million)

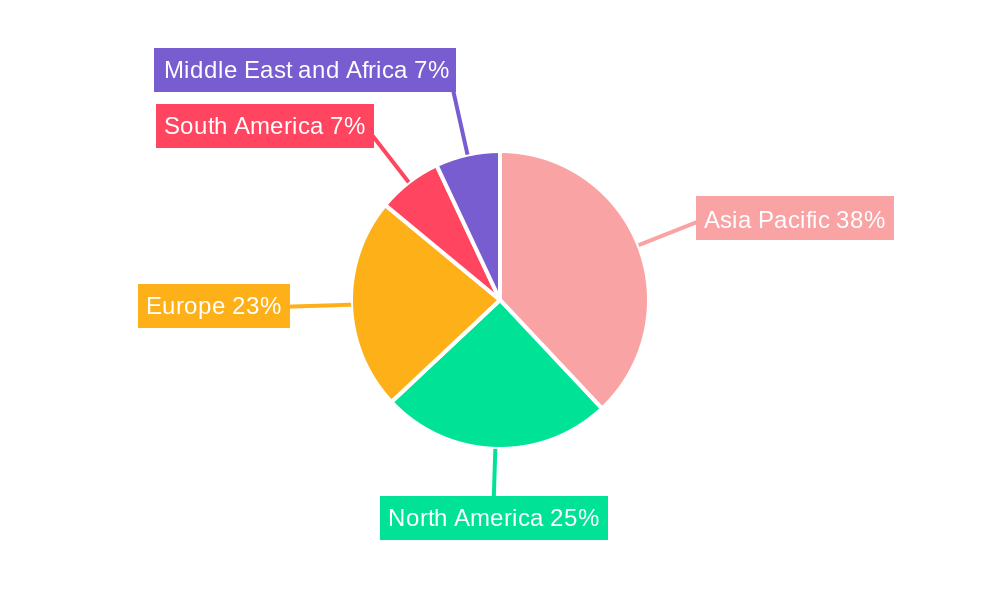

The market features a variety of materials, with Polyethylene (PE) and Polypropylene (PP) currently leading due to their cost-effectiveness and broad applications. Innovative structures such as sheath-core and islands-in-the-sea are emerging, providing specialized performance advantages. Geographically, the Asia Pacific region, particularly China and India, is expected to dominate and lead market growth, supported by rapid industrialization, a strong manufacturing base, and rising disposable incomes. Europe and North America remain significant markets, characterized by established industries and a strong emphasis on sustainability and product innovation. Challenges may arise from fluctuating raw material prices and the emergence of alternative materials. However, ongoing research and development, alongside strategic partnerships among leading companies, will propel the Bicomponent Fiber Market forward.

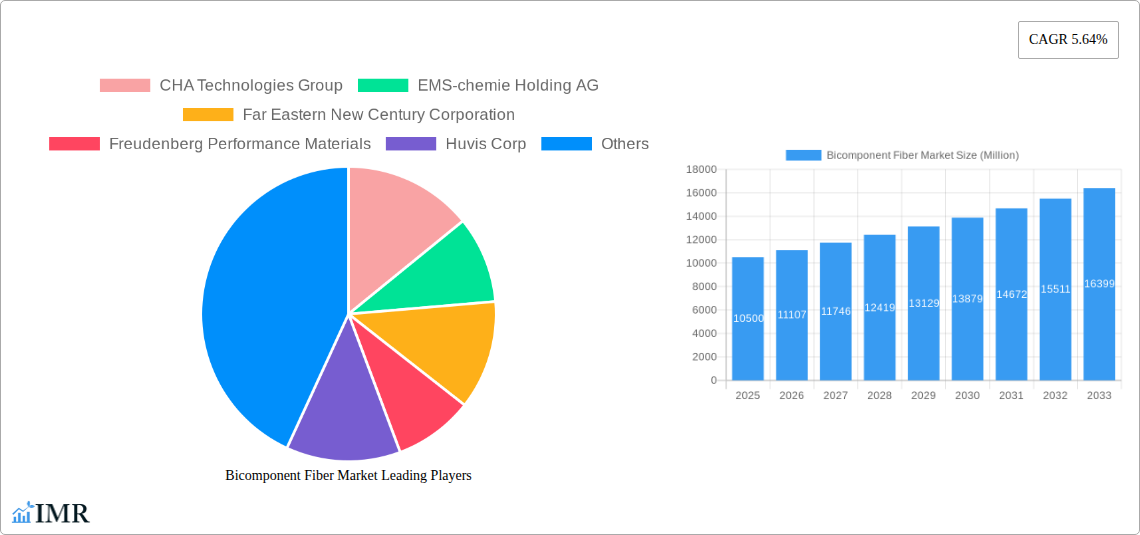

Bicomponent Fiber Market Company Market Share

This comprehensive report offers an in-depth analysis of the Bicomponent Fiber Market, including market size, growth projections, and key industry trends. All data points are presented in million units.

Bicomponent Fiber Market: Comprehensive Analysis & Growth Forecast (2019-2033)

This in-depth report provides an exhaustive analysis of the global Bicomponent Fiber market, offering critical insights into its dynamics, growth trajectory, and future potential. Covering the historical period from 2019 to 2024, the base year of 2025, and an extensive forecast period extending to 2033, this report is an indispensable resource for stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving industry. With a granular segmentation by material (including Polyethylene (PE)/Polypropylene (PP), Polyprop, High-density Polyethylene/Low-density Polyethylene, Polyethylene/polyethylene Terephthalate (pet), Polyester/PBT, and Other Materials), structure types (Sheath-core, Side-by-Side, Islands in the Sea, and Other Structure Types), and end-user industries (Non-Woven Textiles, Automotive, Hygiene, Construction, Medical, and Other End-user Industries), this report delivers unparalleled market intelligence. We provide precise quantitative data, including market size estimations in Million units, compound annual growth rates (CAGR), and market penetration figures, alongside qualitative assessments of technological advancements, regulatory impacts, and consumer behavior shifts.

Bicomponent Fiber Market Market Dynamics & Structure

The bicomponent fiber market is characterized by a moderately consolidated structure, with leading players investing significantly in research and development to drive technological innovation. Key drivers include the increasing demand for high-performance materials in textiles and the growing adoption of sustainable fibers. Regulatory frameworks focusing on environmental impact and product safety are also shaping market strategies. Competitive product substitutes, such as monocomponent fibers and other advanced materials, present a challenge, necessitating continuous innovation from bicomponent fiber manufacturers. End-user demographics are shifting towards more environmentally conscious consumers and industries seeking lightweight, durable, and functional materials. Mergers and acquisitions (M&A) activity is a notable trend, with companies consolidating to enhance their market reach and technological capabilities. For instance, the historical period (2019-2024) witnessed an estimated xx M&A deals in the fiber industry, aiming to strengthen portfolios in specialty fibers like bicomponent types. Innovation barriers primarily stem from the high capital investment required for advanced manufacturing processes and the need for specialized expertise in fiber extrusion.

- Market Concentration: Moderate, with a few key players holding significant market share.

- Technological Innovation Drivers: Demand for enhanced properties (strength, softness, breathability), cost-effectiveness, and sustainability.

- Regulatory Frameworks: Growing emphasis on eco-friendly production and recyclability.

- Competitive Product Substitutes: Monocomponent fibers, natural fibers, and advanced composite materials.

- End-User Demographics: Increasing demand from hygiene, medical, and automotive sectors for specialized functionalities.

- M&A Trends: Strategic acquisitions to expand product portfolios and global presence.

Bicomponent Fiber Market Growth Trends & Insights

The bicomponent fiber market is poised for robust growth, driven by an escalating demand across diverse end-use applications. Leveraging advanced analytical models, this report projects a significant market size evolution throughout the forecast period (2025–2033). The adoption rates of bicomponent fibers are accelerating, particularly in the non-woven textiles, hygiene, and automotive industries, due to their superior performance characteristics such as enhanced strength, softness, and thermal insulation. Technological disruptions, including advancements in melt spinning technologies and the development of novel polymer combinations, are enabling the production of bicomponent fibers with tailored properties for specific applications. Consumer behavior shifts, with a growing preference for sustainable and high-performance materials, are further propelling market penetration. The market is expected to witness a compound annual growth rate (CAGR) of approximately xx% from 2025 to 2033. Current market penetration for bicomponent fibers in key sectors like hygiene is estimated to be around xx%, with significant room for expansion. The introduction of bio-based bicomponent fibers and those designed for circular economy principles are emerging as critical trends, aligning with global sustainability goals. The projected market size for bicomponent fibers is expected to reach an estimated USD [XX] million by 2033, up from USD [YY] million in 2025. This growth trajectory is supported by ongoing investments in production capacity and product development by major manufacturers.

Dominant Regions, Countries, or Segments in Bicomponent Fiber Market

The global bicomponent fiber market exhibits regional dominance driven by a confluence of manufacturing capabilities, end-user industry concentration, and favorable economic policies. Asia-Pacific, particularly China and India, is a leading region due to its extensive manufacturing infrastructure for textiles and non-wovens, coupled with a large domestic market and significant export potential. The Material: Polyethylene (PE)/Polypropylene (PP) segment is a primary driver of this dominance. This material combination offers an optimal balance of cost-effectiveness and desirable properties for a wide range of applications, from disposable hygiene products to industrial fabrics. The End-user Industry: Non-Woven Textiles is another major contributor to market growth. This sector relies heavily on bicomponent fibers for creating absorbent, soft, and durable materials used in diapers, feminine hygiene products, medical gowns, and wipes. The widespread availability of raw materials and a strong presence of non-woven fabric manufacturers in Asia-Pacific further bolster this segment.

Within the Asia-Pacific region, China stands out as a dominant country, boasting the largest production capacity and consumption of bicomponent fibers. This is attributed to its robust manufacturing ecosystem, government support for the textile and chemical industries, and a burgeoning middle class driving demand for consumer goods. Economic policies promoting industrialization and technological upgrades have facilitated the widespread adoption of advanced fiber technologies, including bicomponent fiber production. Furthermore, the country's extensive logistics network supports efficient distribution of finished products both domestically and internationally.

The Structure Type: Sheath-core is another segment experiencing significant growth and contributing to regional dominance, especially in Asia. This structure allows for the creation of fibers with a distinct core and sheath, enabling unique performance characteristics. For example, a bicomponent fiber with a lower melting point sheath and a higher melting point core can be used in thermal bonding applications, eliminating the need for additional binders and reducing manufacturing costs and environmental impact. This efficiency is highly valued in large-scale production within the non-woven sector. The combination of readily available PE/PP materials, the high demand from the non-woven industry, and the prevalence of sheath-core structures creates a powerful synergy that propels the bicomponent fiber market forward. Market share for bicomponent fibers within the non-woven segment in Asia-Pacific is estimated to be over 60%, with significant growth potential projected from advancements in hygiene and medical textiles.

Bicomponent Fiber Market Product Landscape

The bicomponent fiber market is characterized by continuous product innovation focused on enhancing performance and sustainability. Key advancements include the development of bicomponent fibers with tailored cross-sections, such as trilobal or hollow structures, which impart unique aesthetic and functional properties like improved bulkiness, moisture management, and insulation. Innovations in polymer blending and extrusion processes are enabling the creation of fibers with synergistic properties, such as increased tensile strength with enhanced softness, or superior flame retardancy combined with breathability. Applications are expanding beyond traditional uses in hygiene and geotextiles to include advanced filtration media, high-performance apparel, and durable automotive interiors. The unique selling proposition of bicomponent fibers lies in their ability to achieve performance characteristics that are difficult or impossible to attain with monocomponent fibers, often at a competitive cost.

Key Drivers, Barriers & Challenges in Bicomponent Fiber Market

Key Drivers:

- Growing Demand in Hygiene and Medical Sectors: The need for soft, absorbent, and barrier materials in disposable hygiene products and advanced medical textiles is a primary growth engine.

- Automotive Lightweighting Initiatives: Bicomponent fibers are increasingly used in automotive interiors and components for their lightweighting properties, contributing to fuel efficiency.

- Technical Textiles and Geotextiles Expansion: The demand for durable, high-performance fibers in construction, filtration, and industrial applications is rising.

- Sustainability and Eco-Friendly Alternatives: The development of bicomponent fibers from recycled materials and bio-based polymers caters to the growing demand for sustainable solutions.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of petroleum-based polymers, such as polypropylene and polyethylene, can impact production costs and market competitiveness.

- Technological Complexity and Capital Investment: Setting up and operating bicomponent fiber production lines requires significant capital investment and specialized technical expertise.

- Competition from Monocomponent Fibers and Other Materials: Established monocomponent fibers and alternative materials can pose a challenge in certain price-sensitive applications.

- Stringent Environmental Regulations: Evolving regulations regarding chemical usage, emissions, and recyclability can necessitate costly process adaptations.

Emerging Opportunities in Bicomponent Fiber Market

Emerging opportunities in the bicomponent fiber market lie in the development of novel applications driven by material science advancements. The growing trend towards sustainable fashion and activewear presents a significant avenue for bicomponent fibers offering enhanced comfort, moisture-wicking, and durability. Innovations in smart textiles, where bicomponent fibers can be engineered to incorporate conductive properties or responsiveness to stimuli, open doors to applications in wearable electronics and advanced healthcare monitoring. Furthermore, the circular economy approach is fostering opportunities for bicomponent fibers designed for easier recycling or derived from renewable resources. The untapped potential in niche markets such as advanced filtration for industrial processes and specialized protective clothing also represents a substantial growth prospect.

Growth Accelerators in the Bicomponent Fiber Market Industry

Several catalysts are accelerating the long-term growth of the bicomponent fiber market. Technological breakthroughs in melt spinning and fiber engineering are enabling the creation of fibers with unprecedented functionalities and cost-effectiveness. Strategic partnerships between raw material suppliers, fiber manufacturers, and end-product developers are crucial for fostering innovation and market penetration. For instance, collaborations focused on developing novel polymer formulations can lead to bicomponent fibers with enhanced biodegradability or superior thermal properties. Market expansion strategies, including geographical diversification and penetration into emerging end-user industries, are also key growth accelerators. Investment in advanced manufacturing facilities and automation further enhances production efficiency and scalability.

Key Players Shaping the Bicomponent Fiber Market Market

- CHA Technologies Group

- EMS-chemie Holding AG

- Far Eastern New Century Corporation

- Freudenberg Performance Materials

- Huvis Corp

- Indorama Ventures Public Company Limited

- JNC Corporation

- Kolon Glotech

- Kuraray Co Ltd

- OC Oerlikon Management AG

- PTT Global Chemical Public Company Limited

- Shaoxing Yaolong Spunbonded Nonwoven Technology Co Ltd

- TEIJIN Limited

- TORAY Industries Inc

- WPT Nonwovens Corp

Notable Milestones in Bicomponent Fiber Market Sector

- October 2022: Teijin Frontier Co. Ltd, a subsidiary company of Teijin Limited, opened a new manufacturing facility for the highly efficient production of polyester filaments. The company invested JPY 1 million (USD 0.01 million) in constructing this facility, and it is expected to produce 1,500 tons of polyester filaments, including bicomponent fiber, annually by the end of the year 2024.

In-Depth Bicomponent Fiber Market Market Outlook

The future outlook for the bicomponent fiber market is exceptionally promising, driven by a confluence of innovation, sustainability imperatives, and expanding application horizons. Growth accelerators, including the relentless pursuit of high-performance materials in sectors like automotive and medical, coupled with the increasing consumer preference for eco-friendly products, will continue to fuel demand. Strategic partnerships and continued investment in R&D will unlock new possibilities for bicomponent fibers with advanced functionalities. The market is well-positioned to benefit from global trends towards lightweighting, enhanced durability, and a circular economy, making it a key sector for future industrial growth and material innovation. The projected market expansion indicates significant opportunities for both established players and new entrants.

Bicomponent Fiber Market Segmentation

-

1. Material

- 1.1. Polyethylene (PE)/Polypropylene (PP)

- 1.2. Polyprop

- 1.3. High-density Polyethylene/Low-density Polyethylene

- 1.4. Polyethylene/polyethylene Terephthalate (pet)

- 1.5. Polyester/PBT

- 1.6. Other Materials

-

2. Structure Types

- 2.1. Sheath-core

- 2.2. Side-by-Side

- 2.3. Islands in the Sea

- 2.4. Other Structure Types

-

3. End-user Industry

- 3.1. Non-Woven Textiles

- 3.2. Automotive

- 3.3. Hygiene

- 3.4. Construction

- 3.5. Medical

- 3.6. Other End-user Industries

Bicomponent Fiber Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. South Africa

- 5.3. Rest of Middle East and Africa

Bicomponent Fiber Market Regional Market Share

Geographic Coverage of Bicomponent Fiber Market

Bicomponent Fiber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Bicomponent Fiber In the Hygiene Industry; Rising Demand From the Non-woven Textile Industry

- 3.3. Market Restrains

- 3.3.1. Growing Adoption of Bicomponent Fiber In the Hygiene Industry; Rising Demand From the Non-woven Textile Industry

- 3.4. Market Trends

- 3.4.1. Hygiene Industry to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Bicomponent Fiber Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Polyethylene (PE)/Polypropylene (PP)

- 5.1.2. Polyprop

- 5.1.3. High-density Polyethylene/Low-density Polyethylene

- 5.1.4. Polyethylene/polyethylene Terephthalate (pet)

- 5.1.5. Polyester/PBT

- 5.1.6. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Structure Types

- 5.2.1. Sheath-core

- 5.2.2. Side-by-Side

- 5.2.3. Islands in the Sea

- 5.2.4. Other Structure Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Non-Woven Textiles

- 5.3.2. Automotive

- 5.3.3. Hygiene

- 5.3.4. Construction

- 5.3.5. Medical

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Asia Pacific Bicomponent Fiber Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Polyethylene (PE)/Polypropylene (PP)

- 6.1.2. Polyprop

- 6.1.3. High-density Polyethylene/Low-density Polyethylene

- 6.1.4. Polyethylene/polyethylene Terephthalate (pet)

- 6.1.5. Polyester/PBT

- 6.1.6. Other Materials

- 6.2. Market Analysis, Insights and Forecast - by Structure Types

- 6.2.1. Sheath-core

- 6.2.2. Side-by-Side

- 6.2.3. Islands in the Sea

- 6.2.4. Other Structure Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Non-Woven Textiles

- 6.3.2. Automotive

- 6.3.3. Hygiene

- 6.3.4. Construction

- 6.3.5. Medical

- 6.3.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. North America Bicomponent Fiber Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Polyethylene (PE)/Polypropylene (PP)

- 7.1.2. Polyprop

- 7.1.3. High-density Polyethylene/Low-density Polyethylene

- 7.1.4. Polyethylene/polyethylene Terephthalate (pet)

- 7.1.5. Polyester/PBT

- 7.1.6. Other Materials

- 7.2. Market Analysis, Insights and Forecast - by Structure Types

- 7.2.1. Sheath-core

- 7.2.2. Side-by-Side

- 7.2.3. Islands in the Sea

- 7.2.4. Other Structure Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Non-Woven Textiles

- 7.3.2. Automotive

- 7.3.3. Hygiene

- 7.3.4. Construction

- 7.3.5. Medical

- 7.3.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe Bicomponent Fiber Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Polyethylene (PE)/Polypropylene (PP)

- 8.1.2. Polyprop

- 8.1.3. High-density Polyethylene/Low-density Polyethylene

- 8.1.4. Polyethylene/polyethylene Terephthalate (pet)

- 8.1.5. Polyester/PBT

- 8.1.6. Other Materials

- 8.2. Market Analysis, Insights and Forecast - by Structure Types

- 8.2.1. Sheath-core

- 8.2.2. Side-by-Side

- 8.2.3. Islands in the Sea

- 8.2.4. Other Structure Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Non-Woven Textiles

- 8.3.2. Automotive

- 8.3.3. Hygiene

- 8.3.4. Construction

- 8.3.5. Medical

- 8.3.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. South America Bicomponent Fiber Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Polyethylene (PE)/Polypropylene (PP)

- 9.1.2. Polyprop

- 9.1.3. High-density Polyethylene/Low-density Polyethylene

- 9.1.4. Polyethylene/polyethylene Terephthalate (pet)

- 9.1.5. Polyester/PBT

- 9.1.6. Other Materials

- 9.2. Market Analysis, Insights and Forecast - by Structure Types

- 9.2.1. Sheath-core

- 9.2.2. Side-by-Side

- 9.2.3. Islands in the Sea

- 9.2.4. Other Structure Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Non-Woven Textiles

- 9.3.2. Automotive

- 9.3.3. Hygiene

- 9.3.4. Construction

- 9.3.5. Medical

- 9.3.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Middle East and Africa Bicomponent Fiber Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Polyethylene (PE)/Polypropylene (PP)

- 10.1.2. Polyprop

- 10.1.3. High-density Polyethylene/Low-density Polyethylene

- 10.1.4. Polyethylene/polyethylene Terephthalate (pet)

- 10.1.5. Polyester/PBT

- 10.1.6. Other Materials

- 10.2. Market Analysis, Insights and Forecast - by Structure Types

- 10.2.1. Sheath-core

- 10.2.2. Side-by-Side

- 10.2.3. Islands in the Sea

- 10.2.4. Other Structure Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Non-Woven Textiles

- 10.3.2. Automotive

- 10.3.3. Hygiene

- 10.3.4. Construction

- 10.3.5. Medical

- 10.3.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CHA Technologies Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 EMS-chemie Holding AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Far Eastern New Century Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Freudenberg Performance Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Huvis Corp

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Indorama Ventures Public Company Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 JNC Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kolon Glotech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kuraray Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 OC Oerlikon Management AG

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 PTT Global Chemical Public Company Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Shaoxing Yaolong Spunbonded Nonwoven Technology Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TEIJIN Limited

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 TORAY Industries Inc

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 WPT Nonwovens Corp *List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 CHA Technologies Group

List of Figures

- Figure 1: Global Bicomponent Fiber Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Bicomponent Fiber Market Revenue (million), by Material 2025 & 2033

- Figure 3: Asia Pacific Bicomponent Fiber Market Revenue Share (%), by Material 2025 & 2033

- Figure 4: Asia Pacific Bicomponent Fiber Market Revenue (million), by Structure Types 2025 & 2033

- Figure 5: Asia Pacific Bicomponent Fiber Market Revenue Share (%), by Structure Types 2025 & 2033

- Figure 6: Asia Pacific Bicomponent Fiber Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Bicomponent Fiber Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Bicomponent Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 9: Asia Pacific Bicomponent Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Bicomponent Fiber Market Revenue (million), by Material 2025 & 2033

- Figure 11: North America Bicomponent Fiber Market Revenue Share (%), by Material 2025 & 2033

- Figure 12: North America Bicomponent Fiber Market Revenue (million), by Structure Types 2025 & 2033

- Figure 13: North America Bicomponent Fiber Market Revenue Share (%), by Structure Types 2025 & 2033

- Figure 14: North America Bicomponent Fiber Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 15: North America Bicomponent Fiber Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Bicomponent Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 17: North America Bicomponent Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Bicomponent Fiber Market Revenue (million), by Material 2025 & 2033

- Figure 19: Europe Bicomponent Fiber Market Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe Bicomponent Fiber Market Revenue (million), by Structure Types 2025 & 2033

- Figure 21: Europe Bicomponent Fiber Market Revenue Share (%), by Structure Types 2025 & 2033

- Figure 22: Europe Bicomponent Fiber Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 23: Europe Bicomponent Fiber Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Bicomponent Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Bicomponent Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Bicomponent Fiber Market Revenue (million), by Material 2025 & 2033

- Figure 27: South America Bicomponent Fiber Market Revenue Share (%), by Material 2025 & 2033

- Figure 28: South America Bicomponent Fiber Market Revenue (million), by Structure Types 2025 & 2033

- Figure 29: South America Bicomponent Fiber Market Revenue Share (%), by Structure Types 2025 & 2033

- Figure 30: South America Bicomponent Fiber Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 31: South America Bicomponent Fiber Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Bicomponent Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 33: South America Bicomponent Fiber Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Bicomponent Fiber Market Revenue (million), by Material 2025 & 2033

- Figure 35: Middle East and Africa Bicomponent Fiber Market Revenue Share (%), by Material 2025 & 2033

- Figure 36: Middle East and Africa Bicomponent Fiber Market Revenue (million), by Structure Types 2025 & 2033

- Figure 37: Middle East and Africa Bicomponent Fiber Market Revenue Share (%), by Structure Types 2025 & 2033

- Figure 38: Middle East and Africa Bicomponent Fiber Market Revenue (million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Bicomponent Fiber Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Bicomponent Fiber Market Revenue (million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Bicomponent Fiber Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Bicomponent Fiber Market Revenue million Forecast, by Material 2020 & 2033

- Table 2: Global Bicomponent Fiber Market Revenue million Forecast, by Structure Types 2020 & 2033

- Table 3: Global Bicomponent Fiber Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Bicomponent Fiber Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Bicomponent Fiber Market Revenue million Forecast, by Material 2020 & 2033

- Table 6: Global Bicomponent Fiber Market Revenue million Forecast, by Structure Types 2020 & 2033

- Table 7: Global Bicomponent Fiber Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Bicomponent Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 9: China Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: India Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Japan Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: South Korea Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Rest of Asia Pacific Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Global Bicomponent Fiber Market Revenue million Forecast, by Material 2020 & 2033

- Table 15: Global Bicomponent Fiber Market Revenue million Forecast, by Structure Types 2020 & 2033

- Table 16: Global Bicomponent Fiber Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 17: Global Bicomponent Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 18: United States Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Canada Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Mexico Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: Global Bicomponent Fiber Market Revenue million Forecast, by Material 2020 & 2033

- Table 22: Global Bicomponent Fiber Market Revenue million Forecast, by Structure Types 2020 & 2033

- Table 23: Global Bicomponent Fiber Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Bicomponent Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 25: Germany Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: United Kingdom Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Italy Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: France Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Rest of Europe Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Global Bicomponent Fiber Market Revenue million Forecast, by Material 2020 & 2033

- Table 31: Global Bicomponent Fiber Market Revenue million Forecast, by Structure Types 2020 & 2033

- Table 32: Global Bicomponent Fiber Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 33: Global Bicomponent Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 34: Brazil Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: Argentina Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Bicomponent Fiber Market Revenue million Forecast, by Material 2020 & 2033

- Table 38: Global Bicomponent Fiber Market Revenue million Forecast, by Structure Types 2020 & 2033

- Table 39: Global Bicomponent Fiber Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 40: Global Bicomponent Fiber Market Revenue million Forecast, by Country 2020 & 2033

- Table 41: Saudi Arabia Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: South Africa Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: Rest of Middle East and Africa Bicomponent Fiber Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Bicomponent Fiber Market?

The projected CAGR is approximately 5.64%.

2. Which companies are prominent players in the Bicomponent Fiber Market?

Key companies in the market include CHA Technologies Group, EMS-chemie Holding AG, Far Eastern New Century Corporation, Freudenberg Performance Materials, Huvis Corp, Indorama Ventures Public Company Limited, JNC Corporation, Kolon Glotech, Kuraray Co Ltd, OC Oerlikon Management AG, PTT Global Chemical Public Company Limited, Shaoxing Yaolong Spunbonded Nonwoven Technology Co Ltd, TEIJIN Limited, TORAY Industries Inc, WPT Nonwovens Corp *List Not Exhaustive.

3. What are the main segments of the Bicomponent Fiber Market?

The market segments include Material, Structure Types, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.86 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Bicomponent Fiber In the Hygiene Industry; Rising Demand From the Non-woven Textile Industry.

6. What are the notable trends driving market growth?

Hygiene Industry to Dominate the Market.

7. Are there any restraints impacting market growth?

Growing Adoption of Bicomponent Fiber In the Hygiene Industry; Rising Demand From the Non-woven Textile Industry.

8. Can you provide examples of recent developments in the market?

October 2022: Teijin Frontier Co. Ltd, a subsidiary company of Teijin Limited, opened a new manufacturing facility for the highly efficient production of polyester filaments. The company invested JPY 1 million (USD 0.01 million) in constructing this facility, and it is expected to produce 1,500 tons of polyester filaments, including bicomponent fiber, annually by the end of the year 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Bicomponent Fiber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Bicomponent Fiber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Bicomponent Fiber Market?

To stay informed about further developments, trends, and reports in the Bicomponent Fiber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence