Key Insights

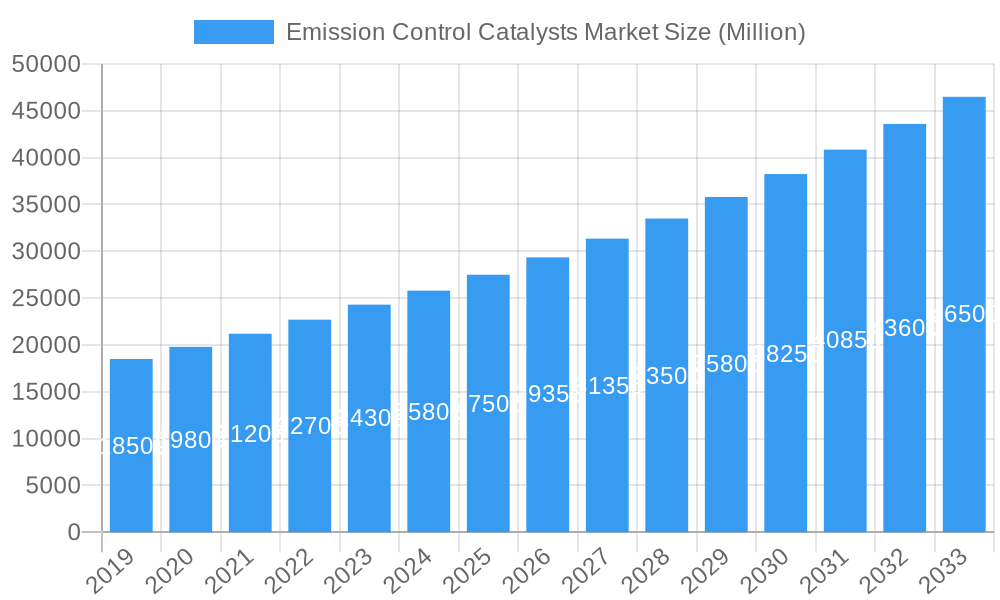

The global Emission Control Catalysts market is set for significant expansion, driven by stringent environmental regulations and a growing worldwide commitment to reducing vehicular emissions. With an estimated market size of $3.8 billion in 2024, the sector is projected to achieve a Compound Annual Growth Rate (CAGR) of 4.7%. This growth is propelled by technological advancements in catalyst efficiency for internal combustion engines and rising demand in hybrid and electric vehicle applications. Asia-Pacific is a key growth region, attributed to rapid industrialization, a booming automotive sector, and increasingly strict emission standards in nations like China and India. North America and Europe will remain vital markets, influenced by fleet upgrades and aftermarket demand.

Emission Control Catalysts Market Market Size (In Billion)

The forecast period, from 2024 onwards, indicates sustained positive market momentum. The market's robustness is further supported by continued demand for catalysts in existing internal combustion engine vehicles, even with the rise of electrification. Leading manufacturers are prioritizing R&D for more durable, cost-effective catalysts capable of managing diverse emissions such as nitrogen oxides (NOx) and particulate matter (PM). The historical period (2019-2024) likely established a solid growth foundation. Key market participants are focusing on innovation, strategic alliances, and capacity expansion to address the escalating global demand for effective emission control solutions. The fundamental requirement to comply with evolving environmental legislation across all automotive segments ensures a consistent and dynamic market trajectory for emission control catalysts.

Emission Control Catalysts Market Company Market Share

Emission Control Catalysts Market: Comprehensive Growth Analysis & Future Outlook (2019-2033)

Unlock unparalleled insights into the global Emission Control Catalysts market with this definitive report. Covering a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, this analysis delves deep into market dynamics, growth trends, regional dominance, product innovations, and future opportunities. We provide granular data on market size, CAGR, adoption rates, and competitive landscapes, making it an indispensable resource for stakeholders seeking to navigate this rapidly evolving sector.

Emission Control Catalysts Market Dynamics & Structure

The global Emission Control Catalysts market is characterized by a moderate to high degree of concentration, driven by significant capital investment in research and development and stringent manufacturing processes. Technological innovation is a primary catalyst, with constant advancements in catalyst formulations and support structures aimed at improving efficiency, durability, and cost-effectiveness in pollutant conversion. Regulatory frameworks, particularly emissions standards set by bodies like the EPA (Environmental Protection Agency) and the European Union, are pivotal in shaping market demand and driving the adoption of advanced catalytic converters.

- Market Concentration: Dominated by a few key players with substantial R&D capabilities and global manufacturing footprints.

- Technological Innovation Drivers: Focus on reducing precious metal loading, enhancing NOx reduction, and developing catalysts for emerging fuel types.

- Regulatory Frameworks: Stringent emission norms (e.g., Euro 7, EPA Tier 4) are forcing manufacturers to invest in cutting-edge catalyst technologies.

- Competitive Product Substitutes: Limited viable substitutes for traditional catalytic converters in most applications, though emerging technologies like electric vehicles pose a long-term threat.

- End-User Demographics: Primarily driven by the automotive sector, with increasing relevance in industrial applications for pollution abatement.

- M&A Trends: Strategic acquisitions and partnerships are observed as companies seek to expand their product portfolios, technological expertise, and geographical reach. For instance, the historical period witnessed an estimated 3-5 significant M&A deals annually, focusing on niche technologies or regional market access.

Emission Control Catalysts Market Growth Trends & Insights

The Emission Control Catalysts market is poised for robust growth, fueled by escalating global environmental concerns and increasingly stringent emission regulations across both mobile and stationary applications. The market size, estimated to be in the range of $25,000 million units in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 6.5% over the forecast period of 2025–2033. This sustained expansion is a direct consequence of the automotive industry's continuous efforts to comply with ever-tightening emission standards, such as the forthcoming Euro 7 norms, which demand a significant reduction in harmful pollutants like nitrogen oxides (NOx), particulate matter (PM), and carbon monoxide (CO).

The adoption rate of advanced catalytic converters is accelerating, particularly in developing economies where industrialization and vehicular populations are on the rise. Technological disruptions are primarily focused on enhancing the efficiency of precious metal utilization (platinum, palladium, rhodium) and developing more durable and cost-effective catalyst formulations. For example, innovations in three-way catalytic converters (TWC) and selective catalytic reduction (SCR) systems are crucial for gasoline and diesel engines, respectively. Consumer behavior is also shifting, with a growing preference for vehicles that offer better fuel efficiency and lower emissions, indirectly boosting the demand for high-performance emission control systems. The market penetration of advanced catalyst technologies in the automotive segment is expected to reach 90% by 2033. Furthermore, the growing awareness of air quality and the implementation of industrial emission control mandates are expanding the market for stationary emission control catalysts.

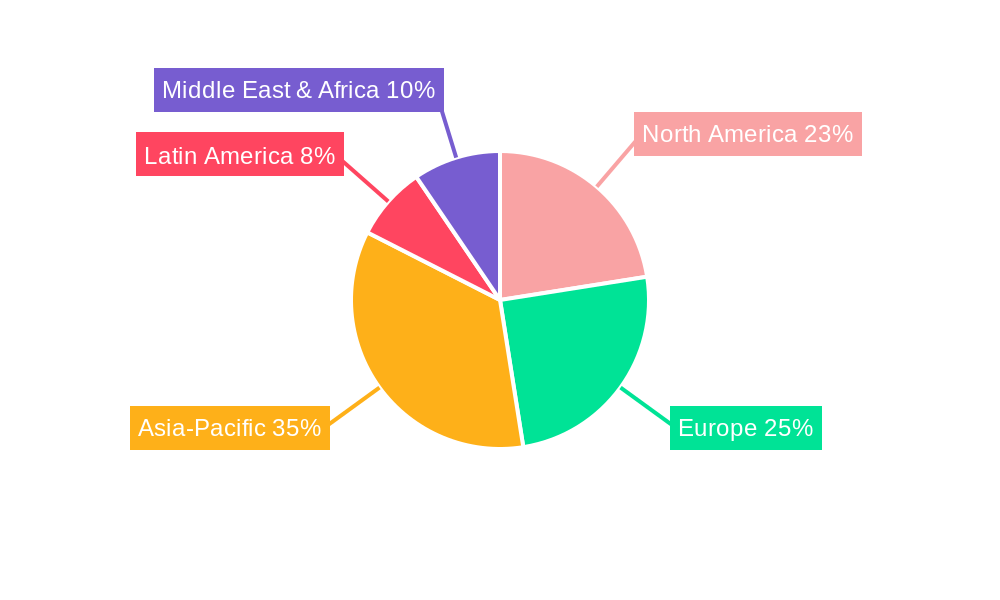

Dominant Regions, Countries, or Segments in Emission Control Catalysts Market

The Automotive end-user industry stands as the undisputed dominant segment within the global Emission Control Catalysts market, commanding an estimated 80% of the market share in 2025. This dominance is primarily driven by the sheer volume of vehicle production worldwide and the stringent, continuously evolving emission regulations imposed on internal combustion engine (ICE) vehicles. The Mobile Emission Control Catalysts application segment, intrinsically linked to the automotive sector, also exhibits significant market leadership.

Asia Pacific, particularly China and India, is emerging as a pivotal region for market growth. Rapid industrialization, a burgeoning automotive manufacturing base, and increasing disposable incomes are fueling a surge in vehicle sales. While regulatory frameworks in these regions are still maturing compared to those in North America and Europe, they are rapidly being harmonized with international standards, creating a substantial demand for emission control catalysts. For instance, China's "Blue Sky" initiatives and India's Bharat Stage VI (BS-VI) emission standards are compelling automakers to adopt advanced catalytic converter technologies. The region's market share is projected to grow from 30% in 2025 to an estimated 38% by 2033, driven by increased production volumes and a growing installed base of vehicles.

Within the Metal segment, Palladium currently holds the largest market share due to its exceptional efficacy in oxidizing CO and hydrocarbons in gasoline engines. However, significant price volatility and supply chain concerns are prompting research and development into alternative formulations and increased use of Platinum and Rhodium in both gasoline and diesel applications, particularly for NOx reduction. The Rhodiium segment, though smaller, is critical for NOx reduction in diesel engines and is expected to see substantial growth driven by stricter diesel emission standards. The Other Metals segment, encompassing materials like cerium and zirconium, plays a crucial supporting role in catalyst performance and durability, contributing to overall market value. The Industrial segment, while smaller than automotive, is experiencing steady growth driven by regulations on emissions from power plants, manufacturing facilities, and other industrial sources, with significant potential in sectors like chemical manufacturing and oil and gas.

Emission Control Catalysts Market Product Landscape

The product landscape of the Emission Control Catalysts market is defined by continuous innovation aimed at enhancing catalytic efficiency, durability, and cost-effectiveness. Key product developments include advanced three-way catalytic converters (TWC) for gasoline engines, featuring optimized washcoat formulations and substrate designs to improve the conversion of CO, HC, and NOx. For diesel applications, selective catalytic reduction (SCR) systems and diesel oxidation catalysts (DOC) are paramount, with ongoing research focusing on reducing ammonia slip and improving low-temperature performance. Emerging innovations involve the development of catalysts with reduced precious metal loading, the use of novel washcoat materials like ceria-zirconia solid solutions for enhanced thermal stability, and the integration of advanced sensor technologies for real-time monitoring and control of catalyst performance. The unique selling proposition of leading products lies in their ability to meet increasingly stringent emission standards while offering a longer service life and reduced backpressure.

Key Drivers, Barriers & Challenges in Emission Control Catalysts Market

Key Drivers:

- Stringent Emission Regulations: Global mandates like Euro 7 and EPA Tier 4 are the primary growth drivers, compelling manufacturers to adopt advanced catalytic technologies.

- Automotive Production Growth: Increasing vehicle production, especially in emerging economies, directly translates to higher demand for emission control catalysts.

- Environmental Awareness: Growing public concern for air quality and climate change is pushing for cleaner vehicles and industrial processes.

- Technological Advancements: Innovations in catalyst formulations, precious metal reduction, and durability enhance performance and create market opportunities.

Key Barriers & Challenges:

- Precious Metal Volatility: Fluctuations in the prices of platinum, palladium, and rhodium significantly impact manufacturing costs and product pricing.

- Supply Chain Disruptions: Geopolitical factors and mining concentration can lead to supply shortages and price instability for key raw materials.

- Electric Vehicle (EV) Transition: The long-term shift towards EVs poses a significant threat to the traditional internal combustion engine (ICE) catalyst market.

- Cost of Advanced Technologies: Implementing cutting-edge emission control systems can increase vehicle manufacturing costs, potentially impacting consumer affordability.

- Counterfeiting and Substandard Products: The presence of counterfeit catalysts can undermine market integrity and environmental effectiveness.

Emerging Opportunities in Emission Control Catalysts Market

Emerging opportunities lie in the development of catalysts for alternative fuels, such as hydrogen and synthetic fuels, as well as enhanced formulations for hybrid vehicles. The growing demand for emission control in stationary sources, including industrial boilers and power plants, presents a significant untapped market. Furthermore, advancements in catalyst recycling technologies offer a circular economy approach, reducing reliance on primary metal sourcing and creating value from end-of-life catalysts. The development of compact and highly efficient catalytic converters for smaller engines and portable emission sources also represents a niche but growing opportunity.

Growth Accelerators in the Emission Control Catalysts Market Industry

Long-term growth in the Emission Control Catalysts market will be significantly accelerated by continued investment in R&D for next-generation catalysts that can handle ultra-low emission standards and alternative fuel compositions. Strategic partnerships between catalyst manufacturers, automakers, and raw material suppliers are crucial for innovation and cost optimization. Market expansion strategies targeting developing economies with rapidly growing automotive sectors will also be key. Furthermore, the increasing adoption of electric vehicles will not hinder growth entirely, as there will be a sustained demand for catalysts in the transitional phase and for the vast existing fleet of ICE vehicles. The focus on developing more sustainable and recyclable catalyst materials will also drive innovation and market resilience.

Key Players Shaping the Emission Control Catalysts Market Market

- Umicore

- Haldor Topsoe A/S

- Clariant

- JGC C&C

- DCL International Inc

- Aerinox-Inc

- CDTi Advanced Materials Inc

- Evonik Industries AG

- Hitachi Zosen Corporation

- CORMETECH

- Nikki-Universal Co Ltd

- BASF SE

- Johnson Matthey

- IBIDEN Ceram GmbH

Notable Milestones in Emission Control Catalysts Market Sector

- 2019: Introduction of new catalyst formulations with reduced palladium loading to address price volatility.

- 2020: Increased regulatory scrutiny and stricter enforcement of emission standards in key markets like the EU and China.

- 2021: Significant advancements in SCR technology for heavy-duty diesel vehicles, improving NOx reduction efficiency.

- 2022: Growing interest and investment in catalyst recycling processes and technologies.

- 2023: Announcement of proposed Euro 7 emission standards by the European Commission, signaling the need for further catalyst innovation.

- 2024: Intensified research into catalysts for alternative fuels and hybrid powertrain applications.

In-Depth Emission Control Catalysts Market Market Outlook

The future of the Emission Control Catalysts market is characterized by resilience and continuous adaptation. While the long-term transition to electric mobility presents a challenge, the significant installed base of internal combustion engine vehicles, coupled with increasingly stringent regulations, will ensure sustained demand for advanced catalytic converters for decades to come. Strategic partnerships, technological breakthroughs in precious metal utilization and alternative materials, and the expansion into emerging markets will be key growth accelerators. The focus on sustainability and circular economy principles, including robust recycling programs, will also shape the market's trajectory, ensuring both environmental compliance and economic viability. The market is set to witness further consolidation and specialization as companies strive to maintain a competitive edge in this vital sector of environmental technology.

Emission Control Catalysts Market Segmentation

-

1. Metal

- 1.1. Platinum

- 1.2. Palladium

- 1.3. Rhodium

- 1.4. Other Metals

-

2. Application

- 2.1. Mobile Emission Control Catalysts

- 2.2. Stationary Emission Control Catalysts

-

3. End-user Industry

- 3.1. Automotive

- 3.2. Industrial

- 3.3. Other End-user Industries

Emission Control Catalysts Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. ASEAN Countries

- 1.6. Rest of Asia Pacific

-

2. North America

- 2.1. United States

- 2.2. Canada

- 2.3. Mexico

-

3. Europe

- 3.1. Germany

- 3.2. United Kingdom

- 3.3. Italy

- 3.4. France

- 3.5. Russia

- 3.6. Rest of Europe

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Emission Control Catalysts Market Regional Market Share

Geographic Coverage of Emission Control Catalysts Market

Emission Control Catalysts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Enactment of Stringent Emission Norms; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Impact of COVID-19 Pandemic; Other Restraints

- 3.4. Market Trends

- 3.4.1. Platinum - The Most used Metal

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Emission Control Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Metal

- 5.1.1. Platinum

- 5.1.2. Palladium

- 5.1.3. Rhodium

- 5.1.4. Other Metals

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Mobile Emission Control Catalysts

- 5.2.2. Stationary Emission Control Catalysts

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Automotive

- 5.3.2. Industrial

- 5.3.3. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.4.2. North America

- 5.4.3. Europe

- 5.4.4. South America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Metal

- 6. Asia Pacific Emission Control Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Metal

- 6.1.1. Platinum

- 6.1.2. Palladium

- 6.1.3. Rhodium

- 6.1.4. Other Metals

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Mobile Emission Control Catalysts

- 6.2.2. Stationary Emission Control Catalysts

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Automotive

- 6.3.2. Industrial

- 6.3.3. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Metal

- 7. North America Emission Control Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Metal

- 7.1.1. Platinum

- 7.1.2. Palladium

- 7.1.3. Rhodium

- 7.1.4. Other Metals

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Mobile Emission Control Catalysts

- 7.2.2. Stationary Emission Control Catalysts

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Automotive

- 7.3.2. Industrial

- 7.3.3. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Metal

- 8. Europe Emission Control Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Metal

- 8.1.1. Platinum

- 8.1.2. Palladium

- 8.1.3. Rhodium

- 8.1.4. Other Metals

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Mobile Emission Control Catalysts

- 8.2.2. Stationary Emission Control Catalysts

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Automotive

- 8.3.2. Industrial

- 8.3.3. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Metal

- 9. South America Emission Control Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Metal

- 9.1.1. Platinum

- 9.1.2. Palladium

- 9.1.3. Rhodium

- 9.1.4. Other Metals

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Mobile Emission Control Catalysts

- 9.2.2. Stationary Emission Control Catalysts

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Automotive

- 9.3.2. Industrial

- 9.3.3. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Metal

- 10. Middle East and Africa Emission Control Catalysts Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Metal

- 10.1.1. Platinum

- 10.1.2. Palladium

- 10.1.3. Rhodium

- 10.1.4. Other Metals

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Mobile Emission Control Catalysts

- 10.2.2. Stationary Emission Control Catalysts

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Automotive

- 10.3.2. Industrial

- 10.3.3. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Metal

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Umicore*List Not Exhaustive

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Haldor Topsoe A/S

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Clariant

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 JGC C&C

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DCL International Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aerinox-Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CDTi Advanced Materials Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Evonik Industries AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hitachi Zosen Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 CORMETECH

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Nikki-Universal Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 BASF SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Johnson Matthey

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 IBIDEN Ceram GmbH

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Umicore*List Not Exhaustive

List of Figures

- Figure 1: Global Emission Control Catalysts Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Asia Pacific Emission Control Catalysts Market Revenue (billion), by Metal 2025 & 2033

- Figure 3: Asia Pacific Emission Control Catalysts Market Revenue Share (%), by Metal 2025 & 2033

- Figure 4: Asia Pacific Emission Control Catalysts Market Revenue (billion), by Application 2025 & 2033

- Figure 5: Asia Pacific Emission Control Catalysts Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: Asia Pacific Emission Control Catalysts Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: Asia Pacific Emission Control Catalysts Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Asia Pacific Emission Control Catalysts Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Asia Pacific Emission Control Catalysts Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Emission Control Catalysts Market Revenue (billion), by Metal 2025 & 2033

- Figure 11: North America Emission Control Catalysts Market Revenue Share (%), by Metal 2025 & 2033

- Figure 12: North America Emission Control Catalysts Market Revenue (billion), by Application 2025 & 2033

- Figure 13: North America Emission Control Catalysts Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: North America Emission Control Catalysts Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: North America Emission Control Catalysts Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: North America Emission Control Catalysts Market Revenue (billion), by Country 2025 & 2033

- Figure 17: North America Emission Control Catalysts Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Emission Control Catalysts Market Revenue (billion), by Metal 2025 & 2033

- Figure 19: Europe Emission Control Catalysts Market Revenue Share (%), by Metal 2025 & 2033

- Figure 20: Europe Emission Control Catalysts Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Europe Emission Control Catalysts Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Emission Control Catalysts Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Europe Emission Control Catalysts Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Europe Emission Control Catalysts Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Emission Control Catalysts Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Emission Control Catalysts Market Revenue (billion), by Metal 2025 & 2033

- Figure 27: South America Emission Control Catalysts Market Revenue Share (%), by Metal 2025 & 2033

- Figure 28: South America Emission Control Catalysts Market Revenue (billion), by Application 2025 & 2033

- Figure 29: South America Emission Control Catalysts Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Emission Control Catalysts Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: South America Emission Control Catalysts Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: South America Emission Control Catalysts Market Revenue (billion), by Country 2025 & 2033

- Figure 33: South America Emission Control Catalysts Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Emission Control Catalysts Market Revenue (billion), by Metal 2025 & 2033

- Figure 35: Middle East and Africa Emission Control Catalysts Market Revenue Share (%), by Metal 2025 & 2033

- Figure 36: Middle East and Africa Emission Control Catalysts Market Revenue (billion), by Application 2025 & 2033

- Figure 37: Middle East and Africa Emission Control Catalysts Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Emission Control Catalysts Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Emission Control Catalysts Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Emission Control Catalysts Market Revenue (billion), by Country 2025 & 2033

- Figure 41: Middle East and Africa Emission Control Catalysts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Emission Control Catalysts Market Revenue billion Forecast, by Metal 2020 & 2033

- Table 2: Global Emission Control Catalysts Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Emission Control Catalysts Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Emission Control Catalysts Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Emission Control Catalysts Market Revenue billion Forecast, by Metal 2020 & 2033

- Table 6: Global Emission Control Catalysts Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Emission Control Catalysts Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Emission Control Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: China Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Japan Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: South Korea Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: ASEAN Countries Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Rest of Asia Pacific Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Global Emission Control Catalysts Market Revenue billion Forecast, by Metal 2020 & 2033

- Table 16: Global Emission Control Catalysts Market Revenue billion Forecast, by Application 2020 & 2033

- Table 17: Global Emission Control Catalysts Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Emission Control Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 19: United States Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Canada Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Mexico Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Global Emission Control Catalysts Market Revenue billion Forecast, by Metal 2020 & 2033

- Table 23: Global Emission Control Catalysts Market Revenue billion Forecast, by Application 2020 & 2033

- Table 24: Global Emission Control Catalysts Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 25: Global Emission Control Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Germany Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Italy Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: France Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Russia Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Emission Control Catalysts Market Revenue billion Forecast, by Metal 2020 & 2033

- Table 33: Global Emission Control Catalysts Market Revenue billion Forecast, by Application 2020 & 2033

- Table 34: Global Emission Control Catalysts Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 35: Global Emission Control Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Brazil Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Argentina Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: Rest of South America Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Global Emission Control Catalysts Market Revenue billion Forecast, by Metal 2020 & 2033

- Table 40: Global Emission Control Catalysts Market Revenue billion Forecast, by Application 2020 & 2033

- Table 41: Global Emission Control Catalysts Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 42: Global Emission Control Catalysts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 43: Saudi Arabia Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: United Arab Emirates Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 45: South Africa Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Rest of Middle East and Africa Emission Control Catalysts Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Emission Control Catalysts Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Emission Control Catalysts Market?

Key companies in the market include Umicore*List Not Exhaustive, Haldor Topsoe A/S, Clariant, JGC C&C, DCL International Inc, Aerinox-Inc, CDTi Advanced Materials Inc, Evonik Industries AG, Hitachi Zosen Corporation, CORMETECH, Nikki-Universal Co Ltd, BASF SE, Johnson Matthey, IBIDEN Ceram GmbH.

3. What are the main segments of the Emission Control Catalysts Market?

The market segments include Metal, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.8 billion as of 2022.

5. What are some drivers contributing to market growth?

; Enactment of Stringent Emission Norms; Other Drivers.

6. What are the notable trends driving market growth?

Platinum - The Most used Metal.

7. Are there any restraints impacting market growth?

; Impact of COVID-19 Pandemic; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Emission Control Catalysts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Emission Control Catalysts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Emission Control Catalysts Market?

To stay informed about further developments, trends, and reports in the Emission Control Catalysts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence