Key Insights

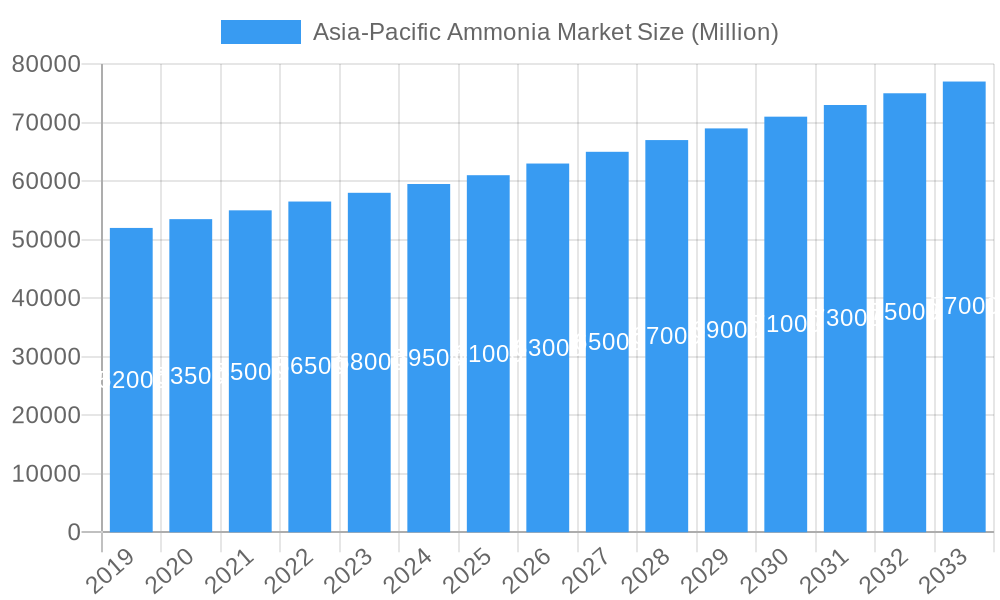

The Asia-Pacific ammonia market is poised for significant expansion, driven by robust demand from agriculture, the burgeoning industrial sector, and a growing focus on cleaner energy solutions. With a current estimated market size of approximately $60 billion in 2025, the region is projected to witness a compound annual growth rate (CAGR) of around 4.5% between 2019 and 2033. This growth trajectory is underpinned by the increasing need for fertilizers to support food security for a rapidly growing population, as well as the essential role of ammonia in the production of chemicals, plastics, and textiles. Furthermore, the emerging trend of ammonia as a decarbonized fuel source and hydrogen carrier is expected to add a substantial layer of demand in the coming years, particularly as governments in the region invest in green ammonia initiatives.

Asia-Pacific Ammonia Market Market Size (In Billion)

The historical period from 2019 to 2024 has seen a steady climb in ammonia consumption, influenced by agricultural cycles and industrial output. The base year of 2025 marks a strong starting point for future projections, with an estimated market size of $60 billion. Looking ahead to 2033, the market is anticipated to reach a substantial valuation, fueled by these multifaceted drivers. Key economies within the Asia-Pacific region, such as China and India, will continue to be dominant forces, accounting for a significant portion of both production and consumption. Emerging markets in Southeast Asia are also expected to contribute to overall growth as their industrial bases and agricultural sectors mature. Innovations in ammonia production technologies, including those that reduce carbon emissions, will play a crucial role in shaping the market's evolution and ensuring its sustainability.

Asia-Pacific Ammonia Market Company Market Share

Asia-Pacific Ammonia Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Asia-Pacific Ammonia Market, a critical component of global industrial and agricultural supply chains. With a study period spanning from 2019 to 2033, and a base year of 2025, this report leverages cutting-edge market intelligence to offer unparalleled insights into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, opportunities, and the competitive landscape. We delve into both the parent market for ammonia and its child markets across various applications, ensuring a holistic understanding. All values are presented in million units for clarity and ease of comparison.

Asia-Pacific Ammonia Market Market Dynamics & Structure

The Asia-Pacific ammonia market is characterized by a moderate to high degree of concentration, with a few dominant players controlling significant production capacity. Technological innovation plays a crucial role, particularly in enhancing production efficiency, reducing energy consumption, and developing sustainable ammonia production methods like green and blue ammonia. Regulatory frameworks, influenced by environmental policies and agricultural mandates, are increasingly shaping market access and investment. Competitive product substitutes, though limited for core ammonia applications, exist in niche areas, driving innovation. End-user demographics are heavily skewed towards the agriculture sector, but growth in textiles, pharmaceuticals, and refrigeration presents diversification opportunities. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their geographical reach, acquire advanced technologies, and consolidate market share. For instance, recent strategic partnerships and plant revamps indicate a focus on operational efficiency and sustainability. Barriers to innovation include the capital-intensive nature of ammonia production and the need for specialized infrastructure.

- Market Concentration: Dominated by key global and regional producers.

- Technological Innovation Drivers: Energy efficiency improvements, sustainable ammonia production (green/blue ammonia), advanced catalyst development.

- Regulatory Frameworks: Environmental protection laws, agricultural subsidies, international climate agreements.

- Competitive Product Substitutes: Limited for core applications, but niche alternatives exist.

- End-user Demographics: Agriculture is the primary consumer, with growing demand from other sectors.

- M&A Trends: Consolidation for market share, technology acquisition, and geographical expansion.

- Innovation Barriers: High capital expenditure, complex regulatory approvals, infrastructure development challenges.

Asia-Pacific Ammonia Market Growth Trends & Insights

The Asia-Pacific ammonia market is poised for significant growth, driven by robust demand from its primary end-user industries and an increasing focus on sustainable solutions. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period. Adoption rates for conventional ammonia production remain high, but there is a discernible shift towards embracing cleaner technologies. Technological disruptions, such as advancements in electrolysis for green ammonia production and carbon capture utilization and storage (CCUS) for blue ammonia, are set to redefine the market landscape. Consumer behavior shifts, particularly from governments and large corporations demanding more sustainable inputs, are influencing investment decisions and production strategies. The agricultural sector, being the largest consumer, will continue to be a primary growth engine, supported by government initiatives to enhance food security and improve crop yields through enhanced fertilizer usage.

- Market Size Evolution: Steady upward trajectory driven by industrial and agricultural needs.

- Adoption Rates: High for conventional ammonia, with increasing uptake of sustainable production methods.

- Technological Disruptions: Rise of green and blue ammonia technologies, improved energy efficiency in production.

- Consumer Behavior Shifts: Growing demand for sustainable and environmentally friendly ammonia products.

- Market Penetration: Deep penetration in agriculture, with increasing reach in emerging end-use industries.

- CAGR (Forecast Period 2025-2033): XX%

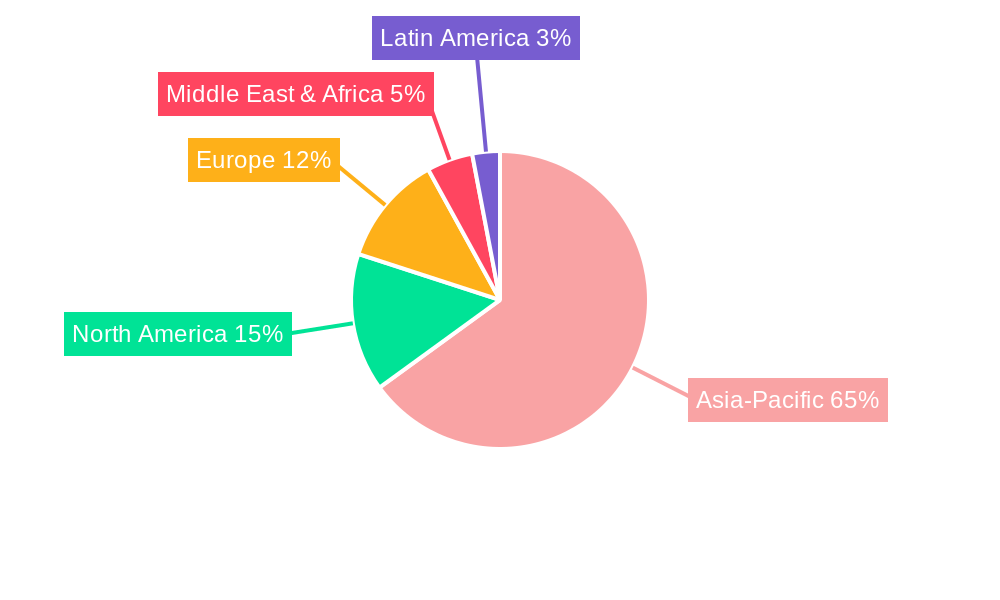

Dominant Regions, Countries, or Segments in Asia-Pacific Ammonia Market

The Asia-Pacific ammonia market's dominance is primarily attributed to the Agriculture end-user industry, closely followed by its significance as a feedstock in other industrial processes. Within this sector, China stands out as the largest producer and consumer of ammonia, propelled by its massive agricultural base and extensive industrial manufacturing capabilities. Government policies aimed at boosting agricultural productivity, coupled with substantial investments in ammonia production facilities, underpin China's leading position. India, with its growing population and a strong focus on food security, also represents a significant and rapidly expanding market. The Liquid ammonia segment generally holds a larger market share due to its ease of transportation and storage, although the Gas segment remains crucial for specific industrial applications.

The dominance of the Agriculture segment is driven by:

- Food Security Initiatives: Governments prioritize agricultural output, leading to sustained demand for fertilizers.

- Increasing Crop Yields: Ammonia-based fertilizers are essential for enhancing productivity.

- Growing Population: A larger population necessitates higher food production.

Key drivers for regional dominance include:

- Economic Policies: Favorable government support, subsidies for fertilizer production and use.

- Infrastructure Development: Robust logistics networks for raw material sourcing and finished product distribution.

- Availability of Natural Resources: Access to natural gas and other feedstocks for ammonia synthesis.

- Technological Advancements: Adoption of efficient production technologies.

Growth potential is further amplified by the increasing adoption of ammonia in emerging end-user industries such as textiles and pharmaceuticals.

Asia-Pacific Ammonia Market Product Landscape

The Asia-Pacific ammonia market product landscape is characterized by the primary forms of ammonia: Liquid Ammonia and Gas Ammonia. Liquid ammonia, owing to its convenient storage and transportation, is widely used across various sectors. Gas ammonia finds its application in specialized industrial processes. Innovations are increasingly focused on enhancing the purity of ammonia for pharmaceutical and electronic applications, as well as developing sustainable production routes that yield low-carbon ammonia. Performance metrics are measured by factors such as energy efficiency in production, purity levels, and the carbon footprint associated with its manufacturing and delivery. Unique selling propositions often revolve around cost-competitiveness, reliability of supply, and adherence to stringent quality standards.

Key Drivers, Barriers & Challenges in Asia-Pacific Ammonia Market

Key Drivers:

The Asia-Pacific ammonia market is propelled by several key factors. The burgeoning agricultural sector, driven by the need for enhanced food security and increased crop yields, remains the primary demand driver. Government initiatives promoting agricultural productivity and food self-sufficiency further bolster this demand. Technological advancements in ammonia production, leading to improved energy efficiency and reduced environmental impact, also act as significant growth accelerators. The increasing adoption of ammonia as a clean energy carrier and a potential hydrogen carrier in the future presents a substantial long-term opportunity. Furthermore, the expanding industrial base across the region, with growing demand from sectors like textiles and chemicals, contributes to market expansion.

Barriers & Challenges:

Despite the promising growth trajectory, the market faces several challenges. The high capital intensity of ammonia production facilities presents a significant barrier to entry and expansion. Volatility in natural gas prices, a key feedstock for conventional ammonia production, directly impacts production costs and market competitiveness. Stringent environmental regulations and the growing pressure to decarbonize the industry pose compliance challenges and necessitate substantial investments in cleaner technologies. Supply chain disruptions, geopolitical uncertainties, and fluctuations in raw material availability can also impact production and pricing. Furthermore, the development of a robust infrastructure for green ammonia distribution and utilization is still in its nascent stages.

Emerging Opportunities in Asia-Pacific Ammonia Market

Emerging opportunities in the Asia-Pacific ammonia market are primarily centered around the burgeoning demand for green ammonia and blue ammonia. As countries globally strive to meet climate targets, the development of low-carbon ammonia production methods presents a significant growth avenue. This includes leveraging renewable energy sources for green ammonia synthesis and implementing carbon capture, utilization, and storage (CCUS) technologies for blue ammonia production. The potential of ammonia as a carbon-free fuel for shipping and power generation is gaining traction, opening up new markets and applications. Furthermore, the increasing use of ammonia in industries beyond agriculture, such as textiles, pharmaceuticals, and refrigeration, offers diversified growth prospects. Untapped markets in developing economies within the region also represent significant expansion potential.

Growth Accelerators in the Asia-Pacific Ammonia Market Industry

Several catalysts are accelerating the growth of the Asia-Pacific ammonia market. Technological breakthroughs in electrolysis and renewable energy integration are making green ammonia production more economically viable and scalable. Strategic partnerships between ammonia producers, technology providers, and end-users are fostering innovation and facilitating market penetration. For instance, collaborations focused on developing ammonia-based fuel solutions are crucial. Market expansion strategies by key players, including investments in new production facilities and acquisitions of companies with advanced technologies or regional presence, are also driving growth. The growing global emphasis on decarbonization and the search for sustainable energy solutions are fundamentally reshaping the demand for ammonia, positioning it as a crucial component of the future energy landscape.

Key Players Shaping the Asia-Pacific Ammonia Market Market

- BASF SE

- CF Industries Holdings Inc

- Chambal Fertilizers and Chemicals Limited

- Gujarat Narmada Valley Fertilizers & Chemicals Limited

- IFFCO

- Indorama Corporation

- National Fertilizers Limited

- Petroliam Nasional Berhad (PETRONAS)

- Pride-Chem Industries

- Rashtriya Chemicals and Fertilizers Limited

- SABIC

- Yara

Notable Milestones in Asia-Pacific Ammonia Market Sector

- July 2024: Rashtriya Chemicals and Fertilizers Limited approved a contract with Topsoe AS to revamp its ammonia plant in Thal, Maharashtra, India. The contract includes procuring a basic engineering design package and supplying proprietary equipment and catalysts. This project targets reducing the plant's specific energy consumption.

- October 2023: Gentari, the clean energy arm of Malaysia’s Petroliam Nasional Bhd (Petronas), and AM Green, a producer specializing in hydrogen and ammonia, signed agreements with Singapore's investment entity, GIC. Together, they committed a substantial USD 2 billion to a shared goal of producing 5,000 kilotons annually of green ammonia in India by 2030.

In-Depth Asia-Pacific Ammonia Market Market Outlook

The Asia-Pacific ammonia market is on an upward trajectory, driven by a confluence of factors that promise sustained growth and transformation. The ongoing investment in sustainable ammonia production, particularly green and blue ammonia, is a key indicator of future market direction. Strategic partnerships and technological advancements are paving the way for a more decarbonized ammonia industry. The growing recognition of ammonia's potential as a clean fuel and a crucial building block for a hydrogen economy will unlock new markets and applications. Companies that invest in innovation, embrace sustainability, and strategically expand their market reach are best positioned to capitalize on the significant future potential within this dynamic sector. The outlook is one of robust expansion, diversification, and a pivotal role in the region's industrial and energy transition.

Asia-Pacific Ammonia Market Segmentation

-

1. Type

- 1.1. Liquid

- 1.2. Gas

-

2. End-user Industry

- 2.1. Agriculture

- 2.2. Textile

- 2.3. Mining

- 2.4. Pharmaceutical

- 2.5. Refrigeration

- 2.6. Other End-user Industries

Asia-Pacific Ammonia Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Ammonia Market Regional Market Share

Geographic Coverage of Asia-Pacific Ammonia Market

Asia-Pacific Ammonia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives

- 3.3. Market Restrains

- 3.3.1. Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives

- 3.4. Market Trends

- 3.4.1. Expanding Agricultural Industry Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Ammonia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Liquid

- 5.1.2. Gas

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Agriculture

- 5.2.2. Textile

- 5.2.3. Mining

- 5.2.4. Pharmaceutical

- 5.2.5. Refrigeration

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 BASF SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 CF Industries Holdings Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Chambal Fertilizers and Chemicals Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Gujarat Narmada Valley Fertilizers & Chemicals Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 IFFCO

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Indorama Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 National Fertilizers Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Petroliam Nasional Berhad (PETRONAS)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pride-Chem Industries

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rashtriya Chemicals and Fertilizers Limited

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SABIC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Yara*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 BASF SE

List of Figures

- Figure 1: Asia-Pacific Ammonia Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Ammonia Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Ammonia Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia-Pacific Ammonia Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Asia-Pacific Ammonia Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Ammonia Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Asia-Pacific Ammonia Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: Asia-Pacific Ammonia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Ammonia Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Ammonia Market?

The projected CAGR is approximately 5.9%.

2. Which companies are prominent players in the Asia-Pacific Ammonia Market?

Key companies in the market include BASF SE, CF Industries Holdings Inc, Chambal Fertilizers and Chemicals Limited, Gujarat Narmada Valley Fertilizers & Chemicals Limited, IFFCO, Indorama Corporation, National Fertilizers Limited, Petroliam Nasional Berhad (PETRONAS), Pride-Chem Industries, Rashtriya Chemicals and Fertilizers Limited, SABIC, Yara*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Ammonia Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives.

6. What are the notable trends driving market growth?

Expanding Agricultural Industry Driving Market Growth.

7. Are there any restraints impacting market growth?

Abundant Use in the Fertilizers Industry; Increasing Usage to Produce Explosives.

8. Can you provide examples of recent developments in the market?

July 2024: Rashtriya Chemicals and Fertilizers Limited approved a contract with Topsoe AS to revamp its ammonia plant in Thal, Maharashtra, India. The contract includes procuring a basic engineering design package and supplying proprietary equipment and catalysts. This project targets reducing the plant's specific energy consumption.October 2023: Gentari, the clean energy arm of Malaysia’s Petroliam Nasional Bhd (Petronas), and AM Green, a producer specializing in hydrogen and ammonia, signed agreements with Singapore's investment entity, GIC. Together, they committed a substantial USD 2 billion to a shared goal of producing 5,000 kilotons annually of green ammonia in India by 2030.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Ammonia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Ammonia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Ammonia Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Ammonia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence