Key Insights

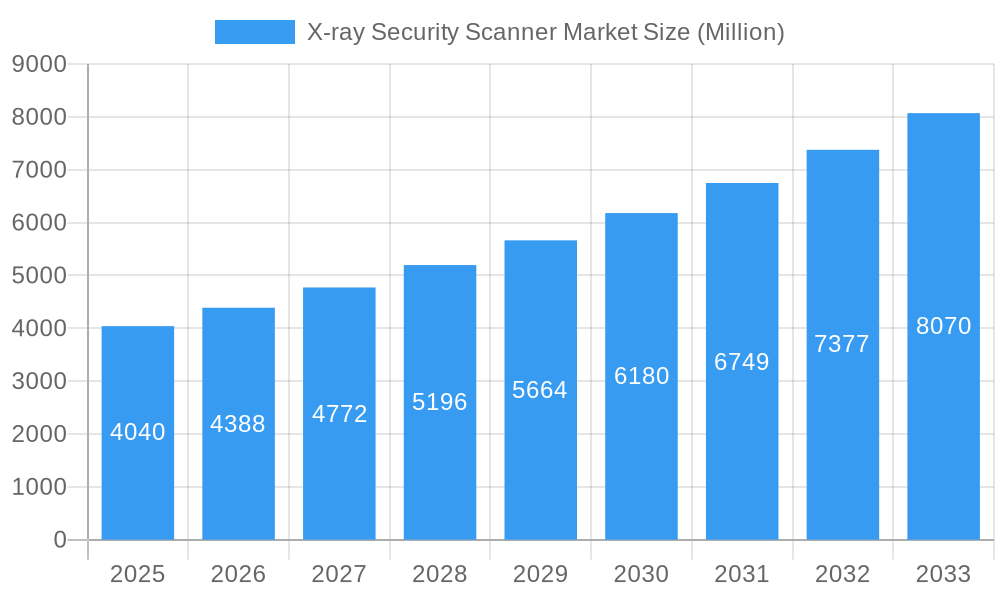

The global X-ray Security Scanner Market is poised for significant expansion, projected to reach a substantial valuation of $4.04 billion by 2025. This growth trajectory is underpinned by a robust Compound Annual Growth Rate (CAGR) of 8.89%, indicating a dynamic and expanding market over the forecast period of 2025-2033. The increasing global focus on security across various sectors, including commercial enterprises, law enforcement, and especially aviation and transportation, is a primary driver. Heightened concerns about terrorism, cargo screening regulations, and the need for efficient baggage inspection are fueling demand for advanced X-ray security scanning solutions. Emerging technologies in image processing, artificial intelligence for threat detection, and miniaturization of scanning equipment are further propelling market growth, making scanners more effective and accessible.

X-ray Security Scanner Market Market Size (In Billion)

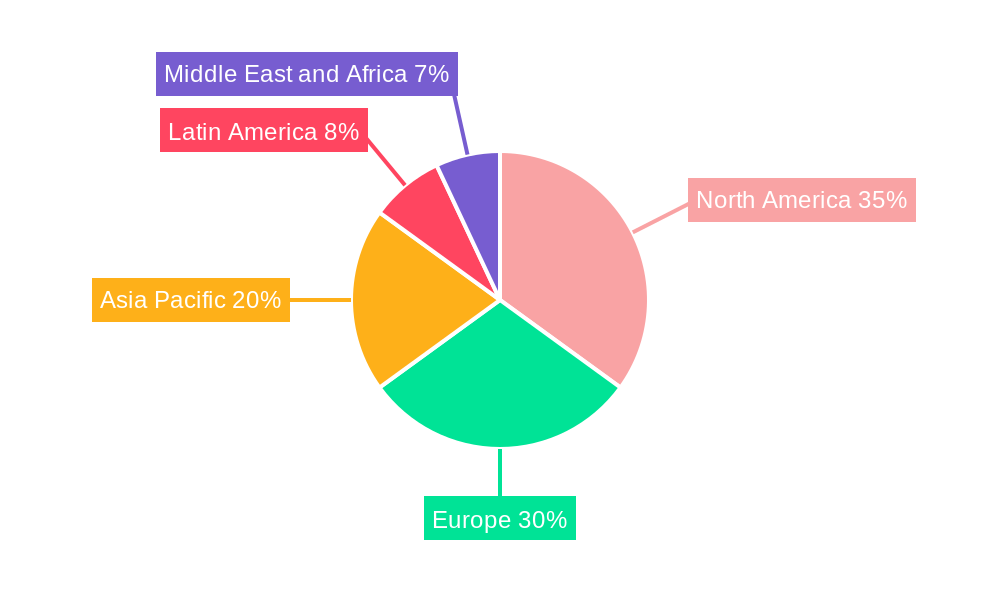

The market is segmented by application, encompassing both people and product screening (mail, parcels, cargo, and baggage). The end-user industries are diverse, ranging from commercial and law enforcement to aviation and transportation, with each segment presenting unique growth opportunities. The aviation and transportation sector, in particular, is expected to be a dominant force due to stringent international security mandates and the sheer volume of passenger and cargo traffic. Key industry players like Astrophysics Inc., Smiths Detection Inc., and Rapiscan Systems Inc. are at the forefront of innovation, developing sophisticated systems that enhance detection capabilities and operational efficiency. Despite the positive outlook, potential restraints could include the high initial investment costs for advanced systems and the need for continuous technological upgrades to stay ahead of evolving threats. Geographically, North America and Europe are expected to remain dominant markets, driven by established security infrastructure and high spending on advanced security technologies, while the Asia Pacific region presents significant growth potential due to rapid infrastructure development and increasing security consciousness.

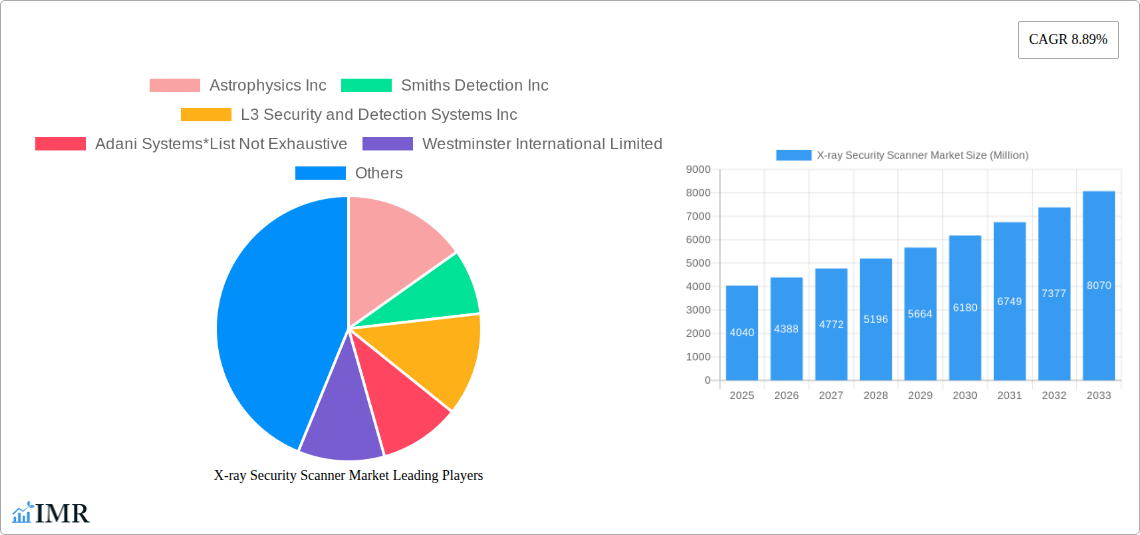

X-ray Security Scanner Market Company Market Share

X-ray Security Scanner Market: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a comprehensive analysis of the global X-ray Security Scanner market, a critical segment within the broader security screening technology landscape. Focusing on the period from 2019 to 2033, with a base year of 2025, this study delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, and emerging opportunities. We leverage high-traffic keywords such as "X-ray security scanners," "threat detection," "screening technology," "airport security," "cargo screening," and "mail screening" to ensure maximum visibility and reach for industry professionals, policymakers, and investors. The report meticulously breaks down the market by application (People, Mail and Parcel, Cargo and Baggage) and end-user industry (Commercial, Law Enforcement, Aviation and Transportation, Other End-user Industries), providing granular insights into market segmentation and growth potential. Values are presented in Million units for clarity and ease of comparison.

X-ray Security Scanner Market Market Dynamics & Structure

The global X-ray Security Scanner market is characterized by a moderate to high market concentration, driven by a limited number of established players and significant capital investment required for research, development, and manufacturing. Technological innovation is a primary driver, with continuous advancements in imaging resolution, artificial intelligence for threat detection, and miniaturization of scanner components. Regulatory frameworks, particularly those mandated by aviation authorities and customs agencies worldwide, play a pivotal role in shaping market demand and product specifications. Competitive product substitutes, while present in certain niche applications, are largely unable to replicate the comprehensive threat detection capabilities of advanced X-ray scanners. End-user demographics are diverse, spanning individuals passing through checkpoints to vast quantities of mail, parcels, and cargo. Mergers and acquisitions (M&A) trends are indicative of strategic consolidation, with larger entities acquiring smaller innovative companies to expand their product portfolios and market reach. For instance, the historical period (2019-2024) has seen several strategic acquisitions aimed at bolstering technological capabilities in AI-driven threat identification.

- Market Concentration: Dominated by a few key players, with strategies focused on product differentiation and global distribution networks.

- Technological Innovation Drivers: Increasing sophistication of AI for automated threat recognition, enhanced image clarity, and integration with data analytics platforms.

- Regulatory Frameworks: Stringent security mandates from bodies like TSA (Transportation Security Administration) and ICAO (International Civil Aviation Organization) are critical market determinants.

- Competitive Product Substitutes: Limited alternatives for comprehensive threat screening of opaque objects and complex materials.

- End-User Demographics: Broad spectrum including government agencies, private security firms, logistics companies, and manufacturing facilities.

- M&A Trends: Strategic acquisitions to gain access to new technologies, expand market share, and achieve economies of scale, with an estimated xx M&A deals in the past five years.

X-ray Security Scanner Market Growth Trends & Insights

The X-ray Security Scanner market is poised for robust growth, propelled by escalating global security concerns and the ever-present threat of illicit activities. The market size evolution is demonstrably upward, driven by an increasing adoption rate across various end-user industries. Technological disruptions, such as the integration of dual-view imaging and advanced detection algorithms, are enhancing scanner efficiency and accuracy, thereby shortening inspection times and improving throughput. Consumer behavior shifts, particularly the growing reliance on e-commerce and the subsequent surge in mail and parcel volume, are creating sustained demand for sophisticated screening solutions. The market penetration of advanced X-ray scanners is steadily increasing, moving beyond traditional aviation hubs to encompass diverse commercial applications, including critical infrastructure, event security, and high-volume logistics centers. The forecast period (2025–2033) anticipates a significant CAGR, estimated at xx%, underscoring the market’s strong growth trajectory. The continuous need to counter evolving threats, coupled with government investments in homeland security, further solidifies the market's expansion. Innovations in detector technology and software analytics are key factors in this sustained growth, enabling scanners to identify a wider range of threats with greater precision.

Dominant Regions, Countries, or Segments in X-ray Security Scanner Market

The Aviation and Transportation end-user industry segment is currently the dominant force driving growth in the global X-ray Security Scanner market. This dominance is primarily attributed to the critical need for stringent security measures in airports, seaports, and railway stations worldwide. The sheer volume of passenger traffic and the constant flow of cargo necessitate advanced screening technologies to detect threats effectively and efficiently. North America, particularly the United States, has historically been a leading region due to its substantial investments in homeland security and advanced airport infrastructure. However, the Asia-Pacific region is emerging as a significant growth engine, fueled by rapid infrastructure development, a burgeoning aviation sector, and increasing security awareness. Key drivers for this regional dominance include:

- Economic Policies: Government initiatives and increased defense spending aimed at enhancing national security.

- Infrastructure Development: Expansion of airports, ports, and transportation networks demanding comprehensive security screening solutions.

- Regulatory Mandates: Strict adherence to international aviation and transportation security standards.

- Technological Adoption: Early adoption of advanced X-ray security scanner technologies to meet evolving threat landscapes.

Within the Aviation and Transportation segment, the Cargo and Baggage application sub-segment is experiencing particularly rapid expansion. The growth in global trade and e-commerce has led to an exponential increase in the volume of goods and luggage requiring screening. This has spurred demand for high-throughput, multi-energy X-ray scanners capable of detecting a wide array of prohibited items and threats. The market share of this sub-segment is estimated to be xx% of the total X-ray security scanner market in the base year 2025. The increasing focus on supply chain security and the need to prevent the smuggling of contraband and dangerous materials further bolster the importance of this application.

X-ray Security Scanner Market Product Landscape

The X-ray Security Scanner market is witnessing a wave of product innovations designed to enhance detection capabilities and operational efficiency. Key advancements include the development of dual-view scanners, which provide horizontal and vertical imaging of screened objects, significantly improving the detection of concealed items. Furthermore, the integration of Artificial Intelligence (AI) and machine learning algorithms is revolutionizing threat identification, enabling scanners to distinguish between benign and hazardous materials with unprecedented accuracy. These innovations are crucial for applications involving people, mail and parcel screening, and cargo and baggage inspection. The performance metrics are continually improving, with faster scanning speeds and higher resolution imaging becoming standard. Unique selling propositions often revolve around the scanners' ability to detect specific threats like explosives, narcotics, and weapons, while also offering user-friendly interfaces and robust data management capabilities.

Key Drivers, Barriers & Challenges in X-ray Security Scanner Market

Key Drivers:

- Rising Global Security Threats: Persistent concerns over terrorism, smuggling, and criminal activities necessitate advanced screening solutions.

- Government Mandates and Investments: Increased public spending on homeland security and border protection drives demand.

- Technological Advancements: Continuous innovation in imaging, AI, and detector technology enhances scanner performance.

- Growth in Aviation and Transportation: Expanding air travel and global trade fuels the need for efficient security screening.

- E-commerce Boom: The surge in mail and parcel volumes requires sophisticated screening for logistics.

Barriers & Challenges:

- High Initial Investment Costs: The capital expenditure for advanced X-ray security scanners can be substantial, posing a barrier for smaller organizations.

- Regulatory Compliance Hurdles: Navigating complex and evolving international security regulations can be challenging.

- Technological Obsolescence: Rapid advancements mean that older models can become outdated quickly, requiring frequent upgrades.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of critical components and lead to production delays.

- Skilled Workforce Requirement: Operating and maintaining advanced X-ray scanners requires trained personnel, which can be a challenge to source. The estimated cost of a significant equipment upgrade can range from xx to xx Million units.

Emerging Opportunities in X-ray Security Scanner Market

Emerging opportunities in the X-ray Security Scanner market lie in the expansion of advanced screening solutions into non-traditional sectors. The growing emphasis on critical infrastructure security, encompassing power plants, water treatment facilities, and data centers, presents a significant untapped market. Furthermore, the development of more compact and portable X-ray scanners offers opportunities for deployment in localized security operations and rapid response scenarios. Innovative applications, such as the use of AI-powered scanners for non-destructive testing in industrial settings, are also gaining traction. Evolving consumer preferences for seamless and efficient security experiences are driving demand for integrated systems that minimize passenger or cargo dwell times, creating opportunities for vendors offering comprehensive, end-to-end security solutions. The potential for integration with other sensor technologies for multi-modal threat detection is another promising avenue.

Growth Accelerators in the X-ray Security Scanner Market Industry

The growth accelerators in the X-ray Security Scanner industry are primarily driven by continuous technological breakthroughs and strategic market expansion initiatives. The ongoing development of AI-driven threat detection algorithms, capable of identifying increasingly sophisticated threats with higher accuracy, is a significant catalyst. Strategic partnerships between scanner manufacturers and software developers are fostering innovation and enabling the creation of integrated security ecosystems. Market expansion strategies, including penetration into emerging economies with rapidly growing transportation infrastructure and increasing security consciousness, are further propelling growth. Government initiatives focused on modernizing security infrastructure and investing in advanced surveillance technologies also play a crucial role. The anticipated market expansion into sectors beyond traditional aviation and law enforcement will further cement long-term growth.

Key Players Shaping the X-ray Security Scanner Market Market

- Astrophysics Inc

- Smiths Detection Inc

- L3 Security and Detection Systems Inc

- Adani Systems

- Westminster International Limited

- Rapiscan Systems Inc

- Autoclear LLC

- Aventura Technologies Inc

Notable Milestones in X-ray Security Scanner Market Sector

- August 2023: Smiths Detection launches the SDX 100100 DV series, comprising two dual-view X-ray scanners, enhancing inspection capabilities for tightly packed objects and reducing inspection times.

In-Depth X-ray Security Scanner Market Market Outlook

The X-ray Security Scanner market is projected to experience sustained and robust growth throughout the forecast period (2025–2033). Growth accelerators, including advancements in AI-powered threat detection and the expansion into new end-user industries like critical infrastructure and logistics, will continue to fuel market expansion. Strategic partnerships and a focus on developing integrated security solutions will be key to capturing market share. The increasing global emphasis on security and the need for efficient, reliable threat detection systems position the X-ray Security Scanner market for significant future potential. The market outlook is optimistic, with continuous innovation and evolving security demands creating a dynamic and expanding landscape for industry stakeholders.

X-ray Security Scanner Market Segmentation

-

1. Application

- 1.1. People

-

1.2. Product

- 1.2.1. Mail and Parcel

- 1.2.2. Cargo and Baggage

-

2. End-user Industry

- 2.1. Commercial

- 2.2. Law Enforcement

- 2.3. Aviation and Transportation

- 2.4. Other End-user Industries

X-ray Security Scanner Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Italy

- 2.4. France

- 2.5. Rest of the Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia and New Zealand

- 3.6. Rest of the Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Mexico

- 4.3. Rest of Latin America

- 5. Middle East and Africa

X-ray Security Scanner Market Regional Market Share

Geographic Coverage of X-ray Security Scanner Market

X-ray Security Scanner Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.89% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Number of Terror Attacks; Increasing Smuggling of Illegal Goods Across Borders

- 3.3. Market Restrains

- 3.3.1. High Investment Costs for On-Premise Solutions; Lack of Skilled Professionals

- 3.4. Market Trends

- 3.4.1. Aviation and Transportation Segment to Occupy Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global X-ray Security Scanner Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. People

- 5.1.2. Product

- 5.1.2.1. Mail and Parcel

- 5.1.2.2. Cargo and Baggage

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Commercial

- 5.2.2. Law Enforcement

- 5.2.3. Aviation and Transportation

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America X-ray Security Scanner Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. People

- 6.1.2. Product

- 6.1.2.1. Mail and Parcel

- 6.1.2.2. Cargo and Baggage

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Commercial

- 6.2.2. Law Enforcement

- 6.2.3. Aviation and Transportation

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe X-ray Security Scanner Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. People

- 7.1.2. Product

- 7.1.2.1. Mail and Parcel

- 7.1.2.2. Cargo and Baggage

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Commercial

- 7.2.2. Law Enforcement

- 7.2.3. Aviation and Transportation

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific X-ray Security Scanner Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. People

- 8.1.2. Product

- 8.1.2.1. Mail and Parcel

- 8.1.2.2. Cargo and Baggage

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Commercial

- 8.2.2. Law Enforcement

- 8.2.3. Aviation and Transportation

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America X-ray Security Scanner Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. People

- 9.1.2. Product

- 9.1.2.1. Mail and Parcel

- 9.1.2.2. Cargo and Baggage

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Commercial

- 9.2.2. Law Enforcement

- 9.2.3. Aviation and Transportation

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa X-ray Security Scanner Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. People

- 10.1.2. Product

- 10.1.2.1. Mail and Parcel

- 10.1.2.2. Cargo and Baggage

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Commercial

- 10.2.2. Law Enforcement

- 10.2.3. Aviation and Transportation

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Astrophysics Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Smiths Detection Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 L3 Security and Detection Systems Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Adani Systems*List Not Exhaustive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Westminster International Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Rapiscan Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Autoclear LLC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aventura Technologies Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.1 Astrophysics Inc

List of Figures

- Figure 1: Global X-ray Security Scanner Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America X-ray Security Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America X-ray Security Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America X-ray Security Scanner Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America X-ray Security Scanner Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America X-ray Security Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America X-ray Security Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe X-ray Security Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe X-ray Security Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe X-ray Security Scanner Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe X-ray Security Scanner Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe X-ray Security Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe X-ray Security Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific X-ray Security Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific X-ray Security Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific X-ray Security Scanner Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia Pacific X-ray Security Scanner Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia Pacific X-ray Security Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific X-ray Security Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America X-ray Security Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America X-ray Security Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America X-ray Security Scanner Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America X-ray Security Scanner Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America X-ray Security Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America X-ray Security Scanner Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa X-ray Security Scanner Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa X-ray Security Scanner Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa X-ray Security Scanner Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa X-ray Security Scanner Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa X-ray Security Scanner Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa X-ray Security Scanner Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global X-ray Security Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global X-ray Security Scanner Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global X-ray Security Scanner Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global X-ray Security Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global X-ray Security Scanner Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global X-ray Security Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global X-ray Security Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: Global X-ray Security Scanner Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 11: Global X-ray Security Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Germany X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of the Europe X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global X-ray Security Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global X-ray Security Scanner Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 19: Global X-ray Security Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: China X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: India X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Japan X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: South Korea X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Australia and New Zealand X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Rest of the Asia Pacific X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Global X-ray Security Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 27: Global X-ray Security Scanner Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 28: Global X-ray Security Scanner Market Revenue Million Forecast, by Country 2020 & 2033

- Table 29: Brazil X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Mexico X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Latin America X-ray Security Scanner Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global X-ray Security Scanner Market Revenue Million Forecast, by Application 2020 & 2033

- Table 33: Global X-ray Security Scanner Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 34: Global X-ray Security Scanner Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the X-ray Security Scanner Market?

The projected CAGR is approximately 8.89%.

2. Which companies are prominent players in the X-ray Security Scanner Market?

Key companies in the market include Astrophysics Inc, Smiths Detection Inc, L3 Security and Detection Systems Inc, Adani Systems*List Not Exhaustive, Westminster International Limited, Rapiscan Systems Inc, Autoclear LLC, Aventura Technologies Inc.

3. What are the main segments of the X-ray Security Scanner Market?

The market segments include Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Number of Terror Attacks; Increasing Smuggling of Illegal Goods Across Borders.

6. What are the notable trends driving market growth?

Aviation and Transportation Segment to Occupy Significant Share in the Market.

7. Are there any restraints impacting market growth?

High Investment Costs for On-Premise Solutions; Lack of Skilled Professionals.

8. Can you provide examples of recent developments in the market?

August 2023 - Smiths Detection, the leader in threat detection and screening technology, today announces that it has launched the SDX 100100 DV series, comprising two dual-view X-ray scanners. X-ray technology scanners provide a horizontal and vertical view of the screened object, facilitating reliable inspections of tightly packed objects and shortening inspection times.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "X-ray Security Scanner Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the X-ray Security Scanner Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the X-ray Security Scanner Market?

To stay informed about further developments, trends, and reports in the X-ray Security Scanner Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence