Key Insights

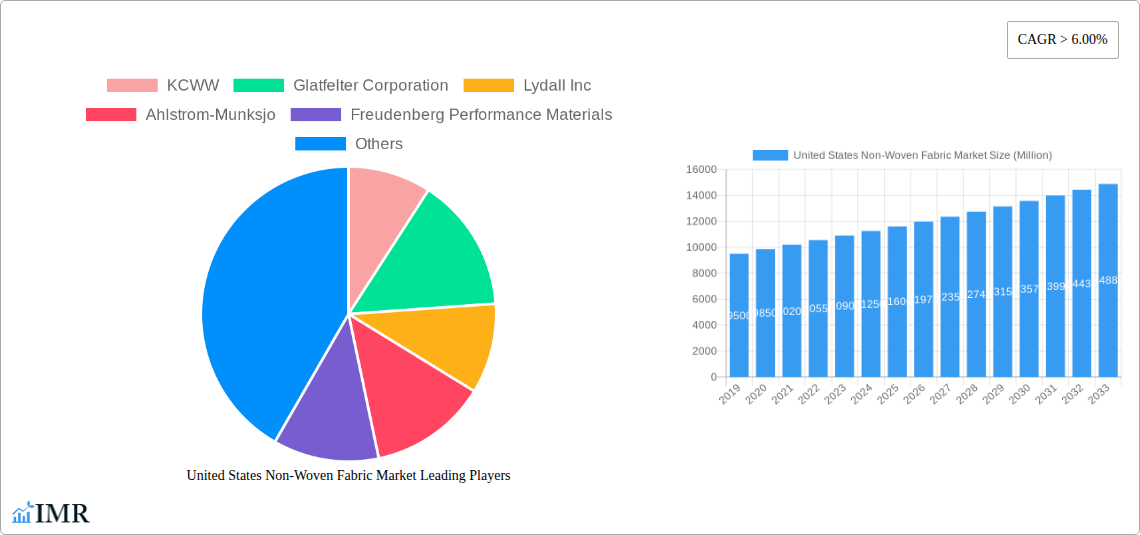

The United States non-woven fabric market is poised for robust growth, with an estimated market size of approximately $12,000 million in 2025, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 6.00% through 2033. This expansion is significantly fueled by the increasing demand for advanced materials in key end-user industries such as construction, healthcare, and automotive. In construction, non-woven fabrics are crucial for their reinforcing, insulating, and waterproofing properties, contributing to the development of more sustainable and durable infrastructure. The healthcare sector's continuous need for sterile and high-performance disposable products, including masks, gowns, and wound dressings, further propels market growth. Moreover, the automotive industry's focus on lightweighting and enhanced vehicle performance drives the adoption of non-wovens for interior components, filtration systems, and sound dampening. Emerging applications in hygiene products and advanced filtration systems are also playing a pivotal role in shaping the market's trajectory.

United States Non-Woven Fabric Market Market Size (In Billion)

Technological advancements in non-woven manufacturing processes, such as improvements in spunbond, wet-laid, and dry-laid technologies, are enabling the production of fabrics with enhanced properties, including superior strength, breathability, and biodegradability. This innovation directly caters to evolving consumer preferences and stringent environmental regulations. The market is characterized by a diverse range of materials, with polyester and polypropylene being dominant due to their cost-effectiveness and versatile performance characteristics. However, growing interest in sustainable materials is fostering the increased use of rayon and other bio-based alternatives. Key players are actively investing in research and development to innovate and expand their product portfolios, focusing on meeting the specific requirements of these dynamic end-user industries and solidifying their market positions.

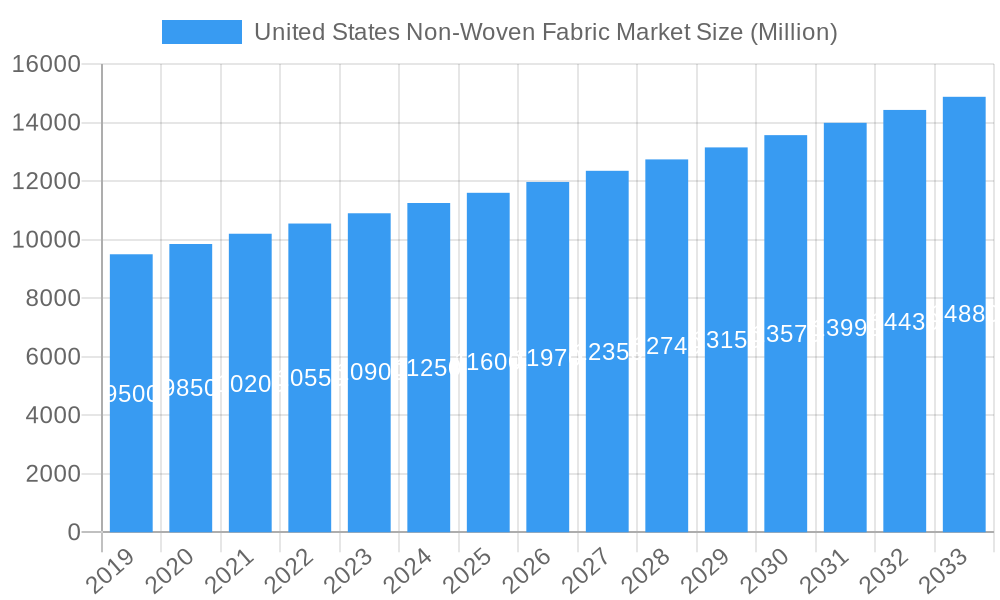

United States Non-Woven Fabric Market Company Market Share

This in-depth report provides a comprehensive analysis of the United States Non-Woven Fabric Market, offering crucial insights for industry professionals, investors, and stakeholders. Spanning from 2019 to 2033, with a detailed focus on the 2025 base year and forecast period, this study delves into market dynamics, growth trends, dominant segments, product landscape, key drivers, barriers, challenges, and emerging opportunities. We meticulously examine parent and child market segments across technologies, materials, and end-user industries, all presented with quantitative data in Million units where applicable. This report is optimized with high-traffic keywords to maximize search engine visibility and deliver unparalleled value.

United States Non-Woven Fabric Market Market Dynamics & Structure

The United States Non-Woven Fabric Market is characterized by a dynamic interplay of technological innovation, evolving end-user demands, and a moderately concentrated competitive landscape. Key drivers include advancements in spunbond and meltblown technologies, facilitating the production of high-performance fabrics for diverse applications. Regulatory frameworks, particularly those concerning environmental sustainability and material safety in healthcare, significantly influence market development. The market experiences continuous innovation driven by companies like Toray Industries, Inc. and Berry Global Inc., as evidenced by their recent developments in sustainable and hydrophilic nonwovens. The competitive product substitute landscape involves traditional textiles, but the unique properties of nonwovens, such as breathability, absorbency, and filtration capabilities, ensure their sustained demand. End-user demographics are shifting towards sustainable solutions and increased demand in hygiene, healthcare, and construction sectors. Mergers and acquisitions (M&A) play a crucial role in market consolidation and expansion, with strategic deals aimed at enhancing product portfolios and market reach. While innovation barriers exist, such as high R&D costs and the need for specialized manufacturing equipment, the overall market trajectory remains robust, driven by a continuous pursuit of improved material performance and application diversity.

United States Non-Woven Fabric Market Growth Trends & Insights

The United States Non-Woven Fabric Market is poised for significant expansion, driven by a confluence of technological advancements, evolving consumer preferences, and increasing adoption across various end-user industries. The market size has witnessed a steady evolution, with projected substantial growth in the forecast period. Adoption rates for non-woven fabrics are accelerating, particularly in hygiene products, medical applications, and construction materials, owing to their cost-effectiveness, disposability, and superior performance characteristics. Technological disruptions, such as the development of advanced spunbond fabrics with enhanced hydrophilic properties and improved softness, are expanding the application spectrum and driving demand for premium non-woven solutions. Consumer behavior shifts are a pivotal factor, with a growing emphasis on sustainability, hygiene, and convenience fueling the demand for non-woven-based products like disposable diapers, masks, and personal care items. The market penetration of non-woven fabrics is expected to deepen as manufacturers continue to innovate and address specific industry needs. The CAGR for the United States Non-Woven Fabric Market is estimated at XX% from 2025 to 2033, reflecting a robust growth trajectory. This growth is underpinned by increasing disposable incomes, a rising awareness of hygiene standards, and government initiatives promoting domestic manufacturing and sustainable practices. The versatility and performance advantages of non-woven fabrics will continue to drive their integration into a wider array of applications, from automotive interiors to specialized industrial filters, solidifying their importance in the American manufacturing landscape.

Dominant Regions, Countries, or Segments in United States Non-Woven Fabric Market

The United States Non-Woven Fabric Market is experiencing significant growth, with specific segments and end-user industries acting as dominant forces.

Dominant Technology Segment: Spunbond

- The spunbond technology segment consistently leads the market due to its versatility, cost-effectiveness, and ability to produce fabrics with desirable properties like high tensile strength and breathability.

- Key Drivers: High demand from the hygiene sector (diapers, feminine care), medical disposables, and geotextiles. Its compatibility with various polymers like polypropylene and polyester makes it highly adaptable. The market share for spunbond is estimated at XX% of the total market in 2025.

- Growth Potential: Continued innovation in spunbond processes, such as thermal bonding and chemical bonding, is enhancing fabric performance for specialized applications.

Dominant Material Segment: Polypropylene

- Polypropylene (PP) remains the most widely used material in the non-woven fabric market due to its excellent balance of properties, including low cost, chemical resistance, and good tensile strength.

- Key Drivers: Its widespread use in spunbond and meltblown fabrics for hygiene, medical, and filtration applications. Polypropylene resin and polypropylene staple fiber are key sub-segments. The market share for polypropylene is projected at XX% in 2025.

- Growth Potential: Increasing focus on sustainable PP solutions, including recycled and bio-based polypropylene, is expected to further boost its dominance.

Dominant End-User Industry: Healthcare

- The healthcare industry is a primary driver of the United States Non-Woven Fabric Market, driven by stringent hygiene standards and the ongoing demand for disposable medical products.

- Key Drivers: High demand for surgical gowns, masks, drapes, wound dressings, and personal protective equipment (PPE), particularly amplified during health crises. The market share for healthcare applications is estimated to be XX% in 2025.

- Growth Potential: An aging population, increasing healthcare expenditure, and the continuous need for sterile and disposable medical supplies ensure sustained growth.

Other Influential Segments:

- Material - Polyester: Increasingly used for its durability, strength, and thermal resistance, finding applications in filtration and automotive textiles.

- End-User Industry - Textiles: Non-wovens are gaining traction in apparel interlinings, upholstery, and technical textiles due to their cost-effectiveness and unique aesthetic qualities.

- Technology - Wet-laid: Significant growth potential in absorbent products and specialized filtration due to its ability to incorporate a wide range of fibers.

United States Non-Woven Fabric Market Product Landscape

The United States Non-Woven Fabric Market is characterized by a dynamic product landscape marked by continuous innovation and a focus on enhanced performance and sustainability. Key product developments include spunbond nonwoven fabrics with persistent hydrophilicity and softness, ideal for sensitive hygiene applications, as demonstrated by Toray Industries, Inc.'s advancements. Furthermore, the market is seeing a surge in sustainable solutions, with companies like Berry Global Inc. achieving ISCC PLUS certification for their nonwoven manufacturing locations, producing spunbond, spunlace, and spunmelt nonwovens from responsibly sourced materials. These innovations address the growing consumer demand for eco-friendly products in infant diapers, feminine care, and adult incontinence. The performance metrics of these advanced nonwovens, such as improved absorbency, breathability, barrier properties, and tactile comfort, are continuously being refined, expanding their applicability across diverse sectors.

Key Drivers, Barriers & Challenges in United States Non-Woven Fabric Market

Key Drivers:

- Technological Advancements: Continuous innovation in spunbond, meltblown, and other non-woven technologies, leading to enhanced fabric properties and new applications.

- Growing Demand in Hygiene and Healthcare: Increasing awareness of hygiene standards and an aging population drive demand for disposable products like diapers, feminine hygiene items, and medical disposables.

- Sustainability Initiatives: Growing consumer and regulatory pressure for eco-friendly products is boosting demand for non-wovens made from recycled or bio-based materials.

- Versatility and Cost-Effectiveness: The ability of non-wovens to be engineered for specific properties at a competitive price point makes them attractive across multiple industries.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of polypropylene and polyester, the primary raw materials, can impact production costs and market competitiveness.

- Environmental Concerns: While some non-wovens are biodegradable, the disposal of single-use non-woven products presents a challenge, driving research into more sustainable alternatives and recycling solutions.

- Intense Competition: The market is characterized by numerous global and regional players, leading to price pressures and the need for constant product differentiation.

- Regulatory Hurdles: Stringent regulations in healthcare and food contact applications require rigorous testing and certification, adding to development costs and timelines.

- Supply Chain Disruptions: Global supply chain issues can affect the availability and cost of raw materials and finished goods, impacting production schedules.

Emerging Opportunities in United States Non-Woven Fabric Market

Emerging opportunities within the United States Non-Woven Fabric Market lie in the development of advanced, sustainable, and specialized non-woven solutions. The growing demand for eco-friendly materials presents a significant avenue for growth, with a focus on biodegradable and compostable non-wovens derived from renewable resources. Furthermore, the expansion of the healthcare sector, coupled with a rising elderly population, will continue to fuel demand for high-performance non-wovens in medical disposables and wound care. Innovations in filtration technologies, driven by stricter air and water quality regulations, offer opportunities for specialized non-woven filters. The automotive industry's pursuit of lighter and more sustainable materials also presents a fertile ground for the application of advanced non-wovens. Finally, exploring untapped niche applications in construction, agriculture, and personal care can unlock new market potential.

Growth Accelerators in the United States Non-Woven Fabric Market Industry

Several catalysts are accelerating the growth of the United States Non-Woven Fabric Market. Technological breakthroughs in spunbond and meltblown processes are enabling the production of non-wovens with enhanced functionalities, such as superior barrier properties and improved comfort. Strategic partnerships between raw material suppliers, non-woven manufacturers, and end-product converters are fostering innovation and streamlining the supply chain. Market expansion strategies, including geographical diversification and the development of tailored solutions for emerging industries, are also crucial growth drivers. For instance, the increasing adoption of non-woven fabrics in the automotive sector for sound dampening and interior components, driven by the need for lightweight and durable materials, is a significant growth accelerator. Furthermore, the continuous R&D efforts focused on sustainability, such as the development of bio-based polymers and advanced recycling techniques, are positioning the industry for long-term, responsible growth.

Key Players Shaping the United States Non-Woven Fabric Market Market

- KCWW

- Glatfelter Corporation

- Lydall Inc

- Ahlstrom-Munksjo

- Freudenberg Performance Materials

- 3M

- Fybon Nonwovens Inc

- Jasztex Inc

- PFNonwovens Holding SRO

- Suominen Corporation

- DuPont

- Johns Manville

- Berry Global Inc

Notable Milestones in United States Non-Woven Fabric Market Sector

- September 2022: Toray Industries, Inc. developed a spunbond nonwoven fabric that is both persistently hydrophilic and soft on the skin. This fabric can be used to make disposable diapers, masks, feminine hygiene products, and other sanitary items. When the production technology is fully established, the company intends to begin full-scale production. Polypropylene, which is softer than polyester, is commonly used in spunbond nonwoven materials for sanitary applications.

- June 2022: Berry's first two nonwoven manufacturing locations in America received the International Sustainability and Carbon Certification (ISCC) PLUS designation, in response to increased customer demand for more sustainable solutions in the United States. SCS Global Services has awarded the certificate to the company's operations in Mooresville, North Carolina, and Waynesboro, Virginia. Both plants produce spunbond, spunlace, and spunmelt nonwovens for usage in infant diapers, feminine care, adult incontinence, and wipes.

In-Depth United States Non-Woven Fabric Market Market Outlook

The United States Non-Woven Fabric Market is projected for sustained and robust growth, fueled by an increasing demand for high-performance and sustainable materials. Key growth accelerators include ongoing technological advancements in material science and manufacturing processes, particularly in spunbond and meltblown technologies, which enable the creation of fabrics with enhanced functionalities like superior absorbency, breathability, and barrier properties. Strategic collaborations and partnerships within the industry are fostering innovation and ensuring efficient supply chains, while a growing emphasis on circular economy principles is driving the development and adoption of eco-friendly non-wovens. The market's future potential is further amplified by the expanding applications in critical sectors such as healthcare, hygiene, construction, and automotive. Strategic opportunities abound in developing advanced filtration media, biodegradable hygiene products, and lightweight automotive components, all aligned with evolving consumer preferences and stringent environmental regulations. The market is well-positioned to capitalize on these trends, ensuring a dynamic and expanding future.

United States Non-Woven Fabric Market Segmentation

-

1. Technology

- 1.1. Spunbond

- 1.2. Wet-laid

- 1.3. Dry-laid

- 1.4. Other Technologies

-

2. Material

-

2.1. Polyester

- 2.1.1. Polyester Staple Fiber

- 2.1.2. Polyester Resin (Bottle Grade)

-

2.2. Polypropylene

- 2.2.1. Polypropylene Resin

- 2.2.2. Polypropylene Staple Fiber

- 2.3. Polyethylene

- 2.4. Rayon

- 2.5. Fluff Pulp

- 2.6. Other Materials

-

2.1. Polyester

-

3. End-User Industry

- 3.1. Construction

- 3.2. Textiles

- 3.3. Healthcare

- 3.4. Automotive

- 3.5. Other End-User Industries

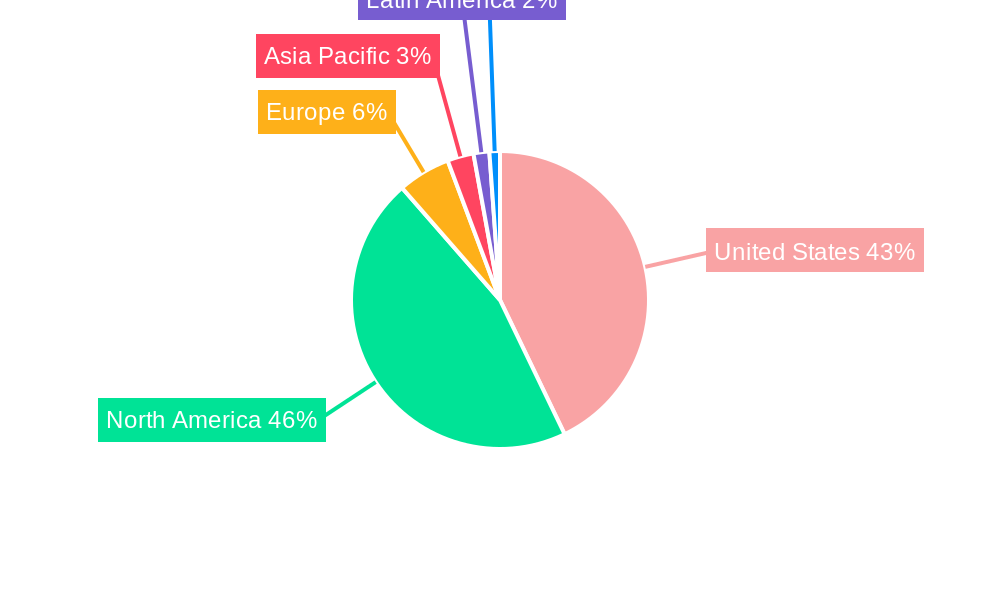

United States Non-Woven Fabric Market Segmentation By Geography

- 1. United States

United States Non-Woven Fabric Market Regional Market Share

Geographic Coverage of United States Non-Woven Fabric Market

United States Non-Woven Fabric Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications in the Healthcare Industry; Increasing Demand for Spunbond

- 3.3. Market Restrains

- 3.3.1. Low Durability and Strength of the Fabric; Other Restraints

- 3.4. Market Trends

- 3.4.1. The Healthcare Industry Promotes the Demand for Non-Woven Fabric

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Non-Woven Fabric Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Spunbond

- 5.1.2. Wet-laid

- 5.1.3. Dry-laid

- 5.1.4. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyester

- 5.2.1.1. Polyester Staple Fiber

- 5.2.1.2. Polyester Resin (Bottle Grade)

- 5.2.2. Polypropylene

- 5.2.2.1. Polypropylene Resin

- 5.2.2.2. Polypropylene Staple Fiber

- 5.2.3. Polyethylene

- 5.2.4. Rayon

- 5.2.5. Fluff Pulp

- 5.2.6. Other Materials

- 5.2.1. Polyester

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. Construction

- 5.3.2. Textiles

- 5.3.3. Healthcare

- 5.3.4. Automotive

- 5.3.5. Other End-User Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 KCWW

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Glatfelter Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lydall Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ahlstrom-Munksjo

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Freudenberg Performance Materials

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 3M

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fybon Nonwovens Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Jasztex Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PFNonwovens Holding SRO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Suominen Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DuPont

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Johns Manville

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Berry Global Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 KCWW

List of Figures

- Figure 1: United States Non-Woven Fabric Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United States Non-Woven Fabric Market Share (%) by Company 2025

List of Tables

- Table 1: United States Non-Woven Fabric Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: United States Non-Woven Fabric Market Revenue Million Forecast, by Material 2020 & 2033

- Table 3: United States Non-Woven Fabric Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: United States Non-Woven Fabric Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: United States Non-Woven Fabric Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 6: United States Non-Woven Fabric Market Revenue Million Forecast, by Material 2020 & 2033

- Table 7: United States Non-Woven Fabric Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: United States Non-Woven Fabric Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Non-Woven Fabric Market?

The projected CAGR is approximately > 6.00%.

2. Which companies are prominent players in the United States Non-Woven Fabric Market?

Key companies in the market include KCWW, Glatfelter Corporation, Lydall Inc, Ahlstrom-Munksjo, Freudenberg Performance Materials, 3M, Fybon Nonwovens Inc, Jasztex Inc, PFNonwovens Holding SRO, Suominen Corporation*List Not Exhaustive, DuPont, Johns Manville, Berry Global Inc.

3. What are the main segments of the United States Non-Woven Fabric Market?

The market segments include Technology, Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications in the Healthcare Industry; Increasing Demand for Spunbond.

6. What are the notable trends driving market growth?

The Healthcare Industry Promotes the Demand for Non-Woven Fabric.

7. Are there any restraints impacting market growth?

Low Durability and Strength of the Fabric; Other Restraints.

8. Can you provide examples of recent developments in the market?

September 2022: Toray Industries, Inc. developed a spunbond nonwoven fabric that is both persistently hydrophilic and soft on the skin. This fabric can be used to make disposable diapers, masks, feminine hygiene products, and other sanitary items. When the production technology is fully established, the company intends to begin full-scale production. Polypropylene, which is softer than polyester, is commonly used in spunbond nonwoven materials for sanitary applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Non-Woven Fabric Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Non-Woven Fabric Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Non-Woven Fabric Market?

To stay informed about further developments, trends, and reports in the United States Non-Woven Fabric Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence