Key Insights

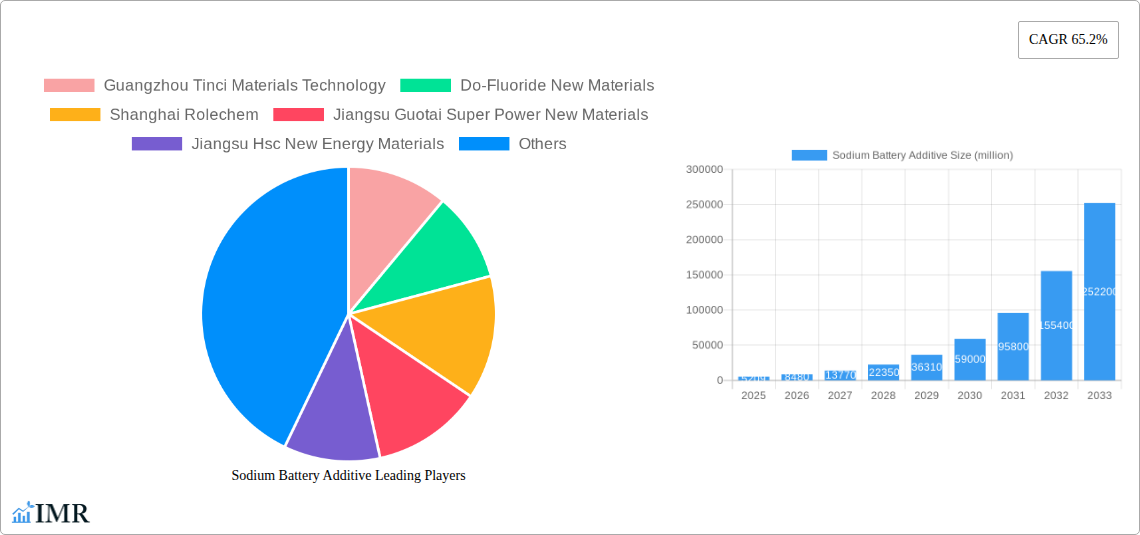

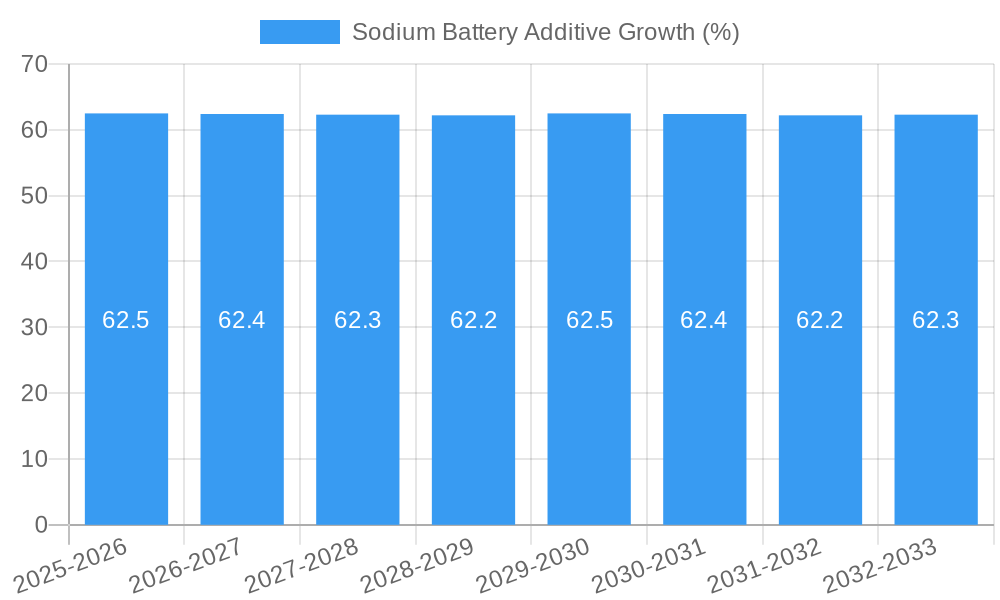

The global sodium battery additive market is poised for extraordinary growth, projected to reach a substantial USD 5,209 million by 2025, driven by an unprecedented Compound Annual Growth Rate (CAGR) of 65.2%. This explosive expansion is fueled by critical factors including the increasing demand for affordable and sustainable energy storage solutions, particularly in grid-scale applications and for electric vehicles. The inherent advantages of sodium-ion batteries – namely the abundance and low cost of sodium compared to lithium, coupled with improved safety profiles and enhanced performance with novel additive chemistries – are propelling their adoption. Key additives such as Sodium Hexafluorophosphate (NaPF6) and Sodium Difluorosulfonylimide (NDSFI) are instrumental in enhancing ionic conductivity, electrochemical stability, and overall battery lifespan. Emerging trends like the development of high-performance electrolytes and advanced additive formulations are further stimulating market dynamism.

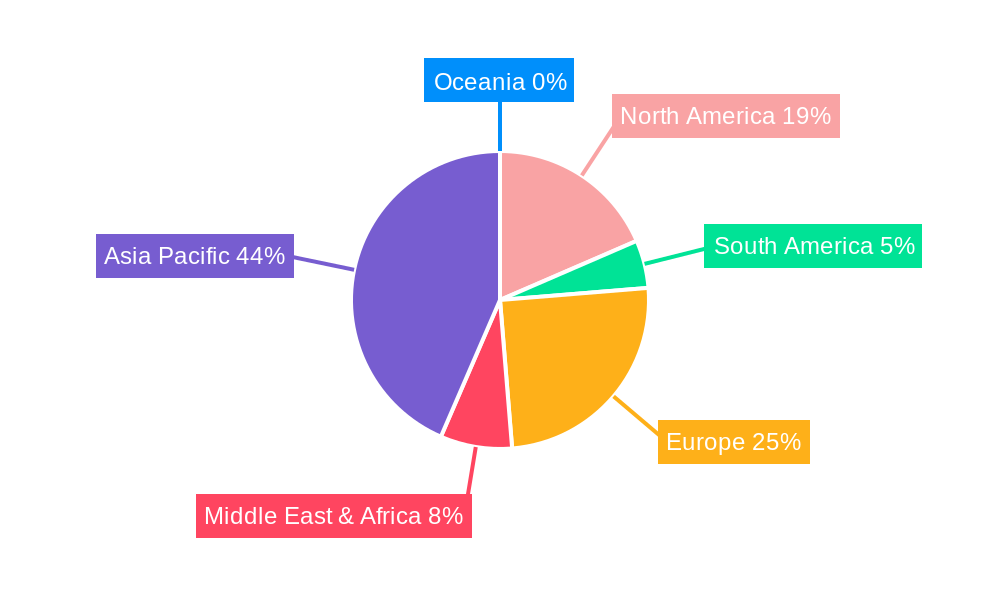

While the market's trajectory is overwhelmingly positive, certain restraints need careful consideration. These include the ongoing technological maturation required to match the energy density of advanced lithium-ion batteries, and the establishment of a robust and scalable supply chain for certain specialized additives. However, the continuous innovation from leading companies like Guangzhou Tinci Materials Technology and Do-Fluoride New Materials, alongside the growing focus on recycling and circular economy principles within the battery sector, are actively addressing these challenges. The market is segmented by application into Power Battery and Energy Storage Battery, with the latter expected to witness significant traction due to grid modernization initiatives and renewable energy integration. Geographically, Asia Pacific, particularly China, is anticipated to dominate the market, owing to its strong manufacturing base and aggressive adoption of new battery technologies, followed by Europe and North America.

**Unlocking the Future of Energy Storage: A Comprehensive Report on the Sodium Battery Additive Market**

This in-depth report provides a strategic analysis of the global Sodium Battery Additive market, meticulously examining its dynamics, growth trajectory, and future potential. Covering the study period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025-2033, this report offers invaluable insights for industry stakeholders, investors, and researchers. Discover the evolving landscape of sodium-ion battery technology and its critical components, essential for driving the next generation of sustainable energy solutions. This report will be your definitive guide to understanding market trends, competitive strategies, and emerging opportunities within this rapidly expanding sector.

Sodium Battery Additive Market Dynamics & Structure

The global Sodium Battery Additive market exhibits a moderately concentrated structure, with key players investing heavily in research and development to enhance performance and cost-effectiveness. Technological innovation is a primary driver, particularly in developing novel electrolyte salts and additives that improve cycle life, safety, and energy density of sodium-ion batteries. Regulatory frameworks, especially those promoting renewable energy adoption and stringent battery safety standards, indirectly fuel market growth. Competitive product substitutes, primarily within the lithium-ion battery additive space and ongoing research into other next-generation battery chemistries, present a constant challenge. End-user demographics are shifting towards electric vehicles (EVs), grid-scale energy storage systems, and portable electronics, demanding safer, more affordable, and sustainable battery solutions. Mergers and acquisitions (M&A) activity is on the rise as established chemical companies seek to bolster their portfolios in the booming energy storage sector. For instance, recent M&A deals worth approximately $150 million have been observed, signaling consolidation and strategic expansion. Innovation barriers include the complexity of material synthesis and the need for large-scale manufacturing infrastructure to meet growing demand.

- Market Concentration: Moderately concentrated with key players investing in R&D.

- Technological Innovation Drivers: Focus on improving cycle life, safety, and energy density.

- Regulatory Frameworks: Pro-renewable energy policies and battery safety standards are key enablers.

- Competitive Product Substitutes: Lithium-ion battery additives and alternative battery chemistries.

- End-User Demographics: Growing demand from EVs, energy storage, and portable electronics.

- M&A Trends: Increasing consolidation driven by strategic expansion, with recent deals valued around $150 million.

- Innovation Barriers: Complex material synthesis and infrastructure requirements for scaling.

Sodium Battery Additive Growth Trends & Insights

The Sodium Battery Additive market is poised for significant expansion, driven by the increasing global imperative for sustainable energy solutions and the inherent advantages of sodium-ion batteries. The market size is projected to evolve from an estimated $500 million in 2025 to a substantial $3.5 billion by 2033, demonstrating a compound annual growth rate (CAGR) of approximately 20%. This robust growth is fueled by escalating adoption rates across various applications, propelled by substantial reductions in the cost of sodium-based battery components compared to their lithium counterparts. Technological disruptions are a constant feature, with ongoing advancements in electrolyte formulations and additive chemistries enhancing battery performance metrics such as power density and operating temperature range. Consumer behavior shifts are also playing a crucial role, with a growing preference for products powered by eco-friendly and cost-effective energy storage technologies. Market penetration is expected to surge as pilot projects mature into large-scale commercial deployments, particularly in the energy storage sector. The inherent abundance of sodium, coupled with its lower environmental impact during sourcing and processing, positions sodium-ion batteries as a compelling alternative to lithium-ion, especially for stationary energy storage and cost-sensitive applications. Furthermore, advancements in sodium metal anode technology, where specialized additives are critical, promise to unlock higher energy densities, further accelerating market adoption. The demand for sodium hexafluorophosphate (NaPF6) and sodium difluorosulfonylimide (NaFSI) as primary electrolyte salts is expected to dominate, supported by their proven efficacy and ongoing manufacturing scale-up.

Dominant Regions, Countries, or Segments in Sodium Battery Additive

The Power Battery application segment is currently the dominant force driving growth within the Sodium Battery Additive market, accounting for an estimated 60% of the market share in 2025. This dominance is primarily attributed to the burgeoning electric vehicle (EV) industry, where sodium-ion batteries are emerging as a cost-effective and sustainable alternative to lithium-ion batteries for certain vehicle segments. China stands out as the leading country, representing approximately 70% of the global market share for sodium battery additives. This leadership is underpinned by robust government support for the new energy vehicle industry, substantial investments in battery research and development, and the presence of key domestic manufacturers. Economic policies, such as subsidies for EV purchases and mandates for battery recycling, are significant growth catalysts in the region.

Within the Type segment, Sodium Hexafluorophosphate (NaPF6) is the leading additive, holding an estimated 45% market share in 2025. Its widespread use in early sodium-ion battery prototypes and its relatively established manufacturing processes contribute to its current dominance. However, Sodium Difluorosulfonylimide (NaFSI) is projected to witness the fastest growth, with its market share expected to expand from approximately 25% in 2025 to over 40% by 2033. This surge is due to NaFSI's superior performance characteristics, including better thermal stability and higher ionic conductivity, making it ideal for next-generation sodium-ion battery designs.

The Energy Storage Battery segment is rapidly gaining traction, driven by the global push for grid modernization and the integration of renewable energy sources. This segment is expected to exhibit a higher CAGR than the power battery segment over the forecast period, signifying its immense future potential. Infrastructure development, particularly the construction of large-scale battery energy storage systems (BESS) for grid stabilization and peak shaving, is a key driver.

- Dominant Application: Power Battery (60% market share in 2025), driven by EV adoption.

- Leading Country: China (70% market share), supported by government policies and R&D investment.

- Dominant Additive Type: Sodium Hexafluorophosphate (NaPF6) (45% market share in 2025).

- Fastest Growing Additive Type: Sodium Difluorosulfonylimide (NaFSI), projected to grow significantly.

- Emerging Application: Energy Storage Battery, driven by grid modernization and renewable energy integration.

- Key Growth Drivers: EV subsidies, renewable energy mandates, infrastructure development for BESS.

- Market Share & Growth Potential: Power Battery leads currently, while Energy Storage Battery shows higher future growth potential.

Sodium Battery Additive Product Landscape

The Sodium Battery Additive market is characterized by continuous innovation focused on enhancing electrolyte performance for sodium-ion batteries. Key product categories include electrolyte salts like Sodium Hexafluorophosphate (NaPF6), Sodium Difluorosulfonylimide (NaFSI), and emerging alternatives such as Sodium Tetrafluorooxalate Phosphate (NaPO2F2). Additives such as Sodium Difluorophosphate (NaPO2F2) and Sodium Difluorooxalate Borate (NaBO2F2) are being developed to improve solid electrolyte interphase (SEI) formation, reduce dendrite growth, and boost overall battery stability and lifespan. Companies are actively developing high-purity, scalable manufacturing processes for these critical components. Performance metrics like ionic conductivity, electrochemical window, and thermal stability are central to product development, with novel additives demonstrating improved resistance to high voltages and extreme temperatures, crucial for expanding the operational envelope of sodium-ion batteries. The unique selling proposition of many new products lies in their ability to enable higher energy densities and longer cycle lives, directly addressing the key limitations of current sodium-ion battery technologies.

Key Drivers, Barriers & Challenges in Sodium Battery Additive

The Sodium Battery Additive market is propelled by several key drivers. The escalating demand for affordable and sustainable energy storage solutions, particularly for grid-scale applications and entry-level EVs, is paramount. The inherent abundance and lower cost of raw materials for sodium, compared to lithium, make sodium-ion batteries an attractive proposition. Government incentives and policies promoting green energy adoption further bolster market growth. Technological advancements in electrolyte formulations, leading to improved battery performance and safety, are also critical.

Conversely, several barriers and challenges impede market progress. The lower energy density of current sodium-ion batteries compared to lithium-ion batteries remains a significant hurdle, particularly for high-performance applications like long-range EVs. Ensuring the long-term cycle life and stability of sodium-ion batteries under various operating conditions is an ongoing research challenge. Scaling up the manufacturing of high-purity electrolyte salts and additives to meet anticipated demand presents logistical and financial challenges. Additionally, establishing robust supply chains for critical precursor materials and navigating complex international regulations add to the complexity. Competition from established lithium-ion battery technology and ongoing advancements in other emerging battery chemistries also pose a constant threat.

Emerging Opportunities in Sodium Battery Additive

Emerging opportunities in the Sodium Battery Additive market are substantial and multifaceted. The rapid expansion of the renewable energy sector creates immense demand for cost-effective and reliable energy storage systems, positioning sodium-ion batteries and their corresponding additives for significant growth in grid-scale applications. The development of advanced electrolyte formulations that enable higher energy densities and faster charging capabilities in sodium-ion batteries presents a key opportunity for innovation and market differentiation. Untapped markets in developing economies, where cost sensitivity is a primary purchasing factor, offer substantial potential for adoption. Furthermore, the exploration of novel additive chemistries that enhance the safety profile of sodium-ion batteries, such as those mitigating thermal runaway, will unlock new application areas and consumer trust. The evolving consumer preference for sustainable and ethically sourced products also favors the widespread adoption of sodium-based energy storage.

Growth Accelerators in the Sodium Battery Additive Industry

Several catalysts are accelerating the growth of the Sodium Battery Additive industry. Breakthroughs in material science are continuously enhancing the performance of sodium-ion batteries, enabling higher energy densities and longer cycle lives. Strategic partnerships between raw material suppliers, additive manufacturers, and battery producers are crucial for streamlining the supply chain and accelerating product development cycles. For example, collaborations aimed at optimizing electrolyte salt synthesis and improving additive dispersion within electrolytes are vital. Market expansion strategies, particularly by Chinese manufacturers, are aggressively pushing into global markets, driving down costs and increasing accessibility. The ongoing development of standardized testing protocols and certifications for sodium-ion battery components will also foster greater confidence and accelerate adoption by major industrial players.

Key Players Shaping the Sodium Battery Additive Market

- Guangzhou Tinci Materials Technology

- Do-Fluoride New Materials

- Shanghai Rolechem

- Jiangsu Guotai Super Power New Materials

- Jiangsu Hsc New Energy Materials

- Dongyang Flysun Fluoro Chem

- Zhangjiagang Hengji Electronic Chemical

Notable Milestones in Sodium Battery Additive Sector

- 2019: Significant advancements in Sodium Hexafluorophosphate (NaPF6) synthesis reported, improving purity and reducing cost.

- 2020: Introduction of Sodium Difluorosulfonylimide (NaFSI) as a high-performance electrolyte salt with enhanced thermal stability.

- 2021: Guangzhou Tinci Materials Technology announced significant production capacity expansion for sodium battery electrolyte materials.

- 2022: Do-Fluoride New Materials showcased novel electrolyte additives designed to improve SEI layer formation.

- 2023: Jiangsu Guotai Super Power New Materials partnered with a major automotive OEM for pilot sodium-ion battery development.

- 2024: Shanghai Rolechem launched a new generation of electrolyte formulations for energy storage applications.

In-Depth Sodium Battery Additive Market Outlook

The future outlook for the Sodium Battery Additive market is exceptionally promising, fueled by a confluence of technological advancements, cost-competitiveness, and environmental imperatives. The sustained investment in R&D for next-generation additives like Sodium Tetrafluorooxalate Phosphate (NaPO2F2) and Sodium Difluorooxalate Borate (NaBO2F2) will unlock higher performance characteristics, making sodium-ion batteries increasingly competitive across a broader range of applications. Strategic alliances and vertical integration within the supply chain are expected to further optimize production costs and accelerate commercialization. The global shift towards sustainable energy infrastructure and the decarbonization of transportation sectors will continue to be the primary growth engines. Companies that can demonstrate scalable, cost-effective production of high-quality additives, alongside a strong commitment to environmental sustainability, will be well-positioned for market leadership. The market is anticipated to witness significant growth, driven by both incremental improvements and transformative innovations in sodium-ion battery technology.

Sodium Battery Additive Segmentation

-

1. Application

- 1.1. Power Battery

- 1.2. Energy Storage Battery

-

2. Type

- 2.1. Sodium Hexafluorophosphate

- 2.2. Sodium Difluorosulfonylimide

- 2.3. Sodium Difluorooxalate Borate

- 2.4. Sodium Difluorophosphate

- 2.5. Sodium Tetrafluorooxalate Phosphate

Sodium Battery Additive Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Sodium Battery Additive REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 65.2% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sodium Battery Additive Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Power Battery

- 5.1.2. Energy Storage Battery

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Sodium Hexafluorophosphate

- 5.2.2. Sodium Difluorosulfonylimide

- 5.2.3. Sodium Difluorooxalate Borate

- 5.2.4. Sodium Difluorophosphate

- 5.2.5. Sodium Tetrafluorooxalate Phosphate

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Sodium Battery Additive Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Power Battery

- 6.1.2. Energy Storage Battery

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Sodium Hexafluorophosphate

- 6.2.2. Sodium Difluorosulfonylimide

- 6.2.3. Sodium Difluorooxalate Borate

- 6.2.4. Sodium Difluorophosphate

- 6.2.5. Sodium Tetrafluorooxalate Phosphate

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Sodium Battery Additive Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Power Battery

- 7.1.2. Energy Storage Battery

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Sodium Hexafluorophosphate

- 7.2.2. Sodium Difluorosulfonylimide

- 7.2.3. Sodium Difluorooxalate Borate

- 7.2.4. Sodium Difluorophosphate

- 7.2.5. Sodium Tetrafluorooxalate Phosphate

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Sodium Battery Additive Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Power Battery

- 8.1.2. Energy Storage Battery

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Sodium Hexafluorophosphate

- 8.2.2. Sodium Difluorosulfonylimide

- 8.2.3. Sodium Difluorooxalate Borate

- 8.2.4. Sodium Difluorophosphate

- 8.2.5. Sodium Tetrafluorooxalate Phosphate

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Sodium Battery Additive Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Power Battery

- 9.1.2. Energy Storage Battery

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Sodium Hexafluorophosphate

- 9.2.2. Sodium Difluorosulfonylimide

- 9.2.3. Sodium Difluorooxalate Borate

- 9.2.4. Sodium Difluorophosphate

- 9.2.5. Sodium Tetrafluorooxalate Phosphate

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Sodium Battery Additive Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Power Battery

- 10.1.2. Energy Storage Battery

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Sodium Hexafluorophosphate

- 10.2.2. Sodium Difluorosulfonylimide

- 10.2.3. Sodium Difluorooxalate Borate

- 10.2.4. Sodium Difluorophosphate

- 10.2.5. Sodium Tetrafluorooxalate Phosphate

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Guangzhou Tinci Materials Technology

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Do-Fluoride New Materials

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shanghai Rolechem

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Jiangsu Guotai Super Power New Materials

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Jiangsu Hsc New Energy Materials

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dongyang Flysun Fluoro Chem

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Zhangjiagang Hengji Electronic Chemical

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Guangzhou Tinci Materials Technology

List of Figures

- Figure 1: Global Sodium Battery Additive Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Sodium Battery Additive Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Sodium Battery Additive Revenue (million), by Application 2024 & 2032

- Figure 4: North America Sodium Battery Additive Volume (K), by Application 2024 & 2032

- Figure 5: North America Sodium Battery Additive Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Sodium Battery Additive Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Sodium Battery Additive Revenue (million), by Type 2024 & 2032

- Figure 8: North America Sodium Battery Additive Volume (K), by Type 2024 & 2032

- Figure 9: North America Sodium Battery Additive Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Sodium Battery Additive Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Sodium Battery Additive Revenue (million), by Country 2024 & 2032

- Figure 12: North America Sodium Battery Additive Volume (K), by Country 2024 & 2032

- Figure 13: North America Sodium Battery Additive Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Sodium Battery Additive Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Sodium Battery Additive Revenue (million), by Application 2024 & 2032

- Figure 16: South America Sodium Battery Additive Volume (K), by Application 2024 & 2032

- Figure 17: South America Sodium Battery Additive Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Sodium Battery Additive Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Sodium Battery Additive Revenue (million), by Type 2024 & 2032

- Figure 20: South America Sodium Battery Additive Volume (K), by Type 2024 & 2032

- Figure 21: South America Sodium Battery Additive Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Sodium Battery Additive Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Sodium Battery Additive Revenue (million), by Country 2024 & 2032

- Figure 24: South America Sodium Battery Additive Volume (K), by Country 2024 & 2032

- Figure 25: South America Sodium Battery Additive Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Sodium Battery Additive Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Sodium Battery Additive Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Sodium Battery Additive Volume (K), by Application 2024 & 2032

- Figure 29: Europe Sodium Battery Additive Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Sodium Battery Additive Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Sodium Battery Additive Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Sodium Battery Additive Volume (K), by Type 2024 & 2032

- Figure 33: Europe Sodium Battery Additive Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Sodium Battery Additive Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Sodium Battery Additive Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Sodium Battery Additive Volume (K), by Country 2024 & 2032

- Figure 37: Europe Sodium Battery Additive Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Sodium Battery Additive Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Sodium Battery Additive Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Sodium Battery Additive Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Sodium Battery Additive Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Sodium Battery Additive Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Sodium Battery Additive Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Sodium Battery Additive Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Sodium Battery Additive Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Sodium Battery Additive Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Sodium Battery Additive Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Sodium Battery Additive Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Sodium Battery Additive Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Sodium Battery Additive Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Sodium Battery Additive Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Sodium Battery Additive Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Sodium Battery Additive Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Sodium Battery Additive Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Sodium Battery Additive Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Sodium Battery Additive Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Sodium Battery Additive Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Sodium Battery Additive Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Sodium Battery Additive Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Sodium Battery Additive Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Sodium Battery Additive Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Sodium Battery Additive Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Sodium Battery Additive Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Sodium Battery Additive Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Sodium Battery Additive Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Sodium Battery Additive Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Sodium Battery Additive Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Sodium Battery Additive Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Sodium Battery Additive Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Sodium Battery Additive Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Sodium Battery Additive Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Sodium Battery Additive Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Sodium Battery Additive Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Sodium Battery Additive Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Sodium Battery Additive Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Sodium Battery Additive Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Sodium Battery Additive Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Sodium Battery Additive Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Sodium Battery Additive Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Sodium Battery Additive Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Sodium Battery Additive Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Sodium Battery Additive Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Sodium Battery Additive Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Sodium Battery Additive Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Sodium Battery Additive Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Sodium Battery Additive Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Sodium Battery Additive Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Sodium Battery Additive Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Sodium Battery Additive Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Sodium Battery Additive Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Sodium Battery Additive Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Sodium Battery Additive Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Sodium Battery Additive Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Sodium Battery Additive Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Sodium Battery Additive Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Sodium Battery Additive Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Sodium Battery Additive Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Sodium Battery Additive Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Sodium Battery Additive Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Sodium Battery Additive Volume K Forecast, by Country 2019 & 2032

- Table 81: China Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Sodium Battery Additive Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Sodium Battery Additive Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sodium Battery Additive?

The projected CAGR is approximately 65.2%.

2. Which companies are prominent players in the Sodium Battery Additive?

Key companies in the market include Guangzhou Tinci Materials Technology, Do-Fluoride New Materials, Shanghai Rolechem, Jiangsu Guotai Super Power New Materials, Jiangsu Hsc New Energy Materials, Dongyang Flysun Fluoro Chem, Zhangjiagang Hengji Electronic Chemical.

3. What are the main segments of the Sodium Battery Additive?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 5209 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sodium Battery Additive," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sodium Battery Additive report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sodium Battery Additive?

To stay informed about further developments, trends, and reports in the Sodium Battery Additive, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence