Key Insights

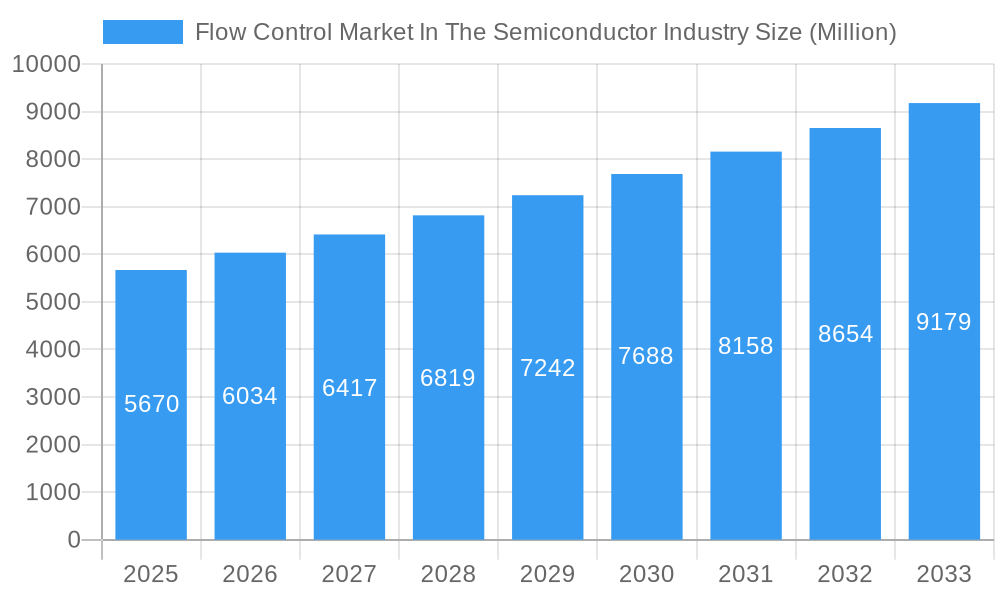

The global market for flow control solutions within the semiconductor industry is poised for significant expansion, projected to reach a valuation of $5.67 billion. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.41% from 2025 to 2033. This upward trajectory is primarily driven by the relentless demand for advanced semiconductor devices across a multitude of burgeoning sectors, including artificial intelligence, 5G technology, the Internet of Things (IoT), and automotive electronics. As these industries evolve, the need for increasingly sophisticated and precise control over fluid and gas flows within semiconductor manufacturing processes becomes paramount. Innovations in wafer fabrication, etching, deposition, and cleaning technologies directly translate to an increased requirement for high-purity, reliable, and meticulously controlled flow systems. Key market drivers include the ongoing miniaturization of transistors, the development of next-generation chip architectures, and the expansion of semiconductor manufacturing capacity worldwide to meet soaring global demand.

Flow Control Market In The Semiconductor Industry Market Size (In Billion)

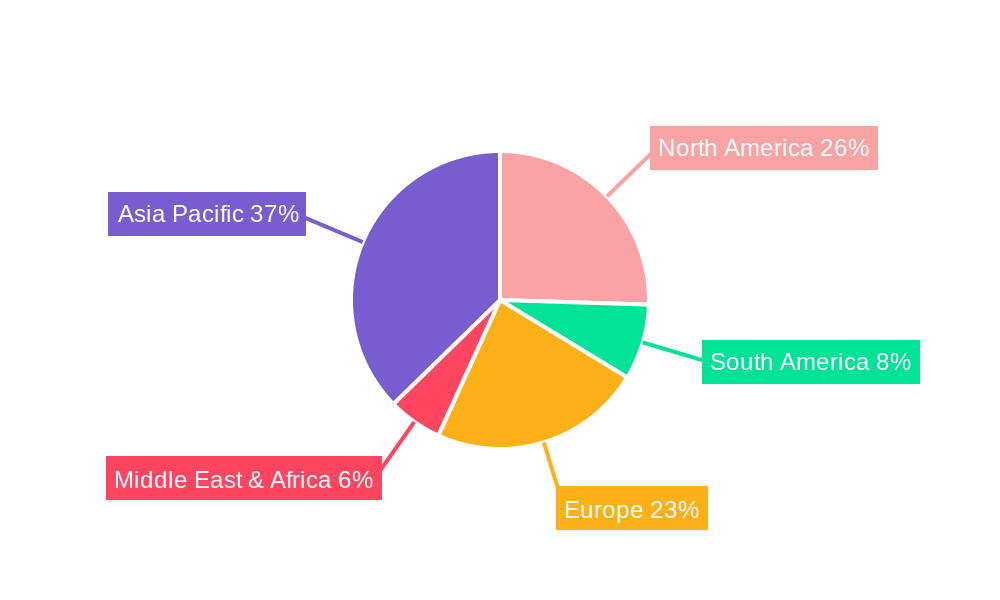

The market is segmented by component type, with vacuum components and specialized valves (ball, butterfly, gate, globe, and others) representing critical areas of innovation and adoption. Mechanical seals also play a vital role in ensuring the integrity and efficiency of these flow control systems, particularly in high-purity and vacuum environments. While the market exhibits strong growth potential, certain restraints, such as the high cost of advanced flow control technologies and stringent regulatory requirements for semiconductor manufacturing, need to be addressed by industry players. Geographically, Asia Pacific, led by China and Japan, is expected to dominate the market, owing to its established manufacturing prowess and significant investments in semiconductor R&D and production. North America and Europe will also remain substantial markets, driven by technological advancements and a growing focus on reshoring semiconductor manufacturing. Leading companies such as DuPont De Nemours Inc., Flowserve Corporation, and Parker-Hannifin Corporation are actively investing in research and development to offer cutting-edge solutions that cater to the evolving needs of the semiconductor industry.

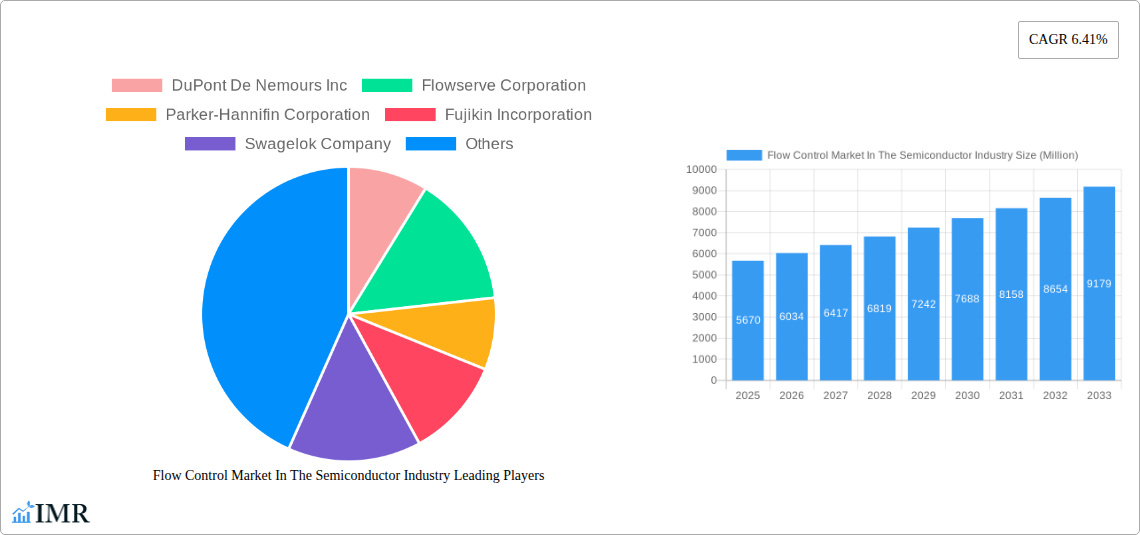

Flow Control Market In The Semiconductor Industry Company Market Share

Flow Control Market In The Semiconductor Industry: Comprehensive Market Analysis and Forecast (2019-2033)

This in-depth report provides a meticulously researched analysis of the global Flow Control Market in the Semiconductor Industry, encompassing a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033. Delving into critical segments like Vacuum, Valves (Ball, Butterfly, Gate, Globe, Other Valves), and Mechanical Seals, the report offers unparalleled insights into market dynamics, growth trajectories, and competitive landscapes. We leverage high-traffic keywords such as "semiconductor flow control," "vacuum valves," "ultra-high purity valves," "semiconductor manufacturing equipment," "process control in semiconductors," and "chemical mechanical planarization (CMP) flow control" to ensure maximum search engine visibility. This report is designed for industry professionals seeking to understand the intricate parent and child market structures, identify emerging opportunities, and strategize for future success in this rapidly evolving sector. All monetary values are presented in Million units for precise financial analysis.

Flow Control Market In The Semiconductor Industry Market Dynamics & Structure

The Flow Control Market in the Semiconductor Industry is characterized by a moderately concentrated landscape, driven by continuous technological innovation and stringent regulatory frameworks. Key players are investing heavily in R&D to develop solutions for increasingly complex semiconductor manufacturing processes, particularly in advanced nodes. The demand for ultra-high purity (UHP) components and precise flow management is paramount, leading to fierce competition and a focus on product differentiation. While market concentration exists, the emergence of specialized players catering to niche requirements creates dynamic competitive forces. Barriers to entry include high capital investment in precision manufacturing and adherence to rigorous quality standards. Mergers and acquisitions (M&A) play a significant role in shaping market structure, with larger entities acquiring innovative startups to expand their product portfolios and market reach. For instance, the acquisition of Malema Engineering Corporation by Dover in May 2022 signifies a trend towards consolidation and the integration of advanced flow measurement technologies. End-user demographics are predominantly large semiconductor fabrication plants (fabs) and original equipment manufacturers (OEMs), who exert considerable influence on product development and quality specifications. The continuous push for higher yields and smaller feature sizes necessitates constant evolution in flow control components.

- Market Concentration: Moderately concentrated with key global players.

- Technological Innovation Drivers: Demand for UHP, precision control, miniaturization, advanced process integration (e.g., Atomic Layer Deposition - ALD).

- Regulatory Frameworks: Strict quality control and environmental compliance standards.

- Competitive Product Substitutes: Limited direct substitutes for UHP and specialized applications; focus on performance enhancements within existing categories.

- End-User Demographics: Semiconductor fabs, OEMs, research institutions.

- M&A Trends: Strategic acquisitions to enhance technological capabilities and market share.

Flow Control Market In The Semiconductor Industry Growth Trends & Insights

The Flow Control Market in the Semiconductor Industry is projected to witness robust growth, fueled by the insatiable global demand for advanced semiconductors across various end-use industries, including artificial intelligence (AI), 5G, automotive, and the Internet of Things (IoT). The market size is expected to expand significantly from an estimated xx Million units in 2025 to xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx%. This growth is underpinned by increasing investments in new fab constructions and expansions worldwide, particularly in regions with strong government support for domestic semiconductor manufacturing. Technological disruptions, such as the advancement of EUV lithography and heterogeneous integration, are creating a demand for novel and highly precise flow control solutions. Consumer behavior shifts, influenced by the increasing reliance on smart devices and data-driven services, indirectly amplify the need for higher chip production volumes, thereby boosting the demand for flow control components. Adoption rates for next-generation flow control technologies, especially those offering enhanced efficiency, contamination control, and process repeatability, are on an upward trajectory. Market penetration is expected to deepen as more advanced manufacturing techniques become mainstream, requiring specialized flow control instrumentation and components. The pursuit of higher chip yields and reduced manufacturing costs by semiconductor manufacturers continues to be a primary driver for innovation and adoption of advanced flow control solutions.

Dominant Regions, Countries, or Segments in Flow Control Market In The Semiconductor Industry

The Valves segment, particularly Ball Valves and Other Valves optimized for ultra-high purity (UHP) applications, is anticipated to dominate the Flow Control Market in the Semiconductor Industry. This dominance is driven by their critical role in precisely controlling the flow of highly reactive and ultrapure gases and liquids essential for various semiconductor fabrication processes, including etching, deposition, and chemical mechanical planarization (CMP). The growing complexity of semiconductor manufacturing, with the advent of advanced nodes and new materials, necessitates highly reliable and contamination-free valve solutions. Asia-Pacific, spearheaded by Taiwan, South Korea, and China, is projected to be the leading region, capitalizing on its substantial semiconductor manufacturing capacity and ongoing investments in expanding fabrication facilities. Government initiatives aimed at bolstering domestic semiconductor production and supply chain resilience further propel growth in this region.

- Dominant Segment: Valves (Ball, Other Valves)

- Key Drivers: Critical for UHP gas and liquid delivery, precision process control, high reliability, contamination prevention.

- Market Share: Expected to hold the largest market share within the flow control components.

- Growth Potential: Driven by advanced node manufacturing, new materials, and increased fab capacity.

- Leading Region: Asia-Pacific

- Dominant Countries: Taiwan, South Korea, China.

- Key Drivers: Largest semiconductor manufacturing hubs, significant investments in new fabs, government support for semiconductor industry, growing demand for advanced chips.

- Economic Policies: Favorable policies promoting domestic production and R&D.

- Infrastructure: Well-established semiconductor manufacturing infrastructure and supply chains.

- Vacuum Segment: Remains a crucial segment due to the inherent vacuum requirements of many semiconductor processes. Advancements in vacuum pump technology and vacuum valves contribute to its sustained importance.

- Mechanical Seals Segment: Essential for maintaining the integrity of rotating and reciprocating equipment in semiconductor manufacturing, preventing leaks and contamination. Growth is linked to the expansion of manufacturing facilities and the demand for durable, high-performance seals.

Flow Control Market In The Semiconductor Industry Product Landscape

The product landscape within the Flow Control Market in the Semiconductor Industry is marked by continuous innovation focused on enhancing purity, precision, and reliability. Key product advancements include the development of ultra-high purity (UHP) diaphragm valves, such as the Swagelok ALD7, designed for improved service life and consistency, crucial for boosting chip yields. These valves offer enhanced flow capacity within standard footprints, facilitating integration into both legacy and new semiconductor manufacturing equipment. Innovations in smart valves with integrated sensors for real-time flow monitoring and diagnostics are also gaining traction, enabling proactive maintenance and process optimization. Furthermore, advancements in material science are leading to the development of specialized seals and components that can withstand corrosive chemicals and extreme temperatures prevalent in semiconductor fabrication. The focus remains on delivering seamless integration, minimizing particle generation, and ensuring absolute process control to meet the exacting demands of advanced chip manufacturing.

Key Drivers, Barriers & Challenges in Flow Control Market In The Semiconductor Industry

Key Drivers:

- Surging Demand for Advanced Semiconductors: Driven by AI, 5G, automotive, and IoT, necessitating increased chip production.

- Technological Advancements in Semiconductor Manufacturing: EUV lithography, advanced node scaling, and heterogeneous integration require more sophisticated flow control.

- Government Initiatives & Investments: Global efforts to bolster domestic semiconductor supply chains and capacity.

- Focus on Yield Improvement & Cost Reduction: Manufacturers seek flow control solutions that enhance efficiency and minimize defects.

Barriers & Challenges:

- Supply Chain Volatility: Geopolitical factors and raw material availability can impact production and lead times.

- Stringent Purity and Quality Requirements: Meeting exceptionally high standards for UHP applications demands significant investment and rigorous quality control.

- High Research and Development Costs: Developing cutting-edge flow control technologies is capital-intensive.

- Intense Competition: A mature market with established players and emerging specialized companies.

- Skilled Workforce Shortage: Demand for specialized engineers and technicians in precision manufacturing.

Emerging Opportunities in Flow Control Market In The Semiconductor Industry

Emerging opportunities within the Flow Control Market in the Semiconductor Industry lie in the development of intelligent, sensor-integrated flow control systems that offer real-time data analytics for predictive maintenance and process optimization. The increasing complexity of advanced packaging techniques and the growing demand for specialized materials in semiconductor manufacturing present a significant opportunity for custom-engineered flow control solutions. Furthermore, the expansion of semiconductor manufacturing into new geographic regions, particularly in emerging economies, opens up untapped markets for flow control components and related services. The focus on sustainable manufacturing practices also creates opportunities for developing energy-efficient flow control technologies.

Growth Accelerators in the Flow Control Market In The Semiconductor Industry Industry

Several factors are accelerating the growth of the Flow Control Market in the Semiconductor Industry. Foremost among these is the sustained global investment in advanced semiconductor manufacturing capacity, including the construction of new fabs and the expansion of existing ones. Technological breakthroughs, such as the continuous drive towards smaller and more powerful chips, necessitate higher precision and purity in flow control, spurring innovation and demand for next-generation components. Strategic partnerships between flow control equipment manufacturers and semiconductor fabs or equipment providers are crucial for co-developing solutions tailored to specific process needs. Market expansion strategies, including the penetration of emerging markets and the development of comprehensive service offerings, also contribute significantly to sustained growth.

Key Players Shaping the Flow Control Market In The Semiconductor Industry Market

- DuPont De Nemours Inc

- Flowserve Corporation

- Parker-Hannifin Corporation

- Fujikin Incorporation

- Swagelok Company

- Pfeiffer Vacuum Gmbh

- Atlas Copco AB

- Greene Tweed & Co Inc

- Festo SE & Co KG

- EnPro Industries Inc

- AESSEAL PLC

- Busch Holding Gmbh

- Freudenberg Group

- GEMÜ Holding GmbH & Co KG

- EKK Eagle SC Inc

- Gardner Denver (ingersoll Rand Inc )

- VAT Vakuumventile AG

Notable Milestones in Flow Control Market In The Semiconductor Industry Sector

- August 2022: Swagelok released a new ultrahigh-purity diaphragm valve, the Swagelok ALD7, designed to enhance service life and consistency for semiconductor fabricators, leading to improved chip yields. This innovation could be integrated into both legacy and new equipment, offering improved flow capacity within a standard 1.5-inch footprint.

- May 2022: Dover announced the acquisition of Malema Engineering Corporation, a key designer and manufacturer of critical flow measurement and control instruments for sectors including semiconductors. This acquisition was integrated into Dover's PSG business unit within its Pumps & Process Solutions segment, strengthening its portfolio in advanced flow control.

In-Depth Flow Control Market In The Semiconductor Industry Market Outlook

The future outlook for the Flow Control Market in the Semiconductor Industry remains exceptionally promising, driven by relentless innovation and expanding global demand for advanced semiconductors. Growth accelerators such as substantial government investments in semiconductor manufacturing infrastructure, particularly in Asia, and the ongoing technological race towards smaller, more powerful, and energy-efficient chips will continue to fuel the market. Strategic partnerships and collaborations between key players and semiconductor manufacturers are expected to foster the development of highly specialized and customized flow control solutions. The increasing adoption of advanced manufacturing techniques, including AI-driven process control and automation, will further propel the demand for intelligent and data-rich flow control components. The market is poised for significant expansion as the semiconductor industry continues to be a cornerstone of global technological advancement.

Flow Control Market In The Semiconductor Industry Segmentation

-

1. Type of Component

- 1.1. Vacuum

-

1.2. Valves

- 1.2.1. Ball

- 1.2.2. Butterfly

- 1.2.3. Gate

- 1.2.4. Globe

- 1.2.5. Other Valves

- 1.3. Mechanical Seals

Flow Control Market In The Semiconductor Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Flow Control Market In The Semiconductor Industry Regional Market Share

Geographic Coverage of Flow Control Market In The Semiconductor Industry

Flow Control Market In The Semiconductor Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Electronics Industry Driven By IIoT Digitalization

- 3.3. Market Restrains

- 3.3.1. ; Low Awareness Across the Population

- 3.4. Market Trends

- 3.4.1. Mechanical Seals to Register the Fastest Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flow Control Market In The Semiconductor Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. Vacuum

- 5.1.2. Valves

- 5.1.2.1. Ball

- 5.1.2.2. Butterfly

- 5.1.2.3. Gate

- 5.1.2.4. Globe

- 5.1.2.5. Other Valves

- 5.1.3. Mechanical Seals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. North America Flow Control Market In The Semiconductor Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type of Component

- 6.1.1. Vacuum

- 6.1.2. Valves

- 6.1.2.1. Ball

- 6.1.2.2. Butterfly

- 6.1.2.3. Gate

- 6.1.2.4. Globe

- 6.1.2.5. Other Valves

- 6.1.3. Mechanical Seals

- 6.1. Market Analysis, Insights and Forecast - by Type of Component

- 7. South America Flow Control Market In The Semiconductor Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type of Component

- 7.1.1. Vacuum

- 7.1.2. Valves

- 7.1.2.1. Ball

- 7.1.2.2. Butterfly

- 7.1.2.3. Gate

- 7.1.2.4. Globe

- 7.1.2.5. Other Valves

- 7.1.3. Mechanical Seals

- 7.1. Market Analysis, Insights and Forecast - by Type of Component

- 8. Europe Flow Control Market In The Semiconductor Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type of Component

- 8.1.1. Vacuum

- 8.1.2. Valves

- 8.1.2.1. Ball

- 8.1.2.2. Butterfly

- 8.1.2.3. Gate

- 8.1.2.4. Globe

- 8.1.2.5. Other Valves

- 8.1.3. Mechanical Seals

- 8.1. Market Analysis, Insights and Forecast - by Type of Component

- 9. Middle East & Africa Flow Control Market In The Semiconductor Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type of Component

- 9.1.1. Vacuum

- 9.1.2. Valves

- 9.1.2.1. Ball

- 9.1.2.2. Butterfly

- 9.1.2.3. Gate

- 9.1.2.4. Globe

- 9.1.2.5. Other Valves

- 9.1.3. Mechanical Seals

- 9.1. Market Analysis, Insights and Forecast - by Type of Component

- 10. Asia Pacific Flow Control Market In The Semiconductor Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type of Component

- 10.1.1. Vacuum

- 10.1.2. Valves

- 10.1.2.1. Ball

- 10.1.2.2. Butterfly

- 10.1.2.3. Gate

- 10.1.2.4. Globe

- 10.1.2.5. Other Valves

- 10.1.3. Mechanical Seals

- 10.1. Market Analysis, Insights and Forecast - by Type of Component

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 DuPont De Nemours Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Flowserve Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Parker-Hannifin Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fujikin Incorporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Swagelok Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Pfeiffer Vacuum Gmbh

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Atlas Copco AB

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Greene Tweed & Co Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Festo SE & Co KG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 EnPro Industries Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 AESSEAL PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Busch Holding Gmbh

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Freudenberg Group

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 GEMÜ Holding GmbH & Co KG

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 EKK Eagle SC Inc

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Gardner Denver (ingersoll Rand Inc )

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 VAT Vakuumventile AG

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 DuPont De Nemours Inc

List of Figures

- Figure 1: Global Flow Control Market In The Semiconductor Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Flow Control Market In The Semiconductor Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 3: North America Flow Control Market In The Semiconductor Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 4: North America Flow Control Market In The Semiconductor Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Flow Control Market In The Semiconductor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Flow Control Market In The Semiconductor Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 7: South America Flow Control Market In The Semiconductor Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 8: South America Flow Control Market In The Semiconductor Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Flow Control Market In The Semiconductor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Flow Control Market In The Semiconductor Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 11: Europe Flow Control Market In The Semiconductor Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 12: Europe Flow Control Market In The Semiconductor Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Flow Control Market In The Semiconductor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Flow Control Market In The Semiconductor Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 15: Middle East & Africa Flow Control Market In The Semiconductor Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 16: Middle East & Africa Flow Control Market In The Semiconductor Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Flow Control Market In The Semiconductor Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Flow Control Market In The Semiconductor Industry Revenue (Million), by Type of Component 2025 & 2033

- Figure 19: Asia Pacific Flow Control Market In The Semiconductor Industry Revenue Share (%), by Type of Component 2025 & 2033

- Figure 20: Asia Pacific Flow Control Market In The Semiconductor Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Flow Control Market In The Semiconductor Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 2: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 4: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 9: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 14: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 25: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Type of Component 2020 & 2033

- Table 33: Global Flow Control Market In The Semiconductor Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Flow Control Market In The Semiconductor Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flow Control Market In The Semiconductor Industry?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the Flow Control Market In The Semiconductor Industry?

Key companies in the market include DuPont De Nemours Inc, Flowserve Corporation, Parker-Hannifin Corporation, Fujikin Incorporation, Swagelok Company, Pfeiffer Vacuum Gmbh, Atlas Copco AB, Greene Tweed & Co Inc, Festo SE & Co KG, EnPro Industries Inc, AESSEAL PLC, Busch Holding Gmbh, Freudenberg Group, GEMÜ Holding GmbH & Co KG, EKK Eagle SC Inc, Gardner Denver (ingersoll Rand Inc ), VAT Vakuumventile AG.

3. What are the main segments of the Flow Control Market In The Semiconductor Industry?

The market segments include Type of Component.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Electronics Industry Driven By IIoT Digitalization.

6. What are the notable trends driving market growth?

Mechanical Seals to Register the Fastest Growth.

7. Are there any restraints impacting market growth?

; Low Awareness Across the Population.

8. Can you provide examples of recent developments in the market?

August 2022: Swagelok released a new ultrahigh-purity diaphragm valve to deliver both the service life and consistency necessary for semiconductor fabricators to improve chip yields. The Swagelok ALD7 could be integrated into either legacy equipment or new tools to provide improved flow capacity in the same 1.5-inch footprint as existing valves.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flow Control Market In The Semiconductor Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flow Control Market In The Semiconductor Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flow Control Market In The Semiconductor Industry?

To stay informed about further developments, trends, and reports in the Flow Control Market In The Semiconductor Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence