Key Insights

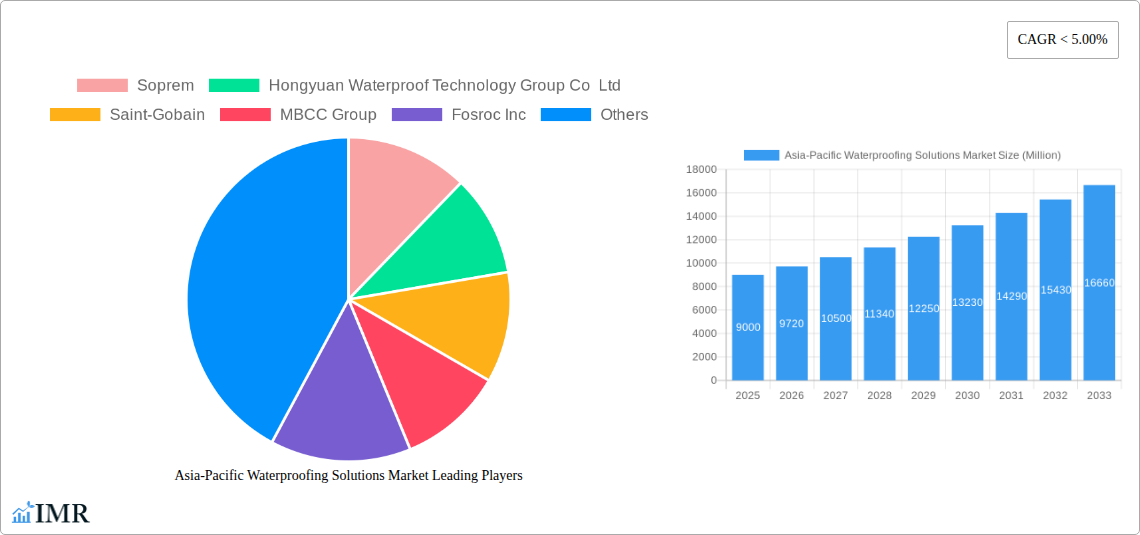

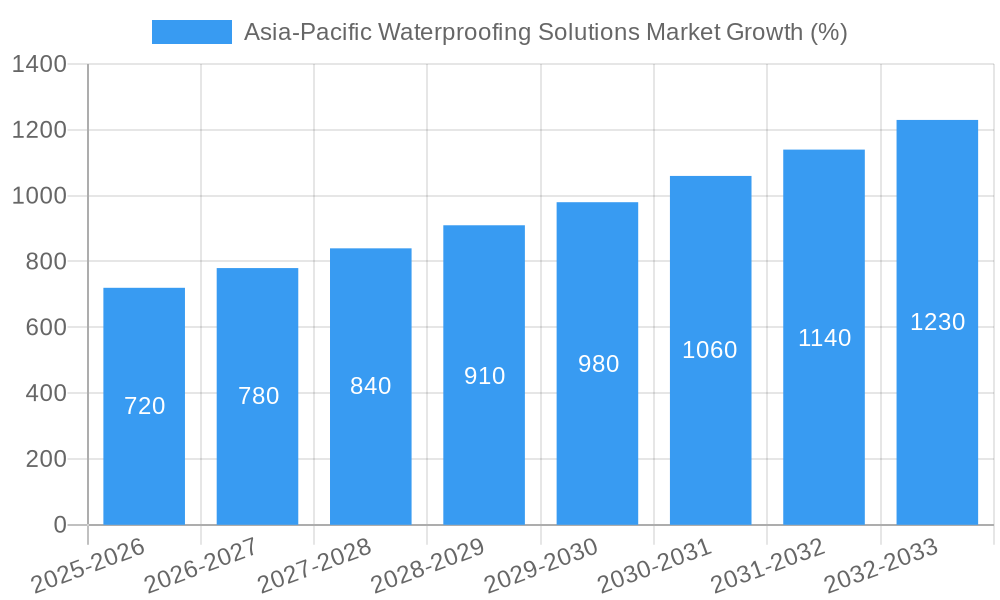

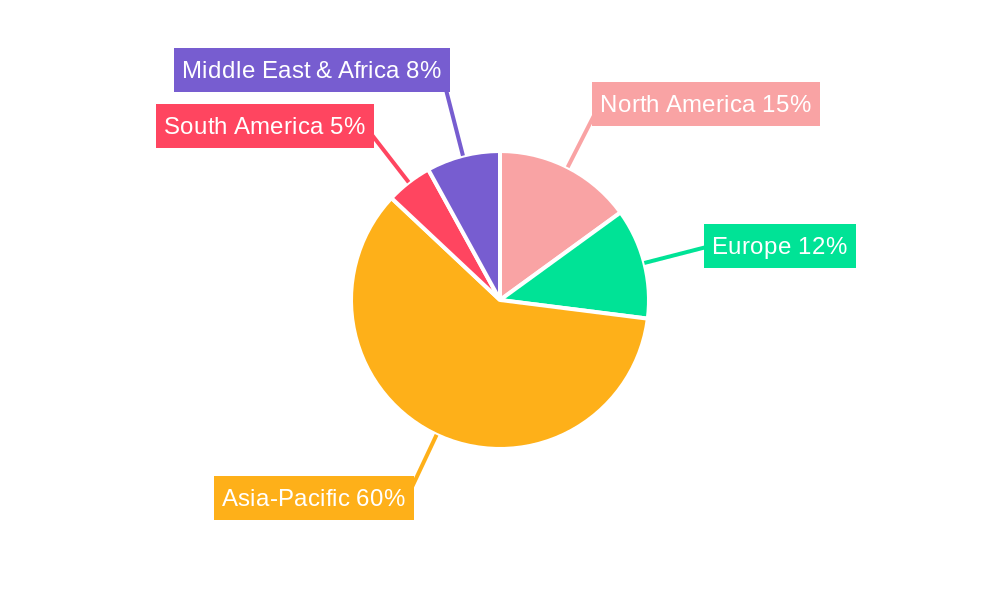

The Asia-Pacific waterproofing solutions market is experiencing robust growth, driven by factors such as rapid urbanization, increasing infrastructure development, and a rising awareness of the importance of building durability and longevity. The region's diverse climate, characterized by monsoons and high humidity in many areas, necessitates robust waterproofing solutions for residential, commercial, and industrial constructions. The market is witnessing a shift towards advanced waterproofing materials such as polyurethane membranes, liquid applied coatings, and high-performance sealants, owing to their superior performance and longer lifespan compared to traditional methods. This transition is further fueled by stringent building codes and regulations aimed at enhancing structural integrity and minimizing water damage. Significant investments in infrastructure projects, particularly in developing economies like India and China, are significantly boosting market demand. Furthermore, the increasing adoption of green building practices and the growing preference for sustainable waterproofing solutions are contributing to market expansion. While the exact market size in 2025 is unavailable, based on a projected CAGR from the provided historical period (2019-2024), and considering the current market trends described above, a reasonable estimate for the 2025 market size in the Asia-Pacific region would be in the range of $8-10 billion USD.

The forecast period (2025-2033) anticipates continued growth, fueled by ongoing infrastructure projects, expanding construction activities, and a heightened focus on sustainable building practices. Key players in the market are focusing on product innovation and strategic partnerships to enhance market penetration. The competitive landscape is characterized by a mix of multinational corporations and regional players, leading to intense competition and a focus on providing value-added services, including technical expertise and installation support. The market segmentation is diverse, encompassing various types of waterproofing materials, application methods, and end-use sectors. This segmentation provides opportunities for specialization and growth for both large and small market participants. The long-term outlook for the Asia-Pacific waterproofing solutions market remains positive, projecting substantial growth throughout the forecast period driven by the sustained expansion of the construction sector and the increasing adoption of advanced waterproofing technologies.

Asia-Pacific Waterproofing Solutions Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific waterproofing solutions market, encompassing market dynamics, growth trends, regional insights, product landscapes, and key player strategies. With a focus on the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The market is segmented by end-use sector (Commercial, Industrial & Institutional, Infrastructure, Residential) and sub-product (Chemicals, Loose Laid Sheet), offering granular insights into market performance and growth potential. The total market value in 2025 is estimated at xx Million.

Asia-Pacific Waterproofing Solutions Market Dynamics & Structure

The Asia-Pacific waterproofing solutions market is characterized by a moderately concentrated landscape, with key players like Sika AG, Saint-Gobain, and Oriental Yuhong holding significant market share. Technological innovation, driven by the increasing demand for sustainable and high-performance solutions, is a key growth driver. Stringent regulatory frameworks related to building codes and environmental concerns influence market dynamics. The market also experiences competition from substitute materials, such as traditional waterproofing methods. M&A activities, as evidenced by recent acquisitions like Sika's acquisition of MBCC Group, are reshaping the competitive landscape. The residential sector currently holds the largest market share, followed by the infrastructure sector, reflecting the region's rapid urbanization and infrastructure development.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on sustainable, high-performance materials like polyurethane membranes and self-adhesive bituminous membranes.

- Regulatory Framework: Compliance with building codes and environmental regulations significantly impacts product selection and market entry.

- Competitive Substitutes: Traditional waterproofing methods still hold a niche, but are gradually being replaced by more efficient solutions.

- M&A Activity: Significant consolidation observed, with larger players acquiring smaller companies to expand their product portfolio and market reach. Total M&A deal value in 2024 estimated at xx Million.

- End-user Demographics: Driven by rapid urbanization, increasing construction activity, and rising disposable incomes across various countries in the region.

Asia-Pacific Waterproofing Solutions Market Growth Trends & Insights

The Asia-Pacific waterproofing solutions market exhibits robust growth, driven by factors like increasing infrastructure development, rising construction activity, and growing awareness of the importance of building durability and longevity. The market size experienced significant expansion during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. Technological disruptions, such as the introduction of innovative waterproofing materials and advanced application techniques, are accelerating market adoption. Changing consumer preferences, shifting towards eco-friendly and high-performance solutions, further fuel market expansion. Market penetration rates are expected to increase steadily, reaching xx% by 2033.

(Note: XXX refers to data sources and methodologies used in generating the market size evolution, adoption rates, technological disruptions, and consumer behavior shifts analysis. Specific details should be included in the report body.)

Dominant Regions, Countries, or Segments in Asia-Pacific Waterproofing Solutions Market

China and India are the dominant markets in the Asia-Pacific waterproofing solutions market, owing to their booming construction industries and extensive infrastructure projects. The Infrastructure segment is witnessing the highest growth due to large-scale government investments in transportation, energy, and water management projects. The Commercial, Industrial & Institutional segment follows closely, driven by the expansion of commercial buildings and industrial facilities. The residential sector maintains a significant market share due to rising housing demand in rapidly urbanizing areas. Within sub-products, the chemicals segment holds a larger market share compared to the loose-laid sheet segment due to versatility and cost-effectiveness.

- Key Drivers (China & India):

- Massive infrastructure development projects.

- Rapid urbanization and rising construction activity.

- Government initiatives promoting sustainable building practices.

- Dominance Factors: High construction activity, large population, and significant government investment in infrastructure development.

- Growth Potential: High, driven by continued urbanization, industrialization, and infrastructure development.

Asia-Pacific Waterproofing Solutions Market Product Landscape

The Asia-Pacific waterproofing solutions market offers a diverse range of products, including polymeric membranes, bituminous membranes, cementitious coatings, and liquid-applied membranes. These products cater to various applications, encompassing roofing, basements, tunnels, bridges, and other structures. Continuous innovation focuses on enhancing product durability, water resistance, and longevity, leading to the development of self-healing membranes and high-performance coatings. Unique selling propositions include ease of application, improved adhesion, and environmental friendliness. Technological advancements in materials science have resulted in products with enhanced flexibility and resistance to extreme weather conditions.

Key Drivers, Barriers & Challenges in Asia-Pacific Waterproofing Solutions Market

Key Drivers:

- Rapid urbanization and infrastructure development.

- Increasing awareness of building durability and longevity.

- Government initiatives promoting sustainable building practices.

- Technological advancements leading to the development of high-performance materials.

Challenges & Restraints:

- Fluctuations in raw material prices.

- Stringent environmental regulations.

- Intense competition among market players.

- Supply chain disruptions due to geopolitical uncertainties. This led to a xx% increase in material costs in 2024, impacting profitability.

Emerging Opportunities in Asia-Pacific Waterproofing Solutions Market

- Growing demand for sustainable and eco-friendly waterproofing solutions.

- Increasing adoption of green building technologies.

- Development of innovative waterproofing applications for specific industries, such as renewable energy.

- Expansion into untapped markets in rural areas.

Growth Accelerators in the Asia-Pacific Waterproofing Solutions Market Industry

Technological advancements, strategic partnerships, and government support for infrastructure development are key growth accelerators. The development of self-healing membranes and smart waterproofing systems will further enhance market growth. Strategic collaborations between manufacturers and construction companies will improve product distribution and market penetration. Government initiatives promoting sustainable construction practices will also drive market growth.

Key Players Shaping the Asia-Pacific Waterproofing Solutions Market Market

- Soprem

- Hongyuan Waterproof Technology Group Co Ltd

- Saint-Gobain

- MBCC Group

- Fosroc Inc

- Ardex Group

- Sika AG

- Keshun Waterproof Technology Co ltd

- Lonseal Corporation

- Oriental Yuhong

Notable Milestones in Asia-Pacific Waterproofing Solutions Market Sector

- March 2023: Oriental Yuhong initiated a strategic cooperation agreement with Luoyang Longfeng Construction Investment Co., Ltd., expanding its product portfolio and resource base.

- May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group for collaborative research in waterproofing membranes and thermal insulation coatings.

- May 2023: Sika acquired MBCC Group, significantly impacting market consolidation and product offerings.

In-Depth Asia-Pacific Waterproofing Solutions Market Market Outlook

The Asia-Pacific waterproofing solutions market is poised for sustained growth, driven by continued urbanization, infrastructure development, and technological innovations. Strategic partnerships, investments in R&D, and expansion into new markets present significant opportunities for market players. The focus on sustainable and high-performance solutions will shape future market dynamics. The market is expected to reach xx Million by 2033, representing a strong growth trajectory.

Asia-Pacific Waterproofing Solutions Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Sub Product

-

2.1. Chemicals

-

2.1.1. By Technology

- 2.1.1.1. Epoxy-based

- 2.1.1.2. Polyurethane-based

- 2.1.1.3. Water-based

- 2.1.1.4. Other Technologies

-

2.1.1. By Technology

-

2.2. Membranes

- 2.2.1. Cold Liquid Applied

- 2.2.2. Fully Adhered Sheet

- 2.2.3. Hot Liquid Applied

- 2.2.4. Loose Laid Sheet

-

2.1. Chemicals

Asia-Pacific Waterproofing Solutions Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Waterproofing Solutions Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Banning/ Limiting Use of Plastics used in packaging applications

- 3.3. Market Restrains

- 3.3.1. ; Harmful Amines in Dyes; Paperless Green Initiatives

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Sub Product

- 5.2.1. Chemicals

- 5.2.1.1. By Technology

- 5.2.1.1.1. Epoxy-based

- 5.2.1.1.2. Polyurethane-based

- 5.2.1.1.3. Water-based

- 5.2.1.1.4. Other Technologies

- 5.2.1.1. By Technology

- 5.2.2. Membranes

- 5.2.2.1. Cold Liquid Applied

- 5.2.2.2. Fully Adhered Sheet

- 5.2.2.3. Hot Liquid Applied

- 5.2.2.4. Loose Laid Sheet

- 5.2.1. Chemicals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. China Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 10. Southeast Asia Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Soprem

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Hongyuan Waterproof Technology Group Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Saint-Gobain

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 MBCC Group

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Fosroc Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Ardex Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Sika AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Keshun Waterproof Technology Co ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Lonseal Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Oriental Yuhong

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Soprem

List of Figures

- Figure 1: Asia-Pacific Waterproofing Solutions Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Waterproofing Solutions Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 3: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 4: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 5: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 6: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 7: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Region 2019 & 2032

- Table 9: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 11: China Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 13: Japan Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 15: India Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 17: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 19: Southeast Asia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Southeast Asia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 21: Australia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 23: Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Asia-Pacific Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 25: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by End Use Sector 2019 & 2032

- Table 26: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by End Use Sector 2019 & 2032

- Table 27: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Sub Product 2019 & 2032

- Table 28: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Sub Product 2019 & 2032

- Table 29: Asia-Pacific Waterproofing Solutions Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: Asia-Pacific Waterproofing Solutions Market Volume K Tons Forecast, by Country 2019 & 2032

- Table 31: China Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 33: Japan Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Japan Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 35: South Korea Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: South Korea Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 37: India Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: India Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 39: Australia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Australia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 41: New Zealand Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: New Zealand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 43: Indonesia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Indonesia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 45: Malaysia Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Malaysia Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 47: Singapore Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Singapore Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 49: Thailand Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Thailand Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 51: Vietnam Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Vietnam Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

- Table 53: Philippines Asia-Pacific Waterproofing Solutions Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Philippines Asia-Pacific Waterproofing Solutions Market Volume (K Tons) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Waterproofing Solutions Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the Asia-Pacific Waterproofing Solutions Market?

Key companies in the market include Soprem, Hongyuan Waterproof Technology Group Co Ltd, Saint-Gobain, MBCC Group, Fosroc Inc, Ardex Group, Sika AG, Keshun Waterproof Technology Co ltd, Lonseal Corporation, Oriental Yuhong.

3. What are the main segments of the Asia-Pacific Waterproofing Solutions Market?

The market segments include End Use Sector, Sub Product.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Banning/ Limiting Use of Plastics used in packaging applications.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

; Harmful Amines in Dyes; Paperless Green Initiatives.

8. Can you provide examples of recent developments in the market?

May 2023: Oriental Yuhong signed a strategic cooperation agreement with Hebei Aorun Shunda Group to collaborate on multi-dimensional research in the fields of waterproofing membranes and thermal insulation coatings, among other solutions.May 2023: Sika, a global leader in construction chemicals, acquired the MBCC Group, including its waterproofing solutions, anchors & grouts, flooring resins, repair & rehabilitation chemicals, and other businesses, with the exception of its concrete admixture operations in Europe, North America, Australia, and New Zealand.March 2023: To further develop its portfolio of building products, including waterproofing solutions, Oriental Yuhong initiated a strategic cooperation agreement with Luoyang Longfeng Construction Investment Co., Ltd. This agreement is expected to result in the exchange of resources in the field of construction materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Waterproofing Solutions Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Waterproofing Solutions Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Waterproofing Solutions Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Waterproofing Solutions Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence