Key Insights

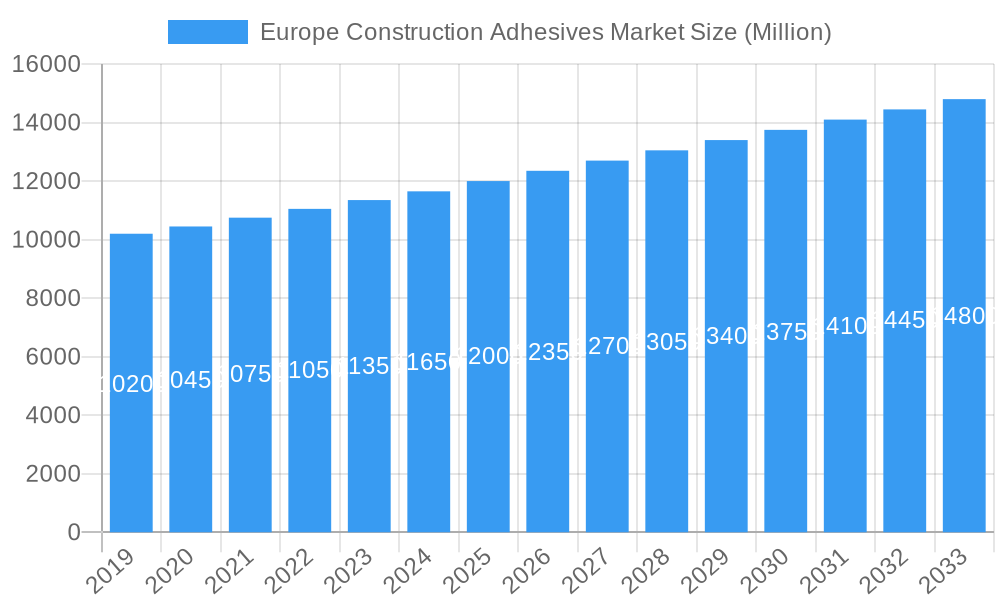

The European construction adhesives market is projected to reach $9.28 billion by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 13.33% through 2033. This expansion is driven by escalating construction activities across residential, commercial, infrastructure, and industrial sectors, fueled by urbanization, infrastructure development, and the increasing demand for sustainable and energy-efficient building solutions. The market is shifting towards water-borne adhesives, aligning with stringent European regulations and consumer preference for eco-friendly materials. Advancements in adhesive formulations, enhancing bonding strength, durability, and curing times, are also significant growth catalysts. High-performance adhesives for specialized applications like façade bonding and modular construction are experiencing a notable rise.

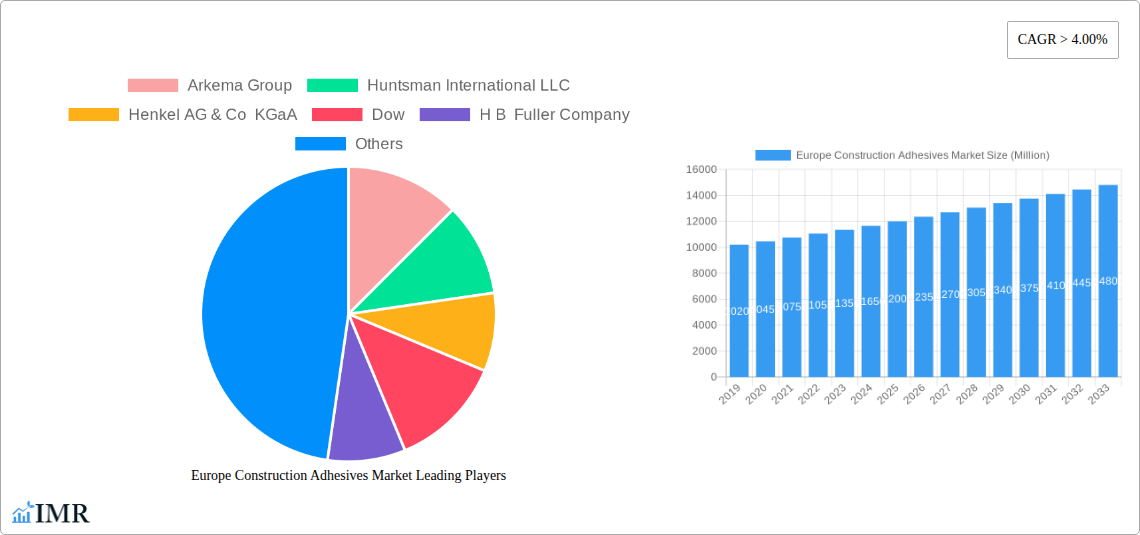

Europe Construction Adhesives Market Market Size (In Billion)

Key market drivers include government initiatives promoting green building standards, a surge in renovation and refurbishment projects, and the growing use of lightweight and composite materials in construction. The market is segmented by resin type, with Acrylics, Epoxies, and Polyurethanes leading due to their versatile properties. Water-borne and reactive technologies dominate due to performance and environmental advantages. Western European countries are expected to spearhead market growth. Potential restraints include volatile raw material prices and intense competition, though continuous innovation is crucial for sustained success.

Europe Construction Adhesives Market Company Market Share

Europe Construction Adhesives Market Analysis & Forecast: 2025-2033

Gain comprehensive insights into the expanding Europe construction adhesives market. This analysis, covering 2019-2033 with a base year of 2025, explores critical market dynamics, growth trends, regional dominance, product innovations, and strategic landscapes. The construction adhesives industry in Europe is driven by increasing construction, demand for sustainable materials, and technological advancements. This report is essential for stakeholders seeking to understand the European adhesives market, including parent and child segments, and identify investment opportunities within the construction chemicals market.

Key Market Segments:

Leading Companies: Arkema Group, Huntsman International LLC, Henkel AG & Co KGaA, Dow, H B Fuller Company, RPM International Inc, Sika AG, Paramelt RMC B V, 3M, AVERY DENNISON CORPORATION, Wacker Chemie AG, Ashland.

- Resin Type: Acrylics, Epoxy, Polyurethanes, Polyvinyl Acetate (PVA), Silicones, Other Resin Types

- Technology: Water-borne, Reactive, Hot-melt, Other Technologies

- End-use Sector: Residential, Commercial, Infrastructure, Industrial

Europe Construction Adhesives Market Market Dynamics & Structure

The Europe construction adhesives market exhibits a moderately consolidated structure, with a few key players like Henkel, Sika AG, and Arkema Group holding significant market shares. Technological innovation is a primary driver, with continuous development in formulations offering enhanced performance, durability, and environmental sustainability. Regulatory frameworks, such as REACH and various national building codes, significantly influence product development and market entry, often favoring eco-friendly construction adhesives. The competitive landscape is characterized by a blend of global giants and specialized regional manufacturers. End-user demographics are shifting, with a growing demand from the residential sector for renovation and new builds, alongside substantial investment in commercial and infrastructure projects across Europe. M&A trends indicate strategic acquisitions aimed at expanding product portfolios, market reach, and technological capabilities. For instance, in the historical period (2019-2024), over 15 significant M&A deals were recorded, reflecting the industry's drive for consolidation. Barriers to innovation include the high cost of R&D for advanced chemistries and stringent testing requirements for construction applications. The adoption of smart adhesives and bio-based alternatives presents both opportunities and challenges for incumbents.

- Market Concentration: Moderately consolidated with strong presence of global players.

- Technological Innovation: Focus on high-performance, sustainable, and application-specific adhesives.

- Regulatory Influence: Stringent regulations drive demand for safer and greener products.

- End-User Demand: Balanced growth across residential, commercial, and infrastructure sectors.

- M&A Activity: Strategic acquisitions to enhance market position and diversify offerings.

Europe Construction Adhesives Market Growth Trends & Insights

The Europe construction adhesives market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033. This expansion is underpinned by several key trends. The ongoing urbanization and population growth across Europe are fueling demand for new residential and commercial constructions, directly translating into increased consumption of high-strength construction adhesives. Furthermore, a significant wave of infrastructure development, including transportation networks, renewable energy projects, and urban regeneration initiatives, is a major growth catalyst. The growing emphasis on sustainable building practices and energy efficiency is driving the adoption of low-VOC construction adhesives and water-borne formulations, aligning with the European Union's Green Deal objectives. The renovation and retrofitting of existing buildings also represent a considerable market opportunity, particularly in older European cities, necessitating advanced adhesive solutions for diverse materials and challenging applications.

Technological advancements are playing a pivotal role in shaping market trends. Innovations such as faster curing times, improved flexibility, enhanced water resistance, and superior bonding capabilities for a wider range of substrates, including composite materials and advanced insulation, are gaining traction. The rise of prefabrication and modular construction techniques also demands specialized structural adhesives that can facilitate rapid assembly and ensure long-term structural integrity. Consumer behavior shifts are also evident, with an increasing preference for DIY solutions and aesthetically pleasing finishes, leading to demand for user-friendly and versatile adhesives. Market penetration of advanced adhesive technologies is expected to deepen, as contractors and builders recognize the long-term cost savings and performance benefits. The estimated market size in 2025 is valued at approximately $12,500 million units, projected to reach over $19,500 million units by 2033. Adoption rates for specialized industrial construction adhesives and exterior construction adhesives are particularly high in countries with robust manufacturing and construction sectors. The shift towards smart adhesives, offering real-time monitoring of bond strength and integrity, is an emerging disruptive trend anticipated to gain momentum in the latter half of the forecast period.

Dominant Regions, Countries, or Segments in Europe Construction Adhesives Market

The Europe construction adhesives market is experiencing robust growth driven by a confluence of factors across its diverse segments and regions. Within the Resin Type segment, Polyurethanes and Epoxy adhesives are projected to dominate, accounting for an estimated combined market share of over 55% in 2025. Polyurethanes offer excellent flexibility, durability, and adhesion to a wide range of substrates, making them ideal for structural bonding and sealing in various construction applications. Epoxy adhesives, known for their exceptional strength, chemical resistance, and thermal stability, are crucial for demanding industrial and infrastructure projects. Acrylics are also gaining significant traction due to their versatility and improved environmental profiles.

In terms of Technology, Reactive adhesives are anticipated to lead the market, driven by their superior bonding performance and durability in structural applications. This category includes polyurethanes, epoxies, and silicones, which cure through chemical reactions, providing long-lasting and robust bonds. Water-borne adhesives are experiencing a notable surge in demand, driven by stringent environmental regulations and a growing preference for low-VOC (Volatile Organic Compound) products, particularly in the residential and commercial sectors. Their market share is expected to increase significantly from 2025 to 2033.

The End-use Sector analysis reveals that the Infrastructure and Commercial sectors are expected to be the primary growth engines, collectively holding an estimated market share of over 60% in 2025. Massive government investments in transportation infrastructure, energy projects (including renewable energy installations), and urban development across major European economies are fueling demand for high-performance construction adhesives. The commercial sector, encompassing office buildings, retail spaces, and hospitality venues, also contributes significantly due to ongoing new construction and extensive renovation projects. The Residential sector remains a vital segment, supported by housing demand and a growing trend in home renovations.

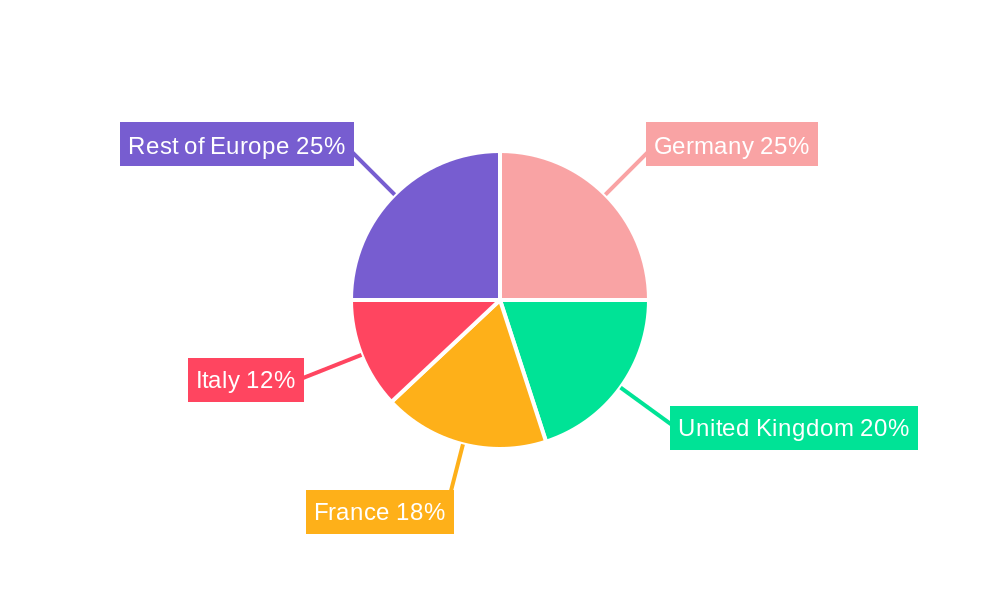

Geographically, Germany is expected to continue its dominance in the Europe construction adhesives market. This leadership is attributed to its strong industrial base, significant investments in infrastructure modernization, a thriving automotive and manufacturing sector that drives demand for specialized adhesives, and a robust construction industry. The country’s commitment to sustainability and stringent quality standards further boosts the adoption of advanced and eco-friendly adhesive solutions. Other significant markets include the United Kingdom, France, and Italy, each contributing substantially due to their active construction sectors and increasing adoption of innovative building materials. The Nordic countries are also emerging as key markets, driven by a strong focus on energy-efficient construction and sustainable building practices.

Europe Construction Adhesives Market Product Landscape

The Europe construction adhesives market is characterized by a dynamic product landscape driven by relentless innovation. Manufacturers are focused on developing advanced formulations that offer enhanced performance metrics, including superior bond strength, increased flexibility, faster curing times, and improved resistance to environmental factors like moisture, heat, and UV radiation. Innovations in structural adhesives are enabling lighter yet stronger building components, contributing to energy efficiency and design flexibility. Application-specific solutions are gaining prominence, with adhesives tailored for bonding diverse materials such as wood, metal, glass, concrete, plastics, and composites, often in challenging architectural designs. Environmentally friendly construction adhesives, including low-VOC and water-borne options, represent a significant area of product development, responding to growing regulatory pressures and consumer demand for sustainable building materials. The incorporation of new functionalities, such as sound dampening or thermal insulation properties within adhesives, is also an emerging trend, offering added value beyond mere bonding.

Key Drivers, Barriers & Challenges in Europe Construction Adhesives Market

Key Drivers:

- Robust Infrastructure Development: Significant government investments in transportation, energy, and urban renewal projects across Europe are a primary growth catalyst.

- Sustainable Building Initiatives: Growing demand for eco-friendly construction materials and energy-efficient buildings, driven by EU policies and consumer awareness.

- Technological Advancements: Development of high-performance, versatile, and application-specific adhesives with improved bonding capabilities and faster curing times.

- Growth in Residential & Commercial Construction: Continued demand for new housing and commercial spaces, alongside extensive renovation and retrofitting activities.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in raw material prices and availability, particularly for key chemical components, can impact production costs and lead times.

- Stringent Regulatory Frameworks: Compliance with evolving environmental and safety regulations (e.g., REACH) requires significant R&D investment and can extend product development cycles.

- Skilled Labor Shortages: A lack of trained professionals capable of applying specialized adhesives can hinder adoption in certain regions.

- Competitive Pricing Pressures: The presence of numerous market players, including low-cost alternatives, creates pricing challenges for premium, innovative products.

Emerging Opportunities in Europe Construction Adhesives Market

Emerging opportunities within the Europe construction adhesives market lie in the growing demand for bio-based and recycled content adhesives, aligning with circular economy principles. The expansion of modular and prefabricated construction offers a significant avenue for high-performance, fast-curing structural adhesives. Furthermore, the increasing integration of smart technologies, such as self-healing or sensor-embedded adhesives for structural health monitoring, presents a futuristic yet viable growth prospect. Untapped potential exists in the renovation of historic buildings, requiring specialized adhesives that respect architectural integrity while providing modern performance. The development of adhesives for advanced insulation materials and energy-efficient building envelopes is also a key area for future innovation and market penetration.

Growth Accelerators in the Europe Construction Adhesives Market Industry

Long-term growth in the Europe construction adhesives market is being accelerated by breakthroughs in material science, leading to the development of adhesives with enhanced durability, environmental resistance, and multifunctionality. Strategic partnerships between adhesive manufacturers and construction companies are fostering innovation by aligning product development with real-world project needs. The increasing adoption of Building Information Modeling (BIM) in construction projects is also driving demand for precisely specified and high-performance adhesives. Furthermore, market expansion strategies focusing on emerging economies within Europe and targeting niche applications, such as advanced façade bonding or green roof installations, are significant growth accelerators. The push towards achieving net-zero emissions in the construction sector will further propel the adoption of sustainable adhesive solutions.

Key Players Shaping the Europe Construction Adhesives Market Market

- Arkema Group

- Huntsman International LLC

- Henkel AG & Co KGaA

- Dow

- H B Fuller Company

- RPM International Inc

- Sika AG

- Paramelt RMC B V

- 3M

- AVERY DENNISON CORPORATION

- Wacker Chemie AG

- Ashland

Notable Milestones in Europe Construction Adhesives Market Sector

- 2019: Henkel launches a new range of sustainable, water-based adhesives for interior construction, meeting stringent VOC regulations.

- 2020: Sika AG acquires a leading provider of façade bonding solutions, strengthening its position in high-performance architectural adhesives.

- 2021: Arkema Group develops a novel bio-based polyurethane adhesive for structural applications, reducing carbon footprint.

- 2022: Huntsman International LLC introduces an innovative epoxy adhesive with enhanced thermal insulation properties for green building applications.

- 2023: The European Union introduces stricter regulations on chemical substances in construction materials, driving further demand for compliant adhesive solutions.

- 2024: Dow expands its portfolio of silicone-based adhesives for weatherproofing and structural glazing, catering to the growing façade construction market.

In-Depth Europe Construction Adhesives Market Market Outlook

The future outlook for the Europe construction adhesives market is exceptionally positive, driven by a synergistic interplay of technological innovation, sustainability mandates, and robust economic drivers. Growth accelerators, including the ongoing digital transformation of the construction industry through platforms like BIM, are creating demand for highly engineered and specified adhesive solutions. Strategic collaborations and targeted market expansion initiatives are poised to unlock new revenue streams. The persistent focus on creating energy-efficient and environmentally responsible buildings will continue to fuel the adoption of low-VOC, water-borne, and bio-based adhesives. The market is expected to witness significant growth in specialized segments like industrial bonding, infrastructure repair, and façade engineering, presenting substantial opportunities for stakeholders who can offer advanced, reliable, and sustainable adhesive solutions.

Europe Construction Adhesives Market Segmentation

-

1. Resin Type

- 1.1. Acrylics

- 1.2. Epoxy

- 1.3. Polyurethanes

- 1.4. Polyvinyl Acetate (PVA)

- 1.5. Silicones

- 1.6. Other Resin Types

-

2. Technology

- 2.1. Water-borne

- 2.2. Reactive

- 2.3. Hot-melt

- 2.4. Other Technologies

-

3. End-use Sector

- 3.1. Residential

- 3.2. Commercial

- 3.3. Infrastructure

- 3.4. Industrial

Europe Construction Adhesives Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Construction Adhesives Market Regional Market Share

Geographic Coverage of Europe Construction Adhesives Market

Europe Construction Adhesives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Solvent-borne Construction Adhesives

- 3.3. Market Restrains

- 3.3.1. ; Limited Usage in High End Applications; Other Restraints

- 3.4. Market Trends

- 3.4.1. Waterborne Technology to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Construction Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 5.1.1. Acrylics

- 5.1.2. Epoxy

- 5.1.3. Polyurethanes

- 5.1.4. Polyvinyl Acetate (PVA)

- 5.1.5. Silicones

- 5.1.6. Other Resin Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Water-borne

- 5.2.2. Reactive

- 5.2.3. Hot-melt

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-use Sector

- 5.3.1. Residential

- 5.3.2. Commercial

- 5.3.3. Infrastructure

- 5.3.4. Industrial

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. United Kingdom

- 5.4.3. France

- 5.4.4. Italy

- 5.4.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Resin Type

- 6. Germany Europe Construction Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 6.1.1. Acrylics

- 6.1.2. Epoxy

- 6.1.3. Polyurethanes

- 6.1.4. Polyvinyl Acetate (PVA)

- 6.1.5. Silicones

- 6.1.6. Other Resin Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Water-borne

- 6.2.2. Reactive

- 6.2.3. Hot-melt

- 6.2.4. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by End-use Sector

- 6.3.1. Residential

- 6.3.2. Commercial

- 6.3.3. Infrastructure

- 6.3.4. Industrial

- 6.1. Market Analysis, Insights and Forecast - by Resin Type

- 7. United Kingdom Europe Construction Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 7.1.1. Acrylics

- 7.1.2. Epoxy

- 7.1.3. Polyurethanes

- 7.1.4. Polyvinyl Acetate (PVA)

- 7.1.5. Silicones

- 7.1.6. Other Resin Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Water-borne

- 7.2.2. Reactive

- 7.2.3. Hot-melt

- 7.2.4. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by End-use Sector

- 7.3.1. Residential

- 7.3.2. Commercial

- 7.3.3. Infrastructure

- 7.3.4. Industrial

- 7.1. Market Analysis, Insights and Forecast - by Resin Type

- 8. France Europe Construction Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 8.1.1. Acrylics

- 8.1.2. Epoxy

- 8.1.3. Polyurethanes

- 8.1.4. Polyvinyl Acetate (PVA)

- 8.1.5. Silicones

- 8.1.6. Other Resin Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Water-borne

- 8.2.2. Reactive

- 8.2.3. Hot-melt

- 8.2.4. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by End-use Sector

- 8.3.1. Residential

- 8.3.2. Commercial

- 8.3.3. Infrastructure

- 8.3.4. Industrial

- 8.1. Market Analysis, Insights and Forecast - by Resin Type

- 9. Italy Europe Construction Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 9.1.1. Acrylics

- 9.1.2. Epoxy

- 9.1.3. Polyurethanes

- 9.1.4. Polyvinyl Acetate (PVA)

- 9.1.5. Silicones

- 9.1.6. Other Resin Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Water-borne

- 9.2.2. Reactive

- 9.2.3. Hot-melt

- 9.2.4. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by End-use Sector

- 9.3.1. Residential

- 9.3.2. Commercial

- 9.3.3. Infrastructure

- 9.3.4. Industrial

- 9.1. Market Analysis, Insights and Forecast - by Resin Type

- 10. Rest of Europe Europe Construction Adhesives Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 10.1.1. Acrylics

- 10.1.2. Epoxy

- 10.1.3. Polyurethanes

- 10.1.4. Polyvinyl Acetate (PVA)

- 10.1.5. Silicones

- 10.1.6. Other Resin Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Water-borne

- 10.2.2. Reactive

- 10.2.3. Hot-melt

- 10.2.4. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by End-use Sector

- 10.3.1. Residential

- 10.3.2. Commercial

- 10.3.3. Infrastructure

- 10.3.4. Industrial

- 10.1. Market Analysis, Insights and Forecast - by Resin Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Arkema Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huntsman International LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Henkel AG & Co KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Dow

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 H B Fuller Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 RPM International Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sika AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Paramelt RMC B V *List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 3M

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AVERY DENNISON CORPORATION

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Wacker Chemie AG

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Ashland

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Arkema Group

List of Figures

- Figure 1: Europe Construction Adhesives Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Construction Adhesives Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Construction Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 2: Europe Construction Adhesives Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 3: Europe Construction Adhesives Market Revenue billion Forecast, by End-use Sector 2020 & 2033

- Table 4: Europe Construction Adhesives Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Construction Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 6: Europe Construction Adhesives Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 7: Europe Construction Adhesives Market Revenue billion Forecast, by End-use Sector 2020 & 2033

- Table 8: Europe Construction Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Europe Construction Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 10: Europe Construction Adhesives Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 11: Europe Construction Adhesives Market Revenue billion Forecast, by End-use Sector 2020 & 2033

- Table 12: Europe Construction Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Europe Construction Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 14: Europe Construction Adhesives Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 15: Europe Construction Adhesives Market Revenue billion Forecast, by End-use Sector 2020 & 2033

- Table 16: Europe Construction Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Europe Construction Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 18: Europe Construction Adhesives Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 19: Europe Construction Adhesives Market Revenue billion Forecast, by End-use Sector 2020 & 2033

- Table 20: Europe Construction Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Europe Construction Adhesives Market Revenue billion Forecast, by Resin Type 2020 & 2033

- Table 22: Europe Construction Adhesives Market Revenue billion Forecast, by Technology 2020 & 2033

- Table 23: Europe Construction Adhesives Market Revenue billion Forecast, by End-use Sector 2020 & 2033

- Table 24: Europe Construction Adhesives Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Construction Adhesives Market?

The projected CAGR is approximately 13.33%.

2. Which companies are prominent players in the Europe Construction Adhesives Market?

Key companies in the market include Arkema Group, Huntsman International LLC, Henkel AG & Co KGaA, Dow, H B Fuller Company, RPM International Inc, Sika AG, Paramelt RMC B V *List Not Exhaustive, 3M, AVERY DENNISON CORPORATION, Wacker Chemie AG, Ashland.

3. What are the main segments of the Europe Construction Adhesives Market?

The market segments include Resin Type, Technology, End-use Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.28 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Solvent-borne Construction Adhesives.

6. What are the notable trends driving market growth?

Waterborne Technology to Dominate the Market.

7. Are there any restraints impacting market growth?

; Limited Usage in High End Applications; Other Restraints.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Construction Adhesives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Construction Adhesives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Construction Adhesives Market?

To stay informed about further developments, trends, and reports in the Europe Construction Adhesives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence