Key Insights

The Graphics Add-in Board Market is projected for significant expansion, expected to reach a market size of $6.23 billion by 2025, driven by a robust CAGR of 13.74%. This growth is fueled by increasing demand for high-performance graphics across Gaming, Design and Visualization, High-performance Computing (HPC), and Data Centers. Advancements in visual fidelity, immersive experiences, 3D modeling, VR technologies, complex simulations, and AI/ML training are key drivers. Emerging trends include more powerful and energy-efficient GPUs, integrated AI acceleration, and cloud gaming services, alongside continuous innovation from leading players.

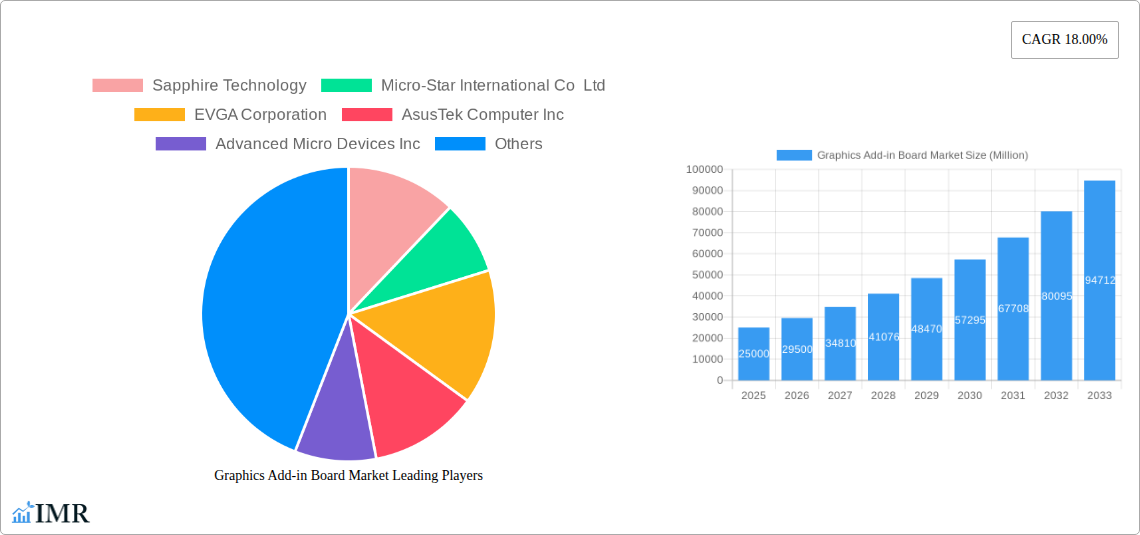

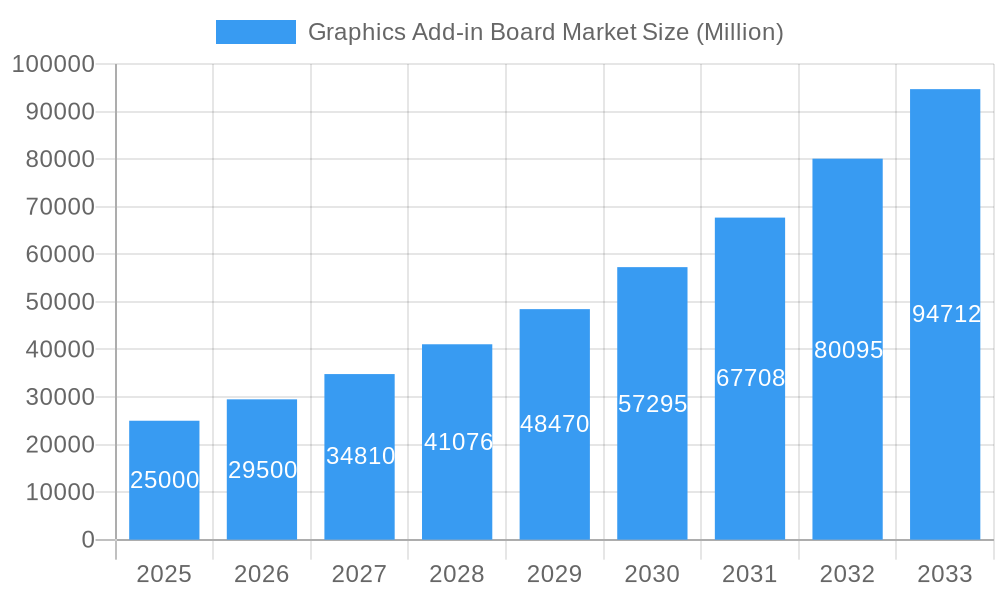

Graphics Add-in Board Market Market Size (In Billion)

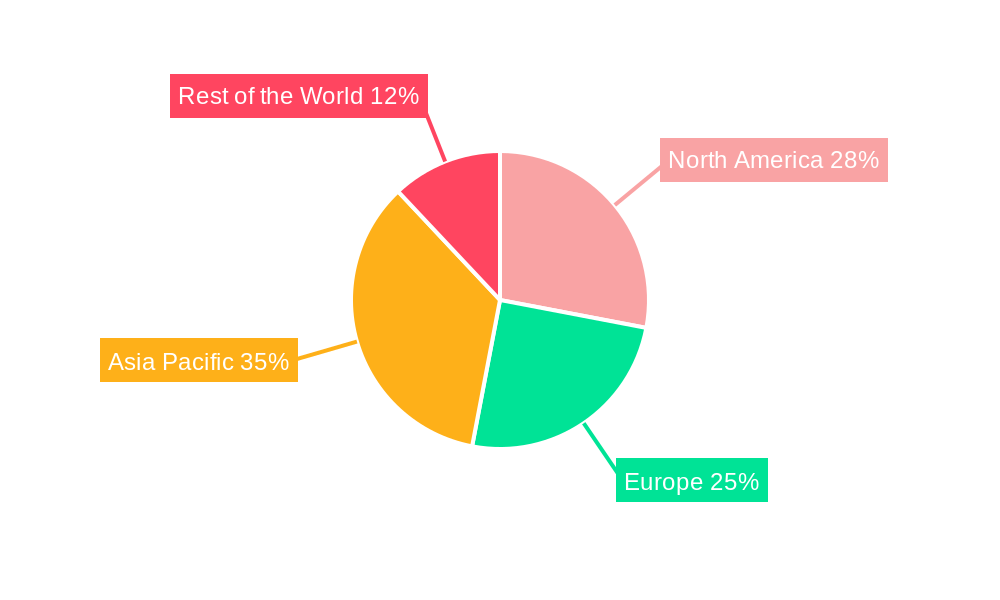

While market growth is strong, potential restraints include supply chain disruptions and the cost of high-end boards. However, persistent demand and ongoing technological advancements are expected to mitigate these challenges. The market is segmented by application, with Gaming and Design/Visualization anticipated to lead. Key players are actively pursuing competitive product development. Geographically, the Asia Pacific region is poised for dominance, followed by North America and Europe.

Graphics Add-in Board Market Company Market Share

This report provides an in-depth analysis of the global Graphics Add-in Board Market. Covering the study period 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, it offers crucial insights for stakeholders in the AI hardware, gaming hardware, and professional visualization sectors. High-traffic keywords are integrated for maximum search engine visibility.

Graphics Add-in Board Market Dynamics & Structure

The Graphics Add-in Board Market exhibits a moderately concentrated structure, driven by significant investments in research and development and stringent technological innovation cycles. Key players like NVIDIA Corporation, Advanced Micro Devices Inc. (AMD), and Intel Corporation dominate the landscape, continually pushing the boundaries of performance and efficiency. Technological innovation is primarily fueled by the escalating demand for enhanced graphics processing power in gaming, high-performance computing (HPC), and data center applications. Regulatory frameworks, while generally supportive of technological advancement, can influence component sourcing and manufacturing standards. Competitive product substitutes, though present in integrated graphics solutions, are increasingly being outpaced by the superior capabilities of discrete add-in boards, particularly for demanding workloads. End-user demographics are diversifying, with a growing influx of content creators, AI researchers, and professionals in the design and visualization sector complementing the established gaming base. Mergers and acquisitions (M&A) trends, though not overtly frequent, signal strategic consolidations to secure market share and acquire cutting-edge intellectual property. For instance, a recent M&A deal in the semiconductor industry involving a component manufacturer could impact the supply chain for specialized graphics processing units (GPUs).

- Market Concentration: Moderately concentrated with top players holding substantial market share.

- Technological Innovation Drivers: Increasing demand from gaming, HPC, AI, and professional visualization.

- Regulatory Frameworks: Focus on component sourcing, environmental impact, and energy efficiency.

- Competitive Product Substitutes: Integrated graphics, but limitations for high-end applications.

- End-User Demographics: Expanding beyond gamers to include professionals in AI, design, and scientific research.

- M&A Trends: Strategic acquisitions for IP and market consolidation.

Graphics Add-in Board Market Growth Trends & Insights

The Graphics Add-in Board Market is poised for robust growth, propelled by a confluence of technological advancements and evolving consumer and enterprise demands. The market size is projected to expand significantly, driven by escalating adoption rates across diverse applications. In the gaming segment, the insatiable appetite for immersive experiences, higher resolutions (4K and 8K), and high refresh rates continues to fuel demand for powerful graphics add-in boards. Emerging trends like cloud gaming and the metaverse are further augmenting this demand. The design and visualization sector is experiencing a substantial surge, with professionals in architecture, engineering, and product design relying on high-fidelity graphics for complex simulations and realistic rendering. This translates to a growing market for professional graphics cards. The high-performance computing (HPC) and data center segments are witnessing unprecedented growth, largely attributed to the exponential rise of artificial intelligence (AI) and machine learning (ML) workloads. The parallel processing capabilities of GPUs make them indispensable for training deep learning models, accelerating scientific research, and powering data analytics. This has led to a significant increase in the deployment of dedicated AI accelerators in the form of add-in boards. Consumer behavior shifts are evident, with an increasing willingness to invest in premium hardware for enhanced productivity and entertainment. Technological disruptions, such as the development of more efficient and powerful GPU architectures and advancements in memory technologies, are continuously reshaping the product landscape. The market penetration of discrete graphics cards is expected to deepen, especially in emerging markets as PC adoption and digital transformation accelerate. The overall market is expected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. The estimated market size for graphics add-in boards is expected to reach USD xxx million units by 2033.

Dominant Regions, Countries, or Segments in Graphics Add-in Board Market

The Gaming segment stands as the undisputed dominant force within the Graphics Add-in Board Market, consistently driving a substantial portion of global demand. This dominance is underpinned by several key factors. The sheer volume of global gamers, coupled with their willingness to invest in high-performance hardware for competitive advantage and immersive experiences, creates a perpetual demand cycle. The proliferation of e-sports further amplifies this trend, necessitating the latest and most powerful graphics solutions. Furthermore, the continuous evolution of game engines and graphics technologies in titles across PC platforms keeps the upgrade cycle alive.

North America and Asia-Pacific are the leading regions, each contributing significantly to market growth due to distinct economic and demographic drivers. North America's dominance is fueled by a mature PC gaming market, a strong presence of technology developers, and high disposable incomes allowing for frequent hardware upgrades. The region also boasts a significant concentration of professionals in design and visualization, as well as a burgeoning AI research and development landscape.

Asia-Pacific, particularly countries like China, South Korea, and Japan, represents a rapidly expanding market. This growth is driven by a massive youth population with a burgeoning interest in gaming, increasing PC penetration rates, and government initiatives promoting digital infrastructure and technology adoption. The burgeoning e-sports scene in this region further accentuates the demand for high-end graphics cards.

In terms of end-users, Desktops remain the primary platform for graphics add-in boards, especially within the gaming and professional workstation segments. However, there is a noticeable trend of increasing power within Notebooks and Tablets for gaming and creative tasks, albeit with specific form factor limitations. Workstations for professional applications in design, visualization, and HPC are crucial segments, demanding specialized, high-performance graphics solutions.

- Dominant Segment: Gaming, driven by immersive experiences and e-sports.

- Leading Regions: North America and Asia-Pacific, supported by strong economies and large gaming populations.

- Key End-User Platforms: Desktops remain dominant, with growing demand from Workstations and higher-performance Notebooks.

- Market Share (Gaming Segment): Projected to hold xx% of the total market by 2033.

- Growth Potential (Asia-Pacific): Expected CAGR of xx% for the region.

Graphics Add-in Board Market Product Landscape

The Graphics Add-in Board Market is characterized by rapid product innovation, with manufacturers continuously launching boards that push the boundaries of performance, power efficiency, and feature sets. Current innovations focus on advancements in GPU architectures, such as ray tracing and AI-accelerated rendering, enabling more realistic visual fidelity. Product offerings range from entry-level boards suitable for basic multimedia and casual gaming to ultra-high-end solutions designed for professional workloads like 8K video editing, complex 3D modeling, and intensive AI model training. Unique selling propositions often revolve around superior cooling solutions, customizable RGB lighting, enhanced memory bandwidth, and proprietary software enhancements for overclocking and performance optimization. Technological advancements include the integration of larger memory capacities (e.g., 24GB, 48GB GDDR6X or HBM2e) and faster interconnects like PCIe 5.0, ensuring seamless data transfer for demanding applications. The market is seeing a rise in specialized AI accelerators and professional GPUs tailored for specific industry needs, often featuring ECC memory and certified drivers for critical applications.

Key Drivers, Barriers & Challenges in Graphics Add-in Board Market

Key Drivers: The primary forces propelling the Graphics Add-in Board Market are the escalating demand from the gaming industry for increasingly realistic and immersive experiences, the burgeoning adoption of AI and machine learning in data centers and research, and the growing need for powerful visualization tools in professional fields like engineering and design. Technological advancements by leading chip manufacturers (NVIDIA, AMD, Intel) continuously introduce more powerful and efficient GPUs, stimulating upgrade cycles. The expanding e-sports ecosystem also significantly contributes to demand.

Barriers & Challenges: Significant challenges include the inherent high cost of cutting-edge graphics add-in boards, which can act as a barrier for some consumer segments. Supply chain disruptions, exacerbated by global chip shortages and geopolitical factors, have historically led to price volatility and limited availability, impacting both manufacturers and end-users. Intense competition among key players can also lead to aggressive pricing strategies and pressure on profit margins. Furthermore, the rapid pace of technological obsolescence necessitates continuous R&D investment, posing a challenge for smaller market participants. The energy consumption of high-performance GPUs remains a concern, driving a need for greater power efficiency.

Emerging Opportunities in Graphics Add-in Board Market

Emerging opportunities in the Graphics Add-in Board Market lie in the expanding metaverse and virtual reality (VR)/augmented reality (AR) ecosystems, which will require increasingly sophisticated graphical capabilities. The growing adoption of AI in edge computing and autonomous systems presents a significant untapped market for specialized, power-efficient graphics processing units. Furthermore, the increasing demand for high-resolution content creation and streaming services creates new avenues for professional and semi-professional graphics solutions. The development of more accessible and affordable AI development platforms for smaller businesses and researchers also represents a significant opportunity.

Growth Accelerators in the Graphics Add-in Board Market Industry

Several catalysts are accelerating long-term growth in the Graphics Add-in Board Market. Breakthroughs in GPU architecture, such as advancements in AI inference acceleration and photonic computing, promise to unlock new levels of performance and efficiency. Strategic partnerships between GPU manufacturers and software developers are crucial for optimizing application performance and expanding the utility of graphics hardware. Market expansion strategies targeting emerging economies, coupled with increased PC adoption and digital transformation initiatives, will further fuel demand. The growing investment in cloud gaming infrastructure and the development of dedicated hardware for AI training and inference in cloud environments are also significant growth accelerators.

Key Players Shaping the Graphics Add-in Board Market Market

- Sapphire Technology

- Micro-Star International Co Ltd

- EVGA Corporation

- AsusTek Computer Inc

- Advanced Micro Devices Inc

- Zotac

- Nvidia Corporation

- INNO3D

- Gigabyte Technology

- Intel Corporation

Notable Milestones in Graphics Add-in Board Market Sector

- 2019: NVIDIA introduces its GeForce RTX SUPER series, enhancing ray tracing capabilities.

- 2020: AMD launches its Radeon RX 6000 series, significantly improving gaming performance and competition.

- 2021: Intel announces its entry into the discrete GPU market with the Xe-HPG architecture, targeting gamers and creators.

- 2022: NVIDIA announces Ada Lovelace architecture for GeForce RTX 40 series, bringing substantial performance gains and AI features.

- 2023: AMD unveils RDNA 3 architecture, focusing on power efficiency and advanced gaming technologies.

- 2024: Continued advancements in AI-specific hardware and professional workstation GPUs, addressing the growing demands of AI development and complex simulations.

- 2025 (Estimated): Expect further integration of AI hardware capabilities directly into consumer-grade graphics cards.

- 2026 (Projected): Potential for significant leaps in ray tracing efficiency and AI-powered upscaling technologies.

In-Depth Graphics Add-in Board Market Market Outlook

The future of the Graphics Add-in Board Market is exceptionally bright, driven by the relentless pace of technological innovation and the ever-expanding applications for graphical processing power. The convergence of AI, high-fidelity gaming, and sophisticated professional visualization will continue to fuel demand for increasingly powerful and specialized add-in boards. Strategic investments in R&D, coupled with the development of more energy-efficient architectures, will be key to navigating market challenges and capitalizing on emerging opportunities. The ongoing digital transformation across industries, coupled with the sustained growth in PC gaming and the nascent but rapidly developing metaverse, positions the graphics add-in board market for sustained and significant expansion.

Graphics Add-in Board Market Segmentation

-

1. Application

- 1.1. Gaming

- 1.2. Design and Visualization

- 1.3. High-performance Computing

- 1.4. Data Center

- 1.5. Others

-

2. End-Users

- 2.1. Desktop

- 2.2. Notebooks and Tablets

- 2.3. Workstations

- 2.4. Others

Graphics Add-in Board Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Graphics Add-in Board Market Regional Market Share

Geographic Coverage of Graphics Add-in Board Market

Graphics Add-in Board Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Penetration of Smartphones; Growing Adoption of Cloud Computing

- 3.2.2 Big Data Analytics

- 3.2.3 and AI

- 3.3. Market Restrains

- 3.3.1. Cyber Security concerns may hinder the growth of the sports betting kiosk market

- 3.4. Market Trends

- 3.4.1. Gaming Industry to Augment the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Graphics Add-in Board Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Gaming

- 5.1.2. Design and Visualization

- 5.1.3. High-performance Computing

- 5.1.4. Data Center

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by End-Users

- 5.2.1. Desktop

- 5.2.2. Notebooks and Tablets

- 5.2.3. Workstations

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Graphics Add-in Board Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Gaming

- 6.1.2. Design and Visualization

- 6.1.3. High-performance Computing

- 6.1.4. Data Center

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by End-Users

- 6.2.1. Desktop

- 6.2.2. Notebooks and Tablets

- 6.2.3. Workstations

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Graphics Add-in Board Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Gaming

- 7.1.2. Design and Visualization

- 7.1.3. High-performance Computing

- 7.1.4. Data Center

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by End-Users

- 7.2.1. Desktop

- 7.2.2. Notebooks and Tablets

- 7.2.3. Workstations

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Graphics Add-in Board Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Gaming

- 8.1.2. Design and Visualization

- 8.1.3. High-performance Computing

- 8.1.4. Data Center

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by End-Users

- 8.2.1. Desktop

- 8.2.2. Notebooks and Tablets

- 8.2.3. Workstations

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Rest of the World Graphics Add-in Board Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Gaming

- 9.1.2. Design and Visualization

- 9.1.3. High-performance Computing

- 9.1.4. Data Center

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by End-Users

- 9.2.1. Desktop

- 9.2.2. Notebooks and Tablets

- 9.2.3. Workstations

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Sapphire Technology

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Micro-Star International Co Ltd

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 EVGA Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 AsusTek Computer Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Advanced Micro Devices Inc

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Zotac

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Nvidia Corporation

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 INNO3D*List Not Exhaustive

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Gigabyte Technology

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Intel Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Sapphire Technology

List of Figures

- Figure 1: Global Graphics Add-in Board Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Graphics Add-in Board Market Revenue (billion), by Application 2025 & 2033

- Figure 3: North America Graphics Add-in Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Graphics Add-in Board Market Revenue (billion), by End-Users 2025 & 2033

- Figure 5: North America Graphics Add-in Board Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 6: North America Graphics Add-in Board Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Graphics Add-in Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Graphics Add-in Board Market Revenue (billion), by Application 2025 & 2033

- Figure 9: Europe Graphics Add-in Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Graphics Add-in Board Market Revenue (billion), by End-Users 2025 & 2033

- Figure 11: Europe Graphics Add-in Board Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 12: Europe Graphics Add-in Board Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Graphics Add-in Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Graphics Add-in Board Market Revenue (billion), by Application 2025 & 2033

- Figure 15: Asia Pacific Graphics Add-in Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Graphics Add-in Board Market Revenue (billion), by End-Users 2025 & 2033

- Figure 17: Asia Pacific Graphics Add-in Board Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 18: Asia Pacific Graphics Add-in Board Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Graphics Add-in Board Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Graphics Add-in Board Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Rest of the World Graphics Add-in Board Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Rest of the World Graphics Add-in Board Market Revenue (billion), by End-Users 2025 & 2033

- Figure 23: Rest of the World Graphics Add-in Board Market Revenue Share (%), by End-Users 2025 & 2033

- Figure 24: Rest of the World Graphics Add-in Board Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Graphics Add-in Board Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Graphics Add-in Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Global Graphics Add-in Board Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 3: Global Graphics Add-in Board Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Graphics Add-in Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Global Graphics Add-in Board Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 6: Global Graphics Add-in Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Graphics Add-in Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 8: Global Graphics Add-in Board Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 9: Global Graphics Add-in Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Graphics Add-in Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Graphics Add-in Board Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 12: Global Graphics Add-in Board Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Graphics Add-in Board Market Revenue billion Forecast, by Application 2020 & 2033

- Table 14: Global Graphics Add-in Board Market Revenue billion Forecast, by End-Users 2020 & 2033

- Table 15: Global Graphics Add-in Board Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Graphics Add-in Board Market?

The projected CAGR is approximately 13.74%.

2. Which companies are prominent players in the Graphics Add-in Board Market?

Key companies in the market include Sapphire Technology, Micro-Star International Co Ltd, EVGA Corporation, AsusTek Computer Inc, Advanced Micro Devices Inc, Zotac, Nvidia Corporation, INNO3D*List Not Exhaustive, Gigabyte Technology, Intel Corporation.

3. What are the main segments of the Graphics Add-in Board Market?

The market segments include Application, End-Users.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.23 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Penetration of Smartphones; Growing Adoption of Cloud Computing. Big Data Analytics. and AI.

6. What are the notable trends driving market growth?

Gaming Industry to Augment the Market Growth.

7. Are there any restraints impacting market growth?

Cyber Security concerns may hinder the growth of the sports betting kiosk market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Graphics Add-in Board Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Graphics Add-in Board Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Graphics Add-in Board Market?

To stay informed about further developments, trends, and reports in the Graphics Add-in Board Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence